City

of hobart

AGENDA

Special Finance and Governance Committee Meeting

Open Portion

Monday, 4 November 2019

at 4:50 pm

Lady Osborne Room, Town Hall

City

of hobart

AGENDA

Special Finance and Governance Committee Meeting

Open Portion

Monday, 4 November 2019

at 4:50 pm

Lady Osborne Room, Town Hall

Working together to make Hobart a better place for the community.

THE VALUES

The Council is:

|

People |

We value people – our community, our customers and colleagues. |

|

Teamwork |

We collaborate both within the organisation and with external stakeholders drawing on skills and expertise for the benefit of our community. |

|

Focus and Direction |

We have clear goals and plans to achieve sustainable social, environmental and economic outcomes for the Hobart community. |

|

Creativity and Innovation |

We embrace new approaches and continuously improve to achieve better outcomes for our community. |

|

Accountability |

We work to high ethical and professional standards and are accountable for delivering outcomes for our community. |

|

|

Agenda (Open Portion) Special Finance and Governance Committee Meeting |

Page 3 |

|

|

4/11/2019 |

|

Business listed on the agenda is to be conducted in the order in which it is set out, unless the committee by simple majority determines otherwise.

APOLOGIES AND LEAVE OF ABSENCE

1. Co-Option of a Committee Member in the event of a vacancy

2. Indications of Pecuniary and Conflicts of Interest

4.1 2018-19 Financial Statements

|

|

Agenda (Open Portion) Special Finance and Governance Committee Meeting |

Page 4 |

|

|

4/11/2019 |

|

Special Finance and Governance Committee Meeting (Open Portion) held Monday, 4 November 2019 at 4:50 pm in the Lady Osborne Room, Town Hall.

|

COMMITTEE MEMBERS Zucco (Chairman) Deputy Lord Mayor Burnet Sexton Thomas Dutta

NON-MEMBERS Lord Mayor Reynolds Briscoe Denison Harvey Behrakis Ewin Sherlock |

Apologies:

Leave of Absence:

|

Ref: Part 2, Regulation 8(7) of the Local Government (Meeting Procedures) Regulations 2015.

Members of the committee are requested to indicate where they may have any pecuniary or conflict of interest in respect to any matter appearing on the agenda, or any supplementary item to the agenda, which the committee has resolved to deal with.

Regulation 15 of the Local Government (Meeting Procedures) Regulations 2015.

A committee may close a part of a meeting to the public where a matter to be discussed falls within 15(2) of the above regulations.

In the event that the committee transfer an item to the closed portion, the reasons for doing so should be stated.

Are there any items which should be transferred from this agenda to the closed portion of the agenda, or from the closed to the open portion of the agenda?

|

Agenda (Open Portion) Special Finance and Governance Committee Meeting |

Page 5 |

|

|

|

4/11/2019 |

|

4.1 2018-19 Financial Statements

Report of the Manager Finance and the Deputy General Manager of 1 November 2019 and attachments.

The General Manager reports:

The Risk and Audit Panel has considered the financial statements and is comfortable with the accuracy of the statements themselves. However, the Panel has also considered a range of strategic financial issues which are informed by the statements and has identified opportunities to strengthen Council’s key performance ratios.

The Risk and Audit Panel understands that Council intends to review its Long Term Financial Management Plan during the current financial year, and fully supports this being undertaken at an early stage. It also recommends that this Plan be utilised as a base line against which future years’ performances are monitored.

Delegation: Council

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance and Governance Committee Meeting |

Page 6 |

|

|

4/11/2019 |

|

REPORT TITLE: 2018-19 Financial Statements

REPORT PROVIDED BY: Manager Finance

Deputy General Manager

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to present the financial statements for the year ended 30 June 2019 for adoption by Council.

2. Report Summary

2.1. The Council’s financial statements for the year ended 30 June 2019 have been prepared and independently audited.

2.2. The Auditor-General has completed his audit and issued an unqualified audit opinion on the financial statements (see Attachments B and C).

2.3. Council’s 2018-19 underlying surplus of $1.246 million is less than the original 2018-19 budget position, however more than the most recent 2018-19 forecast.

|

That:

1. The Council note that in accordance with section 84(4) of the Local Government Act 1993 that the General Manager tables the certified financial statements for the year ended 30 June 2019 marked as Attachment A to this report. 2. In doing so the Council notes the advice from the Risk and Audit Panel as follows: (i) The Risk and Audit Panel has considered the financial statements and is comfortable with the accuracy of the statements themselves. However, the Panel has also considered a range of strategic financial issues which are informed by the statements and has identified opportunities to strengthen Council’s key performance ratios. (ii) The Risk and Audit Panel understands that Council intends to review its Long Term Financial Management Plan during the current financial year, and fully supports this being undertaken at an early stage. It also recommends that this Plan be utilised as a base line against which future years’ performances are monitored.

|

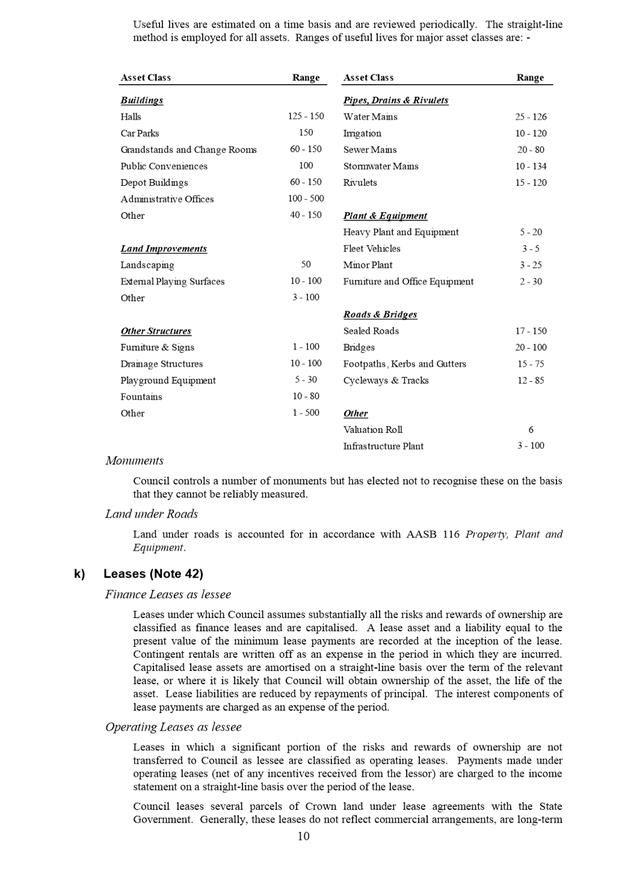

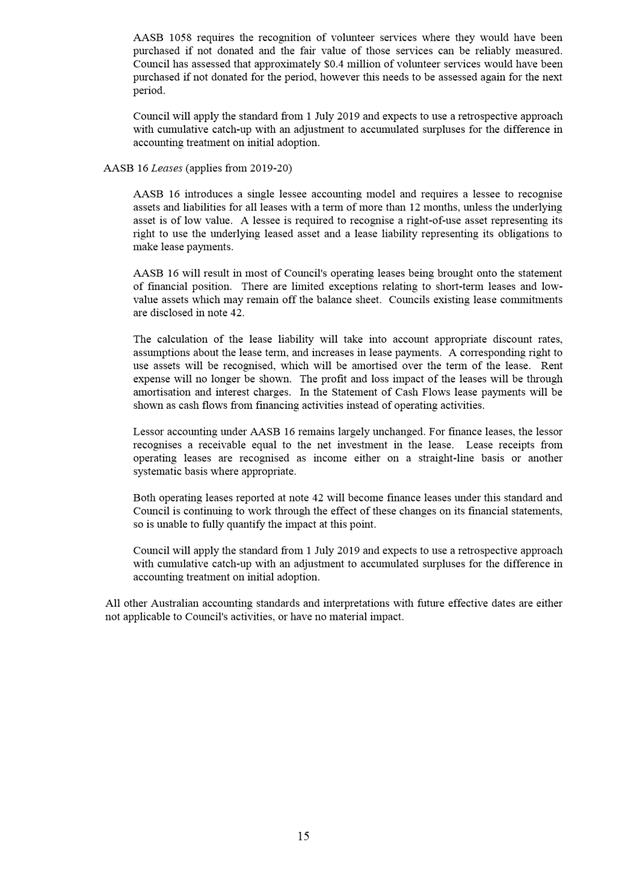

4. Background

4.1. The financial statements for the year ended 30 June 2019 have been prepared on a consistent basis with prior years.

4.2. The financial statements were presented to the Risk and Audit Panel on 6 August 2019 and received the endorsement of that Panel subject to the following changes: -

