City

of hobart

AGENDA

Finance and Governance Committee Meeting

Open Portion

Wednesday, 13 March 2019

at 4:30 pm

Lady Osborne Room, Town Hall

City

of hobart

AGENDA

Finance and Governance Committee Meeting

Open Portion

Wednesday, 13 March 2019

at 4:30 pm

Lady Osborne Room, Town Hall

THE MISSION

Our mission is to ensure good governance of our capital City.

THE VALUES

The Council is:

|

about people |

We value people – our community, our customers and colleagues. |

|

professional |

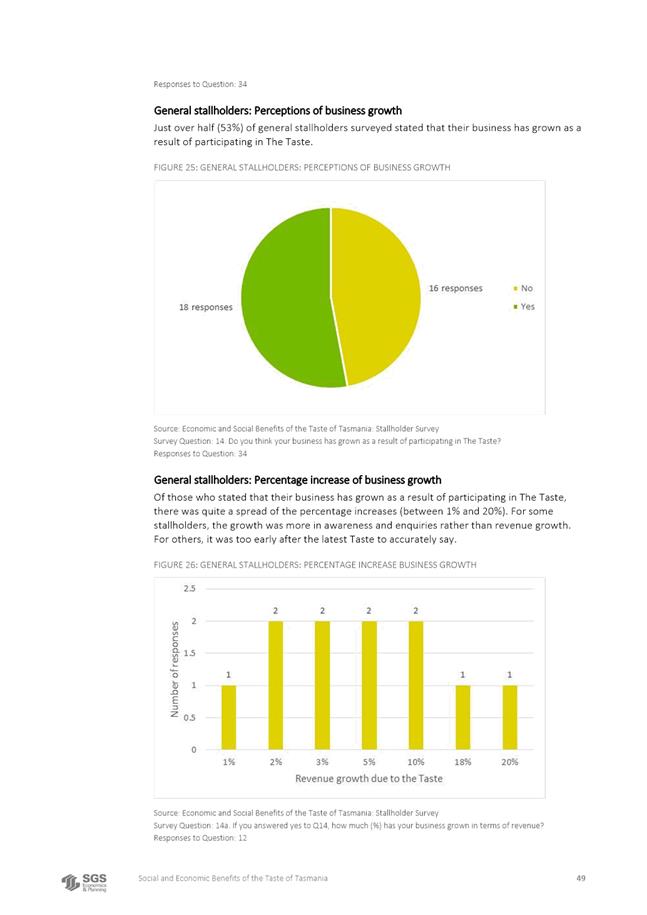

We take pride in our work. |

|

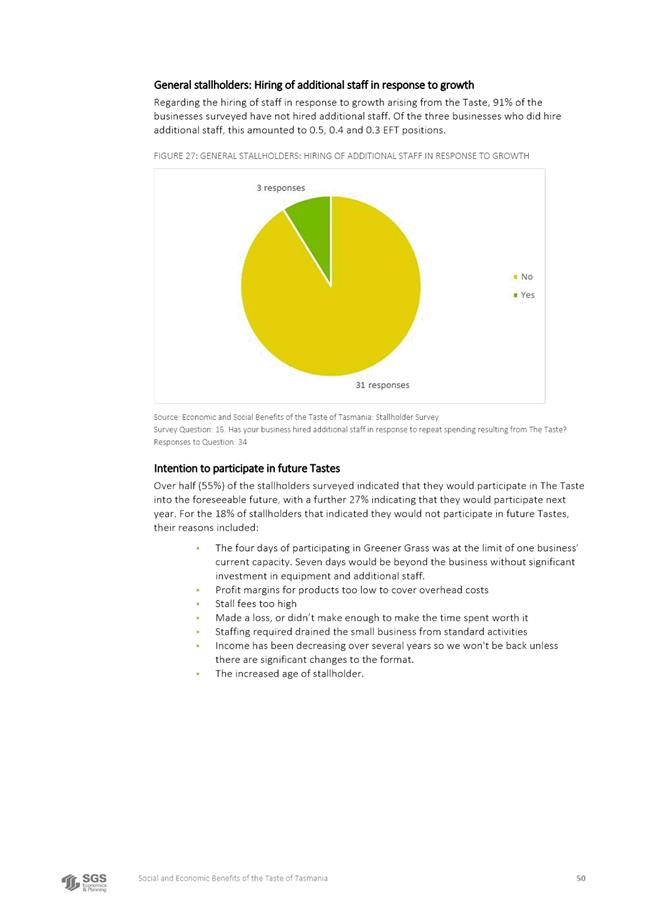

enterprising |

We look for ways to create value. |

|

responsive |

We’re accessible and focused on service. |

|

inclusive |

We respect diversity in people and ideas. |

|

making a difference |

We recognise that everything we do shapes Hobart’s future. |

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 3 |

|

|

13/3/2019 |

|

Business listed on the agenda is to be conducted in the order in which it is set out, unless the committee by simple majority determines otherwise.

APOLOGIES AND LEAVE OF ABSENCE

1. Co-Option of a Committee Member in the event of a vacancy

3. Consideration of Supplementary Items

4. Indications of Pecuniary and Conflicts of Interest

6.1 Petition Requesting Public Meeting - Residents Opposed to the Cable Car Inc

6.2 Petition Requesting Public Meeting - Hobart Not Highrise

6.3 Revised City of Hobart Code for Tenders and Contracts

6.4 The Taste of Tasmania Post Festival Report

6.5 Occupancy Rates - Multi-Storey Car Parks

6.6 Procurement - Quotation Exemption Report

6.7 Outstanding Long Term Parking Permit Debts as at 28 February 2019

7. Committee Action Status Report

7.1 Committee Actions - Status Report

9. Closed Portion Of The Meeting

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 4 |

|

|

13/3/2019 |

|

Finance and Governance Committee Meeting (Open Portion) held Wednesday, 13 March 2019 at 4:30 pm in the Lady Osborne Room, Town Hall.

|

COMMITTEE MEMBERS Zucco (Chairman) Deputy Lord Mayor Burnet Sexton Thomas Dutta

NON-MEMBERS Lord Mayor Reynolds Briscoe Denison Harvey Behrakis Ewin Sherlock |

Apologies:

Leave of Absence: Councillor M Dutta

|

|

The minutes of the Open Portion of the Finance and Governance Committee meeting held on Wednesday, 13 February 2019 and the Special Finance and Governance Committee meeting held on Monday, 18 February 2019, are submitted for confirming as an accurate record.

|

Ref: Part 2, Regulation 8(6) of the Local Government (Meeting Procedures) Regulations 2015.

|

That the Committee resolve to deal with any supplementary items not appearing on the agenda, as reported by the General Manager.

|

Ref: Part 2, Regulation 8(7) of the Local Government (Meeting Procedures) Regulations 2015.

Members of the Committee are requested to indicate where they may have any pecuniary or conflict of interest in respect to any matter appearing on the agenda, or any supplementary item to the agenda, which the committee has resolved to deal with.

Regulation 15 of the Local Government (Meeting Procedures) Regulations 2015.

A committee may close a part of a meeting to the public where a matter to be discussed falls within 15(2) of the above regulations.

In the event that the committee transfer an item to the closed portion, the reasons for doing so should be stated.

Are there any items which should be transferred from this agenda to the closed portion of the agenda, or from the closed to the open portion of the agenda?

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 6 |

|

|

|

13/3/2019 |

|

6.1 Petition Requesting Public Meeting - Residents Opposed to the Cable Car Inc

Memorandum of the General Manager of 8 March 2019.

Delegation: Council

|

Item No. 6.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 7 |

|

|

13/3/2019 |

|

Memorandum: Finance and Governance Committee

Petition Requesting Public Meeting - Residents Opposed to the Cable Car Inc

This report relates to a petition which was presented to the Council, at its meeting of 18 February 2019, by the group Residents Opposed to the Cable Car Inc.

The petition states:

We the electors of Hobart call on the Hobart City Council to hold a Town Hall meeting in accordance with section 57 of the Local Government Act. We request that the Hobart City Council hold this meeting upon receipt by the Hobart City Council of a development application from the Mt Wellington Cableway Company.

The petition was first tabled at the Council meeting on 21 January 2019, noting 1,036 signatures.

The Council resolved to receive and note the petition and refer it to the appropriate committee.

The requirement for the Council to hold a public meeting when petitioned, is regulated under s 59 of Local Government Act 1993 (“the Act”) which provides that:

(1) A petition submitted in accordance with section 57 may request that a council hold a public meeting regarding the subject matter of the petition.

(2) A council must hold a public meeting if the petition complies with section 57 and it is signed by whichever is the lesser of the following:

(a) 5% of the electors in the municipal area;

(b) 1000 of those electors.

The signatures on the petition were checked against the electoral roll and a total of 967 were verified as being from valid electors of the City of Hobart.

As the number did not meet the minimum requirement of 1,000 electors of the City, as provided under the Act, the Council was not obliged to conduct a public meeting, as requested.

This advice was provided to the Council at its meeting of 18 February where the Council noted the number of signatures included on the petition did not meet the minimum requirement to conduct a public meeting.

The petition was again tabled to the Council meeting held on 18 February, 2019, noting a total of 1,123 signatures.

Subsequent to the verification of signatures, the number of City of Hobart electors is confirmed at 1,038 and therefore having now provided the required number of valid signatures under the Act, the petition meets the legislative provisions requiring the Council to conduct a public meeting.

Once the Council has noted its intention to conduct a public meeting, a number of triggers are enacted under s60A of the Act:

1. The Council has 30 days after the day on which it makes the decision to conduct the public meeting, in which to enact its decision;

2. The Council must advertise the details of the meeting twice, invite public submissions in relation the subject matter of the meeting and provide a period of 21 days after the first advertisement for the receipt of submissions;

3. A summary of all submissions received is to be made available to those attending the public meeting.

It should be noted that while the petition requests that the timing of holding the public meeting be ‘upon receipt of a development application’ from the Mt Wellington Cableway Company there is no ability for the petitioners to vary the Council’s statutory timeframe noted above. The Council is therefore bound to conduct the meeting within 30 days of 18 March (being the date of the next Council meeting).

Further, the Act stipulates the timing of actions associated with a public meeting.

Based on the Council adopting the recommendation in this report at its next meeting on 18 March 2019, the following timeframes will apply:

1. The public meeting will be advertised twice, on 20th and 27th March 2019, inviting submissions.

2. Submissions will close on Wednesday 10 April 2019;

3. The public meeting will occur on Tuesday 16 April 2019, with a recommended start time of approximately 7.30pm to maximise the opportunity for people to attend (and following the public meeting for Hobart Not Highrise). This date has been arrived at given the statutory timeframe and also by reference to the Council’s commitments to existing Council and Committee meetings.

There are three options with respect to possible venues – the Town Hall, City Hall or Hotel Grand Chancellor. The details of each option are set-out below.

|

|

Grand Chancellor |

City Hall |

Town Hall |

|

Capacity |

1500 |

1390 |

300 |

|

Cost (including hire, audio visual and security) |

$19,260 |

$17,274.49 |

$13,497.17 |

The Town Hall is not a suitable option because of its capacity. As both public meetings (for the cable car issue and building height issue) will be held on the same night and are both likely to generate significant public interest the Town Hall is not considered to have adequate capacity. Exceeding the 300 patron capacity is not an option as it would result in the Council breaching its occupation for the building.

While the Hotel Grand Chancellor is more expensive, it is the preferred venue both from the perspective of logistics and amenity of those attending.

The Grand Chancellor as a venue is obviously designed for this type of activity, whereas the City Hall has been designed for music concerts with the stage in the City Hall being very high compared to the audience.

The Hotel Grand Chancellor also reduces the City of Hobart labour costs related to set-up and pack-down with the facility manager taking responsibility for all venue arrangements and the Council focussed on the format of the evening.

There is no current budget for the conduct of public meetings.

|

That: 1. The Council note the petition submitted by Residents Opposed to the Cable Car Inc and received by the Council on 18 February 2019, which requests the following action by the Council:

“We the electors of Hobart call on the Hobart City Council to hold a Town Hall meeting in accordance with section 57 of the Local Government Act. We request that the Hobart City Council hold this meeting upon receipt by the Hobart City Council of a development application from the Mt Wellington Cableway Company.” 2. Noting that the number of signatories to the petition meet the criteria required under s 59 (2) of the Local Government Act 1993, the Council resolve to hold a public meeting on Tuesday 16 April 2019 at approximately 6.00pm at the Hotel Grand Chancellor at an estimated cost of $19,260. 3. The General Manager take all necessary steps to facilitate the public meeting in accordance with the requirements of the Local Government Act 1993 and also in regard to logistics including final confirmation of the start time. 4. In resolving to conduct the public meeting, the Council note its statutory obligations as the local government planning authority. 5. The petitioner, Residents Opposed to the Cable Car Inc be advised of the Council’s decision.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N D Heath General Manager |

|

Date: 8 March 2019

File Reference: F19/26733; 16/119-005

|

Item No. 6.2 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 11 |

|

|

13/3/2019 |

|

6.2 Petition Requesting Public Meeting - Hobart Not Highrise

Memorandum of the General Manager of 8 March 2019.

Delegation: Council

|

Item No. 6.2 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 12 |

|

|

13/3/2019 |

|

Memorandum: Finance and Governance Committee

Petition Requesting Public Meeting - Hobart Not Highrise

This report relates to a petition which has been presented to the Council by the group Hobart Not Highrise.

The petition states:

Under section 59 of the Tasmanian Local Government Act, I request Hobart City Council to hold a public meeting about the issues in this petition, as the first step for residents to vote on these issues in an elector poll (under section 60C of the Act) The issues are:

I call on the Hobart City Council to:

1. Introduce absolute maximum building heights

2. Protect Hobart’s heritage buildings, and

3. Protect Hobart’s view-lines,

all as per the City of Hobart’s professional planning officers’ recommendations to the Planning Committee on the 10th December 2018.

These recommendations were not debated at this Planning Committee meeting, nor at the Council meeting the following week.

The petition had been signed by 1,118 electors from the Hobart municipal area which requires the Council to hold a public meeting.

At its meeting of 13 February 2019, the Finance and Governance Committee resolved to defer the item for the provision of further information regarding venue and costings.

There are three options with respect to possible venues – the Town Hall, City Hall or Hotel Grand Chancellor. The details of each option are set-out below.

|

|

Grand Chancellor |

City Hall |

Town Hall |

|

Capacity |

1500 |

1390 |

300 |

|

Cost (including hire, audio visual and security) |

$19,260 |

$17,274.49 |

$13,497.17 |

The Town Hall is not a suitable option because of its capacity. As both public meetings (for the cable car issue and building height issue) will be held on the same night and are both likely to generate significant public interest the Town Hall is not considered to have adequate capacity. Exceeding the 300 patron capacity is not an option as it would result in the Council breaching its occupation for the building.

While the Hotel Grand Chancellor is more expensive, it is the preferred venue both from the perspective of logistics and amenity of those attending.

The Grand Chancellor as a venue is obviously designed for this type of activity, whereas the City Hall has been designed for music concerts with the stage in the City Hall being very high compared to the audience.

The Hotel Grand Chancellor also reduces the City of Hobart labour costs related to set-up and pack-down with the facility manager taking responsibility for all venue arrangements and the Council focussed on the format of the evening.

The petition states the public meeting is being held as the first step to conducting an elector poll. An elector poll requires the provision of a further petition within 30 days of the public meeting and the Council would then have 60 days to conduct the elector poll, which would be conducted by the Tasmanian Electoral Commission (TEC). The timing of this is likely to carry the matter into the next financial year and an appropriate budget allocation will be included for the conduct of an elector poll. Officers will liaise with the TEC in relation to the process of conducting an elector poll.

There is no current budget for the conduct of public meetings or elector polls.

|

That: 1. The Council note the petition submitted by Hobart Not Highrise and received by the Council on 4 February 2019, which requests the following action by the Council:

“Under section 59 of the Tasmanian Local Government Act, I request Hobart City Council to hold a public meeting about the issues in this petition, as the first step for residents to vote on these issues in an elector poll (under section 60c of the Act) The issues are:

I call on the Hobart City Council to:

1. Introduce absolute maximum building heights; 2. Protect Hobart’s heritage buildings, and 3. Protect Hobart’s view-lines;

all as per the City of Hobart’s professional planning officers’ recommendations to the Planning Committee on the 10th December 2018.

