City

of hobart

AGENDA

Finance and Governance Committee Meeting

Open Portion

Tuesday, 16 June 2020

at 4:30 pm

SUPPLEMENTARY ITEM

ORDER OF BUSINESS

City

of hobart

AGENDA

Finance and Governance Committee Meeting

Open Portion

Tuesday, 16 June 2020

at 4:30 pm

SUPPLEMENTARY ITEM

ORDER OF BUSINESS

|

|

Supplementary Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 2 |

|

|

16/6/2020 |

|

This meeting of the Finance and Governance Committee is held in accordance with a Notice issued by the Premier on 3 April 2020 under section 18 of the COVID-19 Disease Emergency (Miscellaneous Provisions) Act 2020.

The General Manager reports:

“That in accordance with the provisions of Part 2 Regulation 8(6) of the Local Government (Meeting Procedures) Regulations 2015, these supplementary matters are submitted for the consideration of the Committee.

Pursuant to Regulation 8(6), I report that:

(a) information in relation to the matter was provided subsequent to the distribution of the agenda;

(b) the matter is regarded as urgent; and

(c) advice is provided pursuant to Section 65 of the Act.”

|

Item No. 10 |

Supplementary Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 3 |

|

|

16/6/2020 |

|

Report of the Manager Finance and City Procurement and the Deputy General Manager of 12 June 2020 and attachments.

Delegation: Council

|

Item No. 10 |

Supplementary Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 4 |

|

|

16/6/2020 |

|

REPORT TITLE: Budget Estimates 2020-21

REPORT PROVIDED BY: Manager Finance and City Procurement

Deputy General Manager

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to present the City’s 2020-21 Estimates, Annual Plan and Rates Resolution and the 2021-2041 Long Term Financial Management Plan for consideration. It is proposed that the Estimates be formally adopted at the Council meeting on 22 June 2020.

2. Report Summary

2.1. This report presents the City’s 2020-21 Estimates, Annual Plan and Rates Resolution together with the Long Term Financial Management Plan 2021–2041.

2.2. The City’s Estimates for 2020-21 have been shaped by the economic impacts of the COVID-19 pandemic, which have been difficult to estimate.

2.3. It is proposed that the 2020-21 Estimates, 2020-21 Annual Plan, Long Term Financial Management Plan 2021-2041 and the City’s Rates Resolution 2020-21 be formally adopted at the Council meeting on 22 June 2020.

2.4. Over the coming months Council’s focus will be on delivering essential services and community support and then as the full extent of the pandemic becomes clearer the City will update the budget outlook and release a mid-year revised budget and Long Term Financial Management Plan.

4. Background

4.1. The City of Hobart’s budget for 2020-21 has been shaped by the economic impacts of the COVID-19 pandemic.

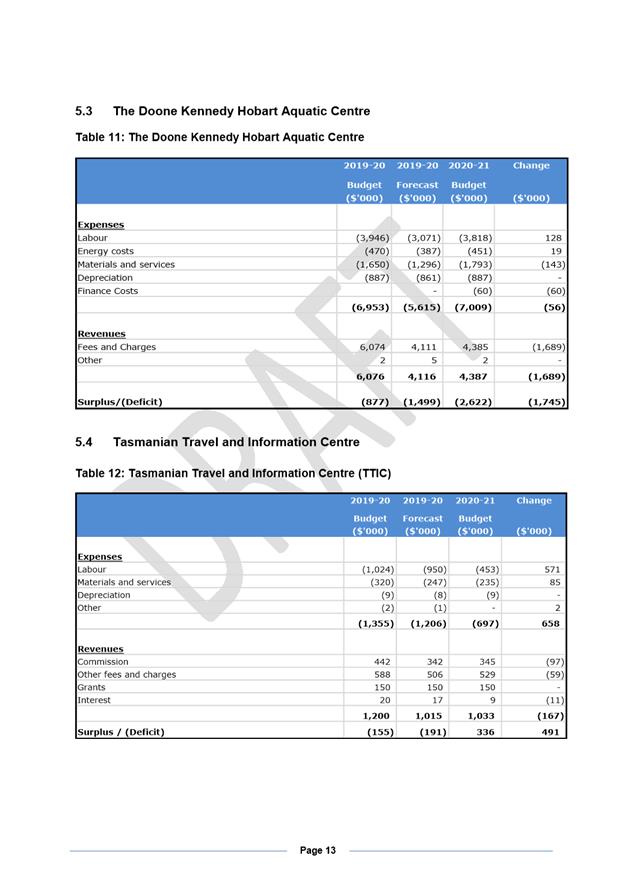

4.2. Like many businesses and organisations the City of Hobart has been financially impacted by the health crisis. While difficult to estimate the impacts, which will be determined by how quickly the City recovers, the estimate is a $17.66M loss of revenue for the City for 2020-21, including from parking fees and charges, parking fines, other fees and charges, distributions from Council’s membership of TasWater and rents on Council owned properties.

4.3. While the City has experienced these economic impacts, the City is also committed to maintaining essential services to the community and to assist those most critically impacted by the economic slowdown caused by the pandemic.

4.4. Over the coming months Council’s focus will be on delivering essential services and community support and then as the full extent of the pandemic becomes clearer the City will update the budget outlook and release a mid-year revised budget and Long Term Financial Management Plan.

4.5. The budget process for 2020-21 has included workshops/briefings with Elected Members and Committee/Council meetings on 3 March, 23 March, 27 April, 25 May and 28 May to discuss matters impacting on the 2020-21 Estimates and the 10 year capital works program.

4.6. The Estimates have now been drafted and are presented for Risk and Audit Panel and Council consideration.

Estimates Preparation

4.7. The Estimates documents comprise:

4.7.1. This report;

4.7.2. A separate document – ‘City of Hobart Budget Estimates 2020-21’, which is attached – refer Attachment A. This document contains discussion of all elements comprising the Estimates and is required pursuant to Section 82 of the Local Government Act 1993;

4.7.3. The Annual Plan for the 2020-2021 Financial Year, which is attached – refer Attachment B. This document is required pursuant to Section 71 of the Local Government Act 1993. It is required to set out how the objectives of Council’s Strategic Plan are to be met, including a summary of the Estimates adopted, and is to be formally adopted by the Council; and

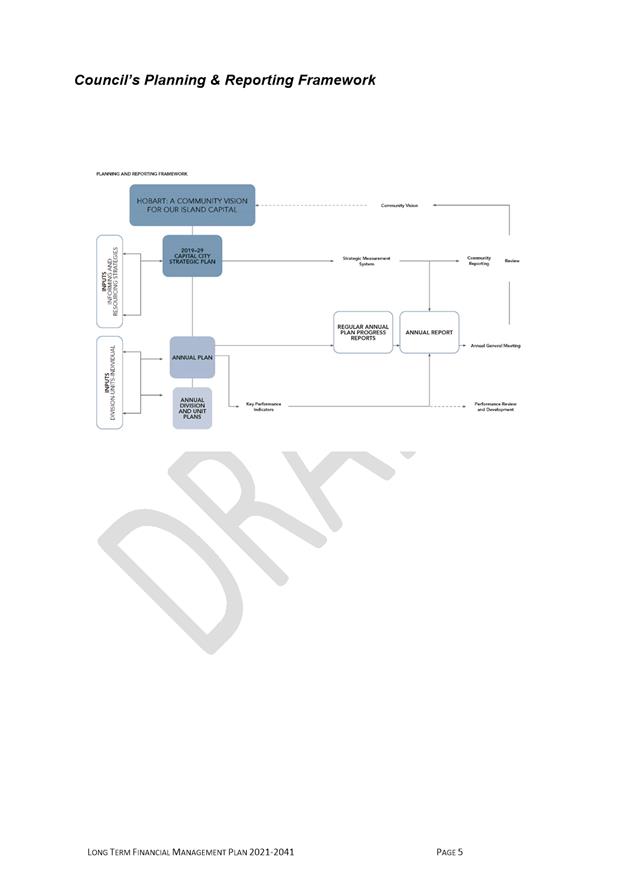

4.7.4. The updated Long Term Financial Management Plan 2021-2041 (LTFMP), which is attached – refer Attachment C. This document is required pursuant to Section 70 of the Local Government Act 1993 and is to be consistent with the Council’s Strategic Plan.

4.7.5. The Rates Resolution for 2020-21, which is attached – refer Attachment D. This document is required pursuant to Part 9 of the Local Government Act 1993.