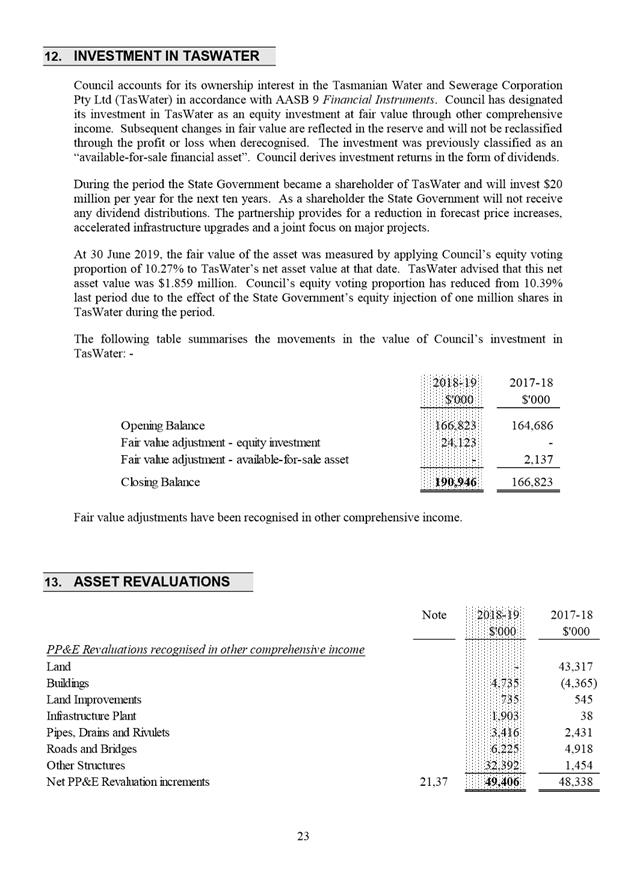

4.2.1. Updating the value of Council’s ownership interest in TasWater,

4.2.2. Correcting the reclassification errors in the cash flow statement, and

4.2.3. Other minor presentation changes.

4.3. The financial statements were delivered to the Auditor-General on 14 August 2019.

4.4. The Auditor-General requested two changes to the financial statements, as follows: -

4.4.1. Remove two rows from the Statement of Changes in Equity, and

4.4.2. Reclassify land in note 23 from “…indexed to March 2019” to “…indexed to March 2018”, and also add a note to specify that indexation was not applied in 2018/19 due to the Valuer-General land indexation factor being 1.0.

4.5. The financial statements were re-presented to the Risk and Audit Panel for endorsement for formal adoption by Council.

4.6. The financial statements are attached to this report (see Attachment A). Highlights of the financial statements are detailed in Section 7 below.

5. Proposal and Implementation

5.1. It is proposed that Council formally adopt the financial statements.

6. Strategic Planning and Policy Considerations

6.1. There are no direct strategic planning implications.

7. Financial Implications

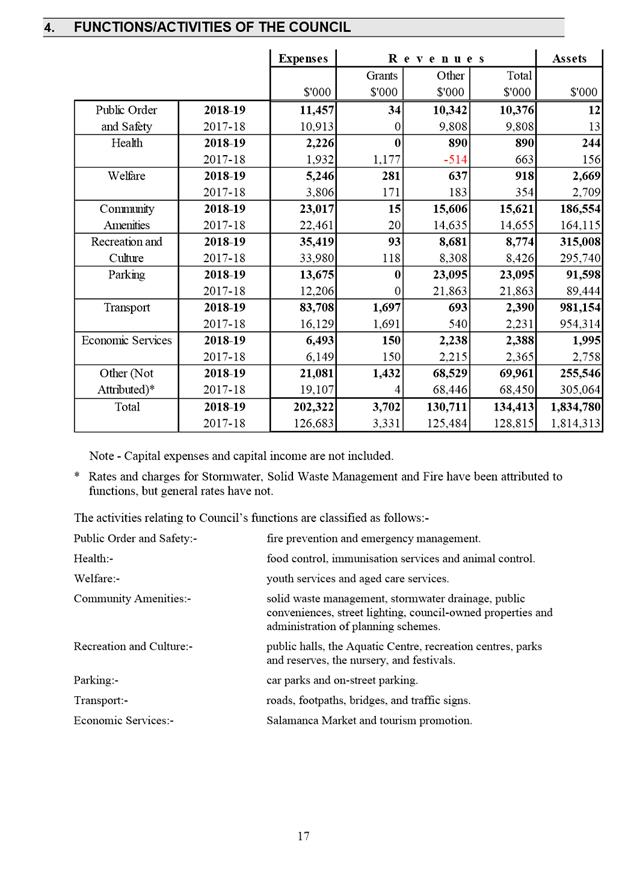

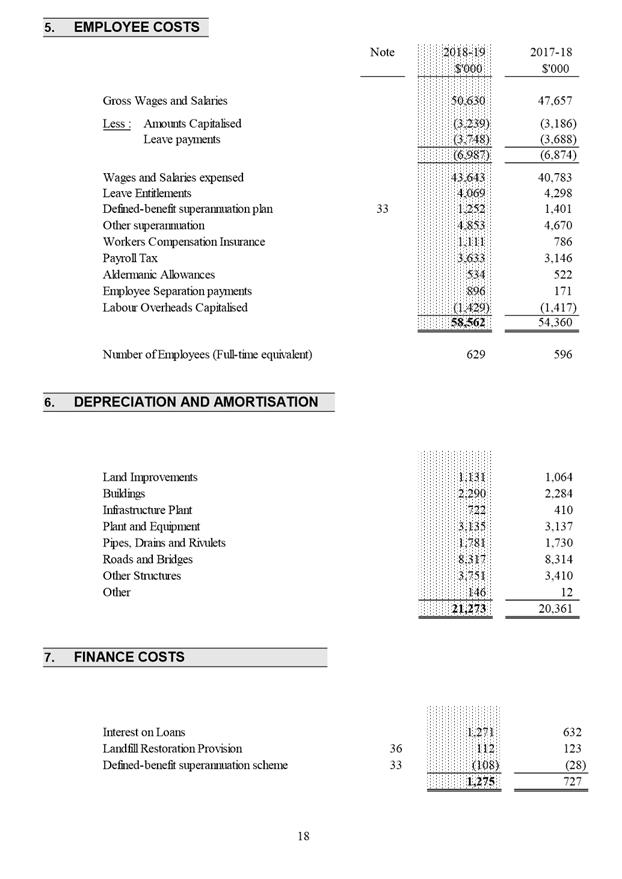

7.1. Financial Sustainability Outcomes

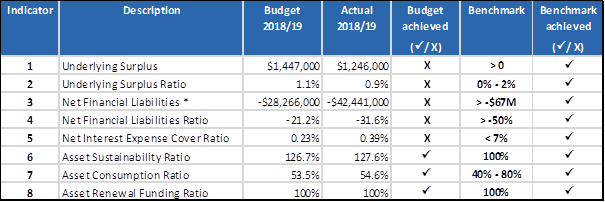

7.1.1. As outlined in Council’s Long-term Financial Management Plan (LTFMP), eight financial sustainability measures have been adopted for the purpose of measuring Council’s financial sustainability.

