City

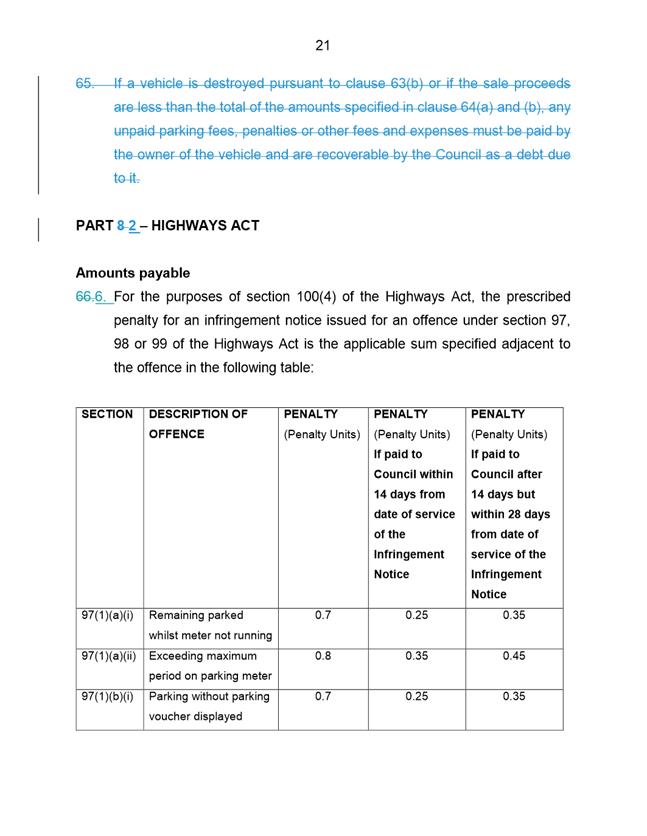

of hobart

AGENDA

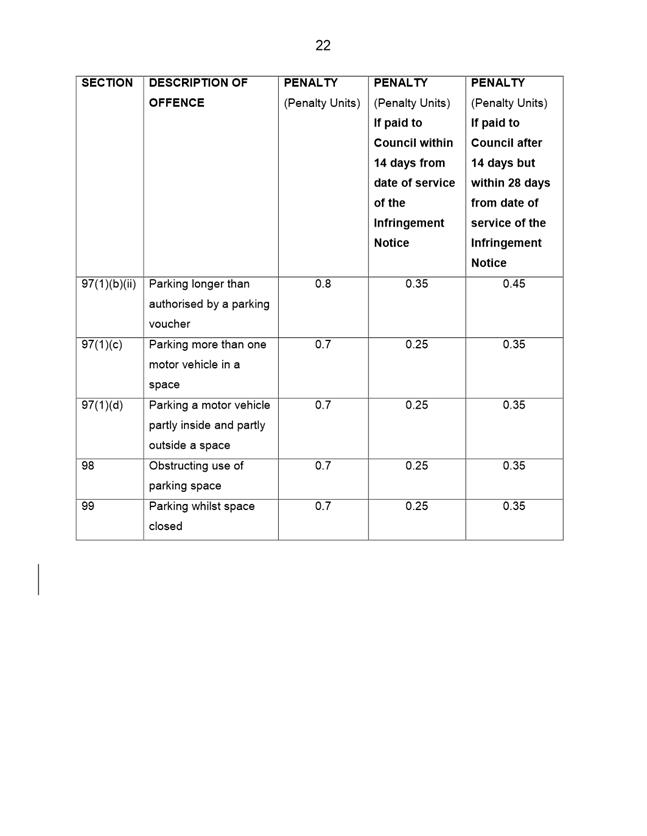

Finance and Governance Committee Meeting

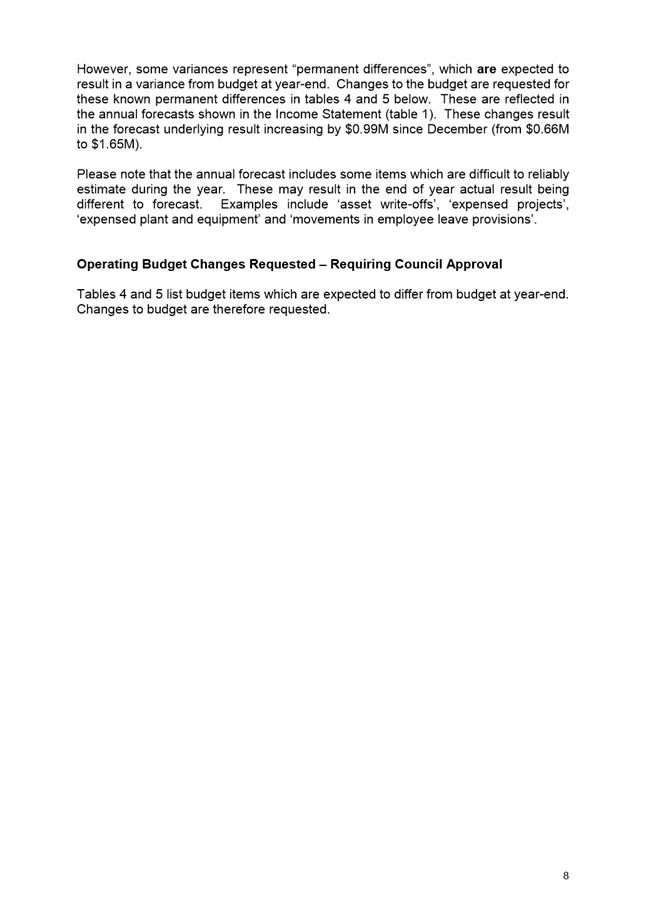

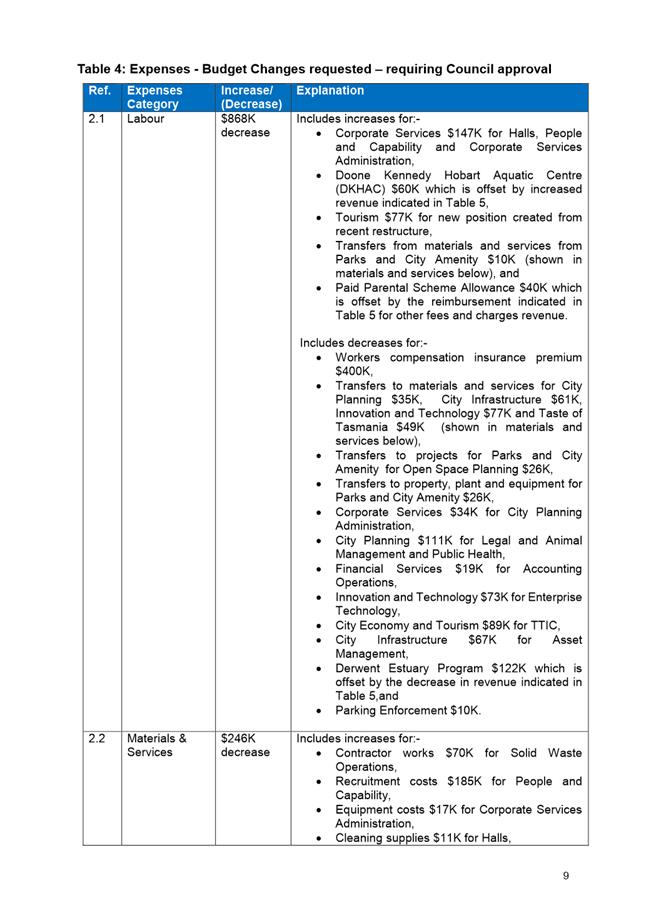

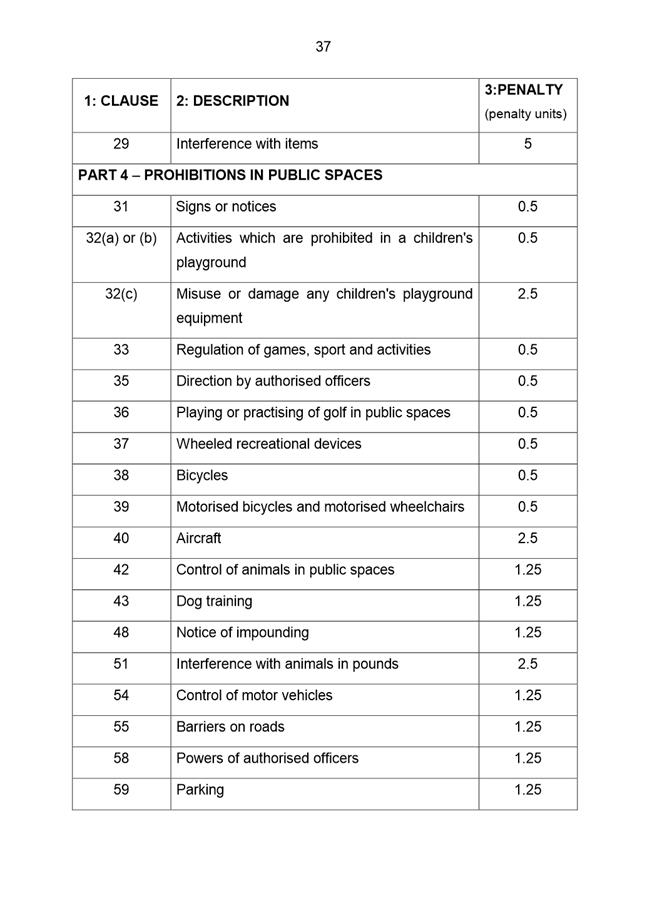

Open Portion

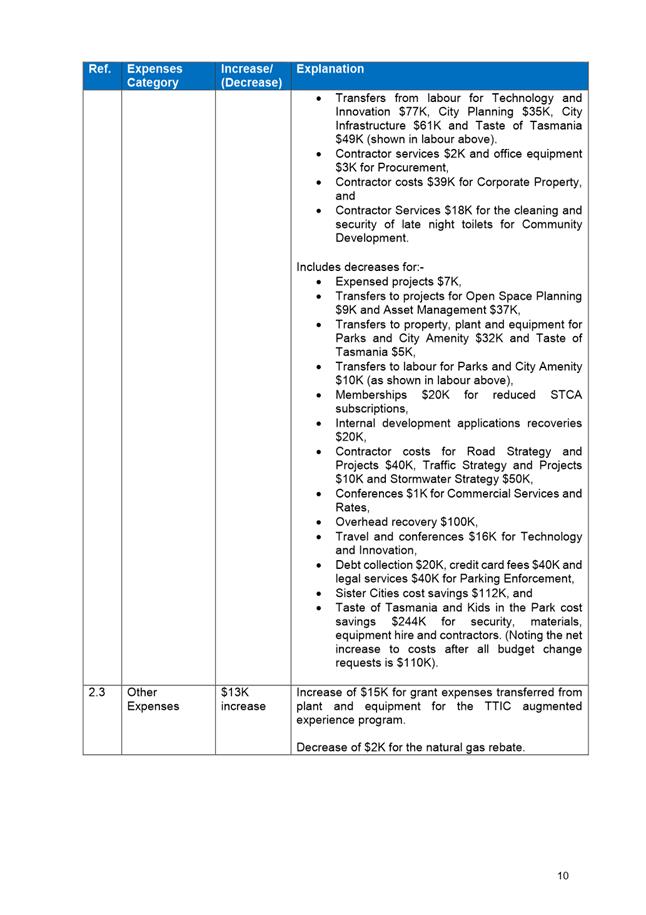

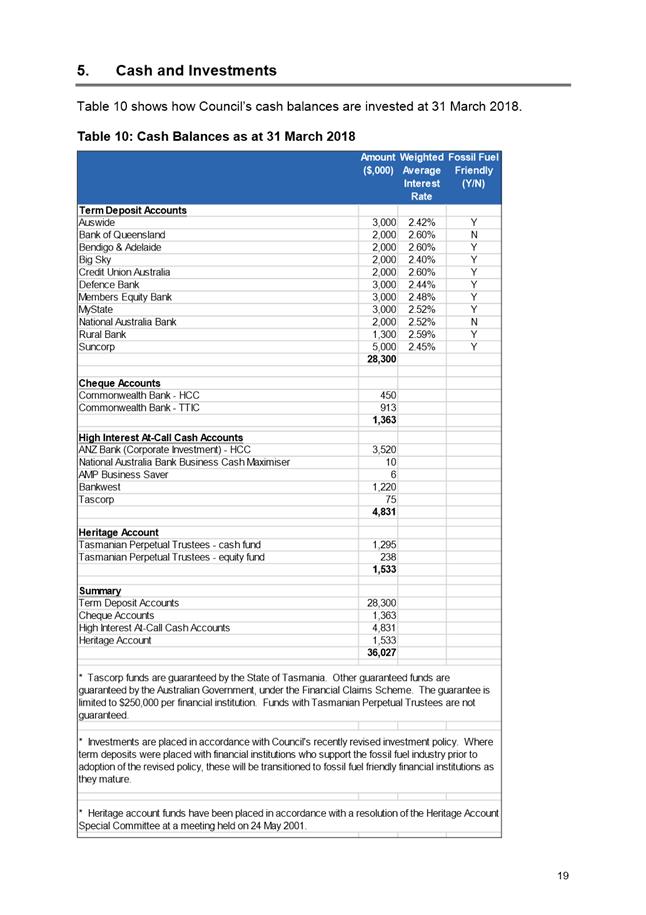

Tuesday, 15 May 2018

at 5.00 pm

Lady Osborne Room, Town Hall

City

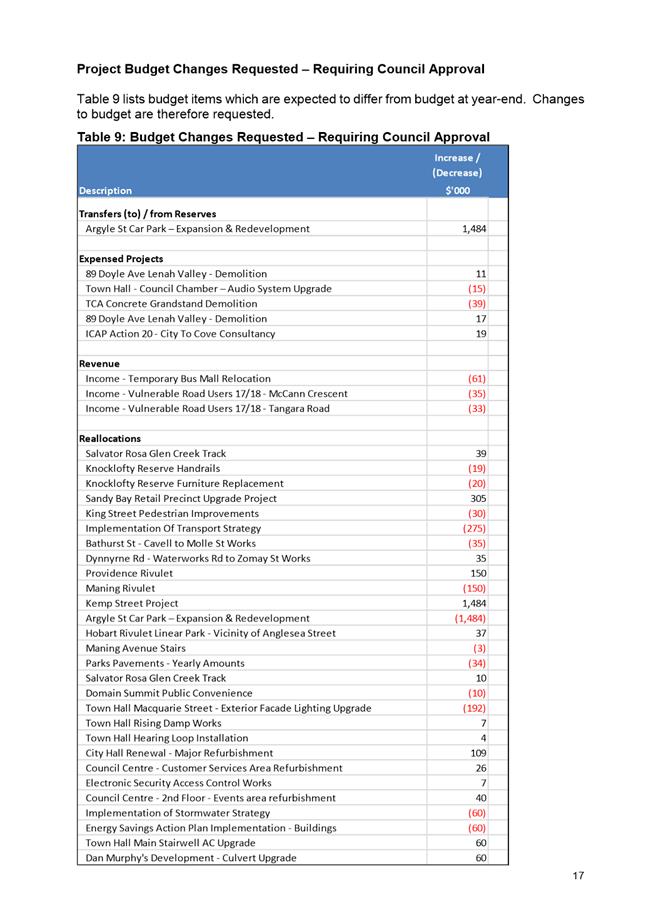

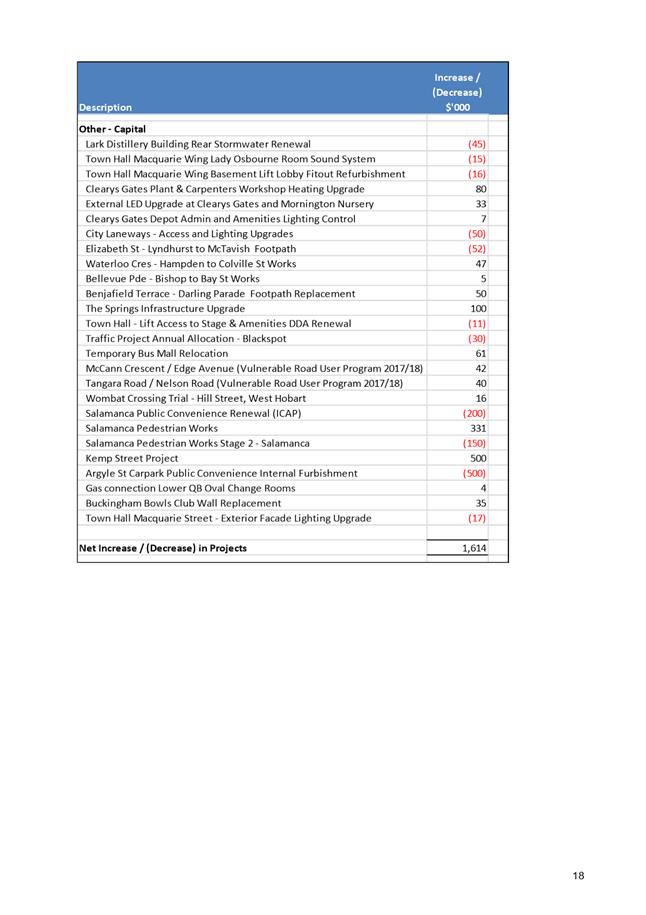

of hobart

AGENDA

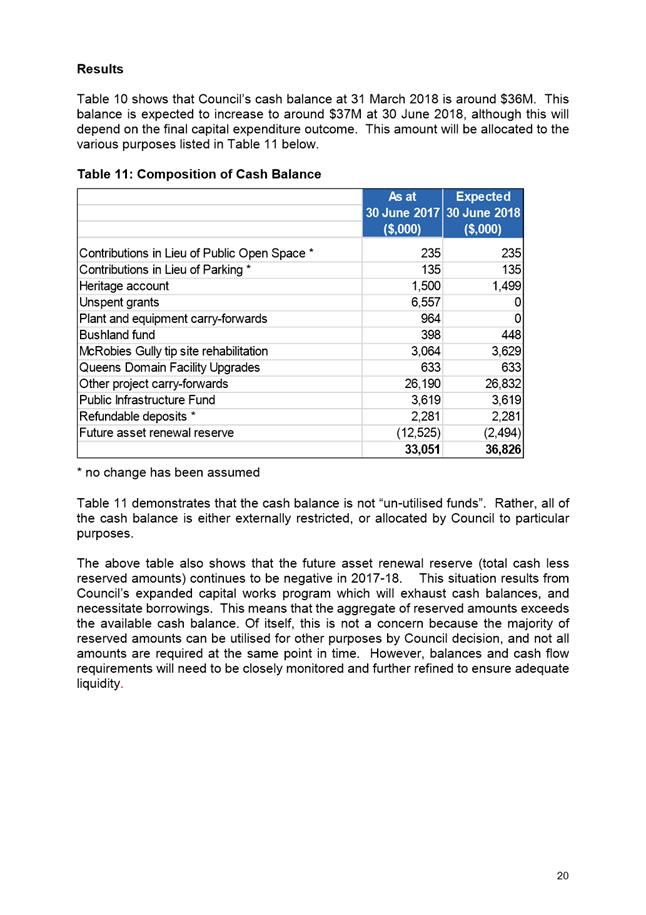

Finance and Governance Committee Meeting

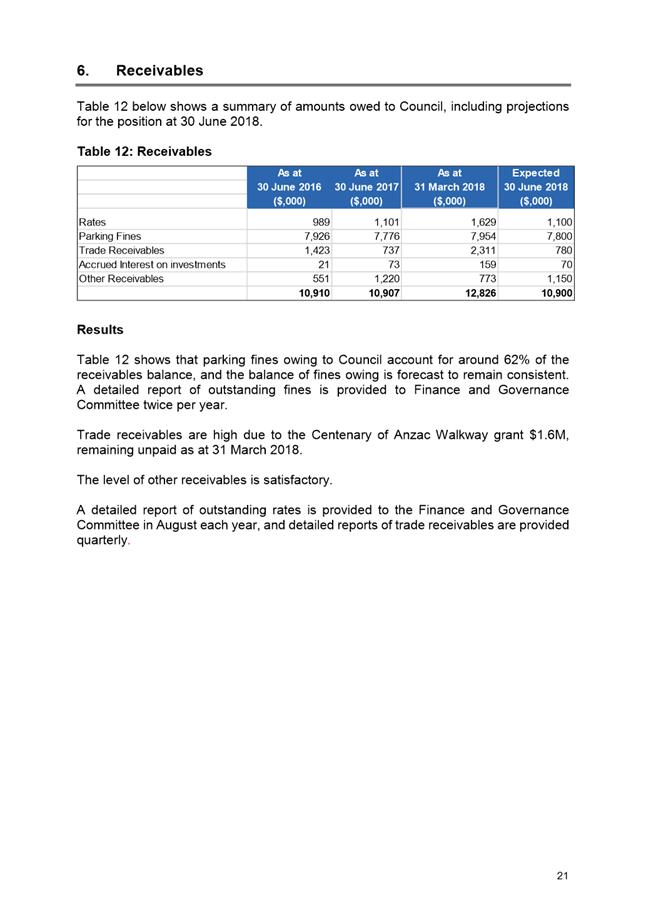

Open Portion

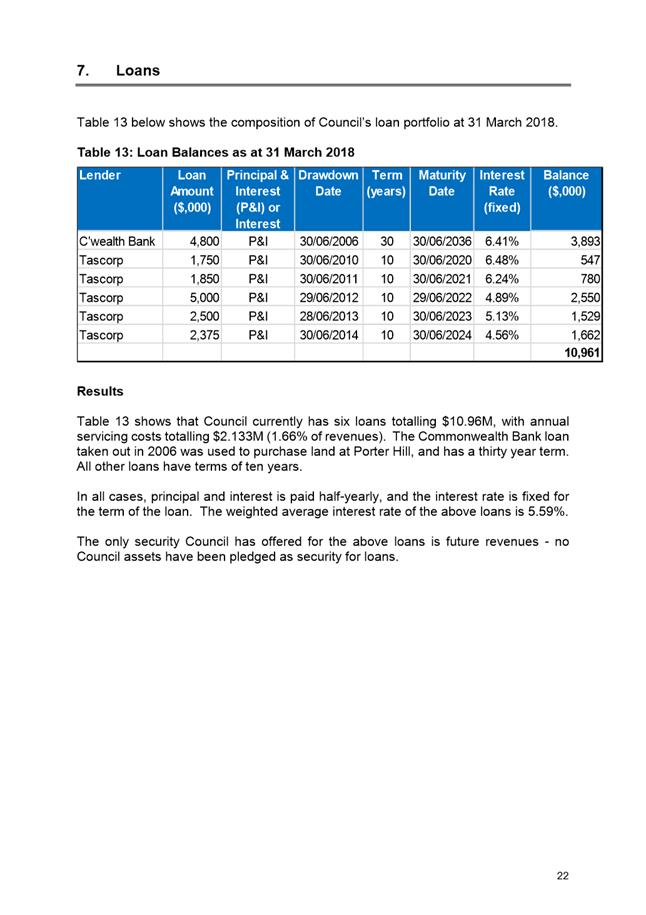

Tuesday, 15 May 2018

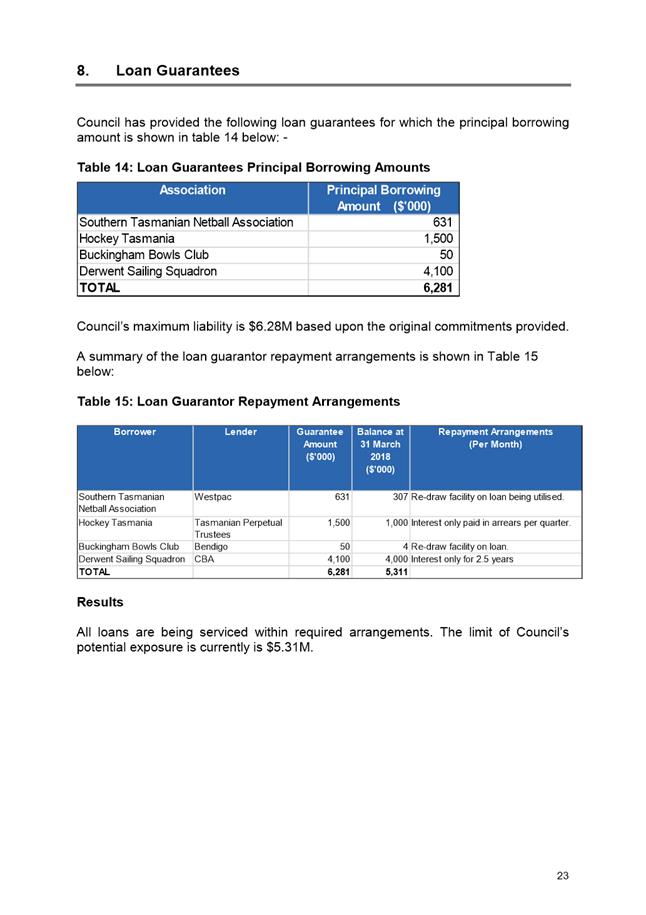

at 5.00 pm

Lady Osborne Room, Town Hall

THE MISSION

Our mission is to ensure good governance of our capital City.

THE VALUES

The Council is:

|

about people |

We value people – our community, our customers and colleagues. |

|

professional |

We take pride in our work. |

|

enterprising |

We look for ways to create value. |

|

responsive |

We’re accessible and focused on service. |

|

inclusive |

We respect diversity in people and ideas. |

|

making a difference |

We recognise that everything we do shapes Hobart’s future. |

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 3 |

|

|

15/5/2018 |

|

Business listed on the agenda is to be conducted in the order in which it is set out, unless the committee by simple majority determines otherwise.