Estimates Overview

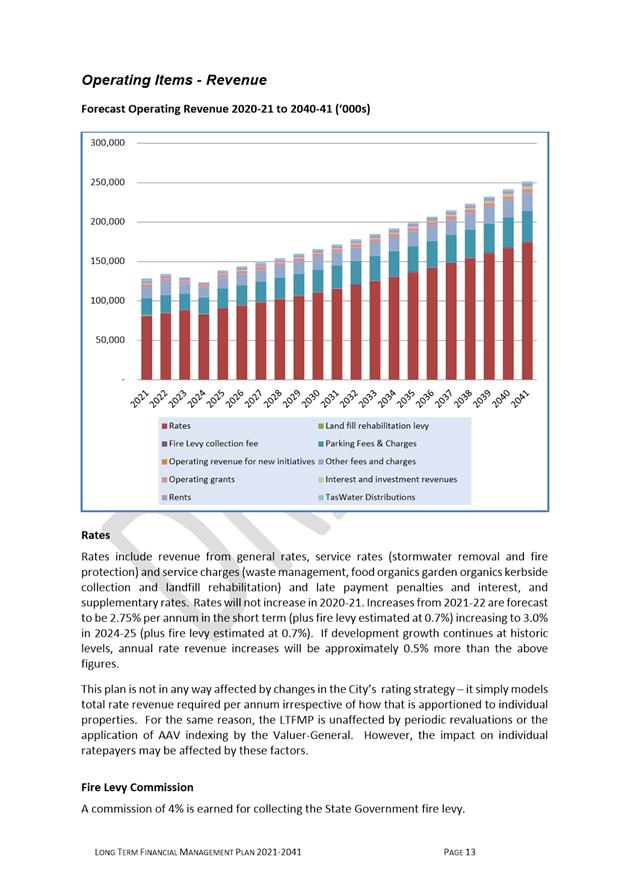

Key aspects of the 2020-21 budget include:

4.8. An operating budget of $135.5 million for the delivery of services to the community.

4.9. A community support package that includes:

4.9.1. A rates freeze by adopting a zero per cent increase in general and service rates for 2020-21. The Council will also freeze the waste collection service charges, the landfill rehabilitation service charges and the green waste service charge. Council introduced a new food organics garden organics (FOGO) kerbside collection service in 2019-20. For 2020-21 the cost of the FOGO kerbside collection will be $10 per property and will be combined with the existing $50 green waste service charge.

4.9.2. Financial hardship assistance of up to $4.6 million for those ratepayers experiencing genuine financial hardship.

4.9.3. A zero per cent increase in all other fees and charges to support the community in doing business with the City.

4.9.4. Rent relief for tenants of Council owned properties experiencing financial hardship.

4.9.5. A community, creative and business grants program of $1.167 million.

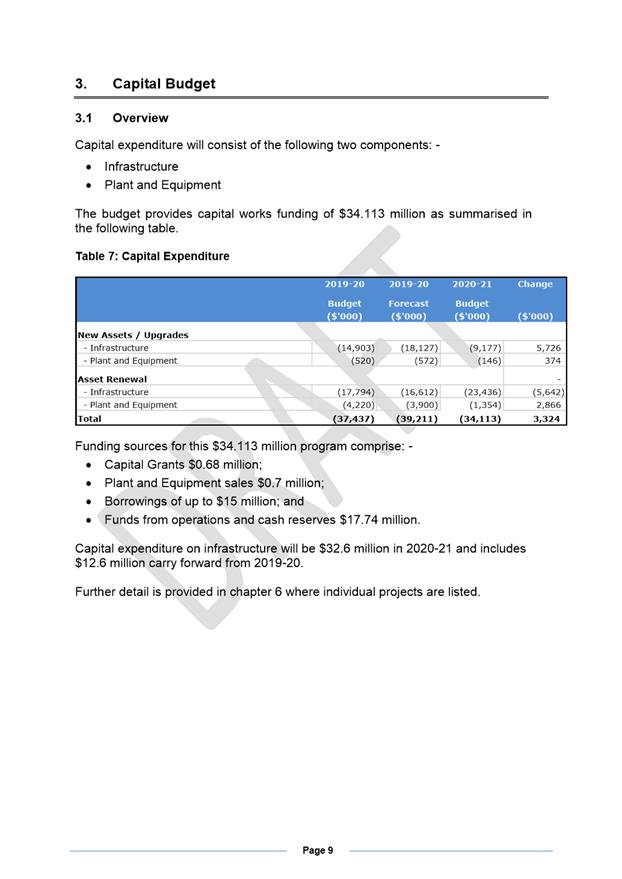

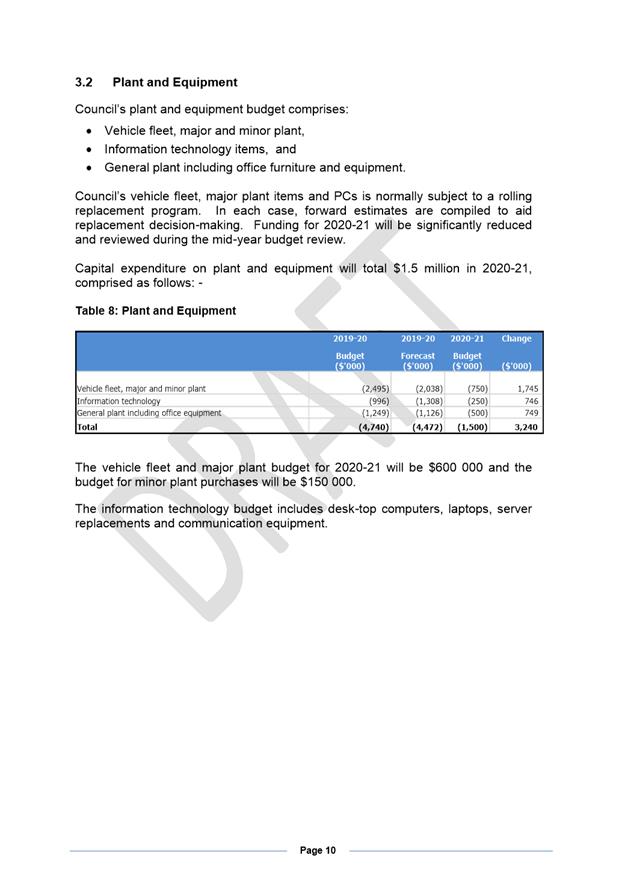

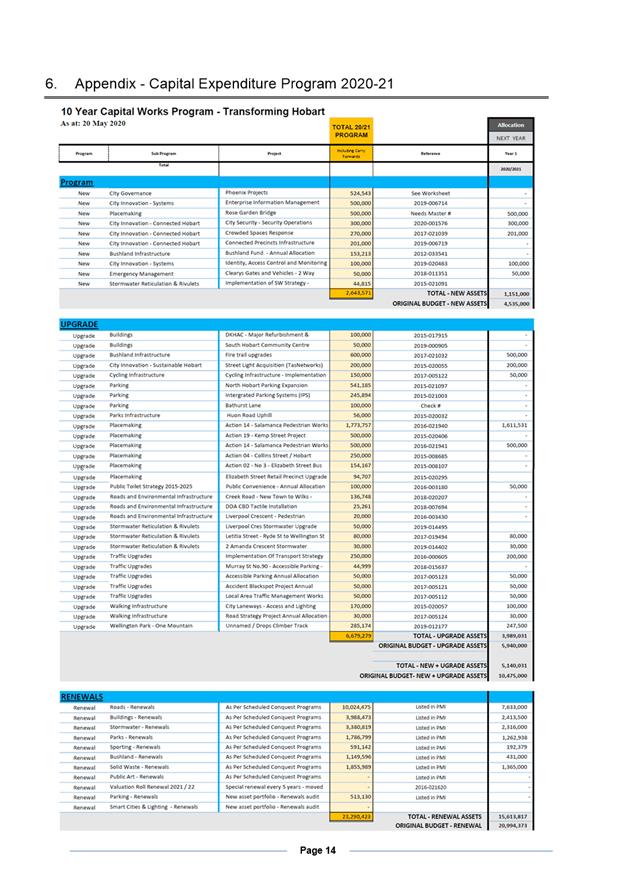

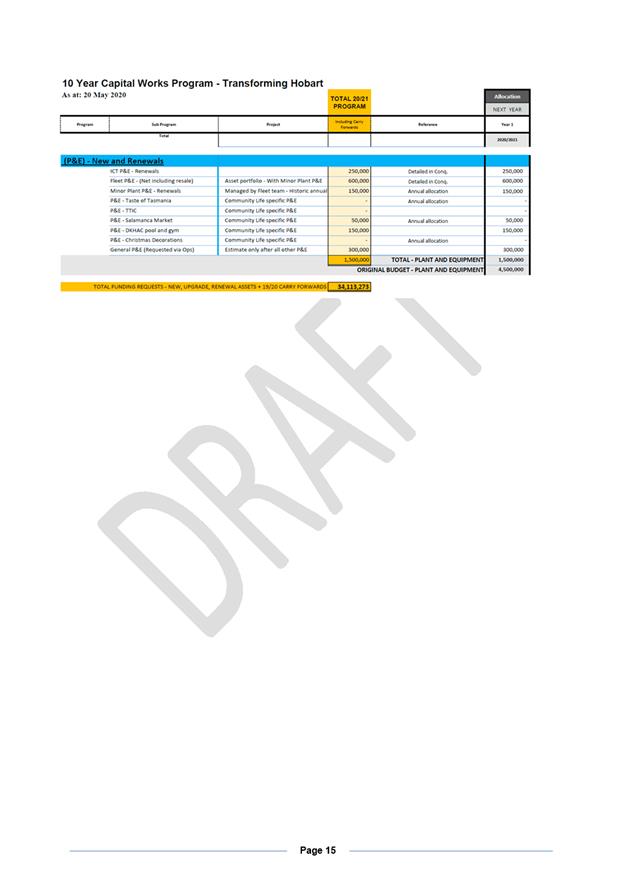

4.10. A capital works program of $34.113 million that will focus on renewing and maintaining the City’s assets. The City is also applying for a range of stimulus grants.

