City

of hobart

AGENDA

Special Finance Committee Meeting

Open Portion

Tuesday, 27 June 2017

at 5.00 pm

Lady Osborne Room, Town Hall

City

of hobart

AGENDA

Special Finance Committee Meeting

Open Portion

Tuesday, 27 June 2017

at 5.00 pm

Lady Osborne Room, Town Hall

THE MISSION

Our mission is to ensure good governance of our capital City.

THE VALUES

The Council is:

|

about people |

We value people – our community, our customers and colleagues. |

|

professional |

We take pride in our work. |

|

enterprising |

We look for ways to create value. |

|

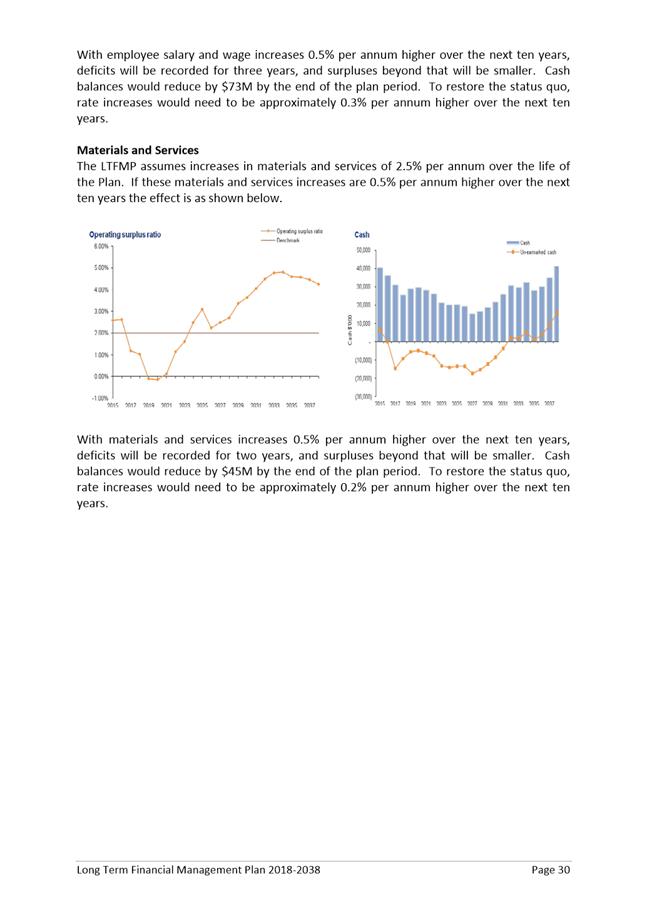

responsive |

We’re accessible and focused on service. |

|

inclusive |

We respect diversity in people and ideas. |

|

making a difference |

We recognise that everything we do shapes Hobart’s future. |

|

|

Agenda (Open Portion) Special Finance Committee Meeting |

Page 3 |

|

|

27/6/2017 |

|

Business listed on the agenda is to be conducted in the order in which it is set out, unless the committee by simple majority determines otherwise.

APOLOGIES AND LEAVE OF ABSENCE

1. Co-Option of a Committee Member in the event of a vacancy

2. Indications of Pecuniary and Conflicts of Interest

4.1 Budget Estimates 2017/2018

6. Closed Portion Of The Meeting

|

|

Agenda (Open Portion) Special Finance Committee Meeting |

Page 4 |

|

|

27/6/2017 |

|

Special Finance Committee Meeting (Open Portion) held Tuesday, 27 June 2017 at 5.00 pm in the Lady Osborne Room, Town Hall.

|

COMMITTEE MEMBERS Thomas (Chairman) Deputy Lord Mayor Christie Zucco Ruzicka Sexton

ALDERMEN Cocker Lord Mayor Hickey Briscoe Burnet Reynolds Denison Harvey |

Apologies: Nil.

Leave of Absence: Nil.

|

1. Co-Option of a Committee Member in the event of a vacancy

Ref: Part 2, Regulation 8(7) of the Local Government (Meeting Procedures) Regulations 2015.

Aldermen are requested to indicate where they may have any pecuniary or conflict of interest in respect to any matter appearing on the agenda, or any supplementary item to the agenda, which the committee has resolved to deal with.

Regulation 15 of the Local Government (Meeting Procedures) Regulations 2015.

A committee may close a part of a meeting to the public where a matter to be discussed falls within 15(2) of the above regulations.

In the event that the committee transfer an item to the closed portion, the reasons for doing so should be stated.

Are there any items which should be transferred from this agenda to the closed portion of the agenda, or from the closed to the open portion of the agenda?

|

Agenda (Open Portion) Special Finance Committee Meeting |

Page 5 |

|

|

|

27/6/2017 |

|

4.1 Budget Estimates 2017/2018

File Ref: F17/58061

Report of the Director Financial Services and Manager Finance of 23 June 2017 and attachments.

Delegation: Council

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting |

Page 7 |

|

|

27/6/2017 |

|

REPORT TITLE: Budget Estimates 2017/2018

REPORT PROVIDED BY: Director Financial Services

Manager Finance

1. Report Purpose and Community Benefit

1.1. The purpose if this report is to present the City’s 2017/18 Estimates and Annual Plan for considerations. It is proposed the Estimates be formally adopted at the Council meeting on 3 July 2017.

2. Report Summary

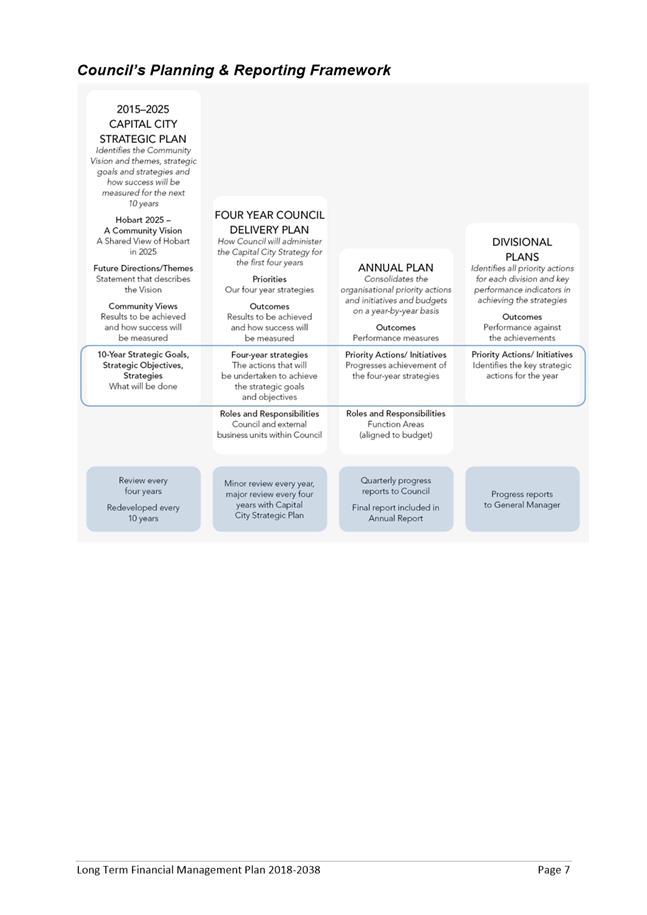

2.1. This report presents the City’s 2017/18 Estimates and Annual Plan together with the Long Term Financial Management Plan 2018 – 2038.

2.2. The Estimates propose a 3.25% increase in rates to fund the increased cost of providing services.

2.3. In total, rates revenue will increase by $3.57M over the previous year resulting from an increase in rates to fund the increased cost of providing services, an increase in the Tasmanian Government Fire Service Levy and growth in the rate base.

2.4. It is proposed that the 2017/18 Estimates, 2017-2018 Annual Plan, and Long Term Financial Management Plan 2018-2038 be formally adopted at the Council meeting on 3 July 2017.

|

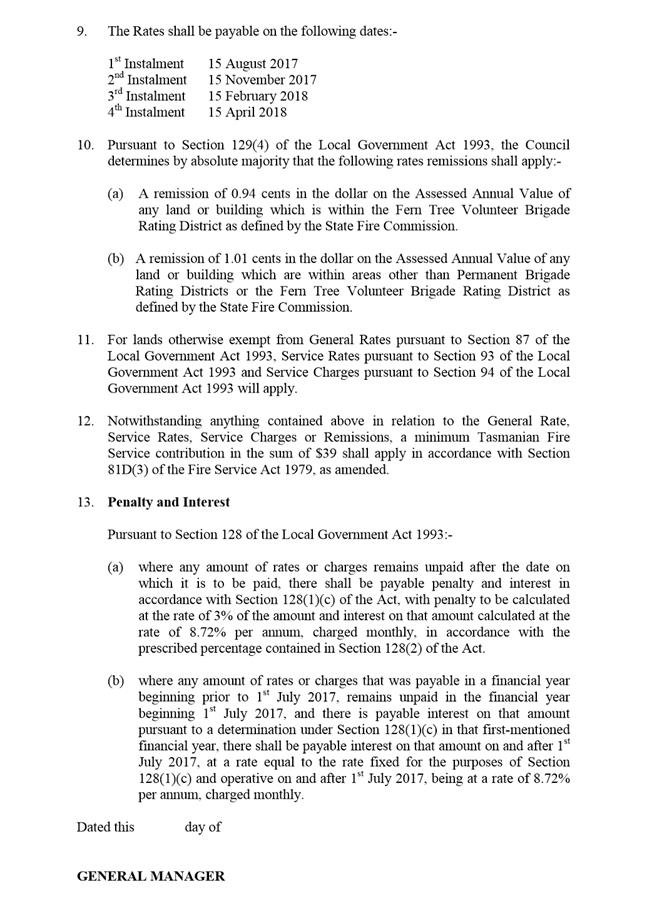

That: 1. The expenses, revenues, capital expenditure, and plant and equipment expenditure detailed in the document ‘City of Hobart, Budget Estimates, for the 2017-2018 Financial Year’ be approved. 2. New borrowings of up to $20M be approved for infrastructure. 3. The Council delegate to the General Manager the power to enter into loan agreements to source the above borrowings on the most favourable terms. 4. The General Rate be 7.75 cents in the dollar of assessed annual value (AAV). 5. The following Service Rates be made: (i) A Stormwater Removal Service Rate of 0.47 cents in the dollar of AAV; and (ii) A Fire Service Rate of 1.30 cents in the dollar of AAV. 6. A Waste Management Service Charge be made and varied according to the use or predominant use of land as follows: (i) A Service charge of $250 to apply to residential properties; (ii) A Service charge of $500 to apply to non-residential properties; 7. A Waste Management Service Charge of $50 be made for kerbside green waste collection for all rateable land within the municipal area to which Council supplies or makes available a green waste collection service utilising a green waste collection bin. 8. A Landfill Rehabilitation Service Charge be made and varied according to the use or predominant use of land as follows: (i) A Service charge of $50 to apply to residential properties; (ii) A Service charge of $100 to apply to non-residential properties. 9. The rates be subject to the following remissions: (i) A remission of 0.94 cents in the dollar on the AAV of any land or building which is within the Fern Tree Volunteer Brigade Rating District as defined by the State Fire Commission. (ii) A remission of 1.01 cents in the dollar on the AAV of any land or building which is within areas other than Permanent Brigade Rating Districts or the Fern Tree Volunteer Brigade Rating District as defined by the State Fire Commission. 10. Unspent 2016/17 capital funding be carried-forward into 2017/18, with any necessary adjustments to be made in the September 2017 quarter financial report to Council. 11. The interest rate on unpaid rates be 8.72% per annum, charged monthly. 12. The 2017-2018 Annual Plan be adopted. 13. The Long Term Financial Management plan 2018-2038 be adopted. 14. The following delegations be approved: (i) Pursuant to Section 22 of the Local Government Act 1993, the Council delegate to the General Manager the power to expend monies on Council’s behalf identified as Delegation Classification 1 items in the Council’s Annual Plan; and, the Council authorise the General Manager to delegate, pursuant Section 64 of the Local Government Act 1993, to such employees of the Council as he considers appropriate, the power to expend monies on Council’s behalf identified as Delegation Classification 1 items in the Council’s Annual Plan. (ii) Pursuant to Section 22 of the Local Government Act 1993, the Council delegate to all the Council Committees the power to expend monies on Council’s behalf identified as Delegation Classification 2 items in the Council’s Annual Plan.

|

4. Background

4.1. The budget process for 2017/18 has included workshops/briefings with Aldermen and Committee/Council meetings on 21 March, 11 April, 24 April, 16 May and 5 June to discuss matters impacting on the 2017/18 Estimates and the 10 year capital works program.

4.2. The Estimates have now been drafted and are presented for consideration.

4.3. The Estimates propose a 3.25% increase in rates to fund the increased cost of providing services.

Estimates Preparation

4.4. The Estimates documents comprise:

4.4.1. This report;

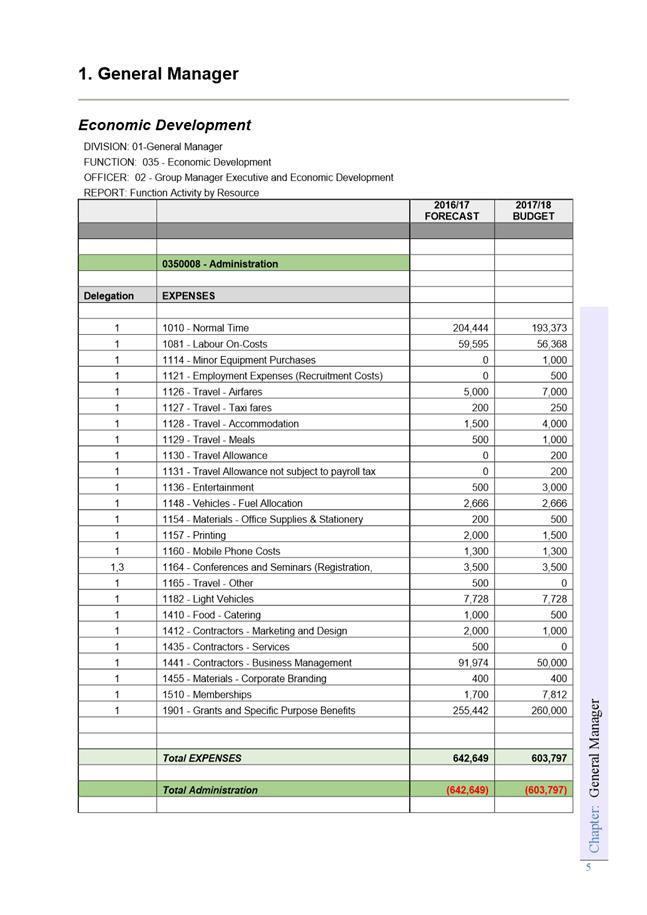

4.4.2. A separate document – ‘City of Hobart, Budget Estimates for the 2017-2018 Financial Year’, which is attached – refer Attachment A. This document contains discussion of all elements comprising the Estimates.

4.4.3. The Annual Plan for the 2017-2018 Financial Year, which is attached – refer Attachment B. This document is required pursuant to Section 71 of the Local Government Act 1993. It is required to set out how the objectives of Council’s Strategic Plan are to be met, including a summary of the Estimates adopted, and is to be formally adopted by the Council; and

4.4.4. The updated Long-Term Financial Management Plan 2018-2038 (LTFMP), which is attached – refer Attachment C.

Estimates Overview

4.5. The Estimates propose a 3.25% increase in the rates to fund the increased cost of providing services.

4.6. In total, rates revenue will be $81.48M, an increase of $3.57M over the previous year. Growth in the rate base contributes $0.56M and an increase in the fire protection service rate (to fund the increase in the State Government Fire Service Levy which is collected by Council on behalf of the Tasmanian Government) contributes $0.5M.

4.7. This increase is comprised of; -

4.7.1. An increase in the total cents in the dollar of Assesed Annual Values (AAV) from 9.41 cents to 9.52 cents;

4.7.2. Increases in waste management service charges, from $245 to $250 for residential properties and from $490 to $500 for non-residential properties;

4.7.3. A landfill rehabilitation service charge of $50 for residential properties and $100 for non-residential properties. These amounts are unchanged from the previous year but will be reviewed during 2017/18; and

4.7.4. A kerbside greenwaste collection service charge of $50 for properties meeting certain criteria within the municipal area to which Council supplies or makes available a green waste collection service utilising a green waste collection bin. This amount is unchanged from the previous year.

Property Valuation Adjustment Factors (Indexation)

4.8. Pursuant to the Valuation of Land Act 2001, AAVs are adjusted every two years according to adjustment factors published by the Valuer-General. The Valuer-General has recently published AAV adjustment factors to apply from 1 July 2017.

4.9. While AAV indexation does not directly impact the Estimates, it does impact the distribution of the rate burden, and the impact on individual ratepayers will vary.

4.10. The Valuer-General last published adjustment factors to apply from 1 July 2013. These resulted in an overall shift in the rate burden from the non-residential sector to the residential sector. Residential properties therefore experienced higher rate increases than non-residential properties in 2013-14.

4.11. A full revaluation which applied from 1 July 2015 saw the opposite effect - an overall shift in the rate burden from the residential sector to the non-residential sector. Consequently, most non-residential properties experienced rate increases in 2015-16, but most residential properties received rate reductions.

4.12. In general terms, AAV indexation to apply from 1 July 2017 will result in a shift in the rate burden from non-residential properties to residential properties. Residential properties will therefore pay more, and non-residential properties will pay less.