7.1.2. Indicators 1-2 are measures of profit and performance and the extent to which expenses are covered by revenues.

7.1.3. Indicators 3-4 are measures of indebtedness and the amount Council owes others (loans, employee provisions, creditors) net of financial assets (cash and amounts owed to Council).

7.1.4. Indicator 5 measures the proportion of income required to meet net interest costs.

7.1.5. Indicators 6-8 are measures of asset management.

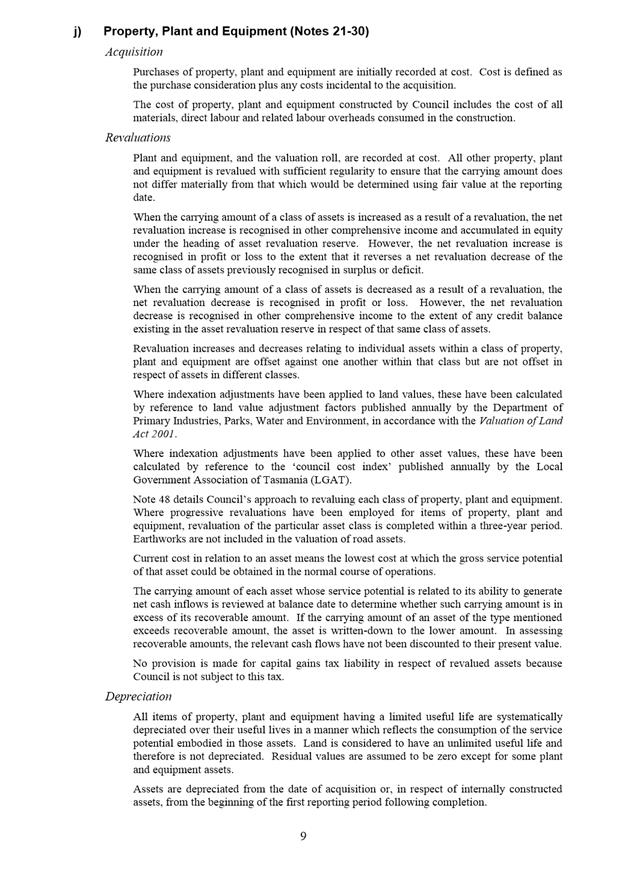

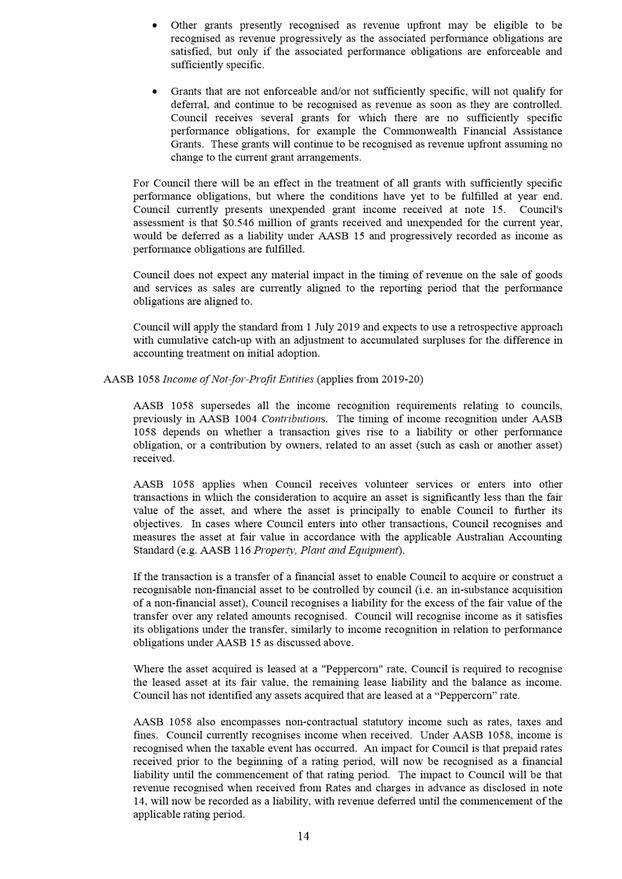

7.1.6. Council’s performance against the eight financial sustainability indicators is shown in Table 1 below: -

Table 1: Performance against Financial Sustainability Indicators

*Note - Net Financial Liabilities includes all liabilities, and therefore differs from the value shown in note 18 of the financial statements (which only includes financial liabilities).

7.1.7. The budget has not been achieved for indicators 1 to 5, however all indicators are within their benchmark ranges.

7.1.8. Indicators 1 and 2 did not meet budget mainly due to lower than expected parking fines revenue.

7.1.9. Indicator 3 and 4 did not meet budget due to a reduction in cash balances mainly from higher capital expenditure and materials and services costs, and lower parking fines revenue.