4.11. A reduction of $5.3 million across programs and activities.

4.12. New borrowings of $15 million, noting that the City has borrowing facility approved by the Treasurer of up to $31M.

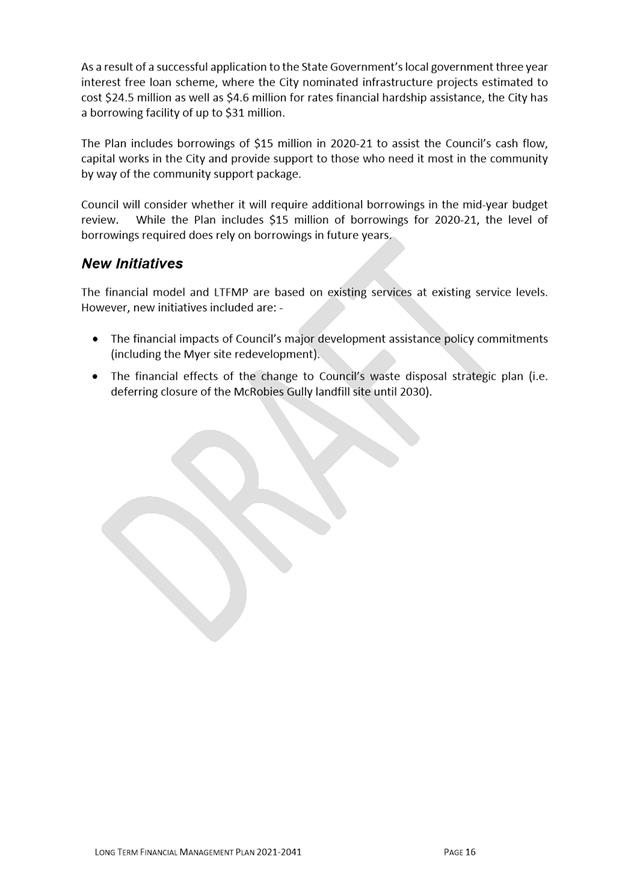

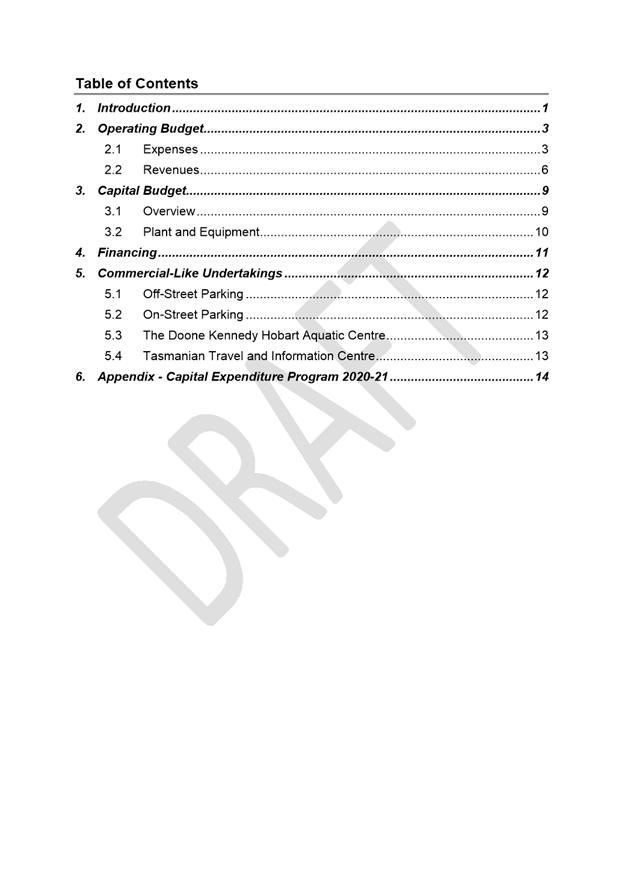

Operating Result

4.13. An underlying deficit is forecast of $11.806 million in 2020-21.

4.14. While greater detail is contained within the Budget Estimates document, the reasons for this are due to the economic impacts of the COVID-19 pandemic on the City’s revenue partially offset by a reduction in expenditure for the City. Some factors impacting on Council’s forecast underlying operating deficit of $11.806 million are: -

4.14.1. A rates freeze and rates relief for 2020-21. The Estimates forecast total Rates income of $83.5 million, a decrease of $4.9 million or 5.5% from 2019-20.

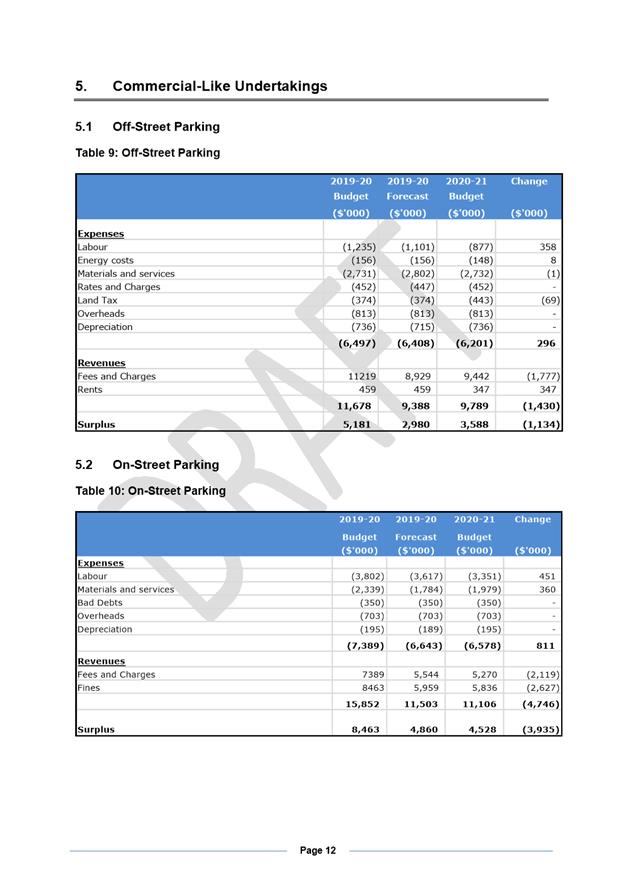

4.14.2. Decreases in parking fines of $2.6 million.

4.14.3. Decreases in parking fees and charges for car parks and on street parking, totalling $3.896 million.

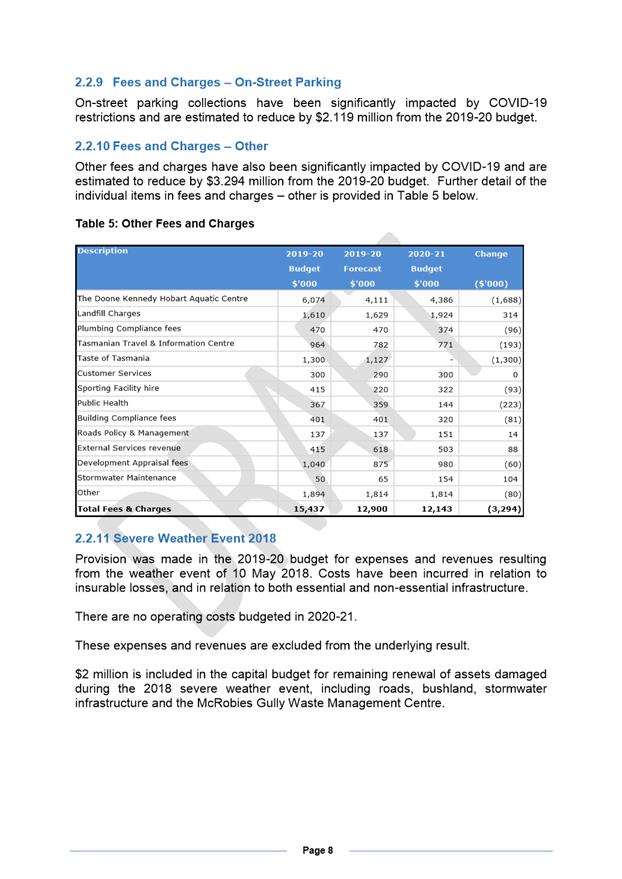

4.14.4. Decreases in other fees and charges income of $3.294 million.

4.14.5. A 50% reduction in distributions from Council’s ownership share in TasWater, totalling $1.086 million.

4.14.6. Decreases in rental income of $1.326 million, which includes from Salamanca Market and Taste of Tasmania stallholders.