APOLOGIES AND LEAVE OF ABSENCE

1. Co-Option of a Committee Member in the event of a vacancy

3. Consideration of Supplementary Items

4. Indications of Pecuniary and Conflicts of Interest

FINANCE

6.1 Outstanding Parking Debt December 31, 2017

6.2 Occupancy Rates - Multi-Storey Car Parks

6.3 Grants and Benefits Listing as at 31 March 2018

6.4 2018/19 Fees and Charges - Financial Services

6.5 2018-19 Fees and Charges - Parking Operations

6.6 Financial Report as at 31 March 2018

6.7 City of Hobart Rates and Charges Policy Amendment - Landfill Rehabilitation Service Charge

GOVERNANCE

6.9 Local Government (General) Regulations 2015

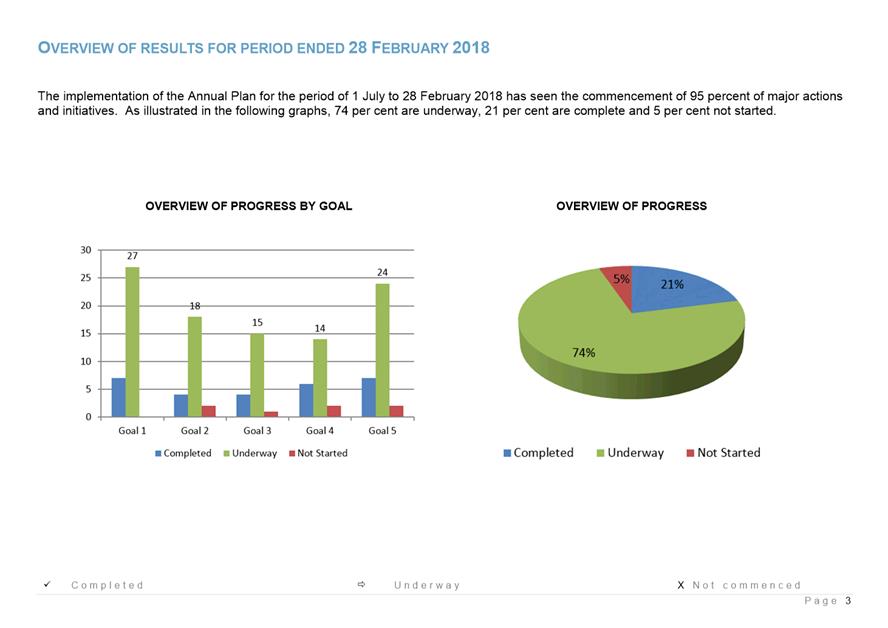

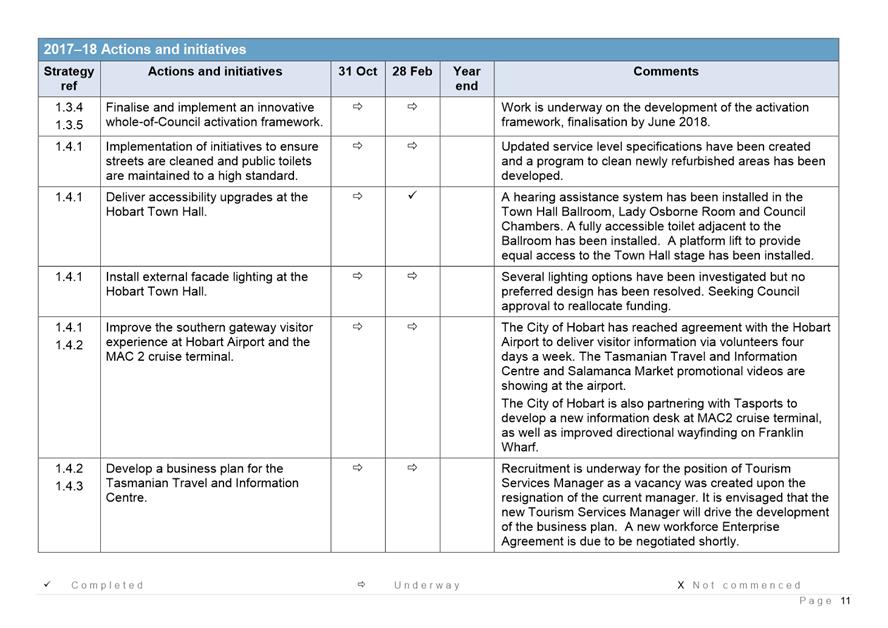

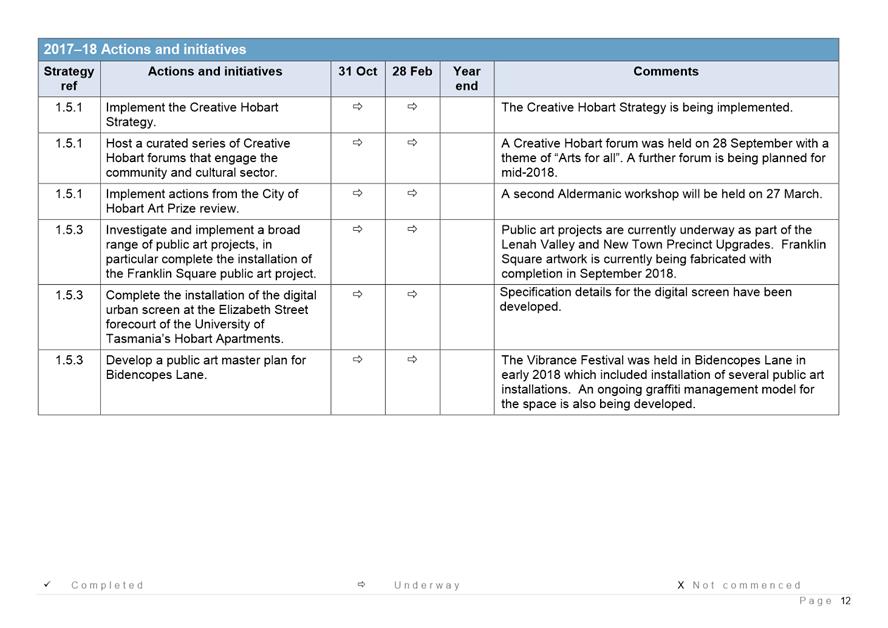

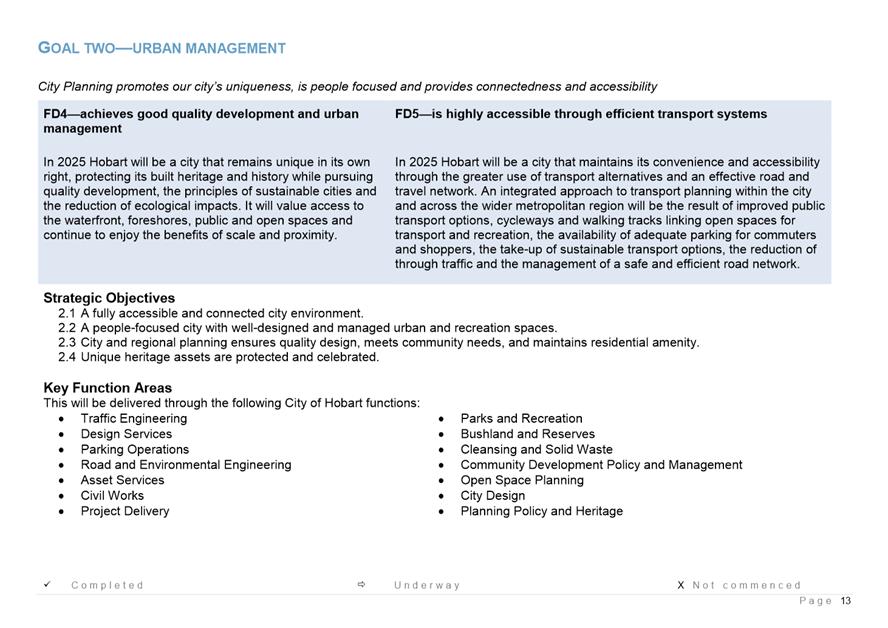

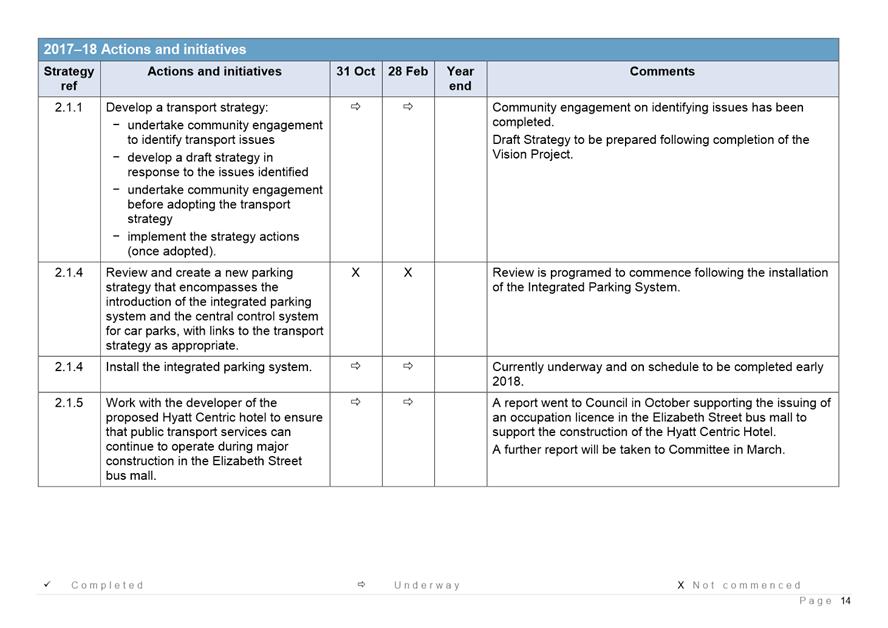

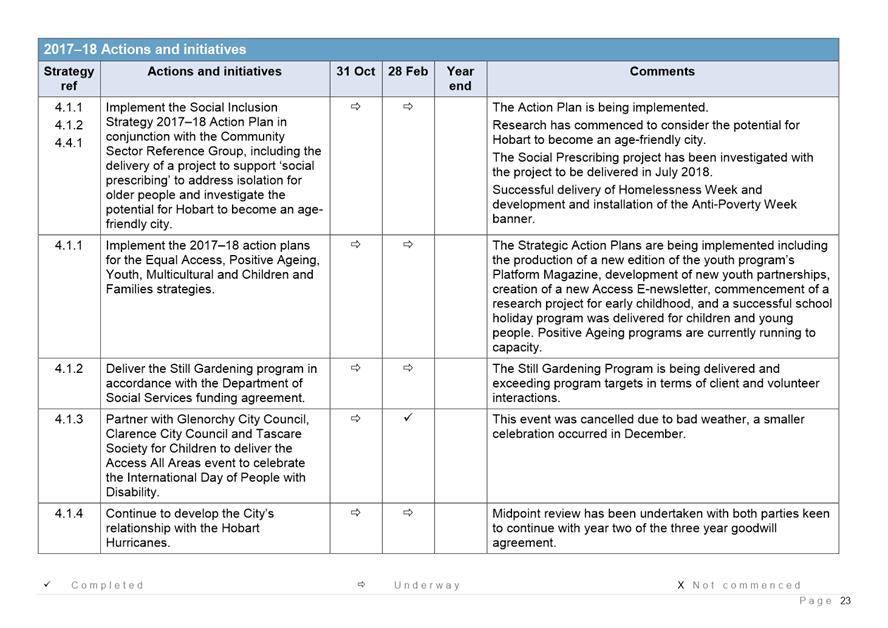

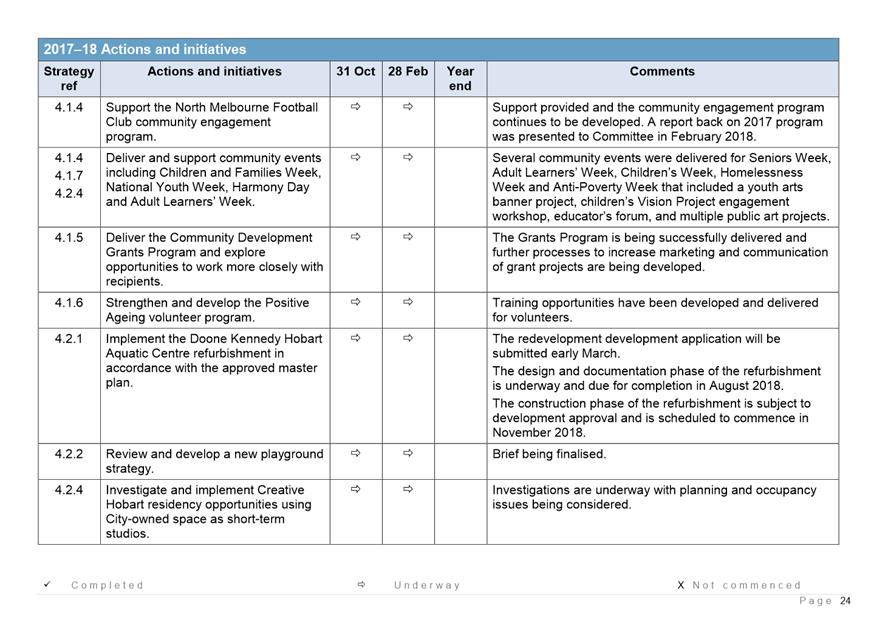

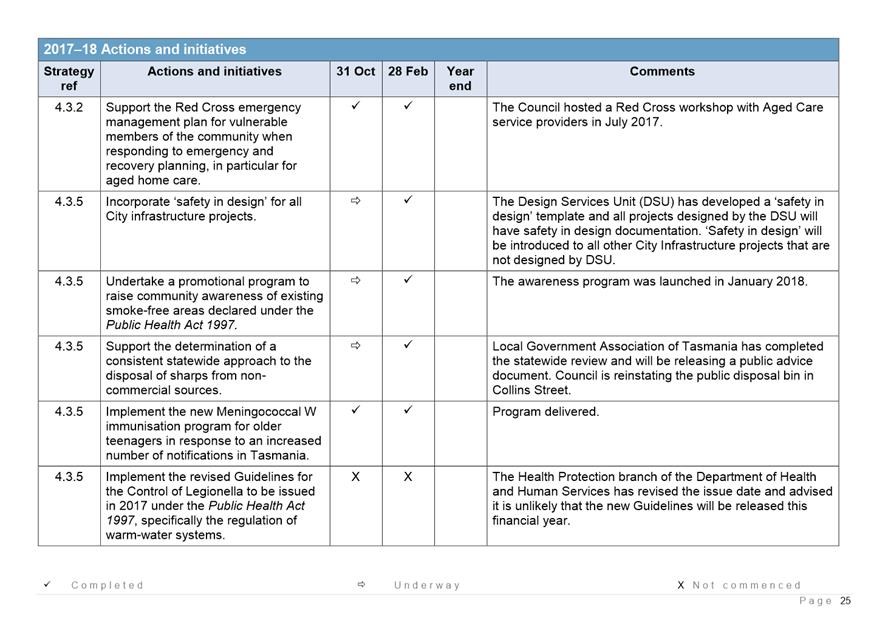

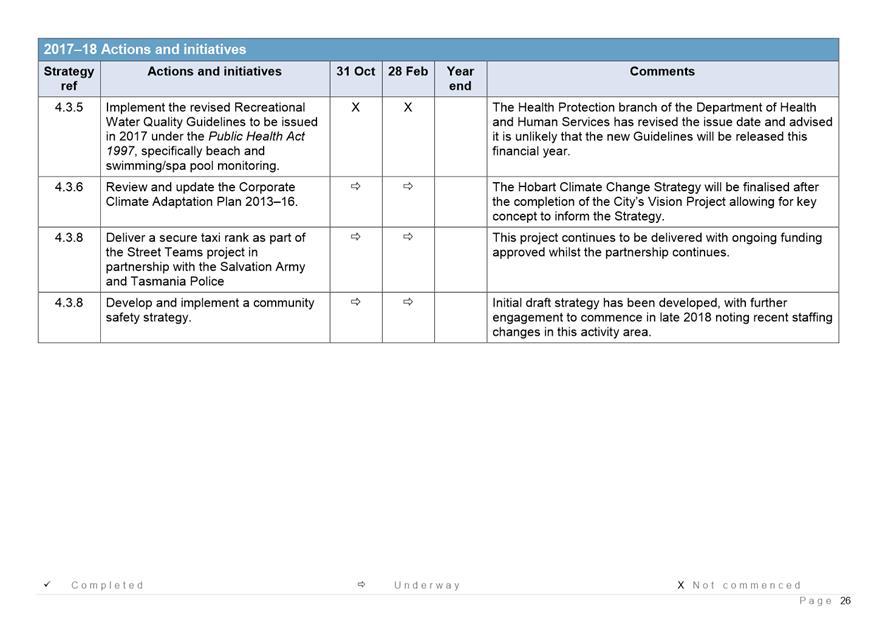

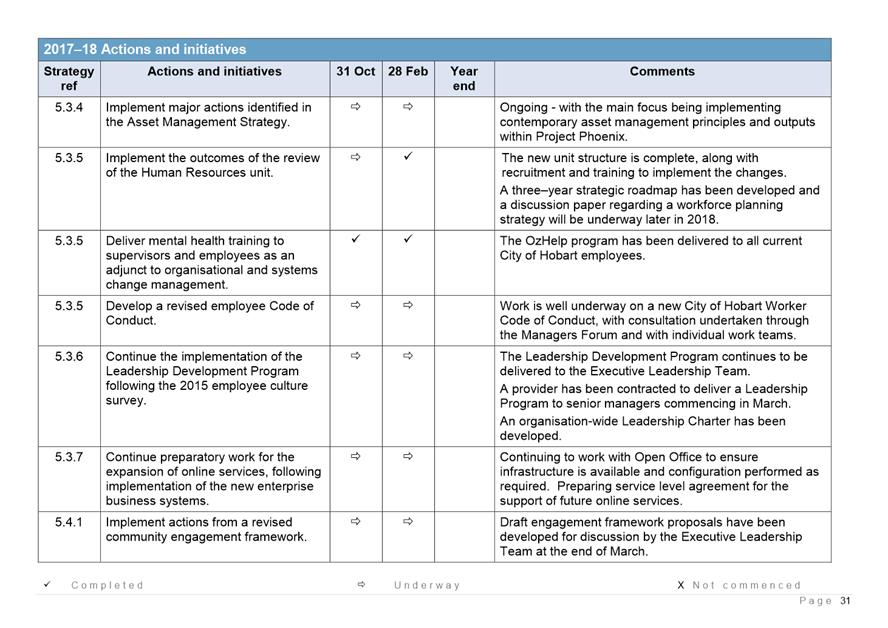

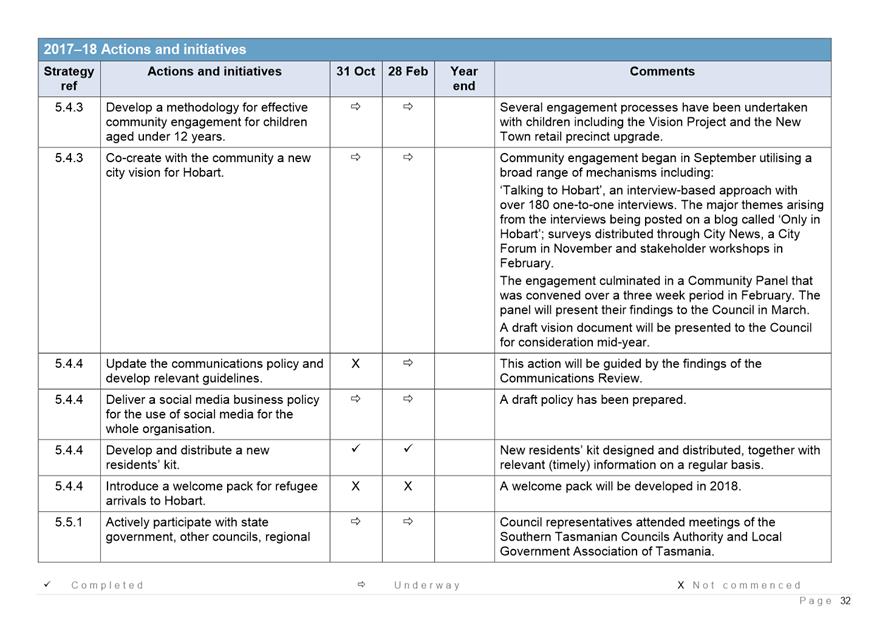

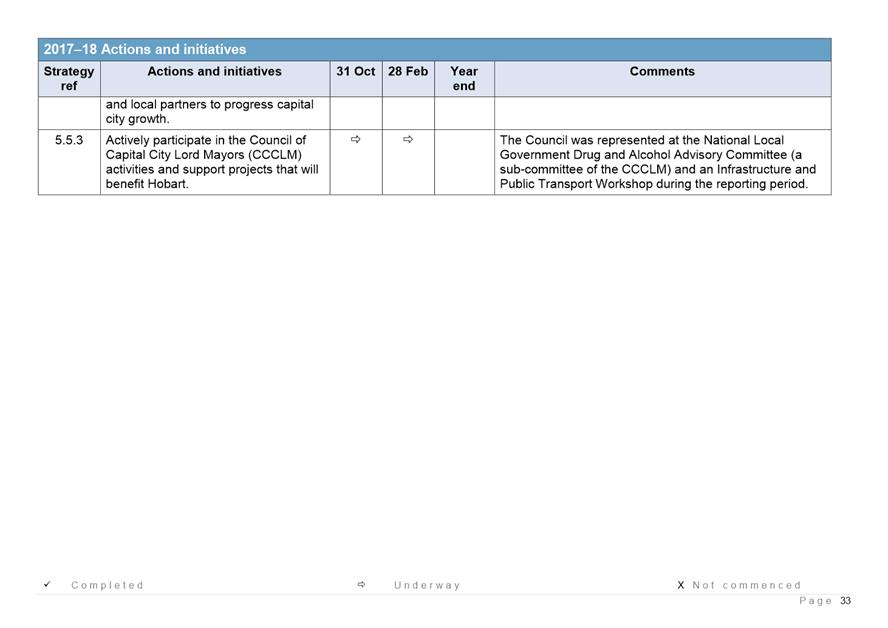

6.11 2017-18 Annual Plan - Progress Report Period Ending 28 February 2018

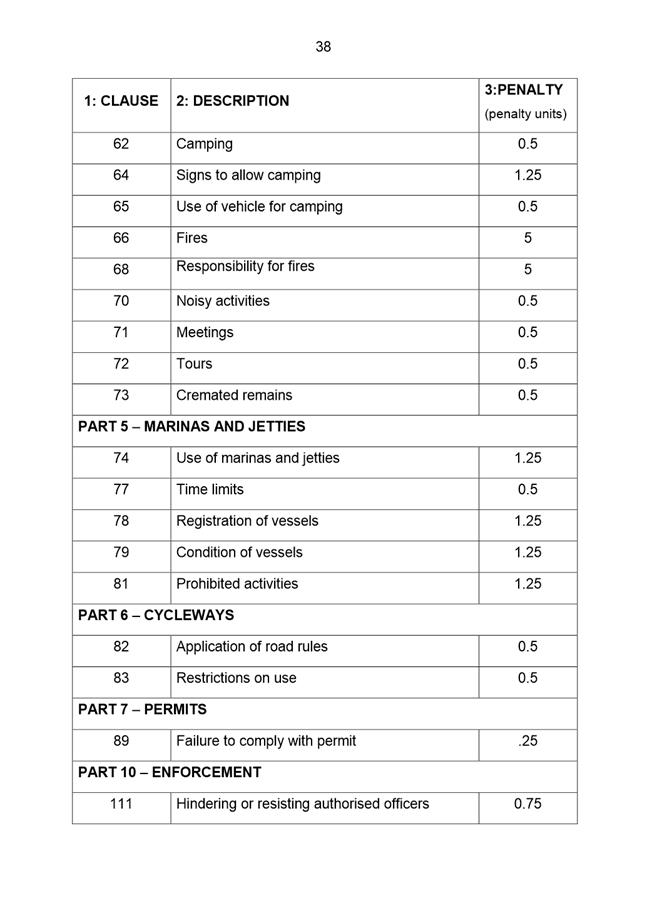

6.12 Draft Vision Document - Hobart: A Community Vision for our Island Capital

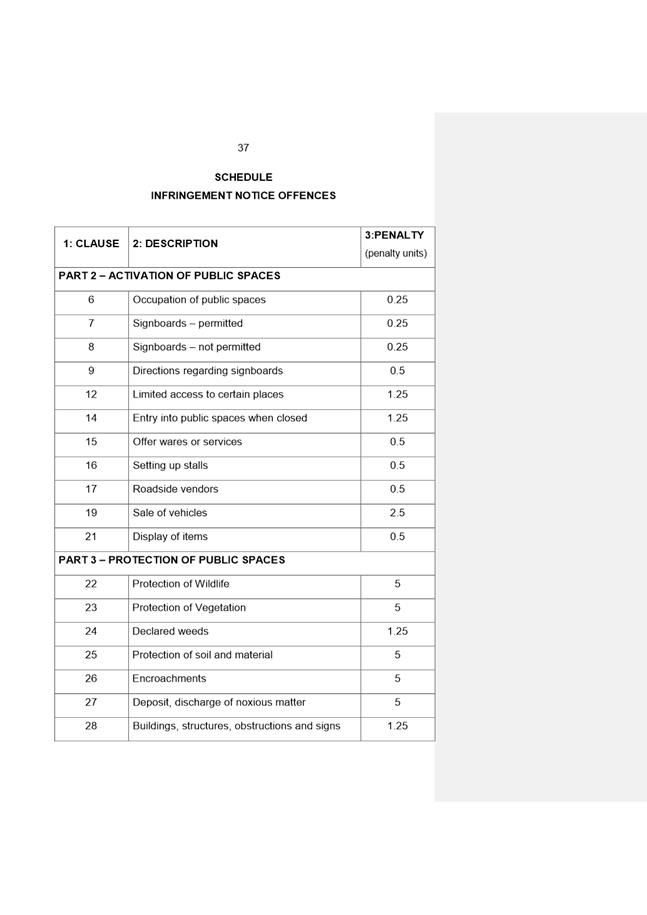

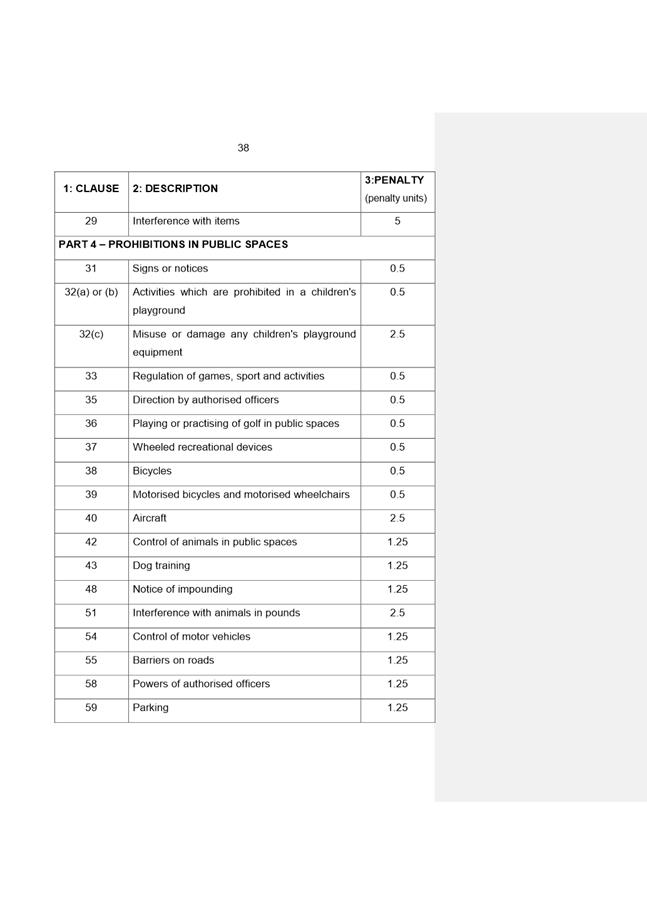

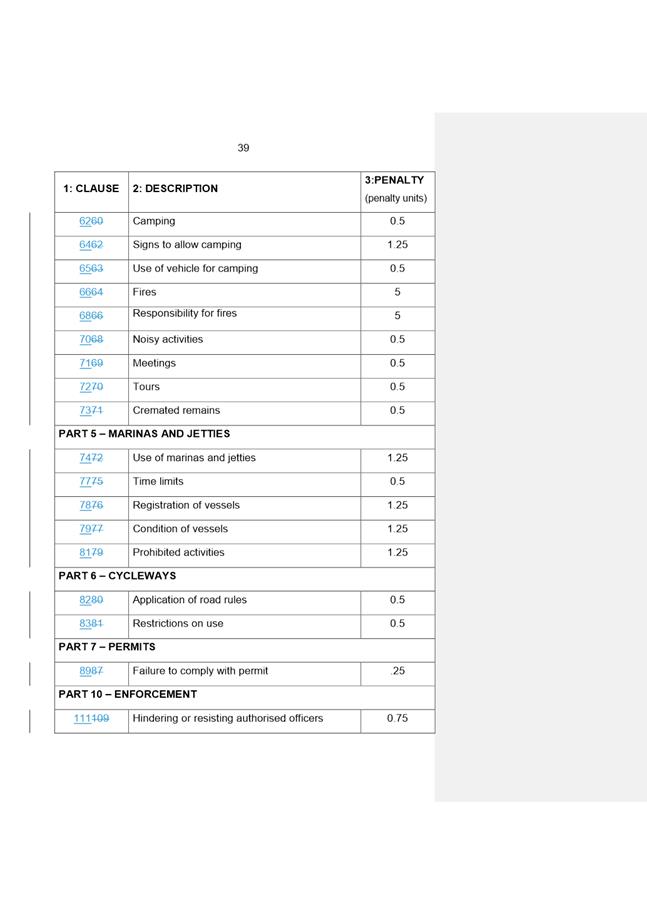

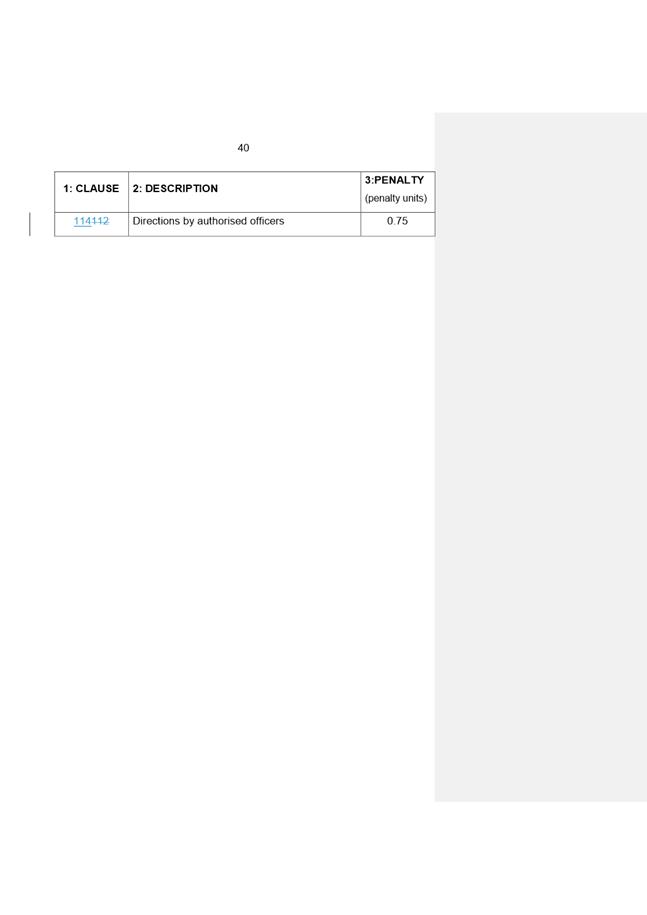

6.13 Draft Public Spaces By-law

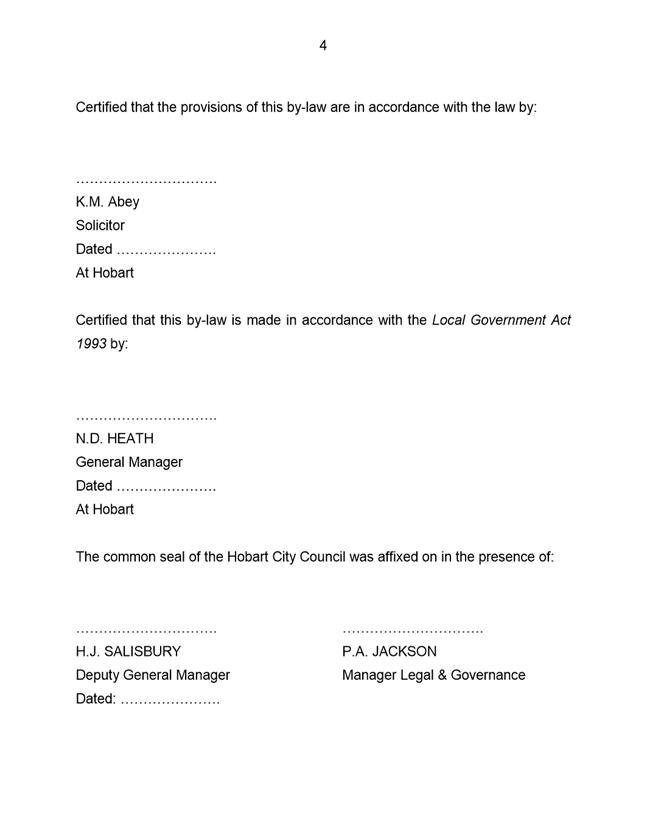

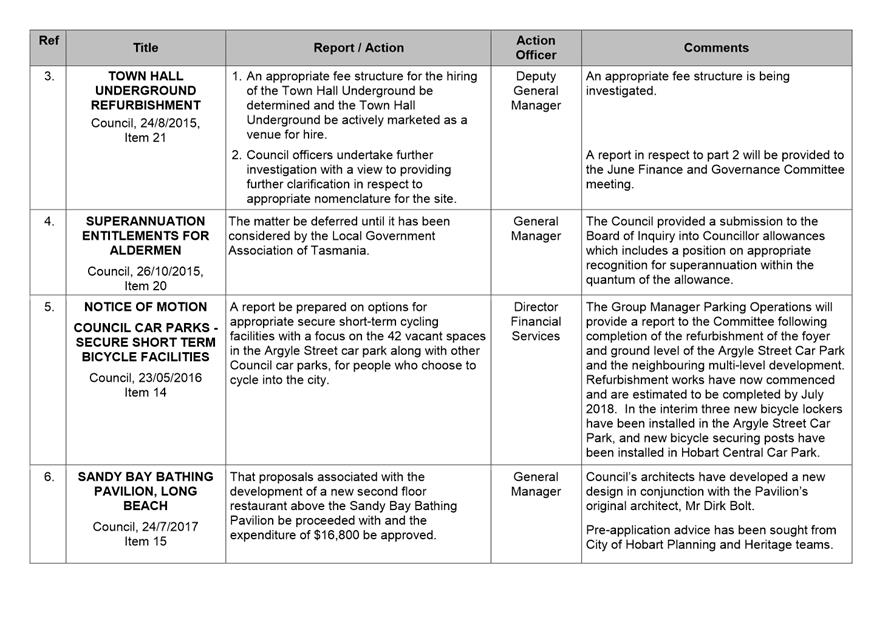

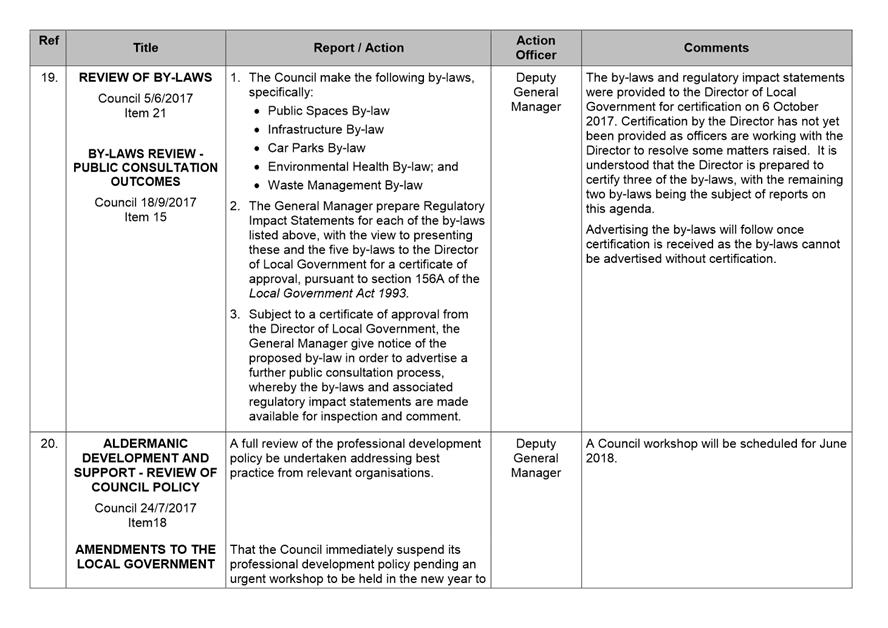

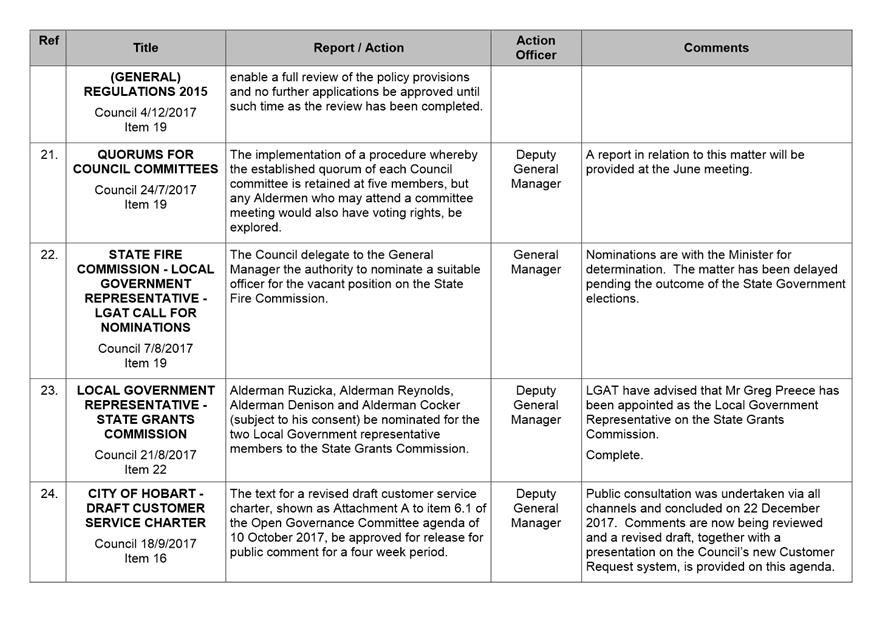

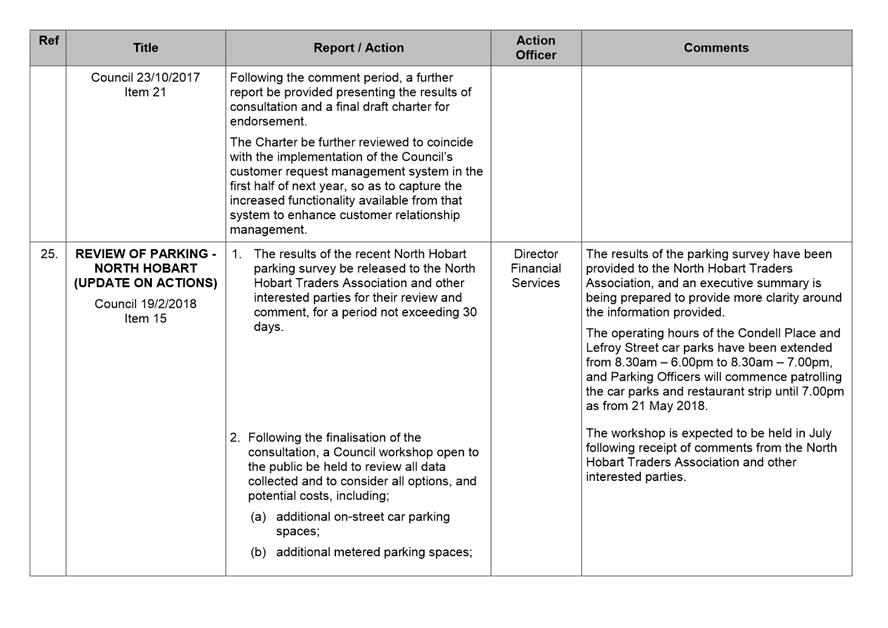

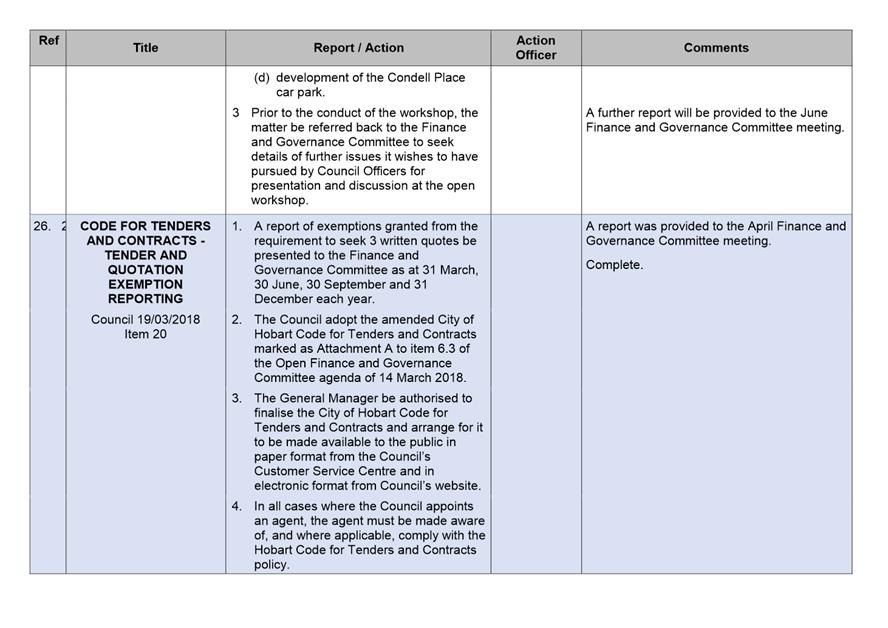

7 Committee Action Status Report

7.1 Committee Actions - Status Report

9. Closed Portion Of The Meeting

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 5 |

|

|

15/5/2018 |

|

Finance and Governance Committee Meeting (Open Portion) held Tuesday, 15 May 2018 at 5.00 pm in the Lady Osborne Room, Town Hall.

|

COMMITTEE MEMBERS Ruzicka (Chairman) Thomas (Chairman) Lord Mayor Christie Zucco Deputy Lord Mayor Sexton Cocker Reynolds

ALDERMEN Briscoe Burnet Denison Harvey |

Apologies:

Leave of Absence: Alderman E R Ruzicka

|

|

The minutes of the Open Portion of the Finance and Governance Committee meeting held on Tuesday, 17 April 2018, are submitted for confirming as an accurate record.

|

Ref: Part 2, Regulation 8(6) of the Local Government (Meeting Procedures) Regulations 2015.

|

That the Committee resolve to deal with any supplementary items not appearing on the agenda, as reported by the General Manager.

|

Ref: Part 2, Regulation 8(7) of the Local Government (Meeting Procedures) Regulations 2015.

Aldermen are requested to indicate where they may have any pecuniary or conflict of interest in respect to any matter appearing on the agenda, or any supplementary item to the agenda, which the committee has resolved to deal with.

Regulation 15 of the Local Government (Meeting Procedures) Regulations 2015.

A committee may close a part of a meeting to the public where a matter to be discussed falls within 15(2) of the above regulations.

In the event that the committee transfer an item to the closed portion, the reasons for doing so should be stated.

Are there any items which should be transferred from this agenda to the closed portion of the agenda, or from the closed to the open portion of the agenda?

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 7 |

|

|

|

15/5/2018 |

|

6.1 Outstanding Parking Debt December 31, 2017

Report of the Group Manager Parking Operations of 9 May 2018 and attachments.

Delegation: Committee

|

Item No. 6.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 8 |

|

|

15/5/2018 |

|

REPORT TITLE: Outstanding Parking Debt December 31, 2017

REPORT PROVIDED BY: Group Manager Parking Operations

