City

of hobart

AGENDA

Finance and Governance Committee Meeting

Open Portion

Tuesday, 16 June 2020

at 4:30 pm

City

of hobart

AGENDA

Finance and Governance Committee Meeting

Open Portion

Tuesday, 16 June 2020

at 4:30 pm

Working together to make Hobart a better place for the community.

THE VALUES

The Council is:

|

People |

We value people – our community, our customers and colleagues. |

|

Teamwork |

We collaborate both within the organisation and with external stakeholders drawing on skills and expertise for the benefit of our community. |

|

Focus and Direction |

We have clear goals and plans to achieve sustainable social, environmental and economic outcomes for the Hobart community. |

|

Creativity and Innovation |

We embrace new approaches and continuously improve to achieve better outcomes for our community. |

|

Accountability |

We are transparent, work to high ethical and professional standards and are accountable for delivering outcomes for our community. |

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 3 |

|

|

16/6/2020 |

|

Business listed on the agenda is to be conducted in the order in which it is set out, unless the committee by simple majority determines otherwise.

APOLOGIES AND LEAVE OF ABSENCE

1. Co-Option of a Committee Member in the event of a vacancy

3. Consideration of Supplementary Items

4. Indications of Pecuniary and Conflicts of Interest

6.1 COVID-19 Community Support Package - Rates Relief

6.2 Working with Vulnerable People Registration - Elected Members

6.4 Grants and Benefits Listing as at 31 December 2019

6.5 Outstanding Long Term Parking Permit Debts as at 29 February 2020

7. Committee Action Status Report

7.1 Committee Actions - Status Report

9. Closed Portion Of The Meeting

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 5 |

|

|

16/6/2020 |

|

Finance and Governance Committee Meeting (Open Portion) held Tuesday, 16 June 2020 at 4:30 pm.

This meeting of the Finance and Governance Committee is held in accordance with a Notice issued by the Premier on 3 April 2020 under section 18 of the COVID-19 Disease Emergency (Miscellaneous Provisions) Act 2020.

|

COMMITTEE MEMBERS Zucco (Chairman) Deputy Lord Mayor Burnet Sexton Thomas Coats

NON-MEMBERS Lord Mayor Reynolds Briscoe Harvey Behrakis Dutta Sherlock Ewin |

Apologies:

Leave of Absence: Nil.

|

|

The minutes of the Open Portion of the Finance and Governance Committee meeting held on Tuesday, 18 February 2020, are submitted for confirming as an accurate record.

|

Ref: Part 2, Regulation 8(6) of the Local Government (Meeting Procedures) Regulations 2015.

|

That the Committee resolve to deal with any supplementary items not appearing on the agenda, as reported by the General Manager.

|

Ref: Part 2, Regulation 8(7) of the Local Government (Meeting Procedures) Regulations 2015.

Members of the Committee are requested to indicate where they may have any pecuniary or conflict of interest in respect to any matter appearing on the agenda, or any supplementary item to the agenda, which the Committee has resolved to deal with.

Regulation 15 of the Local Government (Meeting Procedures) Regulations 2015.

A Committee may close a part of a meeting to the public where a matter to be discussed falls within 15(2) of the above regulations.

In the event that the committee transfer an item to the closed portion, the reasons for doing so should be stated.

Are there any items which should be transferred from this agenda to the closed portion of the agenda, or from the closed to the open portion of the agenda?

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 6 |

|

|

|

16/6/2020 |

|

6.1 COVID-19 Community Support Package - Rates Relief

Memorandum of the General Manager of 11 June 2020 and attachments.

Delegation: Council

|

Item No. 6.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 8 |

|

|

16/6/2020 |

|

Memorandum: Finance and Governance Committee

COVID-19 Community Support Package - Rates Relief

BACKGROUND

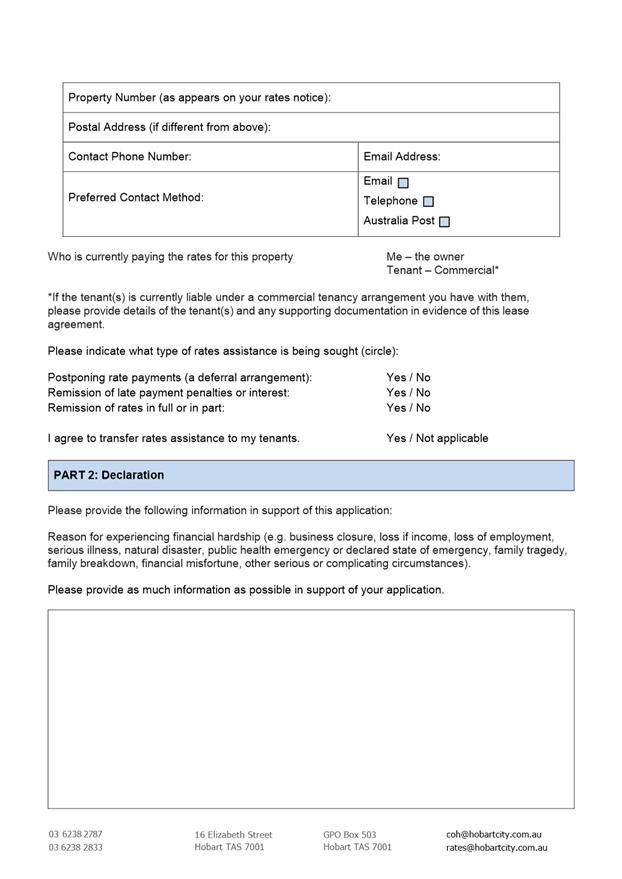

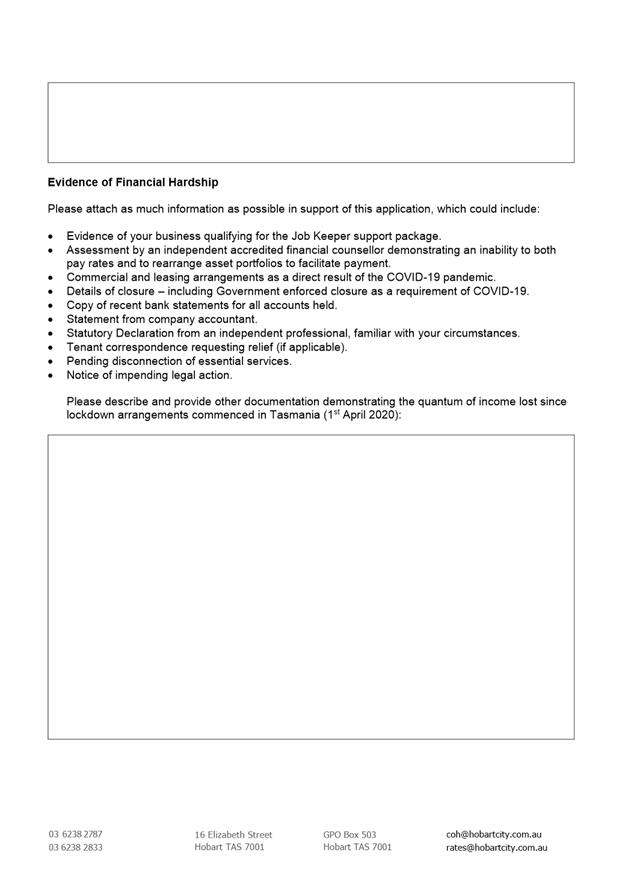

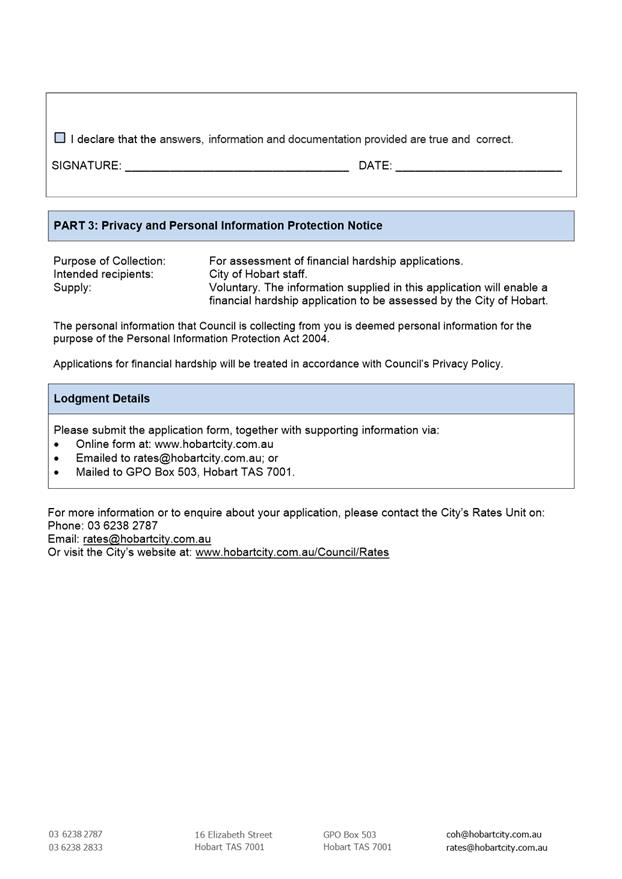

At its meeting on 27 April 2020, the Council approved a Community Support Package in response to the impact of Covid-19 on the Hobart community. The package specifically included:

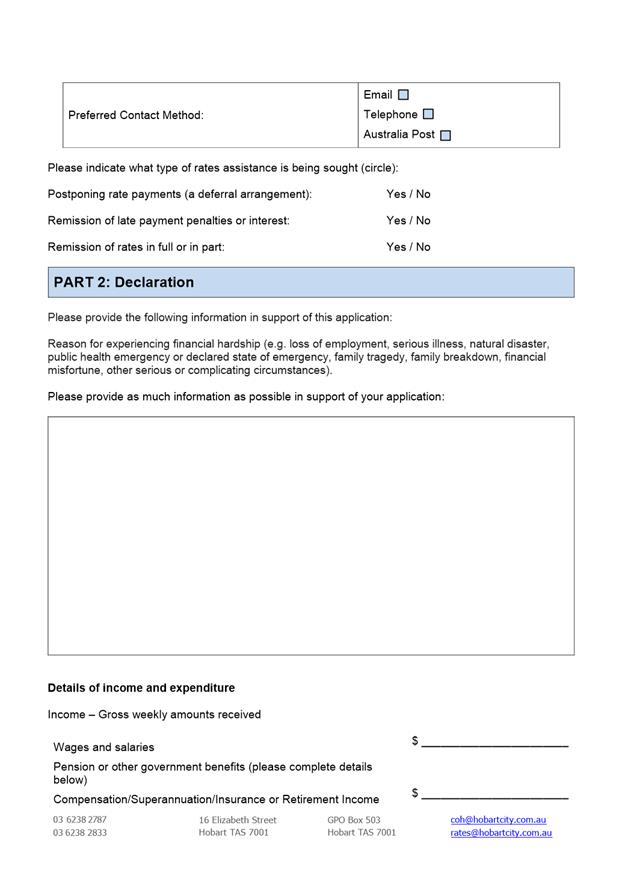

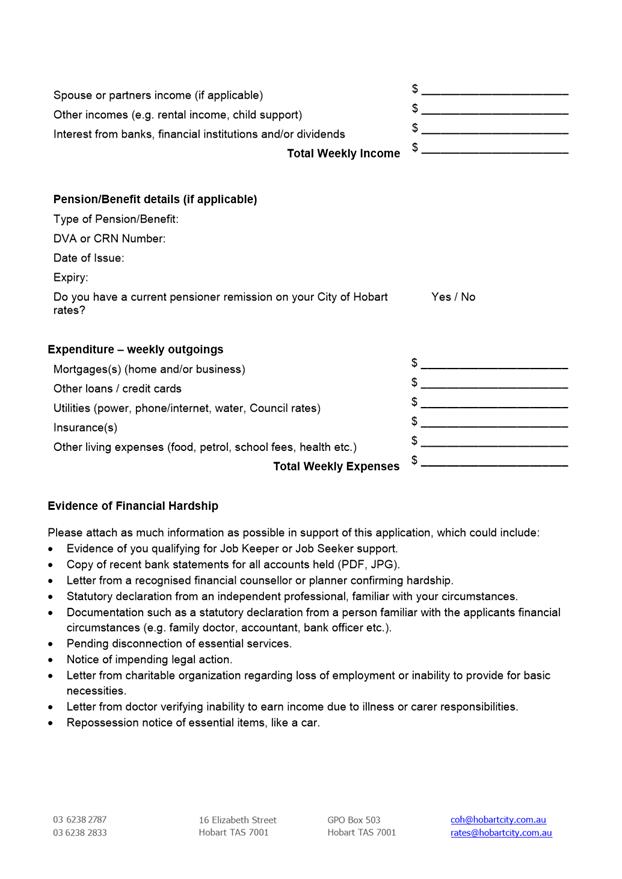

· Rates relief including waiving penalties and interest, negotiated payment plans, formal postponements and remissions on application and determined on a case-by-case basis in accordance with the City’s Financial Hardship Assistance policy approved at the same meeting (Copy at Attachment A).

In the body of the report the modelling for this proposed rates relief indicated a potential impact on rates of some $4.6M, based on remissions for particular property types impacted by Covid-19 (accommodation, arts and galleries, bars, cafes, restaurants, shops etc) in the commercial sector, together with a more limited impact on residential properties, relating to the first rates instalment for 2020-21.

The rates relief in the package aimed to address significant ratepayer concern about the impact of Covid-19 on their business viability and risk of significant closures in the Hobart CBD and was developed at that time in the context of a raft of Federal, State and local government responses to the crisis.

· The Property Council and other bodies and individuals were seeking

Council support in line with that provided by Launceston City Council which

provided a flat rates remission for the last instalment of 2019-20 general

rates and the first instalment of 2020-21 general rates to all commercial

sector properties.

DISCUSSION

In developing the City of Hobart response, the following additional factors were considered:

· Modelling was undertaken on certain classes of properties considered likely to be affected by Covid-19, rather than a blanket coverage for all commercial properties.

· Consistent with the Local Government Act 1993, assistance was to be by application by the ratepayer with assessment on a case by case basis against the Financial Hardship Assistance policy; and

· A range of relief measures were to be considered on application from waiving of late payment penalties and interest through to rates postponements and general rate remissions.

The City’s Financial Hardship Assistance policy, modified from the Local Government Association of Tasmania model policy includes provisions relating to the Covid-19 pandemic and was approved by the Council on 27 April.

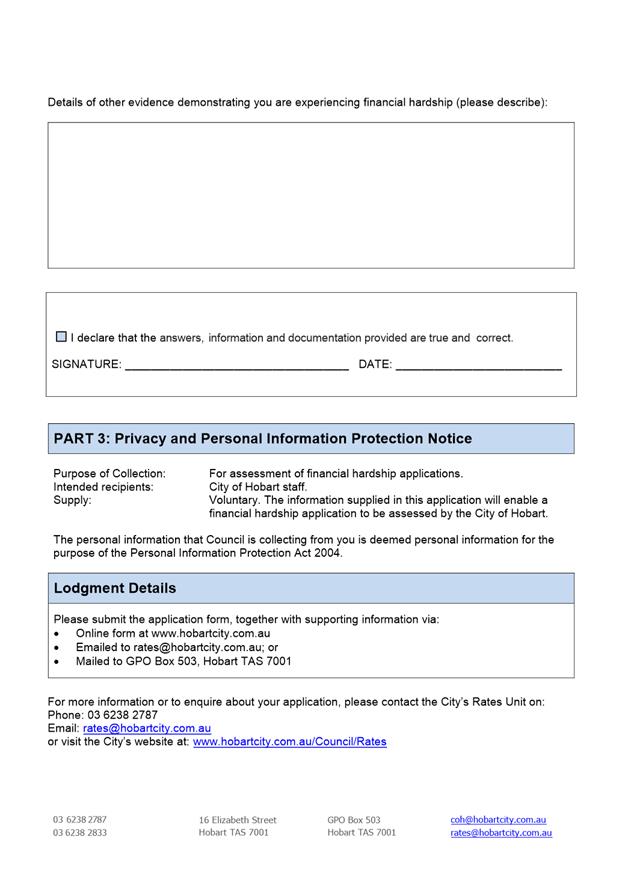

· Since that time, dedicated application information and forms have been developed and promoted on the Council’s web site (Copies at Attachment B and Attachment C).

To date some 74 applications have been received, mostly for rates remissions.

Council’s internal auditors, Wise Lord and Ferguson (WLF) were requested to undertake a compliance audit on the application process in the very early stages so officers could evaluate the methodology and make any amendments to the process before we got too far in.

· The audit was undertaken on all (10) applications assessed as at 5 June 2020

· Initial findings indicate that:

o Compliance testing of the processes and controls implemented by Council indicated full compliance with the processes and documentation implemented.

o The compliance testing indicated that in all instances, hardship was evident and therefore the intent or spirit of the policy is being adopted.

Officers have also identified some issues in application of the policy to the specific Covid-19 situation and these were raised with WLF and considered as an addendum to the compliance audit.

While a formal report is still forthcoming from WLF, based on advice, officers propose the Council consider the following amendments to the Financial Hardship Assistance policy:

Clarity of the Purpose of the Policy

· The Financial Hardship Assistance policy was adopted by Council to broaden the applicability for hardship which was anticipated from the Covid-19 pandemic. In its application it has become apparent that it does not sufficiently cover the Covid-19 circumstances. Where the intention of Council was to support the ratepayers of the City of Hobart through the Covid-19 pandemic, this should be clearly reflected in the policy and the ongoing applicability of the policy should be reviewed after 6 months.

· The current Financial Hardship Assistance Policy is focused on the ratepayer and the hardship experienced at an individual level. It is not structured to specifically deal with residential versus commercial ratepayers and how the Covid-19 pandemic may have impacted commercial ratepayers. For commercial ratepayers, the ownership of property can be held by a range of entities including trusts, companies, partnerships and individuals. The policy is currently structured to consider the hardship of the ‘ratepayer’ and describes a range of personal hardship examples. The ratepayer for commercial properties, however, is the entity that holds the property. If it is the intent of Council is to support the rating base of the City through support for commercial property values, then the policy should reflect this intent and specifically address applications from entities under the policy.

Changes to Criteria

· Applications by commercial ratepayers should be as a result of

rental impacts from tenancies due to COVID-19 or as a result of the impact of

government policy on profitability, such as closing the borders and impacts on

tourism properties.

The applicant ratepayer would be required to provide

clear evidence that the entity who owns the property (the rate paying entity)

has experienced financial hardship, and that any support provided by Council

for landlords as a result of financial hardship of a tenant be passed onto the

tenant. This is a requirement of the Leasing Principles that form part of

the National Code of Conduct legislated by the COVID-19 Disease Emergency

(Commercial Leases) Act 2020. The lease agreements are being

requested as part of the process and they will provide sufficient information

to ascertain the nature of the lease, and the allocation of outgoings to the

tenant in a multi-tenanted property.

