City

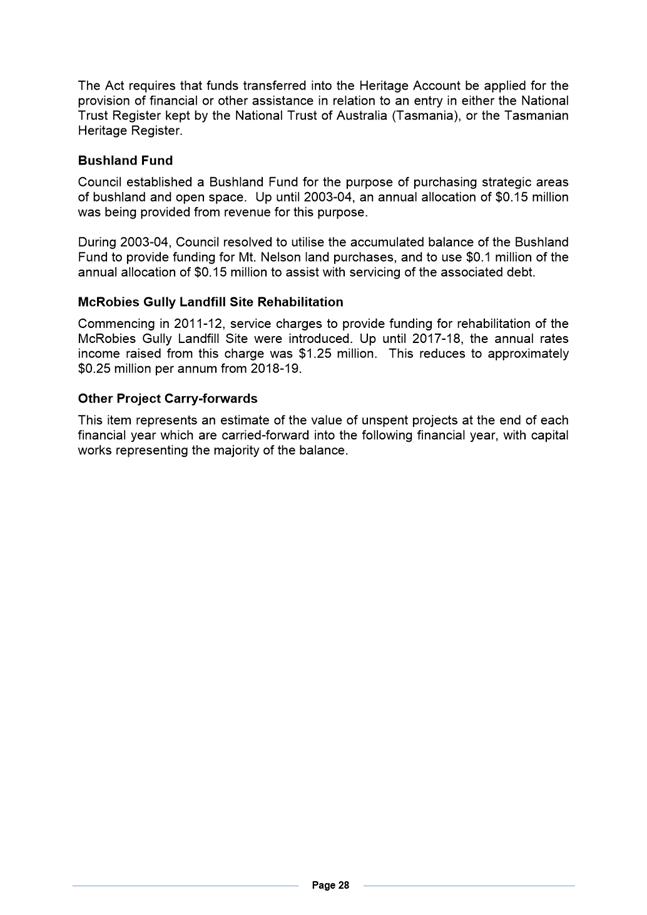

of hobart

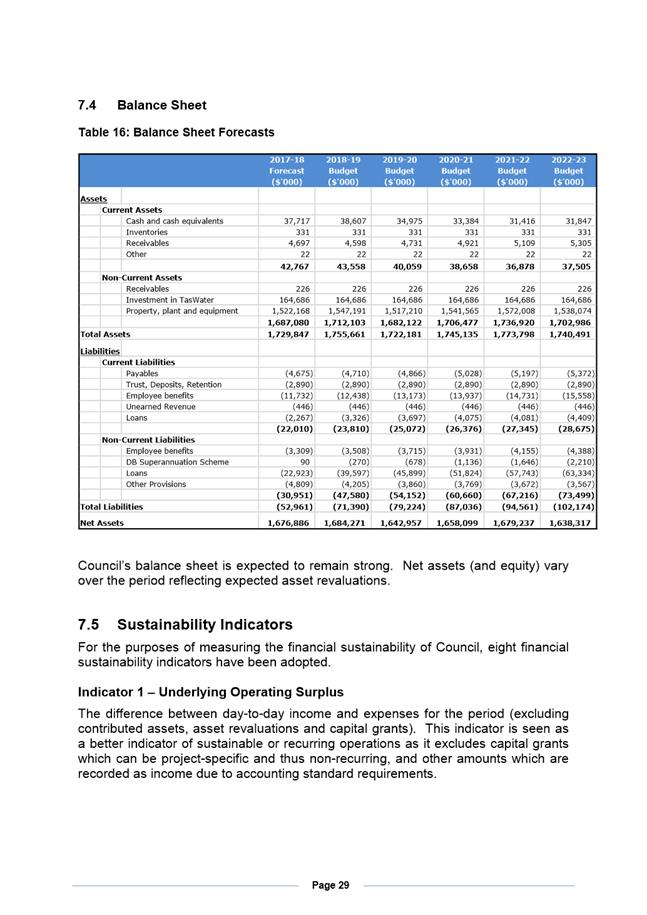

AGENDA

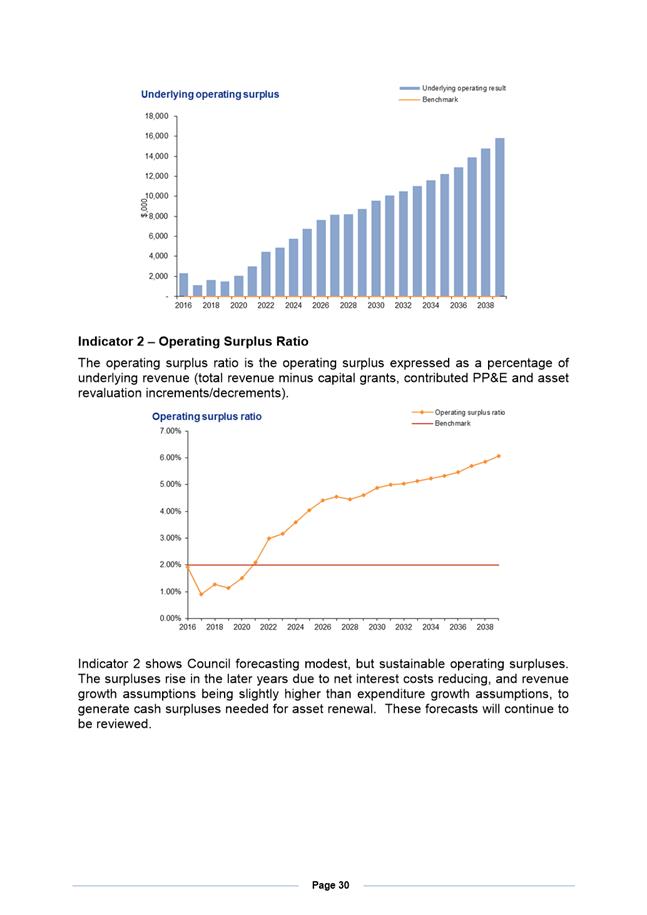

Finance and Governance Committee Meeting

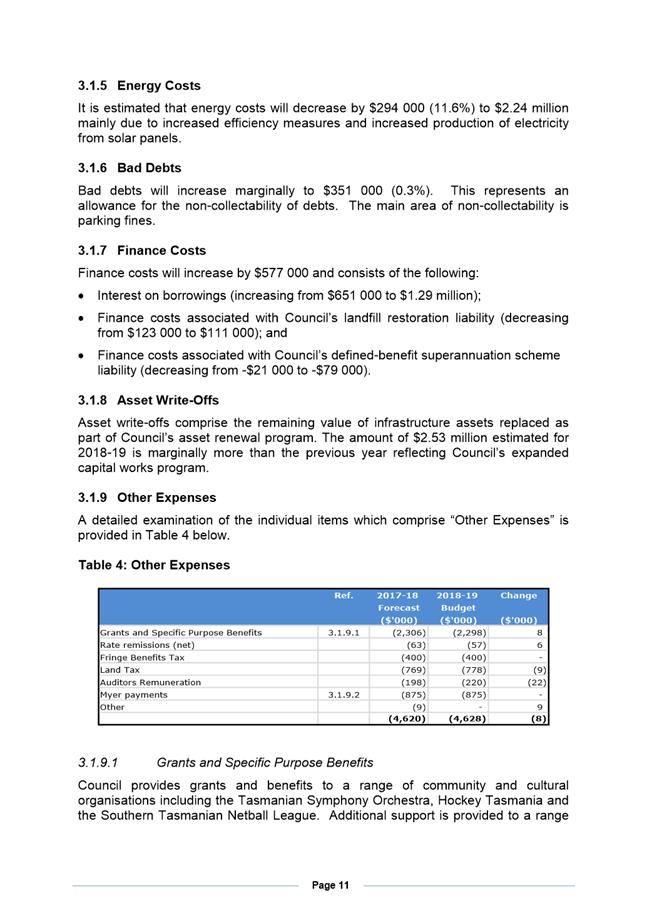

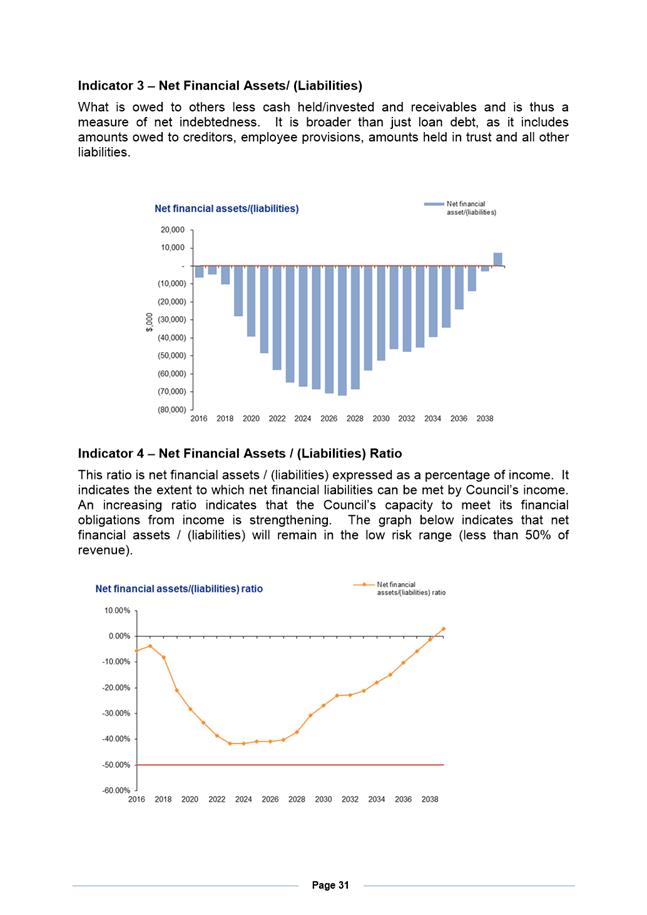

Open Portion

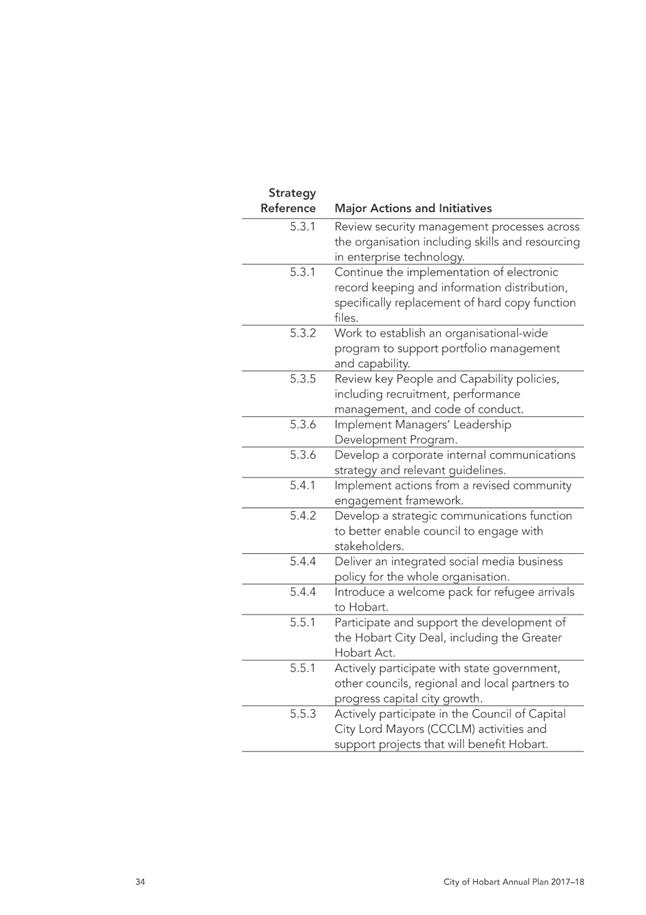

Wednesday, 13 June 2018

at 5.00 pm

Lady Osborne Room, Town Hall

City

of hobart

AGENDA

Finance and Governance Committee Meeting

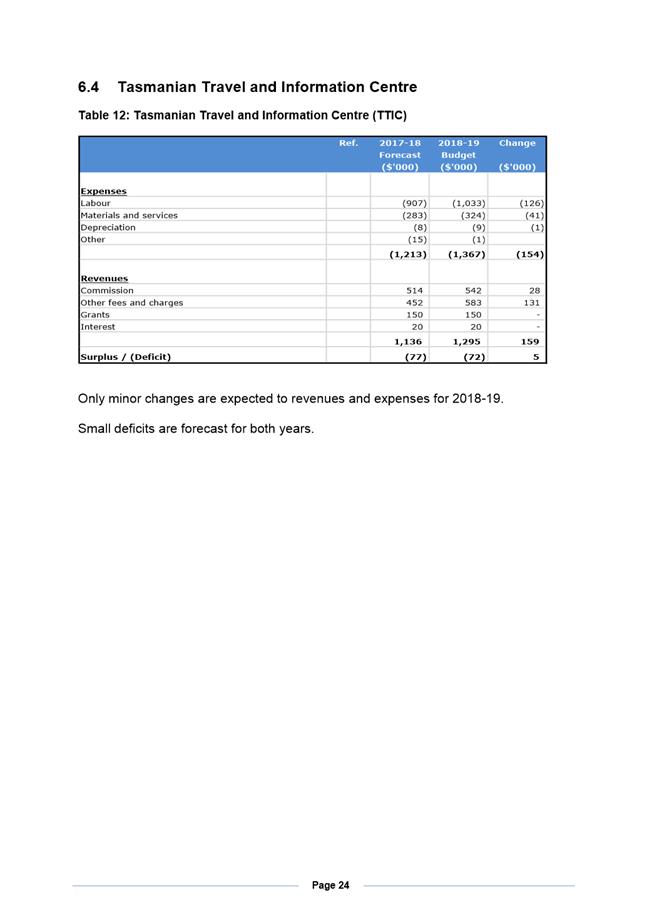

Open Portion

Wednesday, 13 June 2018

at 5.00 pm

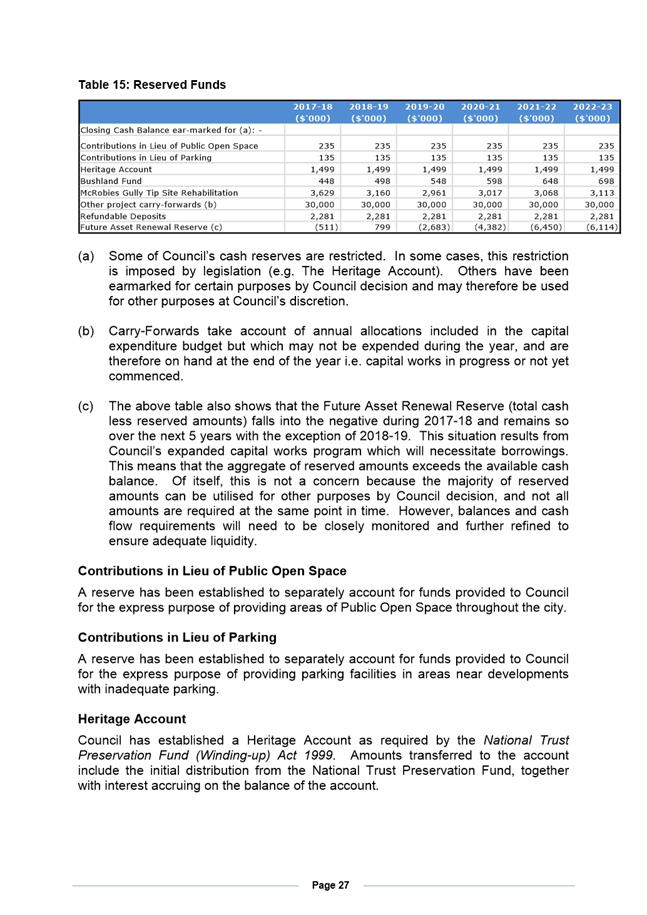

Lady Osborne Room, Town Hall

THE MISSION

Our mission is to ensure good governance of our capital City.

THE VALUES

The Council is:

|

about people |

We value people – our community, our customers and colleagues. |

|

professional |

We take pride in our work. |

|

enterprising |

We look for ways to create value. |

|

responsive |

We’re accessible and focused on service. |

|

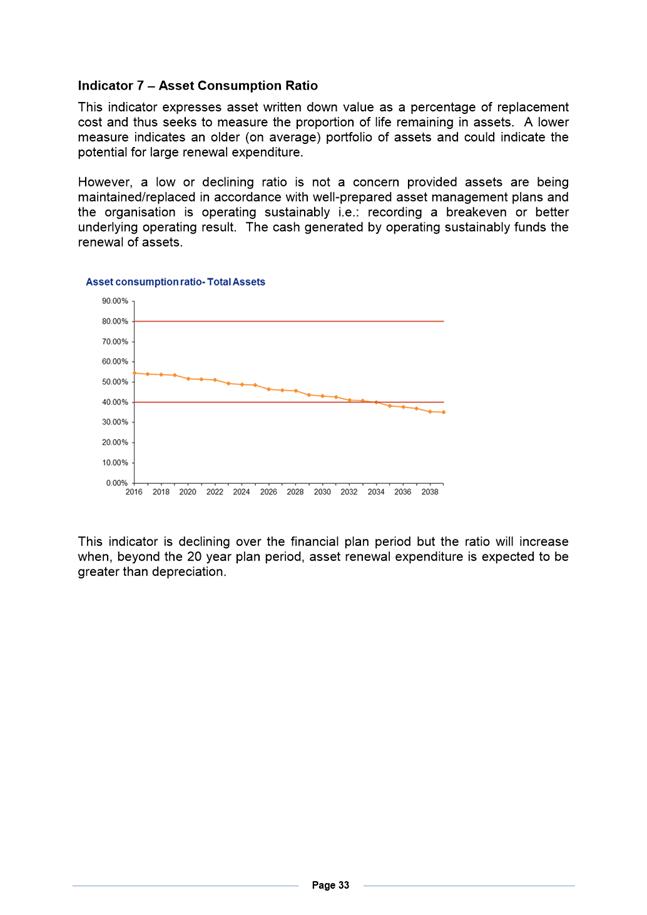

inclusive |

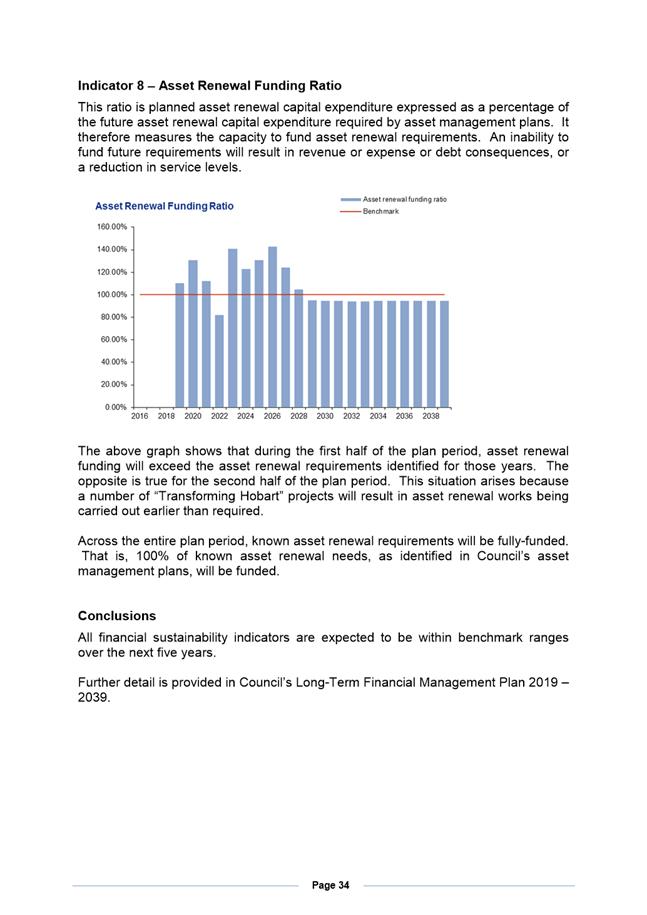

We respect diversity in people and ideas. |

|

making a difference |

We recognise that everything we do shapes Hobart’s future. |

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 3 |

|

|

13/6/2018 |

|

Business listed on the agenda is to be conducted in the order in which it is set out, unless the committee by simple majority determines otherwise.

APOLOGIES AND LEAVE OF ABSENCE

1. Co-Option of a Committee Member in the event of a vacancy

3. Consideration of Supplementary Items

4. Indications of Pecuniary and Conflicts of Interest

6.2 Tax for Vacant or Unused Residential Housing Accommodation.

6.3 99 Norla Street, Tranmere - City's Droughty Pt Radio Transmitter Site - Request for Licence

6.4 3 Morrison Street - Lease to Mawson's Huts Foundation

6.5 Outstanding Long Term Parking Permit Debts as at 31 May 2018

6.6 Aldermanic Professional Development

6.7 Board of Inquiry Report into Councillor Allowances

6.8 Tasmanian Museum and Art Gallery - Community Stakeholders Committee

6.9 2018 Local Government Association of Tasmania Annual Conference

7 Committee Action Status Report

7.1 Committee Actions - Status Report

8. Responses to Questions Without Notice

8.1 Macquarie Street / Davey Street Road Transfer

10. Closed Portion Of The Meeting

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 5 |

|

|

13/6/2018 |

|

Finance and Governance Committee Meeting (Open Portion) held Wednesday, 13 June 2018 at 5.00 pm in the Lady Osborne Room, Town Hall.

|

COMMITTEE MEMBERS Ruzicka (Joint Chairman) Thomas (Joint Chairman) Lord Mayor Christie Deputy Lord Mayor Sexton Zucco Cocker Reynolds

ALDERMEN Briscoe Burnet Denison Harvey |

Apologies: Nil

Leave of Absence: Deputy Lord Mayor Sexton

|

|

The minutes of the Open Portion of the Finance and Governance Committee meeting held on Tuesday, 15 May 2018 and the Special Finance and Governance Committee meeting held on Monday, 21 May 2018, are submitted for confirming as an accurate record.

|

Ref: Part 2, Regulation 8(6) of the Local Government (Meeting Procedures) Regulations 2015.

|

That the Committee resolve to deal with any supplementary items not appearing on the agenda, as reported by the General Manager.

|

Ref: Part 2, Regulation 8(7) of the Local Government (Meeting Procedures) Regulations 2015.