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to provide the Finance and Governance Committee with a progress report relation to the current quantum of outstanding parking debt as at 31 December 2017.

2. Report Summary

2.1. Section 3 of the Council policy, Outstanding Debts – Collecting, Reporting and Writing Off, provides that a report be submitted to the Finance Committee as at 30 June each year, recommending that all ‘No Further Action’ debts that have aged in excess of two (2) years be written off.

2.2. There are 1,795 ‘No Further Action’ fines valued at $110,465.10 issued prior to 1 January 2016 that have been deemed non-collectable.

2.2.1. In accordance with the policy, approval is sought to write these debts off.

|

That in accordance with the Council policy, Outstanding Debts – Collecting, Reporting and Writing Off, approval be given to write off a total of 1,795 unpaid parking meter and traffic fines, valued at $110,465.10 which are over two years old, have a status of ‘No Further Action’, and have been deemed ‘non-collectable’.

|

4. Background

4.1. Section 3 of the Council policy, Outstanding Debts – Collecting, Reporting and Writing Off provides that:

4.1.1. A report be submitted to the Finance Committee as at 30 June each year, recommending that all ‘No Further Action’ debts that have aged in excess of two (2) years be written off and include:

(i) The quantum (number and value) of the unpaid “no further action” infringements; and

(ii) A brief summary of the actions undertaken to collect the infringements.

4.1.2. A report be submitted to the Finance Committee as at the end of December of each year detailing the total value of all fines outstanding at that time.

5. Proposal and Implementation

5.1. Outstanding parking debt falls into three categories:

5.1.1. Infringements payable directly to the City of Hobart;

5.1.2. Matters referred to the Director, Monetary Penalties Enforcement Service (MPES) for collection since establishment in 2008; and

5.1.3. Fines imposed by the Magistrates Court prior to 2008.

5.2. The total combined debt outstanding to the City is $7,646,256.74.

5.3. The value of all infringements directly payable to the City as at 31 December 2017 is $1,993,978.19. This includes infringements that have been issued within the last 6 months that are currently going through the final notice stage or being pursued by Tasmanian Collection Services.

5.4. There have been 34,998 infringements referred to MPES since their inception in 2008. The value outstanding is $3,787,977.50.

5.5. There is an additional $1,864,301.05 MPES are collecting for persons convicted in the Magistrates Court prior to the introduction of the Monetary Penalties Enforcement Act in 2008. These fines are now a minimum of 8 years old, with a number dating back prior to 1995.

5.6. MPES collected an average of $92,504.67 per month for the six month period to December 2017 on behalf of the City of Hobart.

5.7. For the same period, the City referred 4,548 infringements to MPES with an average value of $116,359.27 per month for collection.

5.8. The City of Hobart pays a fee of $47.70 for each infringement referred to MPES. If a debt is not collected by MPES the fee is not recoverable.

5.9. There are 7,961 infringements that have been determined to be non-collectable. These have been so deemed for a number of reasons. A decision is made based on our data and in conjunction with the recommendation from Tasmanian Collection Services whether it is viable to refer the matter to MPES.

5.10. Of these, 1,795 infringements were issued prior to 1 January 2016 and have a nominal value of $110,465.10. In accordance with Council policy, approval is sought to write these debts off.

5.11. Refer Attachment A for a graphical representation of the outstanding debt and the Debt Write-off components.

Recovery Action

5.12. The recovery of all outstanding parking infringements follows the same pathway. The registered operator’s details are obtained from Transport Tasmania, and a final notice of demand is sent after approximately 21 days from the initial infringement being issued.