Partially offset by:

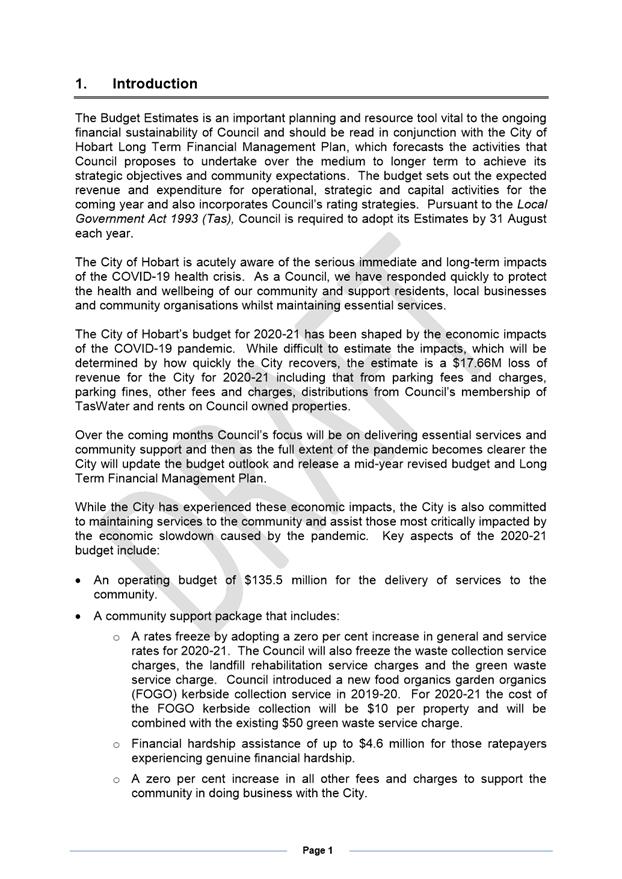

4.14.7. Decreases in labour costs of $2.013 million.

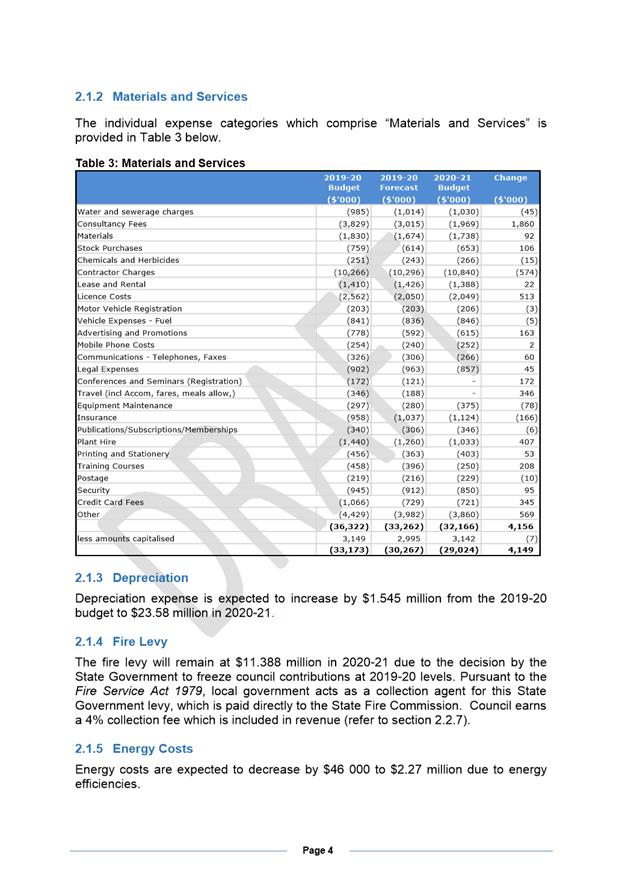

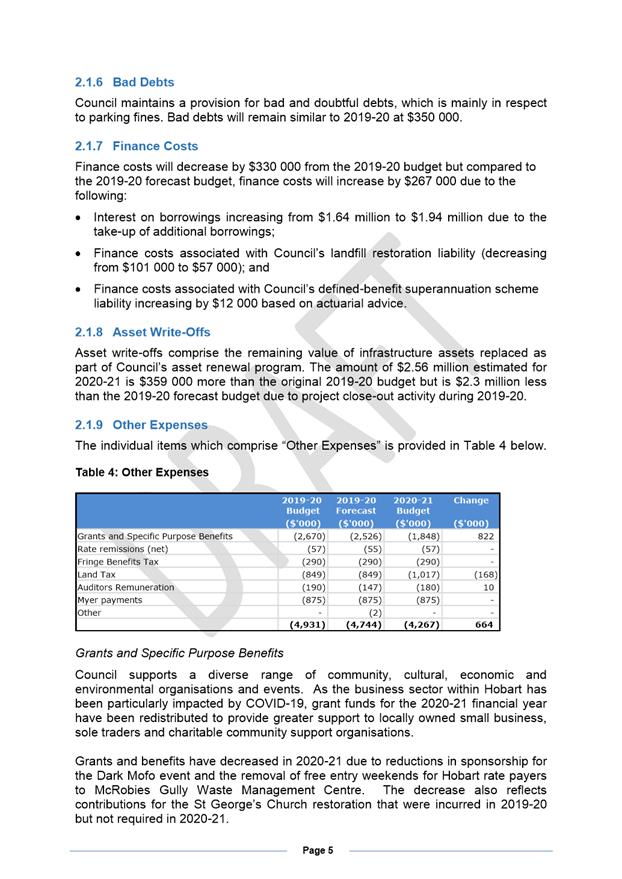

4.14.8. Decreases in materials and services of $4.149 million.

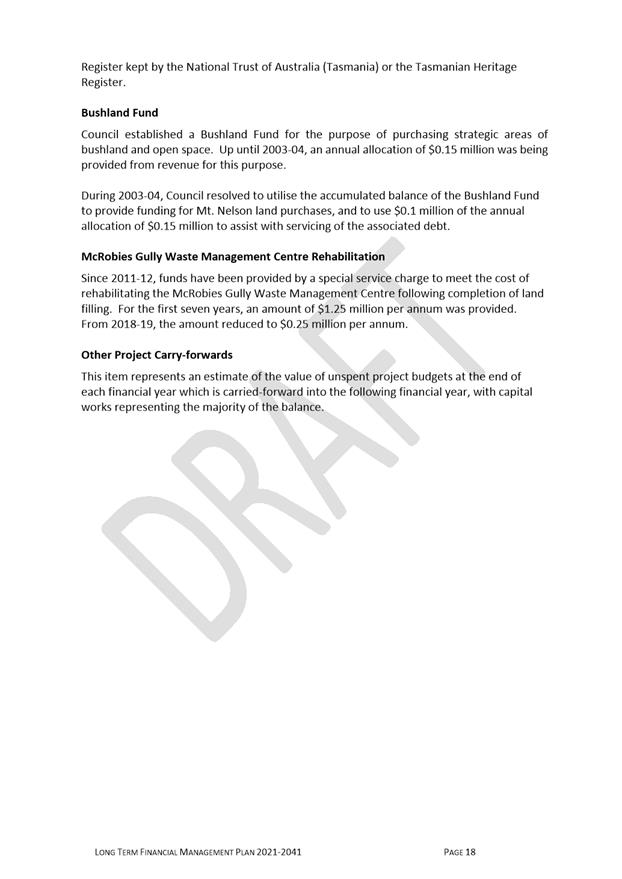

Cash Flows

4.15. Council’s cash balance is forecast to decrease by $4.2 million from $25.4 million at 30 June 2020 to $21.2 million at 30 June 2021.

4.16. Cash provided by operating activities will decrease by $6.8 million, from $23.7 million in 2019-20 to $16.9 million in 2020-21.