Aldermen are requested to indicate where they may have any pecuniary or conflict of interest in respect to any matter appearing on the agenda, or any supplementary item to the agenda, which the committee has resolved to deal with.

Regulation 15 of the Local Government (Meeting Procedures) Regulations 2015.

A committee may close a part of a meeting to the public where a matter to be discussed falls within 15(2) of the above regulations.

In the event that the committee transfer an item to the closed portion, the reasons for doing so should be stated.

Are there any items which should be transferred from this agenda to the closed portion of the agenda, or from the closed to the open portion of the agenda?

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 7 |

|

|

|

13/6/2018 |

|

Report of the Director Financial Services of 6 June 2018 and attachments.

Delegation: Council

|

Item No. 6.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 8 |

|

|

13/6/2018 |

|

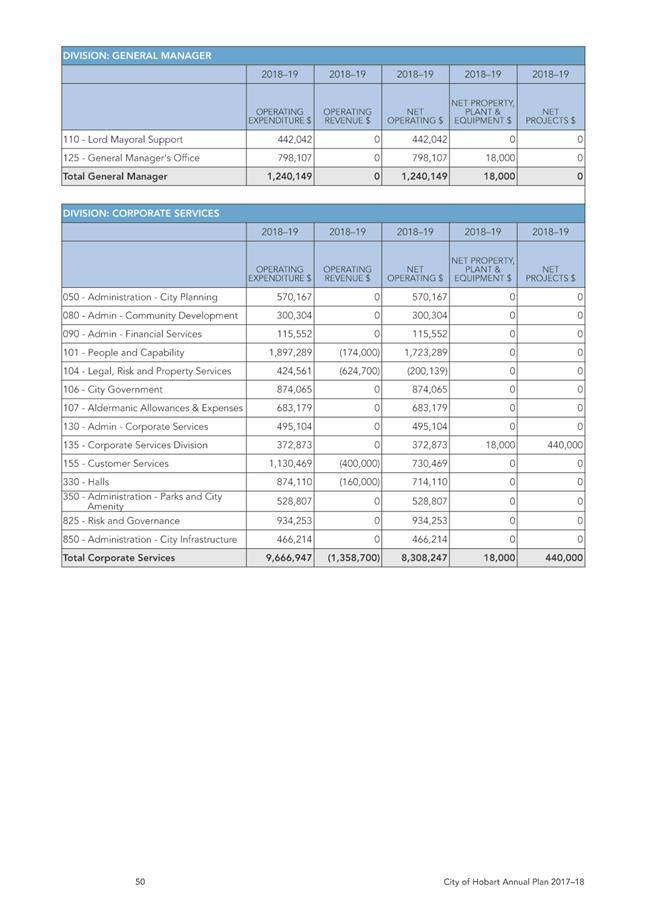

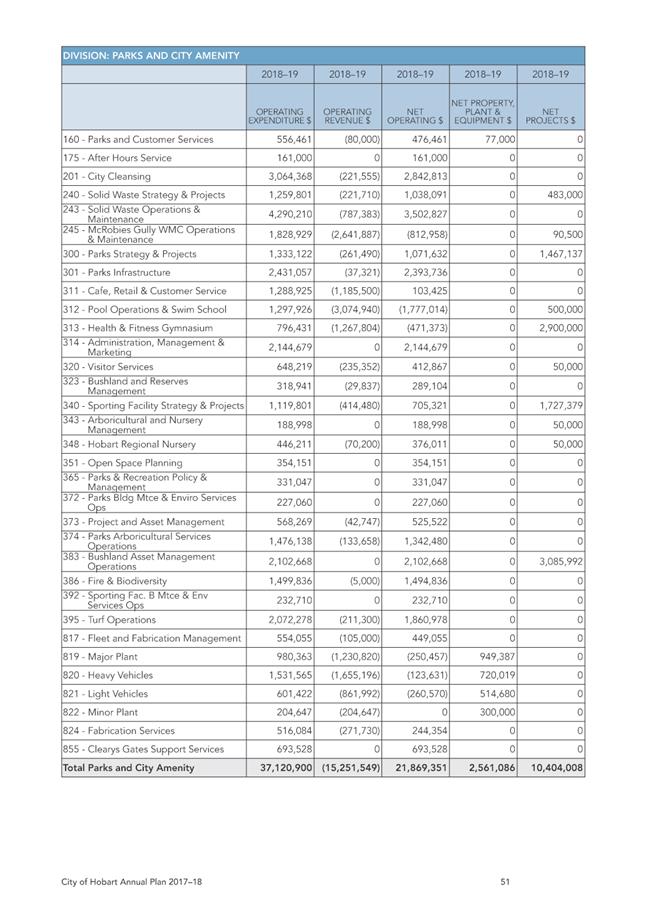

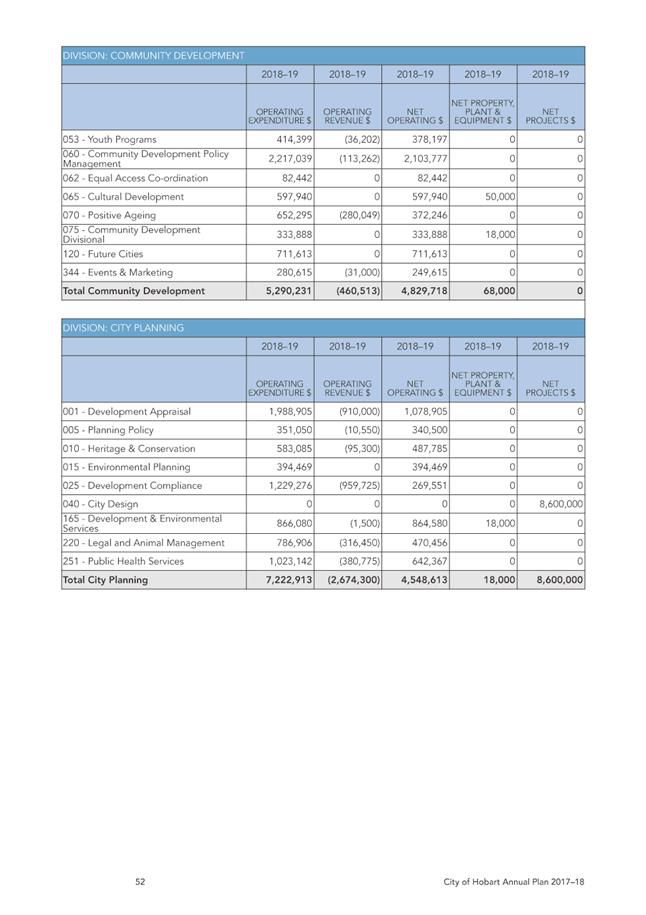

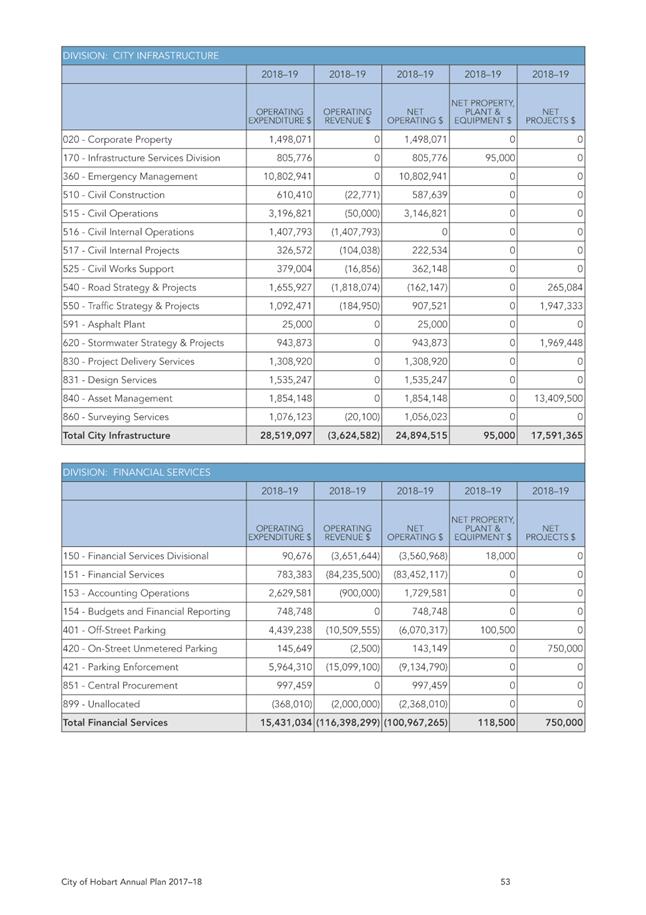

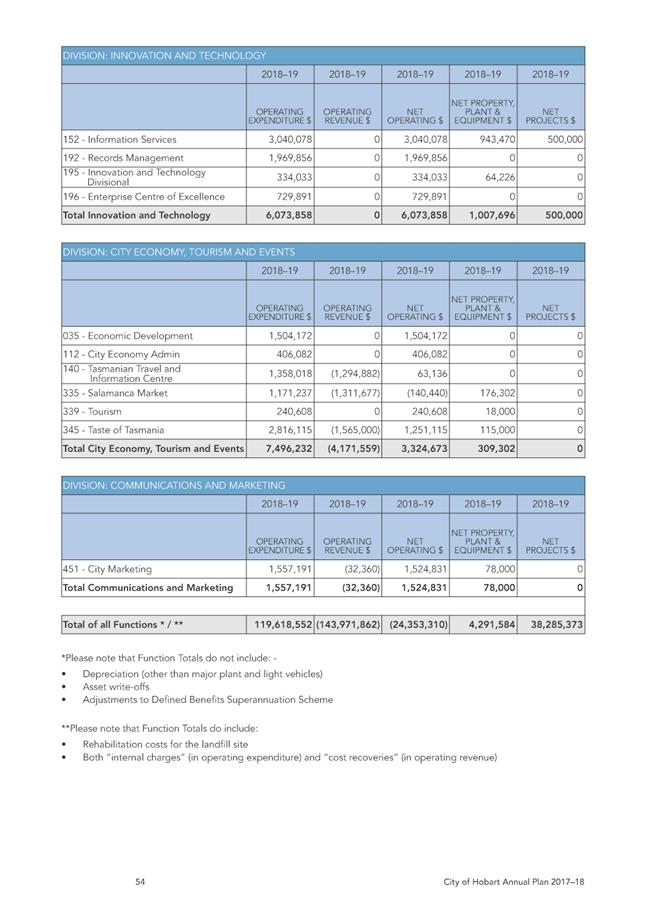

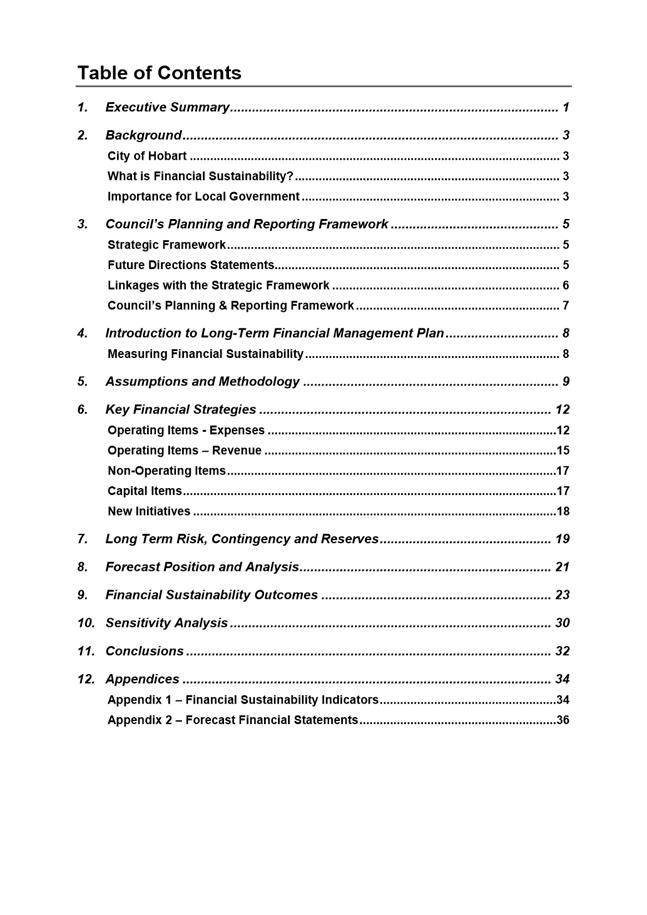

REPORT TITLE: Budget Estimates 2018-19

REPORT PROVIDED BY: Director Financial Services

1. Report Purpose and Community Benefit

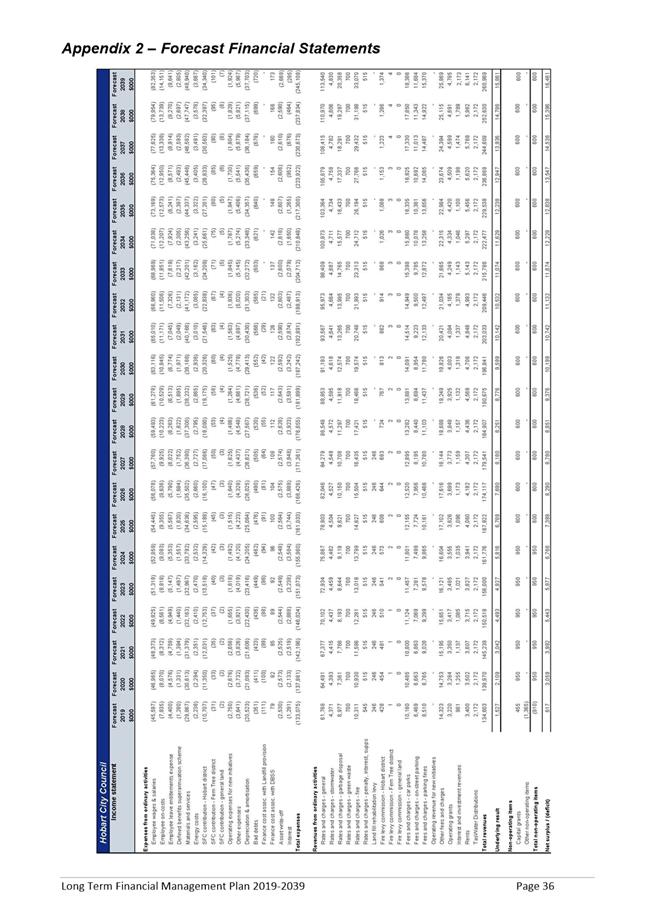

1.1. The purpose of this report is to present the City’s 2018-19 Estimates and Annual Plan for consideration. It is proposed the Estimates be formally adopted at the Council meeting on 18 June 2018.