Effects on Ratepayers

4.13. The combination of amounts which vary according to property value (rates) and amounts which do not vary according to property value (charges) results in differing impacts across the rate base.

4.14. The Estimates propose a 3.25% increase in the rates to fund the Council’s increased cost of providing services.

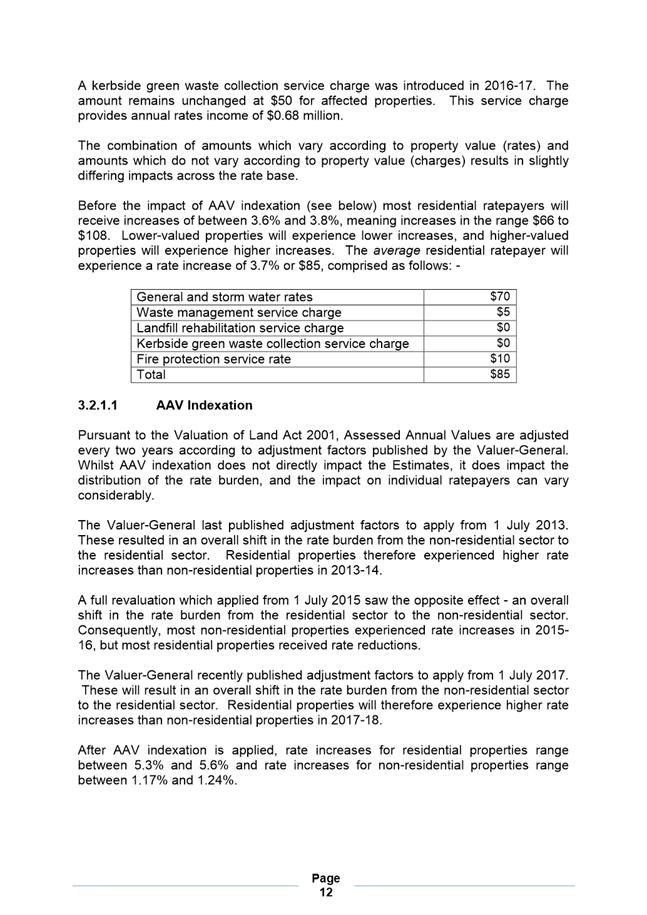

4.15. Including the fire levy, but before the impact of AAV indexation, most residential properties will receive rate increases of between 3.6% and 3.8%, meaning increases in the range $66 to $108. Most non-residential properties will receive rate increases of between 3.8% and 4.1%.

4.16. Including the fire levy, and after indexation is applied, most residential properties will receive rate increases of between 5.3% and 5.6%, meaning increases in the range $100 to $160. Most non-residential properties will receive rate increases of between 1.17% and 1.24%.

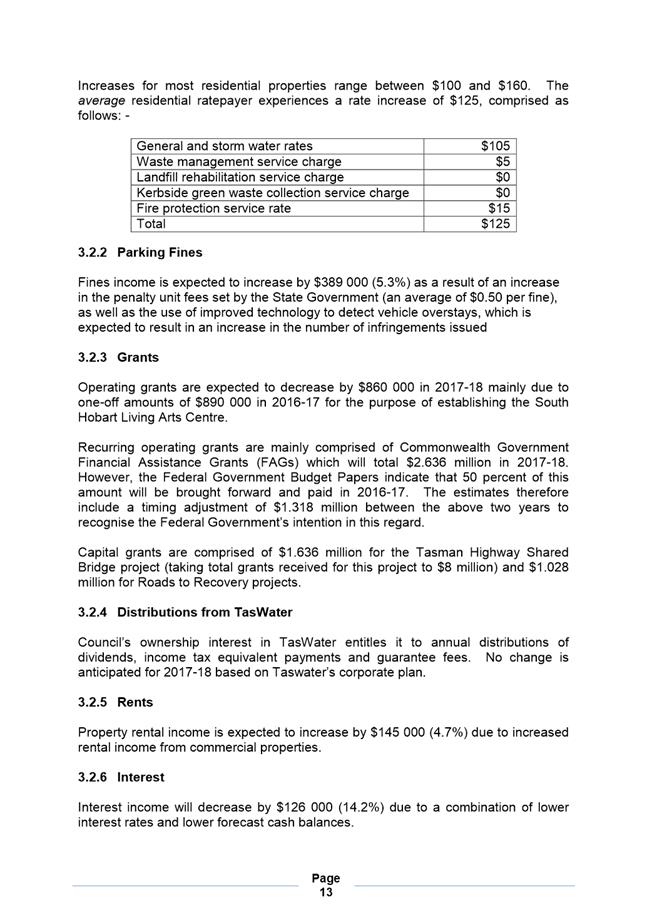

4.17. Therefore, the impact of indexation for most residential properties has been between $34 and $52, with the impact on the average resident being $40.

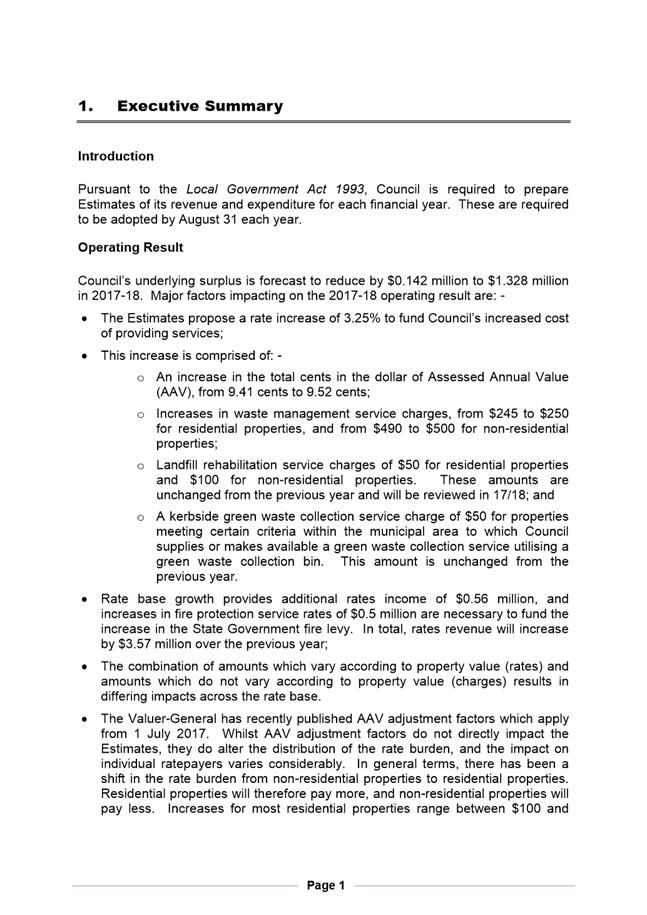

4.18. A residential property with an AAV of $21,463 (average residential ratepayer) will experience an annual rate increase of $125, comprised as follows:

· General and stormwater rates, $105

· Waste Management service charge $5

· Fire protection service rate, $15

4.19. The Fire Services Contribution which Council is obliged to pay to the Tasmanian Fire Service has increased by 5.5% ($0.535M). Pursuant to the Fire Service Act 1979, local government acts as a collection agent for this levy, which is then paid directly to the State Fire Commission.

4.20. The 2017/18 rate resolution is attached – refer Attachment D.

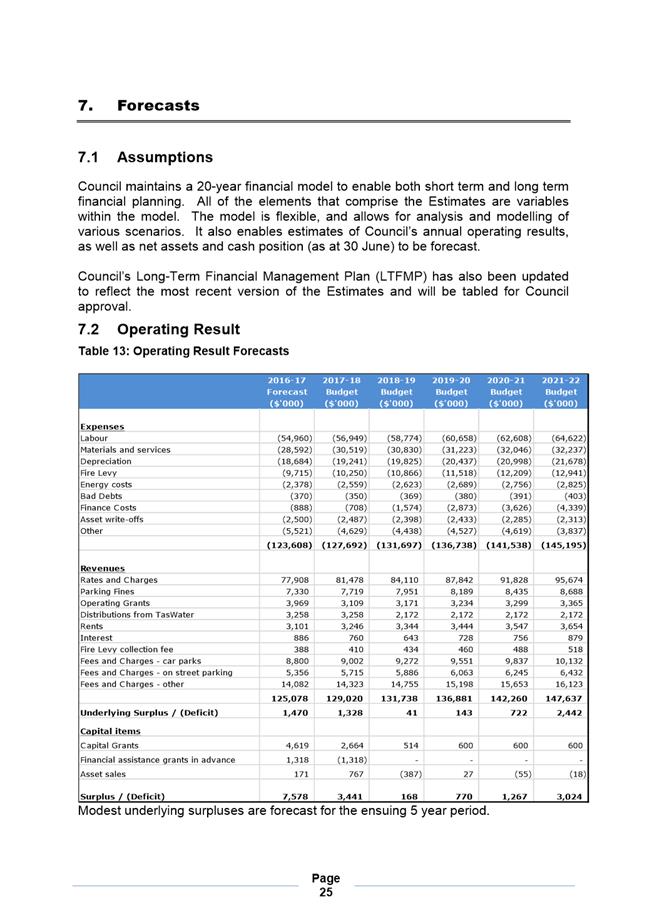

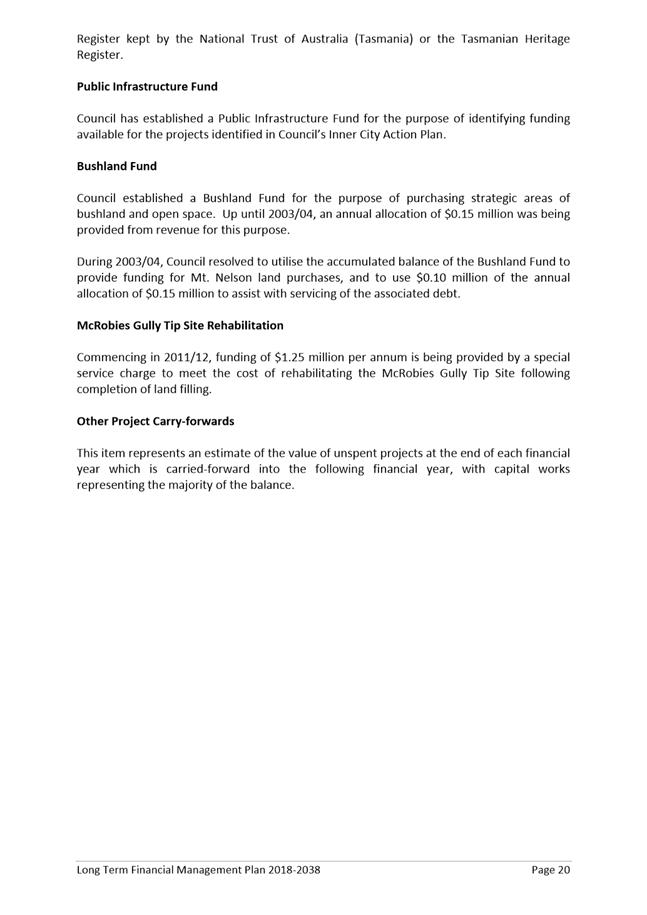

Operating Result

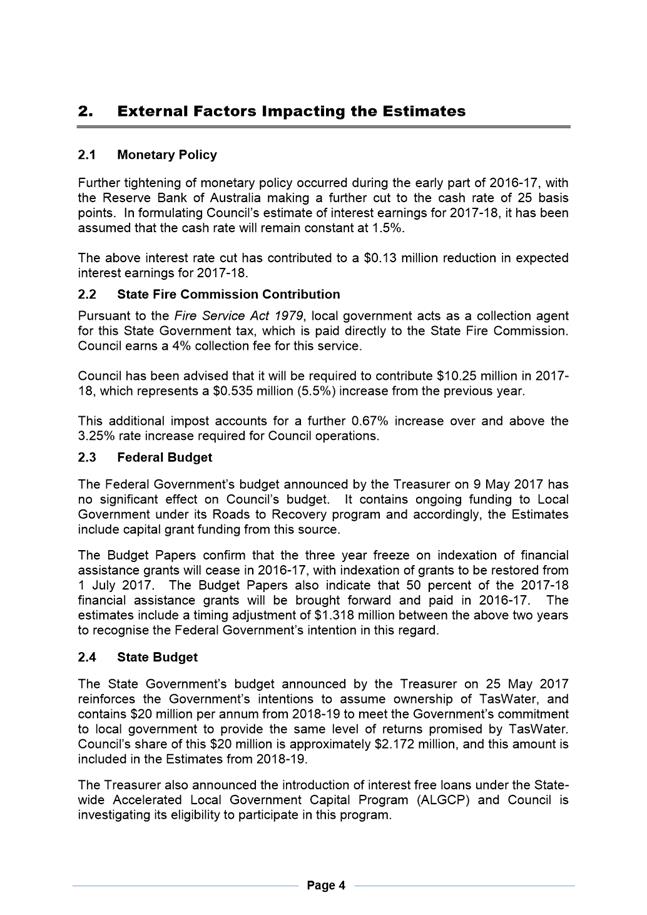

4.21. Greater detail is contained within the Budget Estimates document, however some factors impacting on Council’s forecast underlying surplus of $1.3M are:

4.21.1. An increase in rates and charges income of $3.57M as discussed above;

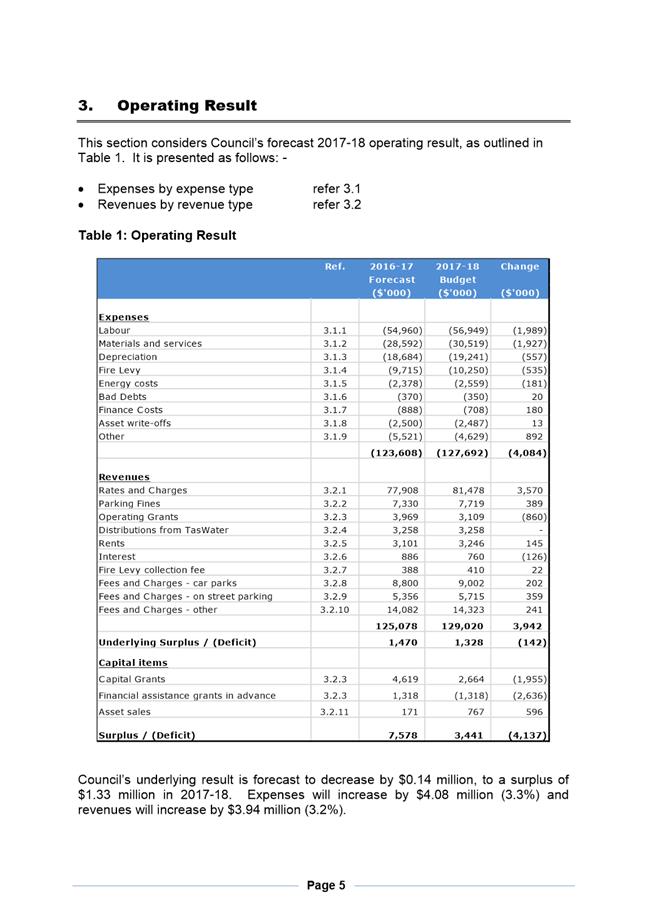

4.21.2. An increase in labour costs of $1.99M (3.6%) from the revised 2016-17 budget, which includes an enterprise bargaining increase of 2.4%;

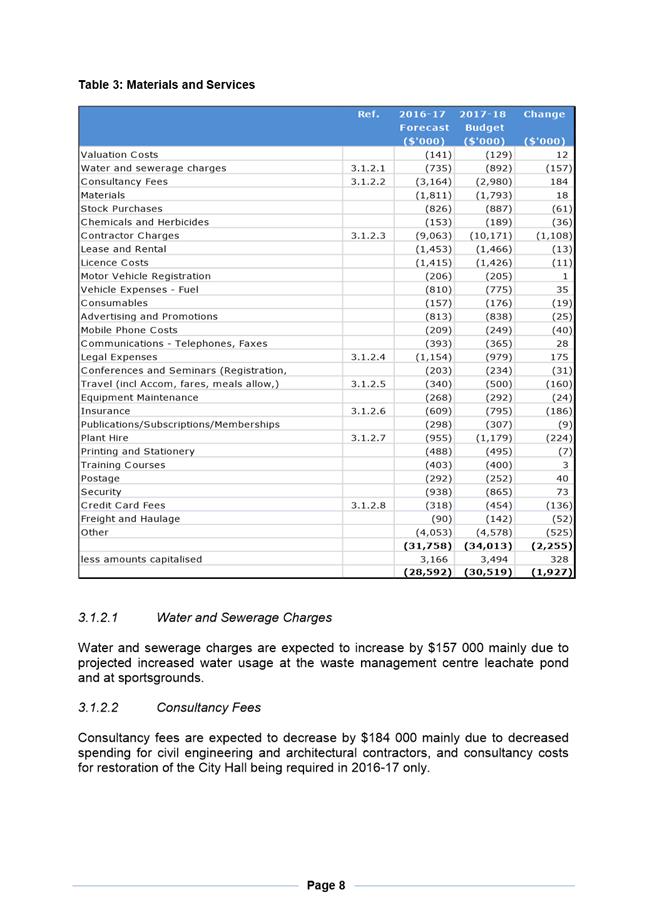

4.21.3. An increase in materials and services costs of $1.93M (6.7%) mainly due to increases in contractor charges for various works, including additional road maintenance works;