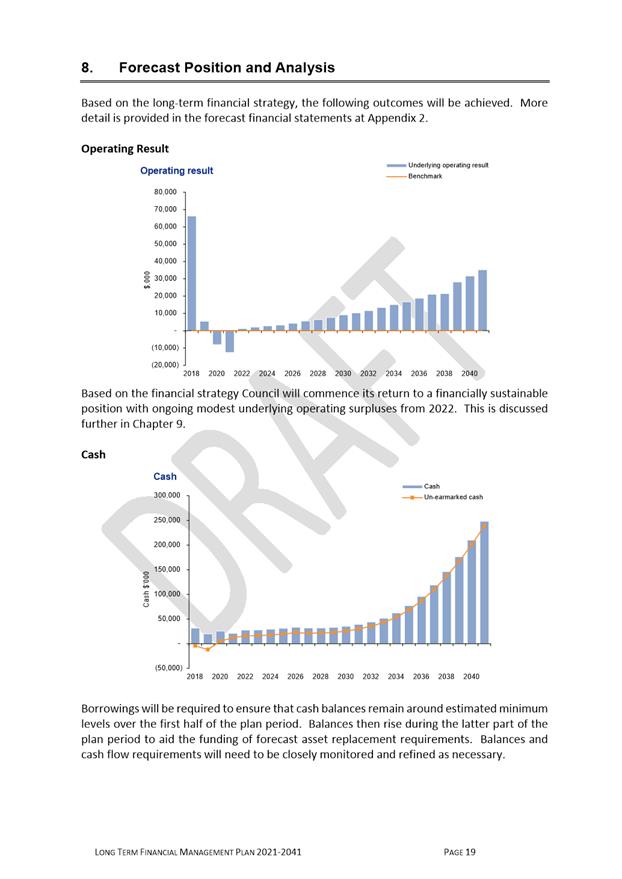

Financing

4.17. New borrowings of $15 million will be undertaken in 2020-21 and existing debt principal repayments of $4.43 million will be made.

4.18. As a result of a successful application to the State Government local government 3 year interest free loan scheme, where the City nominated infrastructure projects estimated to cost $24.5 million as well as $4.6 million for rates financial hardship assistance, the City has a borrowing facility of up to $31 million.

4.19. While borrowings have been minimised at $15 million for 2020-21 at this time, the level of borrowings will be the subject of a mid-year budget review once the financial outlook is clearer.

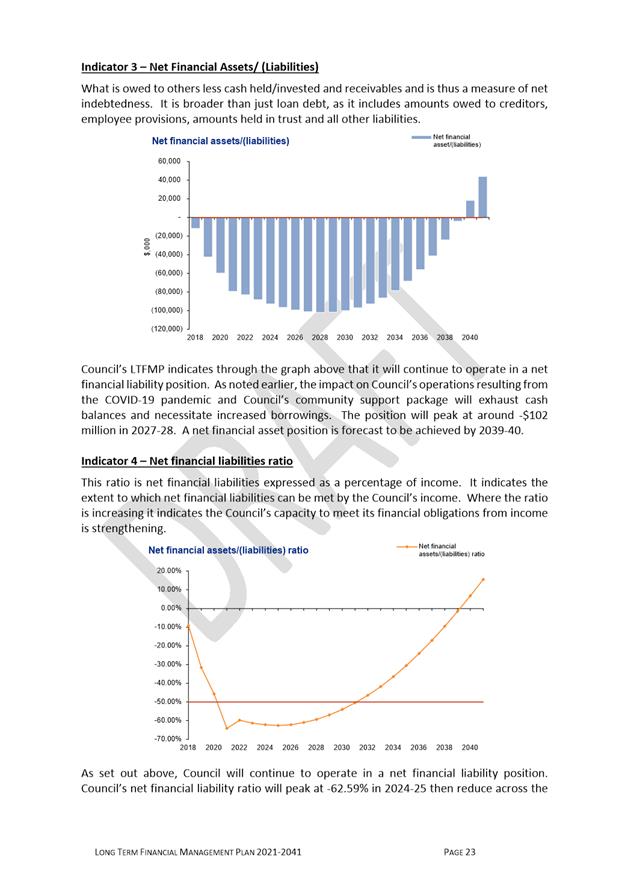

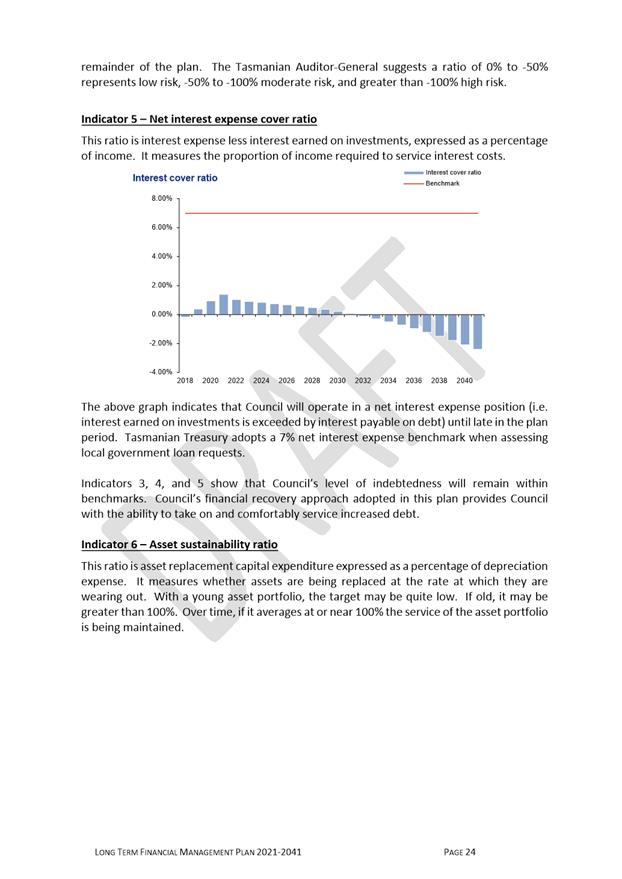

4.20. It should also be noted that the LTFMP previously provided for further borrowings in future years and these will still be required. Modelling undertaken this year for the LTFMP sees Council borrowing ‘peaking’ at $70M in 2021-22 but remaining within LTFMP benchmarks.

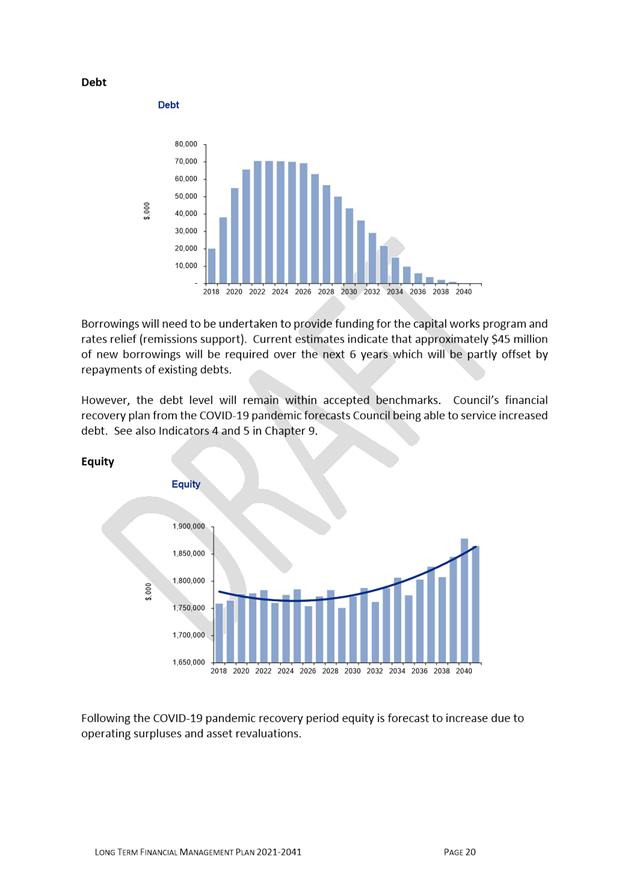

Capital Expenditure – New Assets/Upgrades and Asset Renewal

4.21. The Council considered and endorsed the proposed 2020-21 capital works program at its meeting on 25 May 2020 for inclusion in the Estimates.

4.22. The 2020-21 budget provides capital works funding of $34.1 million, comprising asset renewal of $23.4 million, new assets/upgrades of $9.2 million and plant and equipment funding of $1.5 million.