5.13. After approximately 60 days, the matter is referred to City’s debt collection contractor Tasmanian Collection Service (TCS) for follow up and collection.

5.14. TCS provide their professional recommendation as to whether further legal action is warranted or whether the debt should be abandoned.

5.15. No earlier than 60 days after referral to TCS, and no later than 6 months after the infringement date, the matter is referred to (MPES) for collection or imposition of enforcement sanctions.

5.16. At any one of these stages the infringement can be deemed uncollectable and the status altered to “No Further Action”.

Debt Collection Performance for the Six Month Period to 31 December 2017

5.17. Refer Attachment B for a table and graphical summary of the performance in the last 6 months.

5.18. In the 6 month period to 31 December, the City issued 56,084 infringements with a face value of $2.6M. Of these:

5.18.1. 74 per cent of infringements (41,403) were paid on demand, generating $2.13M income.

5.18.2. 8 per cent (4,467 Infringements) are currently at Final Notice Stage. Overdue notices have been issued and sent to the registered operator.

5.18.3. 4 per cent (2,152 infringements) have been handed to the collection agency (TCS) for formal collection.

5.18.4. A further 2 per cent (1,097 infringements) have been referred to MPES for collection and/or sanctions.

5.18.5. Less than 1 per cent (256 infringements) issued within the last 6 months have been classified as doubtful debts and listed as No Further Action.

5.18.6. 3 per cent (1,934 infringements) were issued to rental vehicles hired by interstate or international drivers, or vehicles registered in another State or Territory,

5.18.7. Of the 1,407 vehicles registered outside Tasmania, only 228 of these vehicles have more than one infringement issued for the period.

5.18.8. The remaining 9 per cent of issued infringements (other) has not yet reached the debt collection trigger.

5.19. During the 6 month period MPES forwarded payments totalling $555,028.02 collected on the Council’s behalf. This related to collections of both current and past (Magistrate’s Court) debts.

6. Strategic Planning and Policy Considerations

6.1. Section 3 of the Council policy, Outstanding Debts – Collecting, Reporting and Writing Off, provides that a report be submitted to the Finance Committee as at 30 June each year, recommending that all ‘No Further Action’ debts that have aged in excess of two (2) years be written off.

6.2. The report aligns with Strategic Objective 2.1 – A fully assessable and connected city environment within the Capital City Strategic Plan 2015-2025, specifically:

2.1.4

– Implement the parking strategy Parking – A Plan for the

Future 2013.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result.

7.1.1. There is $350,000 per annum set aside in the Parking budget as provision for doubtful debt.

7.1.2. This is fully provisioned against budget function 421.

8. Legal, Risk and Legislative Considerations

8.1. No legal, risk and legislative considerations have been identified.

9. Delegation

9.1. This matter is delegated to the Finance and Governance Committee.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Matthew Tyrrell Group Manager Parking Operations |

David Spinks Director Financial Services |

Date: 9 May 2018

File Reference: F18/26953; 16/121

Attachment a: Outstanding

Parking Debt as at Dec 31, 2017 ⇩ ![]()

Attachment

b: Six

Month Snapshot - December 2017 ⇩ ![]()

|

Item No. 6.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 13 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 14 ATTACHMENT b |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 15 |

|

|

|

15/5/2018 |

|

6.2 Occupancy Rates - Multi-Storey Car Parks

Report of the Operations Manager - Car Parks and the Director Financial Services of 10 May 2018 and attachments.