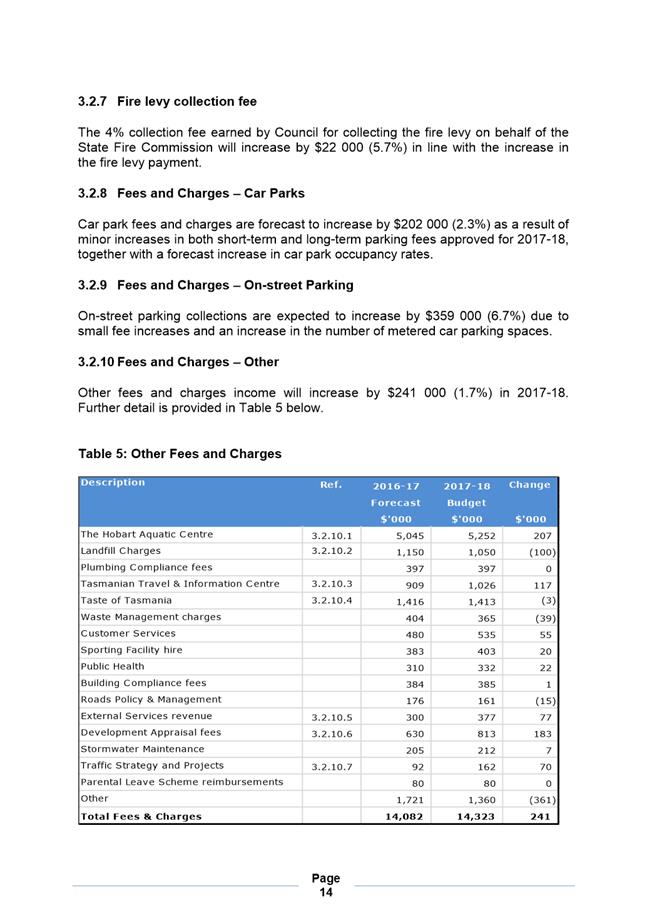

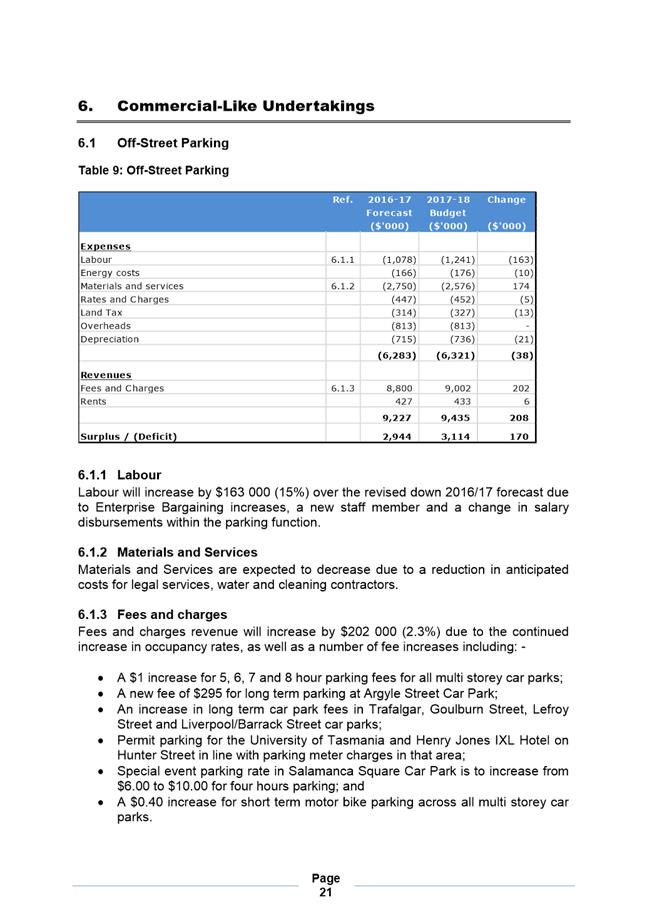

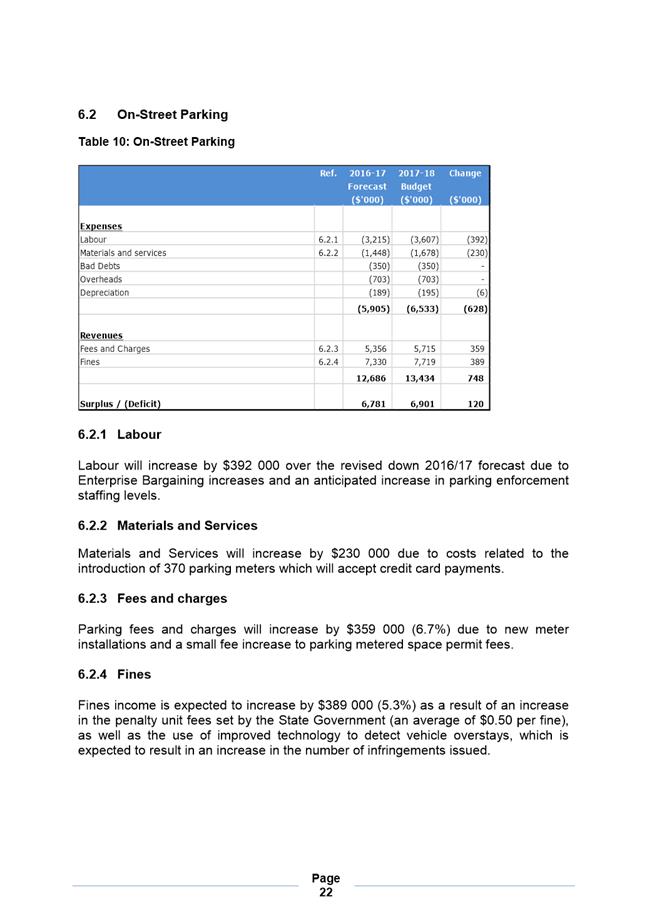

4.21.4. Increases in parking fines, fees and charges of $0.95M (4.4%);

4.21.5. An increase in energy costs of $0.18M (7.6%) mainly due to significant increases in electricity prices;

4.21.6. An increase in property rental income of $0.145M (4.7%);

4.21.7. An expected increase in depreciation expenses of $0.56M (3%) due to Council’s rolling program of asset revaluations;

4.21.8. An increase in the State Government fire levy of $0.54M (5.5%);

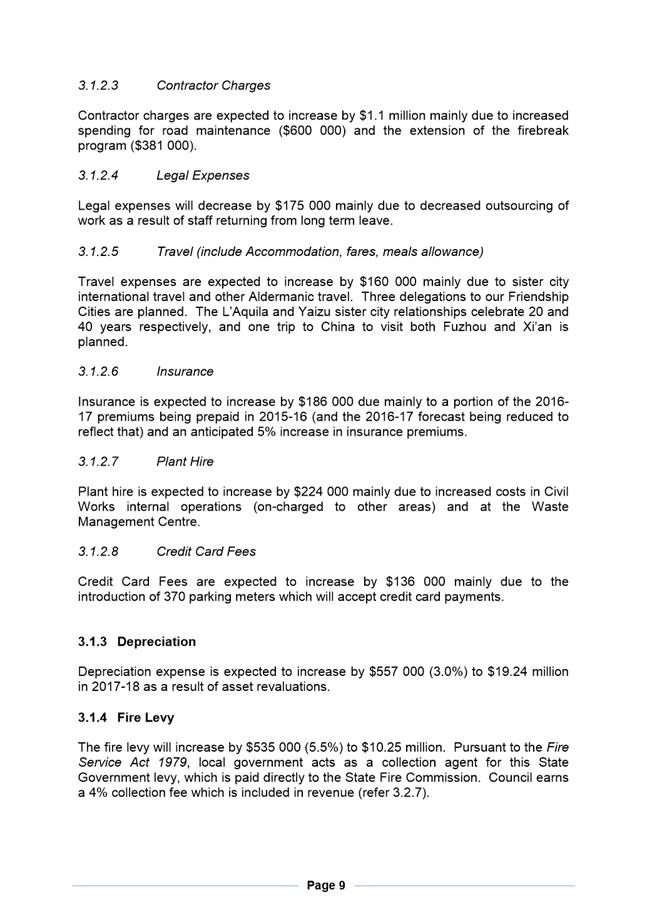

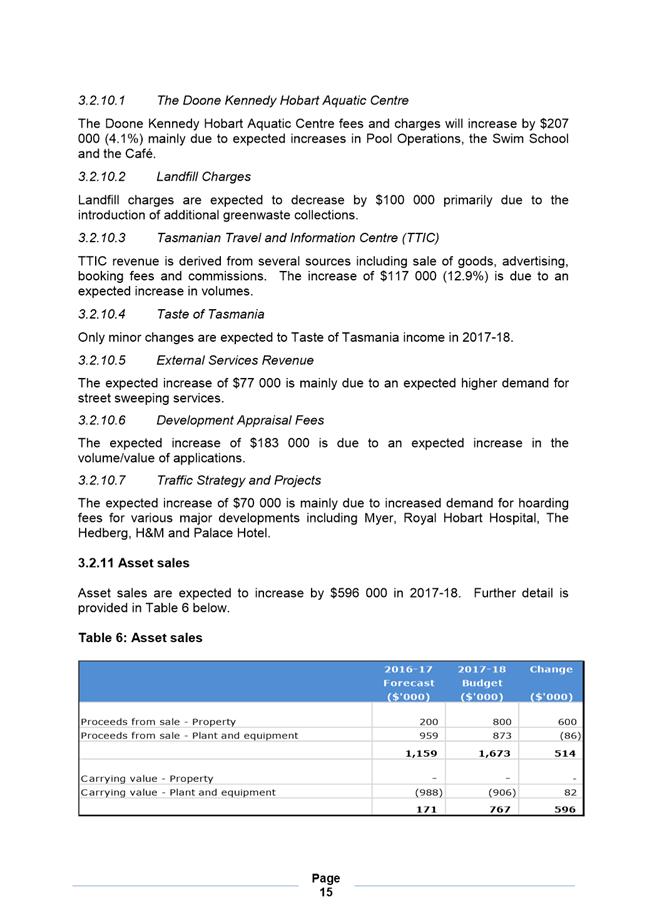

4.21.9. A further payment of $0.875M associated with the Myer site redevelopment; and

4.21.10. A reduction in interest revenue of $0.13M (14.2%).

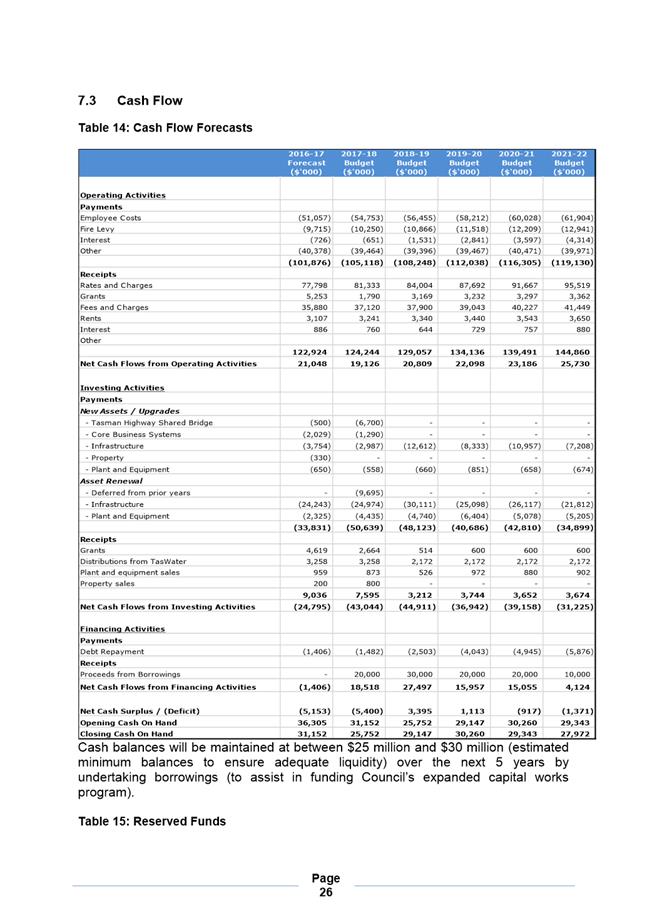

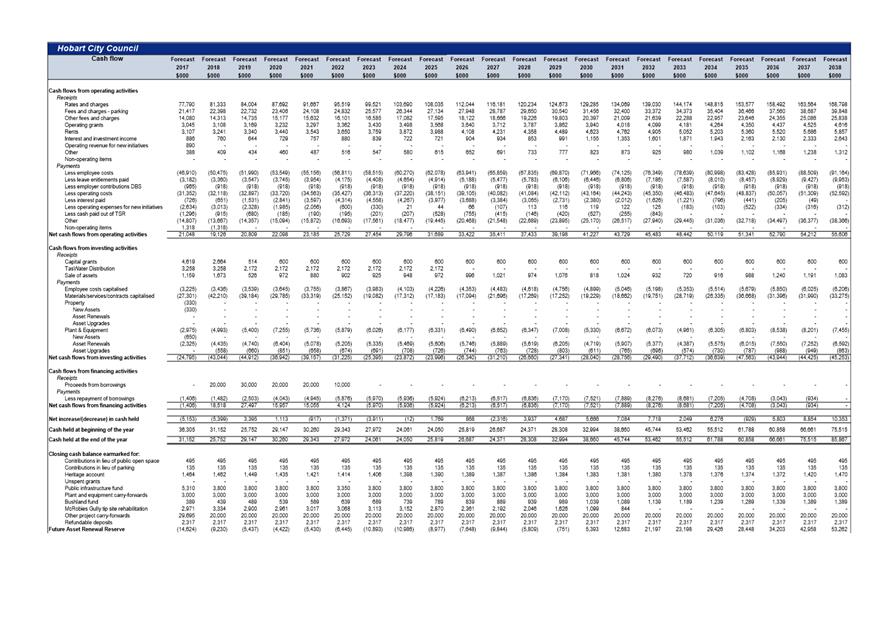

Cash Flows

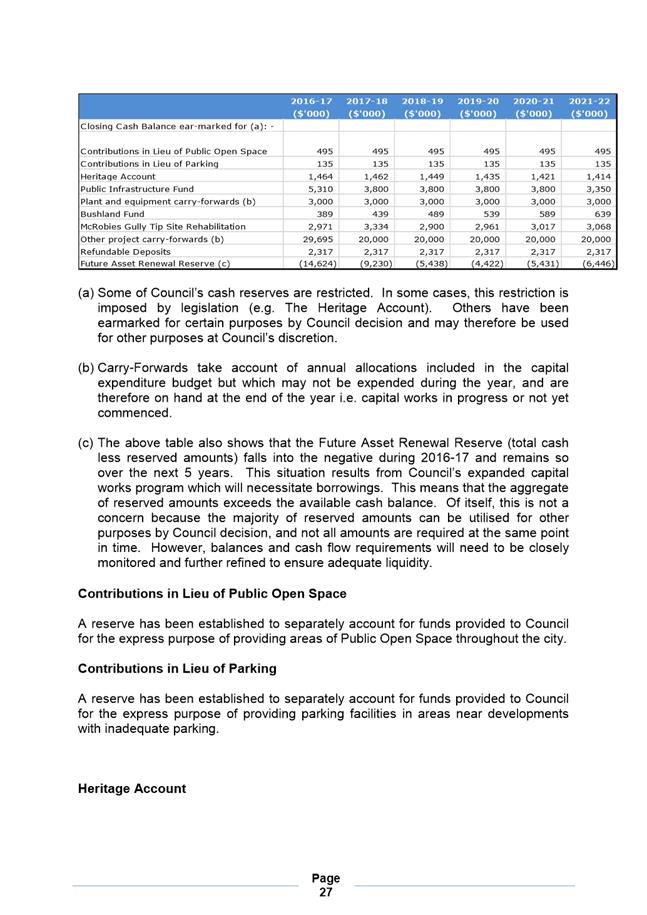

4.22. Council’s cash balance is forecast to reduce by $5.4M from $31.15M at 30 June 2017 to $25.75M at 30 June 2018.

4.23. Cash provided by operating activities will decrease by $1.9M, from $21M to $19.1M but this is due to the bring-forward of Commonwealth financial assistance grants from 2017/18 into 2016/17.