4.23. Further detail on the individual projects in the capital works program for 2020-21 are included in the Estimates.

Long Term Financial Management Plan

4.24. The 2020-21 Estimates have been prepared in accordance with the updated LTFMP (refer Attachment C).

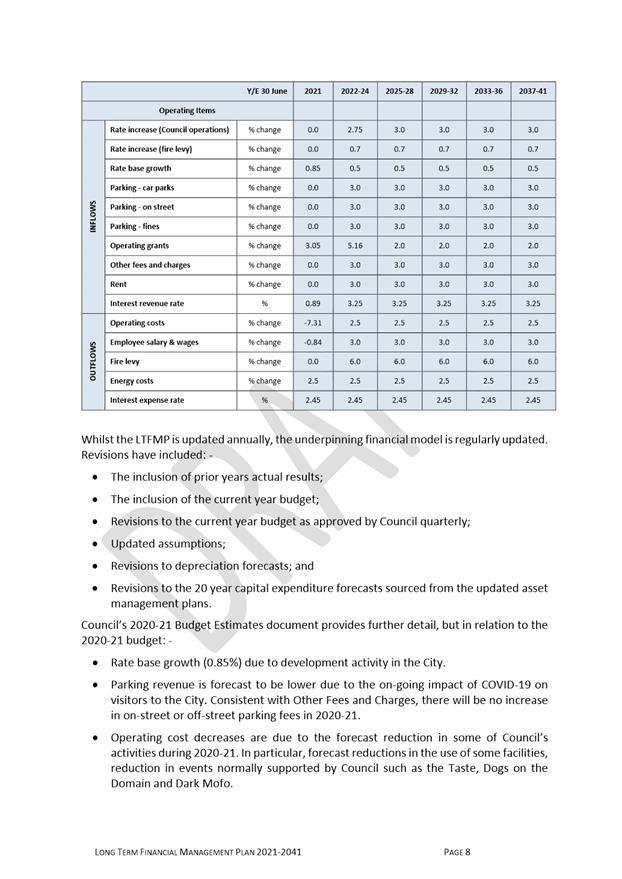

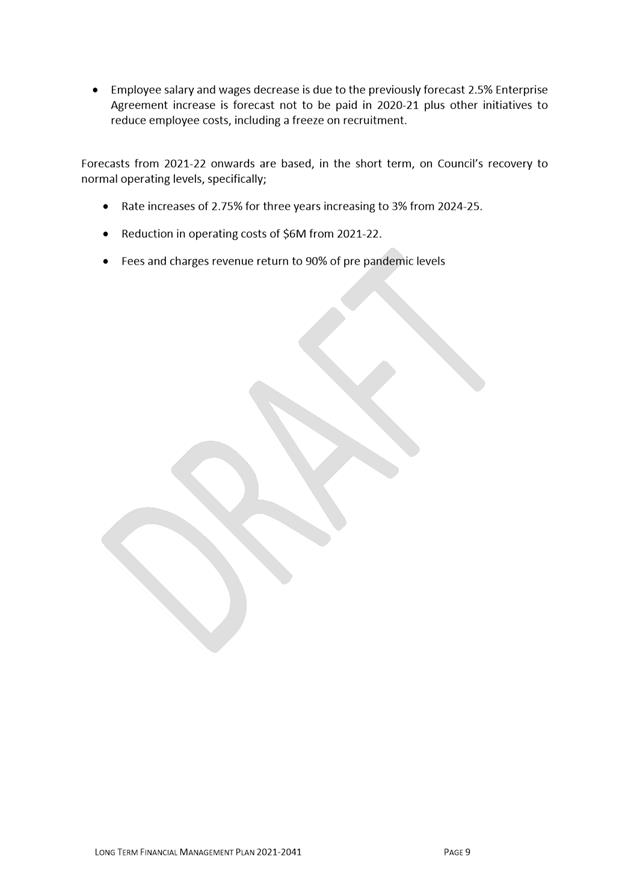

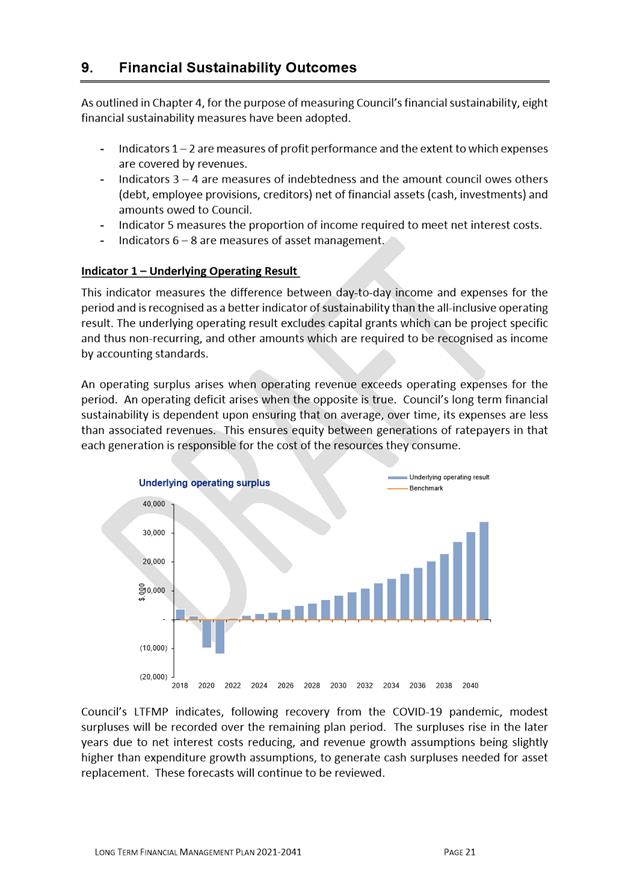

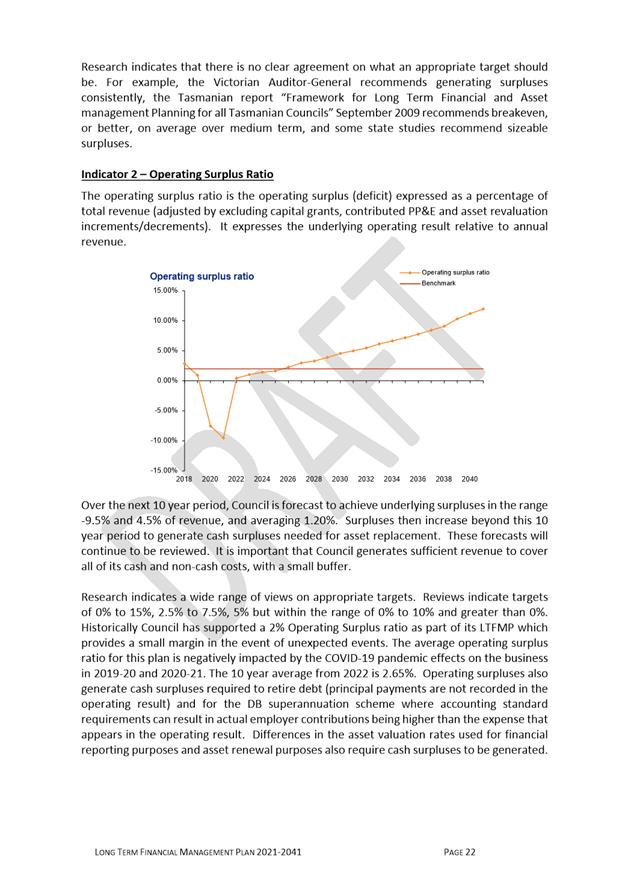

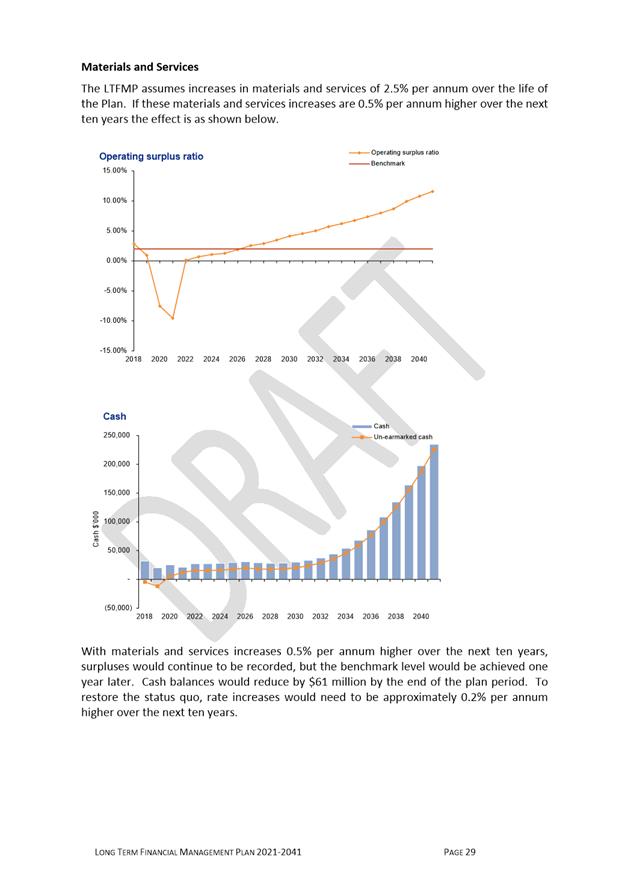

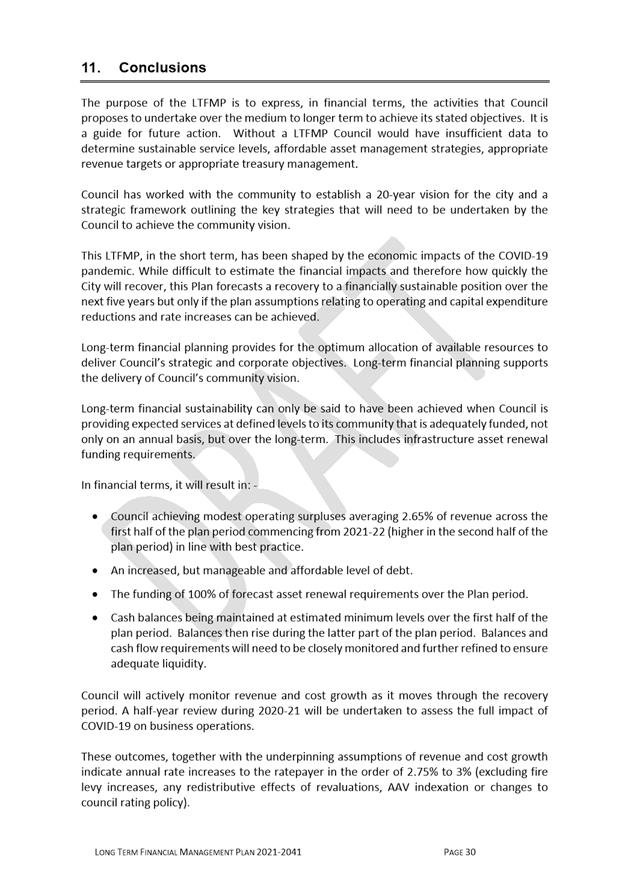

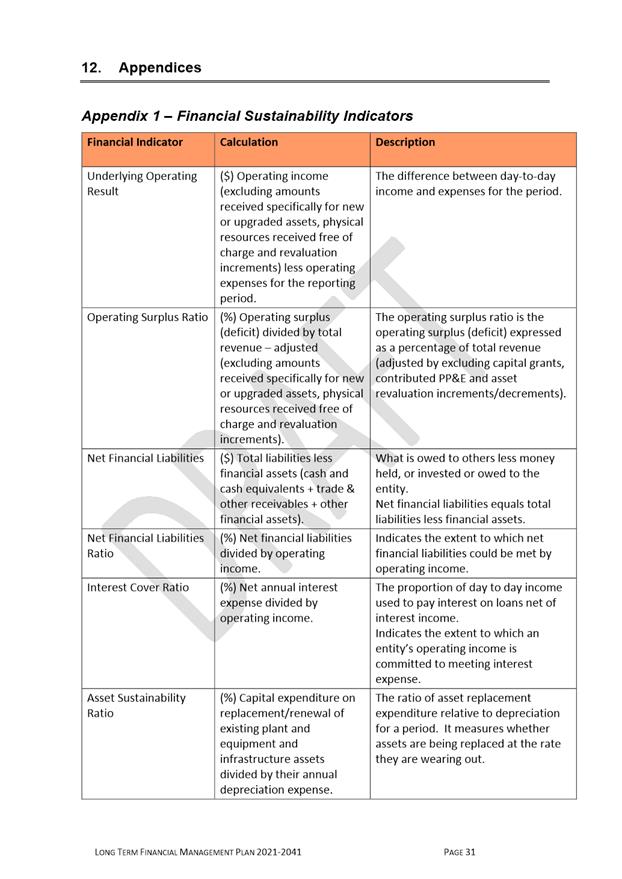

4.25. The LTFMP has been prepared on the basis of assumptions about the financial situation going forward. These include rates increases of 2.75 per cent, a capex program averaging $35M, $6M (ongoing) removed from the operating budget and revenue recovery to 90 per cent all from 2021-22.

4.26. This modelling sees Council return to a modest underlying operating surplus in 2021-22 and achieving the benchmark of 2% of revenue in five years 2025-26 but only if the assumptions relating to operating and capital expenditure reductions and rate increases can be achieved.

4.27. The modelling undertaken by Council officers is being peer reviewed by KPMG and the outcomes of this will be provided to elected members as soon as it is available.

4.28. The forecasts are however entirely dependent on the Council’s and the City’s recovery from Covid-19 as well as the work to be undertaken on a structural review of the Council’s business model.

4.29. It is therefore proposed that a complete review of the LTFMP be undertaken as part of the mid-year budget review.

Unspent Plant and Capital Funds

4.30. As part of the budget approval process it is proposed that unspent capital budgets from 2019-20 be carried forward into 2020-21. Based on year-to-date expenditure, carry-forwards are expected to be around $12.6 million. This includes various place making, stormwater, traffic, roadworks and walking infrastructure. This figure is the expected unexpended cash for capital works only recognising the works program itself is substantially progressed.

5. Proposal and Implementation

5.1. It is proposed that the 2020-21 Estimates be considered at the Special Risk and Audit Panel meeting to be held on 16 June and thereafter be formally considered at the Finance and Governance Committee meeting to be held on 16 June, and be listed on the Council meeting agenda for 22 June for formal adoption by absolute majority.

5.2. Subject to any amendments that may arise following the Risk and Audit Panel meeting and Finance and Governance Committee’s consideration, the following are the draft resolutions that would be presented to Council on 22 June: -

5.2.1. The expenses, revenues, capital expenditure, and plant and equipment expenditure detailed in the document ‘City of Hobart Budget Estimates 2020-21’ be approved.

5.2.2. New borrowings of up to $15 million be approved, noting that the City has a borrowing facility of up to $31 million.

5.2.3. The Council delegate to the General Manager the power to enter into loan agreements to source the above borrowings on the most favourable terms.

5.2.4. The Council adopt the Rates Resolution for 2020-21, which includes:

5.2.4.1. The General Rate be 6.85 cents in the dollar of assessed annual value (AAV).

5.2.4.2. The following Service Rates be made:

5.2.4.2.1 A Stormwater Removal Service Rate of 0.38 cents in the dollar of AAV; and

5.2.4.2.2 A Fire Service Rate of 1.11 cents in the dollar of AAV.

5.2.4.3. A Waste Management Service Charge be made and varied according to the use or predominant use of land as follows:

5.2.4.3.1 A Service charge of $250 to apply to residential properties;

5.2.4.3.2 A Service charge of $500 to apply to non-residential properties.

5.2.4.4. A Waste Management Service Charge of $60 be made for food organics garden organics kerbside waste collection for all rateable land within the municipal area to which Council supplies or makes available a food organics garden organics waste collection service utilising a food organics garden organics waste collection bin.

5.2.4.5. A Landfill Rehabilitation Service Charge be made and varied according to the use or predominant use of land as follows:

5.2.4.5.1 A service charge of $10 to apply to residential properties;

5.2.4.5.2 A service charge of $20 to apply to non-residential properties.

5.2.4.6. The rates be subject to the following remissions:

5.2.4.6.1 A remission of 0.81 cents in the dollar on the AAV of any land or building which is within the Fern Tree Volunteer Brigade Rating District as defined by the State Fire Commission.

5.2.4.6.2 A remission of 0.83 cents in the dollar on the AAV of any land or building which is within areas other than Permanent Brigade Rating Districts or the Fern Tree Volunteer Brigade Rating District as defined by the State Fire Commission.

5.2.5. Unspent 2019-10 capital funding be carried-forward into 2020-21, with any necessary adjustments to be made in the September 2020 quarter financial report to Council.

5.2.6. The interest rate on unpaid rates be 6.81% per annum, charged monthly. Section 128 of the Local Government Act 1993 provides for a maximum rate that can be charged. That rate is the 10 year long term bond rate (on the last business day in February) plus a risk premium of up to 6%. For 2020-21 this calculation results in a maximum rate of 6.81% and this is the rate being recommended.

5.2.7. The 2020-21 Annual Plan be adopted.

5.2.8. The Long Term Financial Management plan 2021-41 be adopted.

5.2.9. The following delegations be approved:

5.2.9.1 Pursuant to Section 22 of the Local Government Act 1993, the Council delegate to the General Manager the power to expend monies on Council’s behalf identified as Delegation Classification 1 items in the Council’s Annual Plan; and, the Council authorise the General Manager to delegate, pursuant Section 64 of the Local Government Act 1993, to such employees of the Council as he considers appropriate, the power to expend monies on Council’s behalf identified as Delegation Classification 1 items in the Council’s Annual Plan.

5.2.9.2 Pursuant to Section 22 of the Local Government Act 1993, the Council delegate to all the Council Committees the power to expend monies on Council’s behalf identified as Delegation Classification 2 items in the Council’s Annual Plan.

6. Strategic Planning and Policy Considerations

6.1. Pillar 8 – Governance is applicable in considering this report, particularly outcome 8.5.

8.5 Quality services are delivered efficiently, effectively and safely.

8.5.5 Optimise service delivery to ensure organisational sustainability and best value for the community.

8.5.8 Maintain a rating system that supports fairness, capacity to pay and effectiveness.

8.5.9 Monitor and maintain the City’s long-term financial sustainability.

8.5.10 Implement best practice management of the City’s assets.

8.5.11 Proactively seek additional funding opportunities.

7. Financial Implications

7.1. Section 82 of the Local Government Act 1993 requires the General Manager to prepare Estimates of Council’s revenue and expenditure for each financial year, and details what the Estimates must contain.