Delegation: Committee

|

Item No. 6.2 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 16 |

|

|

15/5/2018 |

|

Memorandum: Finance and Governance Committee

Occupancy Rates - Multi-Storey Car Parks

At the meeting of the Finance and Corporate Services Committee on 20 August 2013 (Open agenda, item 13 - Questions Without Notice) Alderman Cocker requested the following:-

“Could Aldermen be provided regular updates on the occupancy rates of the Council Multi-storey car parks?”

The General Manager advised that Aldermen will be provided with the figures quarterly.

The initial quarterly car parks occupation rates report was provided to Aldermen at the meeting of the Finance and Corporate Services Committee on 22 October 2013 (item 8 - Closed agenda). The Committee resolved that the report be received and noted. In addition the Chairman informally requested that future reports include occupancy percentages.

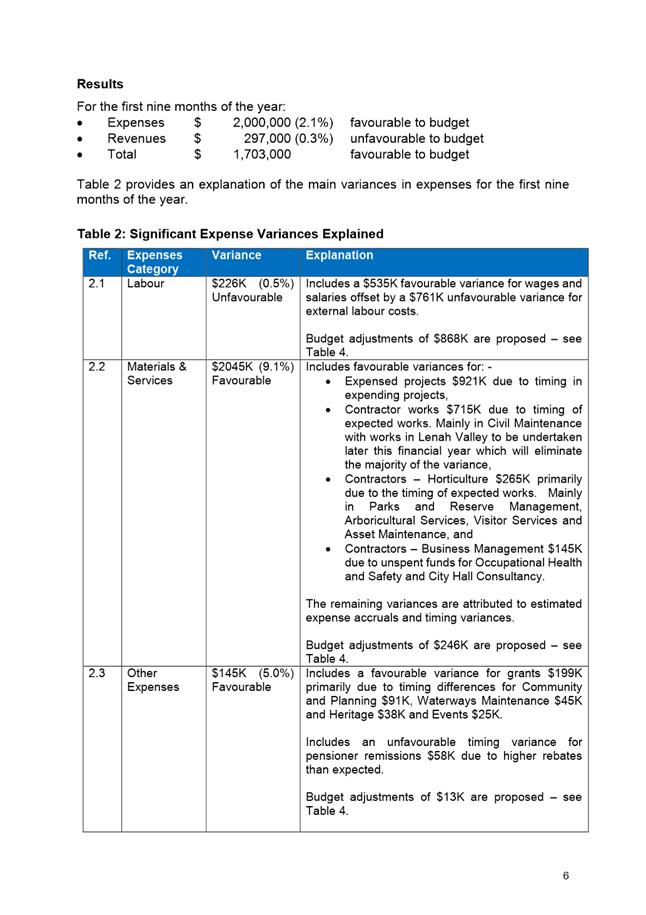

This report, for Quarter two (October - December) of the 2017-18 financial year contains:

· The occupancy rates and income of each of the three multi-storey car parks for the quarter ending December 2017, compared with the same period in 2016 (Table 1).

· Weekday hourly occupation percentages for each of the three multi-storey car parks for the same period (Attachment A).

· Three month overview of the occupancy rates and income generated by the Trafalgar Car Park through permit and early bird parking (Table 2).

Summary of results

The overall result across the car parks is:

· 1.88% increase in vehicle usage.

· Increase in income of 4.15%.

· Trafalgar car park continues to perform well, being slightly ahead of budget.

table 1

|

2016 |

ARGYLE STREET |

CENTREPOINT |

HOBART CENTRAL |

||||

|

|

Cars |

Income |

Cars |

Income |

Cars |

Income |

|

|

October |

93134 |

$238,783.50 |

49966 |

$154,467.60 |

28938 |

$99,295.60 |

|

|

November |

97348 |

$273,015.60 |

52532 |

$172,059.90 |

30248 |

$110,875.50 |

|

|

December |

105299 |

$277,812.20 |

59507 |

$167,446.20 |

32679 |

$101,946.00 |

|

|

Totals |

295781 |

$789,611.30 |

162005 |

$493,973.70 |

91865 |

$312,117.10 |

|

|

|

|||||||

|

2017 |

ARGYLE STREET |

CENTREPOINT |

HOBART CENTRAL |

||||

|

|

Cars |

Income |

Cars |

Income |

Cars |

Income |

|

|

October |

103429 |

$271,208.00 |

48538 |

$162,229.00 |

29181 |

$95,886.00 |

|

|

November |

100708 |

$294,516.80 |

52032 |

$182,650.00 |

30982 |

$103,610.00 |

|

|

December |

105003 |

$292,171.30 |

56548 |

$168,689.10 |

33576 |

$90,971.00 |

|

|

Totals |

309140 |

$857,896.10 |

157118 |

$513,568.10 |

93739 |

$290,467.00 |

|

|

Argyle Street |

Centrepoint |

Hobart Central |

|||||

|

Car park increase/decrease |

13359 |

$68,284.80 |

-4887 |

$19,594.60 |

1874 |

-$21,650.10 |

|

|

4.51% |

5.16% |

-3.01% |

3.96% |

2.03% |

-6.93% |

||

|

Overall increase |

Cars |

10346 |

|||||

|

Income |

$66,229.10 |

||||||

· The decrease in Hobart Central revenue was due to a reduction in the number of early bird spaces allocated during the busy Christmas period and a higher number of short stay free parking. This also provided more short term parking availability during December as indicated by the increase in vehicles numbers

· Income increased in Argyle Street car park, which reflects the fee increase, an increase in vehicle usage and longer stays.

· Income increased in Centrepoint car park by 3.96% which is a result of fee increases and a continuation of some early bird parking during the Christmas period, due to short term demand being down on the previous year. The decrease in early bird parking during the Christmas period was not as significant as that of Hobart Central, therefore income was still better than the previous year.

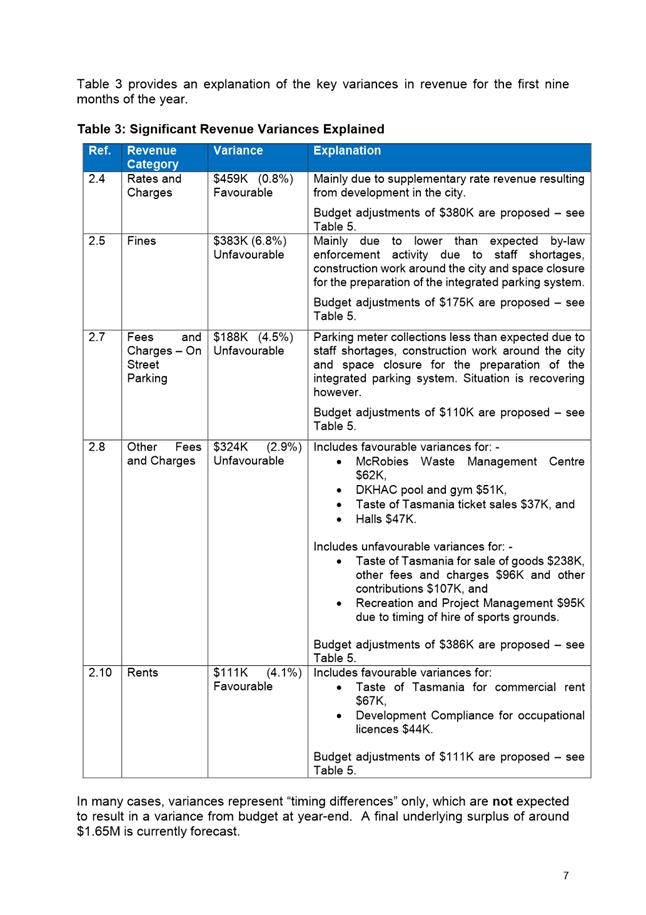

Trafalgar Car Park

Parking Operations assumed operational responsibility of the 544 parking spaces in Trafalgar Car Park on 1 July 2013. As at that date, 388 spaces were leased to permit holders who pay a monthly rental of either $255 or $275 depending on the conditions of their permit.

The goal is to fully occupy the car park with monthly tenants, however in the interim the void between actual and full occupancy is being filled with early bird parkers.

As at 31 December 2017, the number of spaces leased to permit holders was 478, with 66 vacant spaces being utilised for early bird parking. Saturday income increased due to an increase in Salamanca Market patrons taking advantage of the $6 all day parking fee. As at 31 December 2017, the budget for the Trafalgar Car Park showed a favourable balance.

The income for the period 1 October 2017 – 31 December 2017 was split as follows:

Table 2

|

|

Oct-17 |

Nov-17 |

Dec-17 |

Total Income |

Budgeted Income |

|

Permits |

$115,841 |

$113,601 |

$112,017 |

$341,459 |

$324,378 |

|

Early Bird |

$15,269 |

$16,016 |

$14,106 |

$45,391 |

$56,000 |

|

Saturday |

$2,480 |

$2,452 |

$5,632 |

$10,564 |

$10,000 |

|

Total |

$133,590 |

$132,069 |

$31,755 |

$397,414 |

$390,378 |

Car Park Occupancy Rates Oct – Dec 2017

(See Attachment A)

During October, Centrepoint Car Park recorded average occupation rates of 84.71% during the peak period of the day (11.00am – 2.00pm). Argyle Street averaged 92.51%, and Hobart Central averaged 91.53 % for the same period.

In the following two month period (1 November - 31 December 2017) occupancy rates in all three car parks at the peak period of the day were higher – averaging at or above 90.3 %.

Hobart Central and Centrepoint car parks both accept “early bird” parking. During quieter periods the car park operators manually adjust the number of early birds they accept based on the vehicle usage statistics. The higher percentages of occupation in both of these car parks are reflective of this.

During the three month period vehicular traffic in Argyle Street car park remained constant, with the car park not quite filling during the three month period. The average number of vacant spaces available during the peak period of the day was in the vicinity of 102.

Centrepoint and Hobart Central car parks both had busy periods during October, November and December with both car parks filled but only momentarily. Accordingly, early birds were adjusted daily to ensure vacancies remained.

The usage statistics demonstrate that parking capacity remains available even during the busiest periods of the day, which in turn allows for parking availability on-street, thus giving options to parkers when in the City.

|

That the information contained in the memorandum of the Operations Manager – Car Parks, the Group Manager Parking Operations and the Director Financial Services of 9 August 2017 titled “Occupancy Rates – Multi-Storey Car Parks” be received and noted.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

David Fox Operations Manager - Car Parks |

Matthew Tyrrell Group Manager Parking Operations |

|

David Spinks Director Financial Services |

|

Date: 10 May 2018

File Reference: F18/3836

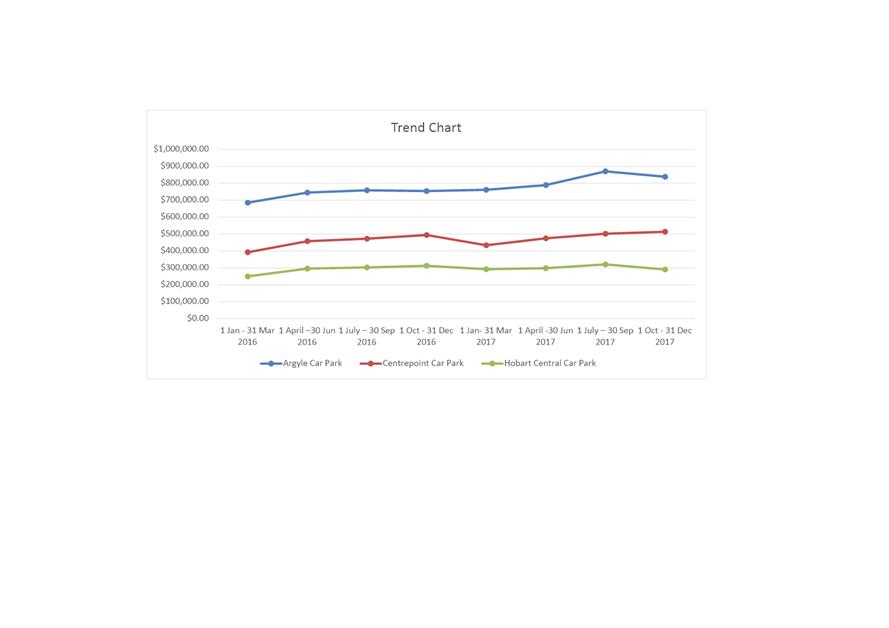

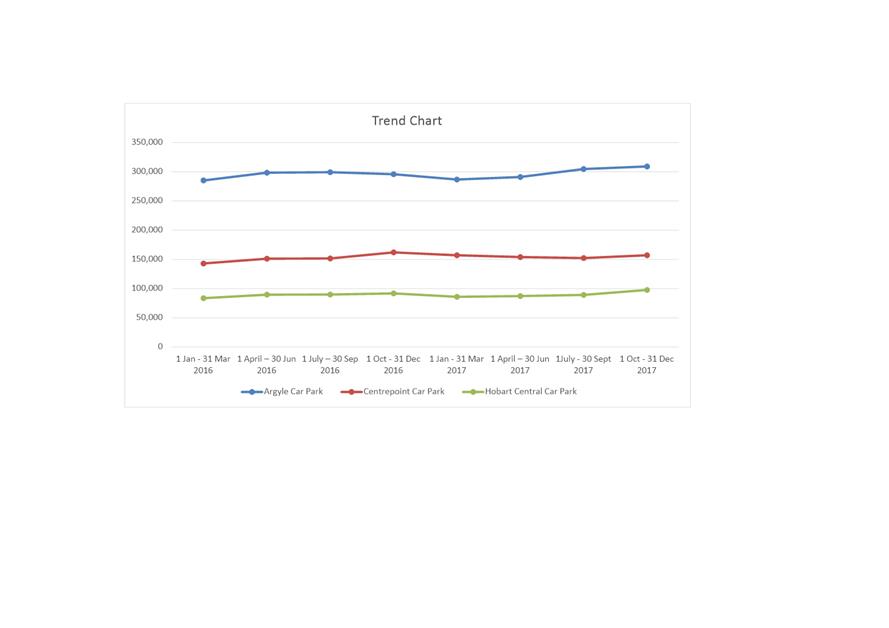

Attachment a: Table

of Occupancy Percentages ⇩ ![]()

Attachment

b: Income

Graph ⇩ ![]()

Attachment

c: Occupancy

Rates Graph ⇩ ![]()

|

Item No. 6.2 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 20 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 21 ATTACHMENT b |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 24 ATTACHMENT c |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 27 |

|

|

|

15/5/2018 |

|

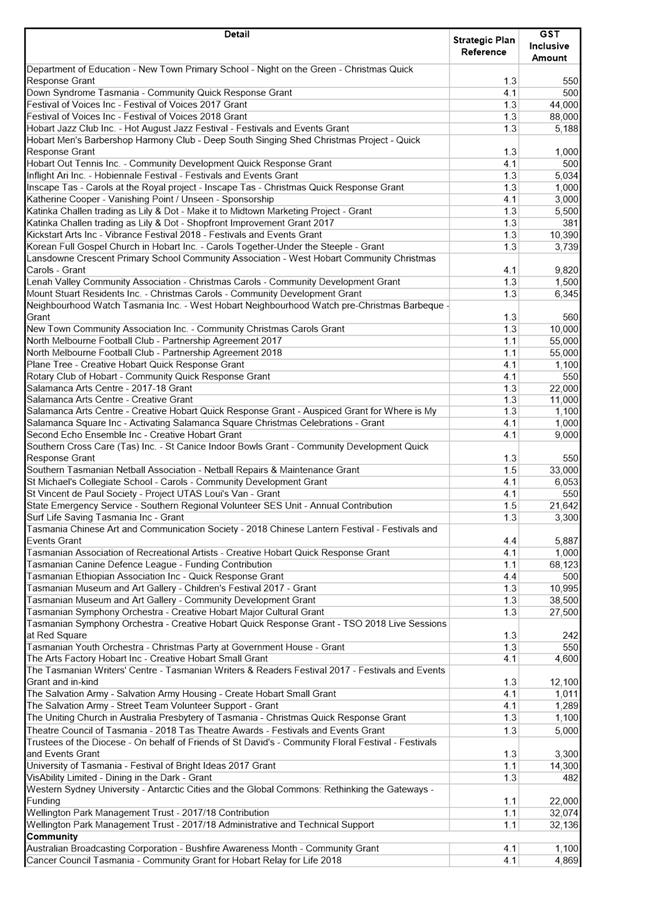

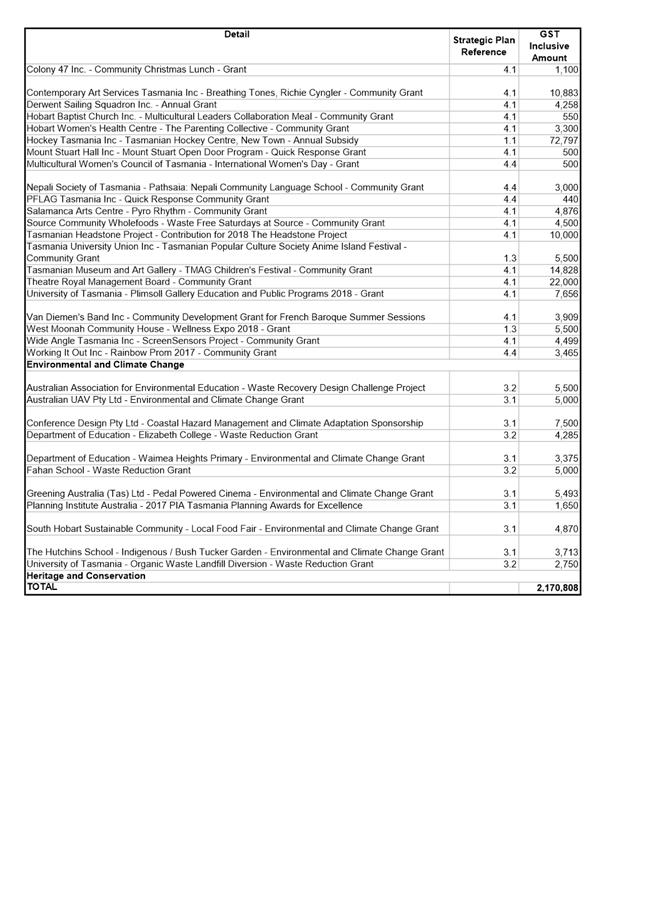

6.3 Grants and Benefits Listing as at 31 March 2018

Report of the Group Manager Rates and Procurement and Director Financial Services of 10 May 2018 and attachment.

Delegation: Committee

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 28 |

|

|

15/5/2018 |

|

REPORT TITLE: Grants and Benefits Listing as at 31 March 2018

REPORT PROVIDED BY: Group Manager Rates and Procurement

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to provide a listing of the grants and benefits provided by the Council for the period 1 July 2017 to 31 March 2018 as requested by the then Parks and Customer Services Committee.

2. Report Summary

2.1. At its meeting on 12 February 2015, the then Parks and Customer Services Committee requested that a quarterly report be provided for the information of the then Finance and Corporate Services Committee outlining all grants and benefits provided by Council Committees and Council.