These recommendations were not debated at this Planning Committee meeting, nor at the Council meeting the following week.” 2. Noting that the number of signatories to the petition meet the criteria required under s 59 2 of the Local Government Act 1993, the Council resolve to hold a public meeting on Tuesday 16 April 2019 at approximately 6.00pm at the Hotel Grand Chancellor at an estimated cost of $19,260. 3. The General Manager take all necessary steps to facilitate the public meeting in accordance with the requirements of the Local Government Act 1993 and also in regard to logistics including final confirmation of the start time. 4. In resolving to conduct the public meeting, the Council note its statutory obligations as the local government planning authority. 5. The petitioner, Hobart Not Highrise be advised of the Council’s decision.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N D Heath General Manager |

|

Date: 8 March 2019

File Reference: F19/26935; 16/119-006

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 15 |

|

|

13/3/2019 |

|

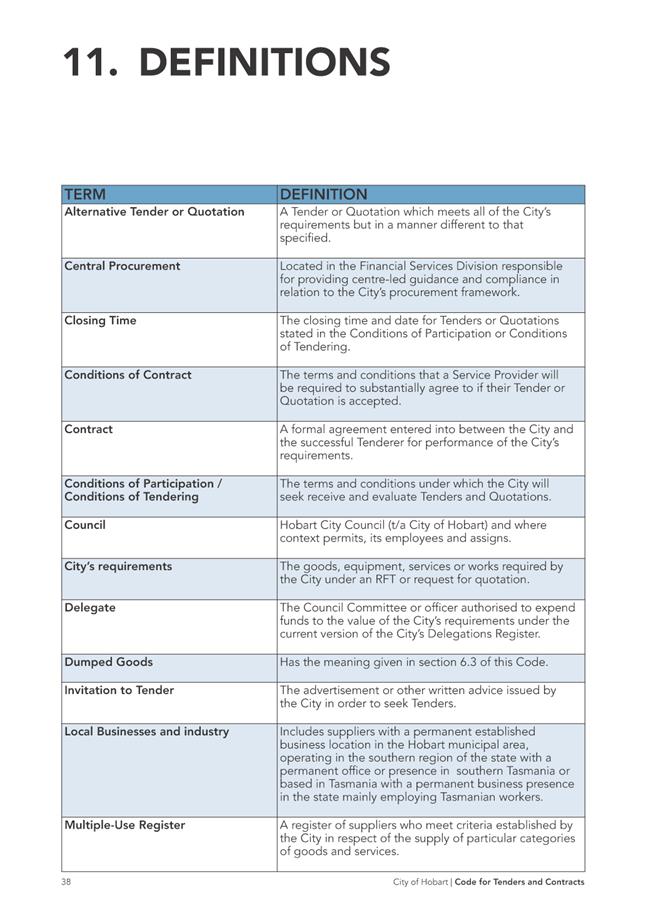

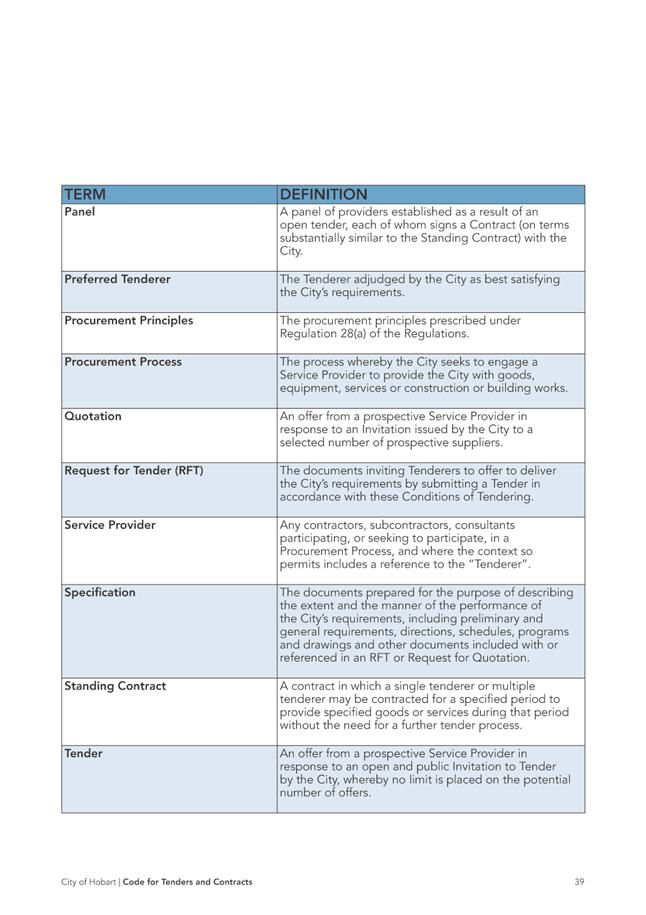

6.3 Revised City of Hobart Code for Tenders and Contracts

Report of the Group Manager Rates and Procurement and the Deputy General Manager of 8 March 2019 and attachments.

Delegation: Council

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 16 |

|

|

13/3/2019 |

|

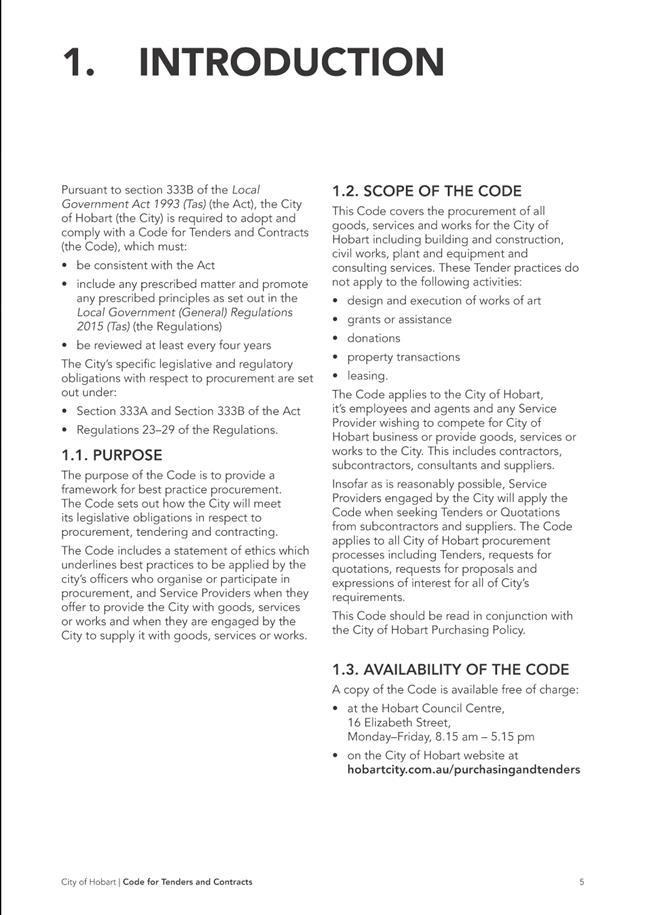

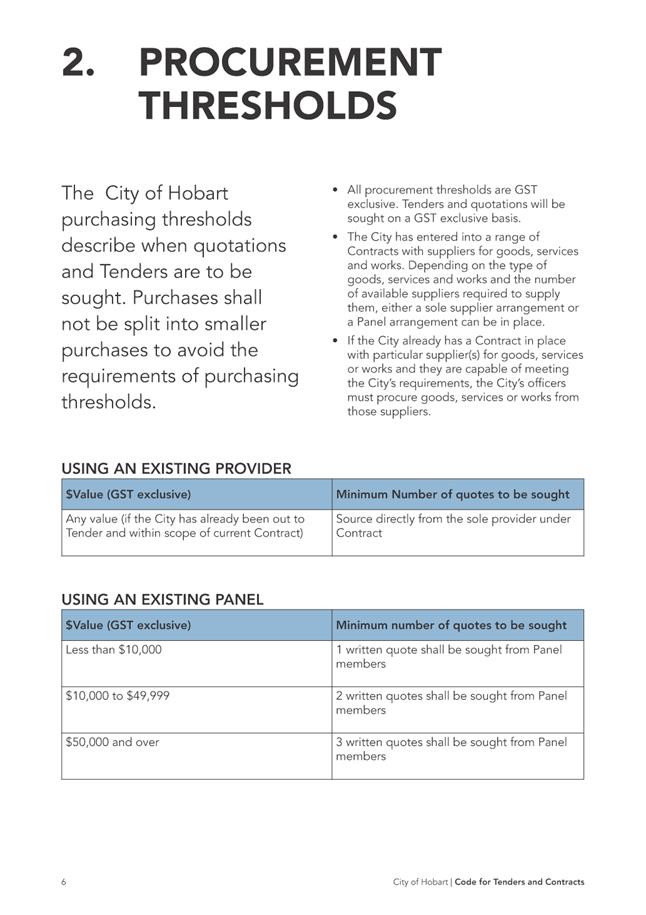

REPORT TITLE: Revised City of Hobart Code for Tenders and Contracts

REPORT PROVIDED BY: Group Manager Rates and Procurement

Deputy General Manager

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to seek Council’s approval of a revised City of Hobart Code for Tenders and Contracts.

1.2. The community benefit is consistent with strategic objective 5.1 in the City of Hobart Capital City Strategic Plan 2015-25, being to deliver best value for money through strategic procurement decision-making.

2. Report Summary

2.1. Under the Local Government Act 1993 (Tas) (LG Act), Council is required to adopt a Code for tenders and contracts (Code), review it every 4 years and make it available to the public. The Code is to include specific matters as set out in the Local Government General Regulations 2015 (Tas) (the Regulations).

2.2. The City has had a Code since March 2012 and before that a Code of Public Tendering. It is regularly reviewed.

2.3. The Code has been recently reviewed and updated to reflect contemporary procurement best practice and to improve readability.

2.4. A revised version of the Code is presented to Council for approval.

|

That: 1. The Report ‘Revised City of Hobart Code for Tenders and Contracts’ be received and noted. 2. Council adopt the revised City of Hobart Code for Tenders and Contracts marked as Attachment A to this report. 3. The General Manager be authorised to finalise the City of Hobart Code for Tenders and Contracts and arrange for it to be made available to the public in paper format from the Council’s Customer Service Centre and in electronic format from Council’s website.

|

4. Background

4.1. Section 333B of the LG Act requires Council to adopt a Code for tenders and contracts, review it every 4 years and make it available to the public.

4.2. The Code must include specific matters, set out in Regulation 28 of the Local Government (General) Regulations 2015 (Tas) – refer Attachment A.

4.3. The purpose of the Code is to provide a framework for best practice procurement. The Code sets out how the City will meet its legislative obligations in respect to procurement, tendering and contracting. The Code includes a statement of ethics which underlines best practices to be applied by the City’s officers who organise or participate in procurement and service providers when they offer and are engaged to provide the City with goods, services or works.

4.4. The City has had a Code since March 2012 and before that a Code of Public Tendering.

4.5. The Code is regularly reviewed to ensure it remains reflective of best practice procurement, ensuring risks are managed to an appropriate level to achieve the City’s procurement activities and achieve best value for money for the City.

4.6. The most recent review was conducted in March 2018 where Council approved a revised Code to reflect Council’s decision to revise its tender and quotation exemption reporting processes.

4.7. At that time Council noted that the Code would be the subject of annual review and any further changes to the Code would be presented to Committee / Council in due course.

4.8. The Code has been recently reviewed and updated to reflect contemporary procurement best practice and to improve readability. The review included a legal review to ensure the Code complies with its legislative requirements.

4.9. The revised Code is presented to the Council for approval – refer Attachment B.

5. Proposal and Implementation

5.1. It is proposed that the Council adopt the attached City of Hobart Code for Tenders and Contracts, as amended, and make copies available to the public in a paper format from the Customer Service Centre and in electronic format prominently from the Council’s website as required under section 333(B)(4) of the LG Act, which states that:

5.1.1. The general manager is to make a copy of the council's code and any amendments to the code available –

(a) for public inspection at the public office during ordinary office hours; and

(b) for purchase at a reasonable charge; and

(c) on its internet site free of charge.

5.2. The revised Code will also be made available from the City’s e-tendering portal TenderLink.

6. Strategic Planning and Policy Considerations

6.1. This report proposes amendments to the City of Hobart Code for Tenders and Contracts.

6.2. This report is consistent with strategic objective 5.1 in the City of Hobart Capital City Strategic Plan 2015-25, being to deliver best value for money through strategic procurement decision-making.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. There are no financial implications arising from this report.

7.2. Impact on Future Years’ Financial Result

7.2.1. Not applicable.

7.3. Asset Related Implications

7.3.1. Not applicable.

8. Legal, Risk and Legislative Considerations

8.1. These are considered elsewhere in this report.

9. Delegation

9.1. This matter is delegated to Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lara MacDonell Group Manager Rates and Procurement |

Heather Salisbury Deputy General Manager |

Date: 8 March 2019

File Reference: F19/21679

Attachment a: Regulation

28 - Code for Tenders and Contracts ⇩ ![]()

Attachment

b: Revised

City of Hobart Code for Tenders and Contracts - March 2019 ⇩ ![]()

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/3/2019 |

Page 20 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/3/2019 |

Page 21 ATTACHMENT b |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 61 |

|

|

|

13/3/2019 |

|

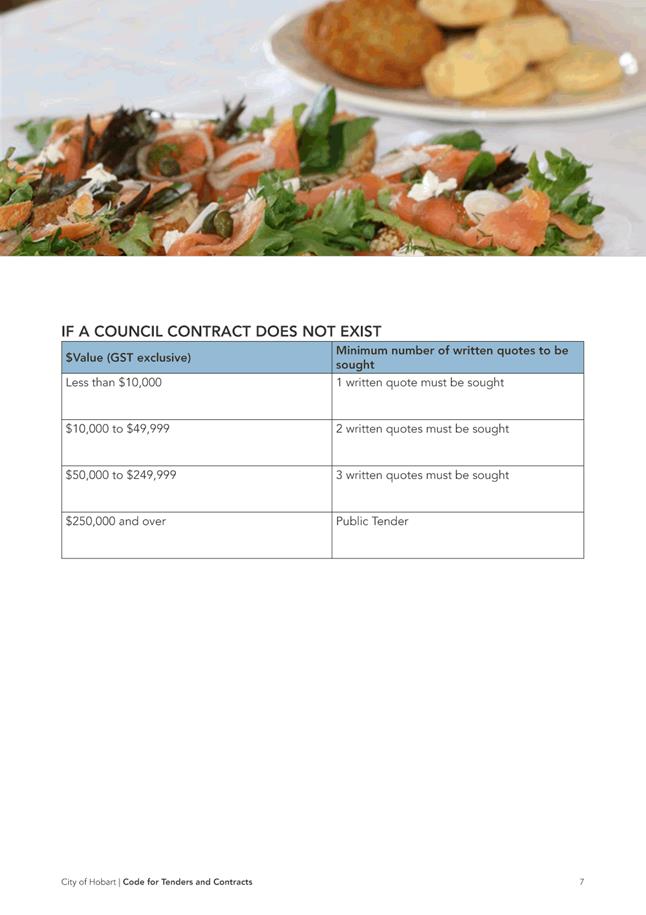

6.4 The Taste of Tasmania Post Festival Report

The General Manager reports that at its meeting on 6 March 2019, the Community Culture & Events Committee resolved the following:

That: 1. The Council resolve to commit to a three-year in principle budget for The Taste of Tasmania of $1.6 million annually, contingent upon the following funding arrangement:

(i) Direct Council investment of:

(a) $1.1M for 2019/20;

(b) $1M for 2020/21; and

(c) $900,000 for 2021/22;

(ii) $250,000 - $500,000 per annum cash grant from the Tasmanian Government;

(ii) $80,000 per annum PW1 hire fee waiver; and

(iv) Maximising the generation of sponsorship and commercial revenue streams over the three year period.

2. The Council delegate to the General Manager the full operational responsibility for the delivery of The Taste of Tasmania including the setting of all fees and charges pursuant to section 22 of the Local Government Act 1993.

3. The General Manager be authorised to finalise discussions with the State Government concerning on-going funding for The Taste of Tasmania as soon as possible.

4. The Council to be advised of the outcome of the negotiations.

5. At the conclusion of three years the General Manager undertake a full review of The Taste of Tasmania and report back to the Council accordingly.

6. The proposed funding arrangement aspects be referred for the consideration of the Finance and Governance Committee.

Part 1 of the recommendation is referred for the consideration of the Finance and Governance Committee.

Delegation: Council

|

Item No. 6.4 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 62 |

|

|

13/3/2019 |

|

REPORT TITLE: The Taste of Tasmania Post Festival Report

REPORT PROVIDED BY: Director Community Life

Festival Director - Taste of Tasmania

1. Report Purpose and Community Benefit

1.1. This report outlines and evaluates The Taste of Tasmania 30th Anniversary including the important, new initiatives and significant developments that were implemented and delivered in 2018–19.

1.2. This post festival report reflects The Taste of Tasmania festival that had a total subsidy of $1.6 million. This subsidy of $1.6 million includes $71,000 for the New Years’ Eve fireworks.

1.3. This report details the achievements that were enabled due to the increased level of investment whilst also discussing the challenges and recommendations for future years.

1.4. In 2018–19 Taste festival with support from State Growth, conducted a full economic benefit study. SGS Economics and Planning were engaged along with local contractors, Myriad Consulting.

1.5. This post festival report largely references the economic benefit study along with reflecting considerable internal and external debrief discussions. The full economic benefit study is attached to this report as Attachment A.

2. Report Summary

2.1. In June 2018, the Hobart City Council committed to a ‘one-off’ $400, 000 increased level of investment; a total subsidy of $1.6 million to fund the 30th Anniversary of The Taste of Tasmania. This subsidy included the New Years’ Eve fireworks at a cost of $71,000.

2.2. Whilst this increased level of investment was granted on a ‘one time only’ contingent, the original recommendation clearly outlined that this level of subsidy was the amount required to deliver a food and wine festival that had statewide significance. More than this, the emphasis was on The Taste festival being able to succeed commercially.

2.3. Council granted this increased level of investment in recognition that the 30th Anniversary was an important milestone and that there were high-expectations in the community that needed to be realised. This increased level of investment was important to ensure future brand success and credibility of The Taste festival.

2.4. To ensure The Taste of Tasmania festival continues to meet the high expectations of the community and to be both relevant and contemporary within the festival space locally, nationally and internationally, the recommendation is that the Hobart City Council commit to an in principle, on-going level of investment of $1.6 million, including the firework celebrations for New Year’s Eve for three years.

2.5. This long-term commitment will enable a strategic plan to be formulated and implemented with the outcome of The Taste of Tasmania festival increasing its own generated income thereby reducing the level of investment required by the Council to support the festival.