2. Report Summary

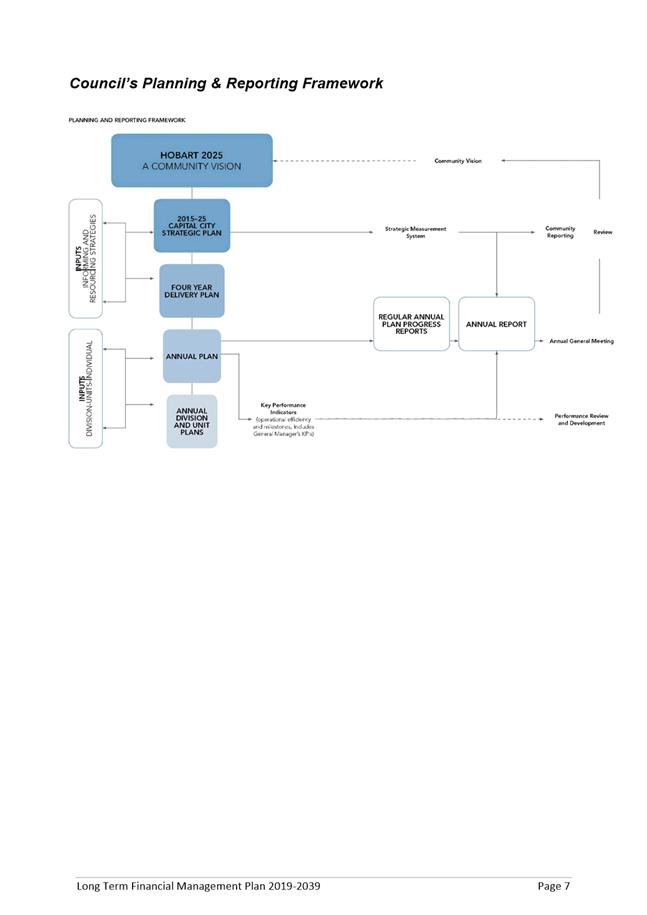

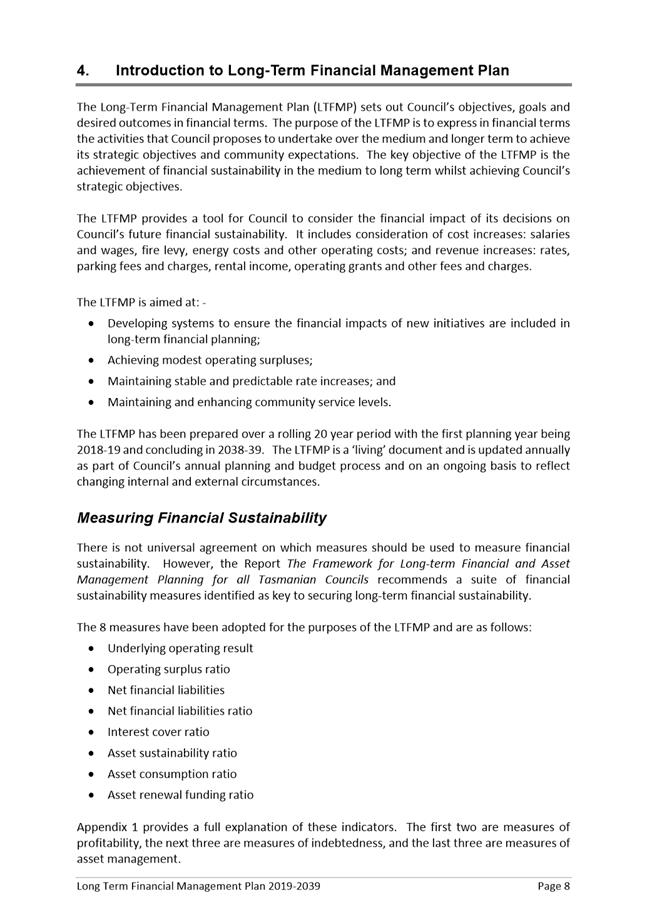

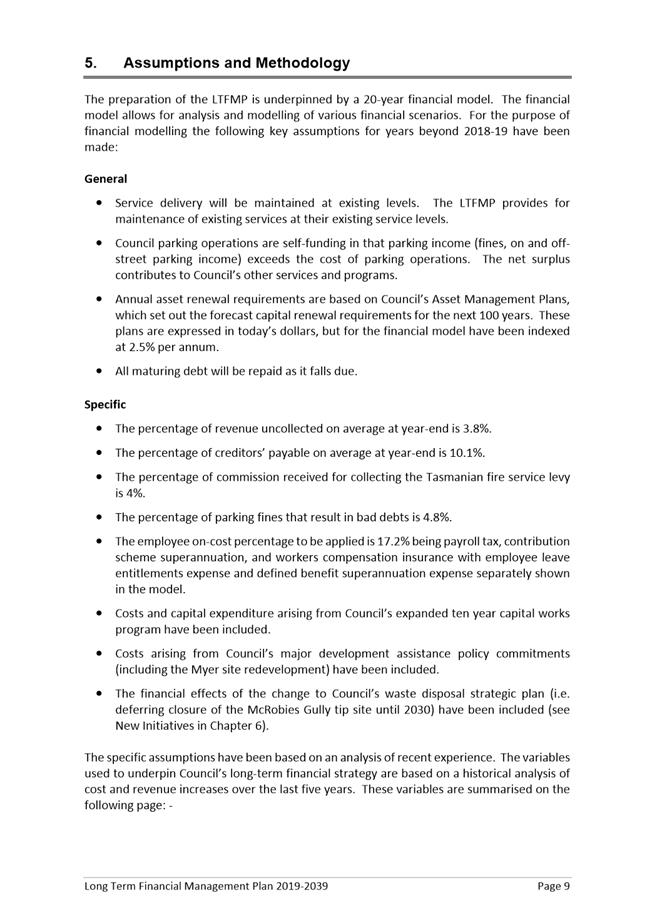

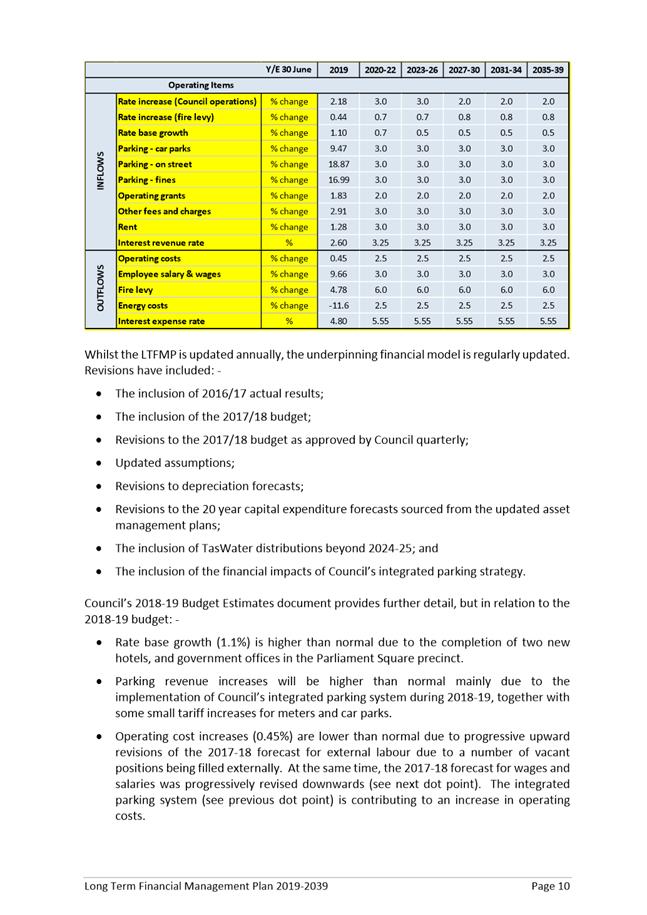

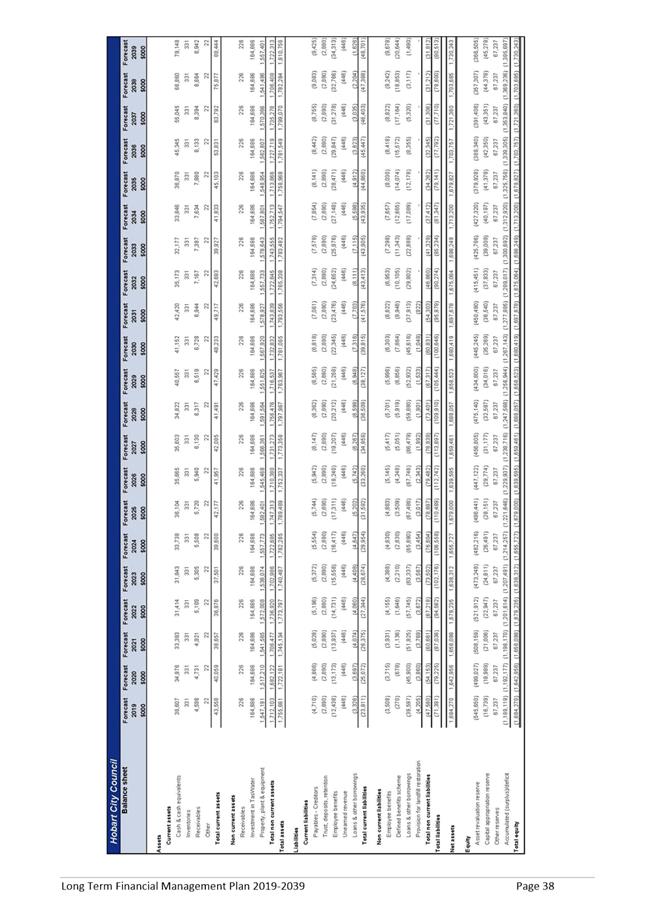

2.1. This report presents the City’s 2018-19 Estimates and Annual Plan together with the Long Term Financial Management Plan 2019 – 2039.

2.2. The Estimates propose a 2.0% increase in rates, to the average residential ratepayer, to fund the increased cost of providing Council services. This equates to an increase of only $48.

2.3. This is considered a pleasing result for Hobart ratepayers given some of the factors affecting the budget, most notably the decreased distribution from TasWater of $1.1M.

2.4. The above is before the increase in the state government fire levy. The average residential ratepayer will pay an additional $11 in fire protection service rates.

2.5. The Hobart March CPI was 2.02%.

2.6. In total, rates revenue will increase by $3.04 million over the previous year resulting from an increase in rates to fund the increased cost of providing services, an increase in the Tasmanian Government Fire Service Levy and growth in the rate base from development activity.

2.7. It is proposed that the 2018-19 Estimates, 2018-19 Annual Plan, and Long Term Financial Management Plan 2019-2039 be formally adopted at the Council meeting on 18 June 2018.

2.8. At this stage, no provision has been made in the proposed budget for costs or financial outcomes arising from the weather event of 10 May. Costs will be incurred in relation to insurable losses, and in relation to essential and non-essential infrastructure. Council will be kept informed on financial consequences, if any.

4. Background

4.1. The budget process for 2018-19 has included workshops/briefings with Aldermen and Committee/Council meetings on 19 February, 27 February, 5 March and 15 May to discuss matters impacting on the 2018-19 Estimates and the 10 year capital works program.

4.2. The Estimates have now been drafted and are presented for consideration.

Estimates Preparation

4.3. The Estimates documents comprise:

4.3.1. This report;

4.3.2. A separate document – ‘City of Hobart, Budget Estimates for the 2018-19 Financial Year’, which is attached – refer Attachment A. This document contains discussion of all elements comprising the Estimates.

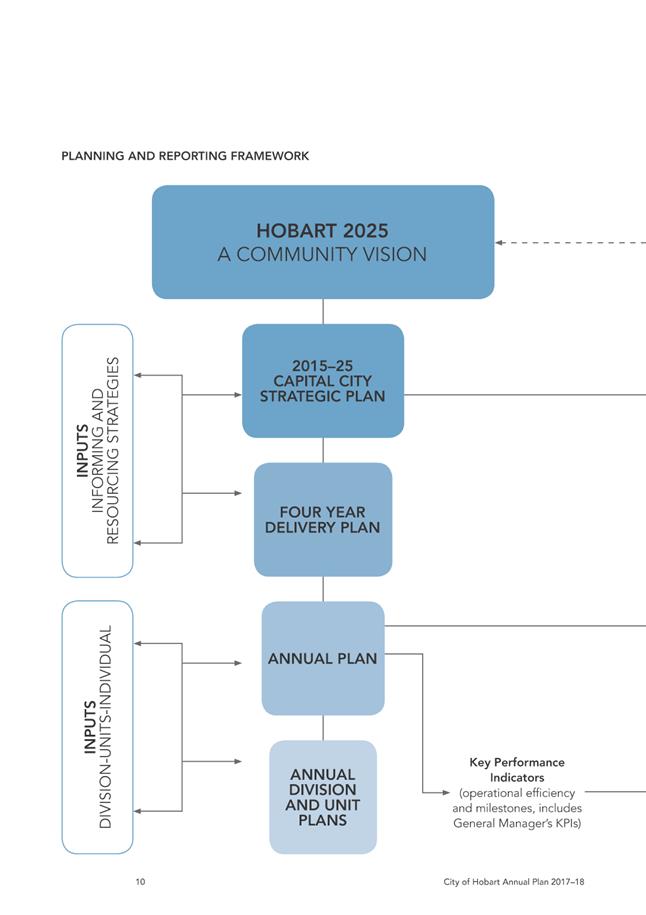

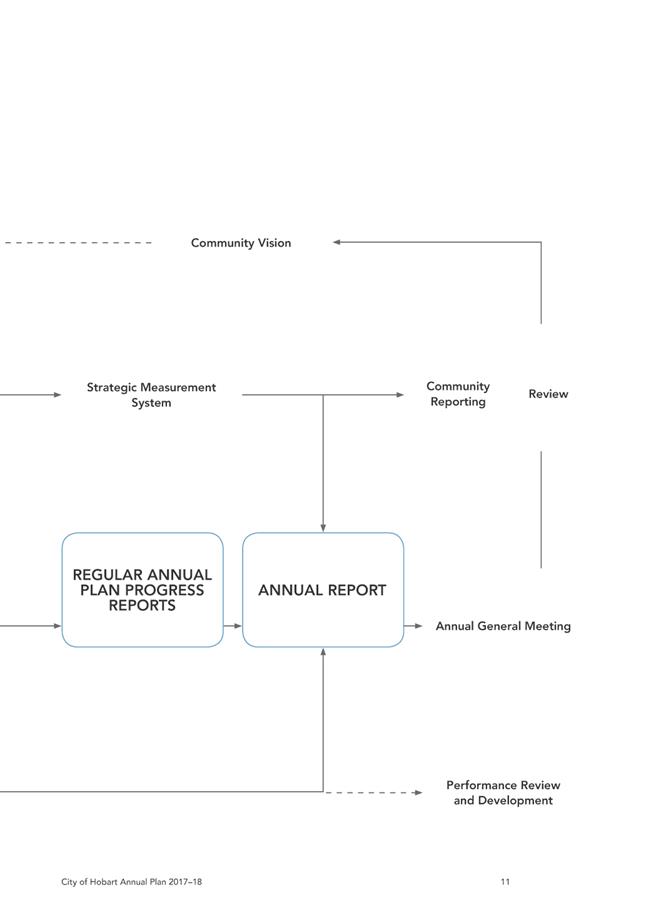

4.3.3. The Annual Plan for the 2018-2019 Financial Year, which is attached – refer Attachment B. This document is required pursuant to Section 71 of the Local Government Act 1993. It is required to set out how the objectives of Council’s Strategic Plan are to be met, including a summary of the Estimates adopted, and is to be formally adopted by the Council; and

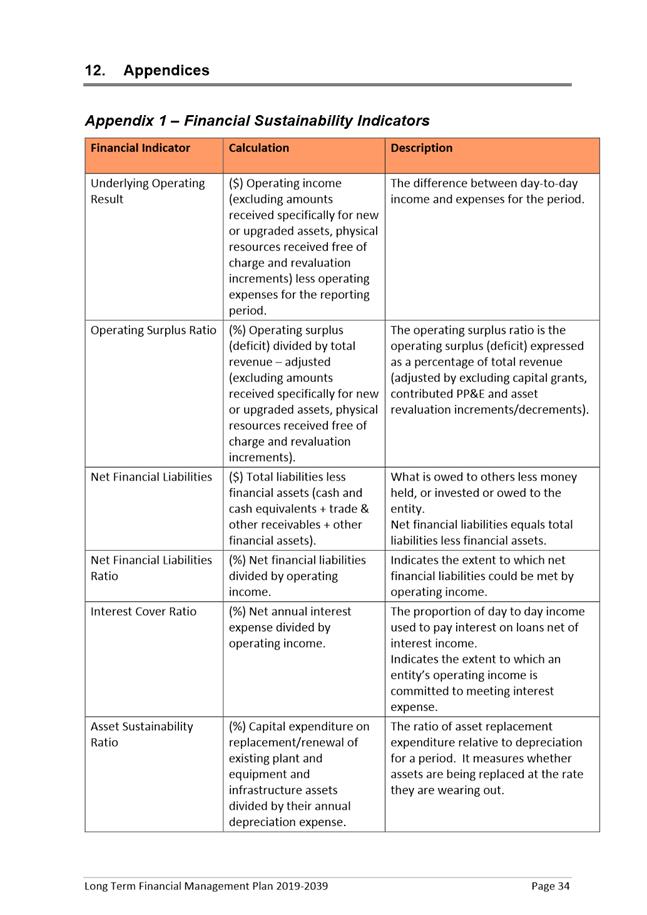

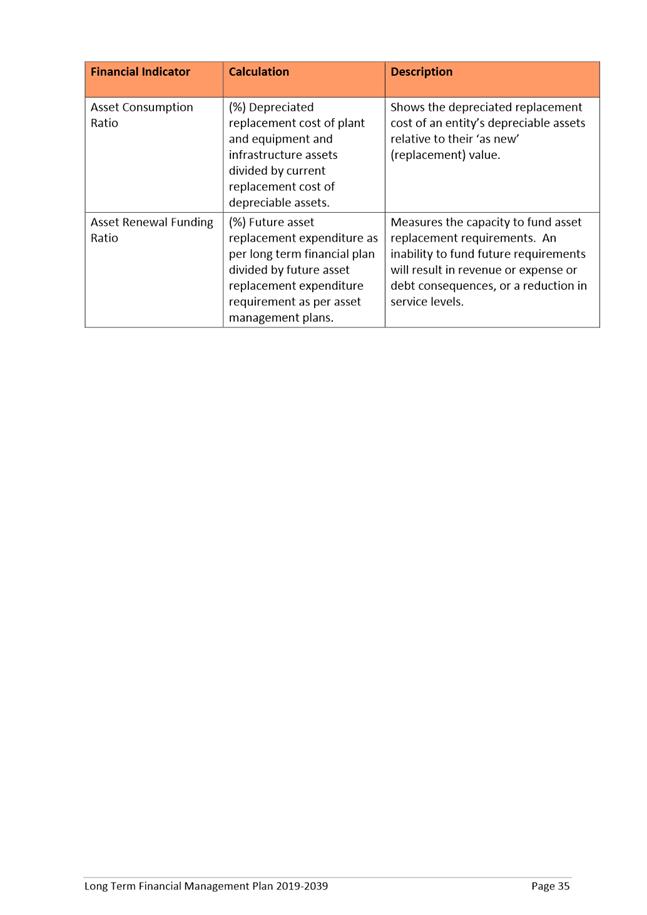

4.3.4. The updated Long-Term Financial Management Plan 2019-2039 (LTFMP), which is attached – refer Attachment C.

Estimates Overview

4.4. In total, rates revenue will be $84.92 million, an increase of $3.04 million over the previous year. Growth in the rate base from development activity contributes $0.9 million and an increase in the fire protection service rate (to fund the increase in the State Government Fire Service Levy which is collected by Council on behalf of the Tasmanian Government) contributes $0.35 million. The average residential ratepayer will receive an increase in rates payable of 2.0% - see further discussion below.

4.5. This increase is comprised of; -

4.5.1. An increase in the total cents in the dollar of Assessed Annual Values (AAV) from 9.52 cents to 9.98 cents;

4.5.2. Waste management service charges of $250 for residential properties and $500 for non-residential properties (amounts are unchanged from the previous year);

4.5.3. Reductions in landfill rehabilitation service charges, from $50 to $10 for residential properties and from $100 to $20 for non-residential properties; and

4.5.4. A kerbside green waste collection service charge of $50 for properties meeting certain criteria within the municipal area to which Council supplies or makes available a green waste collection service utilising a green waste collection bin. This amount is unchanged from the previous year.

Effects on Ratepayers

4.6. Before the impact of the increase in the state government fire levy (see below), the average residential ratepayer will receive a rate increase of 2.0% ($48), comprised as follows: -

· General and storm water rates +$88

· Landfill rehabilitation service charge -$40

4.7. The Hobart March CPI was 2.02%.

4.8. The combination of amounts which vary according to property value (rates) and amounts which do not vary according to property value (charges) results in differing impacts across the rate base.

4.9. Most residential properties (approximately 85%) will receive rate increases of between 0.3% ($5) and 2.8% ($106). Most non-residential properties will receive rate increases of between 1.9% and 4.1%.

4.10. The Fire Services Contribution which Council is obliged to pay to the Tasmanian Fire Service has increased by 4.8% ($0.49 million). Pursuant to the Fire Service Act 1979, local government acts as a collection agent for this levy, which is then paid directly to the State Fire Commission.

4.11. After the impact of this increase in the fire levy, most residential properties will receive rate increases of between 0.7% ($10) and 3.3% ($124). Most non-residential properties will receive rate increases of between 2.3% and 4.6%.