7.1.10. Indicator 5 did not meet budget due to increased interest expense from borrowing earlier than expected.

7.2. Operating Result

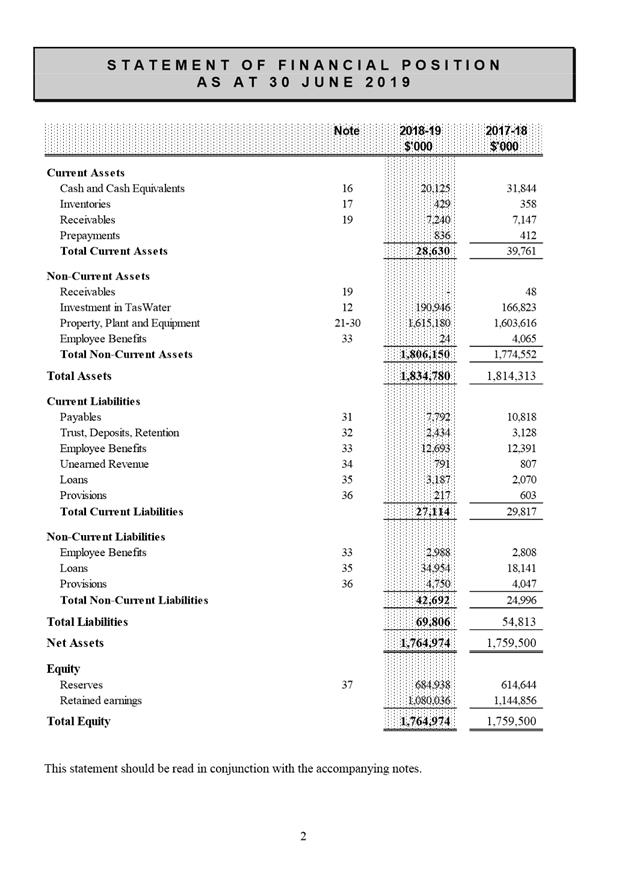

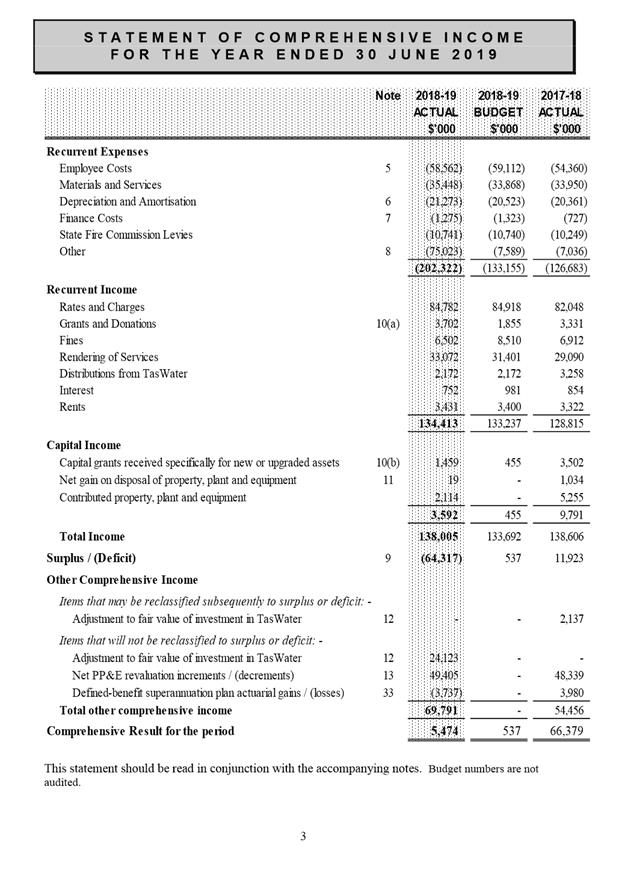

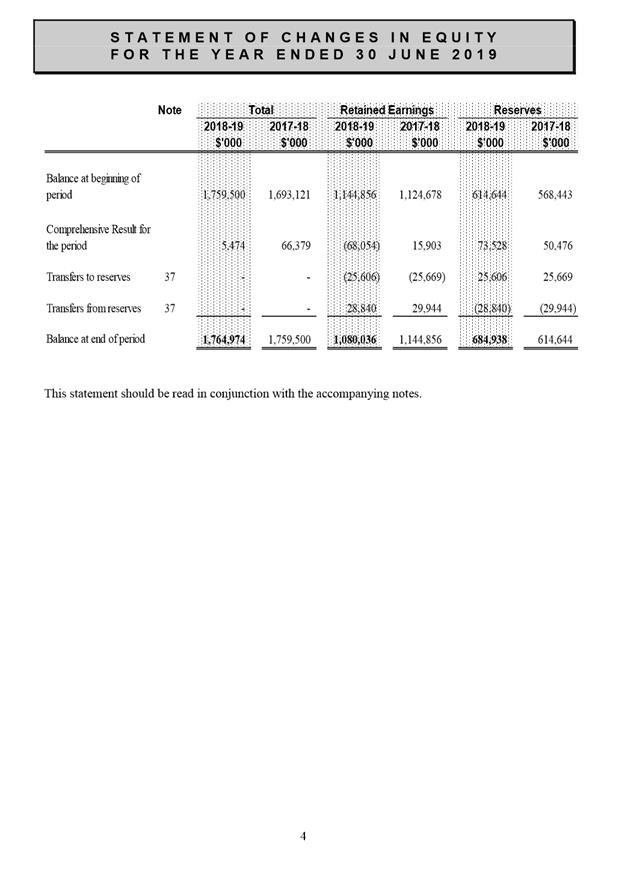

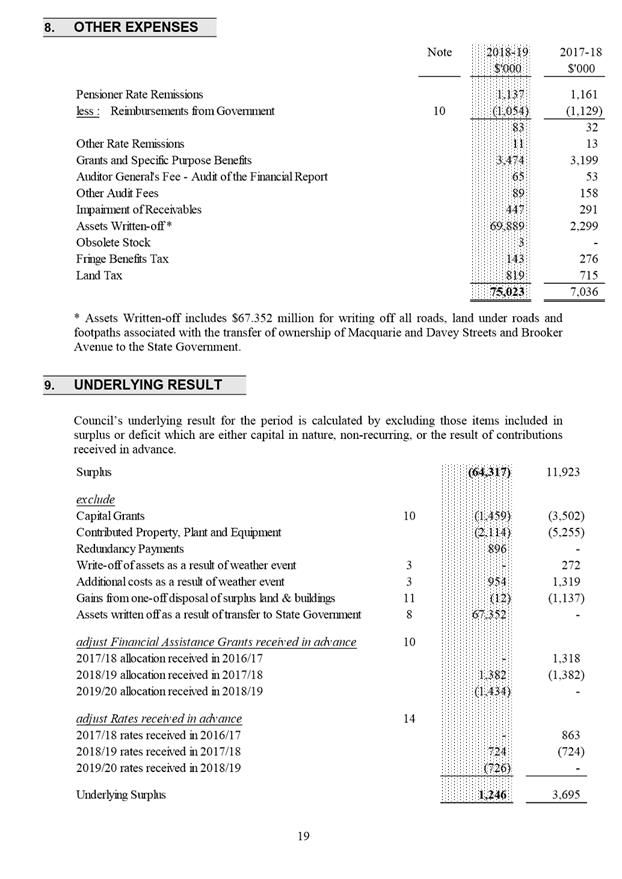

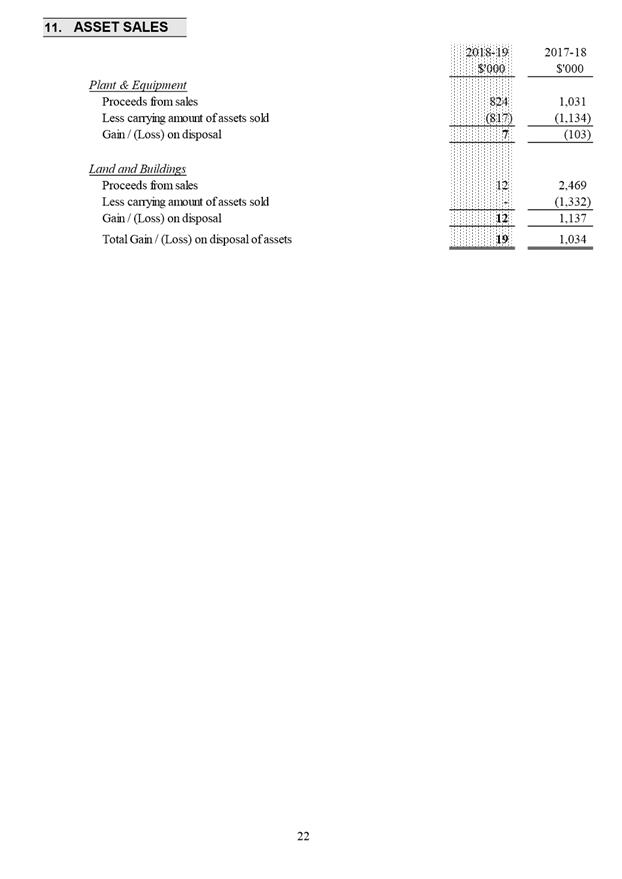

7.2.1. The Operating Result for 2018-19 is a deficit of $64.317 million (2017-18 $11.923 million surplus). This result includes capital grants, contributed infrastructure assets, and the advance receipt of financial assistance grants and rates. The main reason for the large deficit is the $67.352 million for writing off all roads, land under roads and footpaths associated with the transfer of ownership of Macquarie and Davey Streets and Brooker Avenue to the State Government.

7.2.2. Excluding these items, together with continued costs associated with the May 2018 flood event, and profits on sale of property, produces an underlying surplus of $1.246 million (2017-18 $3.695 million), or 0.9% of underlying revenue. This result is $0.201 million unfavourable against the original budget position ($1.447 million surplus) and $0.346 million favourable against the most recent forecast ($0.9 million surplus).