Other evidence required to establish eligibility includes bank statements,

Federal Government Job Keeper entitlement (if appropriate), independent

financial advice, correspondence with tenants.

· Residential Investment Properties – the current Financial Hardship Assistance Policy notes that ‘applications for residential investment properties will generally not be considered’. This portion of the policy is reasonable in a ‘normal’ context where residential investment properties were an indicator that the individual rate payer had a sufficient asset base to not meet the definition of hardship. During COVID-19 however, that premise was changed through government policy. It is proposed that COVID-19 financial hardship in relation to residential investment properties be specifically addressed in the policy.

Rate Postponements versus Remissions

The current

application forms under the policy enable the applicant ratepayer to select

which form of assistance they are applying for.

The option of postponement is an important tool for

Council to consider where ratepayers have a deferral in income, that is, a cash

flow impact from COVID-19, and not a permanent impact to their revenue or

profitability. It is proposed that the policy specifically reflect the

option of applying deferrals where revenue or profitability has been

deferred. For example, where rent deferrals have been put in place with

commercial tenancies and not rent discounts, the Council ‘matches’

the assistance provided and provides a postponement, not a remission.

Remissions can be applied for reductions in revenue and profitability that

cannot be recaptured.

PROPOSAL

The proposed policy amendments outlined above result from learnings acquired during application of new arrangements, instituted in the height of the pandemic crisis. In reconsidering the policy, we need to be mindful of Council’s original intent and expectations raised in the community as a result.

Should the Council support the above proposed policy amendments, a marked up version of the policy would be provided prior to the Council meeting on 22 June 2020.

|

That: 1. That the information be received and noted. 2. The Council reaffirm its decision of 27 April 2020 to provide a rates relief support package including waiving penalties and interest, negotiated payment plans, formal postponements and remissions on application on a case by case basis in accordance with the City’s Financial Hardship Assistance policy. 3. The

Financial Hardship Assistance policy be amended to articulate Council’s

specific intent to support the ratepayers of the City of Hobart through the

COVID-19 pandemic and the policy be reviewed in six months time. 4. The policy also specifically address the following: (i) The specific impact of Covid-19 on commercial ratepayers acknowledging that the ratepayer for commercial properties is the entity that holds the property. (ii) Applications by commercial ratepayer should reflect rental impacts from tenancies due to COVID-19 and the COVID-19 Disease Emergency (Commercial Leases) Act 2020 or as a result of the impact of government policy on profitability, such as closing the borders, imposing restrictions or closures. (iii) The applicant would be required to provide clear evidence that the entity who owns the property (the rate paying entity) has experienced financial hardship, and consistent with the Disease Emergency (Commercial Leases) Act 2020 any support provided by Council for landlords as a result of financial hardship of a tenant be passed onto the tenant. (iv) While generally residential investment properties are excluded from the policy, applications from ratepayers in financial hardship as a result of tenants not paying rent as a result of Covid-19 will be considered.

(v) Rate postponements be considered as the first option in assisting ratepayers affected by Covid-19 where rent deferrals have been put in place with commercial tenancies and not rent discounts. Remissions to be applied for reductions in revenue and profitability that cannot be recaptured. 5. Should the Council support the above proposed policy amendments, a marked up version of the policy be provided prior to the Council meeting on 22 June 2020.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N D Heath General Manager |