2.6. This report proposes a model for achieving this funding outcome however there is a risk with the level of state government support as at this time there is no firm commitment or guarantee of this funding from the state.

2.7. It is critical to point out that if the total overall level of investment is less than $1.6 million, there will be varying degrees of impact to the festival that have the potential to dilute many of the important initiatives that took place in 2018–19.

|

That: 1. The Council resolve to commit to a three-year in principle budget for The Taste of Tasmania of $1.6 million annually. 2. This proposal is contingent upon: (i) $1.02 – $1.27 million direct Council investment. (ii) $250,000 - $500,000 cash grant from the Tasmanian Government. (iii) $80,000 PW1 hire fee waiver. 3. The Council delegate to the General Manager the full operational responsibility for the delivery of The Taste of Tasmania including the setting of all fees and charges pursuant to section 22 of the Local Government Act 1993. 4. The General Manager be authorised to finalise discussions with the State Government concerning on-going funding for The Taste of Tasmania as soon as possible. 5. The Council to be advised of the outcome of those negotiations. 6. At the conclusion of three years the General Manager undertake a full review of The Taste of Tasmania and report back to the Council accordingly.

|

4. Background

4.1. The Taste of Tasmania is the oldest and largest food and wine festival in Australia. In 2018–19 The Taste of Tasmania festival celebrated its 30th birthday anniversary. The festival ran from Friday 28 December, 2018 until Thursday 3 January, 2019.

4.2. The Taste of Tasmania 30th Anniversary festival was overwhelmingly successful; generating exceptionally positive feedback from the local, national and International community of visitors.

4.3. In 2018–19 Taste of Tasmania had an overall attendance of 263,000. The highest recorded attendance in its 30 year history. This number reflects an increased attendance of approximately 43,000 on 2017–18.

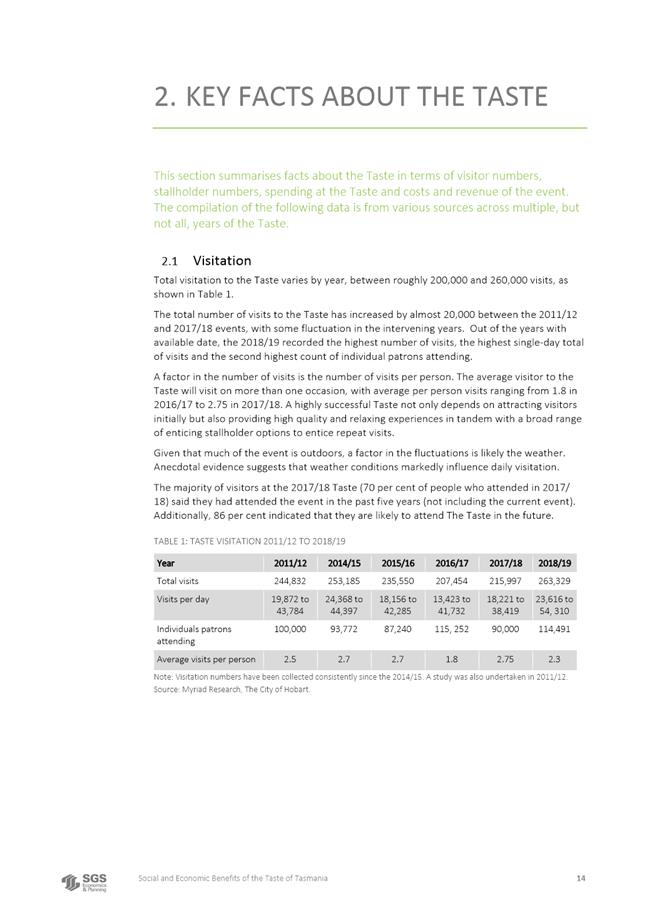

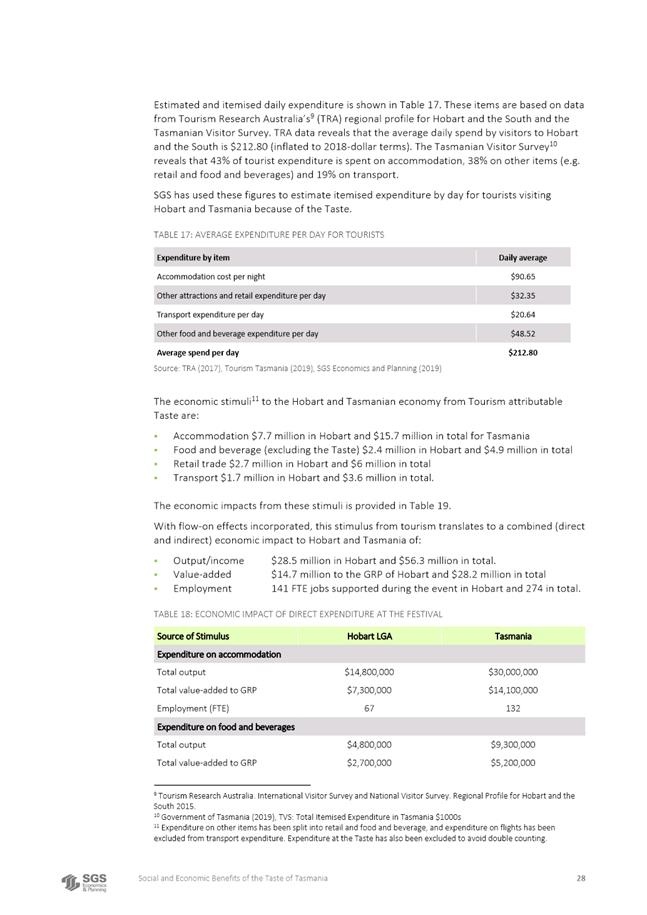

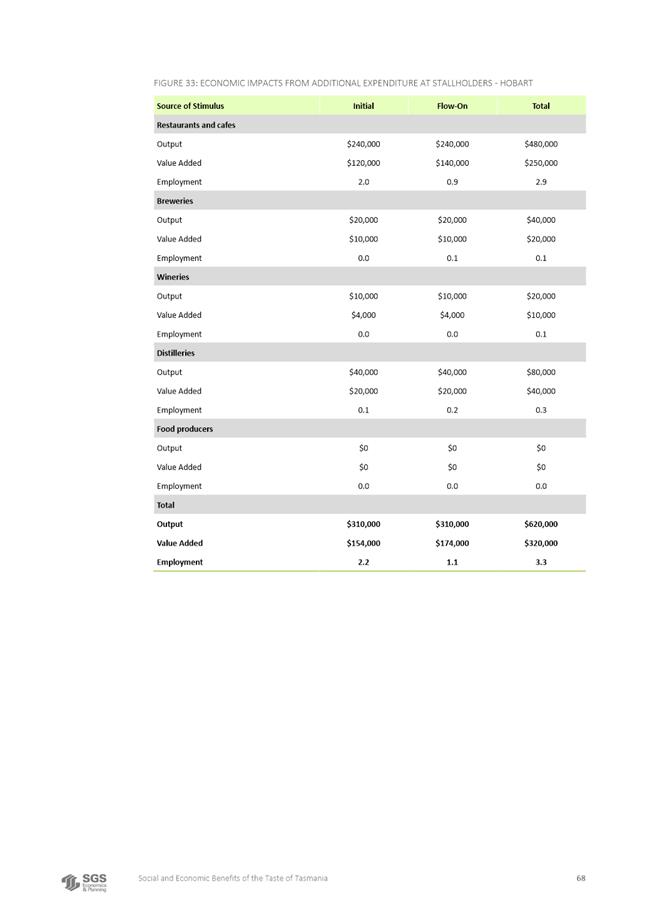

4.4. Myriad Consulting in collaboration with SGS Economic and Planning reports the following:

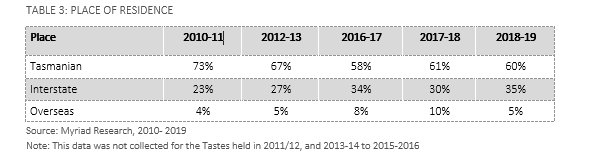

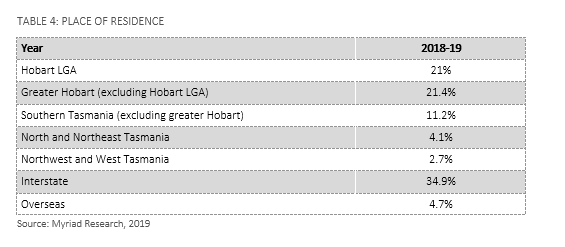

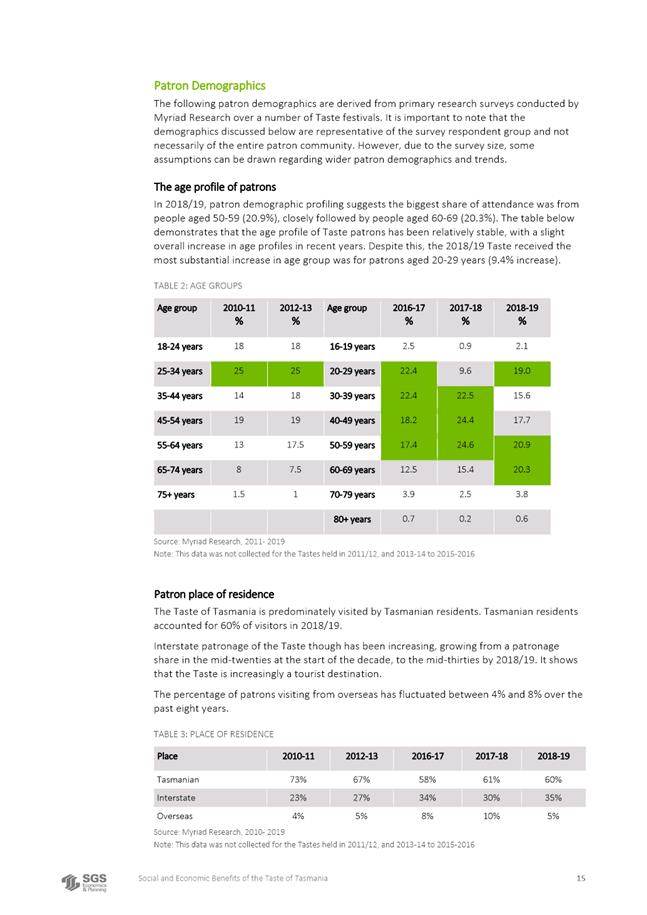

The Taste of Tasmania is predominately visited by Tasmanian residents. Tasmanian residents accounted for 60% of visitors in 2018–19. Interstate patronage of the Taste though has been increasing, growing from a patronage share in the mid-twenties at the start of the decade, to the mid-thirties by 2018–19.

Of the 263,000 attendance, the place of residence is broken down and listed below:

4.5. The

above tables highlight an increase of visitors from Interstate.

In 2018–19 over 35% (over 1/3) of the total audience visitation travelled

from Interstate. The majority of the audience, 60% in 2018–19 is

Tasmanian and broken down even further, 21% of the total audience are

identified as being from the City of Hobart Local Government Area (LGA)

4.6. With this increased level of investment that was granted in June 2018, the 2018–19 Taste of Tasmania festival program introduced several new and important initiatives to the festival: A full detailed analysis of each element of the program is listed below.

4.7. ‘greener grass’

4.7.1. Located in Parliament Lawns, ‘greener grass’ was introduced to engage more specialised, smaller producers; celebrating a true diversity of food and beverage offerings within the curated festival program. More importantly, it created opportunities that encouraged and incentivised new and emerging businesses.

4.7.2. Much like an incubation program, ‘greener grass’ was sensitive to the fact that new and emerging producers had limited or no experience trading in a festival environment. New stallholders were introduced to long standing stallholders, much like a mentorship program.

4.7.3. ‘greener grass’ was a dynamic model and provided the option of trading for 3 days, 4 days or the full 7 days depending on the level of each business’s capability and resourcing.

4.7.4. A total of 22 new and emerging businesses were engaged. ‘greener grass’ featured a diverse variety of foods with an emphasis on multi-cultural foods. Notably, the Migrant Resource Centre (MRC) was invited to be a stallholder in ‘greener grass’ ahead of their official café launch in 2019. This opportunity was a training ground for the MRC. Being a dynamic space, there was 14 stallholders on any one day.

4.7.5. Entrance into ‘greener grass’ took place through a combination of and Expression of Interest (EOI) process and much work needs to be done to extend and strengthen this process in future years.

4.7.6. Whilst the Taste team and City of Hobart divisions were incredibly generous and supportive, more resourcing is required to ensure that stallholders are educated and informed on how to best run a business in a festival environment. Topics such as staffing, menu offerings, financial accounts, health and safety. ‘greener grass’ has extraordinary potential and there is merit in running a formal incubation process year round.

4.7.7. Hosting ‘greener grass’ in Parliament Lawns was challenging and expensive as there was limited infrastructure such as electricity and plumbing. Irrigation on Parliament Lawns was inadequate and problematic.

4.7.8. ‘greener grass’ had a total cost of $210,000 including a dedicated festival food curator to support the delivery of this initiative. ‘greener grass’ was only possible due to the increased level of investment from Council. The Tasmanian Government further contributed $20,000 in support of this new initiative. This $20,000 supplemented $80,000 in-kind support from the state government.

4.7.9. For the first time Parliament Lawns had been granted a liquor license, but again, this proved problematic as the high level of compliance required fencing to be placed around the boundary of Parliament Lawns which sectioned off ‘greener grass’ from the rest of the festival footprint.

4.7.10. To encourage more foot-traffic to ‘greener grass’ the music and entertainment programming was moved from various stages within the main footprint onto ‘greener grass’.

4.7.11. It was expected that there would be considerable learnings after the first year of this initiative. The majority of stallholders involved saw immense benefit from this opportunity to showcase their business in front of a large audience. Encouragingly, The Taste has received several emails from emerging businesses around the state asking to be considered for future years.

4.8. The SMEG Culinary Kitchen program

4.8.1. Recognising that the core of The Taste of Tasmania festival is a food and beverage festival, The SMEG Culinary Kitchen program was a new initiative featuring a ticketed program of 29 events;

4.8.2. Conceptually, the SMEG culinary program had three strategic aims:

4.8.2.1. Positioning The Taste of Tasmania festival as ‘a world class’ food and beverage festival for the state of Tasmania whilst giving the festival a point of difference from other like-minded festivals in Tasmania.

4.8.2.2. Creating additional revenue streams with a long-term strategy that in three – five years’ time, The Taste festival can increase its own generated revenue streams and reduce the amount of funding from the Council.

4.8.2.3. Engaging with a culinary audience, both locally and interstate. It has previously been identified that the brand of The Taste festival had been in a sharp decline over the past five years and as such, alienated the large culinary demographic. So, in the process of rebuilding The Taste brand and restoring its credibility, it was important to engage with this “new” audience and “bring them back”

4.8.3. As part of the concept of the SMEG Culinary Kitchen, significant consideration was given to the programming to ensure that the wider community could access the program and the culinary kitchen program was not considered “exclusive”.

4.8.4. The 29 ticketed events featured a combination of fine-dining banquets, masterclasses, hands-on cooking demonstrations and in-depth discussions lead by chefs, farmers, distillers and culinary influencers from all areas of Tasmania with the aim of “telling the story of Tasmania” through these events.

4.8.5. The capacity for each event varied in accordance to the nature of the event and the chef’s own limitations. However, a concerted effort was made to maximise revenue whilst balancing the need for intimate experiences.

4.8.6. Principally, the masterclasses could accommodate up to 28 people. The fine dining events could accommodate up to 70 people. There were also several events such as ‘Nick and Matthews Community Breakfast’, ‘Beer Fest’ and Sarah Glovers ‘In The Wild’ that were placed on the forecourt and could accommodate up to 300 people.

4.8.7. For its first year in existence, The SMEG Culinary Kitchen program was an incredible success when considering all measures: financial (expenses and revenue), customer satisfaction, talent satisfaction and the effects it had on the culinary and wider community.

4.8.8. The total percentage of tickets sold was 82.35%, exceeding box office targets that were set at 80%. Over 1600 people bought tickets to the SMEG culinary program. This translated to a total revenue of $114,360 with the total potential revenue of $138,860.

4.8.9. The average ticket price (ATP) was approximately $97. It was an important consideration to keep the ATP under $100, particularly in the first year, to not only build the brand but ensure maximum accessibility for the community whilst balancing it with expenses. The entry level price for tickets into the program was $30 and the top ticket price was $160.

4.8.10. A total of two complimentary (comp) tickets were assigned to the majority of events. Comps were held exclusively for media and PR use to encourage media coverage. Strategically, this was important for the brand of The SMEG Culinary Kitchen as well as exposure for festival partner, SMEG. Where media did not use or collect tickets for an event, comp tickets were either assigned to festival sponsors or put back on-sale to the public.

4.8.11. The SMEG Culinary Kitchen cost approx. $292,000 including infrastructure, utensils, food & produce, as well as significant resourcing including two x full time staffing positions for four months to organise and implement. This was alongside the required kitchen staffing such as a kitchen manager, Sioux Chef, Front of House Manager, dishwashers and Front of House team required to deliver each of the 20 events.

4.8.12. Over 30 influential and leading chefs, distillers, farmers, producers were involved in the Culinary Kitchen program including Rodney Dunn, Luke Burgess, Analiese Gregory, Adam James, FICO, Templo, Matthew Evans, Bill Lark, Hannah Moloney (Good Life Permaculture), Sarah Glover, Gillian Lipscombe (Sailor seeks Horse), Etties, Natalie Fryer (The Abel Gin Co.) Keira O’Brien (Winemaking Tasmania).