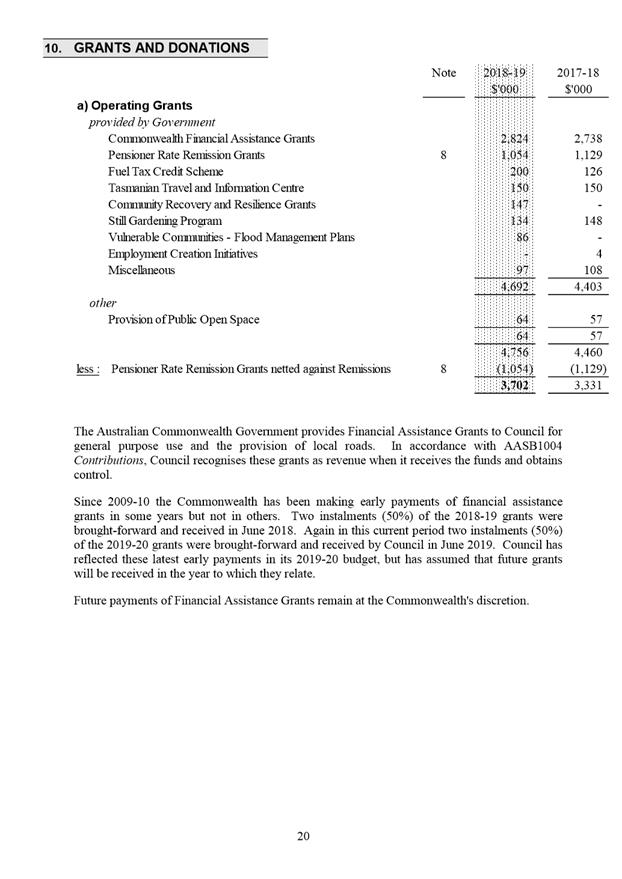

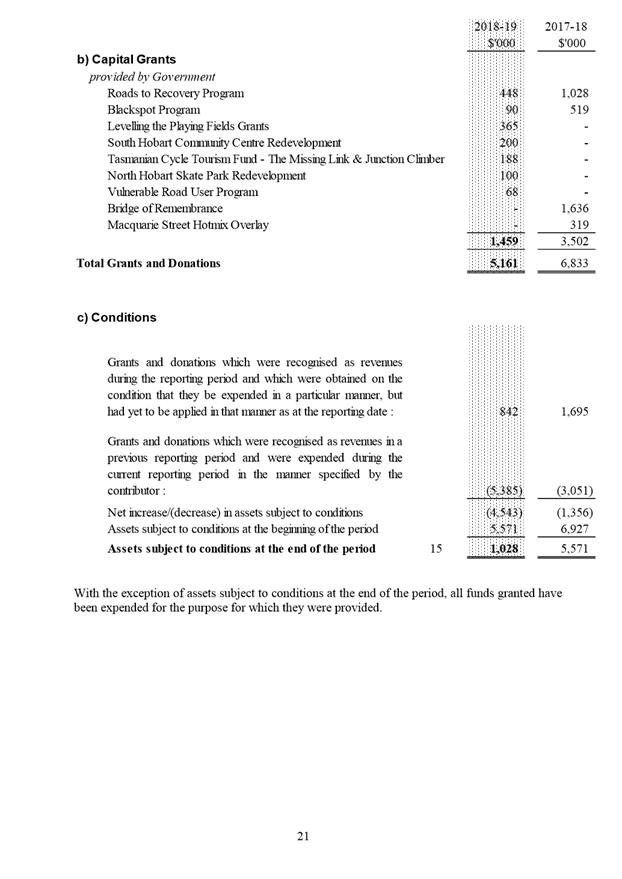

7.2.3. The $0.201 million unfavourable variance against the original budget position is mainly due to lower than expected parking fines revenue and higher than expected materials and services costs (mainly in external labour, water and sewerage, legal fees and recruitment). Favourable variances were experienced in grants (half of the 2019-20 Financial Assistance Grants were brought forward and paid in 2018-19), and services income (mainly in DKHAC pool and gym income, Development Compliance and Appraisal licence and fees and McRobie’s Waste Management Centre income).

7.2.4. The Auditor-General guidelines for calculating the underlying result have been followed in calculating the above number.