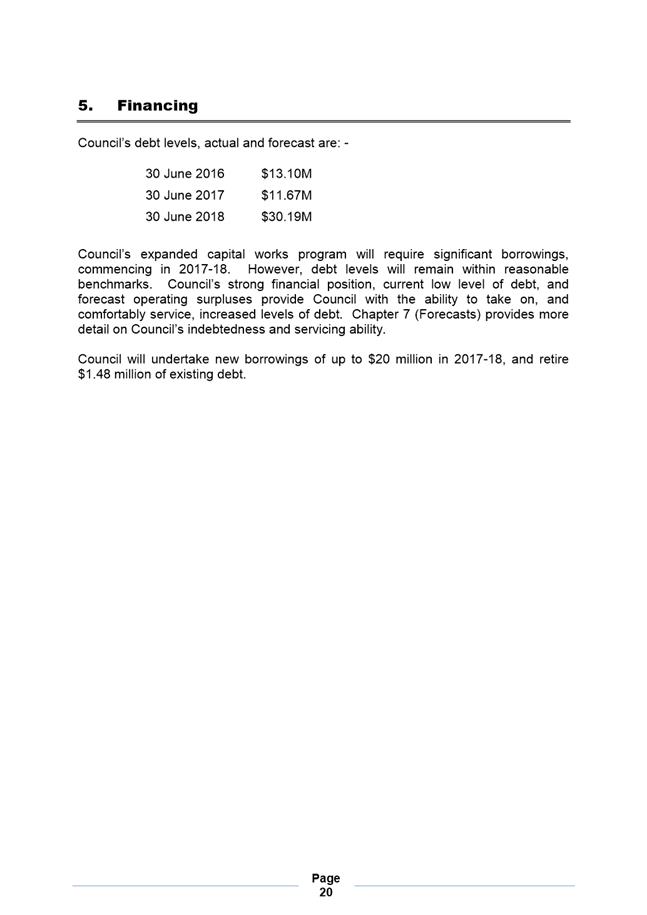

Financing

4.24. New borrowings of up to $20M will be undertaken in 2017/18, and existing debt of $1.48M will be retired.

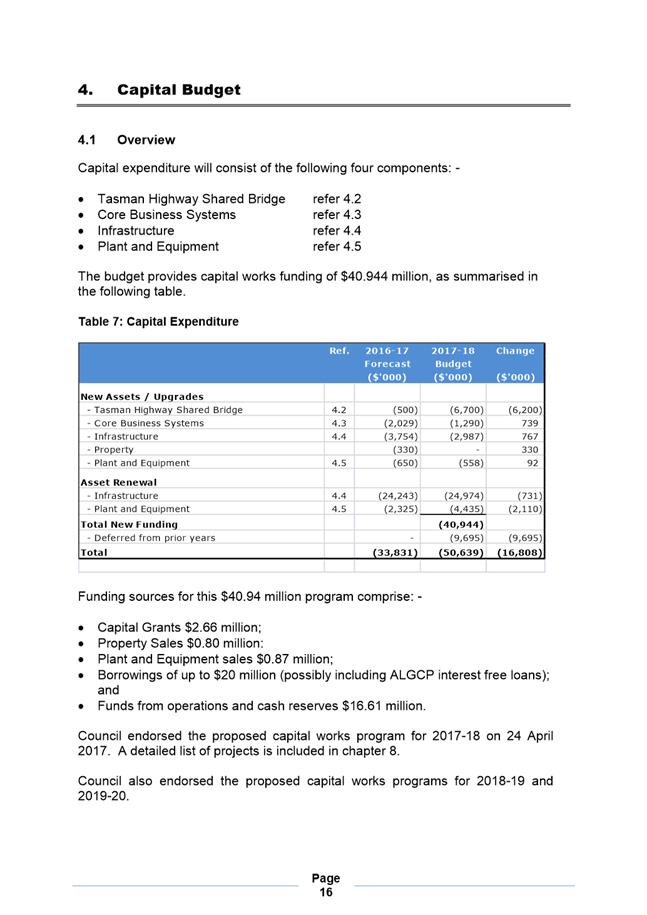

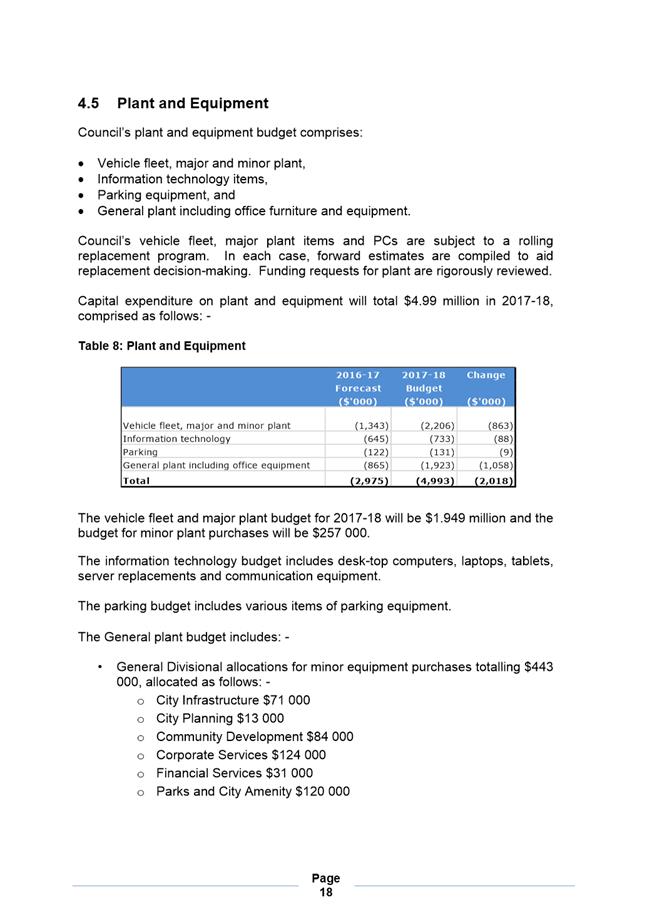

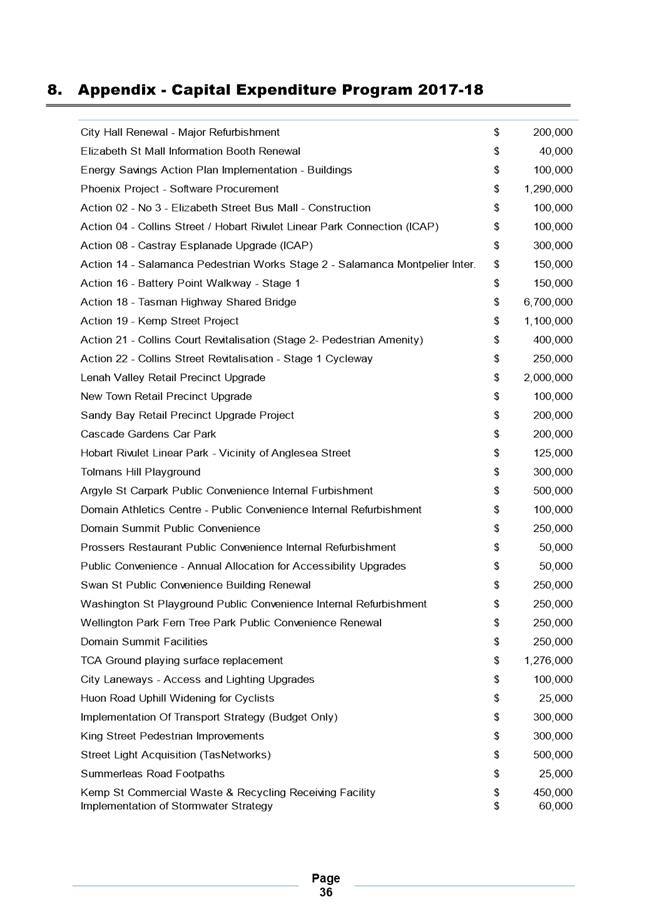

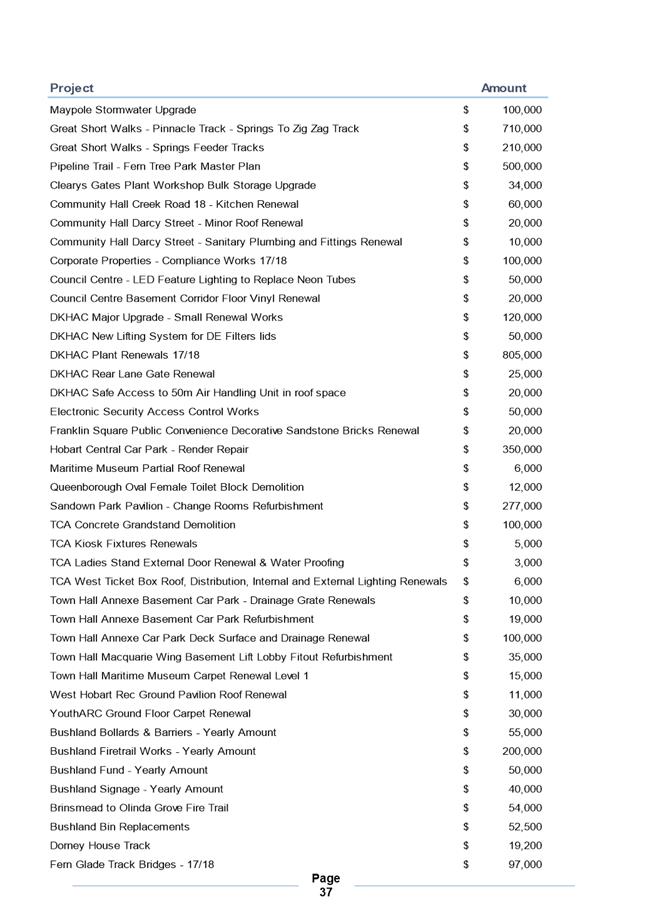

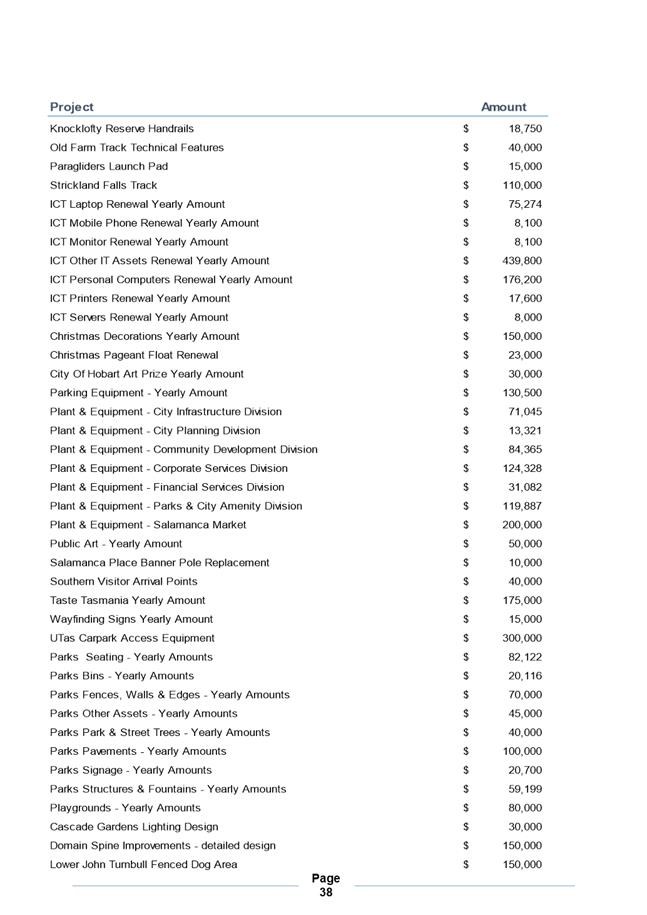

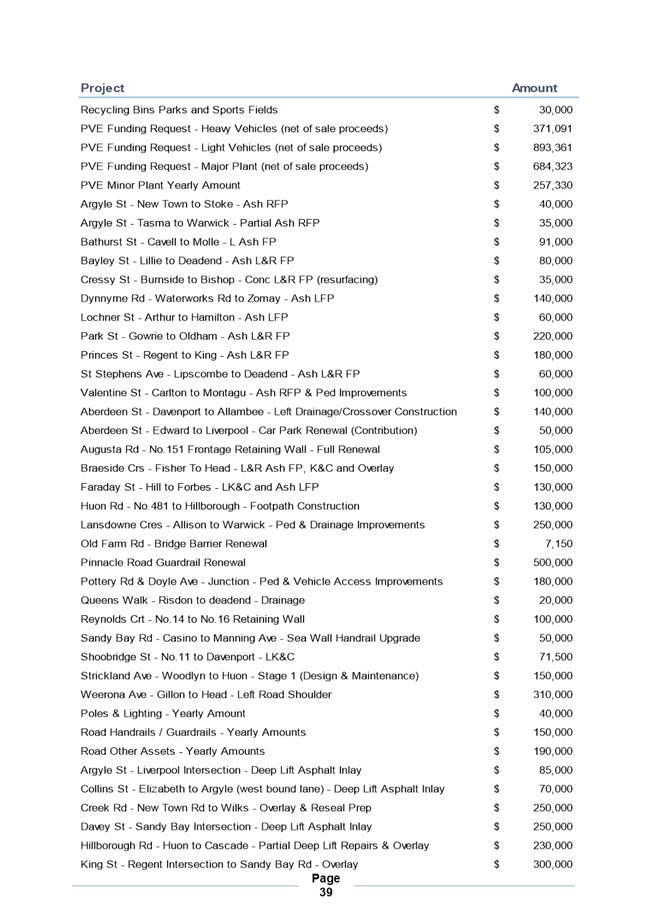

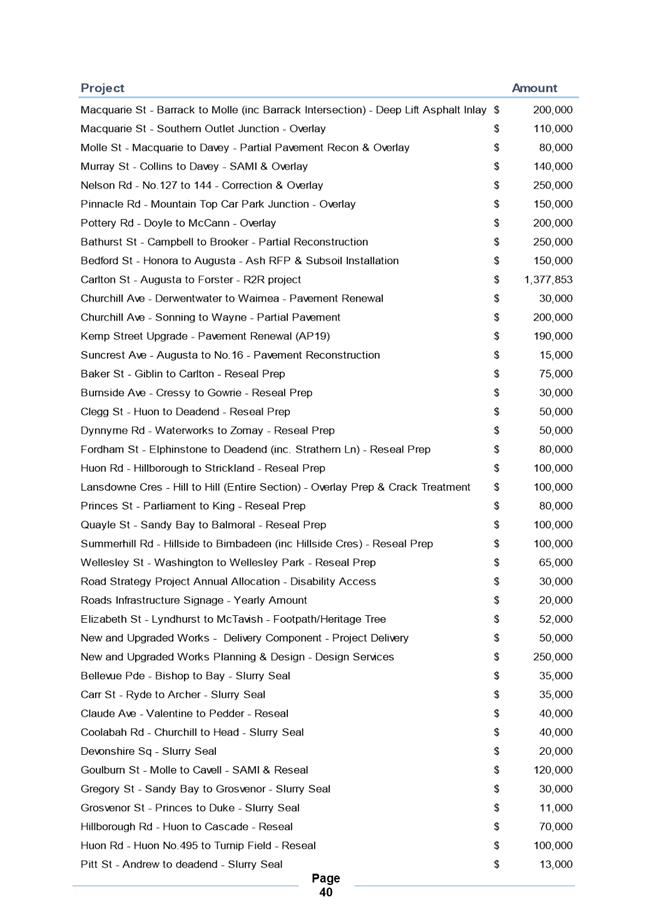

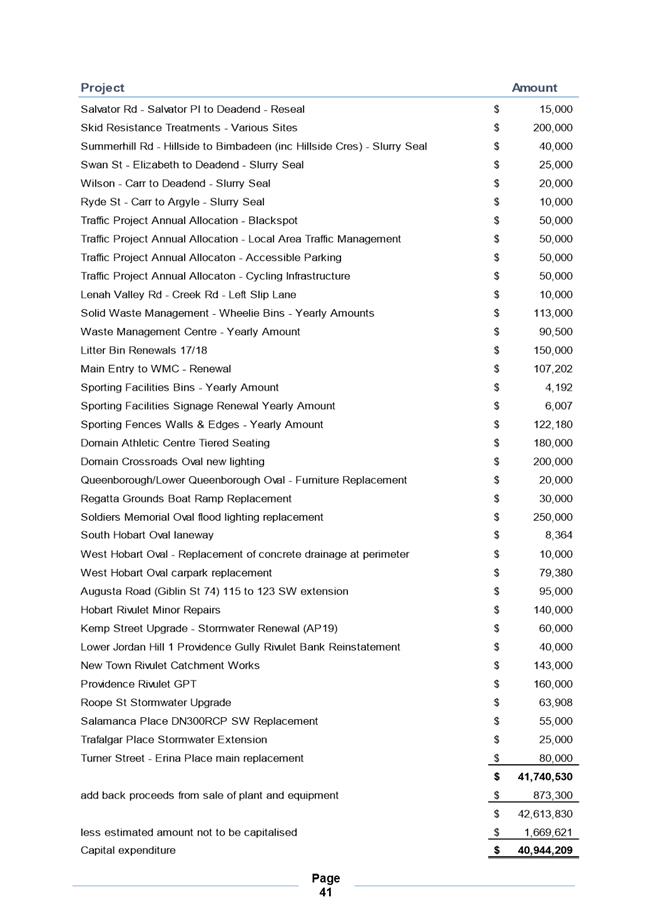

Capital Expenditure – New Assets/Upgrades and Asset Renewal

4.25. The 2017/18 budget provides capital works funding of $40.95M, comprising asset renewal of $29.41M and new assets/upgrades of $11.54M.

4.26. Council considered and endorsed the proposed 2017/18 capital works program on 24 April 2017 subject to any future variation that Council may approve prior to approving the 2017/18 budget. Council also endorsed the proposed capital works programs for 2018/19 and 2019/20 to enable preliminary planning to occur.

4.27. Asset renewal expenditure is split between infrastructure assets ($24.97M) and plant and equipment ($4.44M). The level of asset renewal funding provided for 2017/18 represents 100% of the known requirements (identified in Council’s Asset Management Plans) for that year. Asset renewal funding provided in following years is also 100% of the known requirements for those years.