4.12. The average residential ratepayer will pay an additional $11 in fire protection service rates.

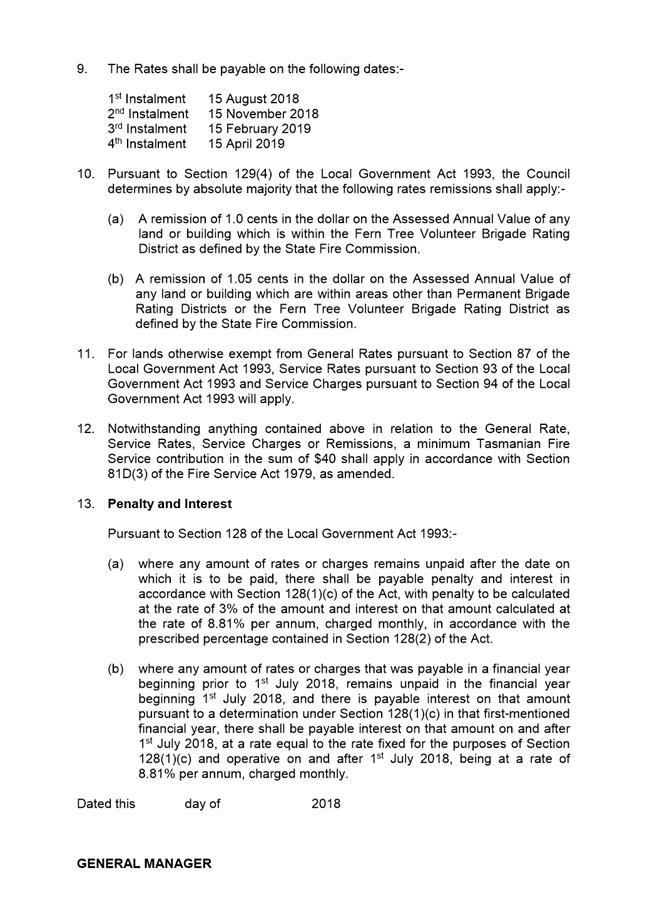

4.13. The 2018-19 rate resolution is attached – refer Attachment D.

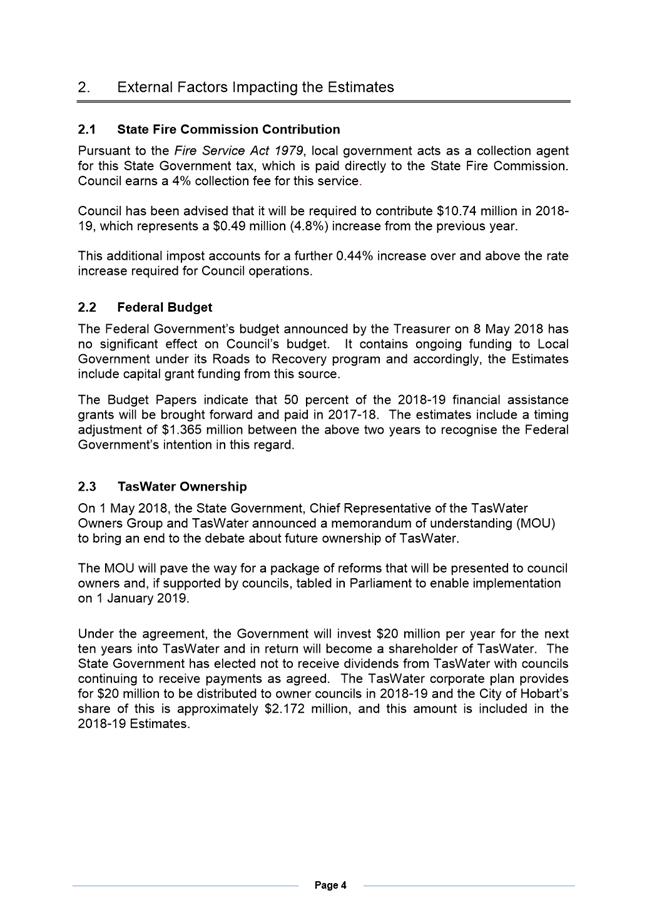

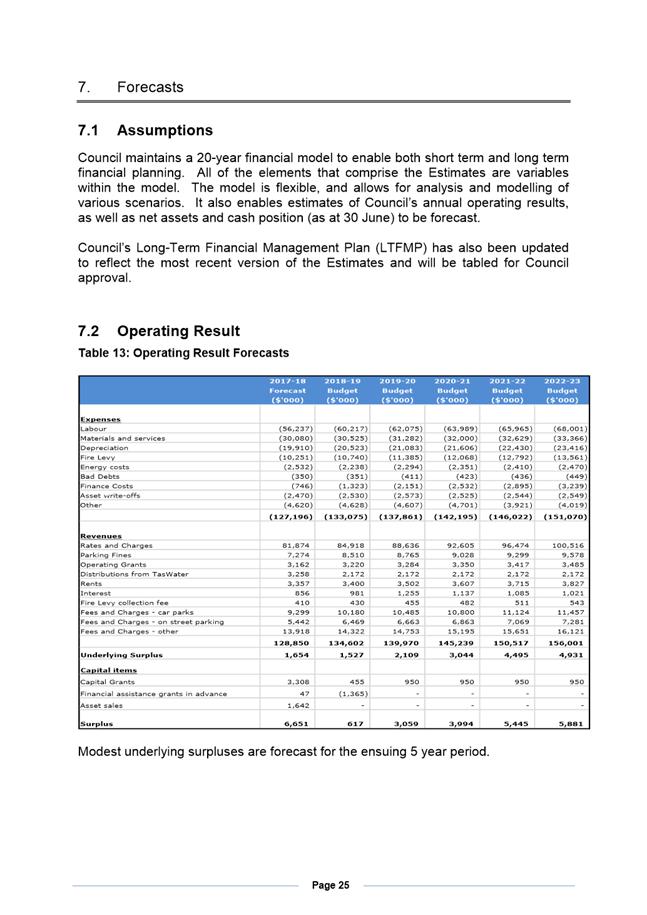

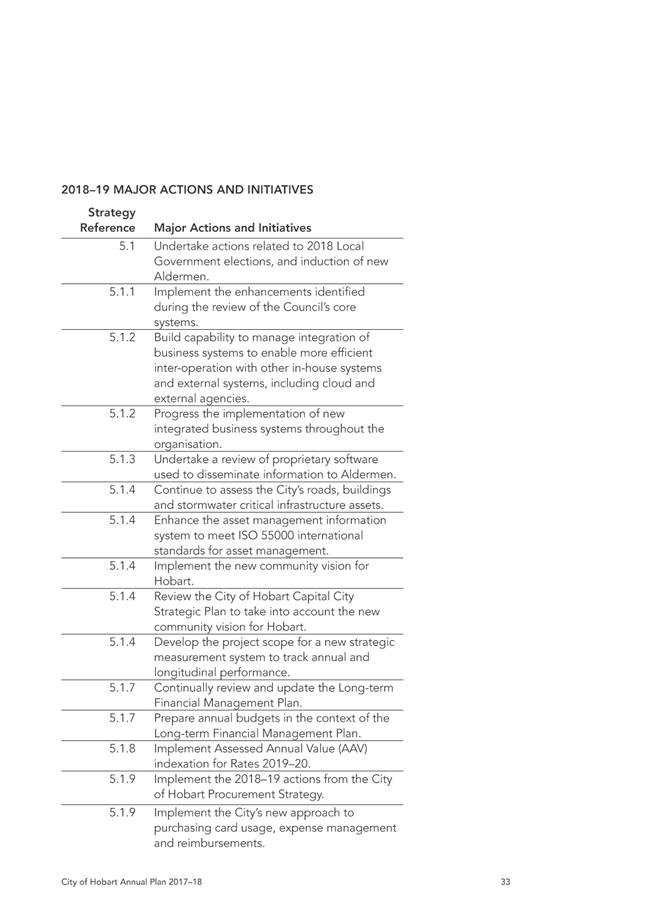

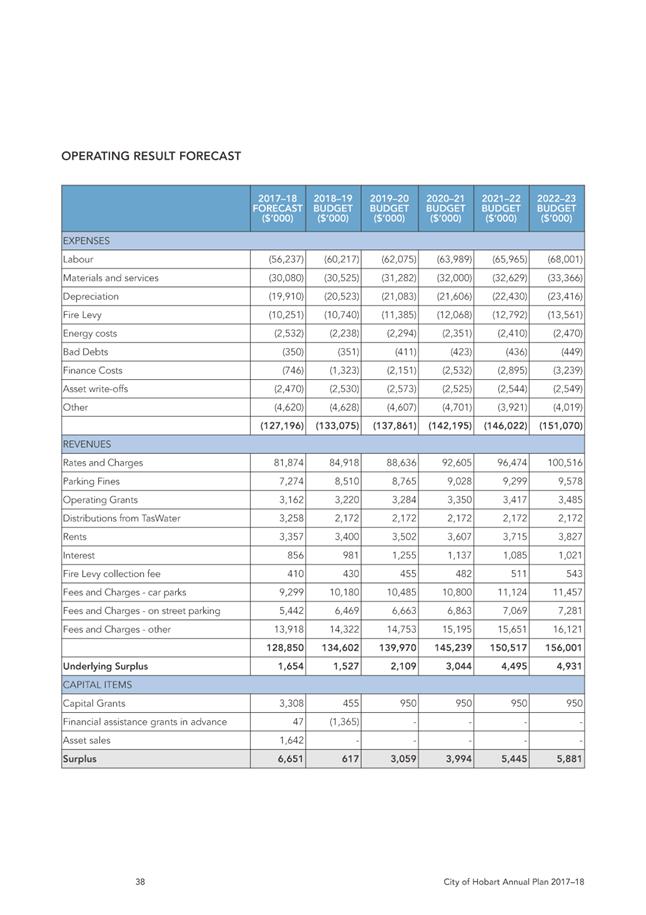

Operating Result

4.14. Greater detail is contained within the Budget Estimates document, however some factors impacting on Council’s forecast underlying surplus of $1.53 million are: -

4.14.1. An increase in rates and charges income of $3.04 million as discussed above;

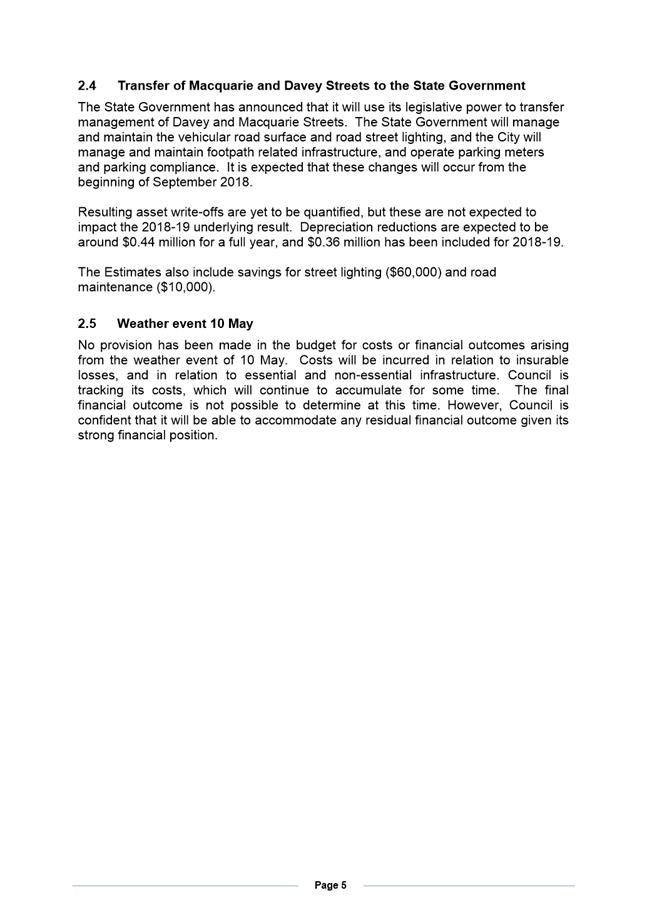

4.14.2. An increase in labour costs of $3.98 million (7.1%), which includes an enterprise bargaining increase of 2.4%;

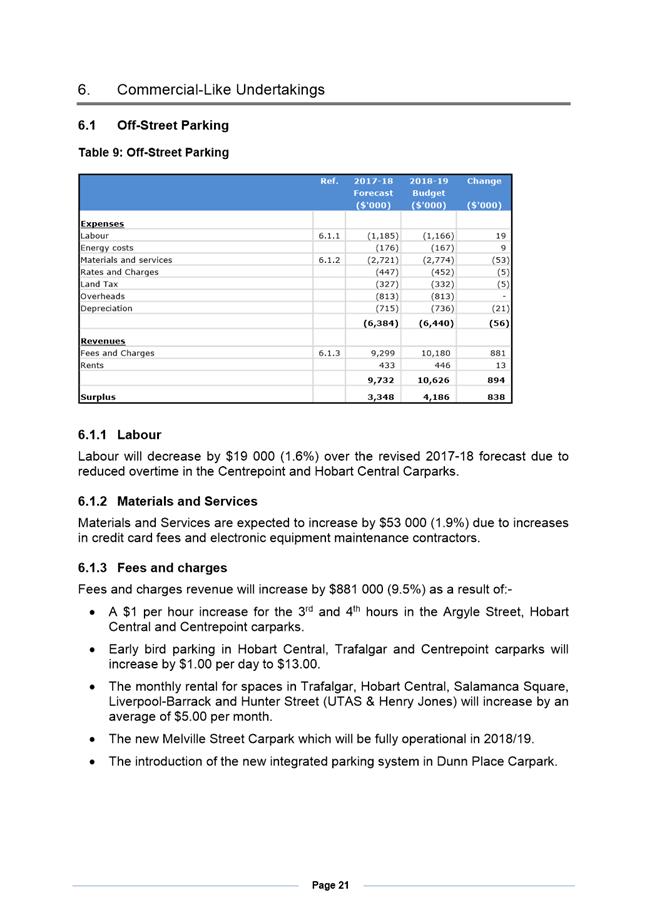

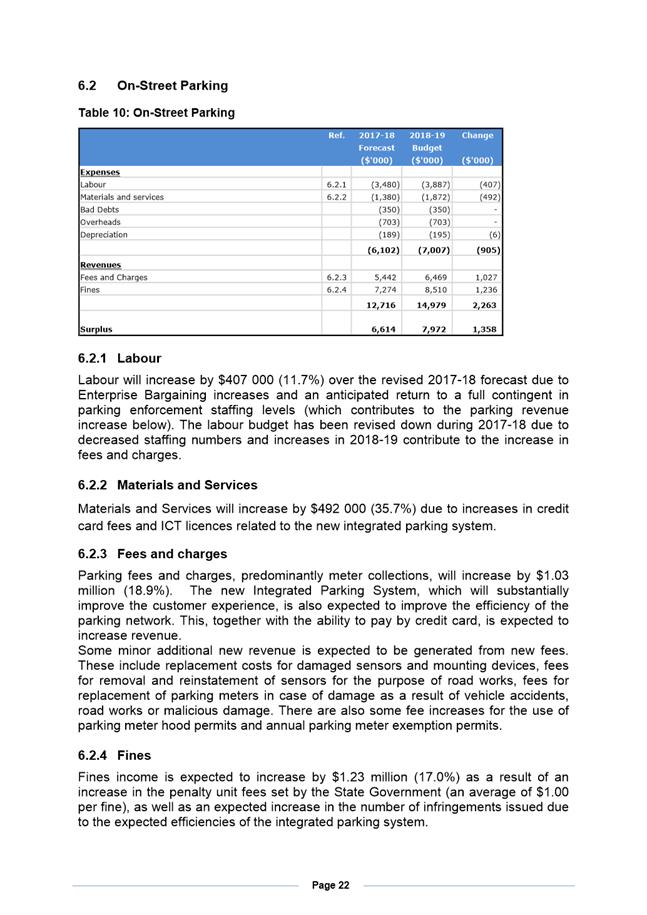

4.14.3. Increases in parking revenues of $3.14 million (14.3%) and parking expenses of $0.58 million due to the rollout of Council’s integrated parking system;

4.14.4. A decrease of $1.1 million (33%) in distributions from TasWater;

4.14.5. An decrease in energy costs of $0.29 million (11.6%) mainly due to increased efficiency measures and increased production of electricity from solar panels;

4.14.6. An increase in interest costs of $0.64 million resulting from borrowings being undertaken in 2017-18 (to fund the enhanced capital works program);

4.14.7. An expected increase in depreciation expenses of $0.97 million due to Council’s rolling program of asset revaluations, and an expected decrease in depreciation expenses of $0.36 million due to the State Government’s planned transfer of Davey and Macquarie streets, together producing a net increase in depreciation expenses of $0.61 million (3.1%);

4.14.8. An increase in the State Government fire levy of $0.49 million (4.8%);

4.14.9. A further payment of $0.875 million associated with the Myer site redevelopment; and

4.14.10. Local government election costs of $0.25 million.

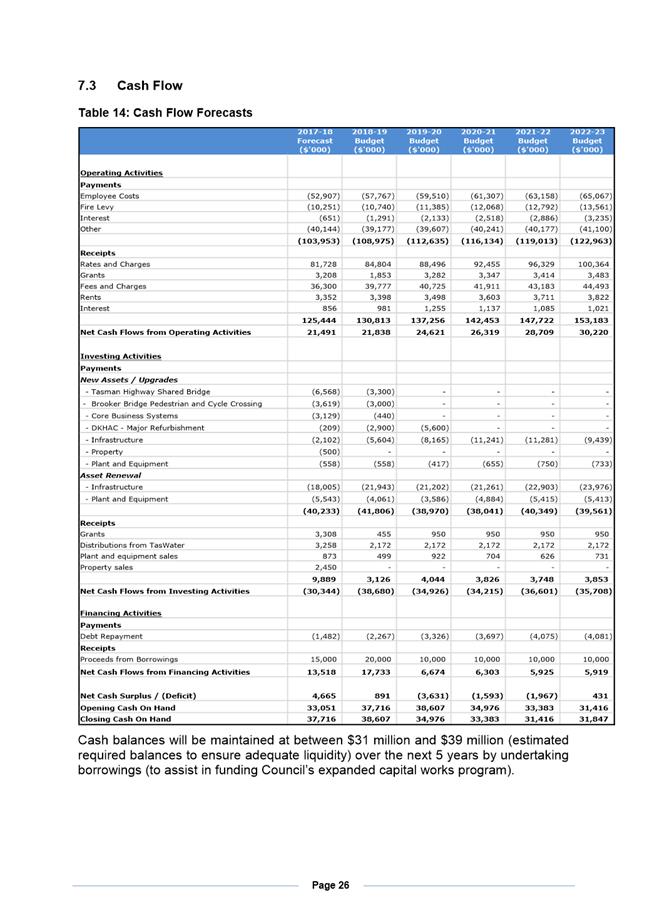

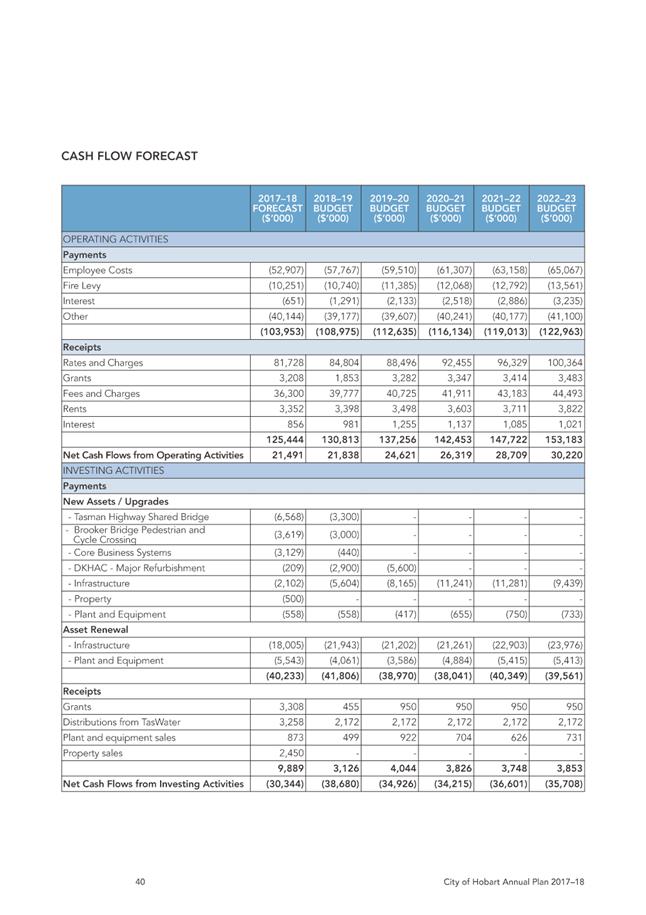

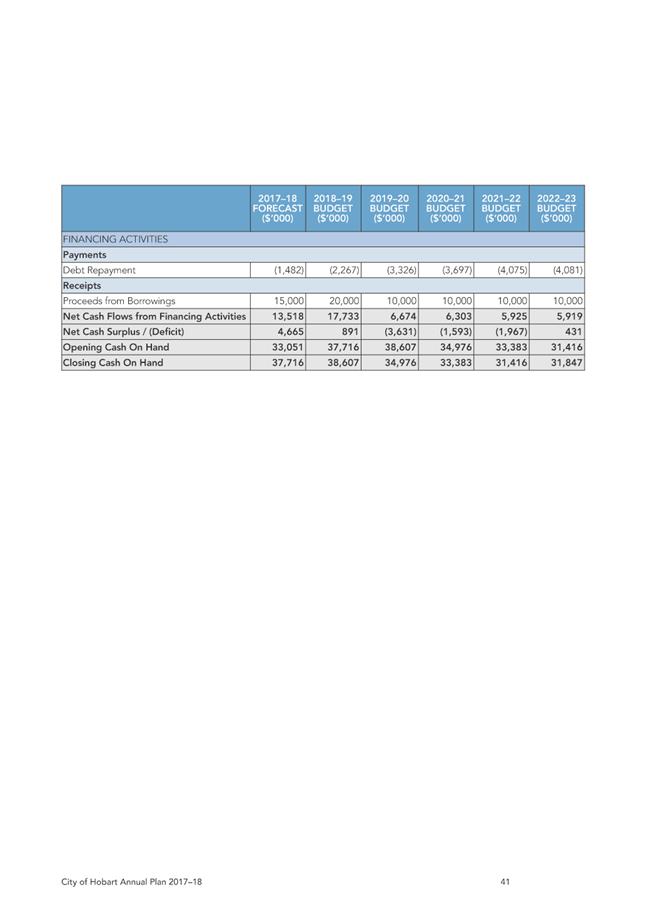

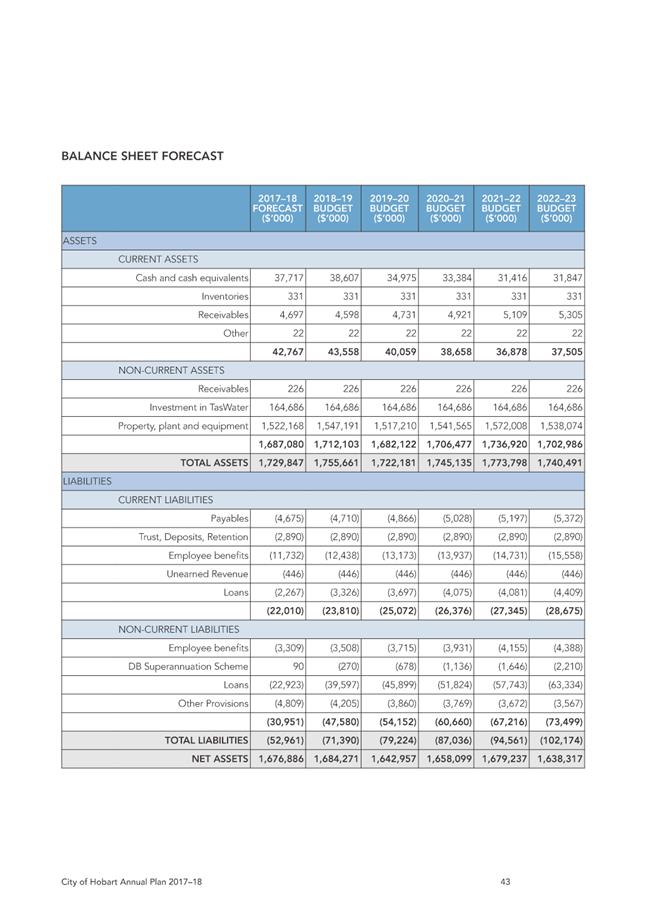

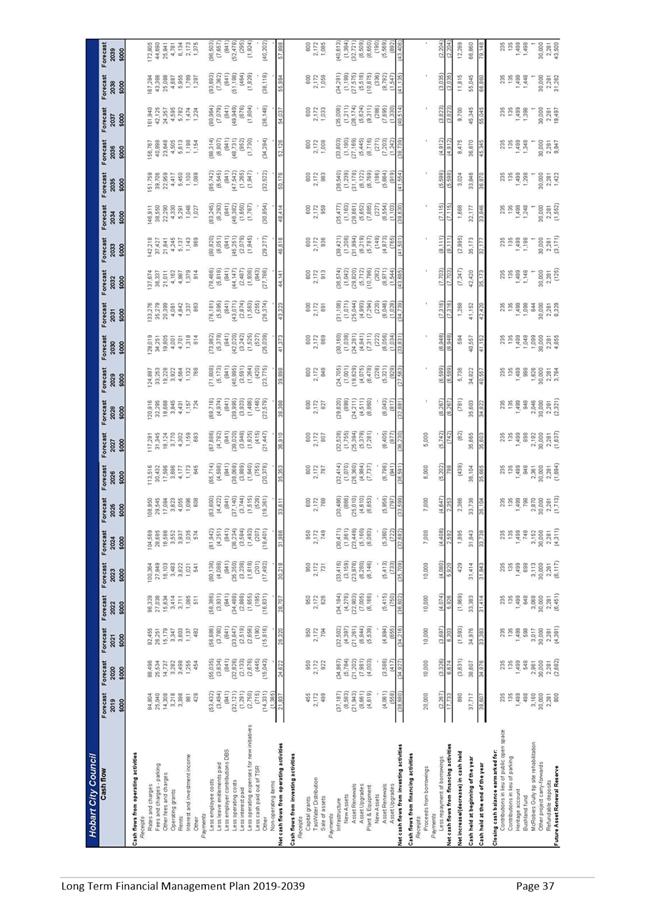

Cash Flows

4.15. Council’s cash balance is forecast to increase by $0.89 million from $37.72 million at 30 June 2018 to $38.61 million at 30 June 2019.