4.8.13. The table below outlines the costs associated with The SMEG Culinary Kitchen.

|

Cost Breakdown |

$ Dollar value |

|

Infrastructure Produce & beverages delivery staffing including Sioux chefs, FOH team, Kitchen washers, cleaners etc |

$130,000 |

|

Talent Fees |

$80,000 |

|

2 x full-time contractors from Sept 18 – Jan 2019 |

$82,000 |

|

Total expenses |

$292,000 |

|

Less Revenue |

$114,360 |

|

Total festival subsidy |

$177,640 |

4.8.14. The total subsidy of The SMEG Culinary Kitchen to the festival was $177,000.

4.8.15. As this was the first this was the first year for The SMEG Culinary Kitchen, it is expected and anticipated that in the event the SMEG Culinary Kitchen proceeds in future years (and it absolutely should), that The SMEG Culinary Kitchen has the potential to break-even. As the brand of The SMEG Culinary Kitchen is strong with a loyal following, there is no foreseeable obstacle or risks in achieving this.

4.8.16. In addition to the ticketed program of events, three large-scale, free events for the public were programmed and delivered. This included an in-depth discussion on the future of Tasmanian wine, “The great Tasmanian Bake-Off” and “Pickle Me Party” that was a workshop instructing people how to pickle their home grown vegetables.

4.9. New Years’ Eve (NYE)

4.9.1. For the Taste of Tasmania NYE event, a conscious effort to depart from the traditional model of The Taste festival where it has always been The Taste featuring a main-stage band, the NYE event became a speakeasy. Still utilising the three stages on-site, there was an emphasis on roaming entertainers such as big bands to engage and entertain the large volume of patrons that buy tickets along the waterfront.

4.9.2. Recognising that The Taste NYE event has showcased many great Australian artists over its 30 year history and that the budget for acquiring artists has not increased, a new “exclusive’ “one time only” band was created. Featuring Tex Perkins, Lisa Miller, Mojo Juju, Monique Brumby and Ella Hooper along with Musical Director Barney McAll. Artists were given the opportunity to play some of their favourite hits such as Beyonce, Michael Jackson, Nina Simone and these hits were supported by a 10 piece big-band.

4.9.3. Supporting entertainment included Miss Burlesque Australia Zelia Rose, Circus strongman Gordo Ramsay and high profile performer Shep Huntly was the EmCee.

4.9.4. Tickets were available in The Atrium, Waterfront and for the first time a Premium ticket was sold in the space reserved for The SMEG Culinary Kitchen.

4.9.5. Ticket prices were $110 for seated areas in The Atrium and along the Waterfront. $75 for General Admission (GA) that didn’t guarantee a seat. Premium tickets were $220. This ticket price offered patrons a grazing table and two x free drinks with use of their own exclusive bar. Furthermore, the Premium area had close proximity to the fireworks and exclusive viewing of the mainstage. The Premium area sold out within four weeks of being on-sale, showing that there is an audience who wants an all-in ticket.

4.9.6. A private event company were engaged to plan, organise and deliver the NYE Premium event including beverages and site dressings. A private catering company was further engaged to deliver the food offerings. Whilst the premium event had the framework in place, the event fell flat in the delivery, lacking ambience, co-ordination and organisation. Also, whilst it was clearly marketed that grazing tables (locally sourced cheeses, cured meats, breads, fruit and desserts) would be provided, many patrons expected a sit-down dining experience. Whilst no written complaints were received, this premium experience is unlikely to proceed again in future years unless additional funding can be sourced to resource experiences such as this.

4.9.7. NYE sold a total of 3,700 tickets and a total revenue of $330,000. When compared to the 2018 event where 4,888 tickets sold with a total revenue raised of $400,000 the results are lower. (But worth noting that 2019 results were an increase of 800 tickets on 2016 NYE events).

4.9.8. Despite the programming being the strongest that it has ever been and also despite every effort and energy being put into the marketing and PR of this NYE event, ticket sales did not meet box office targets of $400,000.

4.9.9. In 2018–19 approximately 1,800 tickets were sold on the day of NYE prior to the event. Historically, the Tasmanian audience has been slow to buy tickets, often the majority of tickets being sold in the days prior to the event. Whilst we remained hopeful that this would happen again, the waterfront precinct and surrounding businesses reported that NYE was very quiet. Tas Police reported zero arrests prior to midnight. Falls Festival also sold considerably less tickets in 2019. Although the visitors that attended the NYE event enjoyed their night, it was quiet onsite and stallholder comments and revenue further reflect this.

4.10. Music, Entertainment, Children & Family Programming

4.10.1. In 2018–19 the Music and Entertainment programming included street performers, roving entertainers, live music and action based stunts. It can best be described as ‘High Vibrance’ entertainment. The entire site of the festival was utilised as a performance space with the main stage, Atrium stage and Castray lawns stage being purpose built for live music.

4.10.2. The programming model was based on engaging 80% local entertainers, musicians whilst 20% were national. Where possible, emphasis was placed on Tasmanian artists living on the mainland. A new “house” band, ‘1988’ was formed where artists from a variety of bands in the daily program came together, collaborating on their favourite power ballads from the year 1988 (the birth of The Taste festival). ‘1988’ had a strong following at each performance and was considered a highlight of the music and entertainment program. Additionally, kids and families loved the unicorn hair studio, operating in ‘greener grass’. This free salon allowed people to have their hair painted in vibrant colours and styled in a wondrous way.

4.10.3. Kids in the Park (KIP) previously located in Parliament Lawns was removed and instead, Children and Family programming integrated with the main program of music and entertainment; again this was spread out over the entire festival site.

4.10.4. In essence, the music and entertainment programming became very fluid and flexible due to moving acts to ‘greener grass’ and changes to Castray. Both efforts to direct traffic to these areas. Late schedule changes were communicated via large blackboard signage along with dedicated staffing on social media. Box Office and Information booths became the central point of information for relaying the entertainment taking place around the site.

4.11. Daily Reserved Seating

4.11.1. The amount of daily reserved seating was relocated to the rear of the Waterfront in 2018–19. It was further reduced from 166 seats to 92 seats. This was done to ensure that the seating area was operating at its optimum. Four sessions were available, daily. A three hour session cost $25. Overall, the first 3.5 days of the festival, the seating area operated at close to 100% capacity. The final 3.5 days when people have returned to work, the capacities were lower between 40-50%. Overall the daily reserved seating averaged 74% sales translating into $31,000 in revenue. It is recommended that this model continue in future years.

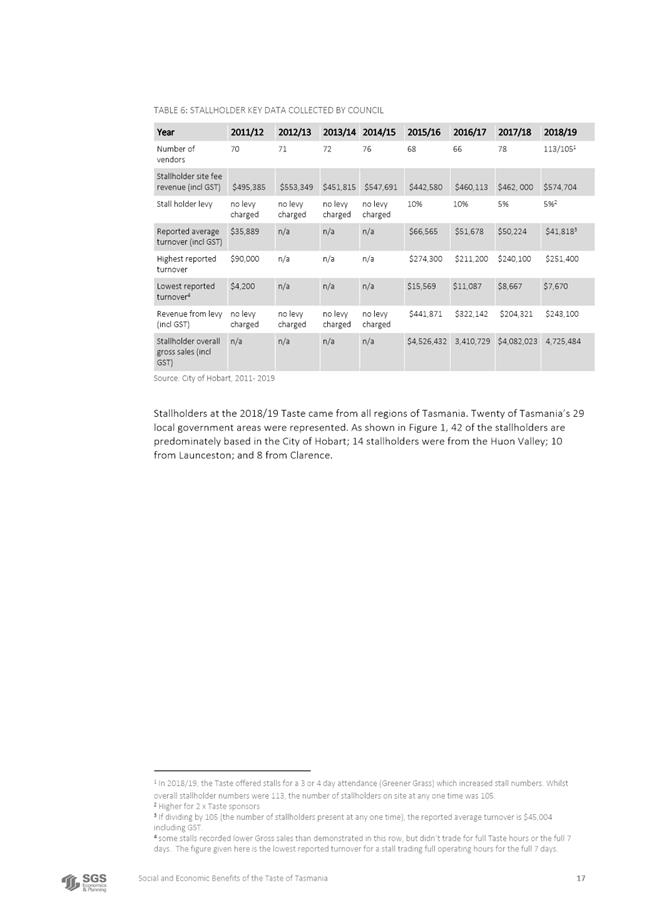

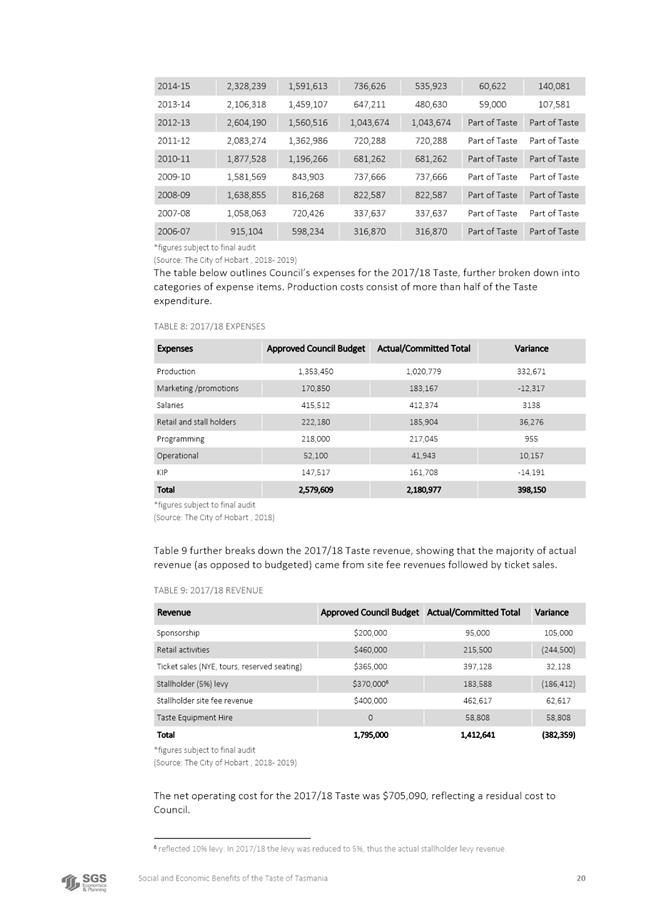

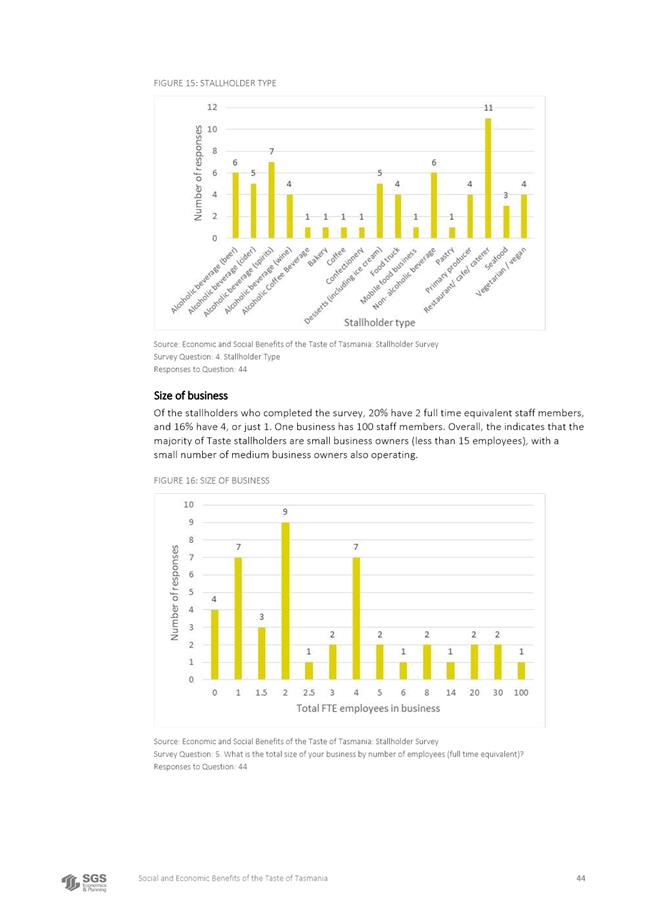

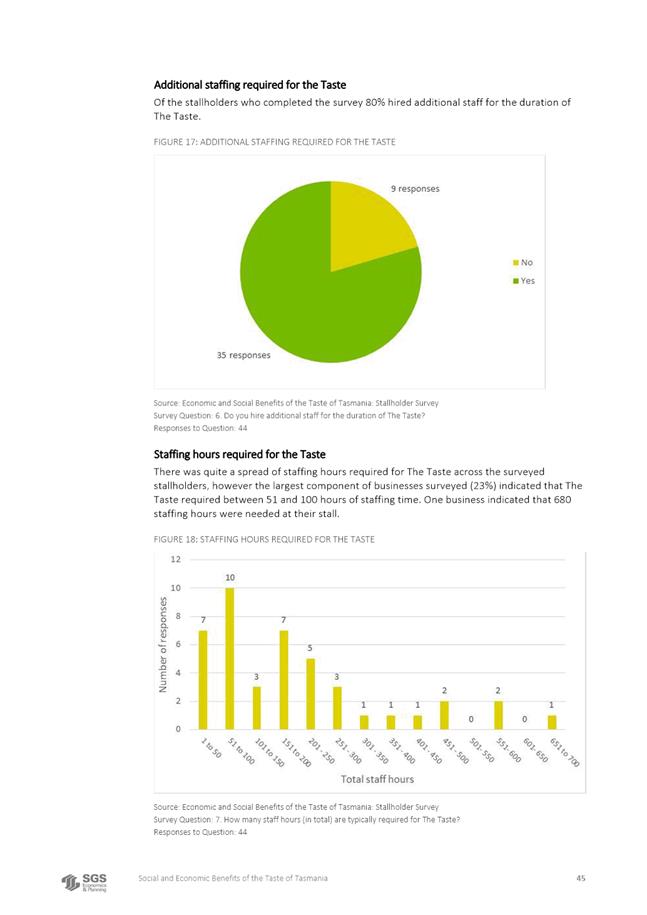

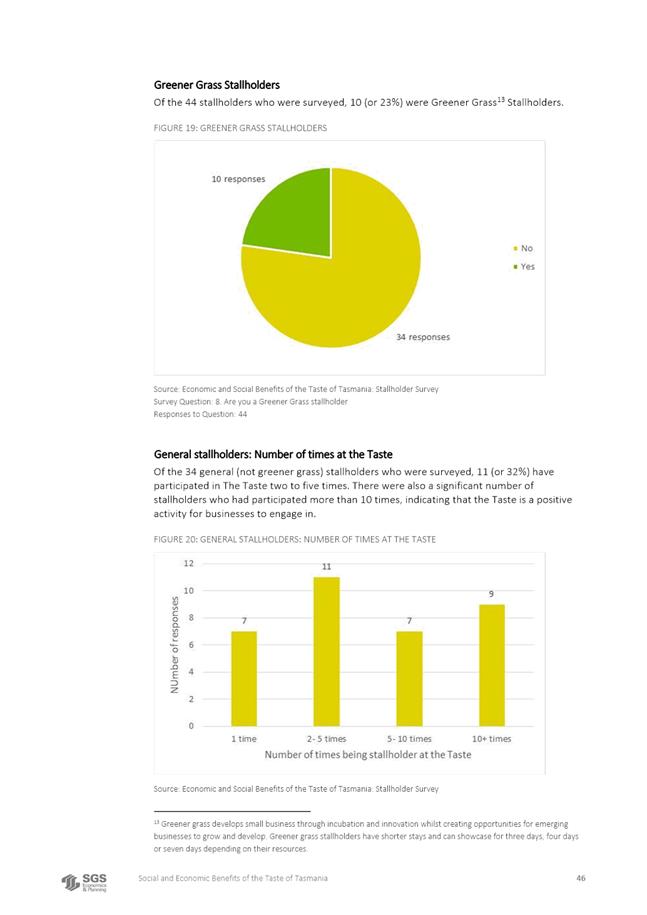

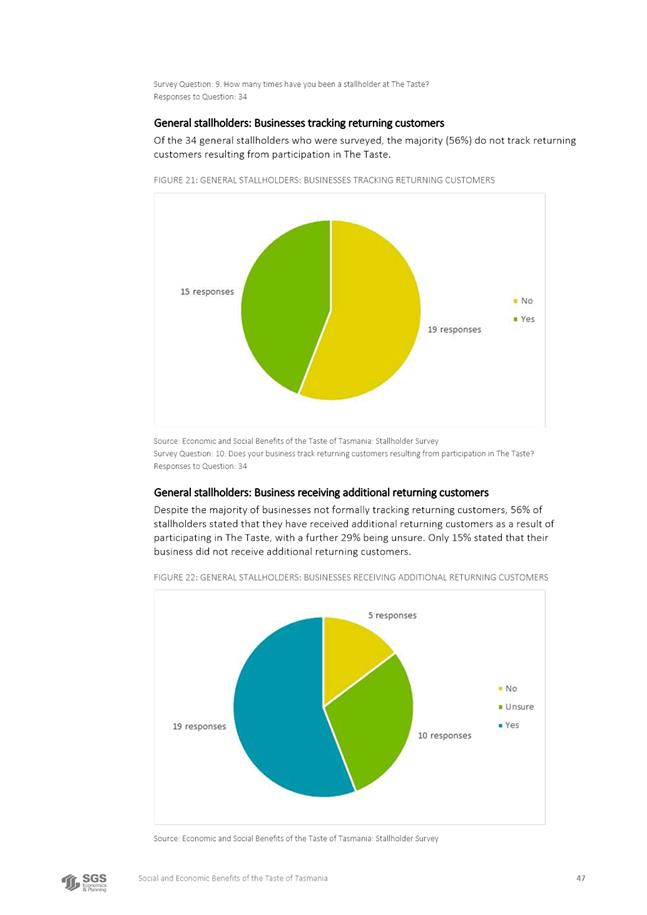

4.12. Stallholders

4.12.1. The 2018–19 Taste had the highest number of attending stallholders on record (113). For the first time, The Taste offered first-time stallholders an opportunity to participate for three or four days, as opposed to the full week long event. This initiative known as ‘greener grass’ increased the number of participating stallholders due to the dynamic and revolving concept. The number of stallholder’s onsite at any one time was 105, an increase of 32 from 2017–18.