2.2. A report is attached being for the period 1 July 2017 to 31 March 2018.

2.3. It is proposed that the Committee note the listing of grants and benefits provided for the period 1 July 2017 to 31 March 2018 and that these are required, pursuant to Section 77 of the Local Government Act 1993 (LG Act), to be included in the annual report of Council.

|

That the Finance and Governance Committee receive and note the information contained in the report titled “Grants and Benefits Listing as at 31 March 2018”.

|

4. Background

4.1. At its meeting on 12 February 2015, the then Parks and Customer Services Committee resolved that:

4.1.1. A quarterly report be provided for the information of the [then] Finance and Corporate Services Committee outlining all grants and benefits approved by Council Committees and Council.

4.2. At its meeting on 19 May 2015, the then Finance Committee resolved that:

4.2.1. Details of all grants and benefits provided under Section 77 of the Local Government Act 1993 be listed on the City of Hobart’s website.

4.3. A report outlining the grants and benefits provided for the period 1 July 2017 to 31 March 2018 is attached – refer Attachment A.

4.4. Pursuant to Section 77 of the LG Act, the details of any grant made or benefit provided will be included in the annual report of the Council.

4.5. The listing of grants and benefits marked as Attachment A, has been prepared in accordance with the Council policy titled Grants and Benefits Disclosure – refer Attachment B.

5. Proposal and Implementation

5.1. It is proposed that the Committee note the grants and benefits listing as at 31 March 2018.

5.2. It is also proposed that the Committee note that the grants and benefits listed are required to be included in the annual report of the Council and will be listed on the City of Hobart’s website.

6. Strategic Planning and Policy Considerations

6.1. Grants and benefits are provided to organisations which undertake activities and programs that strongly align with the Council’s Strategic Framework – Hobart 2025, the City of Hobart Capital City Strategic Plan 2015-2025 as well as other relevant City of Hobart strategies.

6.2. The linkage between the City’s grants and benefits provided and the City of Hobart Capital City Strategic Plan 2015-2025 is referenced in Attachment A.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. All grants and benefits provided as at 31 March 2018 were funded from the 2017/18 budget estimates.

8. Legal, Risk and Legislative Considerations

8.1. The Council provides grants and benefits within the requirements of Section 77 of the LG Act as follows:

Grants and benefits

(1) A council may make a grant or provide a pecuniary benefit or a non-pecuniary benefit that is not a legal entitlement to any person, other than a councillor, for any purpose it considers appropriate.

(1A) A benefit provided under

subsection (1) may include –

(a) in-kind assistance; and

(b) fully or partially reduced fees, rates or charges;

and

(c) remission of rates or charges under Part 9 (rates

and charges)

(2) The details of any grant made or benefit provided are to be included in the annual report of the Council.

8.2. Section 72 of the LG Act requires the Council to produce an Annual Report with Section 77 of the LG Act providing an additional requirement where individual particulars of each grant or benefit given by the Council must be recorded in the Annual Report.

8.3. Section 207 of the LG Act provides for the remitting of all or part of any fee or charge paid or payable.

8.4. Section 129 of the LG Act provides for the remitting of rates.

9. Delegation

9.1. This report is provided to the Finance and Governance Committee for information.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lara MacDonell Group Manager Rates and Procurement |

David Spinks Director Financial Services |

Date: 10 May 2018

File Reference: F18/34899; 25-2-1

Attachment a: Grants

and Benefits Listing as at 31 March 2018 ⇩ ![]()

Attachment

b: Council

Policy Grants and Benefits Disclosure ⇩ ![]()

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 31 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 34 ATTACHMENT b |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 40 |

|

|

|

15/5/2018 |

|

6.4 2018/19 Fees and Charges - Financial Services

Report of the Group Manager Rates and Procurement and the Director Financial Services of 27 April 2018 and attachments.

Delegation: Committee

|

Item No. 6.4 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 41 |

|

|

15/5/2018 |

|

REPORT TITLE: 2018/19 Fees and Charges - Financial Services

REPORT PROVIDED BY: Group Manager Rates and Procurement

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to present the proposed fees and charges for Council’s financial services for the 2018/19 financial year.

1.2. Fees and charges are reviewed each year as part of the Council’s annual budget process.

2. Report Summary

2.1. A review of Council’s financial services fees and charges has been undertaken. The pricing level for 2018/19 is proposed to remain as for the current year due to no increase in transactional banking or Australia Post transaction fees.

2.2. No new Council fees or charges are proposed for 2018/19.

2.3. It is recommended that the attached schedule of fees and charges is adopted for 2018/19.

|

That: 1. The report 2018/19 fees and charges – financial services be received and noted. 2. The attached schedule of fees and charges for financial services be adopted for the 2018/19 financial year.

|

4. Background

4.1. At its meeting on 14 May 2012 Council introduced three new fees, being a direct debit default fee, a cheque re-issue fee and an electronic funds transfer (EFT) default fee.

4.2. The direct debit default fee is charged to a customer where there are insufficient cleared funds in the nominated account when the agreed direct debit payments are to be drawn.

4.3. The cheque re-issue fee is charged when a customer requests Council to re-issue a cheque where the original may have been lost or misplaced. However, the fee is not charged when a cheque is re-issued as a result of a Council error.

4.4. The EFT default fee is charged when an EFT transaction is unsuccessful because the incorrect bank account information was supplied and the EFT is resent by Council as a result.

4.5. At its meeting on 25 May 2015 Council introduced a new fee for the 2015/16 financial year, being a cheque default fee.

4.6. The cheque default fee is charged when a customer pays by cheque but the cheque is dishonoured by the financial institution e.g. ‘bounced cheque’.

4.7. At its meeting on 22 May 2017 Council introduced a new fee for the 2017/18 financial year, being an Australia Post payment default fee.

4.8. The Australia Post payment default fee is charged to a customer who pays at Australia post but the payment defaults. This will usually be because the customer pays by cheque but the cheque is dishonoured by the financial institution.

4.9. Similar fees and charges are imposed by councils both in Tasmania and interstate.

4.10. A pricing review of the financial services fees has been undertaken. A schedule showing the proposed fees for 2018/19 is attached – refer attachment A.

5. Proposal and Implementation

5.1. It is proposed that the attached schedule of fees and charges be adopted for the 2018/19 financial year.

5.2. The pricing level for 2018/19 is proposed to remain as for the current year due to no increase in transactional banking fees. In fact there has been a decline in the banking fee imposed for a cheque re-issue, low inflation and in prior years the fee has been rounded upwards.

5.3. The proposed direct debit default fee of $27 includes the transactional banking fee imposed on Council by its financial institution, being $2.50 per instance, and an amount to recover the administrative costs to Council in rectifying this default.

5.4. The proposed cheque re-issue fee of $27 includes the transactional banking fee imposed by Council by its financial institution, which was $10 per instance but for 2018/19 has been removed, and an amount to recover the administrative costs to Council in re-issuing a cheque.

5.5. The proposed EFT default fee of $27 includes the transactional banking fee imposed by Council by its financial institution, being $2.50 per instance, and an amount to recover the administrative costs to Council in resending the EFT.

5.6. The proposed cheque default fee of $27 is priced consistently with the other financial service fees and charges. The price also reflects the amount to cover the administrative costs to Council in rectifying the default.

5.7. The proposed Australia Post payment default fee of $27 is similarly priced consistently with the other financial service fees and charges, and includes the $25 cost charged to Council by Australia Post and a small amount to cover the administrative costs to Council in rectifying the default.

5.8. Fees and charges for 2018/19 will become effective as at 1 July 2018.

5.9. Pursuant to section 206 of the Local Government Act 1993, the fees will be included in Council’s fees and charges booklet, which is made available to the community from Council’s website and the Customer Service Centre.

6. Strategic Planning and Policy Considerations

6.1. There are no direct strategic planning implications arising from this report.

6.2. The annual review of fees and charges has been undertaken in accordance with Council’s Pricing Policy and Guidelines.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. Not applicable.

7.2. Impact on Future Years’ Financial Result

7.2.1. It is difficult to determine the income that will be generated to Council from these fees as they are applied when a payment default has occurred.

7.2.2. Based upon the number of instances where the fees have been applied to date this financial year, it is envisaged that approximately $4,787 will be generated in income from these fees in 2018/19.

7.3. Asset Related Implications

7.3.1. Not applicable.

8. Legal, Risk and Legislative Considerations

8.1. Pursuant to section 205 of the Local Government Act 1993 (Tas), Council has the following powers:

(1) In addition to any other power to impose fees and charges but subject to subsection (2), a council may impose fees and charges in respect of any one or all of the following matters:

(a) the use of any property or facility owned, controlled, managed or maintained by the council;

(b) services supplied at a person's request;

(c) carrying out work at a person's request;

(d) providing information or materials, or providing copies of, or extracts from, records of the council;

(e) any application to the council;

(f) any licence, permit, registration or authorization granted by the council;

(g) any other prescribed matter.

(2) A council may not impose a fee or charge in respect of a matter if –

(a) a fee or charge is prescribed in respect of that matter; or

(b) this or any other Act provides that a fee or charge is not payable in respect of that matter.

(3) Any fee or charge under subsection (1) need not be fixed by reference to the cost to the council.

8.2. Pursuant to section 206 of the LG Act, council is to keep a list of all fees and charged and make the list available for public inspection during ordinary hours of business.

9. Delegation

9.1. Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lara MacDonell Group Manager Rates and Procurement |

David Spinks Director Financial Services |

Date: 27 April 2018

File Reference: F18/34891; 18/20

Attachment a: Schedule

of Financial Services Fees and Charges for 2018/19 ⇩ ![]()

|

Item No. 6.4 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 46 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 47 |

|

|

|

15/5/2018 |

|

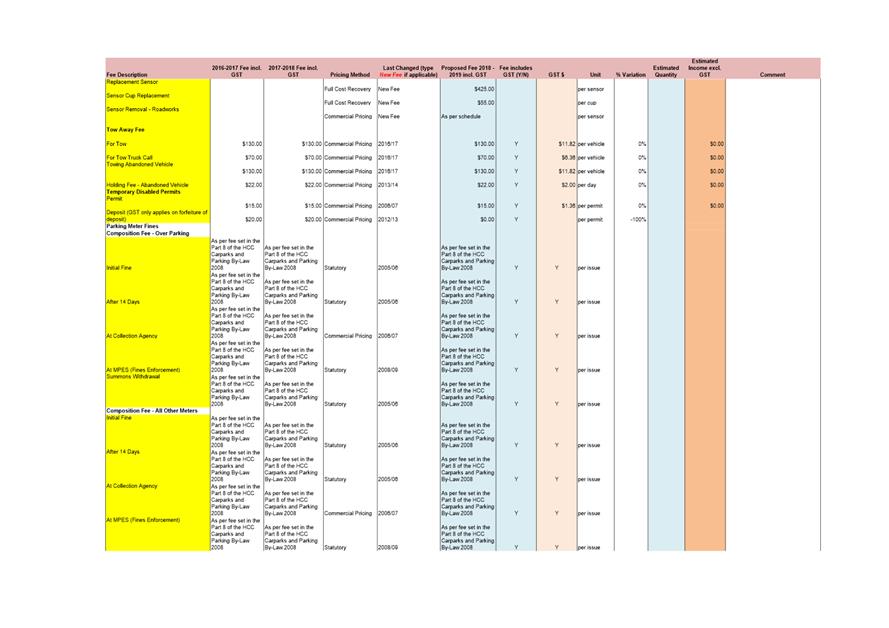

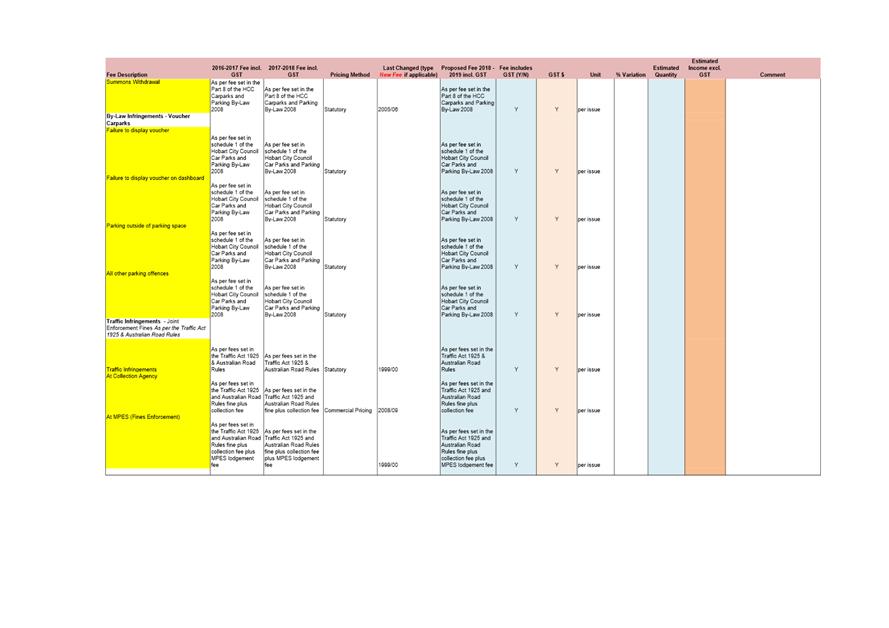

6.5 2018-19 Fees and Charges - Parking Operations

Report of the Group Manager Parking Operations and the Director Financial Services of 9 May 2018 and attachments.

Delegation: Council

|

Item No. 6.5 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 48 |

|

|

15/5/2018 |

|

REPORT TITLE: 2018-19 Fees and Charges - Parking Operations

REPORT PROVIDED BY: Group Manager Parking Operations

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to present the proposed fees and charges applicable to the Financial Services Division – Parking Enforcement and Off-Street Parking for the 2018-19 financial year.

1.2. Fees and charges are reviewed each year as part of the Council’s annual budget process.

2. Report Summary

2.1. A review of Council’s Parking Operations fees and charges has been undertaken and a total increase of 15.55% for all functions within the Parking Operations area is proposed for 2018-19.

2.2. This higher than normal increase in income is essentially a result of the implementation of the new Integrated Parking System. The new system will improve parking management efficiency through the introduction of new payment methods, greater enforcement capabilities and greater coverage of the city and suburban areas as a result of the introduction of sensor technology.

2.3. The new technology will have a greater operational cost than our existing conventional equipment, this includes credit card fees, licencing and communication fees, however, the expected income gains will more than cover these additional operational fees.

2.4. It is recommended that the attached schedule of fees and charges are endorsed for 2018-19.

|

That the schedule of fees and charges for the 2018-19 financial year, as referenced below and attached to this report, be endorsed for consideration by the Finance and Governance Committee; 1. Parking Enforcement (Attachment A) 2. Off-Street Parking Long Term (Attachment B) 3. Off-Street Parking Short Term (Attachment C) 4. Off-Street Parking Short Term Motor Bikes (Attachment D) 5. Meters and Voucher Machines (Attachment E) |

4. Background

4.1. The fees and charges for the 2018-19 financial year have been assessed including methods and timing of payment. Where possible fees and charges are to be paid up-front with additional costs being charged on a cost recovery basis.

4.2. A summary of the proposed fees and charges follows:

Parking General

4.2.1. New fees have been introduced as a result of the purchase of new equipment for the Integrated Parking System. These include replacement costs for damaged sensors and sensor cups (mounting devices), and fees for removal and reinstatement of sensors for the purposes of road works.

4.2.2. Fees for replacement of parking meters have also been included in case of damage as a result of motor vehicle accidents, roadworks or malicious damage as a result of vandalism or attempted theft.

4.2.3. Fee increases have been effected for the use of parking meter hooding permits and annual parking meter exemption permits.

Parking Meter Fines

4.2.4. The penalties for parking meter fines and traffic infringements are set using the State Government penalty unit fees. Penalty unit fees will be increased for the 2018-19 financial year resulting in small increases to penalties charged by Council. The expectation is an average of around $1.00 per fine.

Parking Meter Fees

4.2.5. Parking meter fees will increase in some areas of the city, in particular those areas where the fees have not been reviewed for some time. The fee increase will be effected for some meters in the fringe areas of the city and the following areas:

· Dunn Place

· Condell Place

· Lefroy Street

· Salamanca Place

· Salamanca Square

· Queens Domain

· Regatta Grounds

Car Park Fees

4.2.6. The hourly rate for the 3rd and 4th hour in the Argyle Street, Hobart Central, and Centrepoint multi-storey car parks will increase by $1.00 per hour. Early bird parking in Hobart Central, Centrepoint, and Trafalgar Car Parks will increase by $1.00 per day to $13.00.

Long Term Car Park Fees

4.2.7. The monthly rental for spaces in the following car parks will increase by an average of $5.00 per month:

· Trafalgar

· Hobart Central

· Liverpool-Barrack

· Salamanca Square

· Hunter Street (UTAS & Henry Jones)

5. Proposal and Implementation

5.1. It is recommended that the attached schedules of fees and charges be endorsed for the 2018-19 financial year.

5.2. Fees and charges for 2018-19 will become effective as at 1 July 2018.

5.3. Pursuant to section 206 of the Local Government Act 1993, the fees will be included in Council’s fees and charges booklet, which is made available to the community from Council’s website and the Customer Service Centre.

6. Strategic Planning and Policy Considerations

6.1. There are no direct strategic planning implications arising from this report.

6.2. The annual review of fees and charges has been undertaken in accordance with Council’s Pricing Policy and Guidelines.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. Not applicable.