4.16. Cash provided by operating activities will increase by $0.35 million, from $21.49 million to $21.84 million.

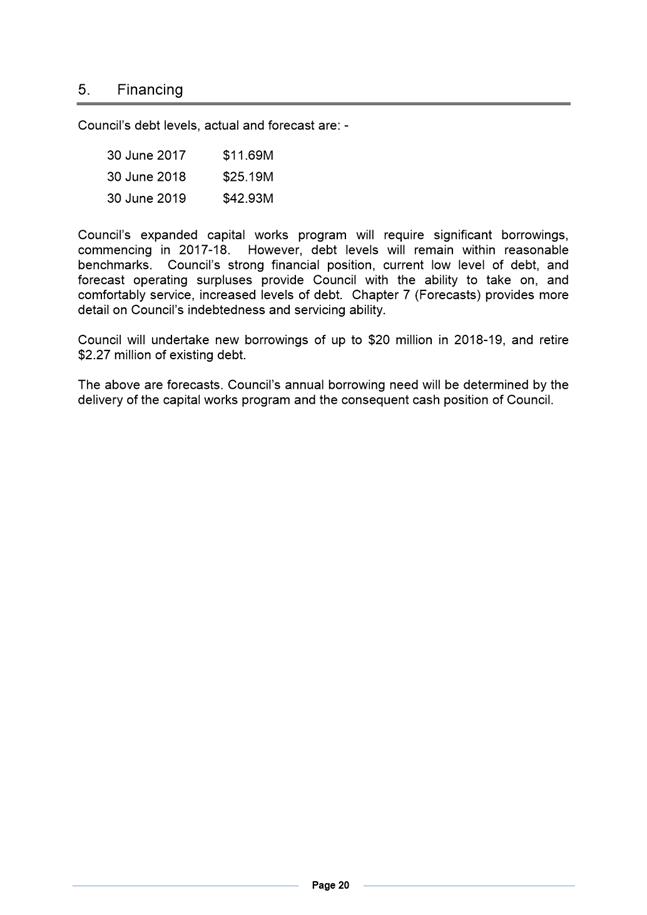

Financing

4.17. New borrowings of up to $20 million will be undertaken in 2018-19, and existing debt of $2.27 million will be retired.

Capital Expenditure – New Assets/Upgrades and Asset Renewal

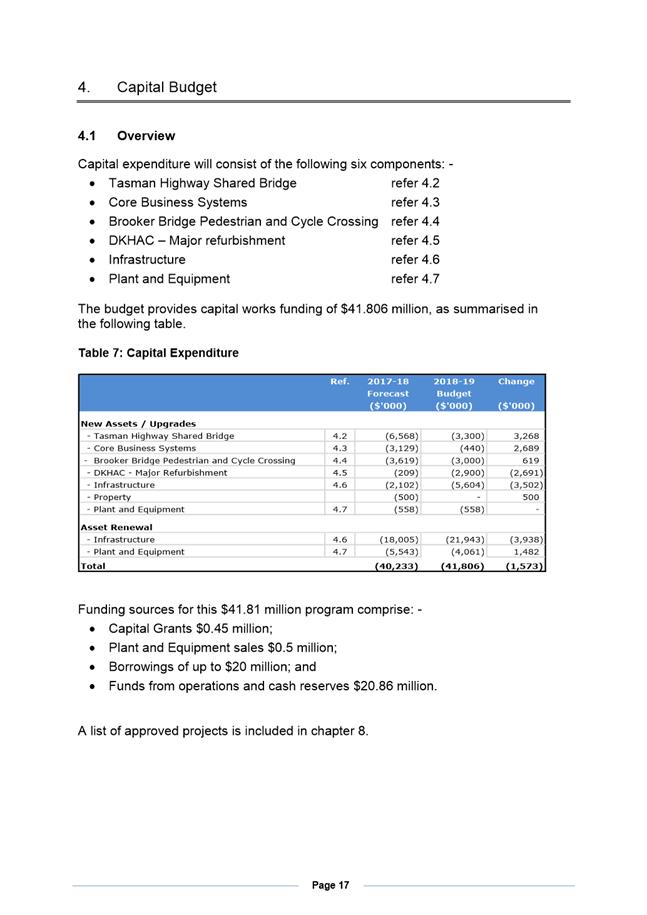

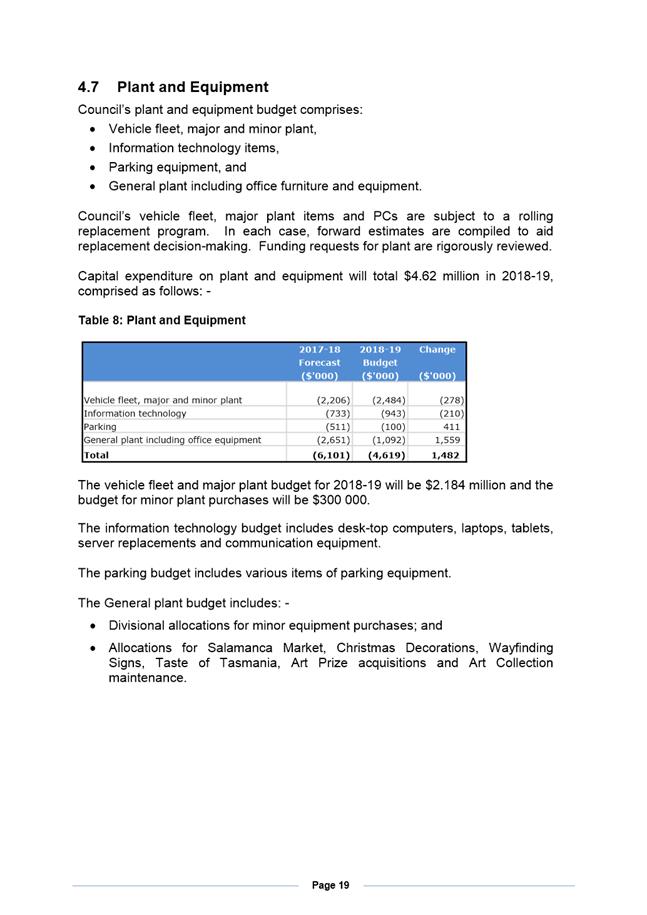

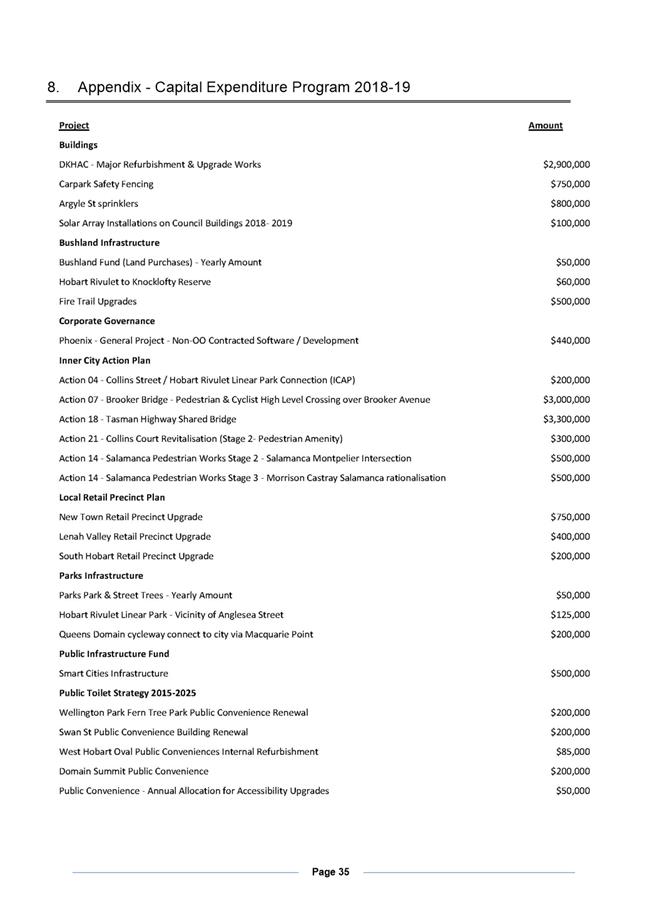

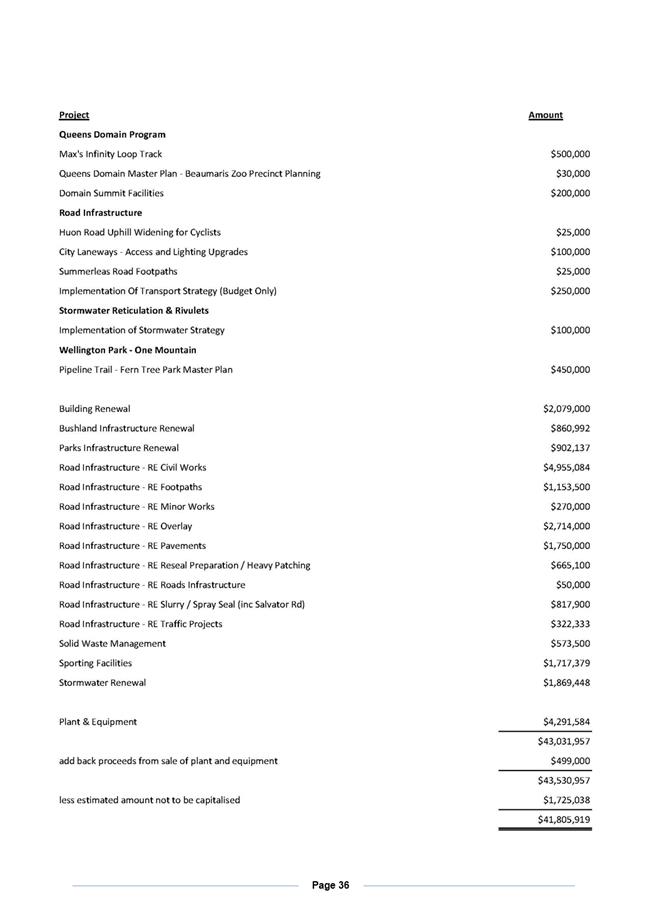

4.18. The 2018-19 budget provides capital works funding of $41.8 million, comprising asset renewal of $26 million and new assets/upgrades of $15.8 million.

4.19. Council considered and endorsed the proposed 2018-19 capital works program on 5 March 2018 subject to any future variation that Council may approve prior to approving the 2018-19 budget. Council also endorsed the proposed capital works programs for 2019-20 and 2020-21 to enable preliminary planning to occur.

4.20. Asset renewal expenditure is split between infrastructure assets ($21.94 million) and plant and equipment ($4.06 million). The level of asset renewal funding provided for 2018-19 is higher than 100% because a number of “Transforming Hobart” projects will result in asset renewal works being carried out sooner than required. This will be the case in following years as well.

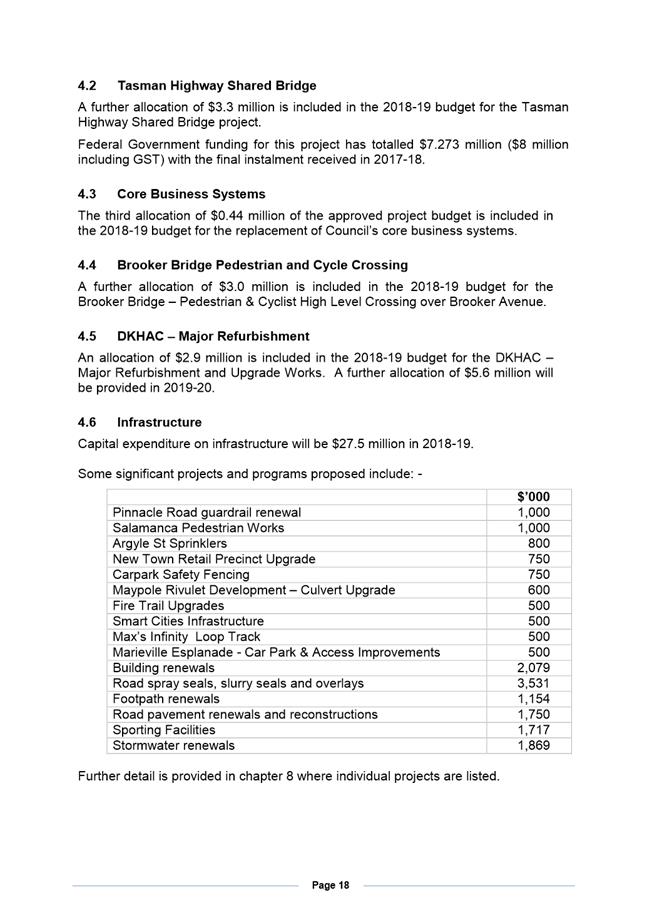

4.21. Some significant projects and programs include:

· $3.3 million for the Tasman Highway Shared Bridge project;

· $3 million for the Brooker Bridge pedestrian and cycle crossing;

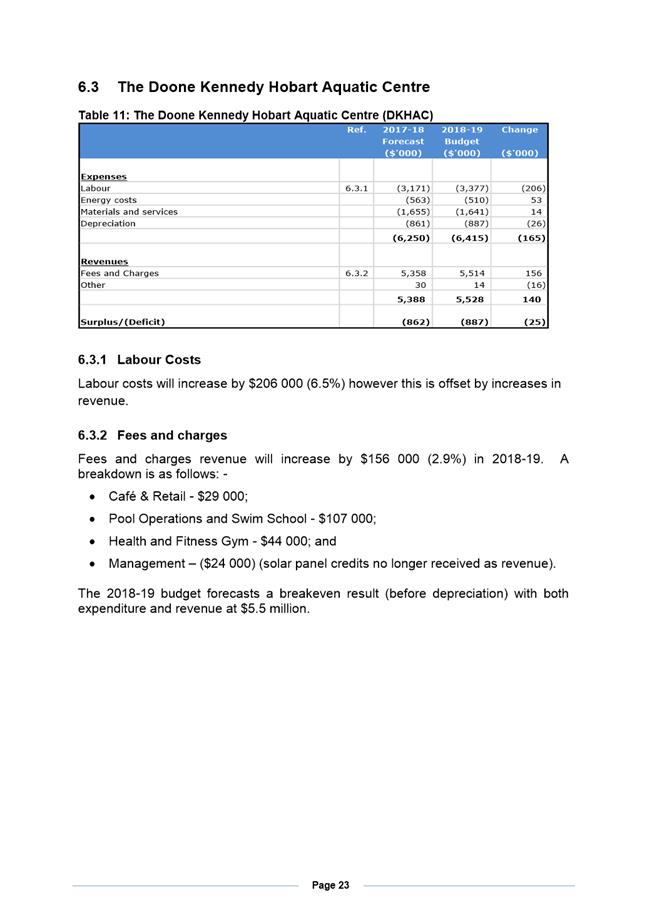

· $2.9 million for the DKHAC refurbishment;

· $3.53 million for road spray seals, slurry seals and overlays;

· $2.1 million for Building renewals;

· $1.87 million for Stormwater renewals;

· $1.75 million for road pavement renewals and reconstructions;

· $1.72 million for Sporting Facilities;

· $1.15 million for footpath renewals;

· $1 million for the Pinnacle Road guardrail renewal;

· $1 million for Salamanca pedestrian works;

· $0.8 million for Argyle Street car park sprinklers;

· $0.75 million for New Town Retail Precinct upgrade; and

· $0.75 million for carpark safety fencing.

Long Term Financial Management Plan

4.22. The 2018-19 Estimates have been prepared in accordance with the updated LTFMP (refer Attachment C), and produce outcomes which are consistent with the plan. These are:

4.22.1. The achievement of modest underlying surpluses;

4.22.2. Debt and liabilities increasing as a result of the expanded capital works program but remaining within reasonable benchmarks; and

4.22.3. Asset renewal funding equal to 100% of known requirements (identified in Council’s Asset Management Plans).

Unspent Plant and Capital Funds

4.23. As part of the budget approval process it is proposed that unspent capital budgets from 2017-18 be carried forward into 2018-19. Based on year-to-date expenditure, carry-forwards are expected to be around $30 million for projects, and around $2 million for plant and equipment. This includes the Tasman Highway Shared Bridge, Brooker Highway Pedestrian Bridge, various traffic and roadworks, the integrated parking system, and replacement of core business systems. This figure is the expected unexpended cash for capital works only recognising the works program itself is substantially progressed.

5. Proposal and Implementation

5.1. It is proposed that the 2018-19 Estimates be formally considered at the Finance and Governance Committee meeting to be held on 13 June, and be listed on the Council meeting agenda for 18 June for formal adoption.

5.2. Subject to any amendments that may arise following the Finance and Governance Committee’s consideration, the following are the draft resolutions that would be presented to Council on 18 June: -

5.2.1. The expenses, revenues, capital expenditure, and plant and equipment expenditure detailed in the document ‘City of Hobart, Budget Estimates, for the 2018-2019 Financial Year’ be approved.

5.2.2. New borrowings of up to $20M be approved for infrastructure.

5.2.3. The Council delegate to the General Manager the power to enter into loan agreements to source the above borrowings on the most favourable terms.

5.2.4. The General Rate be 8.16 cents in the dollar of assessed annual value (AAV).

5.2.5. The following Service Rates be made:

5.2.5.1. A Stormwater Removal Service Rate of 0.47 cents in the dollar of AAV; and

5.2.5.2. A Fire Service Rate of 1.35 cents in the dollar of AAV.

5.2.6. A Waste Management Service Charge be made and varied according to the use or predominant use of land as follows:

5.2.6.1. A Service charge of $250 to apply to residential properties;

5.2.6.2. A Service charge of $500 to apply to non-residential properties.

5.2.7. A Waste Management Service Charge of $50 be made for kerbside green waste collection for all rateable land within the municipal area to which Council supplies or makes available a green waste collection service utilising a green waste collection bin.

5.2.8. A Landfill Rehabilitation Service Charge be made and varied according to the use or predominant use of land as follows:

5.2.8.1. a service charge of $10 to apply to residential properties;

5.2.8.2. a service charge of $20 to apply to non-residential properties.

5.2.9. The rates be subject to the following remissions:

5.2.9.1. A remission of 1.0 cents in the dollar on the AAV of any land or building which is within the Fern Tree Volunteer Brigade Rating District as defined by the State Fire Commission.

5.2.9.2. A remission of 1.05 cents in the dollar on the AAV of any land or building which is within areas other than Permanent Brigade Rating Districts or the Fern Tree Volunteer Brigade Rating District as defined by the State Fire Commission.

5.2.10. Unspent 2017-18 capital funding be carried-forward into 2018-19, with any necessary adjustments to be made in the September 2018 quarter financial report to Council.

5.2.11. The interest rate on unpaid rates be 8.81% per annum, charged monthly.

5.2.12. The 2018-19 Annual Plan be adopted.

5.2.13. The Long Term Financial Management plan 2019-39 be adopted.

5.2.14. The following delegations be approved:

5.2.14.1. Pursuant to Section 22 of the Local Government Act 1993, the Council delegate to the General Manager the power to expend monies on Council’s behalf identified as Delegation Classification 1 items in the Council’s Annual Plan; and, the Council authorise the General Manager to delegate, pursuant Section 64 of the Local Government Act 1993, to such employees of the Council as he considers appropriate, the power to expend monies on Council’s behalf identified as Delegation Classification 1 items in the Council’s Annual Plan.

5.2.14.2. Pursuant to Section 22 of the Local Government Act 1993, the Council delegate to all the Council Committees the power to expend monies on Council’s behalf identified as Delegation Classification 2 items in the Council’s Annual Plan.

5.3. In respect of the interest rate to be applied to outstanding rates (see 4.2.11) the Local Government Act 1993 at section 128 provides for a maximum rate that can be charged. That rate is the 10 year long term bond rate (on the last business day in February) plus a risk premium of up to 6%. For 2018-19 this calculation results in a maximum rate of 8.81% and this is the rate being recommended.

6. Strategic Planning and Policy Considerations

6.1. Goal 5 – Governance is applicable in considering this report, particularly strategic objective:

“5.1 The organisation is relevant to the community and provides good governance and transparent decision-making.

5.1.7 Continually review and update the Long Term Financial Management Plan.

5.1.8 Ensure a rating system that supports fairness, capacity to pay and effectiveness”

6.2. The Budget Estimates provide the resource allocation to deliver on community expectations as expressed in Council’s Capital City Strategic Plan 2015-25.

7. Legal, Risk and Legislative Considerations

7.1. Section 82 of the Local Government Act 1993 requires the General Manager to prepare Estimates of Council’s revenue and expenditure for each financial year, and details what the Estimates must contain.

7.2. The Estimates must be adopted by Council before 31 August by absolute majority.

7.3. As noted above, the 2018-19 Estimates have been prepared in accordance with the updated Long Term Financial Management Plan (refer Attachment C), and produce outcomes which are consistent with the plan, including the provision for contingencies and reserves.

8. Marketing and Media

8.1. Communication of the Council’s approval of the Estimates and General Rates charge will be by a combination of a media release, publication of the Lord Mayor’s budget speech, information on the Council’s website and Facebook pages, an insert with the first rates instalment notice, and a City News article.

9. Community and Stakeholder Engagement

9.1. The preparation of the 2018-19 budget was primarily guided by the City’s Capital City Strategic Plan 2015-2025 and Long-Term Financial Management Plan.