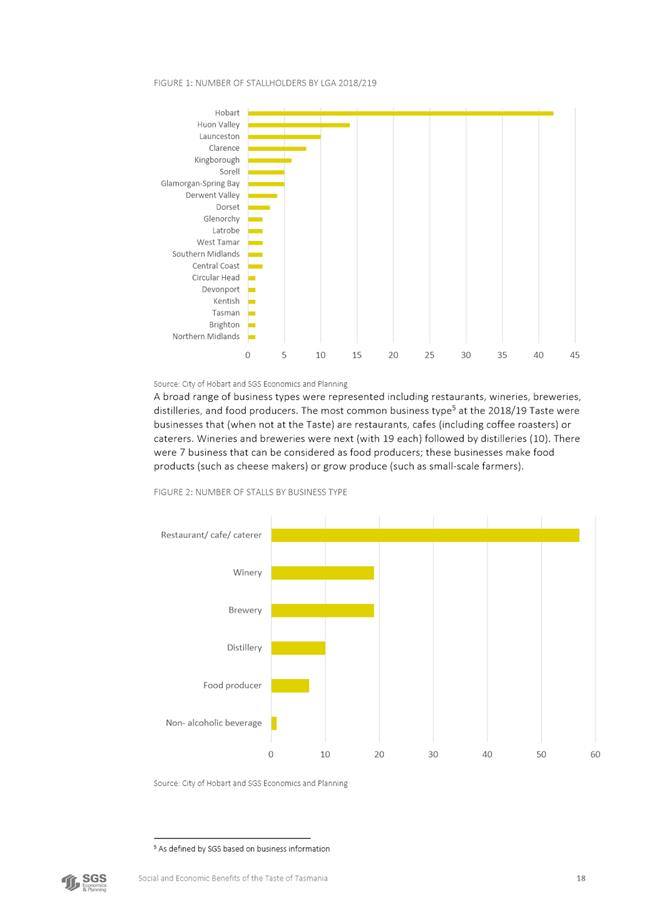

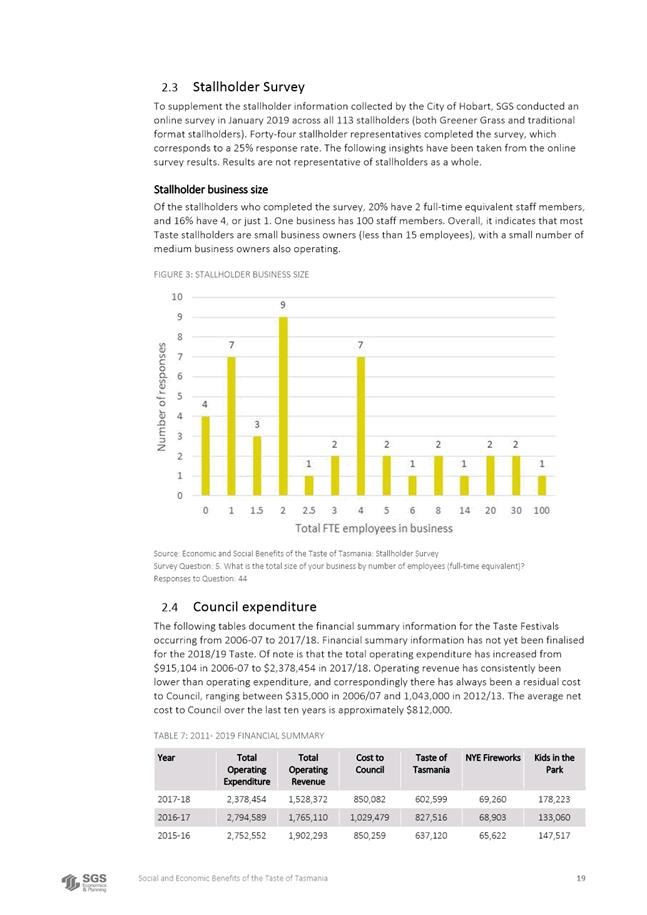

4.12.2. The increased number of stallholders was a conscious effort to increase the diversity of food and beverage offerings. A broad and diverse range of business types was representing including restaurants, wineries, breweries, distilleries and food producers. The most popular business type at the 2018–19 Taste were restaurants, cafes (including coffee roasters) and caterers. Wineries and breweries were next followed by distillers. Overall the food/alcohol balance was 65/35% respectively. A key driver of the festival food curation this year, focused on showcasing niche and unique offerings from smaller producers. This was largely possible because of ‘greener grass’.

4.12.3. Whilst there is always commentary that there is too much alcohol, there is no avoiding the fact that Tasmania currently produces far more alcohol than it does food.

4.12.4. Understanding that there were more stallholders at The Taste in 2018–19 and that patrons attending The Taste celebrated the diversity and choice on offer, it did present far more competition for the stallholders.

4.12.5. Following the 2017–18 Taste, greater emphasis and discussion with the stallholders took place. A greater emphasis was placed on stallholders to revise and in some cases, simplify their offerings. The financial data indicates that new stallholders and/or stallholders that created exclusive offerings for The Taste festival generated large revenue. Other stallholders that kept their offering consistent with what they present at all other festivals, did not reap the financial benefits.

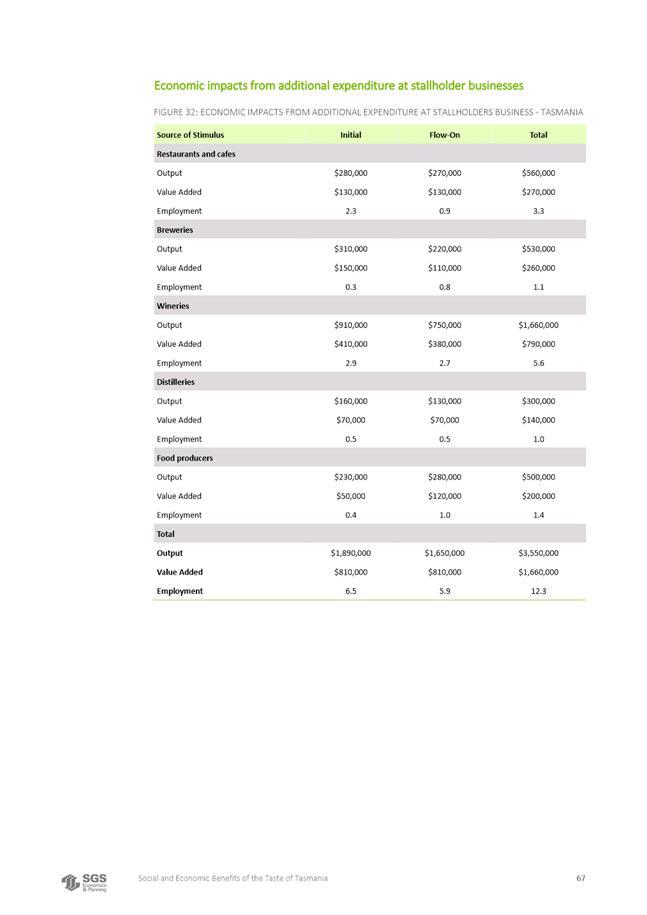

4.12.6. More than revenue being a primary motivator, it was encouraging to see many stallholders adopt ‘big-picture’ thinking where they leveraged the marketing vehicle that The Taste represents. The economic benefit study conducted by SGS discusses this in greater detail, however, many stallholders leveraged their business brand to enhance the year-round benefit of their business being involved in the festival.

4.13. Operational Changes for the 30th Anniversary including staffing

4.13.1. As noted in the report from Associate Director, City Economy Tourism and Events in January 2019 there have been and continue to be systematic resourcing issues inherent within the festival.

4.13.2. Taking into account learnings from the 2017 and previous events, having adequate resourcing in place was a priority for the 2018–19 festival. This meant dedicated resourcing needed to be in place for specialist areas such as Commercial Marketing, Sponsorship, Commercial Producers, an arts and entertainment Legal Advisor to support with overhauling commercial, stallholder and artist contracts.

4.13.3. It was intended that a Sponsorship Director would come on-board but due to the timing of the budget sign-off in 2018, it was not possible to engage a Sponsorship Director and expect them to succeed. Instead, the Festival Director led all conversations and negotiations until a Sponsorship Co-ordinator was engaged in October.

4.13.4. Understanding the large volume of changes made to the site and referencing past years, an additional Production Manager role was implemented in 2018–19. This role provided great relief to the existing team and ensured work hours and mental health were better managed.

4.13.5. Largely, The Taste team operated on a contractor model with 90% of the team placed on short term contracts of up to four months. Ideally, more time was needed, but again due to the budget being signed off in June and factoring in time to find the right skill set, contractors commenced in either September or October.

4.13.6. Many contractors worked remotely, and largely, this worked well. The exception to this was the Marketing Manager role. Although, it was hoped to find a local commercial marketing agency or individual in Hobart, it was challenging to find a marketing professional with commercial experience and/or who was available for a four month contract. Instead a Sydney based company was engaged in August. Due to the dynamic environment of the festival, the marketing manager does need to be based in the office.

4.13.7. A Senior Business Analyst role was introduced in 2018–19 to help relieve some of the pressure and workload volume from the Festival Director, however, due to the lengthy process within Council, this full-time position was advertised too late and did not engage adequate candidates. As such, the role was reverted to a four month contract due to time pressures. As this role was a contractor, many of the responsibilities assigned to this role, fell back with the Festival Director.

4.13.8. Whilst the resourcing for the 2018–19 festival was significantly improved, enabled due to the increased level of investment, earlier budget approvals are required to ensure the festival has the correct staffing in place. In 2018–19 the Festival Director worked the full-time equivalent of four roles. This proved challenging to be both strategic and hands-on; having the direct responsibilities of managing sponsorships, the commercial framework and programming elements of The SMEG Culinary Kitchen whilst also managing internal Council reporting process and a team of 28 people both locally and nationally. Pending the festival concept, The resourcing will be revised in 2019 to ensure more sustainable work practises, however, it’s imperative to have the budget approved no later than mid-March to ensure planning can commence.

4.14. Sponsorship

4.14.1. Due to the fact that the Budget was approved and committed in June 2018 meant that it was not possible to engage a specialised Sponsorship Director. It further translated into limited opportunities on a national level as most businesses, organisations have committed their funding within the previous financial year.

4.14.2. The Festival Director commenced conversations early in February firstly with existing sponsors but then essentially cold called businesses both locally and nationally that would benefit from being involved with The Taste. Due to internal Council timelines, it is fair to say that sponsorships had previously been poorly managed with benefits that were inconsistent. This required the entire fundamental framework of sponsorships to be overhauled for the 2018–19 festival. Sponsorship contracts, sponsorship hierarchies and benefits were revised along with The festival’s need to leverage more from our partners.

4.14.3. The Festival Director led all conversations and negotiations with the sponsors until November when a Sponsorship Co-ordinator was engaged to manage the relationships on a daily, operational level.

4.14.4. The Tasmanian Government, Forty Spotted Gin, Good Meat Australia and The Mercury Newspaper were engaged as Festival Partners, while Josef Chromy, Hartz, James Boags, Tas Foods Company, TasPorts, UTAS were engaged as Festival Supporters. The Taste of Tasmania further partnered with local charity Colony 47, working with them to fundraise across the festival.

4.14.5. Complementing the ticketed events in the SMEG culinary program, was a rigorous program of free events for the community that were programmed in accordance with new festival partnerships.

4.14.6. Good Meat Australia engaged Ben Milbourne who presented two live cooking demonstrations, daily on the forecourt. Additionally, in collaboration with The Mercury newspaper, Festival Director Brooke Webb and Assistant Editor and journalist, Amanda Ducker, created a program of three live-panel discussions. These three panel discussions were broadcast via The Mercury Facebook page and featured talent from the SMEG culinary program as well as engaging Tony Scherer (Sprout), Kim Seagrum (FermenTasmania), David Ball (Head Chef at The Glasshouse), Thea Webb (Taste team) and Trish Hodges from NITA. The panel discussions focused on three topics ‘The Art of Sharing’, ‘Tradition’ and ‘Alchemy and Innovation’.

4.14.7. A total of $154,000 was generated in actual cash sponsorships. A total of $253,000 was the total value of both cash and in-kind sponsorships that included $80,000 in-kind support from the Tasmanian Government. Compared to 2017–18 where a total of $95,000 in cash sponsorships, this was a significant improvement but in order to maintain and grow this result, a dedicated Sponsorship Director with existing national relationships does need to be engaged.

4.14.8. Although this result is both positive and encouraging, the ability of the Festival Director to manage these key, important relationships is limited. Additionally, having the Festival Director manage sponsor relationships does also become a conflict of interest and an awkward relationship.

4.14.9. Sponsorships and Partnerships are a very important part of revenue fundraising and a very particular skill set that needs dedicated resourcing to implement this. Although it is a specialised skill set, it is recommended that a year round Sponsorship Director be engaged to recruit and manage partnerships. The Sponsorship Director can be engaged and work remotely.

5. Proposal and Implementation

5.1. This has been addressed throughout this report.

6. Strategic Planning and Policy Considerations

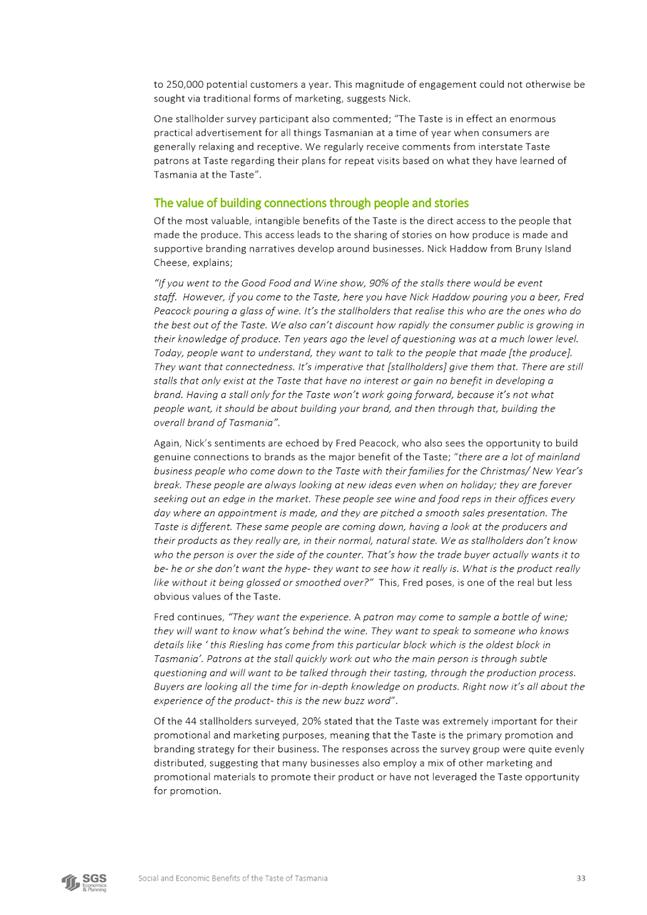

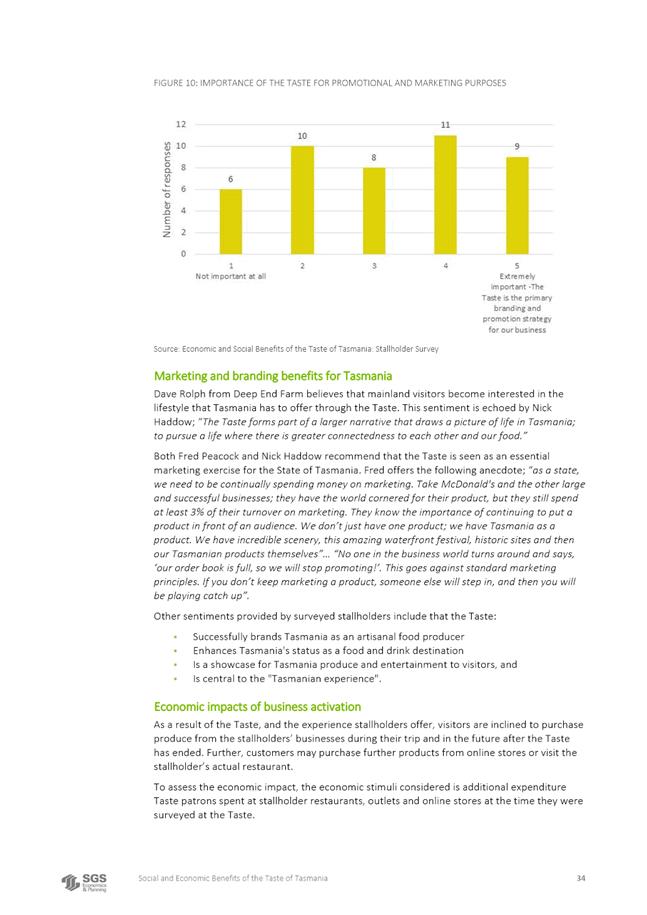

6.1. Responding to the need to develop a deeper understanding of the social and economic contributions the Taste of Tasmania (The Taste) provides, both during the event itself and throughout the entire year, The City of Hobart has commissioned an evaluation of the social and economic benefits of The Taste to the community, both locally (the City of Hobart local government area) and to the State of Tasmania.