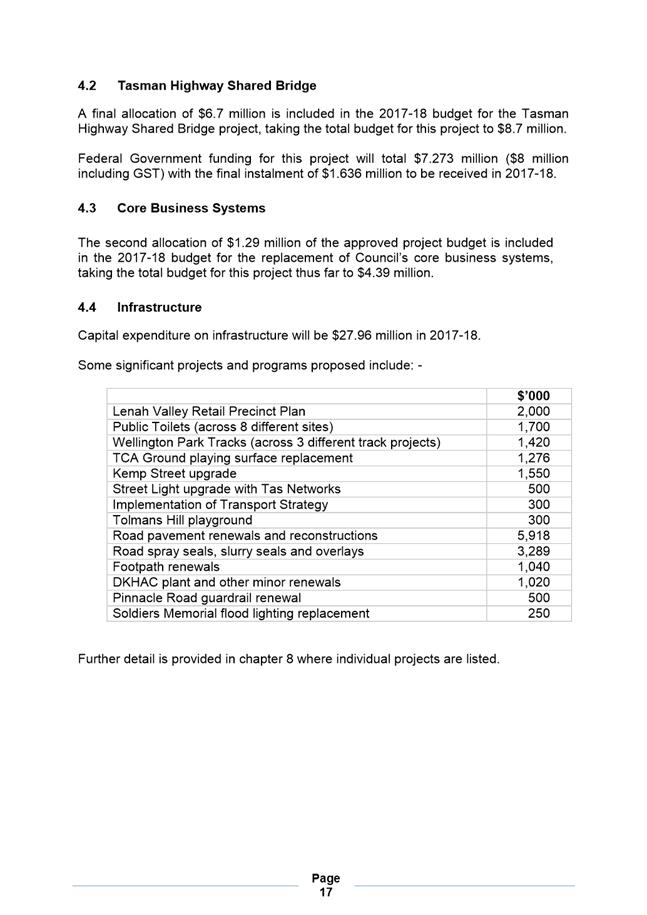

4.28. Some significant projects include:

· $6.7M for the Tasman Highway Shared Bridge project (taking the total budget for this project to $8.7M), mostly funded from grants;

· $5.918M for road pavement renewals and reconstructions;

· $3.289M for road spray seals, slurry seals and overlays;

· $2M for the Lenah Valley Retail Precinct Plan;

· $1.7M for public toilets (across 8 different sites);

· $1.55M for the Kemp Street upgrade which includes $0.45M for a commercial waste and recycling receiving facility;

· $1.42M for Wellington Park tracks (across 3 different track projects);

· $1.29M for new corporate core business systems;

· $1.276M for replacement of the playing surface at the TCA Ground;

· $1.04M for footpath renewals;

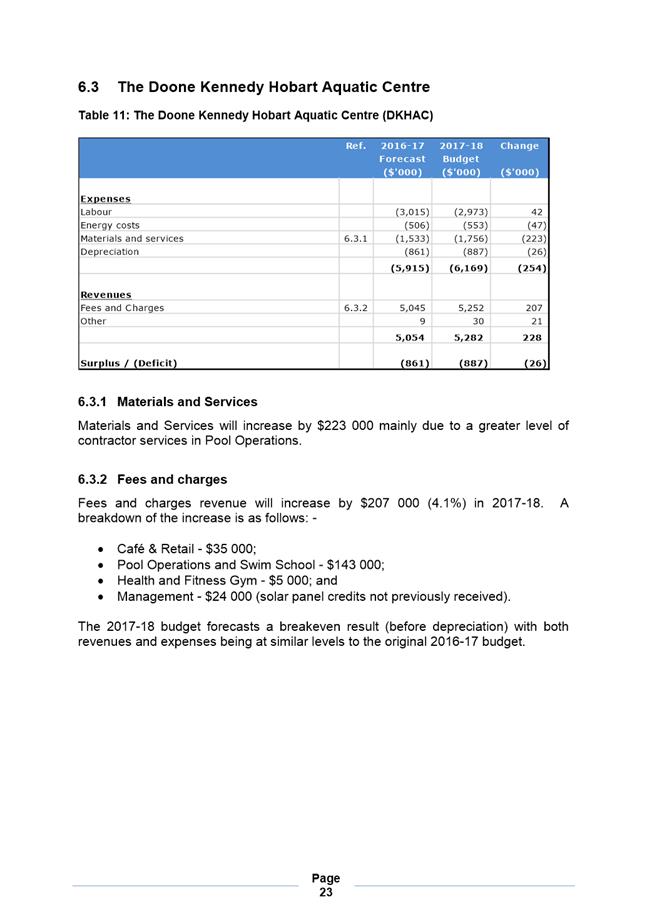

· $1.02M for DKHAC plant and other minor renewals;

· $0.5M for Street Light upgrades;

· $0.5M for Pinnacle Road guardrail renewal;

· $0.3M for implementation of Council’s transport strategy;

· $0.3M for Tolmans Hill playground; and

· $0.25M for Soldiers Memorial flood lighting replacement.

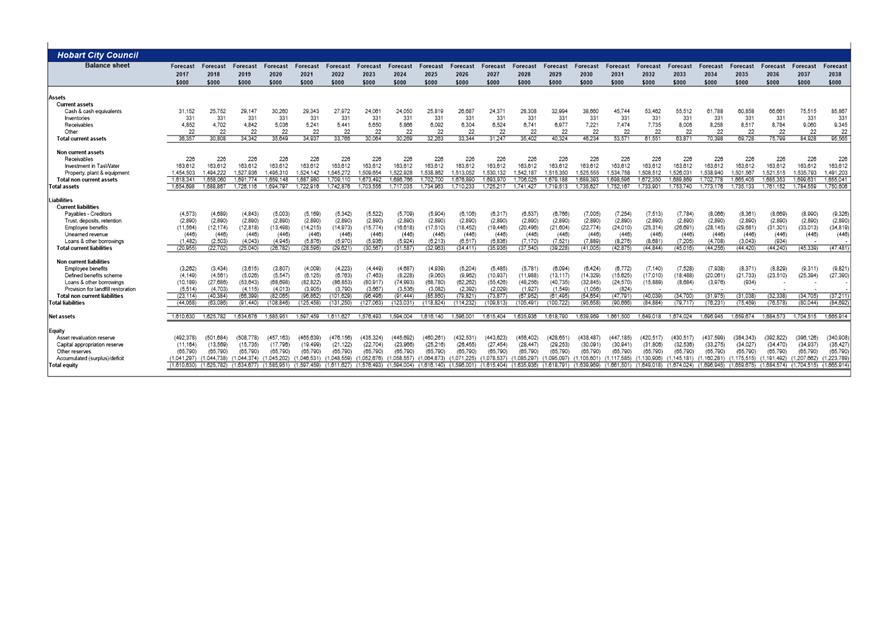

Long Term Financial Management Plan

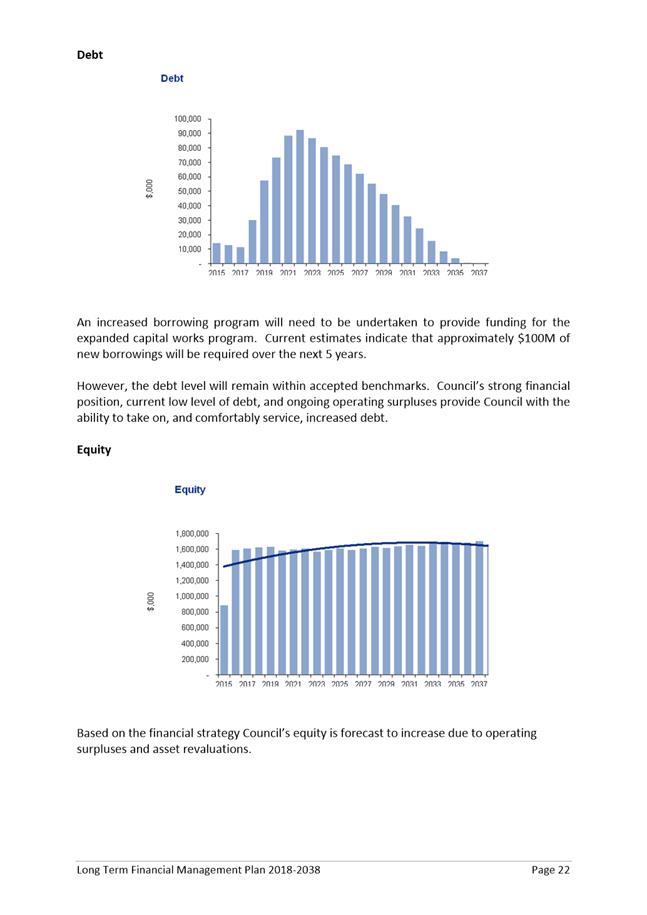

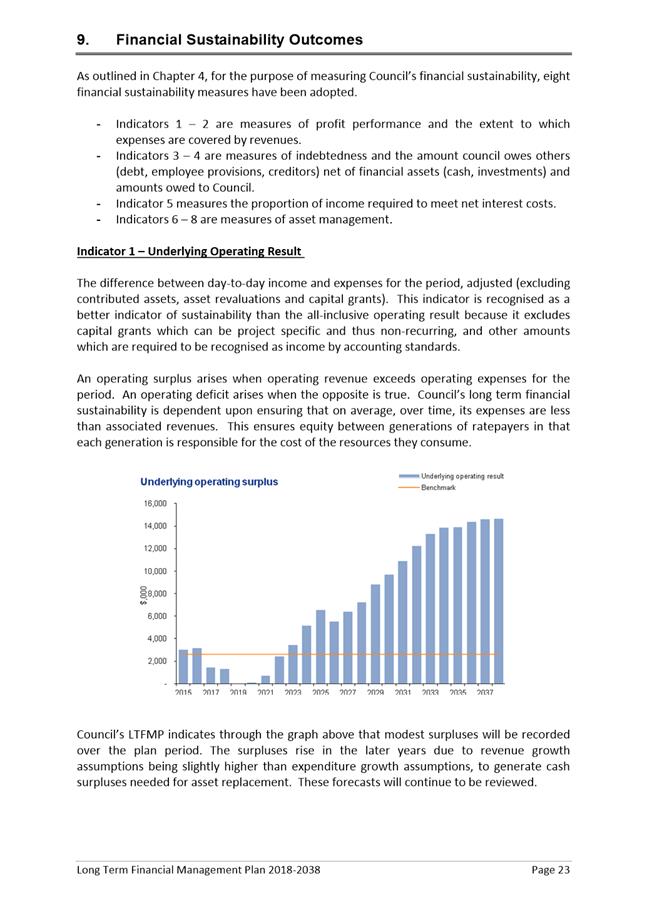

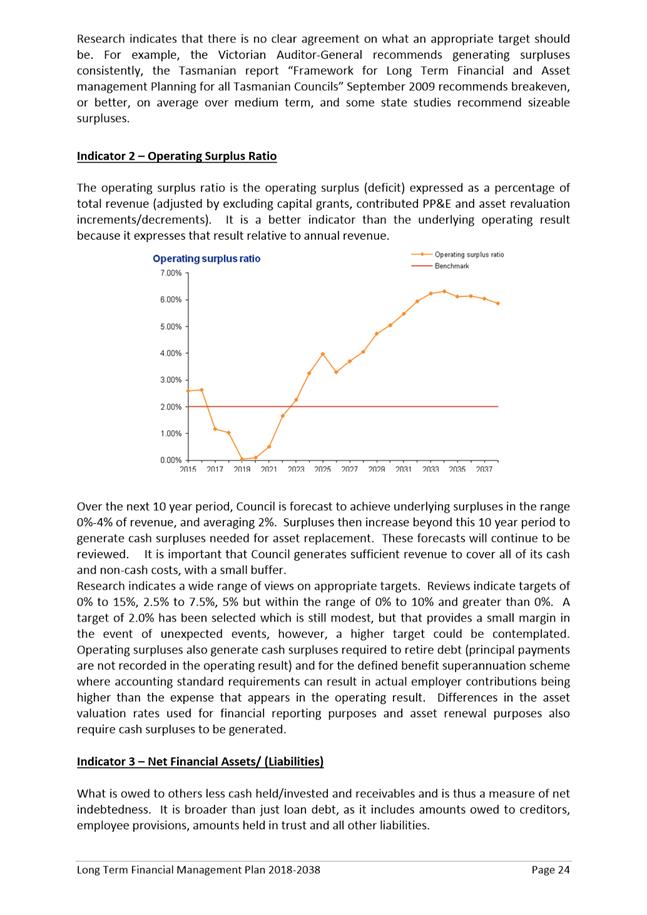

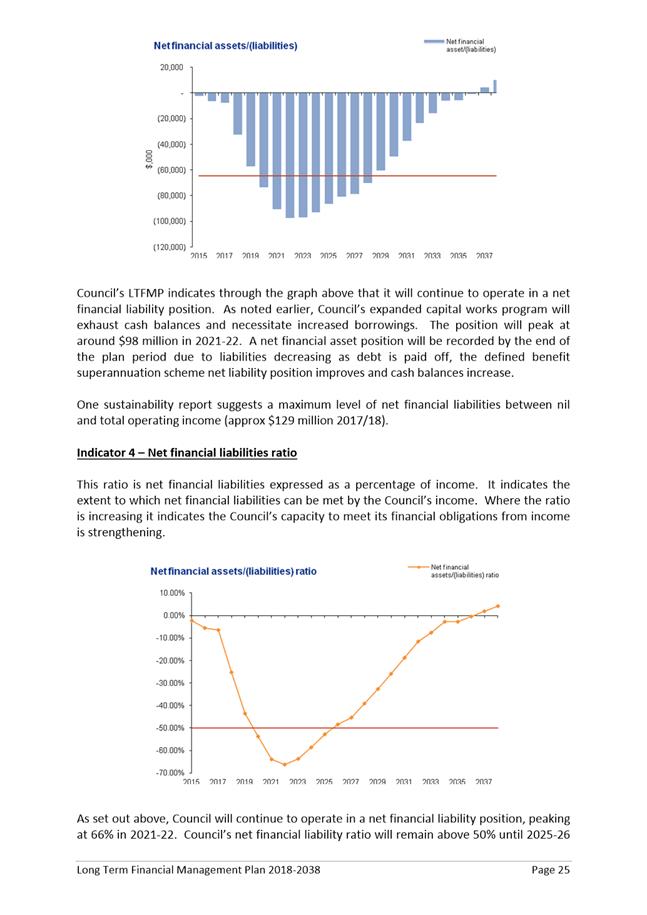

4.29. The 2017/18 Estimates have been prepared in accordance with the updated LTFMP (refer Attachment C), and produce outcomes which are consistent with the plan. These are:

4.29.1. The achievement of modest underlying surpluses;

4.29.2. Debt and liabilities increasing as a result of the expanded capital works program but remaining within reasonable benchmarks; and

4.29.3. Asset renewal funding equal to 100% of known requirements (identified in Council’s Asset Management Plans).

Unspent Plant and Capital Funds

4.30. As part of the budget approval process it is proposed that unspent capital budgets from 2016/17 be carried forward into 2017/18. Based on year-to-date expenditure, carry-forwards are expected to be around $30M for projects, and around $2M for plant and equipment. This includes Soldiers Memorial Oval, Tasman Highway Shared Bridge, various traffic and roadworks, Brooker Highway Pedestrian bridge, bus mall redevelopment, parking meters renewal project, replacement of core business systems and Argyle Street car park redevelopment.

5. Proposal and Implementation

5.1. It is proposed that the 2017/18 Estimates be formally considered at a special Finance Committee meeting to be held on 27 June, and be listed on the Council meeting agenda for 3 July for formal adoption.

5.2. Subject to any amendments that may arise following the Finance Committee’s consideration, the following are the draft resolutions that would be presented to Council on 3 July:

5.2.1. The expenses, revenues, capital expenditure, and plant and equipment expenditure detailed in the document ‘City of Hobart, Budget Estimates, for the 2017-2018 Financial Year’ be approved.

5.2.2. New borrowings of up to $20M be approved for infrastructure.

5.2.3. The Council delegate to the General Manager the power to enter into loan agreements to source the above borrowings on the most favourable terms.

5.2.4. The General Rate be 7.75 cents in the dollar of assessed annual value (AAV).

5.2.5. The following Service Rates be made:

5.2.5.1. A Stormwater Removal Service Rate of 0.47 cents in the dollar of AAV; and

5.2.5.2. A Fire Service Rate of 1.30 cents in the dollar of AAV.

5.2.6. A Waste Management Service Charge be made and varied according to the use or predominant use of land as follows:

5.2.6.1. A Service charge of $250 to apply to residential properties;

5.2.6.2. A Service charge of $500 to apply to non-residential properties.

5.2.7. A Waste Management Service Charge of $50 be made for kerbside green waste collection for all rateable land within the municipal area to which Council supplies or makes available a green waste collection service utilising a green waste collection bin.

5.2.8. A Landfill Rehabilitation Service Charge be made and varied according to the use or predominant use of land as follows:

5.2.8.1. a Service charge of $50 to apply to residential properties;

5.2.8.2. a Service charge of $100 to apply to non-residential properties.

5.2.9. The rates be subject to the following remissions:

5.2.9.1. A remission of 0.94 cents in the dollar on the AAV of any land or building which is within the Fern Tree Volunteer Brigade Rating District as defined by the State Fire Commission.

5.2.9.2. A remission of 1.01 cents in the dollar on the AAV of any land or building which is within areas other than Permanent Brigade Rating Districts or the Fern Tree Volunteer Brigade Rating District as defined by the State Fire Commission.

5.2.10. Unspent 2016/17 capital funding be carried-forward into 2017/18, with any necessary adjustments to be made in the September 2017 quarter financial report to Council.