|

Date: 11 June 2020

File Reference: F20/58648

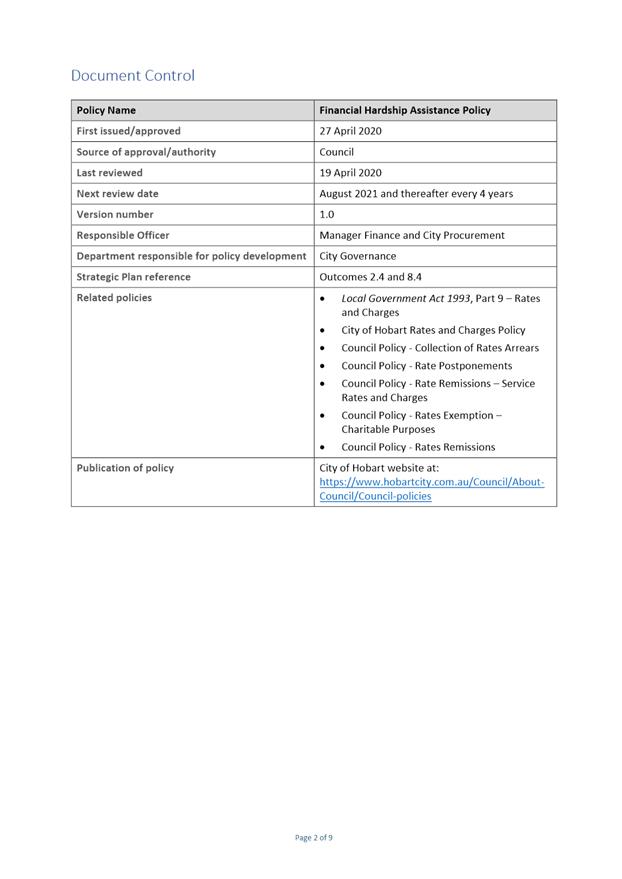

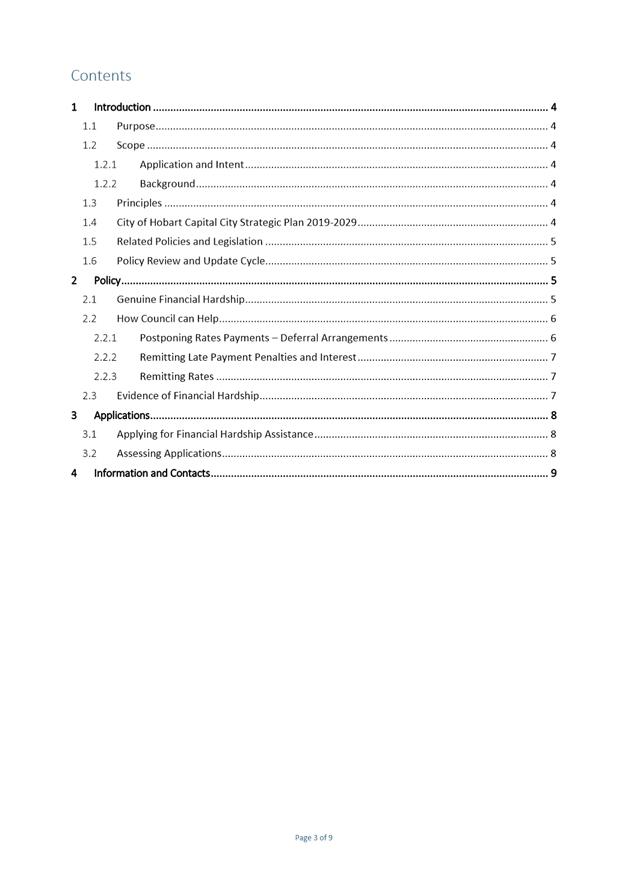

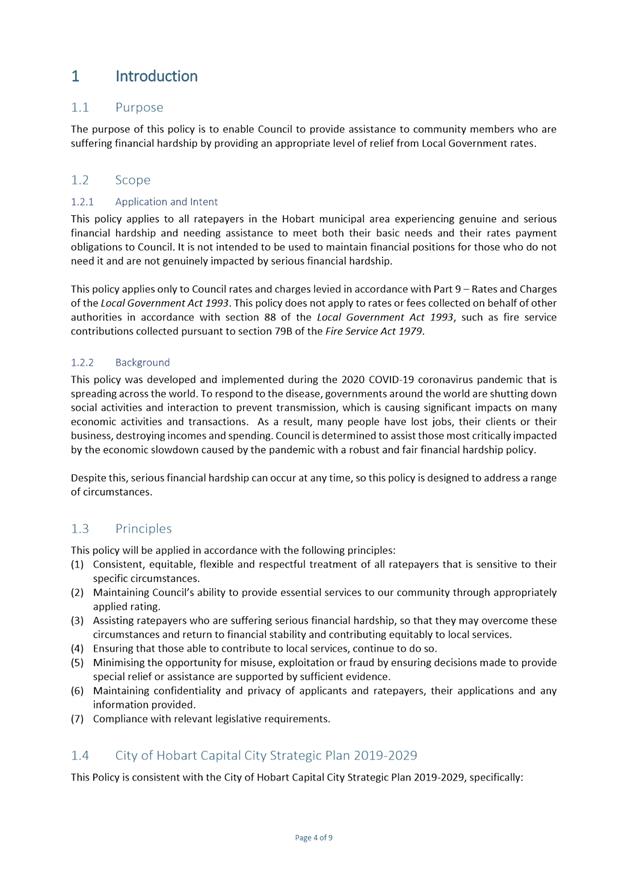

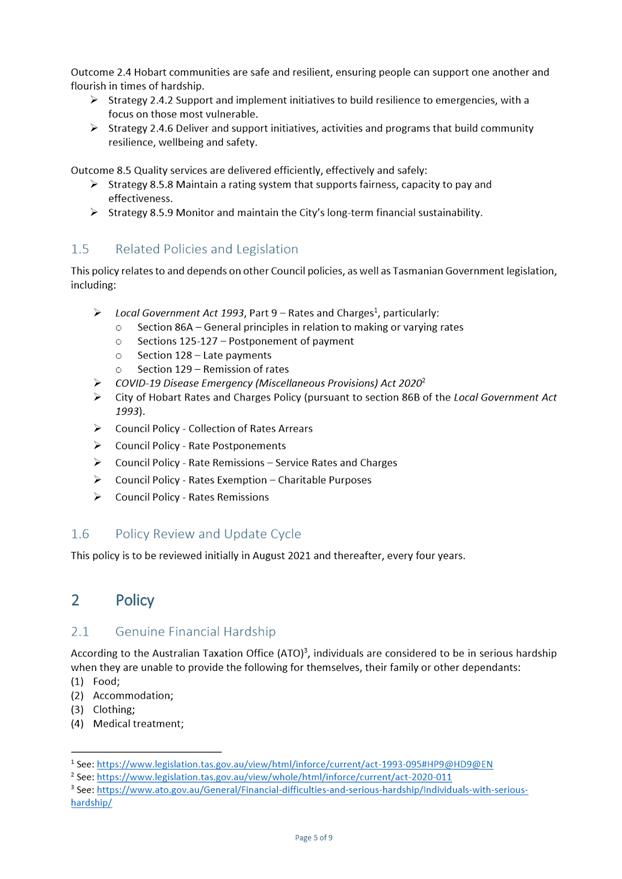

Attachment a: Financial

Hardship Assistance Policy - Council Approved -

27 April 2020 ⇩ ![]()

Attachment

b: Financial

Hardship Application Form - Residential ⇩ ![]()

Attachment

c: Financial

Hardship Application Form - Commercial Business or Organisation ⇩ ![]()

|

Item No. 6.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 16/6/2020 |

Page 20 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 16/6/2020 |

Page 21 ATTACHMENT b |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 16/6/2020 |

Page 30 ATTACHMENT c |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 31 |

|

|

|

16/6/2020 |

|

6.2 Working with Vulnerable People Registration - Elected Members

Memorandum of the General Manager of 30 April 2020.

Delegation: Council

|

Item No. 6.2 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 33 |

|

|

16/6/2020 |

|

Memorandum: Finance and Governance Committee

Working with Vulnerable People Registration - Elected Members

At its meeting of 16 December 2019 the Council resolved the following:

“Given Elected Members often attend functions where there are young and vulnerable community members present a report be prepared investigating the requirement for Elected Members to undertake a Police check and registration to work with vulnerable people. The report to also consider the referral of the matter to the Local Government Association of Tasmania for consideration.”

In consideration of elected members attaining the proposed accreditation there are many examples and instances of interactions that may take place in the course of an elected member carrying out their duties and or acting in a volunteering capacity.

This may include:

· Conducting Town Hall tours with students

· Sister City delegations with accompanying school groups

· Volunteering in emergency response situations

· Children’s week festivities

· YouthArc activities

· Citizenship Ceremonies

· Christmas Pageant

When an application for Working with Vulnerable People (Children) registration is lodged, an applicant gives consent to undergo a national background check.

Costs associated with attaining registration are:

· Employment / volunteer $113.40

· Volunteer only $19.44

It is proposed the costs for registration will be met from the elected member allowances and expenses budget function and there is funding available in the current financial year’s budget. The cost, however, would not be attributed to individual elected members as it is considered a cost related to carrying out the duties of the role as an elected member.

|

That: 1. Elected members be provided the opportunity to attain a Working with Vulnerable People (Children) registration. 2. As a cost related to carrying out the duties of the role as an elected member, the costs associated with the registration will be met from the elected member allowances and expenses budget function. 3. The Local Government Association of Tasmania be advised of the resolution, recommending it encourage other Council’s to adopt the initiative.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N D Heath General Manager |

|

Date: 30 April 2020

File Reference: F20/36798

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 34 |

|

|

16/6/2020 |

|

6.3 Conference Reporting - Local Government

Association of Tasmania Elected Member Professional Development Weekend 2020 -

29 February 2020 to 1 March 2020

Memorandum of the General Manager of 11 June 2020 and attachment.

Delegation: Committee

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 35 |

|

|

16/6/2020 |

|

Memorandum: Finance and Governance Committee

Conference Reporting - Local Government Association of Tasmania Elected Member Professional Development Weekend 2020 - 29 February 2020 to 1 March 2020

Councillor Ewin has submitted the attached report in accordance with Clause H(2) of the Council’s policy titled Elected Member Development and Support.

|

That the information be received and noted.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N D Heath General Manager |

|

Date: 11 June 2020

File Reference: F20/41479

Attachment a: Local

Government Association of Tasmania Elected Member Weekend 2020 - 29 February

2020 to 1 March 2020 - Report ⇩ ![]()

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 16/6/2020 |

Page 38 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 39 |

|

|

|

16/6/2020 |

|

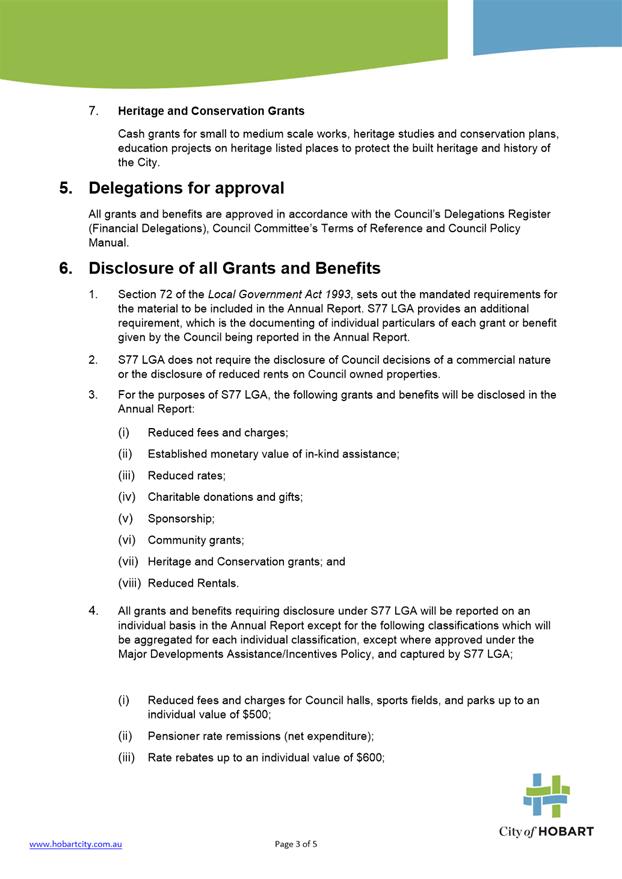

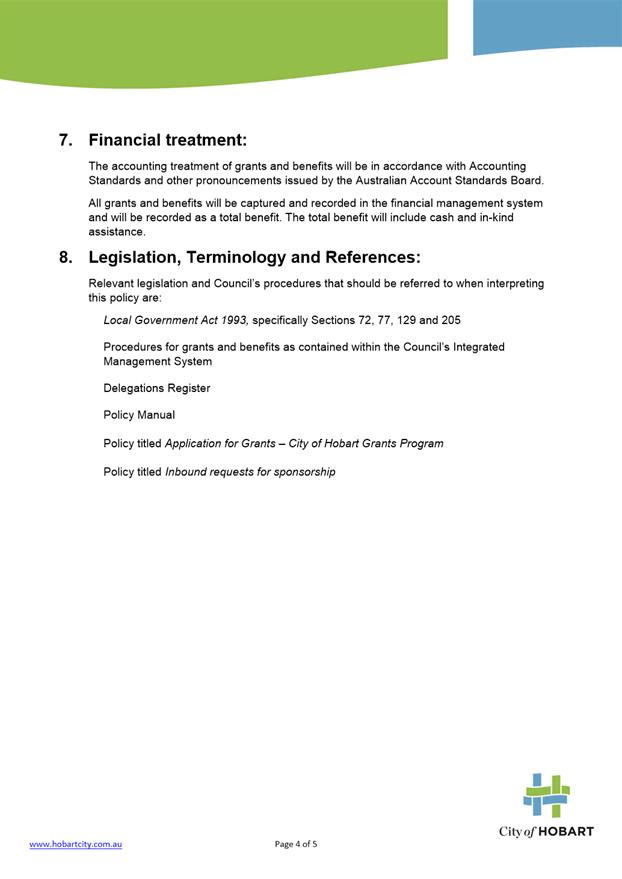

6.4 Grants and Benefits Listing as at 31 December 2019

Report of the Manager Finance and City Procurement and the Deputy General Manager of 30 April 2020 and attachments.