6.2. As previously advised to the Council, the last economic impact assessment of the Taste was conducted in 2010/11. This report has been redistributed to elected members via the Council information website. The report from 2010/11 was based on an estimate of crowd attendance, not an actual count as was the case this year.

6.3. Based on an estimated crowd attendance of 250,000 that study noted that the combined direct and indirect impact of this expenditure at the Taste was an increase in output across Tasmania of $39 million. It also noted 294 full time part time and casual jobs were supported across Tasmania. The increase in Gross Regional Product for Tasmania was $16 Million.

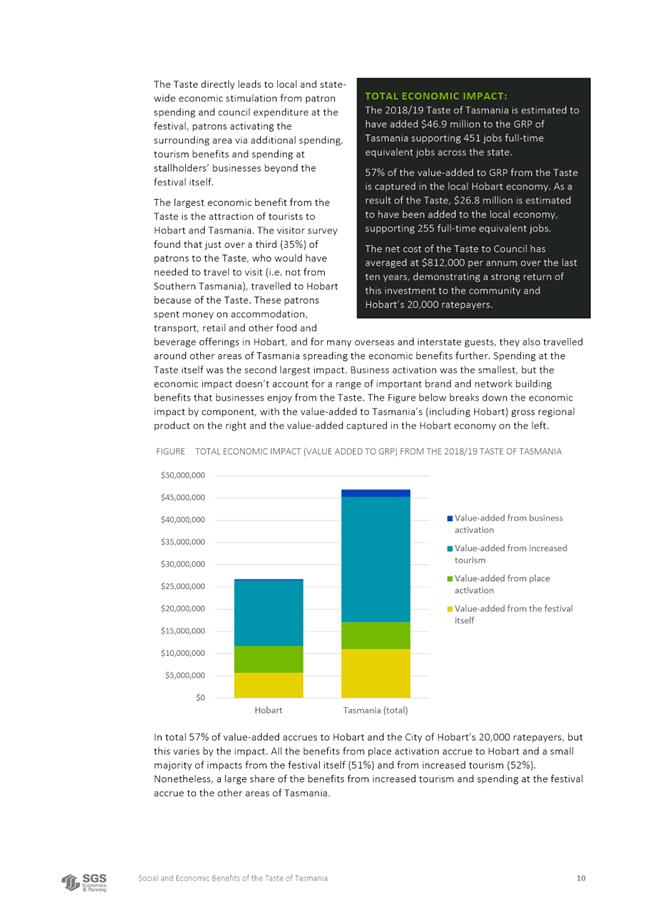

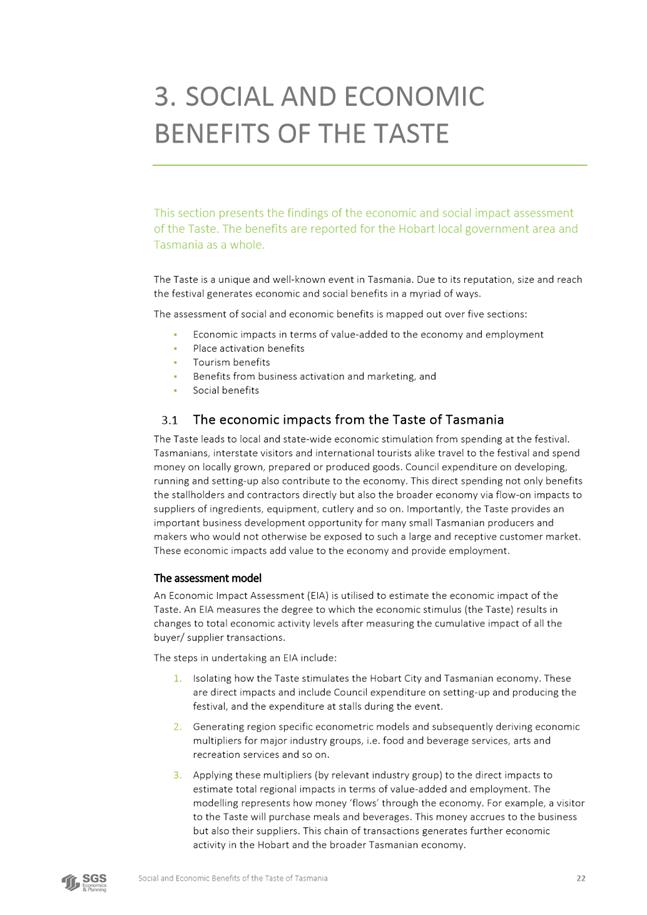

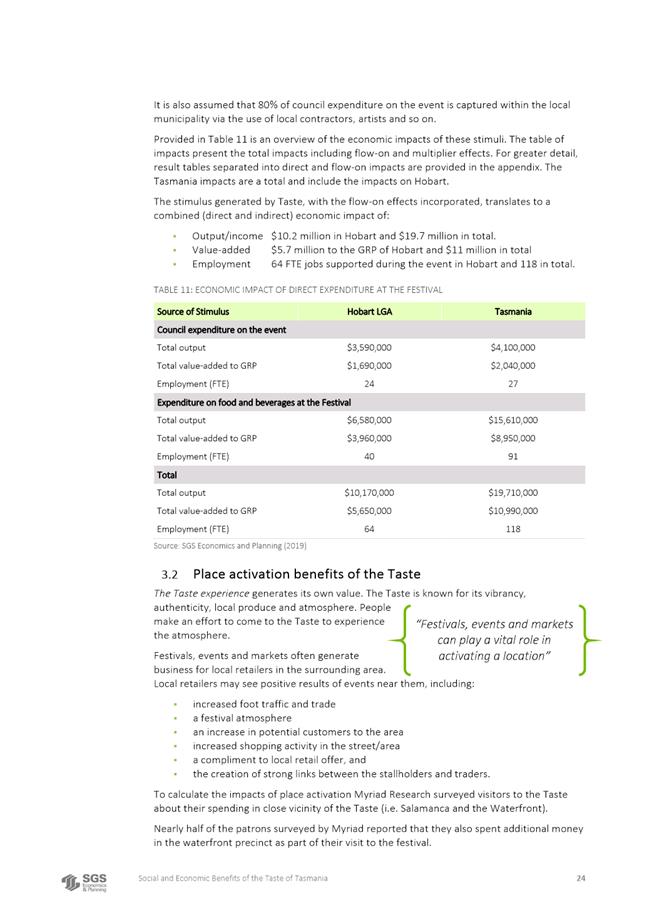

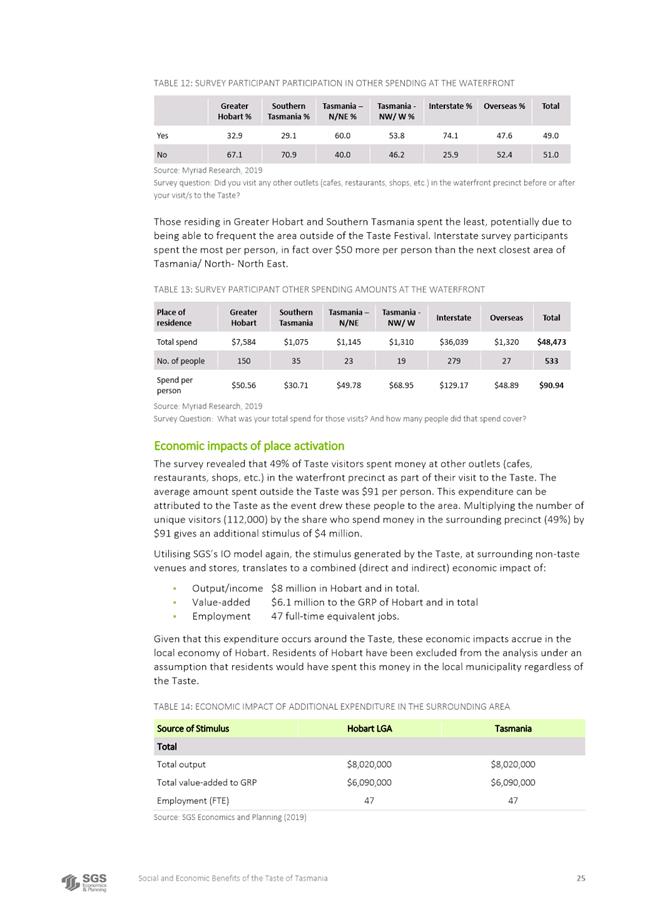

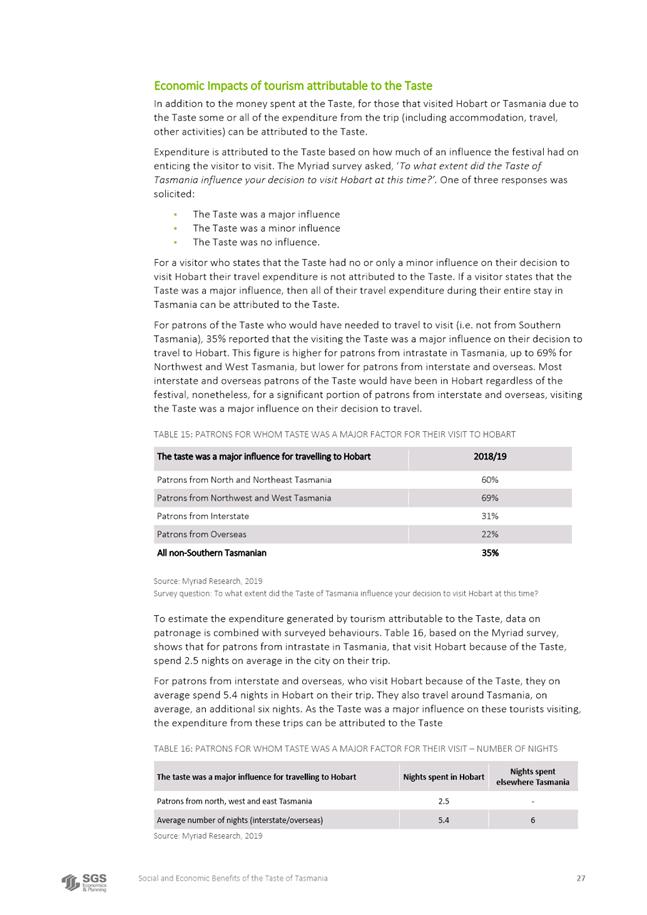

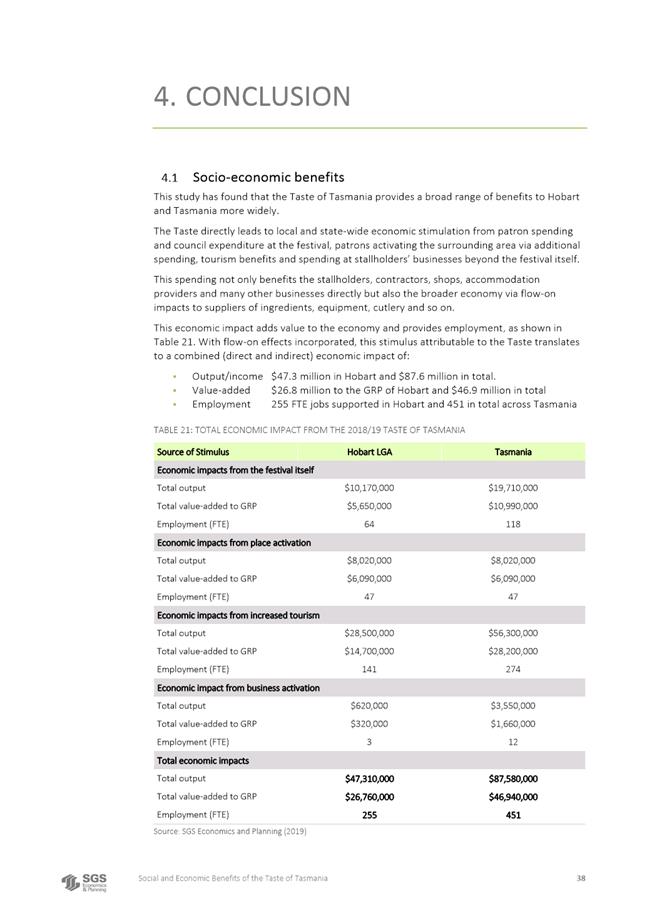

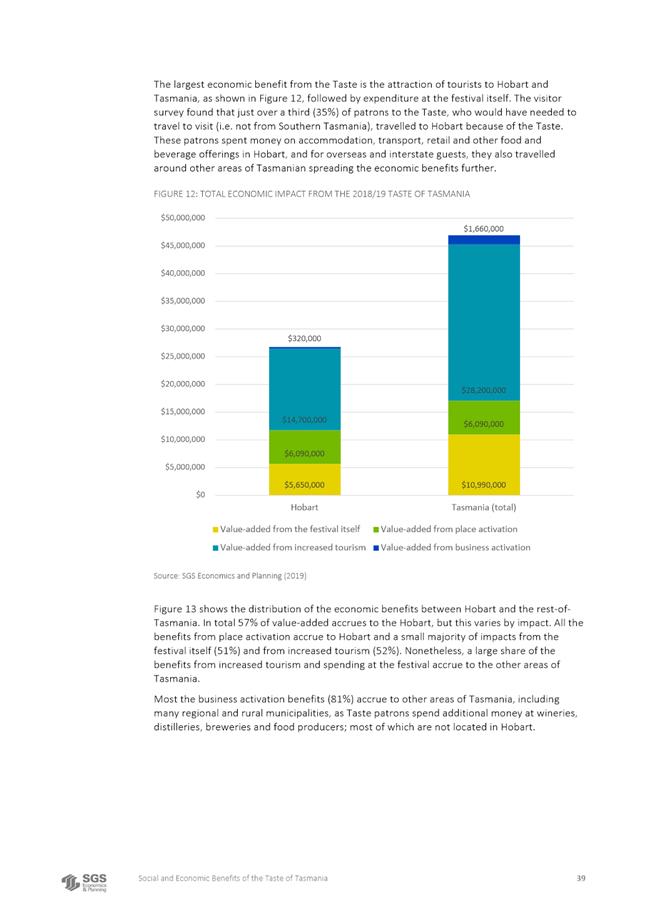

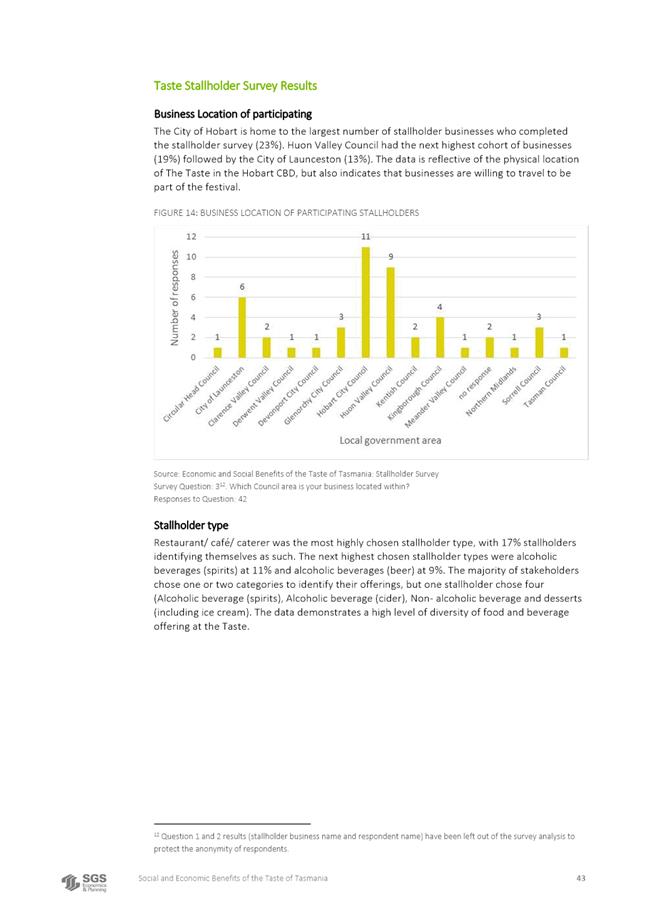

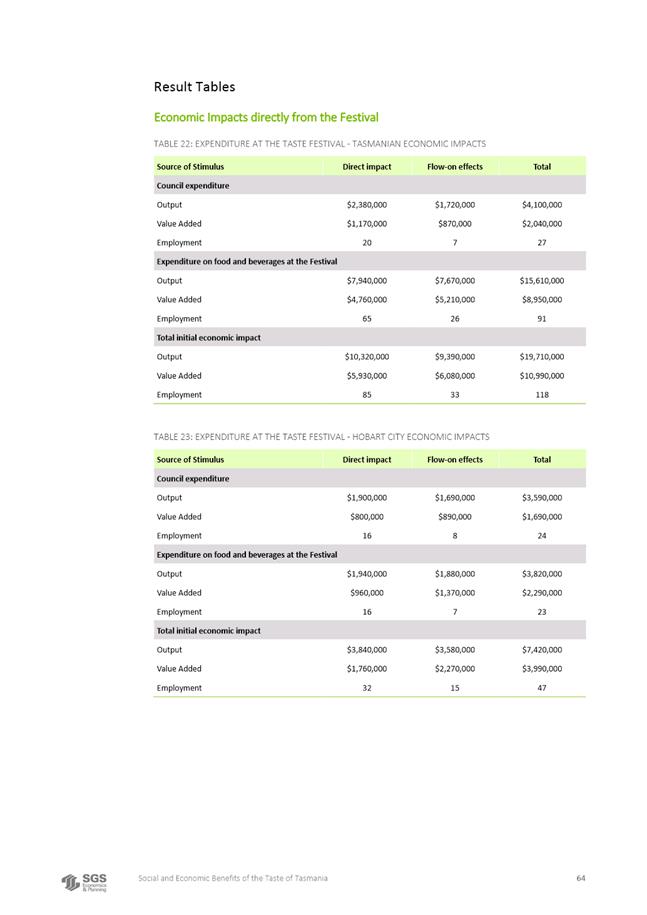

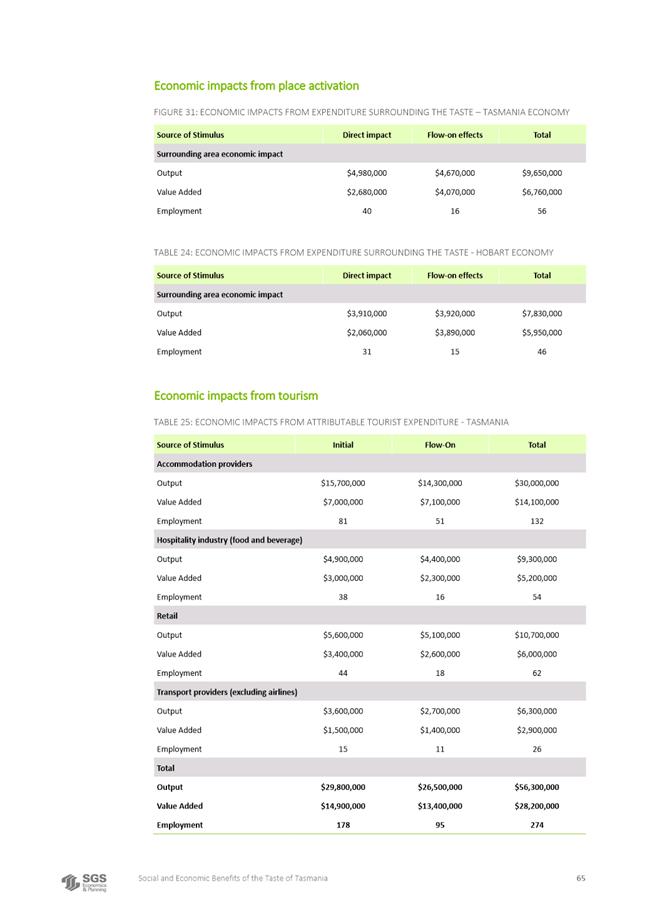

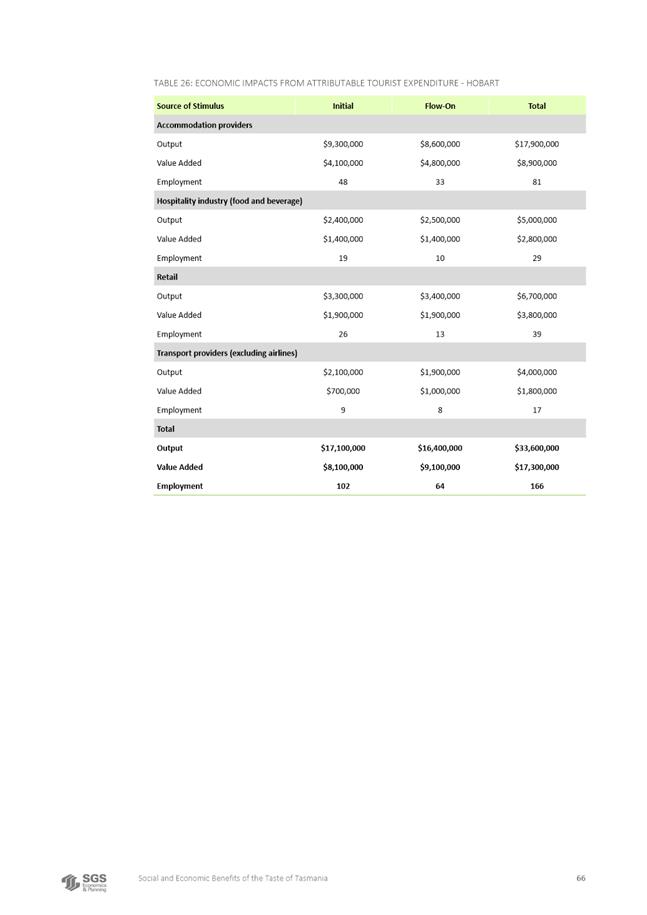

6.4. In contrast, the 2018/19 report prepared by SGS Economics and Planning, uses visitor and stallholder surveys, case studies, background research and economic modelling to assess the social and economic benefits of the Taste for the Hobart LGA and Tasmania as a whole. The SGS report highlights the following:

6.4.1. The Taste directly leads to local and statewide economic stimulation from visitor spending at the festival. Tasmanians, interstate visitors and international tourists alike travel to the festival and spend money on locally grown, prepared or produced goods.

6.4.2. Council expenditure on developing, running and setting-up the festival also contributes to the economy. This direct spending not only benefits the stallholders and contractors directly but also the broader economy via flow-on impacts to suppliers of ingredients, equipment, cutlery and so on. Importantly, the Taste provides an important business development opportunity for many small Tasmanian producers and makers who would not otherwise be exposed to such a large and receptive customer market.

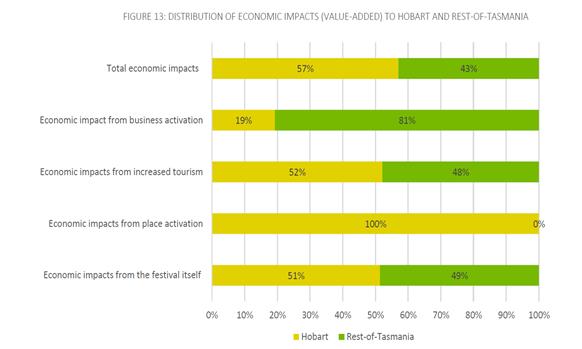

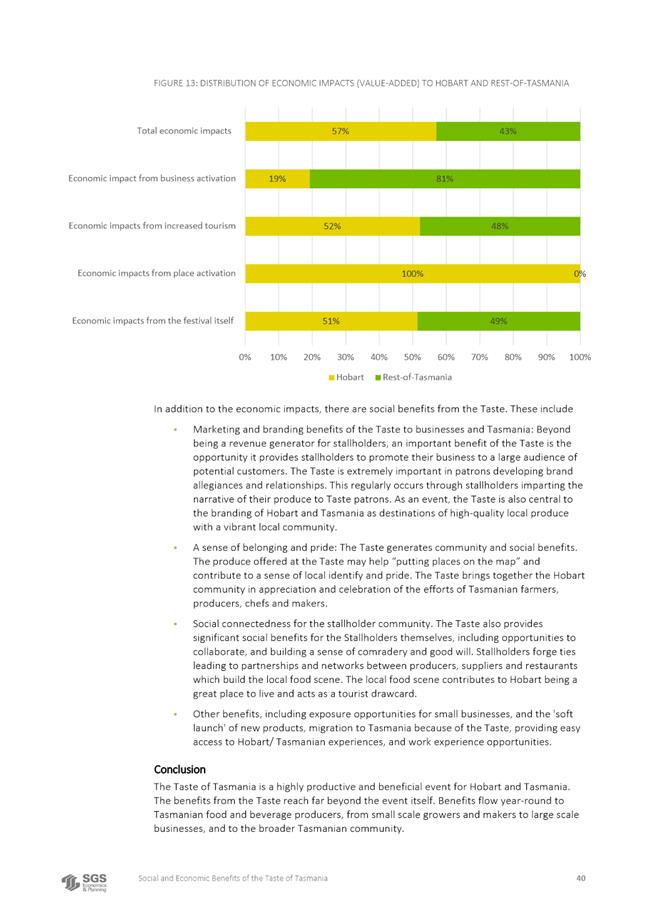

6.4.3. The stimulus generated by The Taste, with the flow-on effects incorporated, translates to a total combined (direct and indirect) economic impact estimated to have added $46.9 million to the Gross Regional Produce (GRP) of Tasmania supporting 451 equivalent jobs full time across the State. 57% of the value-added to GRP from The Taste is captured in the local City of Hobart economy.

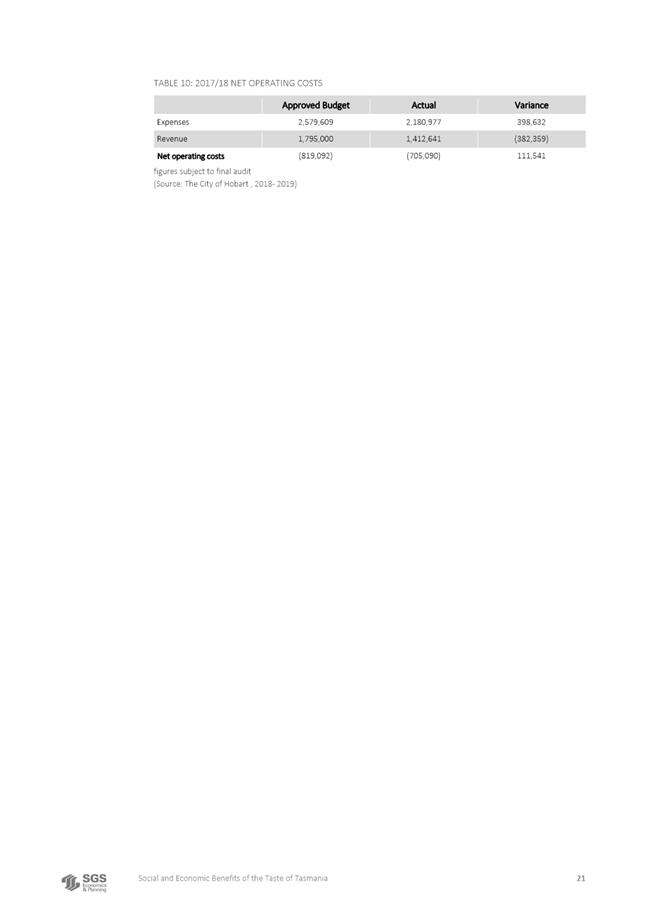

6.4.4. As a result of The Taste, $26.8 million is estimated to have been added to the local economy supporting 255 full-time equivalent jobs. The net cost of The Taste to the Council has averaged at $812,000 per annum over the last ten years, demonstrating without question a strong return of this investment to the community.

7. Financial Implications

7.1. In March 2018, as part of the Council processes, The Taste was advised that it was unlikely to receive the full budget allocation of $1.6 million due to the many competing demands on the Council’s overall budget. The request was to submit a budget reflecting $1.2 million. In June 2018, the Council supported the motion to increase the level of investment by $400,000, resulting in a total net subsidy of $1,651,592.

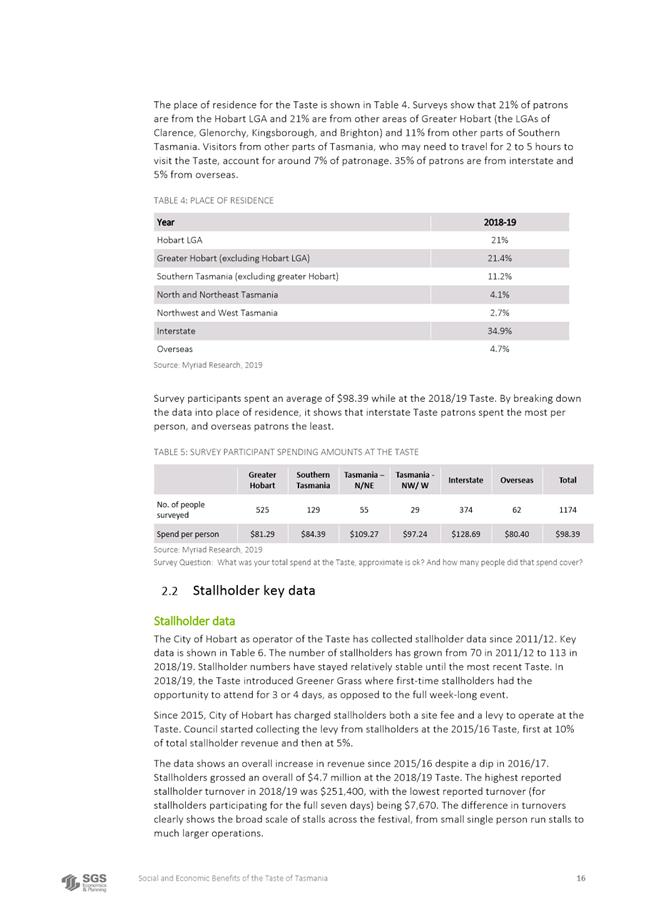

7.2. The table below, compares the original ‘proposed’ budget of $1.2 million with the actual spend which was based on the revised budget amount of $1.651,592.

7.3. With regard to an increased state government investment in The Taste festival, discussions have commenced. However, at the time of writing this report a definitive answer has not been received.

|

Budget Code |

Proposed $1.2 million budget 2018–19 |

Actual $1.6 million 2018/ 2019 |