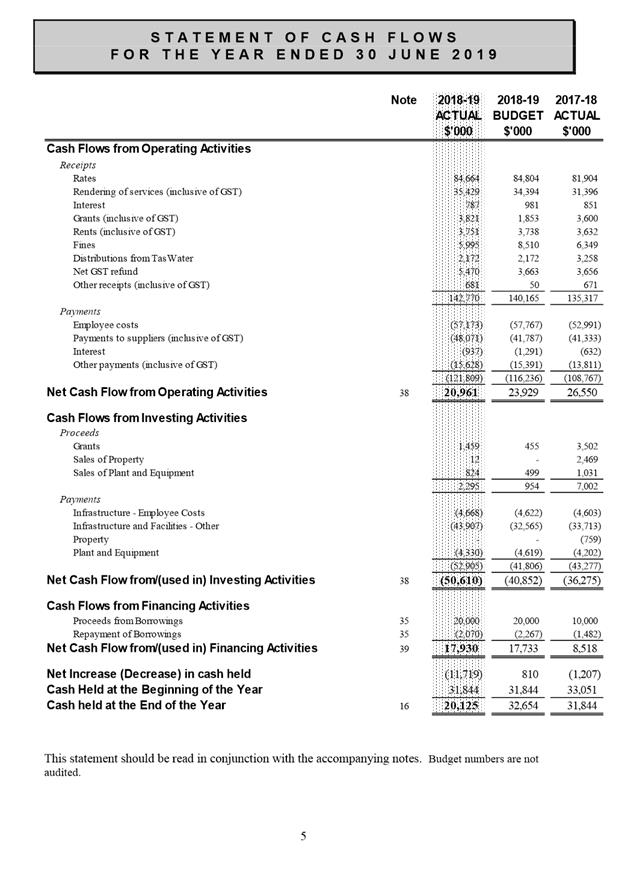

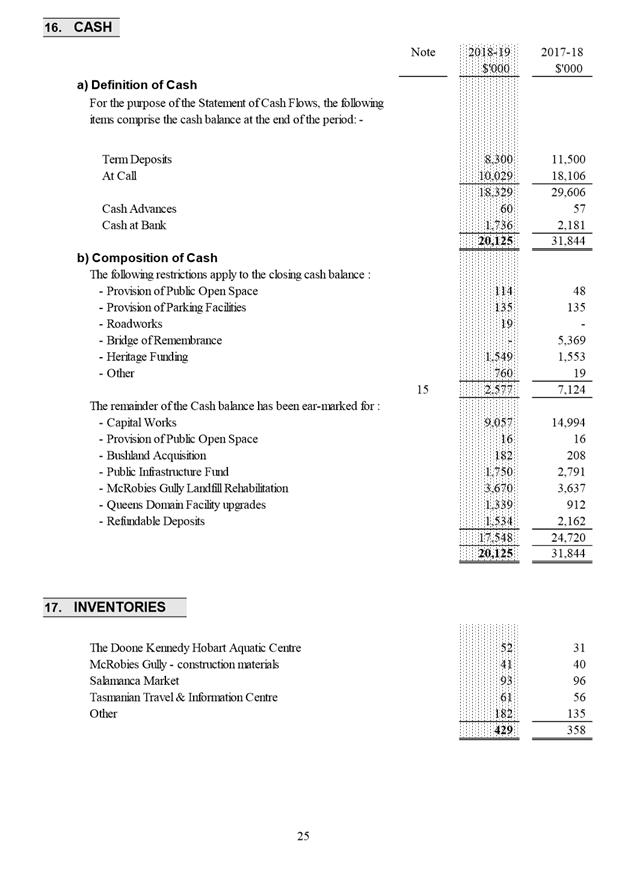

7.3. Cash Position

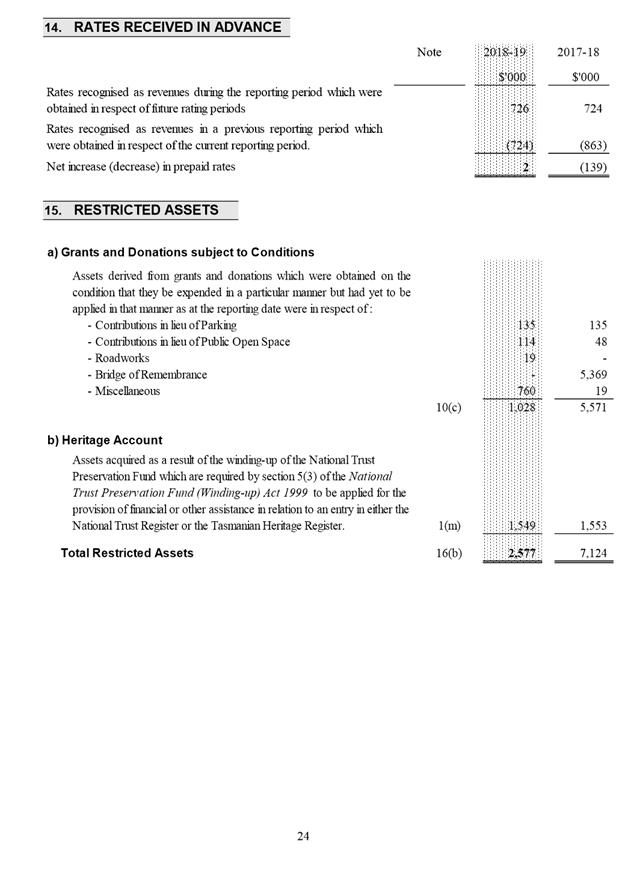

7.3.1. Cash balances have decreased by $11.719 million from $31.844 million to $20.125 million. This amount is allocated to the various purposes listed in note 16 to the financial statements. Note 16 demonstrates that the cash on hand is not “unutilised funds”. In fact, all funds are accounted for in some way. Some funds are restricted (e.g. the Heritage Account and unspent grants) and remaining funds are earmarked for various purposes (e.g. carry-forward capital works).

7.3.2. The decrease in cash is primarily due to higher employee costs and external labour, a lower accounts payable balance, lower proceeds from grants income and sales of property, and partly offset by higher services and rates revenue. The decrease in cash would have been higher had it not been for the early receipt of 2018-19 financial assistance grants and a $10 million borrowing. The 2018-19 budget was premised on $20 million of new borrowings.

7.4. Rate revenue

7.4.1. Rate revenue totalled $84.782 million (2017-18 $82.048 million) and continues to represent approximately 62% of underlying revenue.

7.4.2. The increase of $2.734 million is the result of:

· A 2.18% increase to fund the increased cost of providing existing services,

· A 0.44% increase to fund the increase in the State Government fire levy, and

· A 1.10% increase in Council’s rate base (total AAV) due to development activity.

7.5. Asset Revaluations

7.5.1. In accordance with the requirement to ensure that reported asset values do not differ materially from their fair value, some asset classes were revalued during 2018-19 and indexation was applied to others.

7.5.2. The results of the revaluation exercise were:

|

Infrastructure Plant |

$1.903M |

Increment |

|

Other Structures |

$32.392M |

Increment |

|

|

$34.295M |

Increment |

7.5.3. Other Structures consists mainly of Furniture and Signs, Playgrounds, Fountains, and Drainage Structures that are not classified as Pipes, Drains and Rivulets, such as pollution traps, wetlands etc.

7.5.4. The results of the indexation exercise were:

|

Buildings |

$4.735M |

Increment |

|

Land Improvements |

$0.735M |

Increment |

|

Pipes, Drains and Rivulets |

$3.416M |

Increment |

|

Roads and Bridges |

$6.225M |

Increment |

|

|

$15.111M |

Increment |

7.5.5. The Infrastructure Plant and Other Structures revaluations were undertaken using the current replacement cost methodology, which is the cost to a market participant buyer to acquire or construct a substitute asset of comparable utility, adjusted for obsolescence, in accordance with AASB 13 Fair Value Measurement.

7.5.6. The above revaluation increments and decrements have been recognised in “other comprehensive income” rather than in the surplus.

7.6. Contributed Property, Plant and Equipment

7.6.1. Contributed property, plant and equipment essentially comprises assets required to be constructed for Council by developers.

7.6.2. During 2018-19, these amounted to $2.114 million (2017-18 $5.255 million) and were mainly derived from the Garrington Park Subdivision (stage 5) located at 110 Giblin Street and the Parkwood Gardens Residential Subdivision located at 221A Lenah Valley Road.

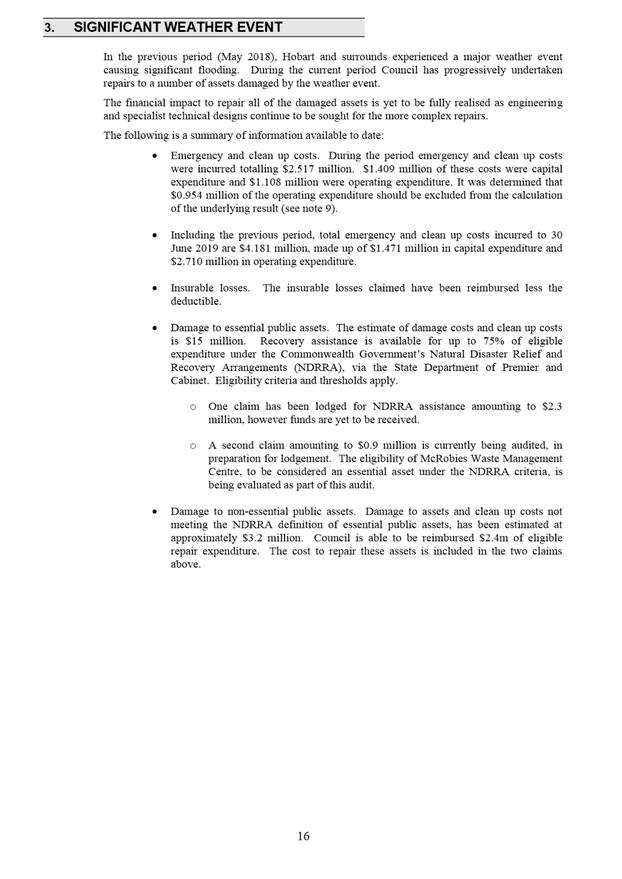

7.7. Asset Write-offs

7.7.1. Asset write-offs mainly comprise of the Macquarie and Davey Streets and Brooker Avenue assets that were transferred to State Government ownership, together with infrastructure assets replaced as part of Council’s on-going asset renewal program.

7.7.2. Asset write-offs totalled $69.889 million (2017-18 $2.299 million) and were in respect of the following asset classes:

|

Land Under Roads |

$50.965M |

|

Sealed Roads |

$15.084M |

|

Footpaths Kerb and Guttering |

$1.724M |

|

Other Structures |

$0.665M |

|

Other Infrastructure Plant |

$0.297M |

|

Bridges |

$0.289M |

|

Playground Equipment |

$0.233M |

|

Furniture Fittings and Office Equipment |

$0.172M |

|

Street Furniture and Signs |

$0.126M |

|

Other |

$0.334M |

|

|

$69.889M |

7.8. Investment in TasWater

7.8.1. Council has an ownership interest in TasWater, which is accounted for as an equity investment at fair value through other comprehensive income. The investment was previously classified as an “available-for-sale financial asset”.