5.2.11. The interest rate on unpaid rates be 8.72% per annum, charged monthly.

5.2.12. The 2017-2018 Annual Plan be adopted.

5.2.13. The Long Term Financial Management plan 2018-2038 be adopted.

5.2.14. Community engagement exercises on the preparation of future budgets be programmed bi-annually.

5.2.15. The following delegations be approved:

5.2.15.1. Pursuant to Section 22 of the Local Government Act 1993, the Council delegate to the General Manager the power to expend monies on Council’s behalf identified as Delegation Classification 1 items in the Council’s Annual Plan; and, the Council authorise the General Manager to delegate, pursuant Section 64 of the Local Government Act 1993, to such employees of the Council as he considers appropriate, the power to expend monies on Council’s behalf identified as Delegation Classification 1 items in the Council’s Annual Plan.

5.2.15.2. Pursuant to Section 22 of the Local Government Act 1993, the Council delegate to all the Council Committees the power to expend monies on Council’s behalf identified as Delegation Classification 2 items in the Council’s Annual Plan.

5.3. In respect of the interest rate to be applied to outstanding rates (see 5.2.11) the Local Government Act 1993 at section 128 provides for a maximum rate that can be charged. That rate is the 10 year long term bond rate (on the last business day in February) plus a risk premium of up to 6%. For 2017/18 this calculation results in a maximum rate of 8.72% and this is the rate being recommended.

6. Strategic Planning and Policy Considerations

6.1. Goal 5 – Governance is applicable in considering this report, particularly strategic objective:

“5.1 The organisation is relevant to the community and provides good governance and transparent decision-making.

5.1.7 Continually review and update the Long Term Financial Management Plan.

5.1.8 Ensure a rating system that supports fairness, capacity to pay and effectiveness”

6.2. The Budget Estimates provide the resource allocation to deliver on community expectations as expressed in Council’s Capital City Strategic Plan 2015-2025.

7. Legal, Risk and Legislative Considerations

7.1. Section 82 of the Local Government Act 1993 requires the General Manager to prepare Estimates of Council’s revenue and expenditure for each financial year, and details what the Estimates must contain.

7.2. The Estimates must be adopted by Council before 31 August by absolute majority.

7.3. As noted above, the 2017/18 Estimates have been prepared in accordance with the updated Long Term Financial Management Plan (refer Attachment C), and produce outcomes which are consistent with the plan, including the provision for contingencies and reserves.

8. Marketing and Media

8.1. Communication of the Council’s approval of the Estimates and General Rates charge will be by a combination of a media release, publication of the Lord Mayor’s budget speech, information on the Council’s website and Facebook pages, an insert with the first rates instalment notice, and a Capital City New article.

9. Community and Stakeholder Engagement

9.1. The preparation of the 2017/18 budget was primarily guided by the City’s Capital City Strategic Plan 2015-2025 and Long-Term Financial Management Plan.

9.2. An engagement process via the City’s Your Say Hobart portal, using the Budget Allocator tool commenced on 31 March and was open for a period of four weeks.

9.3. The community were invited to visit the Your Say Hobart website which outlined the purpose of the engagement. The page contained detailed information explaining each program and service area, the budget process ‘where the money comes from’, ‘where the money goes’ and how budget decisions align with the Council’s strategic direction.

9.4. The Budget Allocator tool challenged the community to tell us how they would allocate $91.3 million of the Council’s 2017/18 operating budget over 11 program and service areas.

9.5. Members of the public were invited to have their say by playing the ‘Budget Challenge’. The budget simulator tool provided for three spending choices – increase spending by 5 per cent, maintain current spending levels or reduce spending by 5 per cent on particular program and service areas to see how their choices impacted the overall budget and ultimately the impact on rates.

9.6. The intent of the of the challenge was to again provide a conceptual tool to educate and demonstrate in simplistic a simplistic way how the Council’s operating budget works, how spending choices have impacts and sometimes difficult decisions need to be made. It provided a high level view of what is a complex budget and process.

9.7. In addition to the challenge, participants were invited to identify one local issue and comment on why they would allocate funding to address it.

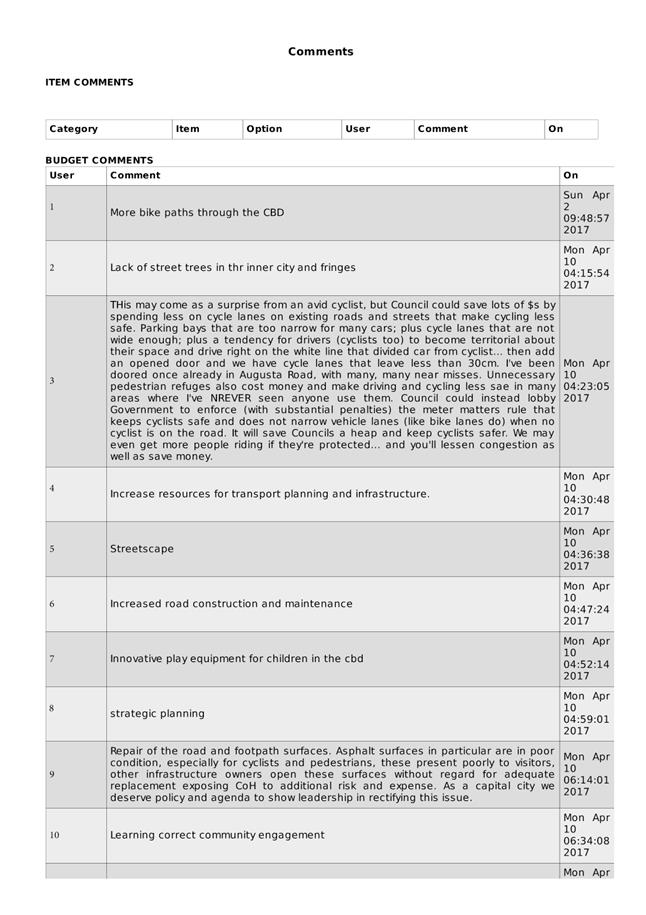

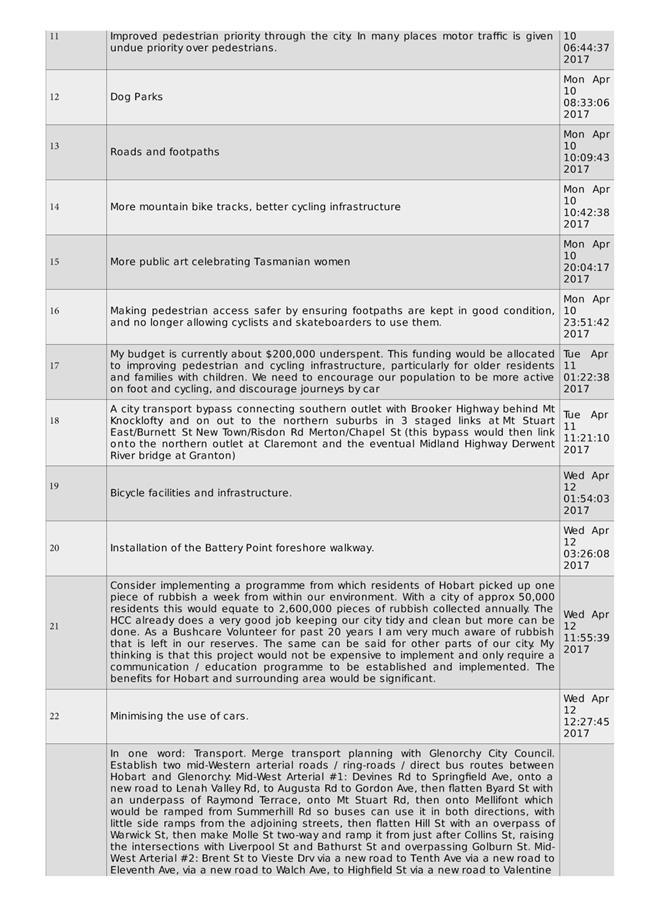

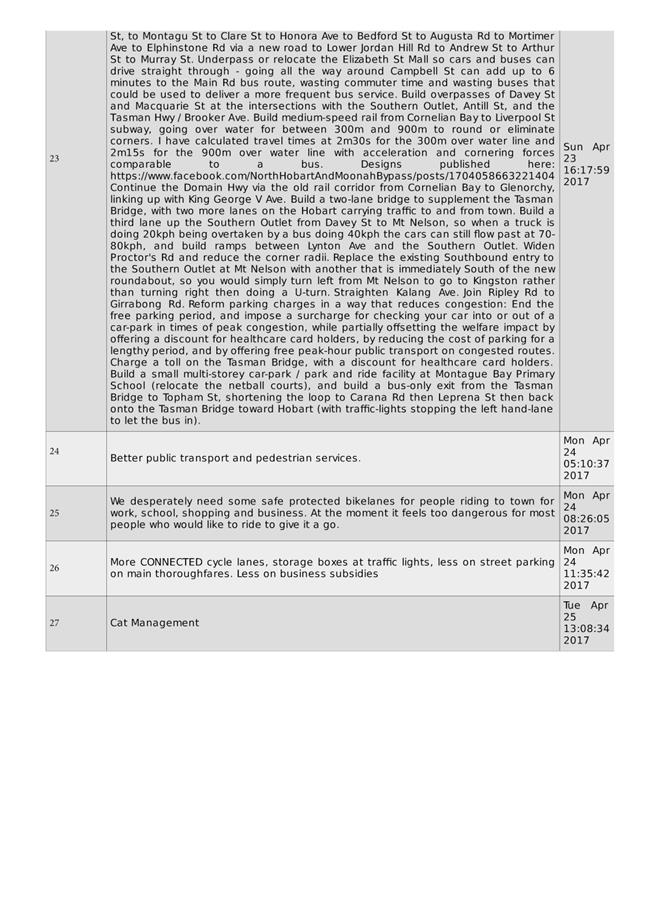

Results

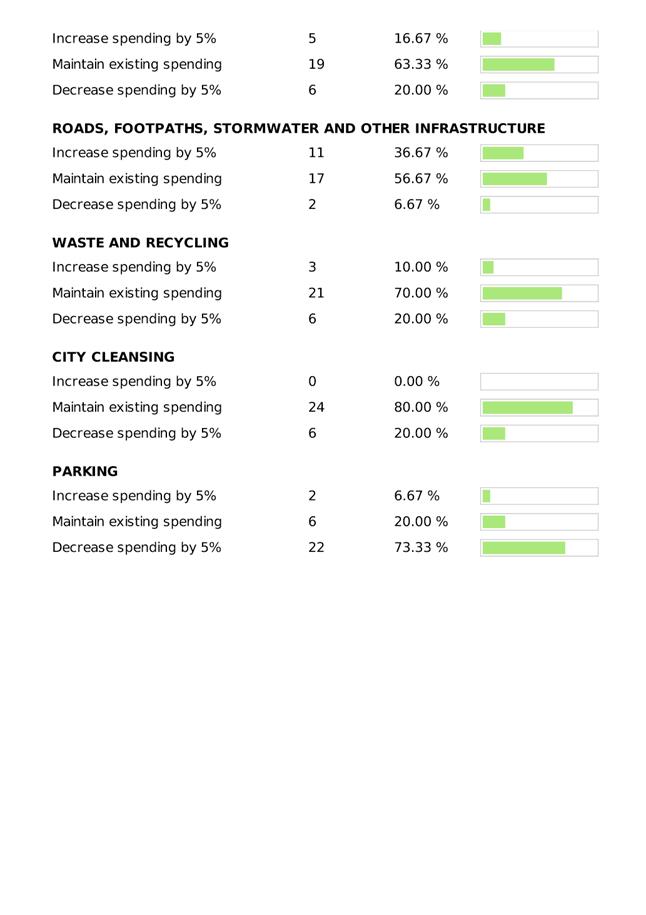

9.8. The results from 32 contributions showed support for maintaining the existing spending levels in 8 of the 11 program and service areas. These include:

· Community Development

· Economic Development, Tourism, Art and Events

· City Operations

· Strategic Planning and Finance

· Environmental Health and Animal Management

· Roads, Footpaths, Stormwater and other infrastructure

· Waste and Recycling

· City Cleansing.

9.9. City Planning at 46.67% was the only program area that showed support for increased spending.

9.10. The area of Parks, Reserves and Recreation (including the Doone Kennedy Hobart Aquatic Centre) showed equal support to both maintain spending and increasing spending at 45.16%.

9.11. Parking was the only program area to show strong support for decreasing spending at 73.33%.

9.12. The comments in response to the question ‘If you could allocate funding to fix one local issue what would it be?’ were varied (refer Attachment F). In general, strongest support is given to transport solutions, pedestrian amenity, road and footpath maintenance and bike infrastructure for improved safety and connectivity though the City.

9.13. The budget engagement provides some understanding of what the community values and where they want the City to be focusing its effort. It showed a general level of satisfaction with current resource allocations. At the same time, a desire for increased road and footpath maintenance was highlighted, and the 2017-18 budget includes an increased allocation for this.

10. Delegation

10.1. Approval of the Estimates is delegated to Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

David Spinks Director Financial Services |

Peter Jenkins Manager Finance |

Date: 23 June 2017

File Reference: F17/58061

Attachment a: City

of Hobart, Budget Estimates for 2017-18 Financial Year

⇩ ![]()

Attachment

b: Annual

Plan 2017-2018 ⇩ ![]()

Attachment

c: Long

Term Financial Management Plan 2018-2038 ⇩ ![]()

Attachment

d: 2017-18

Rate Resolution ⇩ ![]()

Attachment

e: Budget

Detail document 2017-18 ⇩ ![]()

Attachment

f: Budget

Community Consultation results and comments ⇩ ![]()

Attachment

g: Risk

and Audit Panel Draft Resolution - Item 6.1 ⇩ ![]()