7.2. Impact on Future Years’ Financial Result

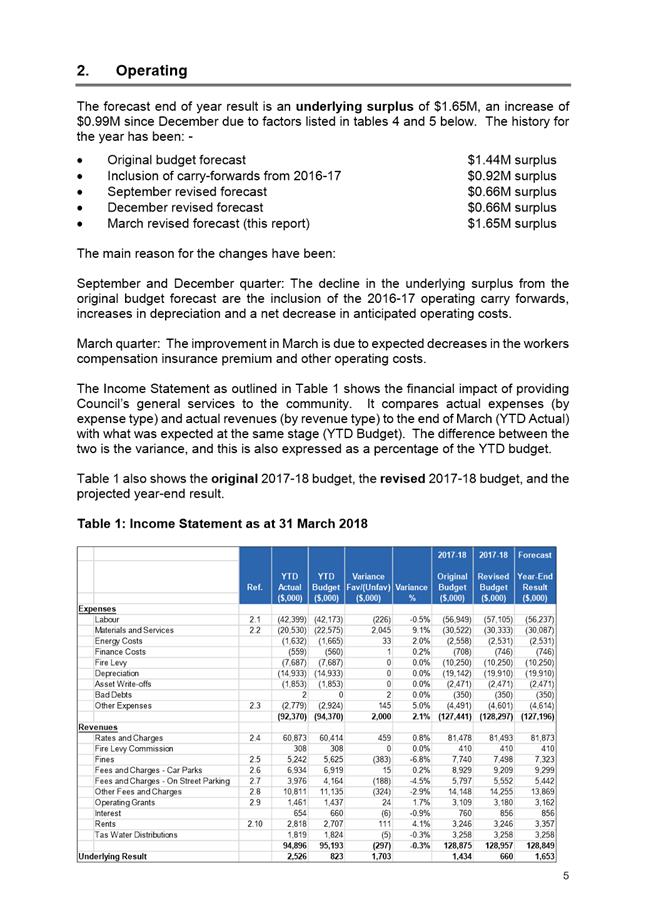

7.2.1. The review of the fees and charges for Parking Operations has been undertaken and increases for the 2018-19 financial year are expected to be:

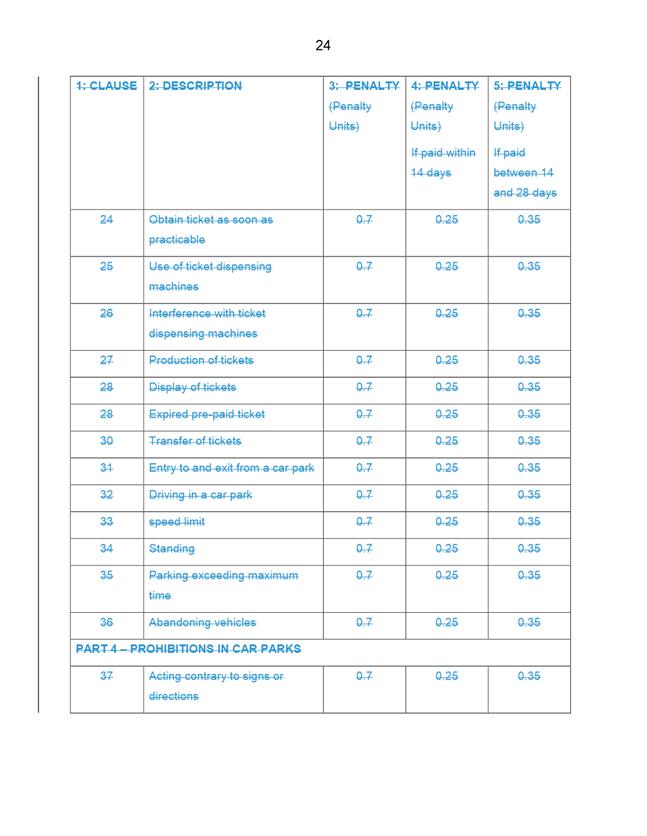

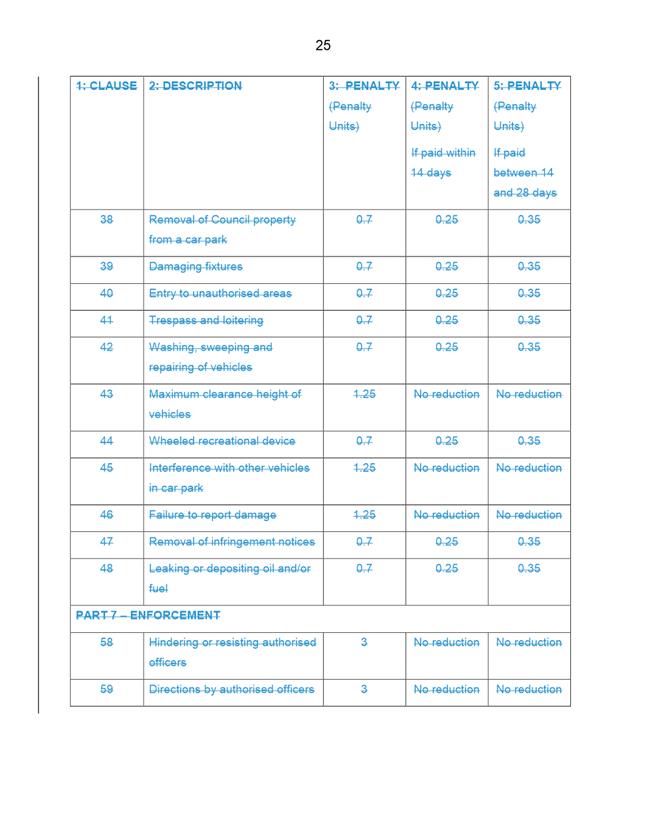

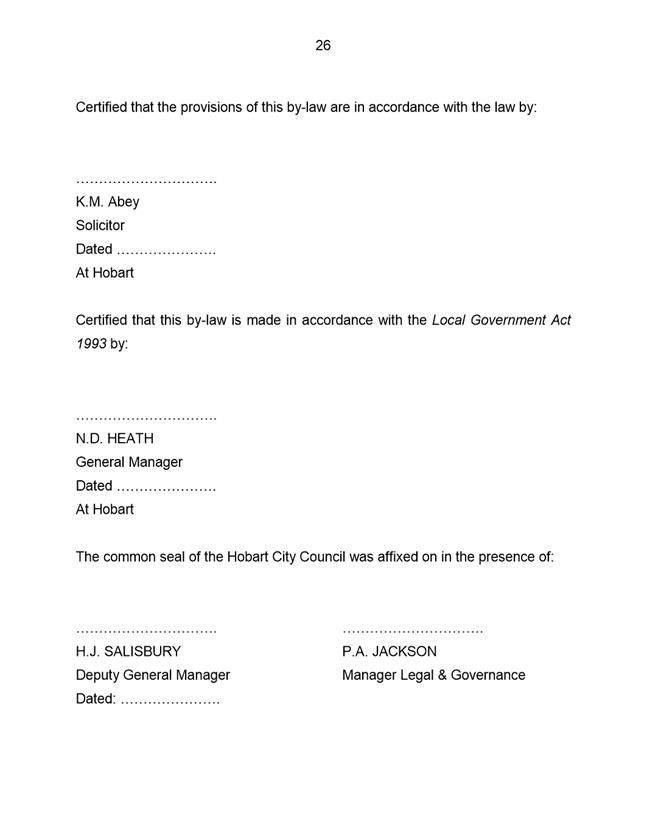

|

FUNCTION AREA |

2017-18 BUDGET |

2018-19 ESTIMATE |

INCREASE / (DECREASE) |

|

|

Parking Enforcement (includes fine and meter collections) |

13,330,247 |

15,099,100 |

1,768,853 |

13.27% |

|

Off-Street Parking Short Term |

5,912,055 |

6,664,500 |

752,445 |

12.73% |

|

Off-Street Parking Long Term |

2,290,016 |

2,444,277 |

154,261 |

6.74% |

|

Meters, Voucher Machines etc (Dunn Place, Condell Place and Queens Domain car parks) |

787,000 |

970,000 |

183,000 |

23.25% |

7.3. Asset Related Implications

7.3.1. Not applicable.

8. Legal, Risk and Legislative Considerations

8.1. Pursuant to section 205 of the Local Government Act 1993, Council may impose fees and charges for various services.

8.2. Pursuant to section 206 of the LG Act, council is to keep a list of all fees and charged and make the list available for public inspection during ordinary hours of business.

9. Delegation

9.1. This matter is delegated to the Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Matthew Tyrrell Group Manager Parking Operations |

David Spinks Director Financial Services |

Date: 9 May 2018

File Reference: F18/40385

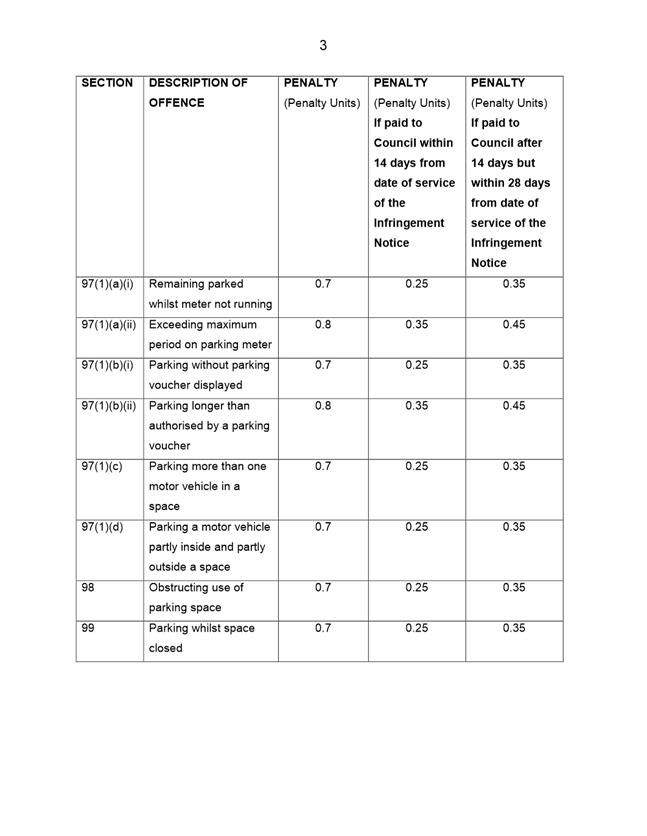

Attachment a: Parking

Enforcement ⇩ ![]()

Attachment

b: Off-Street

Parking Long Term ⇩ ![]()

Attachment

c: Off-Street

Parking Short Term ⇩ ![]()

Attachment

d: Off-Street

Parking Short Term Motorbikes ⇩ ![]()

Attachment

e: Meters

and Voucher Machines ⇩ ![]()

|

Item No. 6.5 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 53 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 57 ATTACHMENT b |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 58 ATTACHMENT c |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 59 ATTACHMENT d |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 60 ATTACHMENT e |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 61 |

|

|

|

15/5/2018 |

|

6.6 Financial Report as at 31 March 2018

Report of the Budget and Reporting Manager, Manager Finance and the Director Financial Services of 10 May 2018 and attachments.

Delegation: Council

|

Item No. 6.6 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 62 |

|

|

15/5/2018 |

|

REPORT TITLE: Financial Report as at 31 March 2018

REPORT PROVIDED BY: Budget and Reporting Manager

Manager Finance

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to present Council’s Financial Report for the period ending 31 March 2018, and to seek approval for changes to the 2017/18 Estimates (budget).

2. Report Summary

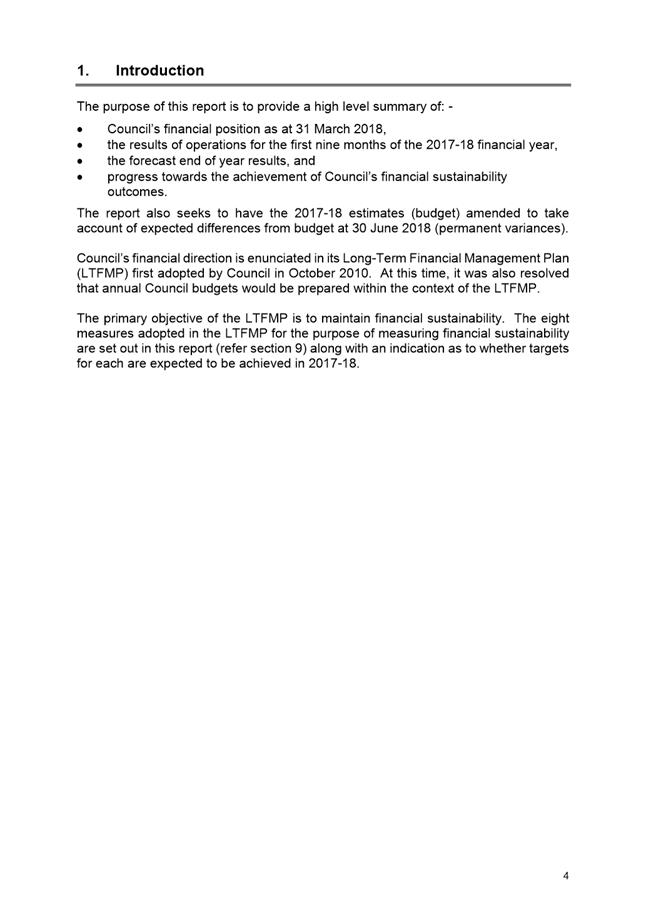

2.1. The Financial Report for the period ending 31 March 2018 is presented for consideration. It shows that expenses are currently favourable when compared to budget and revenues are currently unfavourable, and forecasts the following financial outcomes for 2017/18:

2.1.1. An underlying surplus of $1.65M;

2.1.2. A closing cash balance of around $37M; and

2.1.3. The achievement of targets set for most of the Council’s eight financial sustainability indicators.

2.2. The Council remains in a strong, sustainable financial position.

|

That the Council approve the changes to the 2017/2018 Estimates listed in tables 4, 5, 7 and 9 of Attachment A, noting that the financial impacts of which are to increase the underlying surplus by $0.99M, and to decrease the cash balance by $1.25M. |

4. Background

4.1. The Financial Report as at 31 March 2018 is provided at Attachment A. The Financial Report provides details of:

4.1.1. The Council’s financial position as at 31 March 2018;

4.1.2. The result of operations for the first nine months of the 2017/2018 financial year;

4.1.3. Forecasts for 30 June 2018; and

4.1.4. Progress towards the achievement of the Council’s financial sustainability outcomes.

4.2. In accordance with Council’s decision of 3 July 2017, unspent 2016/17 capital funding has been carried forward to the 2017/18 year.

4.3. Council approved operating carry forwards from 2016/17 as part of the financial report for the period 30 September 2017, which resulted in the forecast underlying surplus decreasing by $0.52M, from $1.44M to $0.92M.

4.4. Council approved further changes to the Estimates as part of the financial report for the period 30 September 2017 which resulted in the forecast underlying surplus decreasing by $0.26M, from $0.92M to $0.66M.

4.5. Council approved further changes to the Estimates as part of the financial report for the period 31 December 2017 which resulted in the forecast underlying surplus for 2017/18 remaining unchanged at $0.66M.

5. Proposal and Implementation

5.1. The Financial Report seeks to have the 2017/18 Estimates (budget) amended to take account of expected differences from budget at 30 June 2018 (permanent variances).

5.2. It is proposed that the Council approve changes to the 2017/18 Estimates as set out in tables 4, 5, 7 and 9 of Attachment A.

6. Strategic Planning and Policy Considerations

6.1. Goal 5 – Governance is applicable in considering this report, particularly Strategic 5.1 objective:

“The organisation is relevant to the community and provides good governance and transparent decision-making”.

7. Financial Implications

7.1. Funding Source

7.1.1. The proposed changes to the Estimates will result in the forecast cash balance decreasing by $1.25M.

7.1.2. The decrease in the forecast cash balance results from a number of factors, but is primarily due to increased capital expenditure which is partially offset by reduced operating costs.

7.1.3. The final cash balance may differ from the current forecast for the following reasons:

7.1.3.1. Current budget variances which are assumed to be timing variances (and therefore forecasts have not been amended) may prove to be permanent variances,

7.1.3.2. Further variances could arise during the remainder of the year, and

7.1.3.3. Capital expenditure could be higher or lower than forecast.

7.2. Impact on Current Year Operating Result

7.2.1. The impact of the proposed changes to the Estimates is to increase the forecast underlying surplus by $0.99M (from $0.66M to $1.65M).

7.2.2. The final result may vary from the current forecast for the following reasons:

7.2.2.1. Current budget variances which are assumed to be timing variances (and therefore forecasts have not been amended) may prove to be permanent variances; and

7.2.2.2. Further variances could arise during the remainder of the year.

7.3. Impact on Future Years’ Financial Result

7.3.1. The impact on future years’ underlying surpluses is difficult to estimate reliably because some changes may be ongoing, whilst others may not.

7.4. Asset Related Implications

7.4.1. No significant asset related implications are anticipated.

7.5. Financial Sustainability Indicators

7.5.1. Budget targets for six of Council’s eight financial sustainability indicators are expected to be achieved in 2017/18. The target for both the asset sustainability ratio and asset consumption ratio are not expected to be met due to impacts from the Roads and Bridges revaluation in 2016-17.

7.5.2. Benchmarks are expected to be achieved (or exceeded) for all financial sustainability indicators.

8. Legal, Risk and Legislative Considerations

8.1. Not Applicable.

9. Delegation

9.1. This matter is delegated to the Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Karelyn Stephens Budget and Reporting Manager |

Peter Jenkins Manager Finance |

|

David Spinks Director Financial Services |

|

Date: 10 May 2018

File Reference: F18/37251; 21-1-1

Attachment a: Financial

Report ending March 2018 ⇩ ![]()

|

Item No. 6.6 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 66 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 93 |

|

|

|

15/5/2018 |

|

6.7 City of Hobart Rates and Charges Policy Amendment - Landfill Rehabilitation Service Charge

Report of the Group Manager Rates and Procurement and Director Financial Services of 10 May 2018 and attachments.

Delegation: Council

|

Item No. 6.7 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 94 |

|

|

15/5/2018 |

|

REPORT TITLE: City of Hobart Rates and Charges Policy Amendment - Landfill Rehabilitation Service Charge

REPORT PROVIDED BY: Group Manager Rates and Procurement

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to seek Council’s approval of an amendment to the City of Hobart Rates and Charges Policy to reflect changes to the City’s landfill rehabilitation service charge, which will take effect from 1 July 2018 until 30 June 2027.

1.2. The amendment to the City’s Rates and Charges Policy will increase transparency and community awareness of the changes to the landfill rehabilitation service charge.

2. Report Summary

2.1. In December 2011, the Local Government Act 1993 (LG Act) was amended to require councils to implement rates and charges policies by 31 August 2012, to provide transparency in decision-making, and to educate their communities about how revenue is raised.

2.2. The Rates and Charges policy is required to be a plain English explanation of the judgements made by the Council to raise revenue for the community.

2.3. The Hobart City Council Rates and Charges Policy was adopted by the Council at its meeting on 27 August 2012, and has been updated four times since then.

2.4. The LG Act requires councils to review their rates and charges policies at a minimum on a four yearly basis or earlier if a change is made.

2.5. At its meeting on 4 December 2017 Council resolved to reduce the amount of the landfill rehabilitation service charge and to amend the period of time the service charge would apply. The City of Hobart Rates and Charges Policy has been updated to reflect these decisions.

2.6. It is proposed that the Council adopt the attached City of Hobart Rates and Charges Policy, as amended, and make copies available to the public in a paper format from the Customer Service Centre and in an electronic format prominently from Council’s website.

|

That: 1. The Council adopt the amended City of Hobart Rates and Charges policy marked as Attachment A to this report. 2. The General Manager be authorised to finalise the City of Hobart Rates and Charges Policy and arrange for it to be made available to the public in a paper format from the Council’s Customer Service Centre and in an electronic format from Council’s website. |

4. Background

4.1. In December 2011, the Local Government Act 1993 (LG Act) was amended to require councils to implement rates and charges policies by 31 August 2012, to provide transparency in decision-making, and to educate their communities about how revenue is raised.

4.2. The Rates and Charges policy is required to be a plain English explanation of the judgements made by the Council to raise revenue for the community.

4.3. At its meeting on 27 August 2012, the Council adopted its Rates and Charges policy. Since then the Council has resolved to amend the policy on four occasions to reflect the limited rates remission delegation to the General Manager, the introduction of the Green Waste Management Service Charge, the legislatively required 4-year review and the introduction of conditions and criteria for the remission of penalty and interest.

4.4. Section 86B(4)(e) of the LG Act states that:

A council must review its rates and charges policy at the same time as, or before, altering the circumstances in which a rate, charge or averaged area rate, or a variation of a rate or charge, is to apply to rateable land.

4.5. At its meeting on 4 December 2017, Council considered a report on the future application of the McRobies Gully Landfill Rehabilitation Levy and resolved the following, that:

The McRobies Gully Landfill Rehabilitation Levy be reduced from $50 to $10 per residential property, and reduced from $100 to $20 per commercial property, commencing 1 July 2018.

The Levy be applied for a period ending on 30 June 2027.

4.6. Pursuant to section 86B(4)(e) of the LG Act, the City of Hobart Rates and Charges Policy has been amended to reflect the Council’s decisions in respect to the changes to the landfill rehabilitation service charge – refer attachment A.