7.8.2. Distributions received from TasWater are recognised as revenue and included in Council’s surplus.

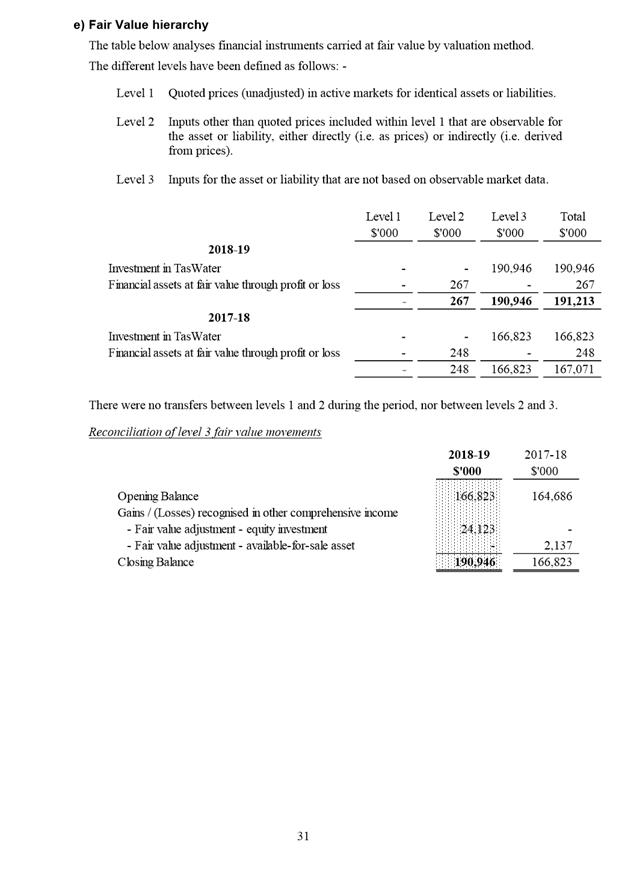

7.8.3. The value of Council’s ownership interest at any point in time is calculated by applying Council’s ownership interest percentage (10.27%) to TasWater’s net asset value. Council’s equity interest has reduced from 10.39% last period due to the effect of the State Government’s equity injection of one million shares in TasWater during the period. Applying this methodology at 30 June 2019 produces a value for Council’s ownership interest of $190.946 million (30 June 2018 $166.823 million). The $24.123 million increase from the previous year has been recognised in “other comprehensive income” rather than in the surplus.

7.9. Defined-Benefit Superannuation Plan

7.9.1. Council’s defined-benefit superannuation plan position has reduced by $4.041 million to a net asset of $0.024 million at 30 June 2019. This movement is mainly due to: -

7.9.1.1. A reduction in the discount rate (from 2.6% to 1.3%) which increases the defined-benefit obligation, and

7.9.1.2. The salaries received by members of the fund in 2017-18 were, on average, 1.9% higher than expected in the 2018 calculations.