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

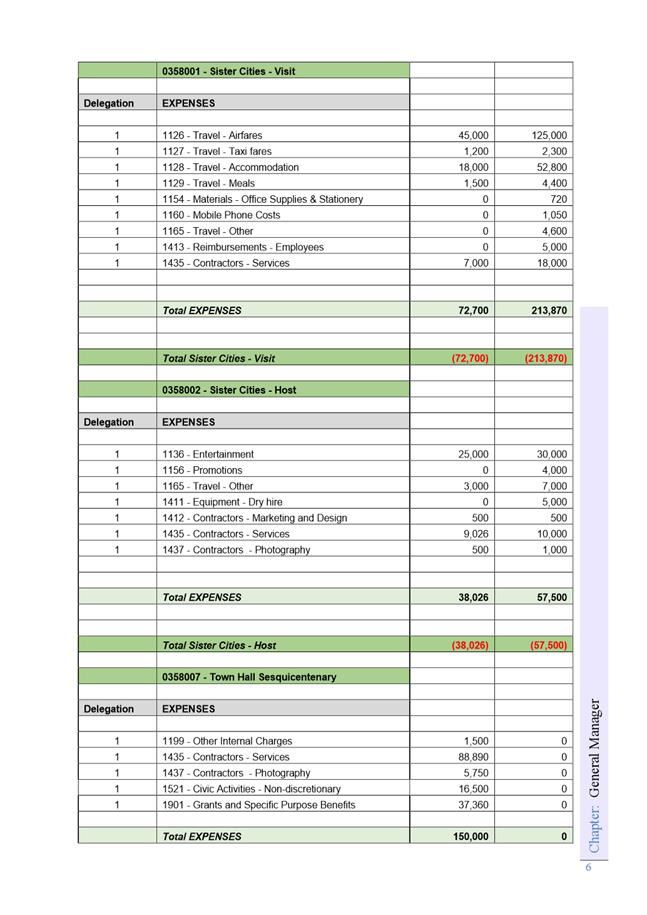

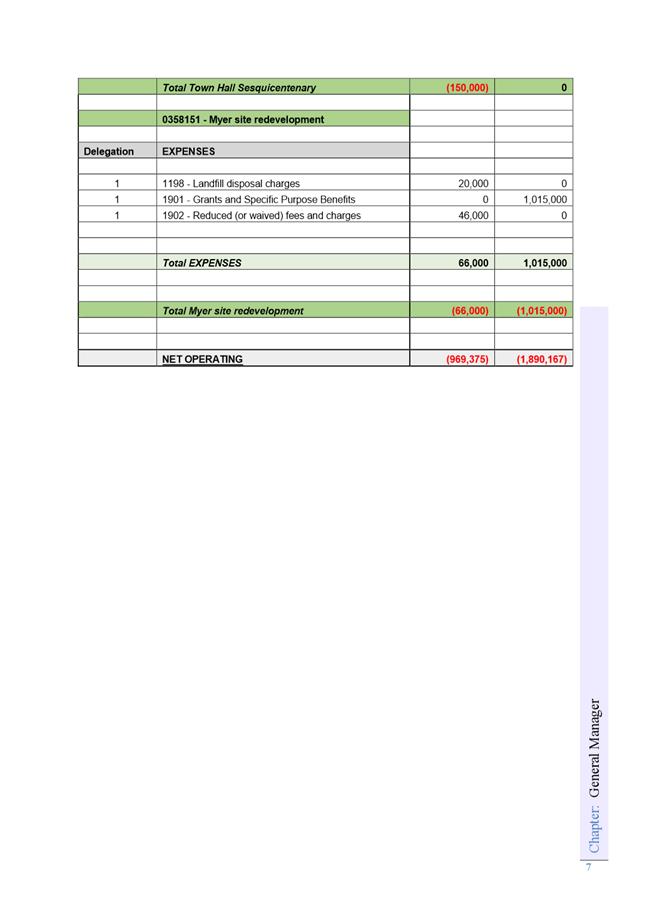

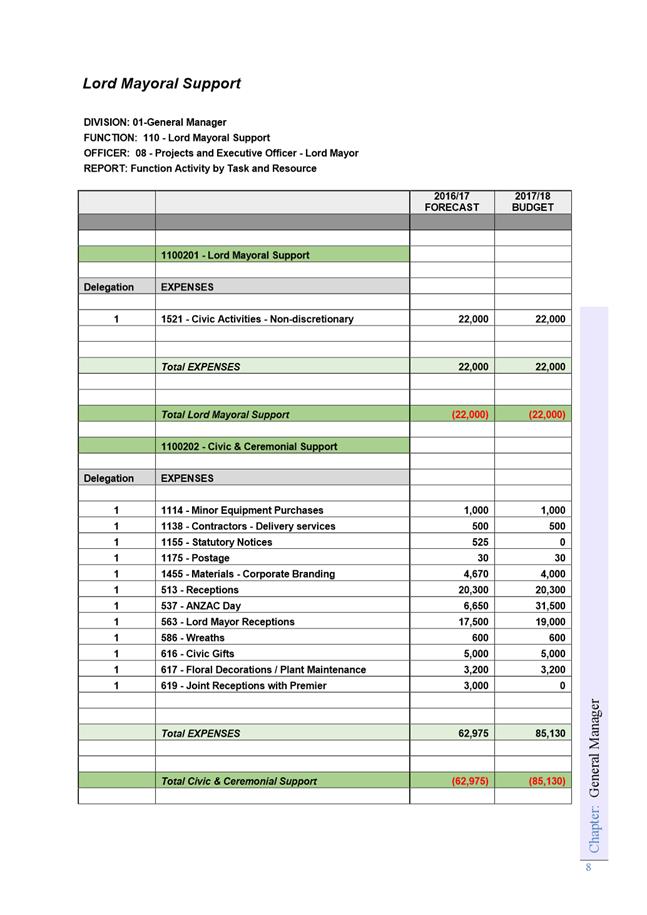

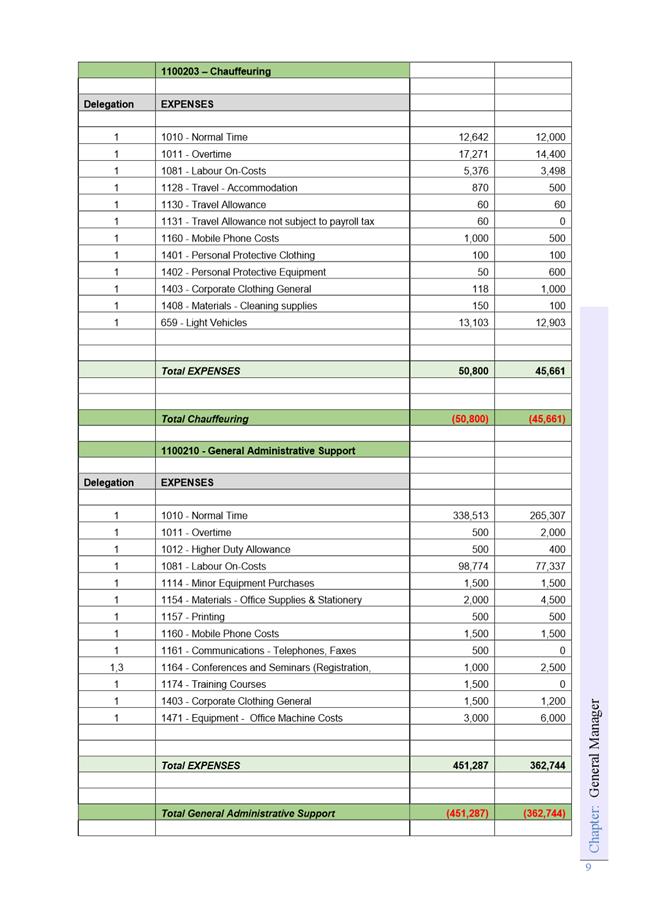

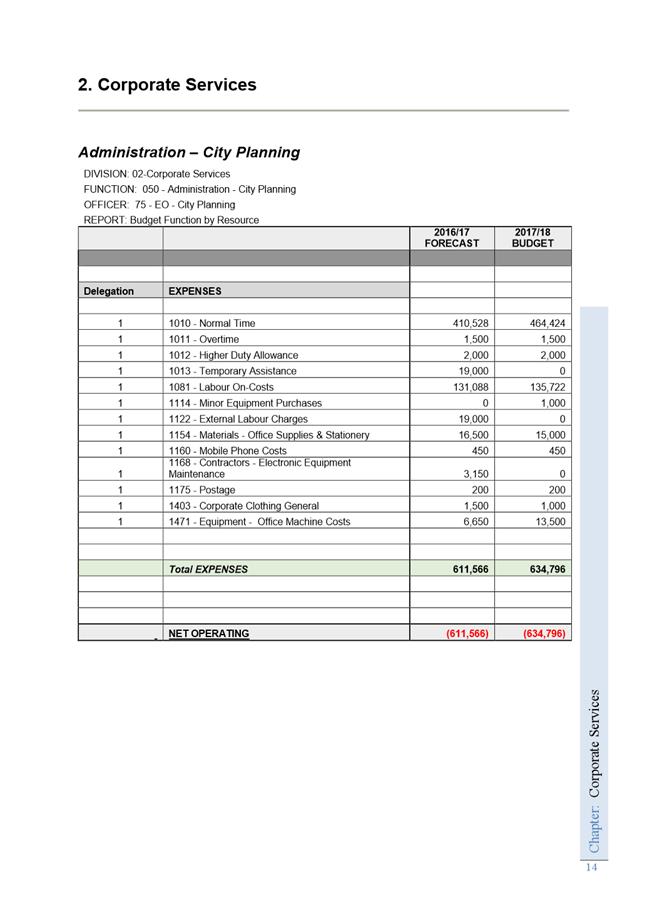

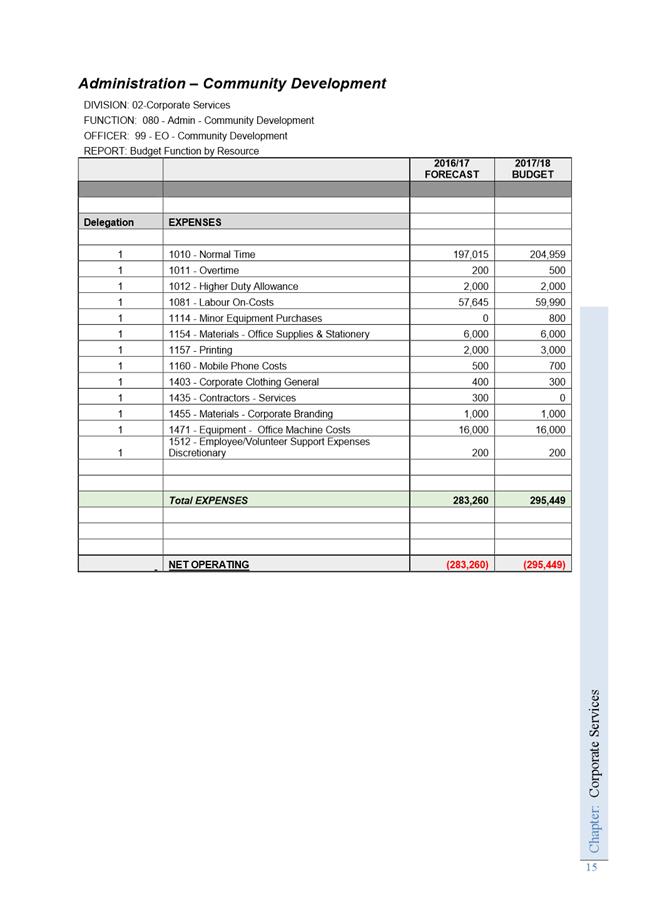

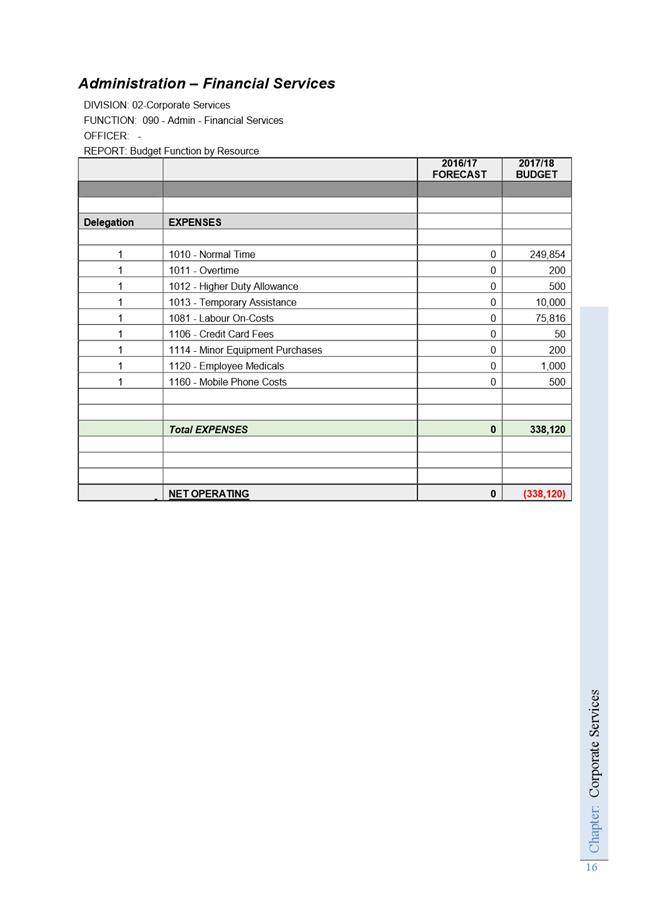

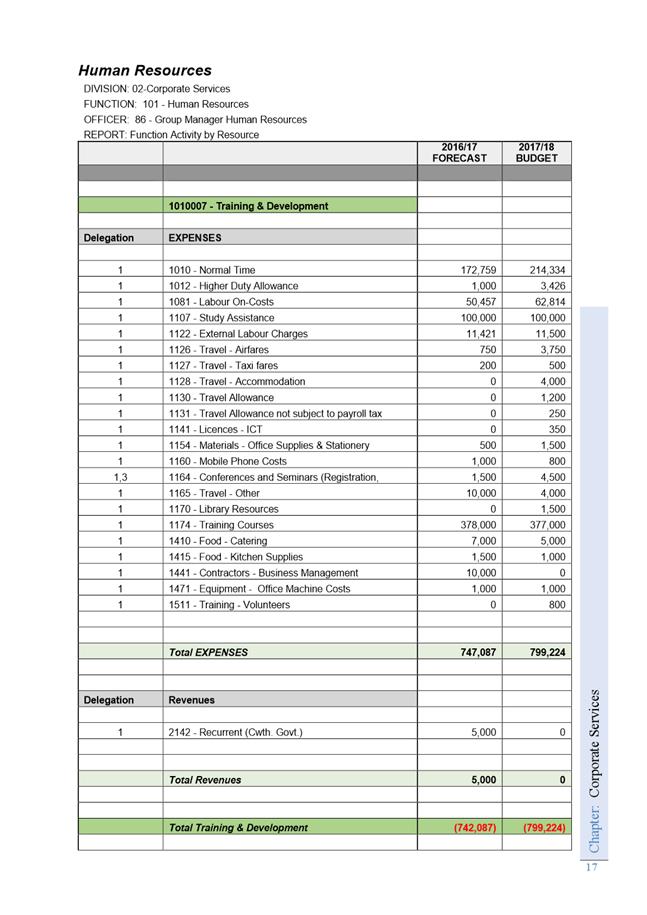

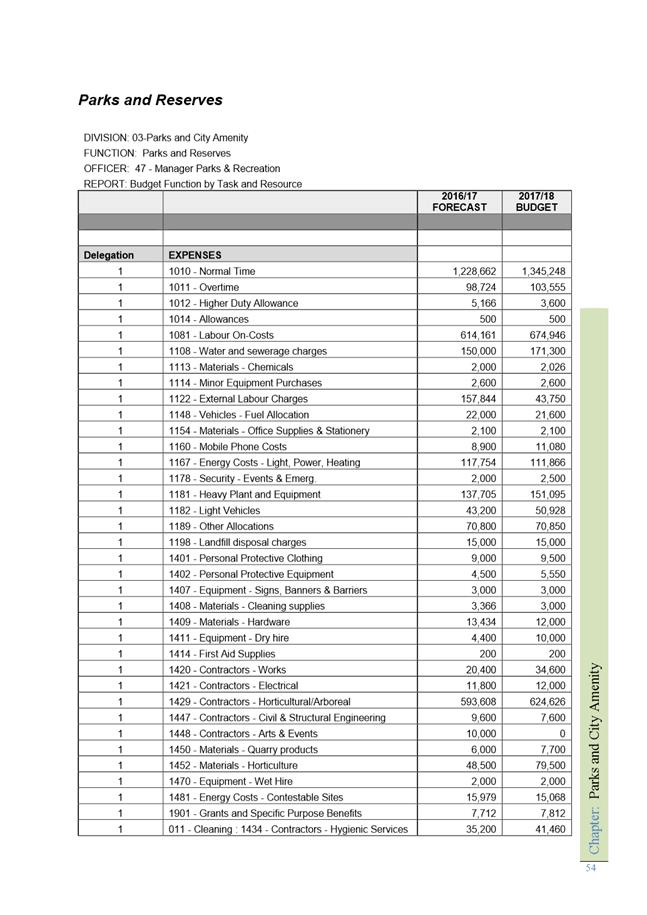

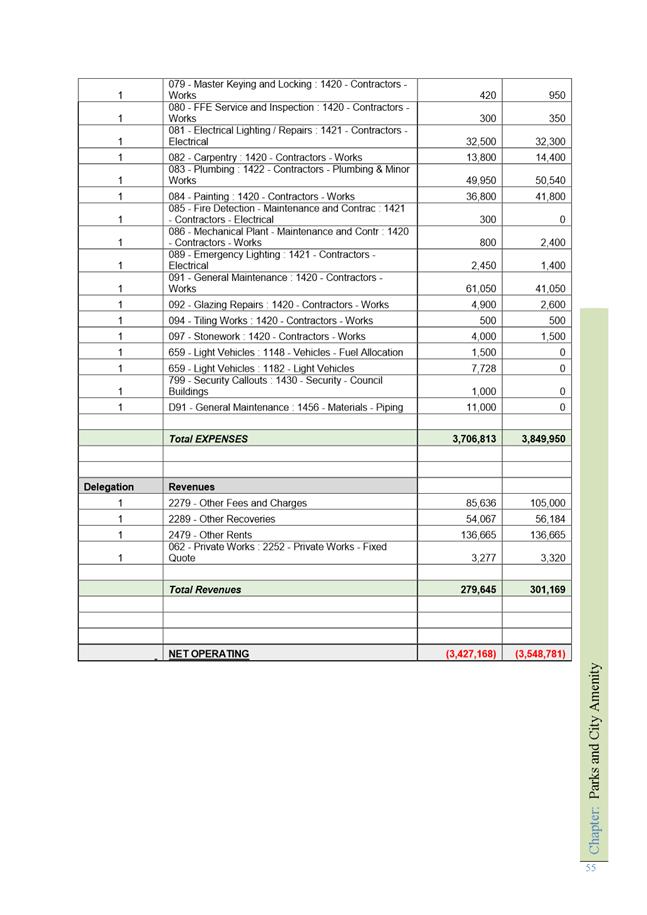