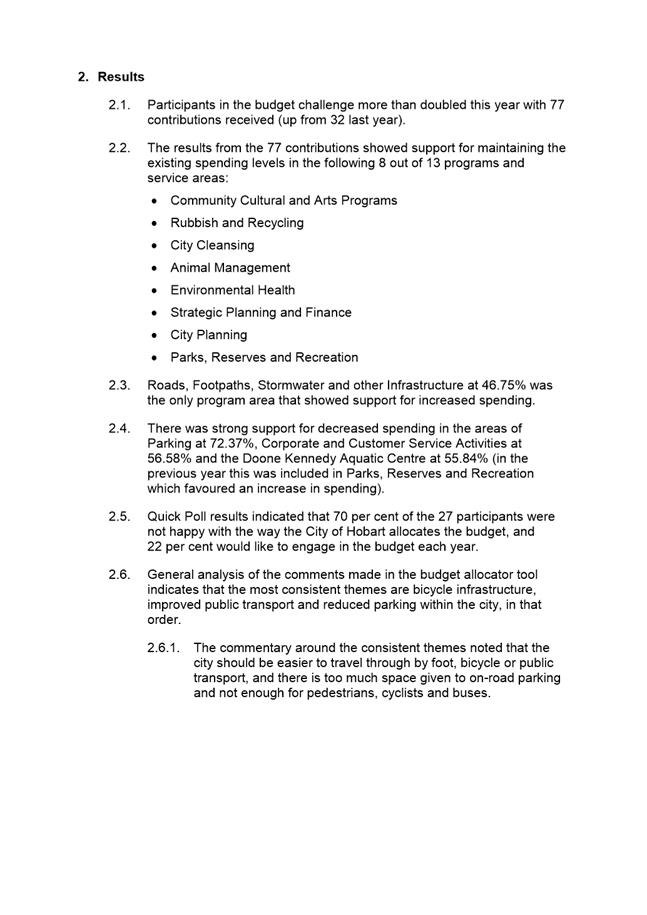

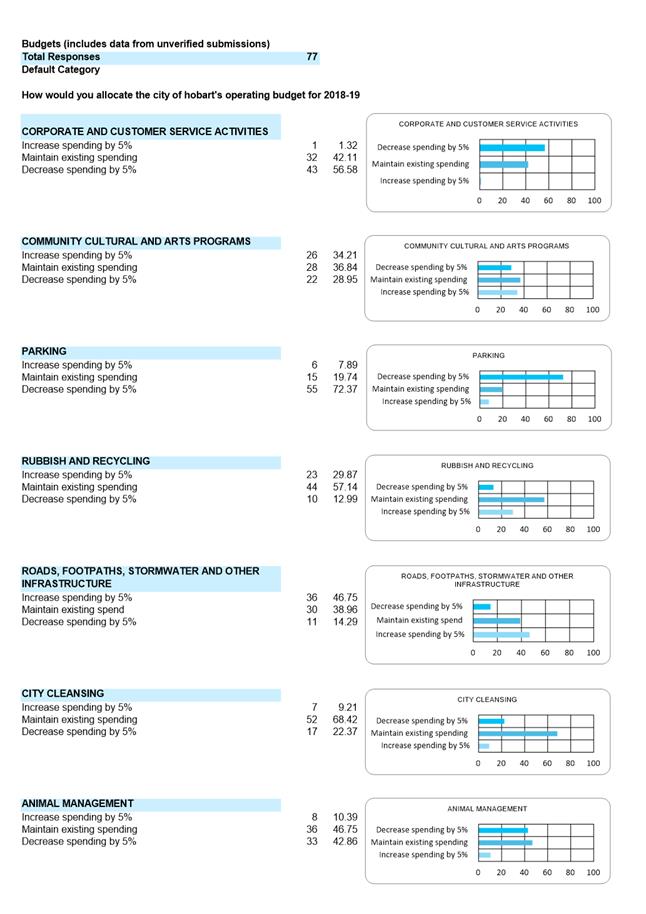

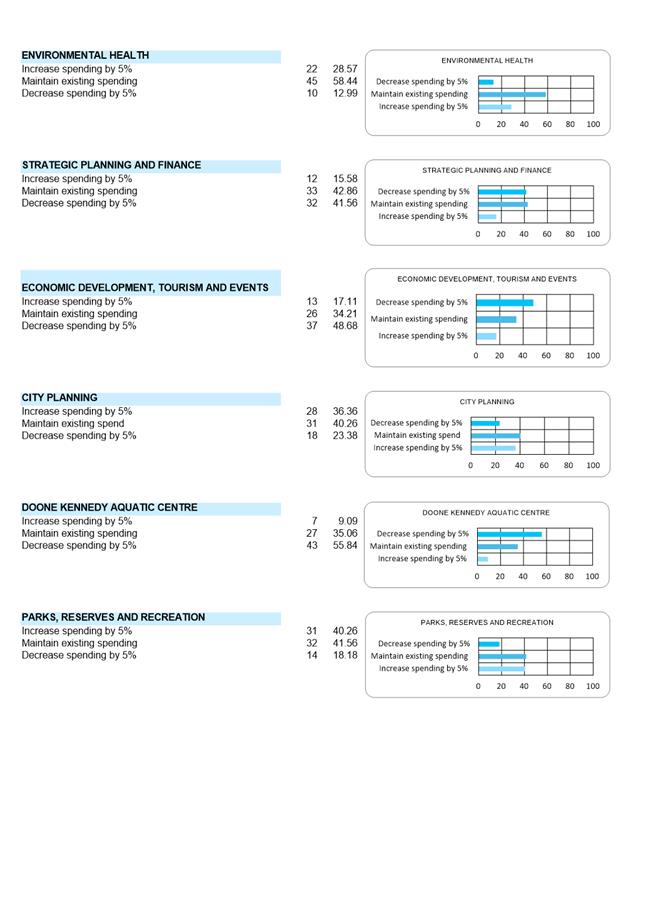

9.2. An engagement process via the City’s Your Say Hobart portal, using the Budget Allocator tool commenced on 8 May and was open for a period of two weeks. A summary is provided at Attachment E providing details of the process and results.

10. Delegation

10.1. Approval of the Estimates is delegated to Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

David Spinks Director Financial Services |

|

Date: 6 June 2018

File Reference: F17/58061

Attachment a: 2018-19

Budget Estimates ⇩ ![]()

Attachment

b: 2018-19

City of Hobart Annual Plan ⇩ ![]()

Attachment

c: 2019-39

Long Term Financial Management Plan ⇩ ![]()

Attachment

d: 2018-19

Rates Resolution ⇩ ![]()

Attachment

e: 2018-19

Budget Your Say Summary ⇩ ![]()

|

Item No. 6.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 19 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 57 ATTACHMENT b |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 113 ATTACHMENT c |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 153 ATTACHMENT d |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 155 ATTACHMENT e |

|

Item No. 6.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 159 ATTACHMENT e |

|

Item No. 6.2 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 165 |

|

|

13/6/2018 |

|

6.2 Tax for Vacant or Unused Residential Housing Accommodation

Report of the Group Manager Rates and Procurement and the Director Financial Services of 6 June 2018 and attachment.

Delegation: Council

|

Item No. 6.2 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 166 |

|

|

13/6/2018 |

|

REPORT TITLE: Tax for Vacant or Unused Residential Housing Accommodation

REPORT PROVIDED BY: Group Manager Rates and Procurement

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to address a notice of motion tabled at the open Finance and Governance Committee meeting of 17 April 2018 and subsequently resolved by Council at its meeting of 23 April 2018, regarding a tax for vacant or unused residential housing accommodation.

1.2. The community benefit relates to consideration of initiatives that may address the shortage of rental accommodation currently being experienced in the Hobart municipal area, which is consistent with the City of Hobart Capital City Strategic Plan 2015-2025.

2. Report Summary

2.1. This report has been prepared in response to a Notice of Motion from Alderman Zucco regarding a possible tax for vacant or unused residential housing accommodation designed to address the shortage of rental accommodation in the Hobart municipal area.

2.2. This report details examples where such initiatives has been implemented in jurisdictions in Australia and worldwide. The purpose of such has broadly been to:

2.2.1. Create an incentive for owners to make long-term vacant residential properties available for sale or rent; and

2.2.2. Raise revenue that can be used to address housing affordability initiatives.

2.3. While some of these initiatives are new and hence difficult to assess effectiveness, the UK example does appear to show a reduction in the number of dwellings left empty although it is unclear whether that is due to this initiative alone.

2.4. While the current legislative framework does not contemplate such a tax or rate in Tasmania it is open for Council to consider whether it wishes to raise the issue with the Local Government Association of Tasmania or the State Government.

|

That: 1. The report titled ‘Tax for vacant or unused residential housing accommodation’ be received and noted. 2. The Council write to the Local Government Association of Tasmania to raise the issue more broadly within the sector. 3. The Council write to the State Government requesting consideration be given of a vacant residential land tax similar to the Victorian model.

|

4. Background

4.1. At its meeting on 23 April 2018 the Council resolved the following notice of motion (NoM) from Alderman Zucco:

4.1.1. That an urgent report be prepared that considers a rate or tax that maybe implemented for approved but vacant and unused residential / housing accommodation in the City of Hobart and that the report will include the findings from any previous reports prepared by Council officers on the matter.

4.1.2. That the report also consider writing to the State Government to also consider a vacant land tax similar to the Victorian model and raising the issue with the Local Government Association of Tasmania.

4.2. The rationale provided with the notice of motion was that:

4.2.1. The Victorian State government has recently implemented a vacant land tax for properties that remain unused for a period of 6 months in any one year.

4.2.2. It is detrimental to the city to have vacant residential accommodation within the City in particular when there is a shortage of rental accommodation.

4.2.3. Even though the State government has made reference that it has no intentions to introduce a “vacant land tax” on similar lines to Victoria, it has plans to introduce a “Stamp Duty” tax on overseas investors, which in itself is a tax on overseas investors.

4.3. In respect to the first part of the NoM, the prior report on this matter is attached – refer Attachment A. This was prepared following a Question without Notice at the March 2017 City Planning Committee from Alderman Cocker.

4.4. In prior years there have also been reports prepared on rating options for dilapidated and derelict buildings to encourage these properties to be properly managed and developed by property owners. These reports are not attached but the relevant information from these reports is included in this report.

Victorian Model

4.5. To help address the lack of housing supply in Victoria, from 1 January 2018 the Victorian Government has introduced a vacant residential land tax that applies to homes in inner and middle Melbourne that were vacant for more than six months in the prior calendar year (the period doesn’t need to be continuous). Vacant means it wasn’t used as a principal place of residence or subject to a bona fide leasing arrangement.

4.6. The annual tax is 1% of the capital value of the land and applies to land used for residential purposes. It also applies to land on which a residence is being renovated or where a former residence has been demolished and a new residence is being constructed. It does not apply to vacant land, commercial residential premises, display homes, residential care facilities, supported residential services or a retirement village.

4.7. There are exemptions to the requirement to pay and homes that are exempt from land tax are also exempt from vacant residential land tax.

4.8. Owners are required to self-notify/report to the State Revenue Office that their property was unoccupied for more than six months in a calendar year and hence subject to the tax.

4.9. The Victorian Government has only introduced this tax in certain suburbs where the issue of housing affordability was most notable. The tax is intended to encourage land owners to make residential properties available for purchase or rent.

UK Model

4.10. Since 2013, local authorities in England have had the discretion to charge a premium of up to 50% of the council tax on the property on long-term empty dwellings - that is, homes that have been unoccupied and substantially unfurnished for at least two years. The Empty Homes Premium (the premium) is in addition to the usual council tax charge that applies to the property.

4.11. In the UK there is a serious shortage of affordable housing and a high number of properties standing empty that attract squatters, vandalism and anti-social behaviour and are a wasted resource with 1.16 million households on the social housing waiting list (Source: Ministry of Housing, Communities & Local Government 2018).

4.12. In 2018 a Bill called ‘Rating (Property in Common Occupation) and Council Tax (Empty Dwellings) Bill’ has been introduced to increase the premium’s level from 50% to 100%.

4.13. The premium is discretionary allowing local authorities to decide whether it is appropriate for their areas, and what level of premium should be charged. It doesn’t apply to homes that are empty due to the owner living in armed forces accommodation and there are statutory exemptions for properties left empty for a specific purposes e.g. if the owner goes into care. Also councils have powers to apply discretionary discounts in cases where homes are empty due to special circumstances such as hardship, fire or flooding.

4.14. Councils also have access to incentives that can be provided to owners of long term empty dwellings to assist in getting the property back into use. This includes home improvement grants (subject to eligibility), advice on letting properties, surveying services and assistance to access a reduced rate of VAT for properties empty over two years.

4.15. The rules are different in Scotland where if your property has been unoccupied for more than 12 months, your council has the option to charge double the normal rate of council tax.

Vancouver Model

4.16. From 1 January 2017 the City of Vancouver in Canada implemented an annual tax on empty or under-utilized residential properties called the Empty Homes Tax to address Vancouver’s housing crisis.

4.17. Vancouver has one of the lowest rental vacancy rates and the highest rental costs in Canada and the purpose of the tax is to return empty or under-utilized properties to use as long-term rental homes.

4.18. The Empty Homes Tax is applied annually and calculated at 1% of a property’s assessed taxable value. Properties are considered vacant is they have been unoccupied for more than 180 days during the calendar year.

4.19. The approach the City of Vancouver has taken is that owners have to make a property status declaration so self-notify / report to the Council. However, if they don’t make the declaration the Council deems the property vacant and hence subject to the tax.

4.20. Due to its length the Officer report to the Vancouver City Council with the recommended approach to the tax is not attached but is available from: http://council.vancouver.ca/20161116/documents/cfsc6.pdf and provides a useful insight into the approach taken by Vancouver City Council in implementing the tax, which included undertaking public consultation.

Tasmania

4.21. In February 2018 Treasurer Gutwein announced that a re-elected Liberal Government would introduce a tax on international purchases of land and residential properties in an effort to improve housing affordability.

4.22. The tax, ‘Foreign Investor Surcharge’, would see an additional 3% in property transfer duty on all purchases of residential property by foreign residents and 0.5% on all purchases of primary production land.

4.23. It was expected that the surcharge would raise $1.5 Million and the surcharge would not apply to Tasmanians.

4.24. The Treasurer indicated that legislation would be introduced in State Parliament to allow the surcharge to take effect on property settlements from 1 July 2018.

4.25. Council does not currently have the legislative power to introduce a tax, whether that be a rate or charge for vacant or unused residential housing accommodation similar to the examples above. It is notable that these examples arose in these jurisdictions due to legislative change enabling the tax, premium or surcharge to take effect.

4.26. From a Council rates perspective Council is unable to identify vacant properties in the City.

4.27. Generally, Council does not keep or collect data on vacant property and owners are under no obligation to advise Council when their property is vacant for an extended period.

5. Proposal and Implementation

5.1. The examples given, while all different in their approach, have had a common theme to address housing availability and affordability in specific areas.

5.2. The initiatives have been introduced to have two broad effects, as follows:

5.2.1. Creating an incentive for owners to make long-term vacant residential properties available for sale or rent; and

5.2.2. Raising revenue that can be used to address housing affordability initiatives.

5.3. It is difficult to determine whether the initiatives have had the desired effect as some of the initiatives are new. However, in the UK where the initiative has been in place since 2013, the number of dwellings left empty for six months dropped from just over 300,000 in 2010 to 205,293 by 2017.

5.4. The premium rise in England has been proposed to address the issue of wealthy owners or property developers who can afford the premium and are waiting for market conditions to be right.

5.5. Although this report details models in Victoria, Vancouver and the UK there are similar initiatives in other jurisdictions worldwide.

6. Strategic Planning and Policy Considerations

6.1. This report relates to Goal 4 – Strong, Safe and Health Communities of The City of Hobart 10-year Capital City Strategic Plan, which states that ‘The Council’s role will also focus on creating an environment that allows for the correct supply of and demand for affordable housing’ as well as strategic objective 4.3.7 ‘Implement a housing and homelessness framework’.

6.2. This report also relates to the City of Hobart Housing and Homelessness Strategy 2016-2019.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. There are no financial implications arising from this report as the report is a discussion paper only.

7.2. Impact on Future Years’ Financial Result

7.2.1. N/A.

7.3. Asset Related Implications

7.3.1. N/A.

8. Legal, Risk and Legislative Considerations

8.1. These are considered elsewhere in the report.

9. Social and Customer Considerations

9.1. As outlined in the City’s Housing and Homelessness Strategy, affordable housing is in chronic short supply in Tasmania, with the public housing wait list at almost 3,000. Housing stress affects a quarter of the State’s low income households. For low income households, 39% of renters, approximately 7,901 households, are in rental stress, and 47% of home buyers, approximately 5,996 households, are in mortgage stress. (Source: Tasmania’s Affordable Housing Strategy 2015 - 2025, available at https://www.dhhs.tas.gov.au/housing/tasmanian_affordable_housing_strategy)

9.2. At the last census 11.2% of housing was recorded as unoccupied in Australia – a total of 1,089,165 dwellings. The trend is an increase from prior census.

10. Delegation

10.1. Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lara MacDonell Group Manager Rates and Procurement |

David Spinks Director Financial Services |

Date: 6 June 2018

File Reference: F18/60964

Attachment a: Response

to QWON - Tax on Vacant Properties 14 March 2017 ⇩ ![]()

|

Item No. 6.2 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 173 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 175 |

|

|

|

13/6/2018 |

|

6.3 99 Norla Street, Tranmere - City's Droughty Pt Radio Transmitter Site - Request for Licence

Report of the Manager Fleet & Support Services and the Director Parks and City Amenity of 5 June 2018 and attachment.

Delegation: Council

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 176 |

|

|

13/6/2018 |

|

REPORT TITLE: 99 Norla Street, Tranmere - City's Droughty Pt Radio Transmitter Site - Request for Licence

REPORT PROVIDED BY: Manager Fleet & Support Services

Director Parks and City Amenity

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to authorise the General Manager to issue a commercial licence agreement to Jettech Networks Pty Ltd in respect to its request to utilise and co-locate communication infrastructure on the City’s Droughty Point radio transmitter site, located 99 Norla St, Tranmere.

1.2. The long established communication facility currently houses infrastructure to support the City’s 2-way radio and related communications requirements and is ideally situated to service the wider Hobart area.

2. Report Summary

2.1. The

City owns property situated at 99 Norla St, Tranmere which houses a bunker

style building where its two-way radio repeater network for its operations and

work crews communications around the City and suburbs is operated from.

Authority is sought for the General Manager to negotiate and issue a licence

agreement with Jettech Networks in respect to its request to utilise and

co-locate communication infrastructure on the site.

2.2. Given the operational nature and purpose of the site, it is proposed that the General Manager be delegated authority to negotiate similar agreements for the site into the future.

|

That: 1. The General Manager be authorised to negotiate and issue a commercial licence agreement with Jettech Networks Pty Ltd in respect to its request to utilise and co-locate communication infrastructure on the City’s Droughty Point radio transmitter site, located 99 Norla St, Tranmere. 2. The term of the initial agreement be from 1 July 2018 to 30 June 2021, at an estimated annual commercial rate $5,200 per annum (exc GST). 3. Given the operational nature and purpose of the site, the General Manager be delegated authority to negotiate similar agreements for the site into the future. |

3. Background

3.1. The City owns property situated at 99 Norla St, Tranmere which houses a bunker style building where its two-way radio repeater network for its operations and work crews communications around the City and suburbs is operated from.

3.2. The site is ideally situated for two-way radio repeater communications from Hobart to other suburban and distant areas that are unable to be contacted with line of sight or distance communications.

3.3. Australian Customs previously utilised the transmitter site, however they closed down and relinquished their licence agreement 31 July 2010.

3.4. Jettech Networks has similar arrangements with other local and state government entities across Tasmania.

4. Proposal and Implementation

4.1. Authority is sought for the General Manager to negotiate and issue a licence agreement with Jettech Networks in respect to its request to utilise and co-locate communication infrastructure on the City’s Droughty Point radio transmitter site, located 99 Norla St, Tranmere..

4.2. Jettech Networks propose to do all works at their costs including;

4.2.1. Tidy and remove any existing antenna masts and mounts from the exterior of the building. This would be undertaken with consultation from the City of Hobart’s radio contractor.

4.2.2. Install a new engineered 6 metre antenna mast that can support Jettech Networks antennas. This would be directly attached to the side of the building.

4.2.3. Replace existing main switchboard to meet current electrical regulations.

4.2.4. Replace existing lighting and power outlets within the building to provide a more suitable arrangement for all users of the site.

4.2.5. Add a new electrical meter for Jettech equipment.

4.2.6. Improve weather, rodent and insect ingress. Add filter material to vents, and seal all cable entry points.

4.2.7. Install 2 x 45RU equipment racks within the building to house Jettech Networks equipment and batteries.

4.2.8. Install antennas to new mast structure. Install cabling, cable supports and lightning protection.

4.3. The works are deemed “Low Impact” under the Telecommunications Act of 1997, and do not require local government planning approval.

4.4. It is proposed that the City enter into a term of licence for a period of three years commencing on 1 July 2018 to 30 June 2021 at a commercially negotiated rate of $5,200 per annum (exc GST).

4.5. It is further proposed that given the operational nature and purpose of the site, the General Manager be authorised to negotiate similar agreements for the site into the future.

5. Strategic Planning and Policy Considerations

5.1. None are foreseen

6. Financial Implications

6.1. Funding Source and Impact on Current Year Operating Result

6.1.1. No implications

6.2. Impact on Future Years’ Financial Result

6.2.1. New income of approximately of $5,200 per annum will be received.

7. Legal, Risk and Legislative Considerations

7.1. The licence agreement will comply with City requirements.

8. Delegation

8.1. The Finance and Governance Committee holds a delegation to approve the lease/re-lease of previously leased properties.

8.2. Pursuant to Section 64 of the Local Government Act 1993, the Council may delegate powers to the General Manager.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Greg Fannon Manager Fleet & Support Services |

Glenn Doyle Director Parks and City Amenity |

Date: 5 June 2018

File Reference: F18/47454; S10-053-01/02

Attachment a: Droughty

Pt Transmitter Site ⇩ ![]()

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 180 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 181 |

|

|

|

13/6/2018 |

|

6.4 3 Morrison Street - Lease to Mawson's Huts Foundation

Memorandum of the Manager Legal and Governance and the Deputy General Manager of 6 June 2018 and attachment.