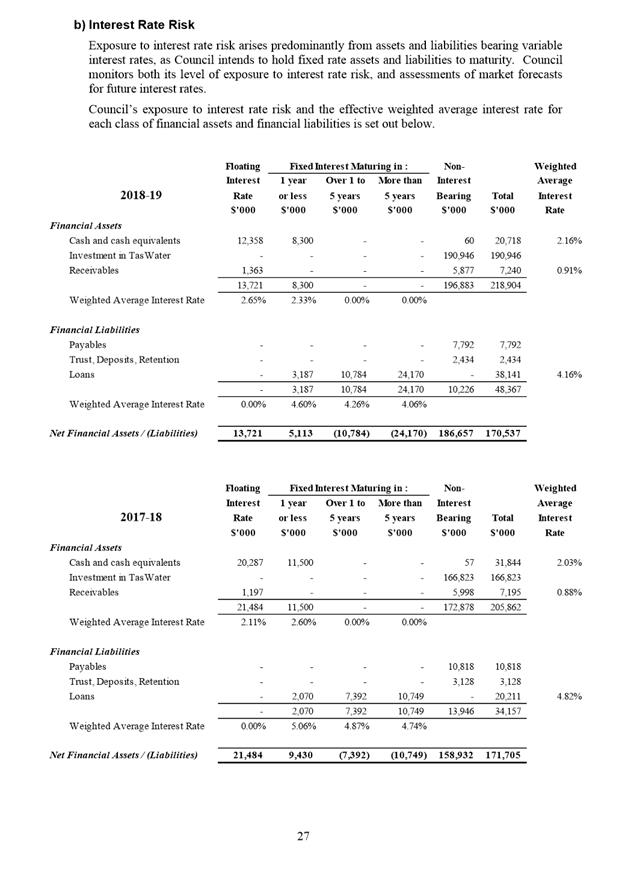

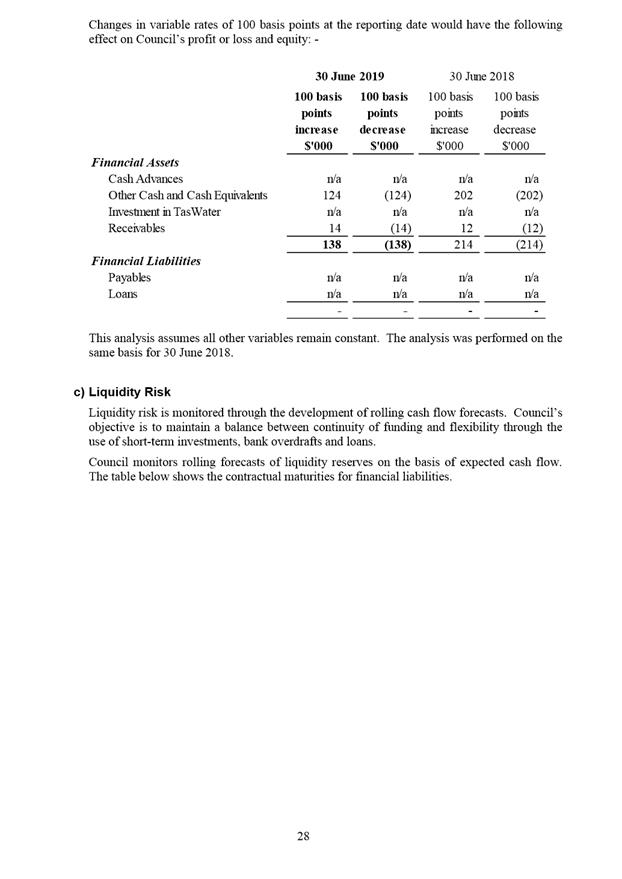

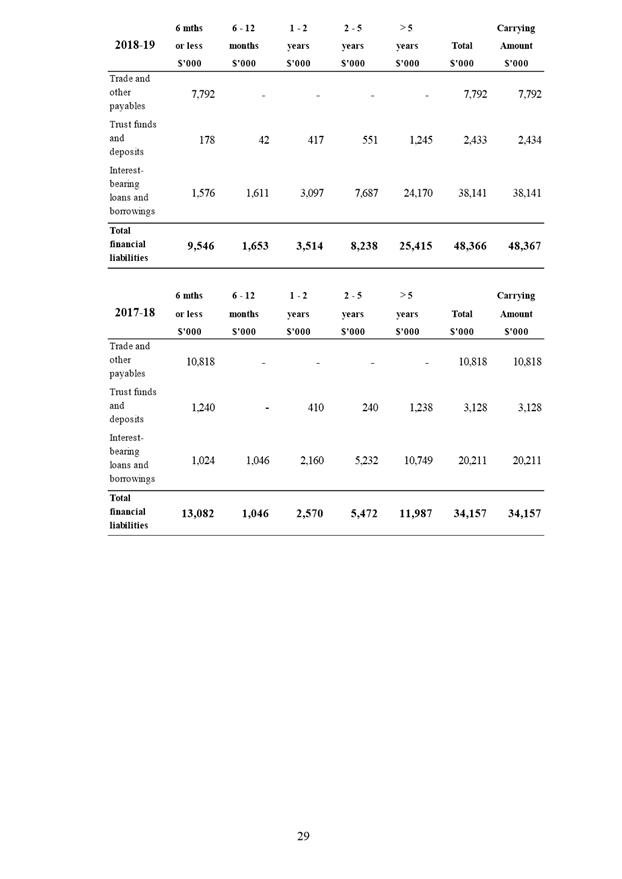

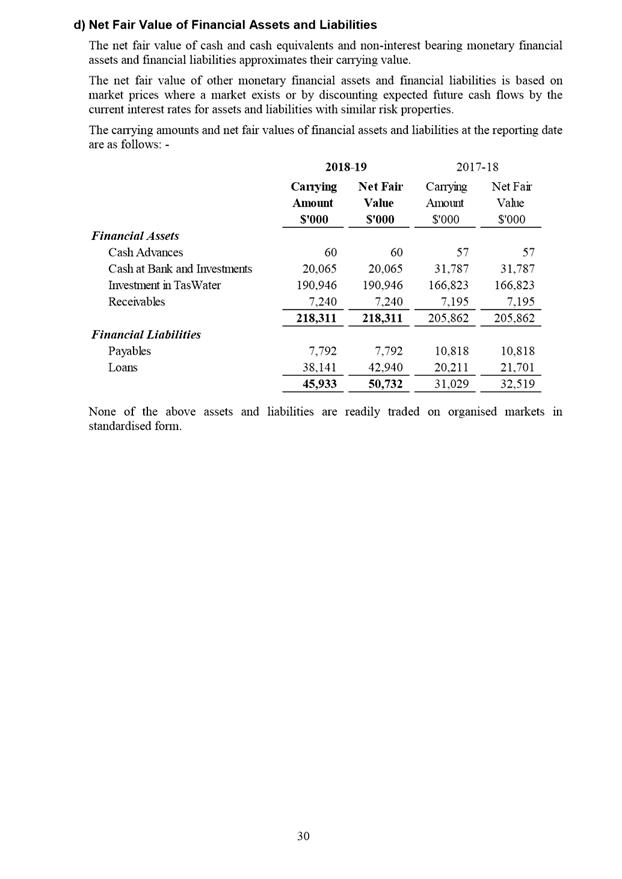

7.10. Financial Instruments

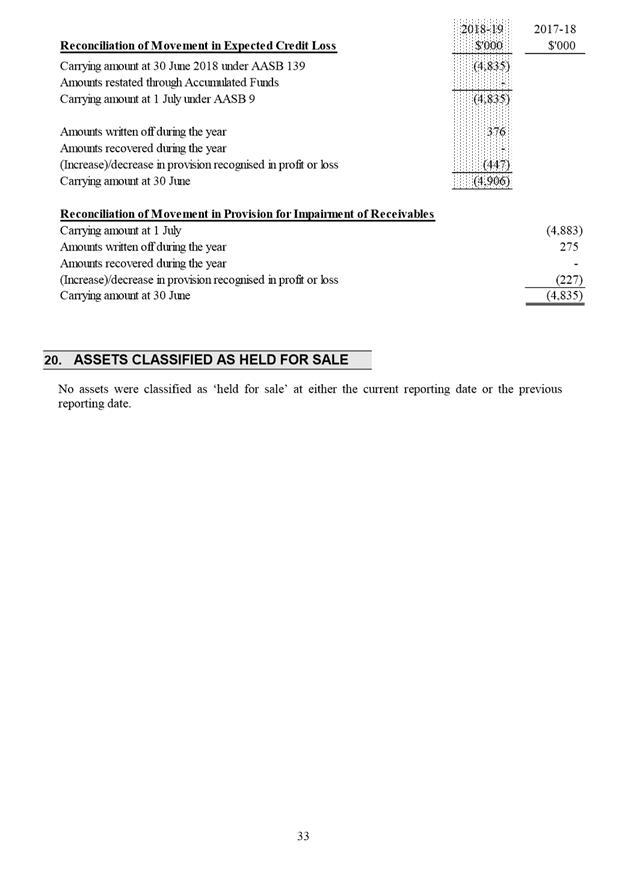

7.10.1. Council has adopted Accounting Standard AASB 9 Financial Instruments in 2018-19.

7.10.2. This standard replaces the existing standard, AASB139 Financial Instruments: Recognition and Measurement and revises classification, measurement and disclosure of financial assets and liabilities.

7.10.3. Council has applied this standard from 1 July 2018 using a retrospective approach with cumulative catch-up. This requires the presentation of both qualitative and quantitative disclosures for affected items, along with a corresponding adjustment to the opening balance of accumulated surpluses for transitional effects of re-measurement.

7.10.4. As a result of this standard:

7.10.5. Council has designated its investment in TasWater as an equity investment at fair value through other comprehensive income, the disclosures of which are contained in notes 12 and 18(e) of the financial statements.

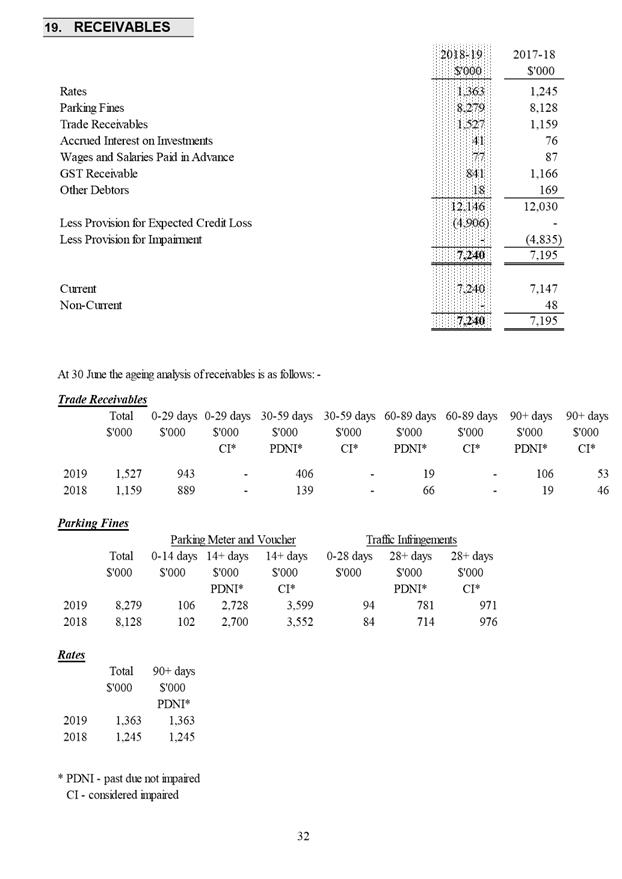

7.10.6. Council now evaluates its impairment provisions based on expected credit losses, rather than incurred credit losses, the disclosures of which are contained in note 19 of the financial statements.

8. Legal, Risk and Legislative Considerations

8.1. Section 84(1) of the Local Government Act 1993 requires the General Manager to prepare and forward to the Auditor-General a copy of Council’s financial statements in accordance with the Audit Act 2008.

8.2. Section 17(1) of the Audit Act 2008 requires the General Manager to prepare and forward a copy of Council’s financial statements to the Auditor-General within 45 days after the end of each financial year.

8.3. Section 17(4) of the Audit Act 2008 requires Council’s financial statements to be prepared in accordance with the accounting standards and other requirements issued by the Australian Accounting Standards Board.

8.4. Section 84(3) of the Local Government Act 1993 requires the General Manager to certify that the financial statements fairly represent Council’s financial position, the results of Council’s operations, and the cash flow of Council. This certification is attached (refer Attachment D).

8.5. Section 84(4) of the Local Government Act 1993 requires the General Manager to table the certified financial statements at a meeting of the Council as soon as practicable.

8.6. All of the above legal requirements have been complied with.

9. Delegation

9.1. This matter is delegated to the Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Michael Greatbatch Manager Finance |

Heather Salisbury Deputy General Manager |

Date: 1 November 2019

File Reference: F19/133891

Attachment a: Financial

Statements for year ended 30 June 2019 ⇩ ![]()

Attachment

b: Final

Management Letter dated 22 October 2019 ⇩ ![]()

Attachment

c: Independent

Audit Report dated 22 October 2019 ⇩ ![]()

Attachment

d: Certification

by General Manager dated 22 October 2019 ⇩ ![]()

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance and Governance Committee Meeting - 4/11/2019 |

Page 22 ATTACHMENT a |

|

Agenda (Open Portion) Special Finance and Governance Committee Meeting - 4/11/2019 |

Page 81 ATTACHMENT b |

|

Agenda (Open Portion) Special Finance and Governance Committee Meeting - 4/11/2019 |

Page 85 ATTACHMENT c |

|

Agenda (Open Portion) Special Finance and Governance Committee Meeting - 4/11/2019 |

Page 86 ATTACHMENT d |

|

|

Agenda (Open Portion) Special Finance and Governance Committee Meeting |

Page 87 |

|

|

4/11/2019 |

|