Variance |

|

Programming |

$533,000.00 |

$956,416.00 |

423,416 |

|

Production |

$1,492,178.00 |

$1,650,596.00 |

158,418 |

|

Marketing |

$199,830.00 |

$208,920.00 |

9,090 |

|

Operations |

$591,307.00 |

$551,919.00 |

-39,388 |

|

Expenses |

$2,816,315.00 |

$3,367,851.00 |

551,536 |

|

Revenue |

$1,565,000.00 |

$1,719,740.00 |

154,740 |

|

Net |

-$1,251,315.00 |

-$1,648,111.00 |

|

|

approved net |

-$1,651,592.00 |

||

|

current status |

$3,481.00 |

7.4. The above table highlights where the increased investment of $400,000 was spent. Programming was the major area, followed by Production.

7.5. The below table more closely defines the programming budget and allocation of costs.

|

Budget Code |

Proposed $1.2 million budget 2018–19 |

Actual $1.6 million |

Variance |

|

2018/ 2019 |

|||

|

Programming |

$533,000.00 |

$956,416.00 |

423,416 |

|

Contractors |

$284,000.00 |

$691,000.00 |

407,000 |

|

artist fees - NYE, Kids & Family, Music & Entertainment |

$220,000.00 |

||

|

Taste "core" team |

$471,000.00 |

||

|

Stock Purchases - Retail |

$90,000.00 |

$92,000.00 |

2,000 |

|

NYE Fireworks |

$71,000.00 |

$71,000.00 |

0 |

|

External Labour charges |

$65,000.00 |

$42,000.00 |

-23,000 |

|

Misc - cash handling, credit card fees, cleaning supplies |

$23,000.00 |

$60,416.00 |

37,416 |

7.6. The above table details the programming budget reflecting the labour including the core Taste team of contractors who were required to bring the festival concept to life through the organisation, planning and delivery. Programming further includes the artist fee costs to engage musicians, street performers, children and family programming

7.7. The below table more closely defines the production budget and allocation

|

Budget Code |

Proposed $1.2 million budget 2018–19 |

Actual $1.6 million |

Variance |

|

2018/ 2019 |

|||

|

Production |

$1,492,178.00 |

$1,650,596.00 |

158,418 |

|

|

|

|

|

|

Security |

$129,878.00 |

$165,000.00 |

35,122 |

|

External labour hire |

$162,000.00 |

$178,000.00 |

16,000 |

|

Delivery services |

$42,000.00 |

$56,000.00 |

14,000 |

|

Contractors services - marquees / audio |

$279,000.00 |

$325,000.00 |

46,000 |

|

Contractors services - cleaning/waste |

$170,000.00 |

$210,000.00 |

40,000 |

|

Equipment - Dry Hire |

$144,300.00 |

$135,000.00 |

-9,300 |

|

Building Hire |

$100,000.00 |

$70,000.00 |

-30,000 |

|

Plumbing & Electrical |

$70,000.00 |

$80,000.00 |

10,000 |

|

Wet Hire |

$145,000.00 |

$155,000.00 |

10,000 |

|

Internal Charges |

$100,000.00 |

$120,000.00 |

20,000 |

|

Miscellaneous - IT licenses, software, fuel, training, mananagement plans |

$150,000.00 |

$156,596.00 |

6,596 |

7.8. The above table reflecting production expenses also highlights an increase. The increase from the proposed budget reflects additional infrastructure such as marquees as well as labour and staffing such as increased security and cleaning/waste staff.

7.9. Noting that all ‘actual’ expenses were contained within the approved parameters. When it was clear that revenue targets for NYE were not being met, the Festival Director in collaboration with the production manager and key staff, reduced expenses where possible to offset the net result.

7.10. The revenue line includes all the retail components as well as revenue gained through the increased revenue streams such as The SMEG Culinary Kitchen. Recognising that The Taste budget operates year round not just reflecting the festival, there is an additional $88,000 projected in revenue to accommodate the Dark MOFO sponsorship and their associated revenue hires. Whilst it is anticipated that this fee will be received in June, ahead of the new financial year, it is pending the actual equipment hire from Dark MOFO. At the time of writing this report, the sponsorship agreement with Dark LAB is under renegotiation. There is a medium risk that this projected revenue will not eventuate.