Delegation: Committee

|

Item No. 6.4 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 182 |

|

|

13/6/2018 |

|

Memorandum: Finance and Governance Committee

3 Morrison Street - Lease to Mawson's Huts Foundation

The purpose of this report is for the Finance and Governance Committee to consider a request to lease the property at 3 Morrison Street from the Mawson’s Huts Foundation.

The property is currently being occupied as part of the Australian Antarctic Festival. That occupation will cease in August 2018 following the end of the Festival.

A request has been received by the Lord Mayor from Mr David Jensen, Chairman of the Mawson’s Huts Foundation, to continue the lease of that property until such time as the Council is able to find a longer-term tenant for that site. This is included as Attachment A to this report.

The Council has previously sought a commercial tenant for this property, however due to the short-term nature of the occupation being offered this has not been successful. Allowing the Mawson’s Huts Foundation to occupy the premises until such time as a commercial tenant is sourced would ensure that the property is activated and well-presented.

The Foundation has requested that the premise be provided for a nominal rent and notwithstanding the short-term nature of the occupation this requires the approval of the Committee.

The most recent valuation of the property sets the value of the rent at $32,000 per annum. To proceed as requested would represent approximately $2,600 per month in foregone rent. However it should be noted that the property has been vacant and this would see the site activated for a period of time. The Council has unsuccessfully tried to obtain a replacement tenant in the premises over the last 12 months. While the value would be recorded as a grant to the Foundation, it is unlikely that the income would actually be foregone.

Given the inability to attract a commercial tenant for the property in the short-term it is considered appropriate to allow the Mawson’s Huts Foundation to lease the property at a nominal rent and the Council having the ability to terminate the lease with 30 days’ notice in the event that a commercial tenant is sourced.

|

That: 1. The Council lease the property at 3 Morrison Street, Hobart to the Mawson’s Huts Foundation on a monthly basis at a nominal rent in accordance with the Council’s not-for-profit leasing policy. 2. The lease be disclosed as a grant in the Council’s Annual Report in accordance with the Council’s not-for-profit leasing policy. 3. The General Manager be delegated the authority to negotiate and agree the lease terms. |

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Paul Jackson Manager Legal and Governance |

Heather Salisbury Deputy General Manager |

Date: 6 June 2018

File Reference: F18/65309; 5669950

Attachment a: Request

for Lease - Mawson's Huts Foundation - 30 May 2018 ⇩ ![]()

|

Item No. 6.4 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 184 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 186 |

|

|

|

13/6/2018 |

|

6.5 Outstanding Long Term Parking Permit Debts as at 31 May 2018

Memorandum of the Manager Finance and the Director Financial Services of 5 June 2018.

Delegation: Committee

|

Item No. 6.5 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 187 |

|

|

13/6/2018 |

|

Memorandum: Finance and Governance Committee

Outstanding Long Term Parking Permit Debts as at 31 May 2018

|

|

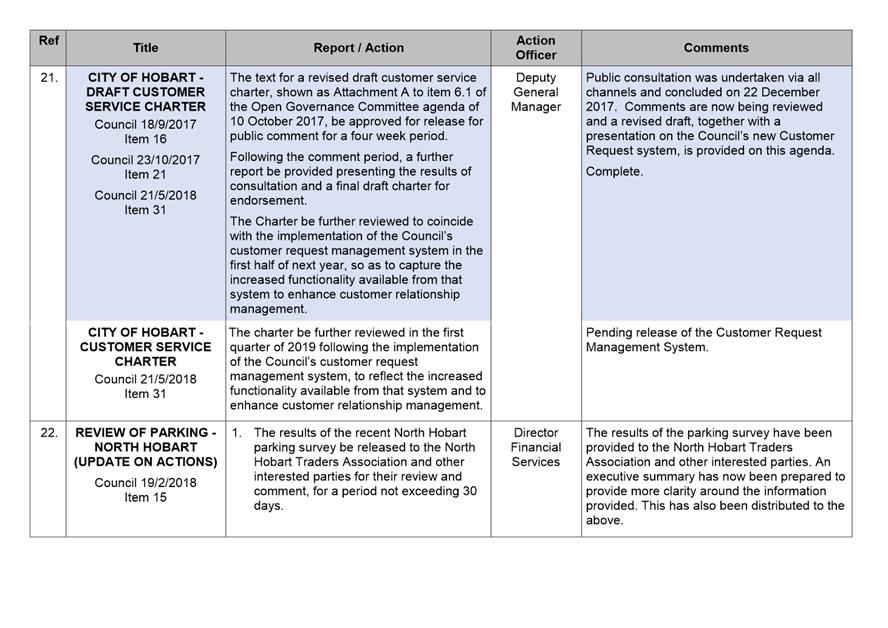

31-May-17 |

% of total O/S |

30-Apr-18 |

% of total O/S |

31-May-18 |

% of total O/S |

|

|

$ |

|

$ |

|

$ |

|

|

Current |

94,284 |

86% |

63,244 |

75% |

19,178 |

22% |

|

30 days |

9,306 |

9% |

2,110 |

3% |

54,065 |

62% |

|

60 days |

59 |

0% |

14,713 |

18% |

2,624 |

3% |

|

90 days |

5,657 |

5% |

3,538 |

4% |

11,300 |

13% |

|

Total |

109,306 |

|

83,605 |

|

87,167 |

|

|

|

|

|

|

|

|

|

|

* 30 days+(all) |

15,022 |

14% |

20,361 |

24% |

67,989 |

78% |

|

That the information contained in the memorandum of the Manager Finance and Director Financial Services of 4 June 2018 titled “Outstanding Long Term Parking Permit Debts as at 31 May 2018” be received and noted. |

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Michael Greatbatch Manager Finance |

David Spinks Director Financial Services |

Date: 5 June 2018

File Reference: F18/64783

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 189 |

|

|

|

13/6/2018 |

|

6.6 Aldermanic Professional Development

Memorandum of the General Manager of 7 June 2018.

Delegation: Council

|

Item No. 6.6 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 190 |

|

|

13/6/2018 |

|

Memorandum: Finance and Governance Committee

Aldermanic Professional Development

Introduction

The purpose of this report is to seek the Council’s approval of the following:

· Defer a review of the Aldermanic Professional Development policy until after the October local government elections, and;

· Allow consideration of professional development applications involving intrastate or interstate travel only.

Background

The Council resolved inter alia at its 24 July 2017 meeting that:

A full review of the professional development policy be undertaken addressing best practice from relevant organisations.

Subsequent to that decision, the Council at its 4 December 2017 meeting resolved, inter alia that:

The Council immediately suspend its professional development policy pending an urgent workshop to be held in the new year to enable a full review of the policy provisions and no further applications be approved until such time as the review has been completed.

Whilst there have been attempts to schedule the workshop other business has taken priority.

In addition to this, the Local Government Division, through the draft Local Government (General) Regulations 2018, has proposed that the Declaration of Office be amended such that elected members are required to engage in ongoing professional development and abide by the principles of good governance. The Council in considering a report in relation to the draft Regulations, resolved inter alia as follows on 21 May 2018:

That the Council make a submission to the Local Government Association of Tasmania that the Council supports the inclusion to the Declaration of Office that an Alderman declare they will engage in ongoing professional development provided that the term ‘professional development’ is defined and, in this respect, the Local Government Division of the Department of Premier and Cabinet develop, in consultation with councils and other relevant stakeholders, a model professional development policy that provides clear guidance as to its requirement.

The Director of Local Government in previous correspondence to the General Manager dated 4 May 2018 advised that “a definition of ‘professional development’ has not been inserted into the draft Amendment Regulations as it is intended that the ordinary meaning of the words and common sense be applied.’

He also went on to say that Ministerial Directions issued to Glenorchy City Council in January 2018 provide indicative areas that professional development should focus on. While Ministerial Direction 2 focuses on training it does not necessarily cover the full breadth of what could be classified as professional development activities.

Discussion

Given the Council’s decision of 21 May 2018 calling for the development of a model professional development policy and the imminent local government elections, it would appear prudent to hold off undertaking a wholesale review of the Council’s professional development policy until such time as the Department of Premier and Cabinet have had time to consider the Council’s submission and a new Council has been sworn in.

If the Council is happy to defer the review of the policy, it may wish to consider ‘relaxing’ its decision that no further professional development applications be approved to allow the consideration of professional development applications which involve only intrastate or interstate travel. As it currently stands, no professional development activities can be undertaken by Aldermen.

Conclusion

In December 2017 the Council agreed to suspend its professional development policy pending an urgent workshop.

Unfortunately due to other business taking priority the workshop has not been able to be held.

It appears sensible given the upcoming local government elections that the review of the policy be undertaken by the incoming council, however, as it stands no professional development activities can be undertaken by Aldermen, therefore, the Council may wish to allow consideration of activities involving intrastate or interstate travel only.

|

That: 1. That the information be received and noted. 2. The Council defer a review of its professional development policy under after a new Council has been sworn in. 3. The Council allow consideration of professional development applications which involve intrastate and interstate travel only.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N.D Heath General Manager |

|

Date: 7 June 2018

File Reference: F18/62628

|

Item No. 6.7 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 193 |

|

|

13/6/2018 |

|

6.7 Board of Inquiry Report into Councillor Allowances

Memorandum of the General Manager of 7 June 2018 and attachment.

Delegation: Council

|

Item No. 6.7 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 194 |

|

|

13/6/2018 |

|

Memorandum: Finance and Governance Committee

Board of Inquiry Report into Councillor Allowances

Introduction

The purpose of this report is to provide Aldermen with the draft outcomes of

the recent Board of Inquiry into Councillor Allowances.

Background

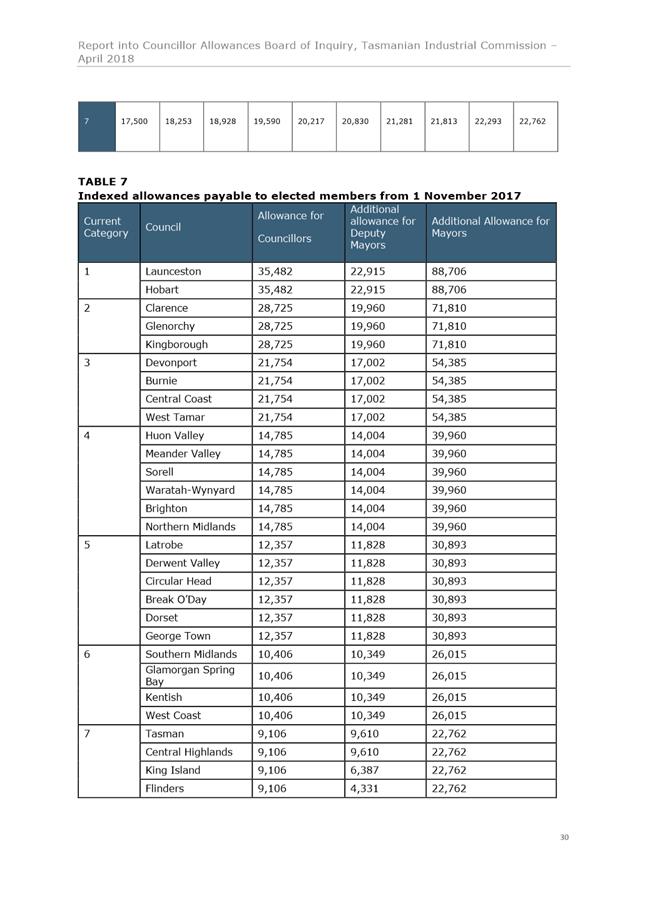

In June 2017, the Minister for Local Government, the Hon. Peter Gutwein MP appointed members from the Tasmanian Industrial Commission (TIC) as a Board of Inquiry under section 215 of the Local Government Act 1993 to review the annual allowances paid to councillors in Tasmania.

The Board of Inquiry was asked to provide recommendations to the Minister, and the reasons for the recommendations, on the appropriate amount to be payable as an annual allowance for the offices of mayor, deputy mayor and councillor of each council, or group of councils in Tasmania.

The Council provided a written submission to the Issues Paper with a verbal submission provided to the TIC on 20 February 2018.

Outcomes of the Review

The TIC has now completed its review and provided the attached report.

The TIC has concluded that the current level of councillor allowances is

financially sustainable and acceptable, and is recommending only minor changes

to the existing allowance regime.

In summary, the TIC recommends:

· the wage price index continues to apply to base allowances, adjusted annually;

· no additional individual allowances be provided in recognition of individual councillors’ experience, skills or training, with a suggestion that councils are to make available an annual budget allocation to undertake identified training;

· a ‘higher duties allowance’ be paid to the Deputy Mayor where the Deputy Mayor is required to act in the role of mayor for more than four consecutive weeks;

· no special ‘capital city loading’ be applied to the Hobart City Council;

· an independent review be conducted into the methodology for calculating base councillor allowances, including the categorisation of councils (eg on the basis of geographic size, population, councillor numbers); and

· consideration be given to undertaking social research to identify effective ways of attracting councillors from more diverse backgrounds – including younger people and women – that better represent their constituencies.

Any changes to councillor allowances emanating from the review will need to be implemented by regulation and is intended to commence from 1 November 2018, following the October 2018 local government elections.

Councils and individual councillors are invited to provide written submissions on the TIC’s findings and recommendations. Submissions are required to be provided by no later than 6 July 2018.

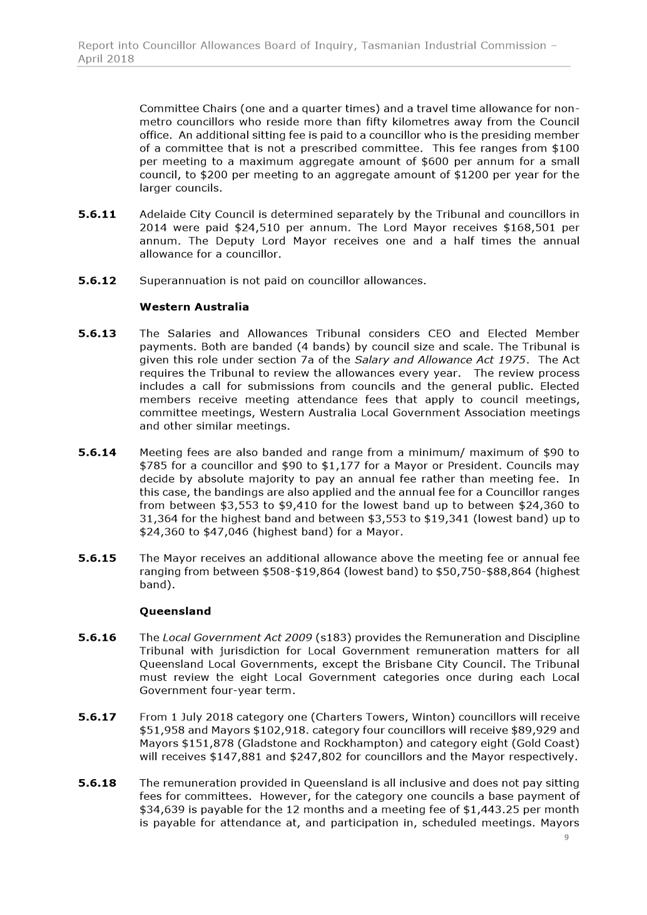

Council’s Submission and the Board of Inquiry Findings and Recommendations

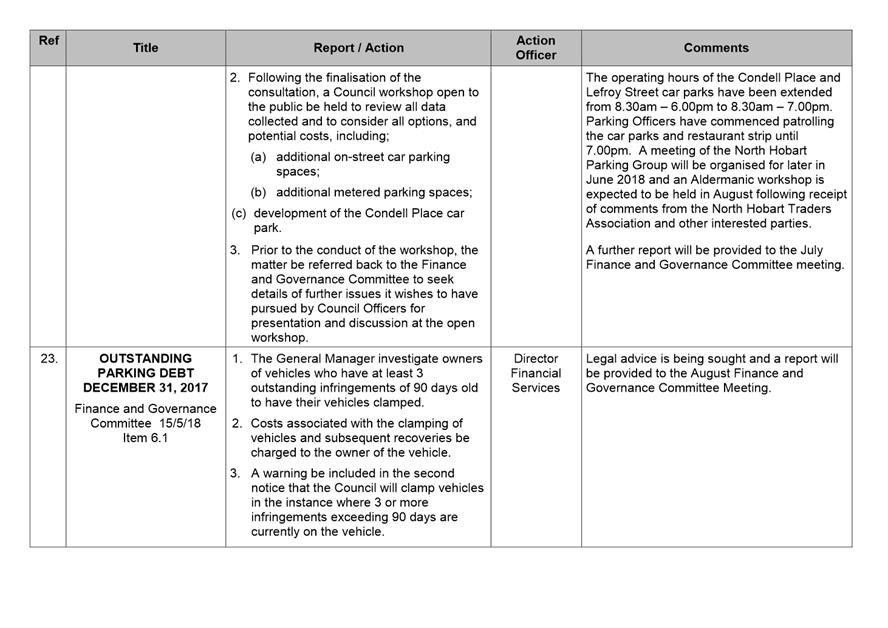

|

Council Submission |

Board of Inquiry Findings and Recommendations |

|

The Board’s review would benefit from including members(s) with Local Government experience |

There was no specific reference to the inclusion of a Board member with Local Government experience. |

|

Appropriate recognition for superannuation within the quantum of the allowance |

The Board noted the one off increase in allowances of 9 per cent in 2004 as an adjustment for superannuation. This increase has carried through and accordingly some allowance for superannuation is already made in the present councillor allowances. |

|

Introduction of a loading in recognition of the workload associated with Hobart capital city status |

The Board was not satisfied that, in Tasmania, there should be a capital city allowance. |

|

Concept of sitting fees be explored by the Board (in line with Perth and Darwin) |

There was no specific mention of sitting fees. The Board recommended that the base allowance remain unchanged, pending the outcome of the review into categorisation of councils. |

|

Consideration be given to incentivising ongoing learning by Aldermen |

The Board recommended that no additional individual allowance be paid to councillors who undertake training in governance or have experience in governance related to local government. Rather, they should be supported through an annual council budget allocation to undertake identified required training. The Board was minded to recommend mandatory training for new councillors within twelve months of election, however, further consultation with the sector is required in relation to the viability and content of such training. |

|

Deputy Lord Mayor receive the Lord Mayor’s allowance when acting in the role of Lord Mayor for an extended period |

When the Deputy Mayor is required to act in the role of Mayor for periods of four weeks or more, the Deputy Mayor be paid a Higher Duty Allowance equivalent to the Mayoral allowance. |

Given the above, the Council may wish to consider whether it would like to make any further submissions to the Tasmanian Industrial Commission in relation to Councillor Allowances.

|

That: 1. That the information be received and noted. 2. The Council determine whether it wishes to make any submissions on the decision of the Tasmanian Industrial Commission in relation to Councillor Allowances.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N.D Heath General Manager |

|

Date: 7 June 2018

File Reference: F18/65441

Attachment a: Board

of Inquiry Draft Report ⇩ ![]()

|

Item No. 6.7 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 197 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 245 |

|

|

|

13/6/2018 |

|

6.8 Tasmanian Museum and Art Gallery - Community Stakeholders Committee

Memorandum of the General Manager of 5 June 2018 and attachment.

Delegation: Council

|

Item No. 6.8 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 246 |

|

|

13/6/2018 |

|

Memorandum: Finance and Governance Committee

Tasmanian Museum and Art Gallery - Community Stakeholders Committee

Introduction

The purpose of this report is to seek the Council’s approval for the

General Manager to accept an invitation from the Tasmanian Museum and Art

Gallery to participate in a high level advisory committee of community

stakeholders.

Discussion

The Tasmanian Museum and Art Gallery (TMAG) became a statutory authority in

2018 with the enactment of the Tasmanian Museum and Art Gallery Act 2017.

New governance arrangements have been put in place and as a result there is an opportunity for TMAG to create partnerships and undertake strategic initiatives in a rapidly developing cultural landscape.

To support this process, the TMAG Board of Trustees has decided to establish a high level committee of community stakeholders to advise TMAG on strategic opportunities, particularly around facilities, partnerships, branding and reach across the State.

The Chair of the TMAG Board, Mr Geoff Willis AM, has written to the General Manager inviting him to join the high level advisory committee as the Hobart City Council representative (attachment A).

It is envisaged that the committee responsibilities will not be onerous and could take the form of a roundtable strategic conversation twice a year. The first meeting is planned for June.