7.2. The Estimates must be adopted by Council before 31 August by absolute majority.

7.3. As noted above, the 2020-21 Estimates have been prepared in accordance with the updated Long Term Financial Management Plan (refer Attachment C).

8. Marketing and Media

8.1. Communication of the Council’s approval of the Estimates and rating strategy will be by a combination of a media release, publication of the Lord Mayor’s budget speech, information on the City’s website and Facebook pages and an insert with the annual rates notice.

9. Delegation

9.1. Approval of the Estimates is delegated to Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lara MacDonell Manager Finance and City Procurement |

Heather Salisbury Deputy General Manager |

Date: 12 June 2020

File Reference: F20/59222

Attachment a: 2020-21

Budget Estimates ⇩ ![]()

Attachment

b: 2020-21

Annual Plan ⇩ ![]()

Attachment

c: 2021-41

Long Term Financial Management Plan ⇩ ![]()

Attachment

d: 2020-21

Rates Resolution ⇩ ![]()

|

Item No. 10 |

Supplementary Agenda (Open Portion) Finance and Governance Committee Meeting - 16/6/2020 |

Page 20 ATTACHMENT a |

|

Supplementary Agenda (Open Portion) Finance and Governance Committee Meeting - 16/6/2020 |

Page 37 ATTACHMENT b |

|

Supplementary Agenda (Open Portion) Finance and Governance Committee Meeting - 16/6/2020 |

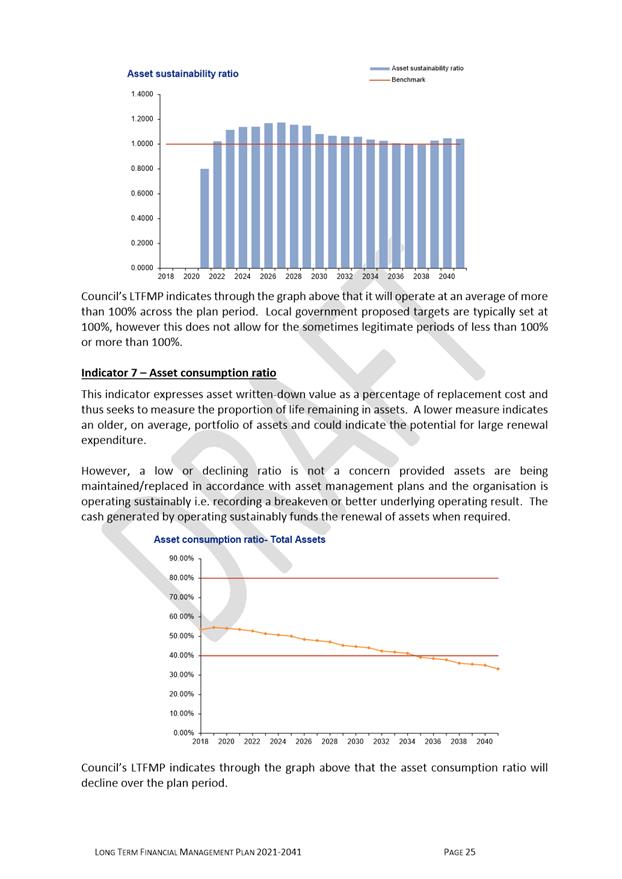

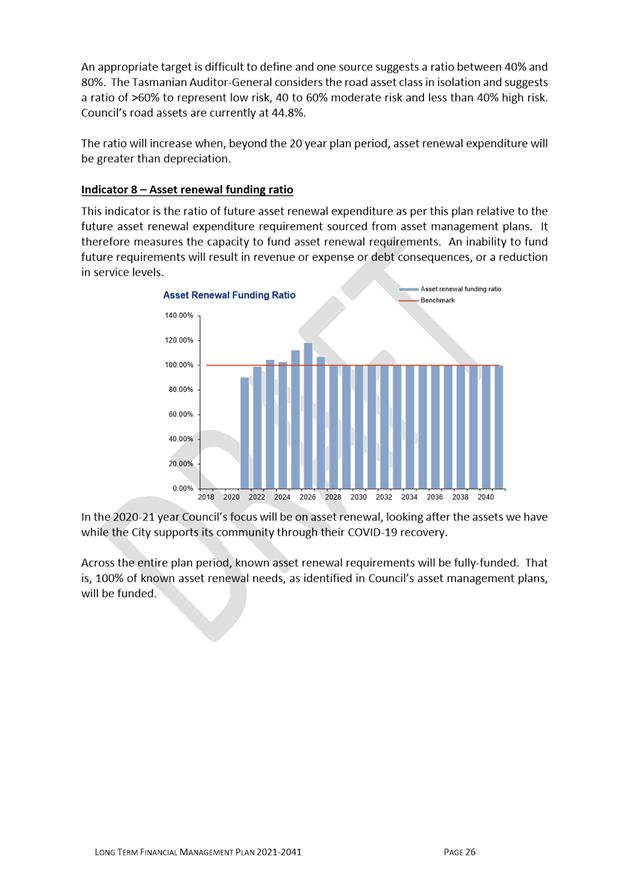

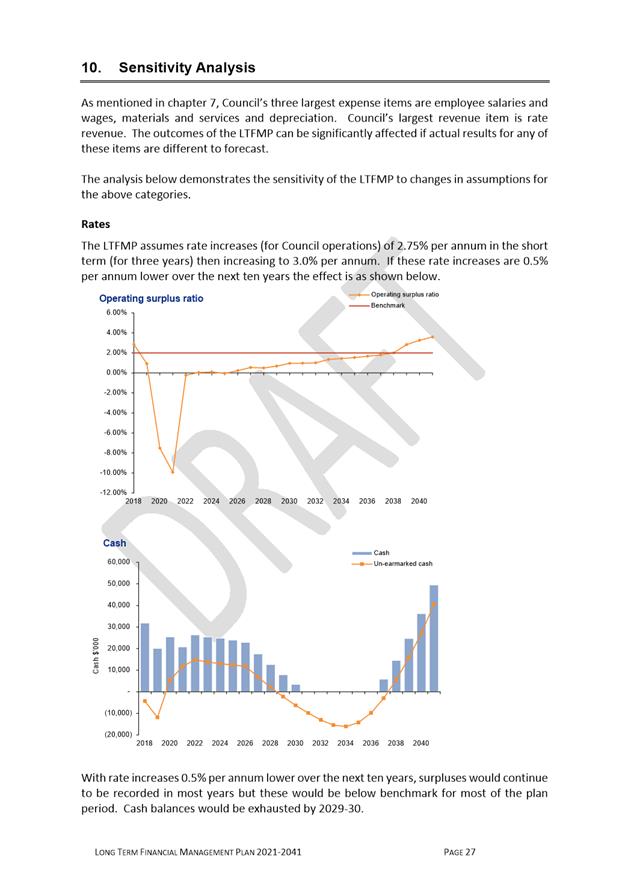

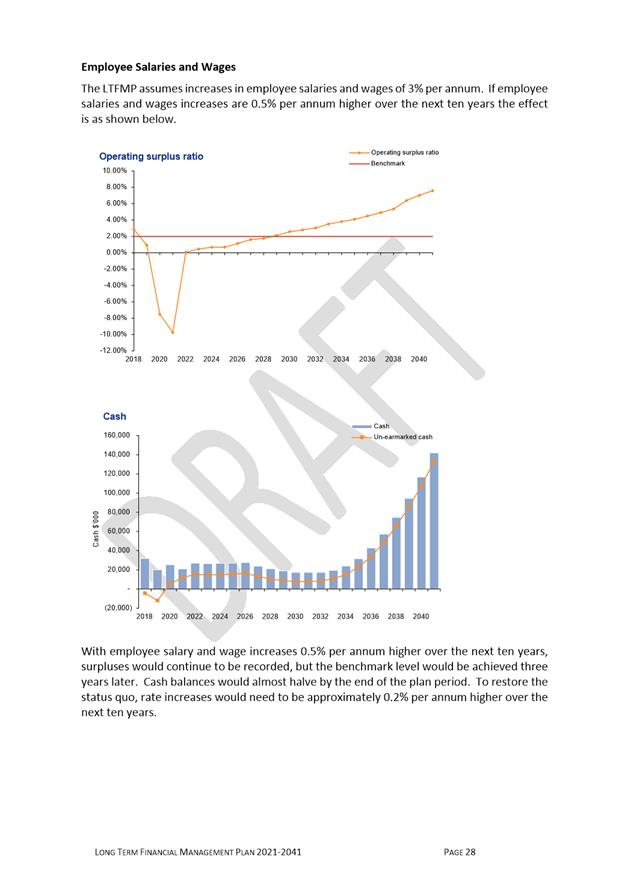

Page 101 ATTACHMENT c |