7.11. The current net result is $3,481 positive to budget.

7.12. Funding Source and Impact on Current Year Operating Result

7.13. This has been addressed throughout the report

7.14. Impact on Future Years’ Financial Result

7.15. Officers have been consistent in recommending that the necessary budget for the Taste to remain a contemporary festival and relevant to our community needs to be $1.6m.

7.16. It is understood that Council may be more comfortable, when considering historical budgets for the Taste, that an amount of up to $1.2 million is the Council investment.

7.17. It is therefore proposed, depending on the level of state government grant, that the funding model could be:

7.17.1. $1.02 – $1.27 million direct Council investment.

7.17.2. $250,000 - $500,000 cash grant from the Tasmanian Government.

7.17.3. $80,000 PW1 hire fee waiver.

8. Asset Related Implications

8.1. None arise from this report.

9. Legal, Risk and Legislative Considerations

9.1. This has been addressed earlier in the report.

10. Environmental Considerations

10.1. There was no ‘Taste of Tasmania Inspection Fee’ charged to stallholders. This $150 fee was waived and absorbed by The Hobart City Council (COH) Environmental Health Office (EHO) Team.

10.2. The COH EHO team reported zero complaints from festival visitors regarding the food hygiene.

10.2.1. In 2018–19 The Taste festival engaged local business Veolia as the waste management company. The table, below details results from the past five years. Please refer to Attachment B that details the full breakdown of waste over the past 5 years.

|

|

Total waste in KG |

|

2018-2019 |

72900 |

|

|

|

|

2017-2018 |

69440 |

|

|

|

|

2016-2017 |

57400 |

|

|

|

|

2015-2016 |

58890 |

|

|

|

|

2014-2015 |

87050 |

|

|

|

|

2013 - 2014 |

72040 |

10.2.2. Despite having over 263,000 visitor attendance, the largest attendance at The Taste, the above total waste was considerably low. This highlights big improvements in reducing waste and reflects a very good outcome.

11. Social and Customer Considerations

11.1. Of particular note the SGS report details case studies with three stallholders from The Taste 2018–19 festival. Each stallholder discusses the immense benefits of being involved in The Taste festival not only for the duration of the festival but year round. Furthermore, the case studies reinforce the impact of participation on their business and sense of connection to the community. These are discussed in detail in the report, refer Attachment A.

11.2. In addition to the economic impacts, The Taste generates community and social benefits that are difficult to quantify from an economic perspective but are important nonetheless. There are three main benefits that have been identified:

11.2.1. Enhanced sense of belonging and pride:

The produce offered at The Taste helps “put Tasmania on the map” and contribute to a sense of identity and pride. The social benefits are strongly related to The Taste experience and the knowledge of place it generates.

11.2.2. Activation of the local community:

The Taste provides a centre point for activity in Hobart over the Christmas and New Year’s period. The festival brings activity and excitement to Greater Hobart.

11.2.3. Social connectedness for the stallholder community:

The Taste also provides significant social benefits for the stallholders themselves. Fred Peacock, owner and winemaker of Bream Creek Wines notes that The Taste is the only annual opportunity for Tasmanian producers to socialise, collaborate and learn from one another. Nick Haddow of Bruny Island Cheese notes that The Taste “shows the community what can be done through food innovation and contributes to a healthier, more connected community”.

12. PR, Media Communications & Marketing

12.1. For the Taste 30th Anniversary, a national campaign was orchestrated. This is in recognition that the interstate visitation has been steadily increasing since 2014 and over 30% of the audience attending The Taste are from Interstate. Another consideration for the national campaign was the increased number of tickets that were required to sell in the culinary kitchen program.

12.2. Cardinal Spin, a Sydney based PR and Communications agency were engaged to execute the PR, Media and Communications for The Taste festival.

12.3. It was a hugely successful campaign. 791 pieces of coverage achieved with a combined circulation reach of 243,479,287. The reach has been calculated by adding up the individual circulation of each piece of coverage that was secured for the festival.

12.4. The PR, Media and Communications campaign reached International media, largely in thanks to Culinary Queen, Martha Stewart attending the festival not once, but twice. More than this, Martha Stewart posted on her social channels promoting The Taste festival as a lively and vibrant food and beverage experience. This exposure was not only of huge value to The Taste festival but it was a fantastic support for the farmers, producers and stallholders.

12.5. The estimated digital advertising value of print, TV and radio, has been calculated at an Advertising Value Equivalent (AVE) of $4,714,352.00. This does not take into account the dedicated value of Print, TV and radio.

12.6. The incredible success of the media, PR and Communications campaign was a positive outcome not just for the brand of The Taste festival but exceptionally important for the sponsors involved and aligned with the festival.

12.7. Festival Director, Brooke Webb was the leading spokesperson for the Media, PR and Communications of The Taste. Other spokespeople included chefs, artists and local personalities, who were engaged to leverage their event and/or the festival.

12.8. There were three festival components considered integral to the marketing campaign; Food and Beverage, Free Music / Entertainment and promoting over 50 ticketed events within the program (The SMEG Culinary Kitchen, daily reserved seating and NYE). Combined with the overall objective of raising awareness and increasing attendance at The Taste of Tasmania across Australia and internationally with a focus on the domestic Tasmania audience.

12.9. The marketing campaign had three program launches, which was important to ensure clarity of the very dense program.

12.10. Social media was the key driver in the marketing campaign and The Taste channels (Facebook, Instagram) increased by 34% approximately six weeks prior to the festival. Social media became the most effective way of directly communicating with The Taste audience.

12.11. The positive response to the festival was largely evident on social media. So much so, that The Taste festival ‘score’ on both Trip Advisor and Facebook event pages (reflecting 70% of the festival audience) increased to 4 out of 5, increasing from 3.4 out of 5 – aligning The Taste festival with other contemporary festivals such as Dark MOFO.

12.12. The Graphic Design was outsourced to a local agency with mixed success, requiring additional support from multiple suppliers. Whilst the intention is to keep all business local, one of the challenges is the limited competition in Hobart/Tasmania. This translates into paying a higher price and despite agreed deadlines, there is no recourse if suppliers do not meet them. Future consideration will need to be given to national suppliers.

12.13. Largely, the introduction of The SMEG Culinary Kitchen and ‘greener grass’ implemented in 2018–19 had a massive effect in raising the awareness of The Taste brand, not only locally but especially to interstate audiences which was seen especially attractive for sponsors. This resulted in the majority of ticket sales for The SMEG Culinary Kitchen coming from Melbourne, Sydney followed by Queensland. Internationally, the strongest engagement on social media was from the USA, United Kingdom then Hong Kong.

12.14. The Tourism market was heavily targeted via a campaign in conjunction with Tourism Tasmania, Timeout Sydney and Melbourne, Tasmania Tourism and Information Centre, Inflight Magazines and via an extensive publicity campaign. A portion of the social media advertising campaign (including Google adverts) focused on the interstate markets, with a large engagement coming from Melbourne.

12.15. A comprehensive, attractive website was created and became a substantial standalone marketing piece that was crucial to the campaign, incorporating festival design with clear booking details and information on all events. Video’s, music clips, event listings, strong imagery and social media plug-ins made this a sophisticated marketing piece.

12.16. On-the-ground, postcards, street banners, bus backs, street stencilling, cinema advertising and program brochures were handed out throughout various locations such as Salamanca Markets, Farm Gate Markets and in areas with dense foot traffic, such as Elizabeth Street Mall. Also, The Spirit of Tasmania also heavily supported The Taste festival by promoting the festival on their in-house TV.

13. Community and Stakeholder Engagement

13.1. Addressed earlier in this report.

14. Delegation

14.1. This is a matter for the Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Tim Short Director Community Life |

Brooke Webb Festival Director - Taste of Tasmania |

Date: 7 March 2019

File Reference: F19/27028

Attachment a: 2018-19

Social and Economic Benefits of The Taste of Tasmania - SGS Economics &

Planning ⇩ ![]()

Attachment

b: The

Taste of Tasmania Waste 2007-08 to 2018-19 ⇩ ![]()

|

Item No. 6.4 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/3/2019 |

Page 83 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/3/2019 |

Page 154 ATTACHMENT b |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 155 |

|

|

|

13/3/2019 |

|

6.5 Occupancy Rates - Multi-Storey Car Parks

Memorandum of the Group Manager Parking Operations and the Director City Innovation of 1 March 2019 and attachments.

Delegation: Committee

|

Item No. 6.5 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 156 |

|

|

13/3/2019 |

|

Memorandum: Finance and Governance Committee

Occupancy Rates - Multi-Storey Car Parks

The following memorandum is provided in response to a request from the Finance and Corporate Services Committee on the 20 August 2013 (Open agenda, item 13 - Questions without Notice) to:-

“Please provide Aldermen with regular updates on the occupancy rates of the Council Multi-storey car parks?”

Accordingly, a quarterly memorandum is now provided to the Finance and Governance Committee providing occupation rates, occupation percentages and financials for the three short term multi storey car parks along with a quarterly overview of the Trafalgar permit holders and early bird car park.

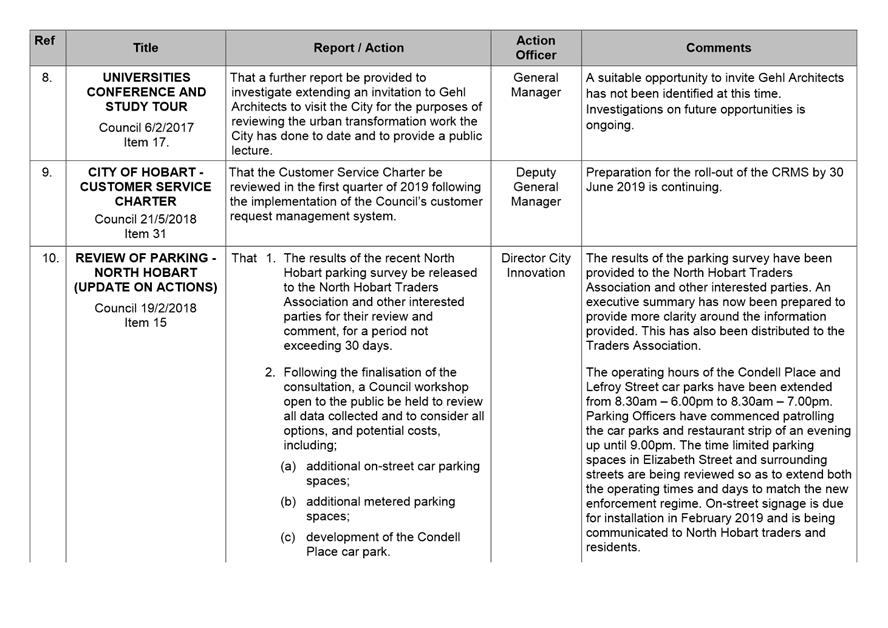

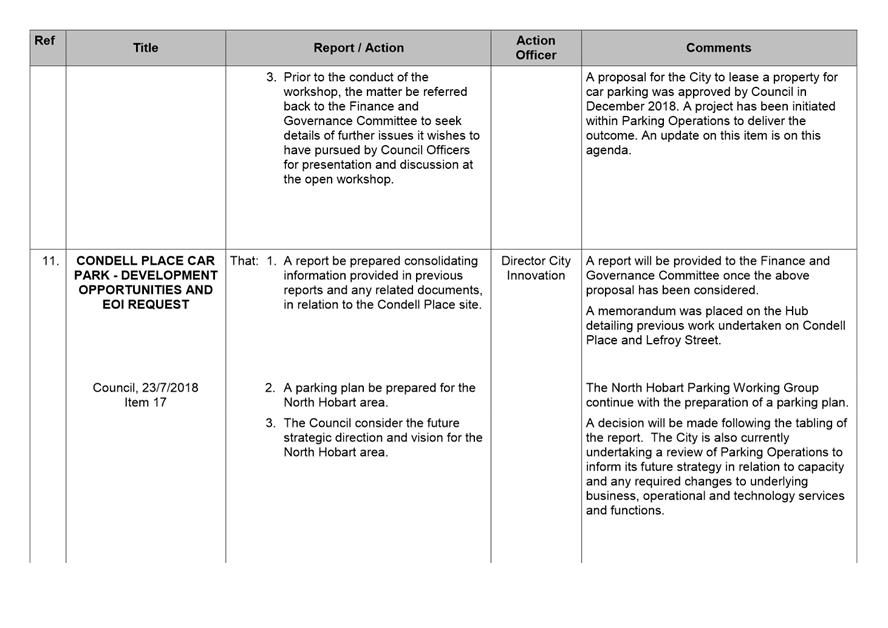

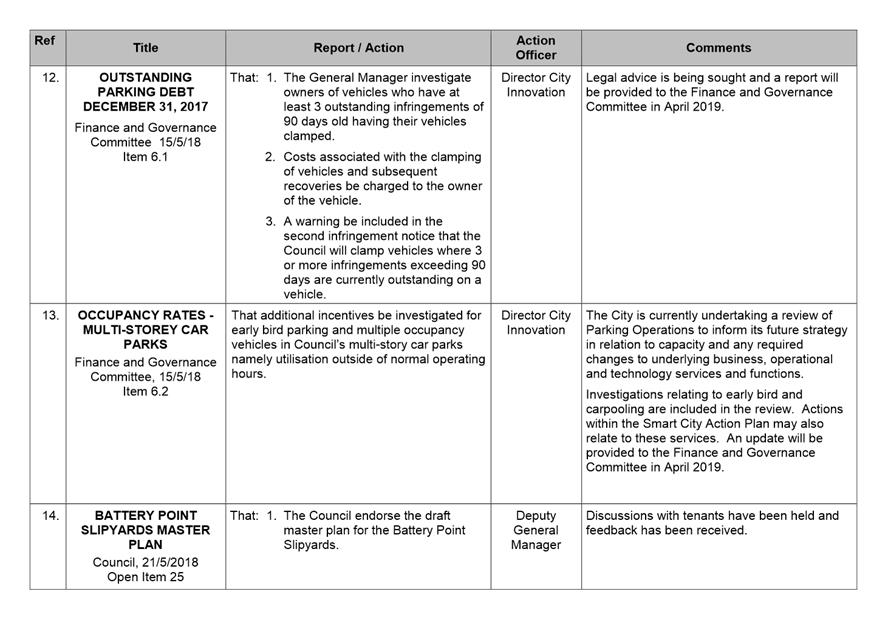

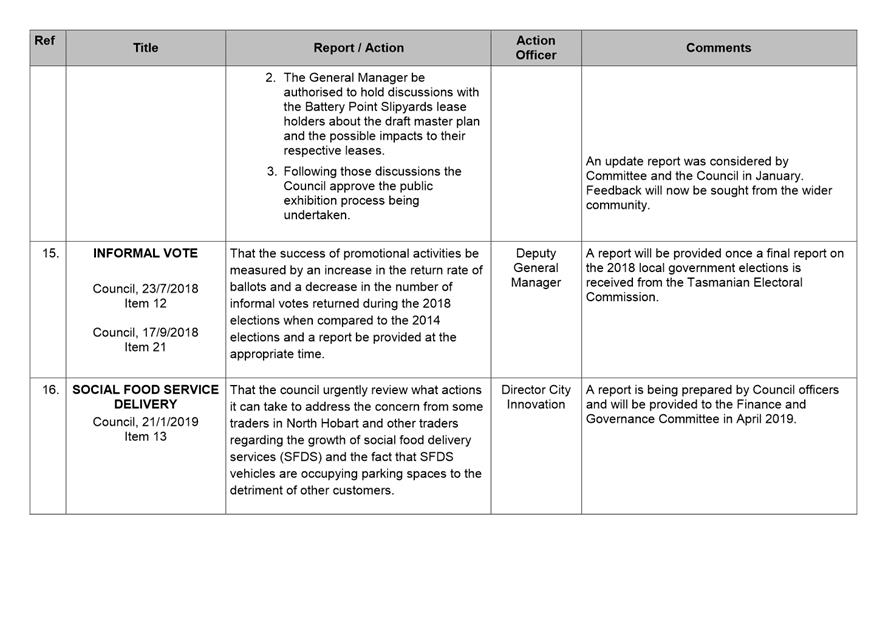

This memorandum provides figures for Quarter one (July- Sept) of the 2017-18 financial year and contains the following:

(i) The occupancy rates and income of each of the three multi-storey car parks for the quarter ending September 2018, and a comparison with the same period in 2017 (refer Table 1).

(ii) A three month overview of the occupancy rates and income generated by the Trafalgar Car Park through permit and early bird parking (refer Table 2).

(iii) Weekday hourly occupation percentages for each of the three multi-storey car parks for the same period (refer Attachment A).

Summary of results

The overall year-on-year result across the car parks for Quarter 2 of the 2018/2019 Financial Year is as follows:

· There was a 0.69% increase in vehicle usage in multi-story car parks;

· There was a 8.83% increase in income in multi-story car parks; and

· The Trafalgar Car Park is slightly down on budget however, this is expected to improve during the summer months.

table 1

|

2017 |

ARGYLE STREET |

CENTREPOINT |

HOBART CENTRAL |

||||

|

|

Cars |

Income |

Cars |

Income |

Cars |

Income |

|

|

July |

100275 |

$281,334.00 |

50622 |

$159,483.00 |

29464 |

$100,141.00 |

|

|

August |

102837 |

$296,635.80 |

53796 |

$173,501.50 |

30184 |

$114,626.00 |

|

|

September |

101543 |

$292,467.10 |

50243 |

$168,441.50 |

29647 |

$105,804.00 |

|

|

Totals |

304655 |

$870,436.90 |