5. Proposal and Implementation

5.1. It is proposed that the City of Hobart Rates and Charges Policy be amended to reflect the changes to the Landfill Rehabilitation Service Charge to take effect from 1 July 2018 until 30 June 2027.

5.2. The opportunity has also been taken to make minor administrative updates to the document.

5.3. It is proposed that the Council adopt the attached City of Hobart Rates and Charges Policy, as amended, and make copies available to the public in a paper format from the Customer Service Centre and in an electronic format prominently from the Council’s website.

6. Strategic Planning and Policy Considerations

6.1. Section 11 of The City of Hobart Rates and Charges policy states that:

6.1.1. Council will exercise its rate recovery powers under the Act in order to reduce the overall rate burden on ratepayers and to better manage the scarce financial resources of the Council. It will be guided by the principles of:

6.1.1.1. Responsibility – making clear the obligation of ratepayers to pay rates.

6.1.1.2. Transparency – making clear the consequences of failing to pay rates.

6.1.1.3. Accountability – ensuring due legal processes are applied to all ratepayers in the recovery process.

6.1.1.4. Capacity to pay – negotiating payment where appropriate.

6.1.1.5. Equity – applying the same treatment for ratepayers with the same circumstances.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. Not applicable.

7.2. Impact on Future Years’ Financial Result

7.2.1. Not applicable.

7.3. Asset Related Implications

7.3.1. Not applicable.

8. Legal, Risk and Legislative Considerations

8.1. These have been considered elsewhere in this report.

9. Delegation

9.1. This matter is delegated to the Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lara MacDonell Group Manager Rates and Procurement |

David Spinks Director Financial Services |

Date: 10 May 2018

File Reference: F18/40619; 22-2-2

Attachment a: Amended

City of Hobart Rates and Charges Policy ⇩ ![]()

|

Item No. 6.7 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 15/5/2018 |

Page 98 ATTACHMENT a |

![]() [Cover Page – to be designed

in-house]

[Cover Page – to be designed

in-house]

Hobart City Council

Rates and Charges Policy

Contents

1. Introduction

2. Relationship between Council’s Strategic Plan, Budget and Rates

2.1 Council’s Vision and Future Directions

2.2 Long-term Financial Management Plan

3. Goal

4. Policy Principles

5. Property Valuation Base

6. Rates and Charges

6.1 General Rate

6.2 Stormwater Removal Service Rate

6.3 Fire Service Rate

6.4 Waste Management Service Charge

6.5 Green Waste Service Charge

6.6 Landfill Rehabilitation Service Charge

7. What Programs and Services does Council provide?

8. Rebate of Rates

9. Rates Remissions

9.1 Pensioner Remissions

9.2 Rate Remissions – Service Rates / Charges

10. Payment of Rates

11. Late Payments

11.1 Sale of Land for Non-Payment of Rates

12. Objection Rights

13. More Information

1. Introduction

Rates and charges are an important revenue source for local government, comprising approximately 65% of the City of Hobart’s (Council’s) annual income. In setting its rates and charges Council has the challenge of balancing the need to fund existing services, the continual demand for increased services, the need to maintain and renew essential infrastructure and the desire to keep increases to rates and charges to a minimum.

Council uses the revenue collected from rates and charges to fund the provision of more than 300 programs and services to the community and provide the infrastructure required and expected of a modern, well serviced Capital City.

This documents sets out the City of Hobart policy for setting and collecting rates from its community and meeting the requirements of Part 9 of the Local Government Act 1993 (the Act).

This Rates and Charges policy will explain:

· The relationship between Council’s Strategic Plan, budget and rates;

· Council’s goal in setting its rates and charges;

· The principles Council uses when setting its rates and charges;

· How Council sets its rates and charges for the year;

· What rates and charges are levied in the Hobart municipal area;

· The services that rates and charges fund for the benefit of the community;

· Rates rebates and remissions;

· How and when to pay rates and the consequences of late payments; and

· Ratepayer objection rights.

The City of Hobart Rates and Charges Policy will be reviewed at least every 4 years by 31 August unless a change occurs that requires Council to amend its Rates and Charges Policy under section 86B(4) of the Act.

2. Relationship between Council’s Strategic Plan, Budget and Rates

The Rates and Charges Policy has been prepared within the context of Council’s strategic planning and reporting framework, which is intended to ensure the best possible results by considering issues and pressures that may affect the community and the level of resources available to achieve the priorities and aspirations. In setting its rates Council gives primary consideration to the long-term vision for the city, (developed in conjunction with residents, business, interest groups, key city stakeholders, young people and students from across the city), strategic directions, financial sustainability and the likely impacts on the community.

The Council has worked with the community to establish a 20 year vision for the city and a set of statements that describe what the city will be like if that vision is achieved.

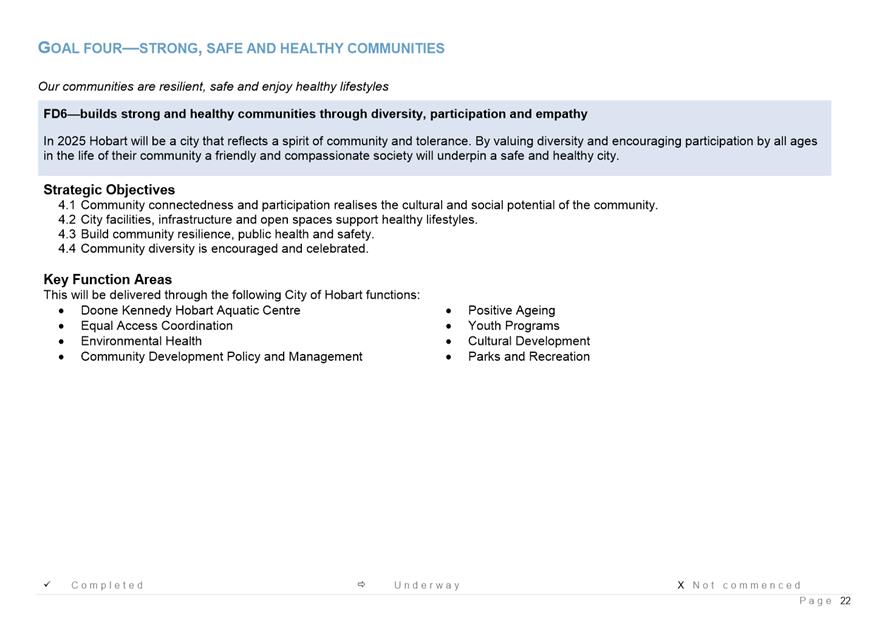

2.1 Council’s Vision and Future Directions

In 2025 Hobart will be a city that: -

· Offers opportunities for all ages and a city for life;

· Is recognised for its natural beauty and quality of environment;

· Is well governed at a regional and community level;

· Achieves good quality development and urban management;

· Is highly accessible through efficient transport options;

· Builds strong and healthy communities through diversity, participation and empathy; and

· Is dynamic, vibrant and culturally expressive.

Offers opportunities for all ages and a city for life

In 2025 Hobart will be a city that provides opportunities for education, employment and fulfilling careers. A city that is able to retain its young people and provide a lifestyle that will encourage all ages to see the city as a desirable location and lifelong home.

Is recognised for its natural beauty and quality of environment

In 2025 Hobart will be a city that respects the natural beauty of Mount Wellington, the Derwent River, the bushland surrounds and waterfront locations. It has worked to enhance the community connection through the protection of views, vistas, access and linkages and the physical environment has been conserved in a manner that will ensure a healthy and attractive city.

Is well governed at a regional and community level

In 2025 Hobart will be a city that works effectively to lead an integrated approach to the planning and development of the metropolitan region. It will create partnerships with governments, the private sector and local communities in achieving significant regional, city and community goals.

Achieves good quality development and urban management

In 2025 Hobart will be a city that remains unique in its own right, protecting its built heritage and history while pursuing quality development, the principles of sustainable cities and the reduction of ecological impacts. It will value access to the waterfront, foreshores, public and open spaces and continues to enjoy the benefits of scale and proximity.

Is highly accessible through efficient transport options

In 2025 Hobart will be a city that maintains its convenience and accessibility through the greater use of transport alternatives and an effective road and travel network.

Improved public transport options, cycle ways and walking tracks linking open spaces for transport and recreation, the availability of adequate parking for commuters and shoppers, the take up of sustainable transport options, the reduction of through traffic and the management of an efficient road network are the result of an integrated approach to transport planning within the city and across the metropolitan region.

Builds strong and healthy communities through diversity, participation and empathy

In 2025 Hobart will be a city that reflects a spirit of community and tolerance. By valuing diversity and encouraging participation by all ages in the life of their community, a friendly and compassionate society will underpin a safe and healthy city.

Is dynamic, vibrant and culturally expressive

In 2025 Hobart will be a city that is a destination of choice and a place for business. Clever thinking and support for creativity will help build a strong economic foundation, and entertainment, arts and cultural activities promote the distinctive character of the city. Lifestyle opportunities and strong communities will ensure a vibrancy and way of life that is Hobart.

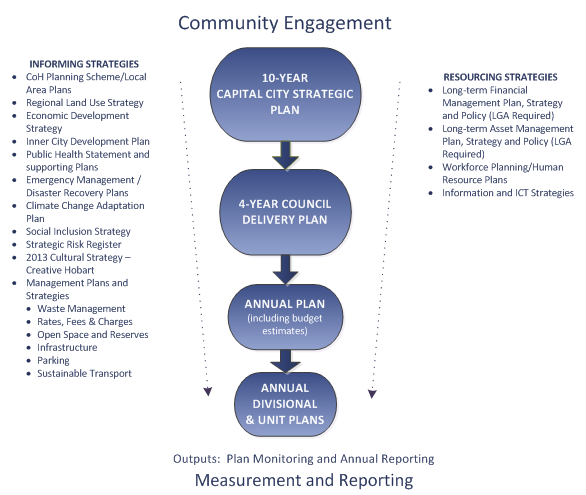

The future directions statements and key strategies underpin the vision and provide the basis for five year strategic plans to be implemented through Council’s Annual Plan. Performance is continually monitored and result documented in an annual report to the community. The framework is outlined in the diagram below:

2.2 Long-term Financial Management Plan

Council’s Long-term Financial Management Plan (LTFMP) provides a plan to resource Council’s future directions outlined above and ensure Council’s financial sustainability in the long-term. Council defines financial sustainability as follows:

“A Council’s long-term financial performance and position is sustainable where planned long-term service and infrastructure levels and standards are met without unplanned increases in rates or disruptive cuts to services.”

Financial sustainability is particularly important for local government because councils hold assets worth in the billions of dollars (large relative to their revenue bases), that have lives of in some cases well over 100 years.

Council has $1.4 billion in physical assets, managed through Asset Management Plans, including buildings, parks infrastructure, plant, vehicles and equipment, playground equipment, road infrastructure, stormwater infrastructure and The Doone Kennedy Hobart Aquatic Centre. The expected life of Council’s infrastructure assets varies from 10 years for plant and vehicles to 160 years for buildings. It is important for Council to adequately fund asset management to ensure its assets achieve their full expected service life but can also be renewed without incurring large rates increases in the future.

Council’s LTFMP is used in the preparation of its annual budget and Council’s rates and charges policy is prepared within its context. Information on how rates and charges are calculated is included in section 5 and 6.

3. Goal

Council’s goal in raising rates and charges is to ensure a sufficient revenue base for Council to:

· Continue to provide existing activities, programs and services to the community.

· Provide new or expanded services to the community.

· Ensure a balanced budget and provide a strong financial basis for effective management of expenditure programs to provide for both current and future community requirements.

· Encourage a strong, growing and sustainable local economy with appropriate levels of infrastructure assets and facilities.

· Provide certainty of funding for the provision of infrastructure identified by Council in its Long-term Financial Management Plan and Asset Management Plans.

4. Policy Principles

· In adopting its Rates and Charges Policy and making decisions concerning the making of rates, Council has taken into account the following pursuant to section 86A(1) of the Act:

·

(a) rates constitute taxation for the purposes of local government, rather than a fee for a service; and

·

(b) the value of rateable land is an indicator of the capacity of the ratepayer in respect of that land to pay rates.

·

Council currently raises revenue for the vast majority of its services through the Assessed Annual Value (AAV) rating system and not through a user pays pricing system. Council’s rating system does not separate those aspects of a particular service that may have a public benefit from those that have a more private benefit such as a kerbside waste collection.

Council rates are based on property values and are therefore a property tax. Generally the Act expects that the higher the value of the property the higher the rates to be paid.

·

· Council determines rates and charges after due consideration of the following:

· The principles of taxation outlined in section 86A(1) of the Act, outlined above.

· The objectives, strategies and actions outlined in the Council’s Strategic Plan, Annual Plan and Long-term Financial Management Plan.

· Council’s legislative obligations.

· The needs and expectations of the general community.

· The level of the cost of maintaining existing facilities and necessary services.

· The need for additional services and facilities.

In setting its policy on rates and charges, Council has applied the following principles of taxation:

· Equity –by taking into account the different levels of capacity to pay within the local community;

· Benefit – by recognising that Council services benefit the community as a whole.

· Simplicity – by using a rating system that is simple and cost effective to administer.

· Sustainability – by making revenue decisions that support the financial strategies for the delivery of infrastructure and services identified in Council’s Long-term Financial Management Plan and Asset Management Plans.

· Effectiveness / efficiency – by meeting the financial, social, economic and environmental, and other strategic objectives outlined in Council’s Strategic Plan.

· Transparency – by being open in the processes involved in the making of rates and charges.

· Timeliness – by ensuring all ratepayers are given adequate notice of their liability to pay rates and charges.

· Flexibility – by responding where possible to unforseen changes in the economy.

· Compliance – by complying with the requirements and intent of relevant legislation.

5. Property Valuation Base

Under section 89A of the Act Council has the choice of three bases of value of land:

· Land Value – the value of the property excluding all visible improvements such as buildings, structure, fixtures, roads, etc.

· Capital Value - the total value of the property, excluding plant and machinery and includes the land value; or

· Assessed Annual Value (AAV) - the estimated yearly rental value of the property, excluding GST, council rates and land tax, but is not to be less than 4% of the capital value of the property.

Council uses the AAV of a property as a basis for valuing land in the municipal area. While some Tasmanian councils have recently adopted Capital Value as their valuation base, AAV is the most widely used property valuation base in Tasmania and has been used by Council since the 1850s. The AAV method of valuing land reflects the property usage and notional income earning capacity of the property and therefore addresses the equity principle of taxation by determining ratepayers of similar wealth and calculating similar rates and determining that ratepayers of greater wealth pay more rates than ratepayers of lesser wealth. Although expressed in terms of a notional rental value, the AAV has the same effect as an implied return on investment for the property with a minimum level of 4 percent.

Adoption of Valuations

Setting rates based on property values, whether on land value, capital value or the assessed annual value (AAV) as determined by the Valuer-General, is a requirement of the Local Government Act 1993.

Under the Valuation of Land Act 2001 the Valuer-General must determine the land value, capital value and assessed annual value of each property in the Hobart municipal area and provide this information to Council. Council has no role in the process of determining the valuations ascribed to individual properties.

Council adopts the valuations made by the Valuer-General as provided to the Council and uses the valuation of each property as the basis for calculating the rates on that property.

All land within the Hobart municipality is rateable except for land specifically exempt under section 87 of the Act.

Ratepayers are encouraged to contact the Office of the Valuer General if they have any objections in relation to their property valuation.

6. Rates and Charges

Rates and charges are calculated each year during Council’s budget process. The budget process involves Council setting its priorities and expenditure levels to enable the key strategic objectives outlined in Council’s Annual Plan to be implemented.

Through the budget process Council also specifies its capital requirements to renew infrastructure assets, plant and equipment and create new essential infrastructure for the City; as well as the community programs and services it will provide in the next financial year; and how much these will cost.

A Council budget also estimates the revenue to be collected from other sources such as parking fines, Commonwealth and State grants, distributions from Council’s ownership interest in TasWater, rents, interest income and parking and other fees and charges. Using these estimates Council determines the amount of revenue it needs to collect in rates revenue to meets its financial responsibilities for the coming year.

Council uses property values as the basis for calculating how much each property owner pays in rates. Property values are not calculated by Council; they are provided to Council by the Office of the Valuer-General.

After identifying how much it needs to collect in rates and charges, Council calculates the total amount required to fund waste management services, stormwater services, the State Government fire levy and landfill rehabilitation services leaving the balance required from General Rates.

Generally, the rate in the dollar is calculated by dividing the amount of money Council needs to raise to provide programs and services by the total $AAV of all rateable properties in the Hobart municipal area.

The rate in the dollar is then multiplied by the value of a property, using the Assessed Annual Value, to establish the amount to be paid by each property owner.

Example:

The total AAV of rateable properties within the municipality is $600,000,000 and Council needs to collect $44,000,000 in rates. The rate in the dollar is 7.33 cents (44,000,000 ÷ 600,000,000). The annual rates payable on a property with an AAV of 18,800 would be $1,378.04.

Council sets its budget annually to ensure it raises the budgeted amount required. Valuations do not determine the rates income of a Council, and as a result, Councils do not gain windfalls from valuation increases and an increase in property values does not cause a rate rise.

Council has adopted a simple rating structure by having one rate in the dollar for all properties. Council raises its rates and charges through the following:

6.1 General Rate

Pursuant to section 90 of the Act, the General Rate is levied on all rateable properties within the Hobart municipality and provides revenue to fund over 300 Council programs and services, except those related to Council’s stormwater removal services, waste management services, landfill rehabilitation services and the State Government fire levy. More information on the programs and services funded through General Rates is provided in section 7 below.

6.2 Stormwater Removal Service Rate

Pursuant to section 93 of the Act, the Stormwater Removal Service Rate is levied on all rateable properties within the Hobart municipal area. It provides revenue that covers the operation and maintenance of the piped and non-piped stormwater systems and the waterways, which includes major rivulets and a host of minor watercourses.

In addition this revenue funds Council’s flood management activities and provides for the replacement of elements of the stormwater and waterways asset base. This includes the kerb and guttering and underground stormwater pipes along Council’s roads and the general maintenance of Council’s rivulet’s and their tributaries. As such these services have a public and community-wide benefit.

The Stormwater Removal Service Rate also contributes towards stormwater works in all roads, which allows residents to travel along those roads safely during rainfall.

Council also has in place litter traps within stormwater systems and waterways to limit the amount of pollution entering the River Derwent.

6.3 Fire Service Rate

Pursuant to the Fire Services Act 1979, local government acts as a collection agent for this State Government tax, which is paid directly to the State Fire Commission.

Council has no control over the level of the Fire Service Rate. It is required to collect this revenue on behalf of the State Government which is then passed onto the Tasmanian Fire Service.

The State Fire Commission identifies 3 districts for the Hobart municipality, being:

· Fern Tree Volunteer Brigade Rating District;

· Permanent Brigade Rating District; and

· General Land.

There is a different fire service rate for each district, which is achieved through rates remissions.

6.4 Waste Management Service Charge

Pursuant to section 94 of the Act, the Waste Management Service Charge is levied on all rateable properties within the Hobart municipal area.

In addition to the standard kerbside waste and recycling collections, the waste management service charge provides revenue that covers a number of activities with a more general benefit such as solid waste minimisation initiatives and contributions to a range of recycling initiatives, which have a public and community-wide benefit.