Conclusion

As Alderman are aware, the City of Hobart and TMAG share a strong

relationship. The opportunity to participate in the strategic roundtable

would further support the existing partnership.

|

That: 1. That the information be received and noted. 2. The Council approve the General Manager’s participation on the Tasmanian Museum and Art Gallery’s high level advisory committee of community stakeholders.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N.D Heath General Manager |

|

Date: 5 June 2018

File Reference: F18/61450

Attachment a: TMAG

Correspondence ⇩ ![]()

|

Item No. 6.8 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 248 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 249 |

|

|

|

13/6/2018 |

|

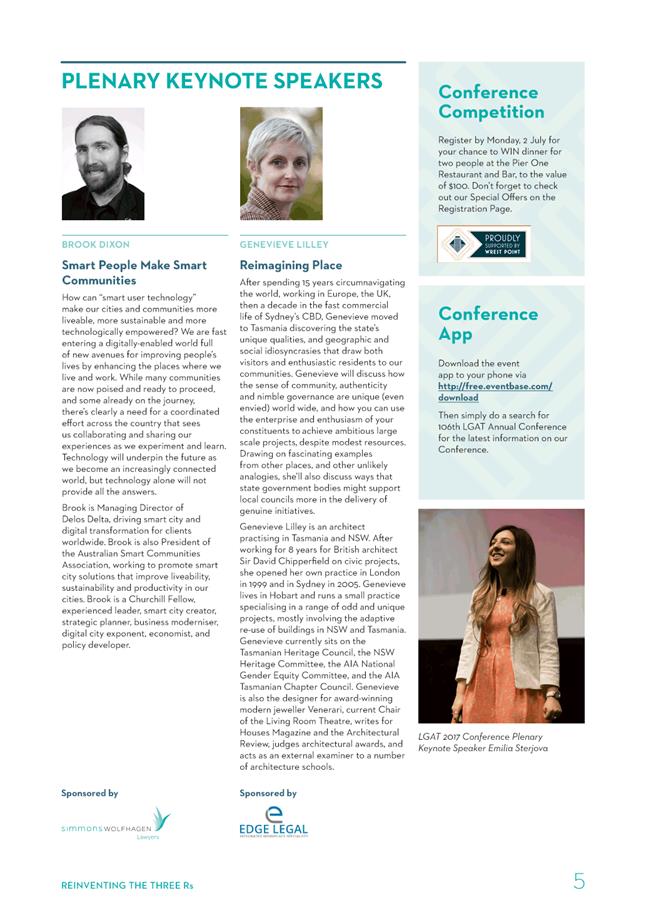

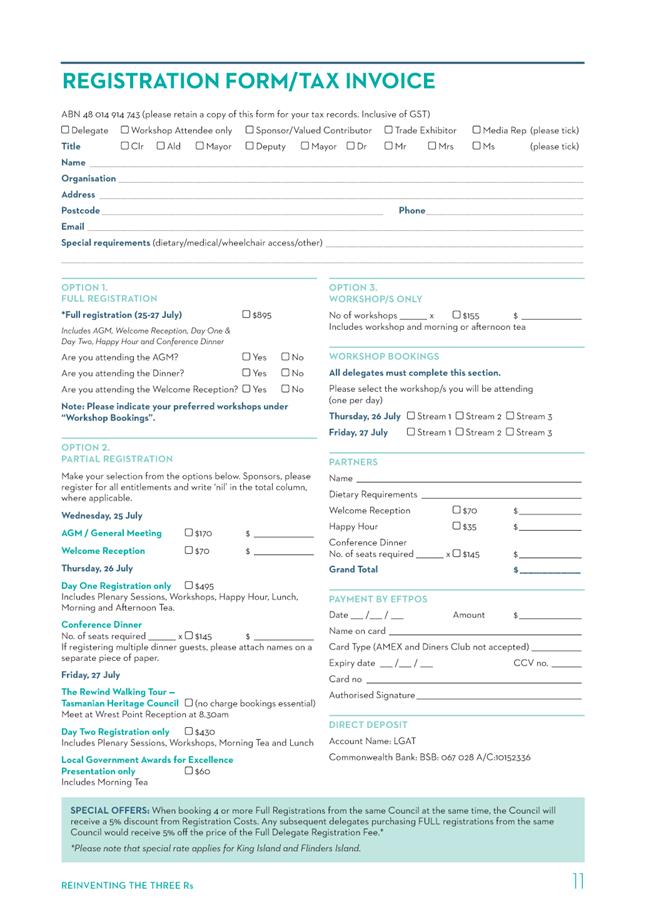

6.9 2018 Local Government Association of Tasmania Annual Conference

Memorandum of the General Manager of 7 June 2018 and attachment.

Delegation: Council

|

Item No. 6.9 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 250 |

|

|

13/6/2018 |

|

Memorandum: Finance and Governance Committee

2018 Local Government Association of Tasmania Annual Conference

The General Manager reports:

“The attached program is provided to enable Aldermanic nominations to be sought for attendance at the 2018 LGAT Annual Conference, to be held in Hobart from 25-27 July 2018.

Clause C3 of the Council’s policy titled Aldermanic Development and Support with regard to conference attendance, provides that:

Aldermanic participation in local government sector activities is considered relevant and appropriate in order to benchmark activities against industry standards, maintain knowledge and relativity within the sector and to network and build relationships and capacity within the industry.

Aldermen may attend conferences, seminars, meetings or training events arranged by sector stakeholders such as:

(i) Local government peak bodies (eg. LGAT, Think South, MAV, ALGA, ALGWA);

(ii) State, Federal or Local Government authorities;

(iii) Australian Institute of Company Directors; and

(iv) The City of Hobart.

The content of the conference is clearly relevant to local government and the Council’s Capital City Strategic Plan 2015-2025 in particular Goal 5 – Governance, Strategic Objective 5.5.3 – represent the city nationally to ensure outcomes are appropriate for the capital city.

The estimated cost of full attendance is approximately $895.00 per person (registration fees only).

As at 30 April 2018, the allocation for aldermanic conferences and training and development activities within the Aldermanic Allowances and Expenses function of the 2017-18 Annual Plan had $564 remaining.

In the event that the Council approves attendance, the actual cost will exceed the approved budget in the 2017-18 Annual Plan. As such, an appropriate off-set has been identified from the Study Assistance line item within the People and Capability function which is unlikely to be fully expended. It is estimated that approximately $8,000 will remain unspent at the end of the financial year. Given the relatively late stage of the financial year, it is unlikely that any staff would be unable to access study assistance because of aldermanic use of the budget.

The information is submitted for consideration.”

|

That: 1. The Council consider Aldermanic representation at the 2018 Local Government Association of Tasmanian Annual Conference, to be held in Hobart from 25 to 27 July 2018. 2. The estimated cost of $895 per person be attributed to the Conference Attendance allocation within the Aldermanic Allowances and Expenses function of the 2017-18 Annual Plan, in accordance with s82 of the Local Government Act 1993, with a corresponding off-set from the Study Assistance line item in the People and Capability function for any expenditure in excess of the existing budget.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N.D Heath General Manager |

|

Date: 7 June 2018

File Reference: F18/53897

Attachment a: LGAT

Annual Conference - Hobart 25-27 July 2018 - Program and Registration ⇩ ![]()

|

Item No. 6.9 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 252 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 264 |

|

|

|

13/6/2018 |

|

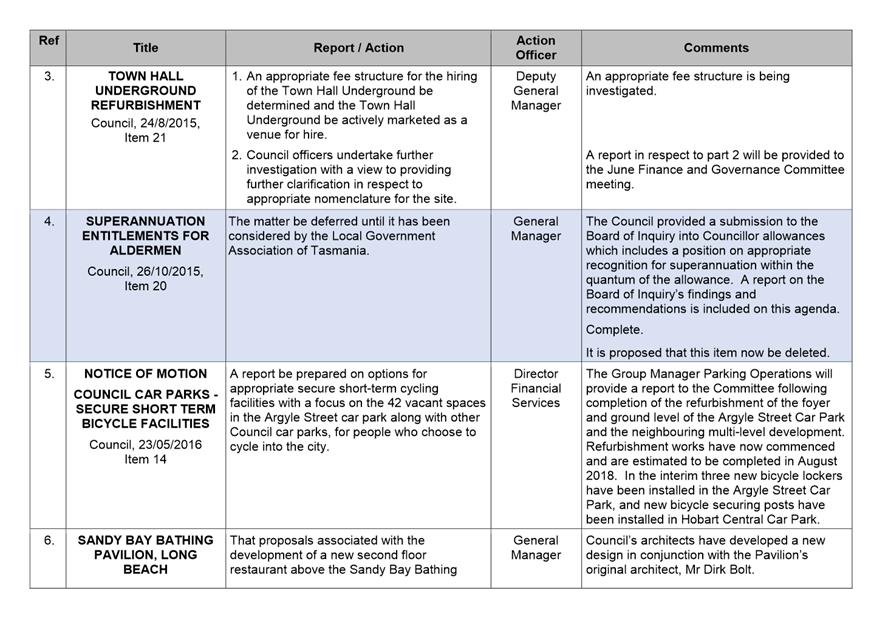

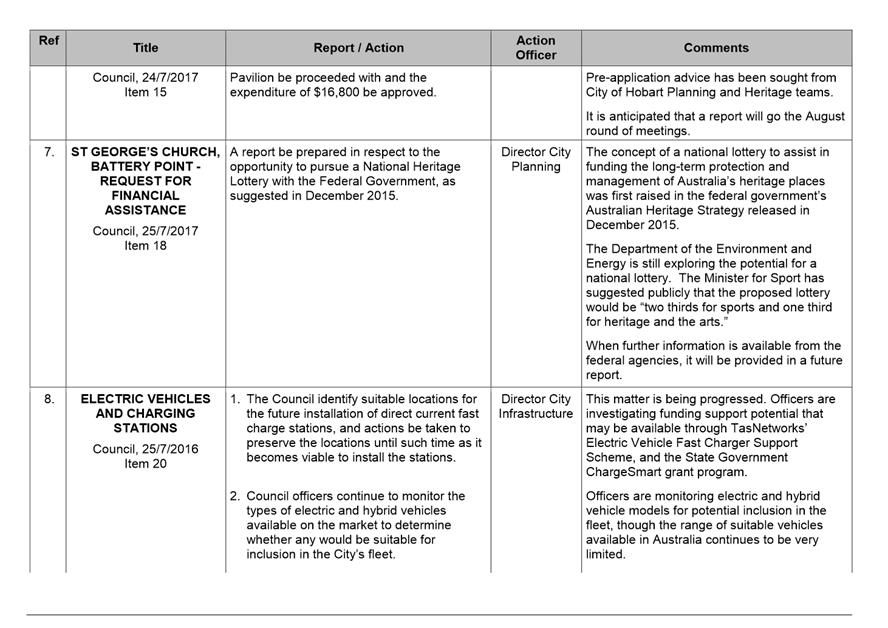

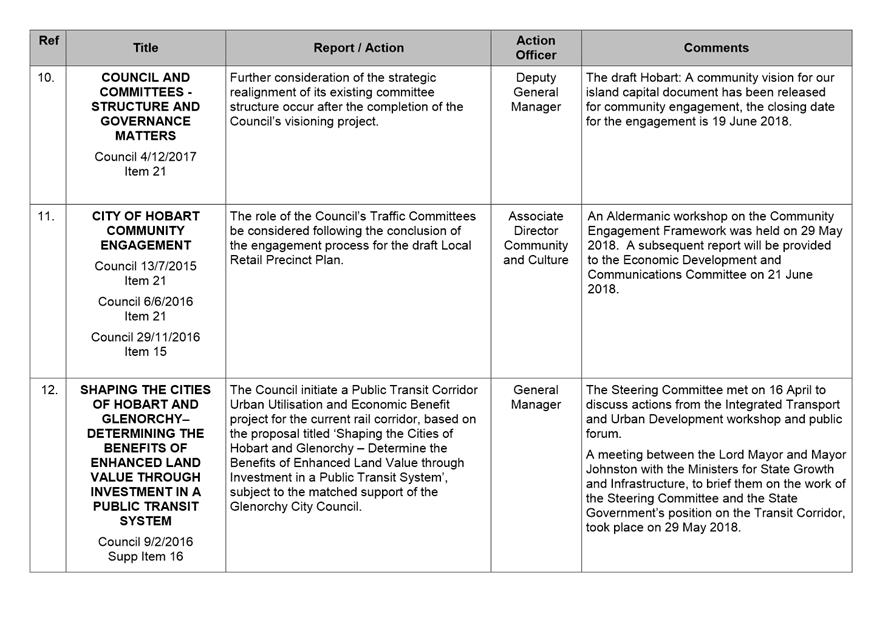

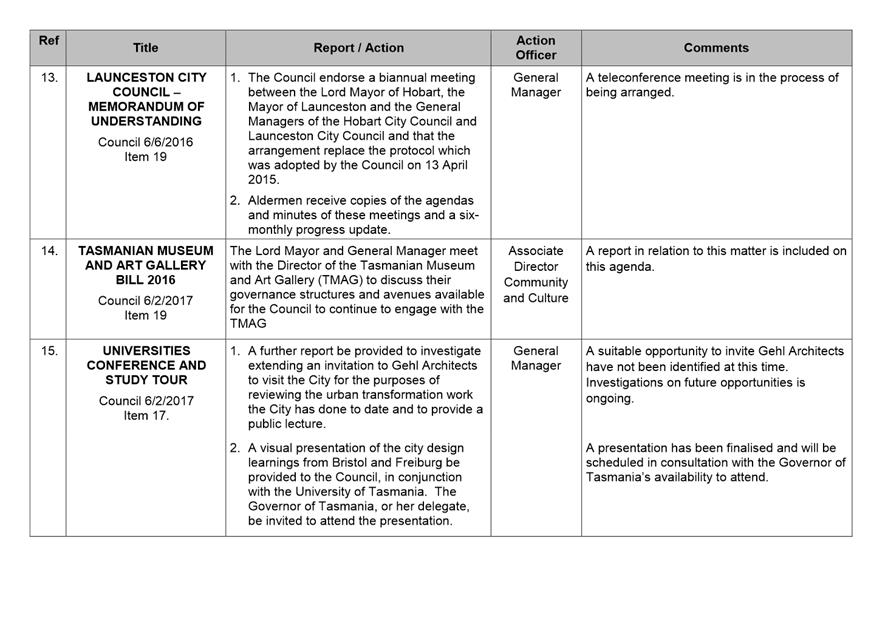

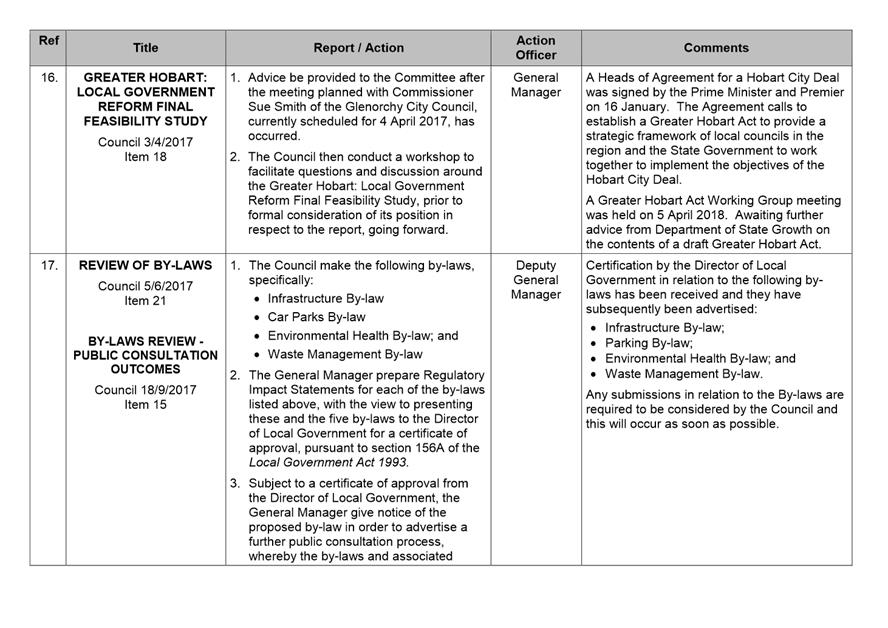

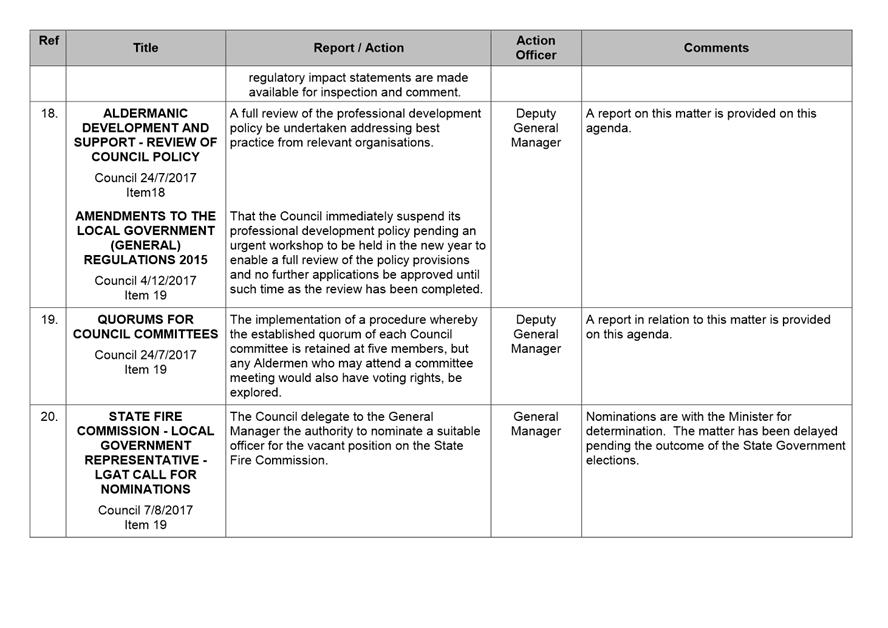

A report indicating the status of current decisions is attached for the information of Aldermen.

REcommendation

That the information be received and noted.

Delegation: Committee

|

Item No. 7.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 13/6/2018 |

Page 265 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 278 |

|

|

|

13/6/2018 |

|

Regulation 29(3) Local Government

(Meeting Procedures) Regulations 2015.

File Ref: 13-1-10

The General Manager reports:-

“In accordance with the procedures approved in respect to Questions Without Notice, the following responses to questions taken on notice are provided to the Committee for information.

The Committee is reminded that in accordance with Regulation 29(3) of the Local Government (Meeting Procedures) Regulations 2015, the Chairman is not to allow discussion or debate on either the question or the response.”

8.1 Macquarie Street / Davey Street Road Transfer

File Ref: F18/49215; 13-1-10

Memorandum of the Director City Infrastructure of 6 June 2018.

Delegation: Committee

|

That the information be received and noted.

|

|

Item No. 8.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 279 |

|

|

13/6/2018 |

|

Memorandum: Lord Mayor

Deputy Lord Mayor

Aldermen

Response to Question Without Notice

Macquarie Street / Davey Street Road Transfer

|

Meeting: Finance and Governance Committee

|

Meeting date: 15 May 2018

|

|

Raised by: Alderman Reynolds |

|

Question:

Can the costs of the Macquarie Street roadworks be factored into the negotiation for the transfer of Davey and Macquarie Streets to the State Government?

Response:

The General Manager and the Director City Infrastructure met with the Transport Commissioner and the General Manager State Roads on Friday 26 May 2018 to discuss the transfer of ownership of Macquarie Street and Davey Street over to the State Government.

The Transport Commissioner has agreed to draft for discussion a list of items to be addressed in the transfer proposal.

Further reports will be provided to the Committee as the need arises.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Mark Painter Director City Infrastructure |

|

Date: 6 June 2018

File Reference: F18/49215; 13-1-10

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 281 |

|

|

13/6/2018 |

|

Section 29 of the Local Government (Meeting Procedures) Regulations 2015.

File Ref: 13-1-10

An Alderman may ask a question without notice of the Chairman, another Alderman, the General Manager or the General Manager’s representative, in line with the following procedures:

1. The Chairman will refuse to accept a question without notice if it does not relate to the Terms of Reference of the Council committee at which it is asked.

2. In putting a question without notice, an Alderman must not:

(i) offer an argument or opinion; or

(ii) draw any inferences or make any imputations – except so far as may be necessary to explain the question.

3. The Chairman must not permit any debate of a question without notice or its answer.

4. The Chairman, Aldermen, General Manager or General Manager’s representative who is asked a question may decline to answer the question, if in the opinion of the respondent it is considered inappropriate due to its being unclear, insulting or improper.

5. The Chairman may require a question to be put in writing.

6. Where a question without notice is asked and answered at a meeting, both the question and the response will be recorded in the minutes of that meeting.

7. Where a response is not able to be provided at the meeting, the question will be taken on notice and

(i) the minutes of the meeting at which the question is asked will record the question and the fact that it has been taken on notice.

(ii) a written response will be provided to all Aldermen, at the appropriate time.

(iii) upon the answer to the question being circulated to Aldermen, both the question and the answer will be listed on the agenda for the next available ordinary meeting of the committee at which it was asked, where it will be listed for noting purposes only.

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 282 |

|

|

13/6/2018 |

|

|

That the Council resolve by absolute majority that the meeting be closed to the public pursuant to regulation 15(1) of the Local Government (Meeting Procedures) Regulations 2015 because the items included on the closed agenda contain the following matters:

· the sale of land compensation · the sale of land for unpaid rates · information of a personal and confidential nature

The following items are listed for discussion:-

Item No. 1 Minutes of the last meeting of the Closed Portion of the Council Meeting Item No. 2 Consideration of supplementary items to the agenda Item No. 3 Indications of pecuniary and conflicts of interest Item No. 4 Reports Item No. 4.1 Wapping Parcel 4 - Sale to UTAS LG(MP)R 15(2)(f) Item No. 4.2 Sale of Land for Unpaid Rates - Update LG(MP)R 15(2)(f) and (g) Item No. 4.3 Outstanding Sundry Debts as at 31 May 2018 LG(MP)R 15(2)(g) Item No. 5 Committee Action Status Report Item No. 5.1 Committee Actions - Status Report LG(MP)R 15(2)(c)(i), (f), (g), e(i) and e(ii) Item No. 6 Questions Without Notice

|