Delegation: Committee

|

Item No. 6.4 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 42 |

|

|

16/6/2020 |

|

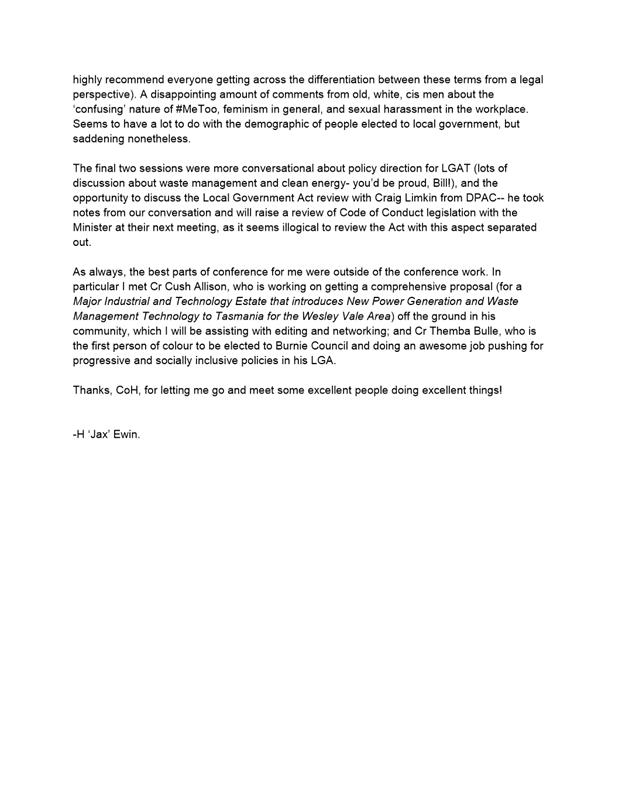

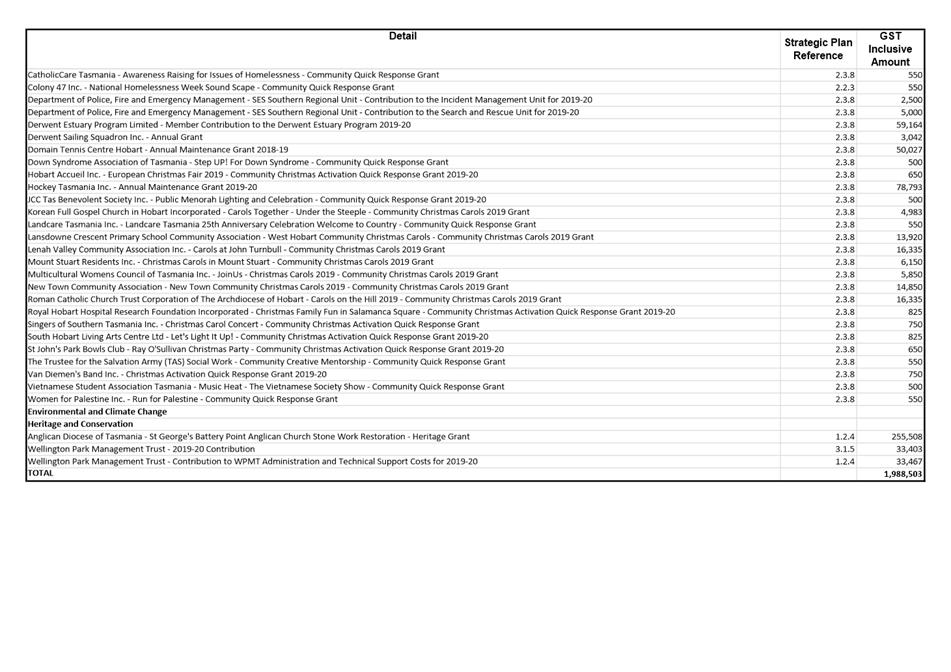

REPORT TITLE: Grants and Benefits Listing as at

31 December 2019

REPORT PROVIDED BY: Manager Finance and City Procurement

Deputy General Manager

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to provide a listing of the grants and benefits provided by the Council for the period 1 October to 31 December 2019.

2. Report Summary

2.1. A report outlining all grants and benefits provided by Council Committees and Council for the period 1 October to 31 December 2019 is attached.

2.2. It is proposed that the Committee note the listing of grants and benefits provided for the period 1 October to 31 December 2019, and that these are required, pursuant to Section 77 of the Local Government Act 1993 (“LG Act”), to be included in the annual report of Council.

|

That the Finance and Governance Committee receive and note the information contained in the report titled ‘Grants and Benefits Listing as at 31 December 2019’.

|

4. Background

4.1. A report outlining the grants and benefits provided for the period 1 October to 31 December 2019 is provided at Attachment A.

4.2. Pursuant to Section 77 of the LG Act, the details of any grant made or benefit provided will be included in the annual report of the Council.

4.3. The listing of grants and benefits marked as Attachment A, has been prepared in accordance with the Council policy titled Grants and Benefits Disclosure – refer Attachment B.

5. Proposal and Implementation

5.1. It is proposed that the Committee note the grants and benefits listing as at 31 December 2019.

5.2. It is also proposed that the Committee note that the grants and benefits listed are required to be included in the Annual Report of the Council and will be listed on the City of Hobart’s website.

6. Strategic Planning and Policy Considerations

6.1. Grants and benefits are provided to organisations which undertake activities and programs that strongly align with the City of Hobart Capital City Strategic Plan 2019-2029 as well as other relevant City of Hobart strategies.

6.2. The linkage between the City’s grants and benefits provided and the City of Hobart Capital City Strategic Plan 2019-2029 is referenced in Attachment A.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. All grants and benefits provided as at 31 December 2019 were funded from the 2019-20 budget estimates.

8. Legal, Risk and Legislative Considerations

8.1. The Council provides grants and benefits within the requirements of Section 77 of the LG Act as follows:

8.1.1. Grants and benefits

(1) A council may make a grant or provide a pecuniary benefit or a non-pecuniary benefit that is not a legal entitlement to any person, other than a councillor, for any purpose it considers appropriate.

(1A) A benefit provided under subsection (1) may include:

(a) in-kind assistance; and

(b) fully or partially reduced fees, rates or charges; and

(c) remission of rates or charges under Part 9 (rates and charges)

(2) The details of any grant made or benefit provided are to be included in the annual report of the council.

8.2. Section 72 of the LG Act requires Council to produce an Annual Report with Section 77 of the LG Act providing an additional requirement where individual particulars of each grant or benefit given by the Council must be recorded in the Annual Report.

8.3. Section 207 of the LG Act provides for the remitting of all or part of any fee or charge paid or payable.

8.4. Section 129 of the LG Act provides for the remitting of rates.

9. Delegation

9.1. This report is provided to the Finance and Governance Committee for information.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lara MacDonell Manager Finance and City Procurement |

Heather Salisbury Deputy General Manager |

Date: 30 April 2020

File Reference: F20/36800; 25-2-1

Attachment a: Grants

and Benefits Listing as at 31 December 2019 ⇩ ![]()

Attachment

b: Council

Policy - Grants and Benefits Disclosure ⇩ ![]()

|

Item No. 6.4 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 16/6/2020 |

Page 44 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 16/6/2020 |

Page 49 ATTACHMENT b |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 50 |

|

|

|

16/6/2020 |

|

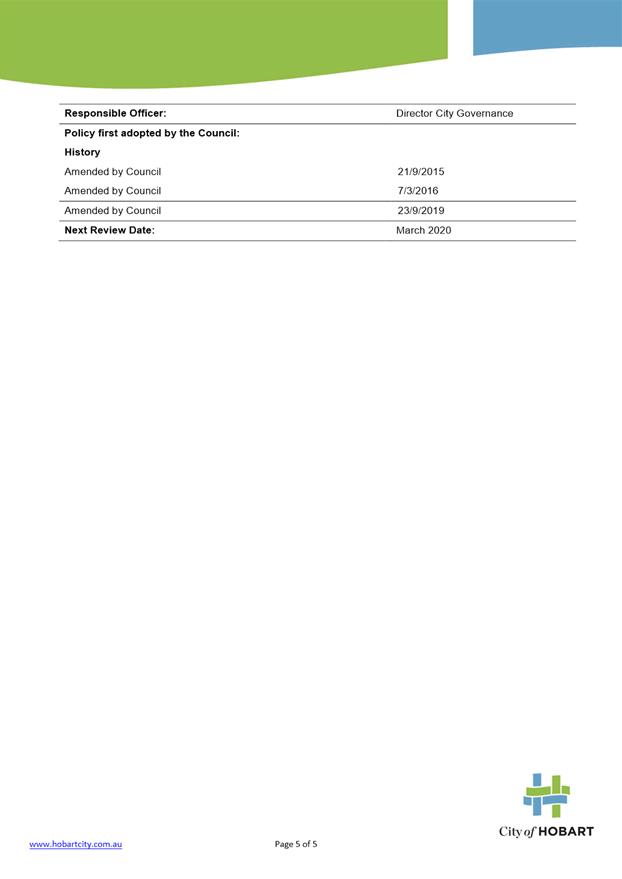

6.5 Outstanding Long Term Parking Permit Debts as at 29 February 2020

Memorandum of the Financial Operations Manager and the Deputy General Manager of 30 April 2020 and attachment.

Delegation: Committee

|

Item No. 6.5 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 52 |

|

|

16/6/2020 |

|

Memorandum: Finance and Governance Committee

Outstanding Long Term Parking Permit Debts as at

29 February 2020

|

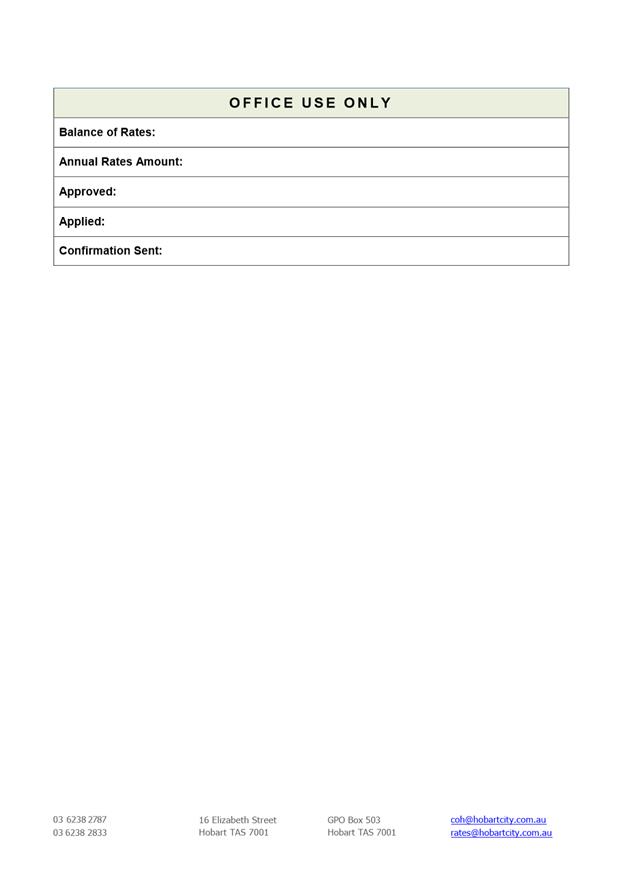

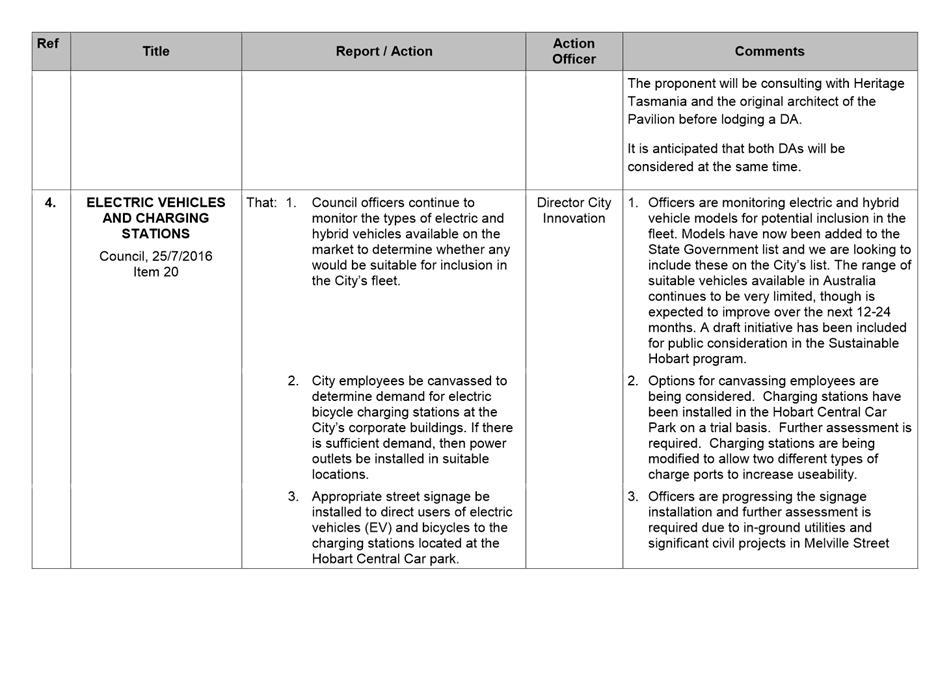

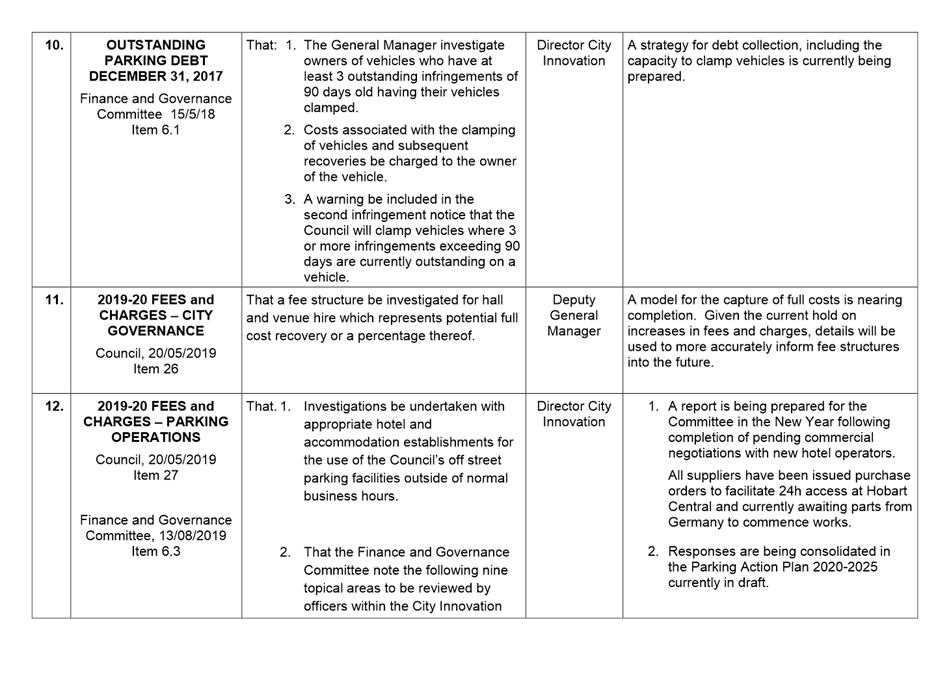

|

28-Feb-19 |

% of total O/S |

31-Jan-20 |

% of total O/S |

29-Feb-20 |

% of total O/S |

|

|

$ |

|

$ |

|

$ |

|

|

Current |

75,805 |

85% |

55,417 |

85% |

63,630 |

91% |

|

30 days |

8,531 |

10% |

4,467 |

7% |

1,432 |

2% |

|

60 days |

803 |

1% |

576 |

1% |

276 |

0% |

|

90 days |

3,514 |

4% |

4,898 |

7% |

4,692 |

7% |

|

Total |

88,653 |

|

65,358 |

|

70,030 |

|

|

|

|

|

|

|

|

|

|

* 30 days+(all) |

12,848 |

15% |

9,941 |

15% |

6,400 |

9% |

Attachment A shows a three year comparison of outstanding long term parking permit debts.

|

That the information contained in the memorandum of the Manager Finance and the Deputy General Manager of 3 March 2020 titled “Outstanding Long Term Parking Permit Debts as at 29 February 2020” be received and noted.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Michael Greatbatch Manager Finance |

Heather Salisbury Deputy General Manager |

Date: 30 April 2020

File Reference: F20/36815

Attachment a: Three

Year Comparison of Outstanding Long Term Parking Permit Debts ⇩ ![]()

|

Item No. 6.5 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 16/6/2020 |

Page 53 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 54 |

|

|

|

16/6/2020 |

|

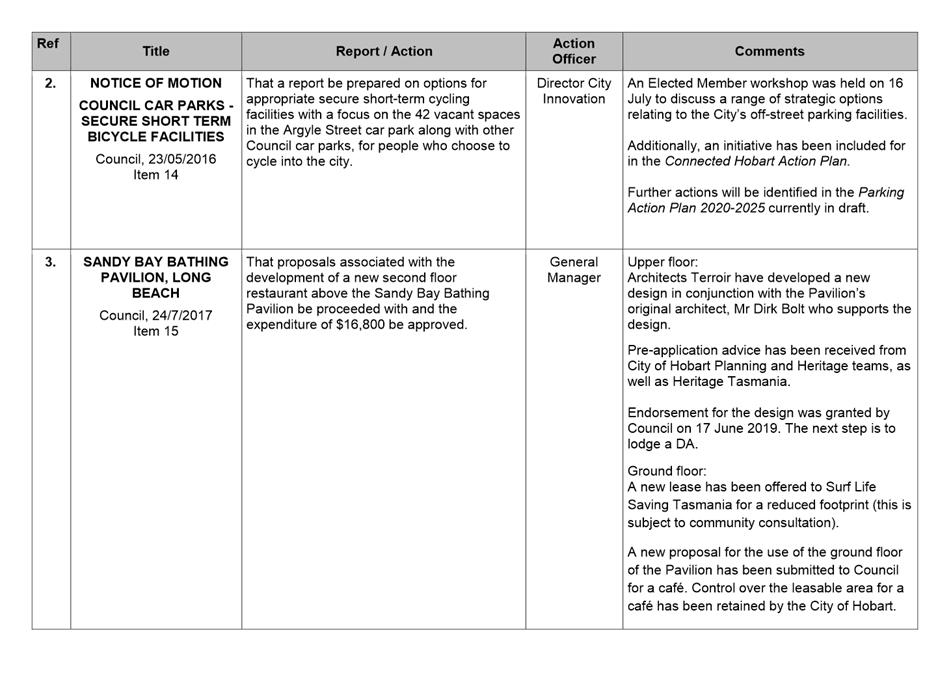

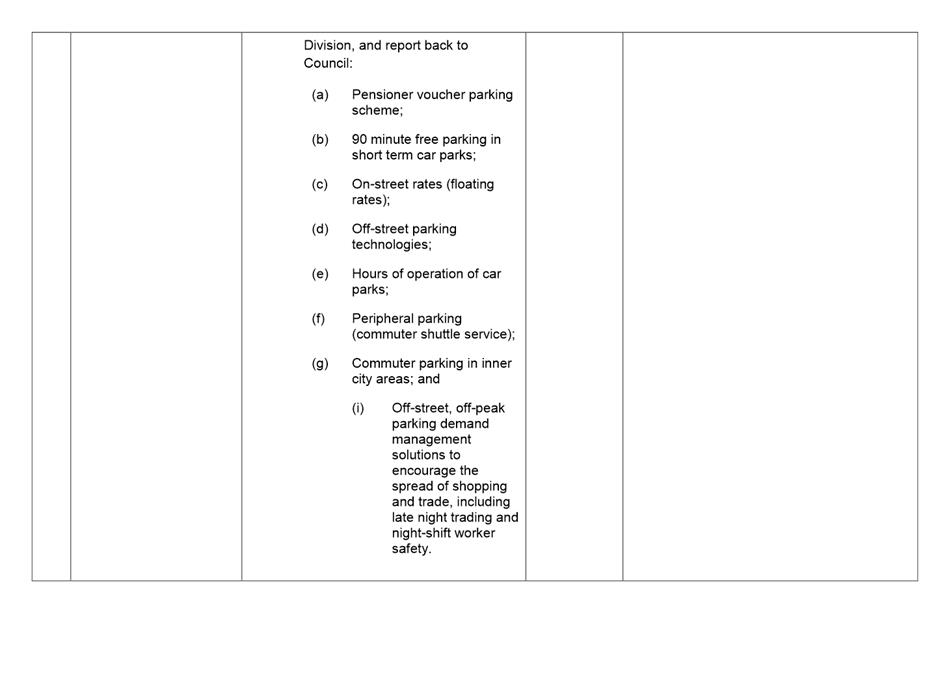

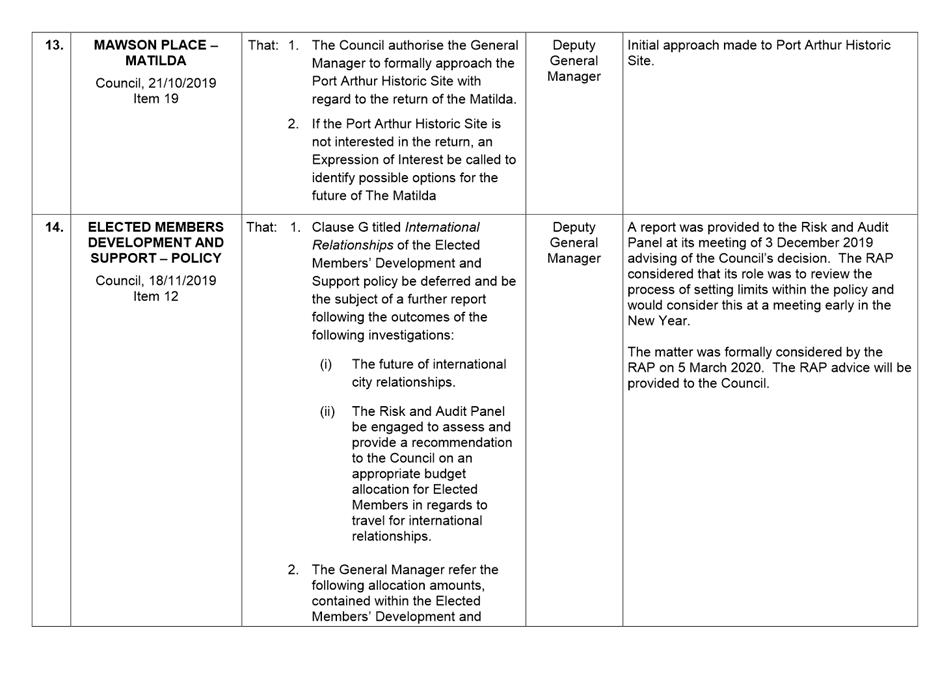

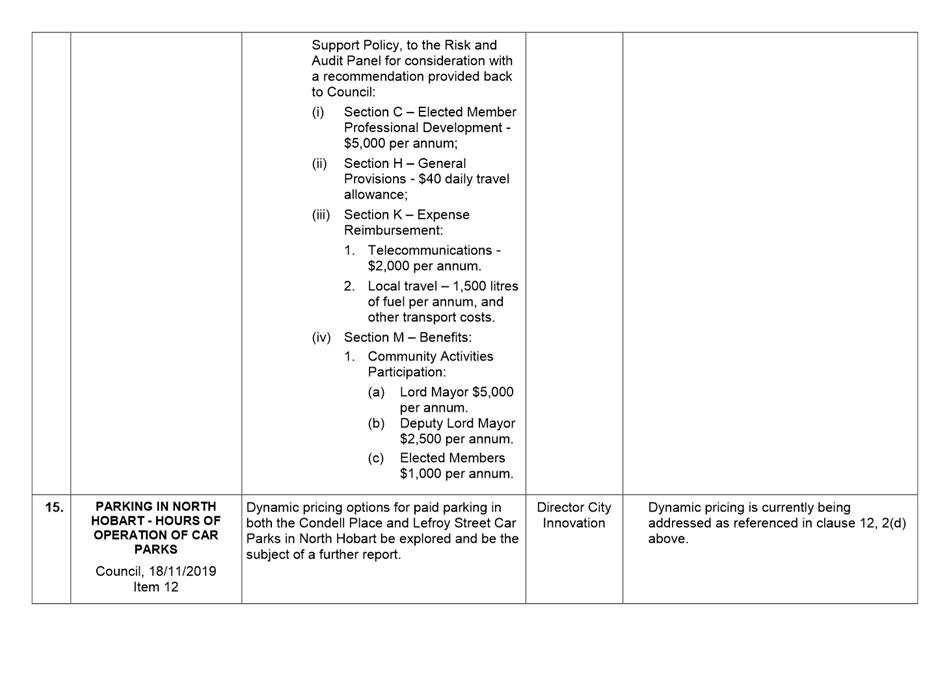

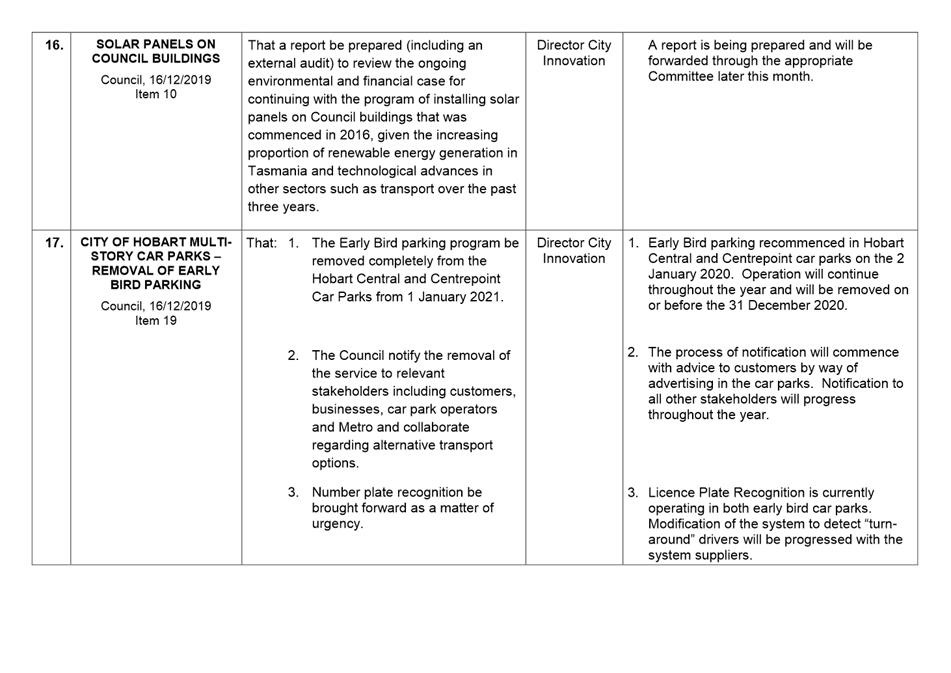

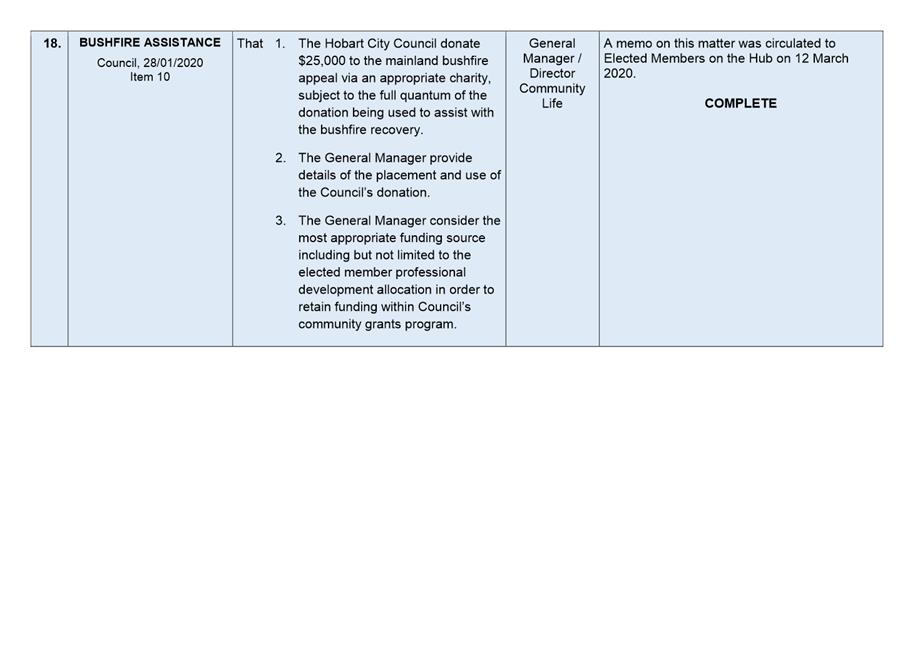

A report indicating the status of current decisions is attached for the information of Elected Members.

REcommendation

That the information be received and noted.

Delegation: Committee

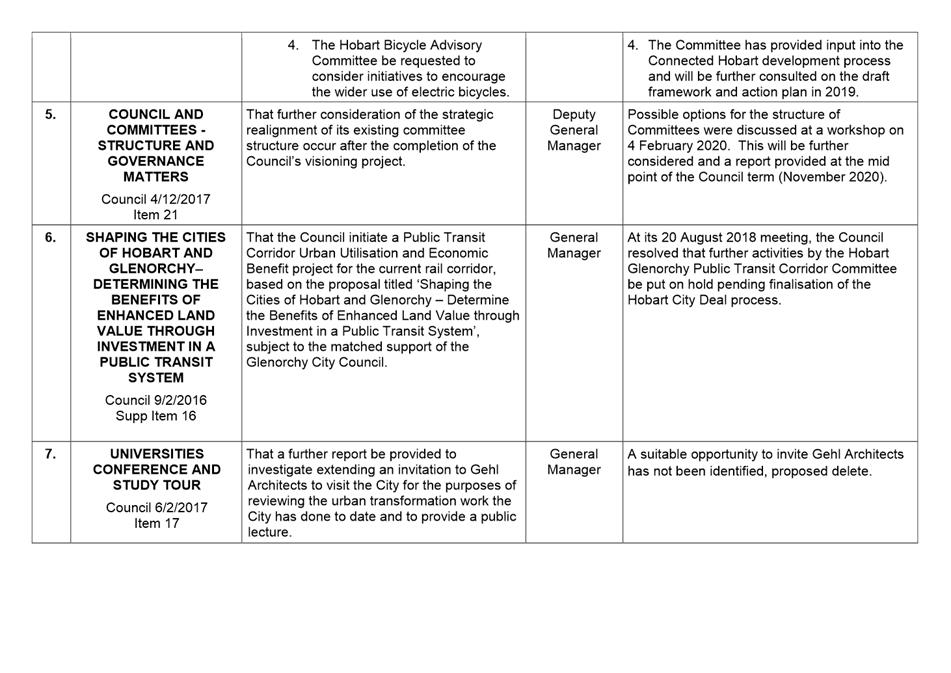

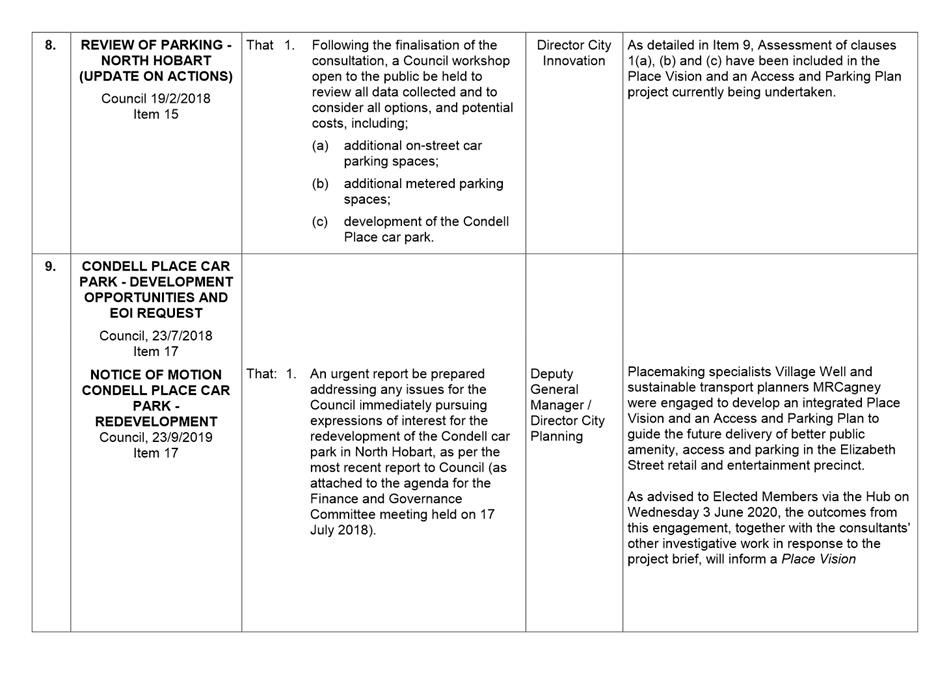

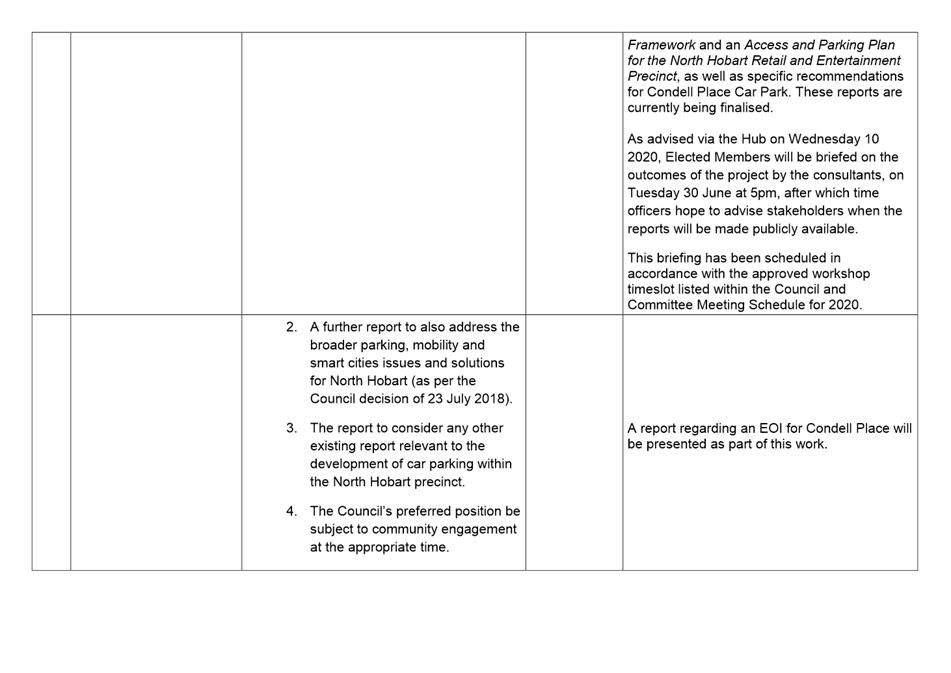

Attachment a: Finance and Governance Committee Status Report - Open

|

Item No. 7.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 16/6/2020 |

Page 66 ATTACHMENT a |

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 67 |

|

|

16/6/2020 |

|

Section 29 of the Local Government (Meeting Procedures) Regulations 2015.

File Ref: 13-1-10

An Elected Member may ask a question without notice of the Chairman, another Elected Member, the General Manager or the General Manager’s representative, in line with the following procedures:

1. The Chairman will refuse to accept a question without notice if it does not relate to the Terms of Reference of the Council committee at which it is asked.

2. In putting a question without notice, an Elected Member must not:

(i) offer an argument or opinion; or

(ii) draw any inferences or make any imputations – except so far as may be necessary to explain the question.

3. The Chairman must not permit any debate of a question without notice or its answer.

4. The Chairman, Elected Members, General Manager or General Manager’s representative who is asked a question may decline to answer the question, if in the opinion of the respondent it is considered inappropriate due to its being unclear, insulting or improper.

5. The Chairman may require a question to be put in writing.

6. Where a question without notice is asked and answered at a meeting, both the question and the response will be recorded in the minutes of that meeting.

7. Where a response is not able to be provided at the meeting, the question will be taken on notice and

(i) the minutes of the meeting at which the question is asked will record the question and the fact that it has been taken on notice.

(ii) a written response will be provided to all Elected Members, at the appropriate time.

(iii) upon the answer to the question being circulated to Elected Members, both the question and the answer will be listed on the agenda for the next available ordinary meeting of the committee at which it was asked, where it will be listed for noting purposes only.

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 68 |

|

|

16/6/2020 |

|

|

That the Committee resolve by majority that the meeting be closed to the public pursuant to regulation 15(1) of the Local Government (Meeting Procedures) Regulations 2015 because the items included on the closed agenda contain the following matters:

· A matter relating to financial hardship; · Proposals for the Council to acquire land or an interest in land or for the disposal of land; and · Information of a personal and confidential nature or information provided to the Council on the condition it is kept confidential.

The following items are listed for discussion:-

Item No. 1 Minutes of the last meeting of the Closed Portion of the Committee Meeting Item No. 2 Consideration of supplementary items to the agenda Item No. 3 Indications of pecuniary and conflicts of interest Item No. 4 Reports Item No. 4.1 Financial Hardship - Rates Remission Request LG(MP)R 15(2)(j) Item No. 4.2 Hobart City Council Loan Portfolio - KPMG Review LG(MP)R 15(2)(b) and (g) Item No. 4.3 Giblin Street Ex-Asphalt Plant Site - Future Options for Residential Zoned Land LG(MP)R 15(2)(f) Item No. 4.4 Outstanding Sundry Debts as at 29 February 2020 LG(MP)R 15(2)(g) Item No. 5 Committee Action Status Report Item No. 5.1 Committee Actions - Status Report LG(MP)R 15(2)(b), (c)(i), (c)(ii), (d), (f), (g), (i) and (j) Item No. 6 Responses to Questions Without Notice Item No. 6.1 Visitor Centres LG(MP)R 15(2)(b) Item No. 7 Questions Without Notice

|