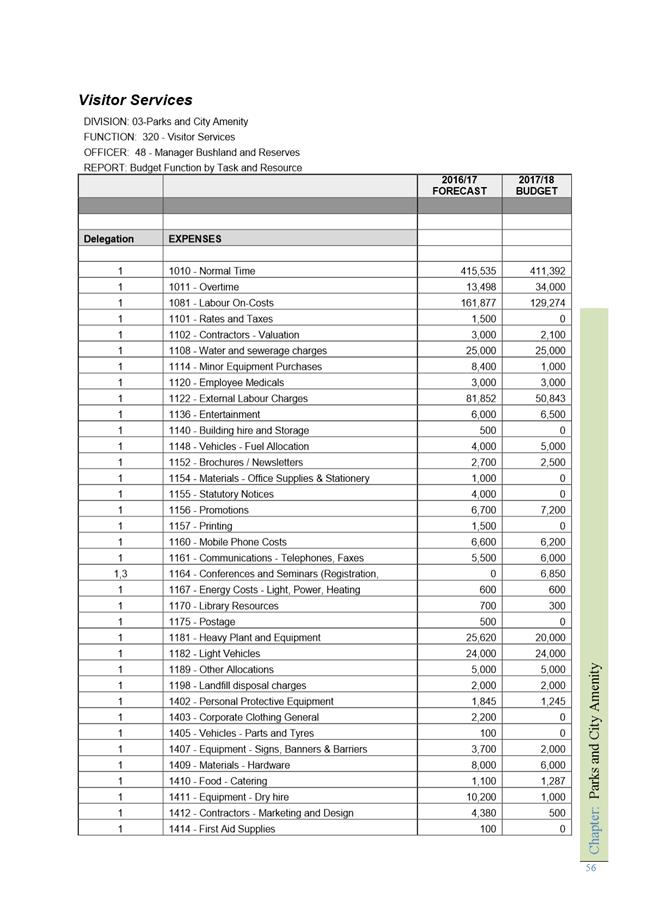

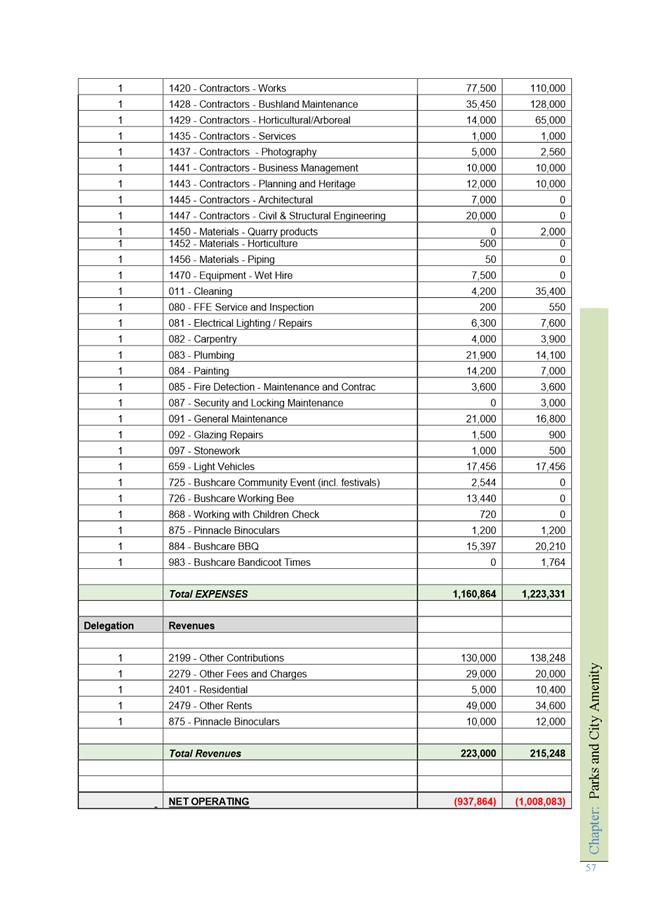

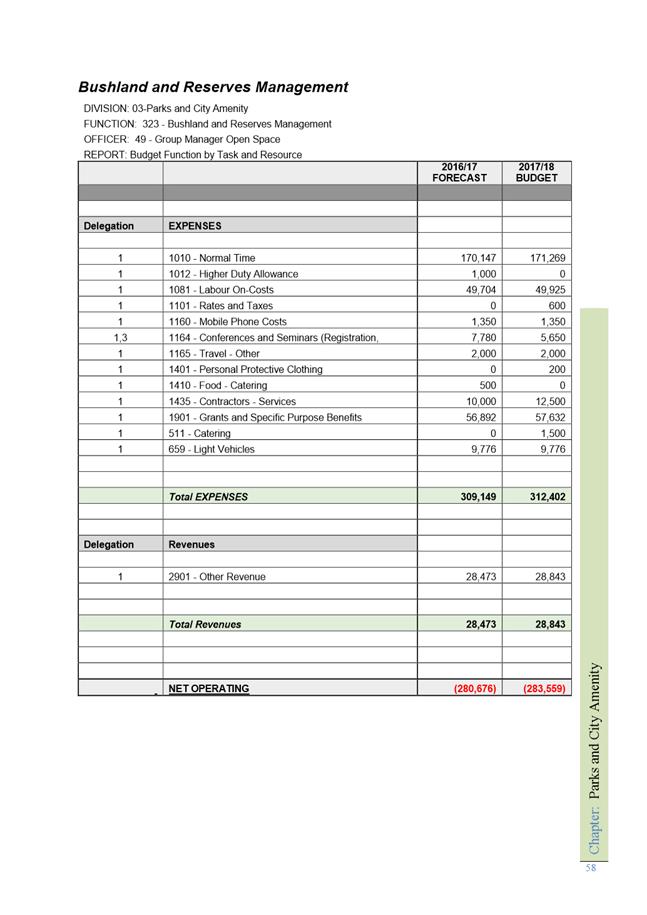

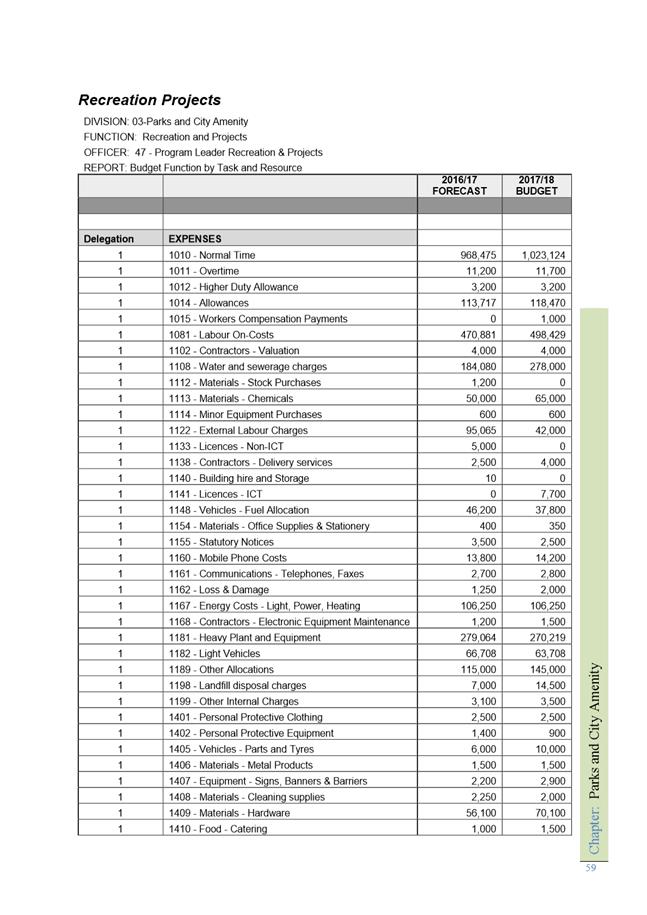

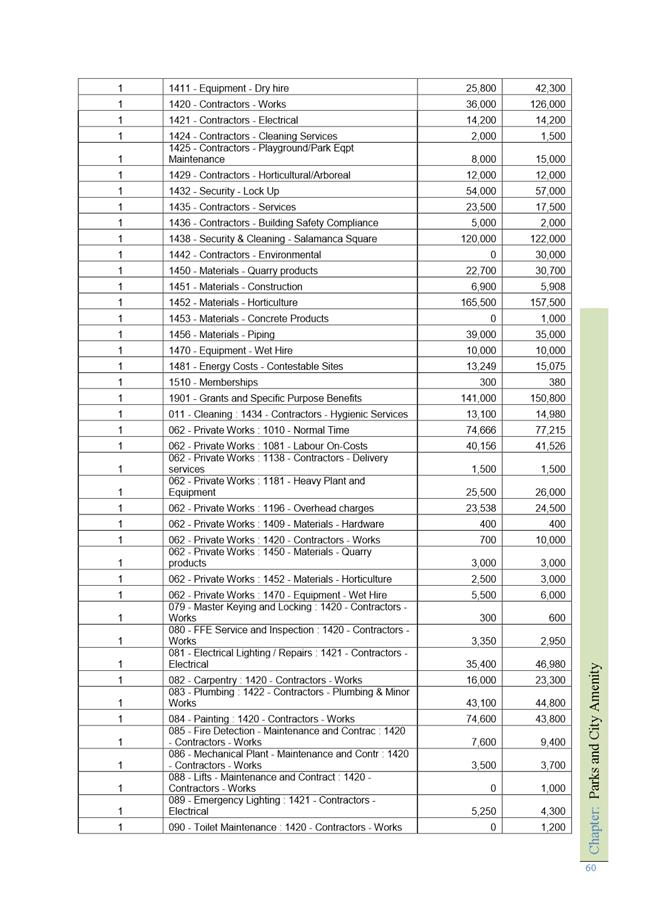

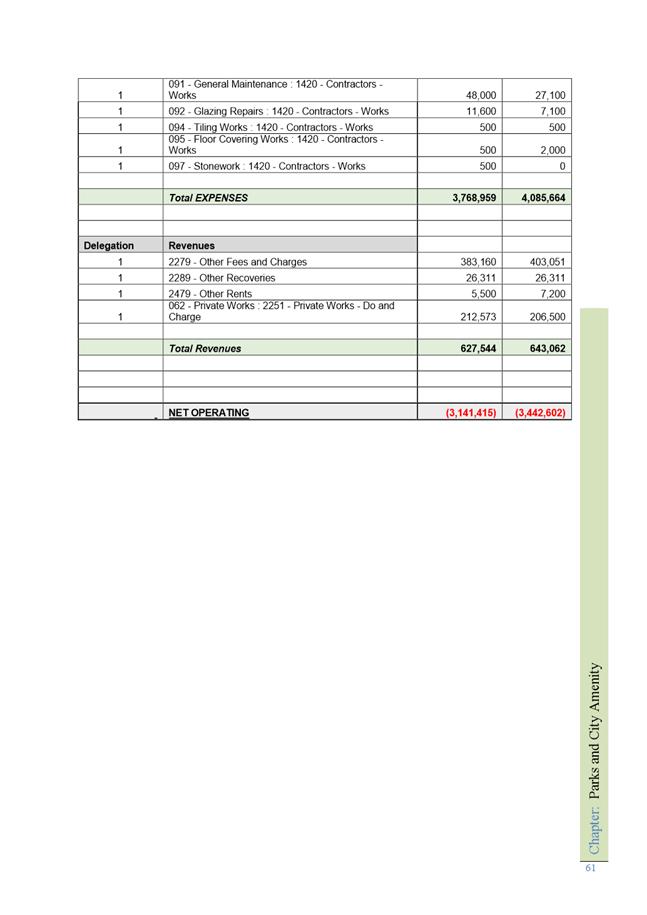

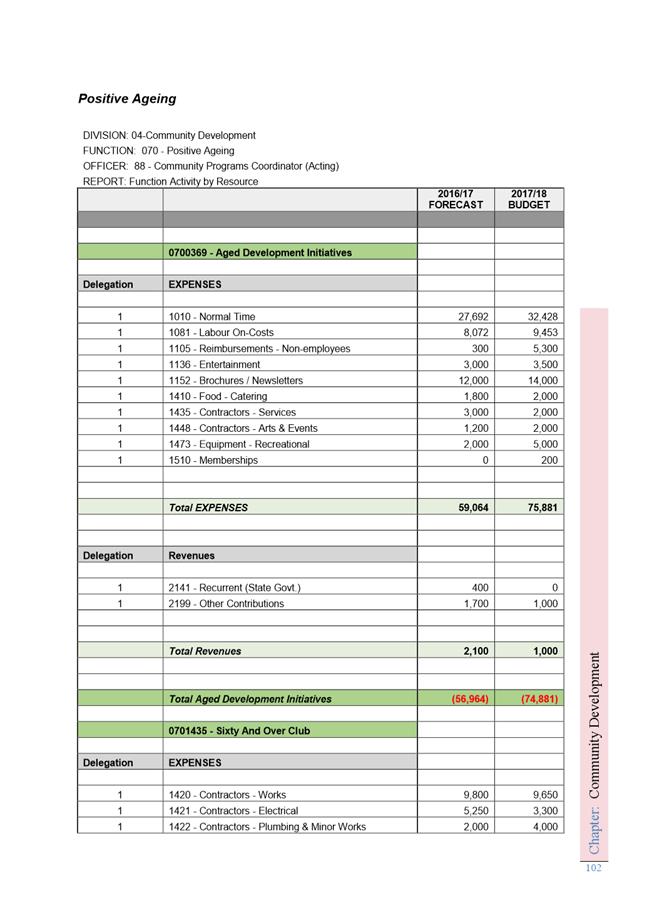

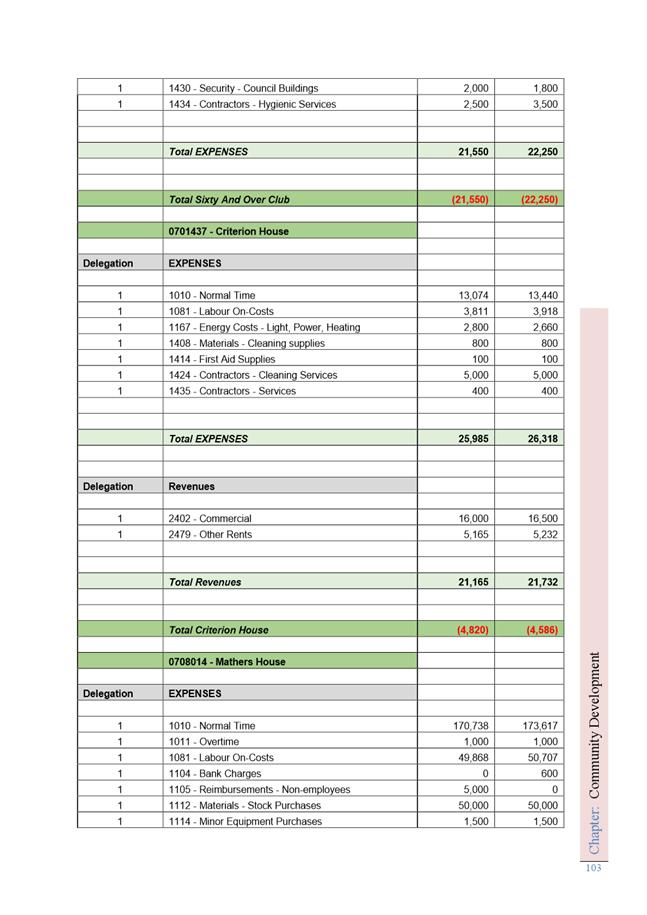

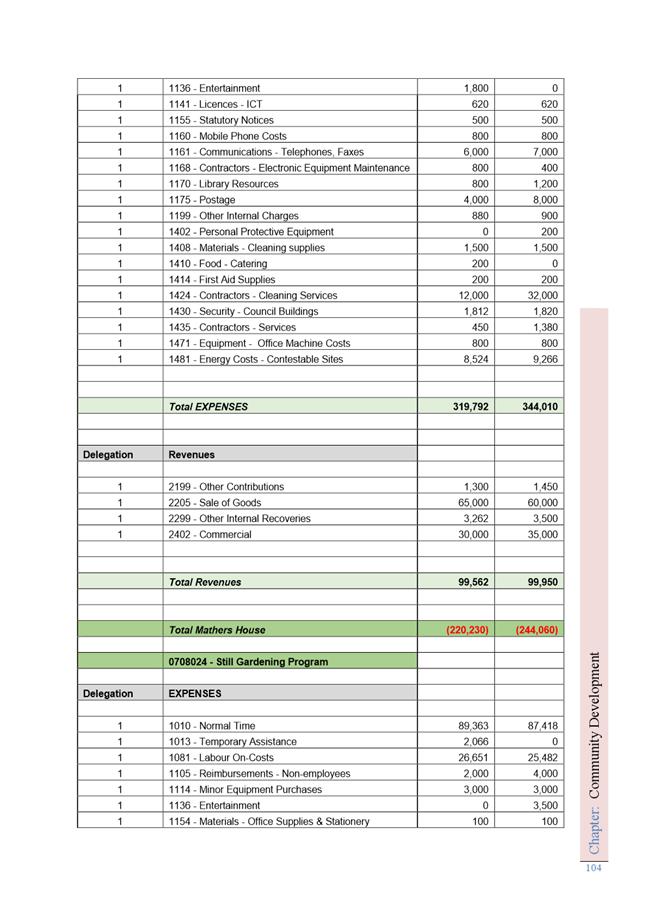

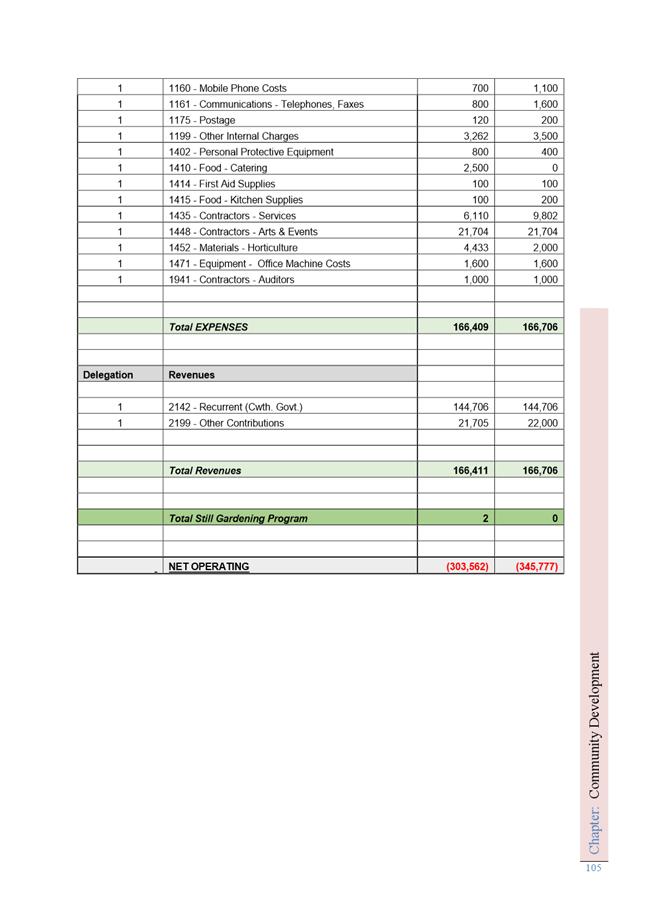

Page 19 ATTACHMENT a |

|

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

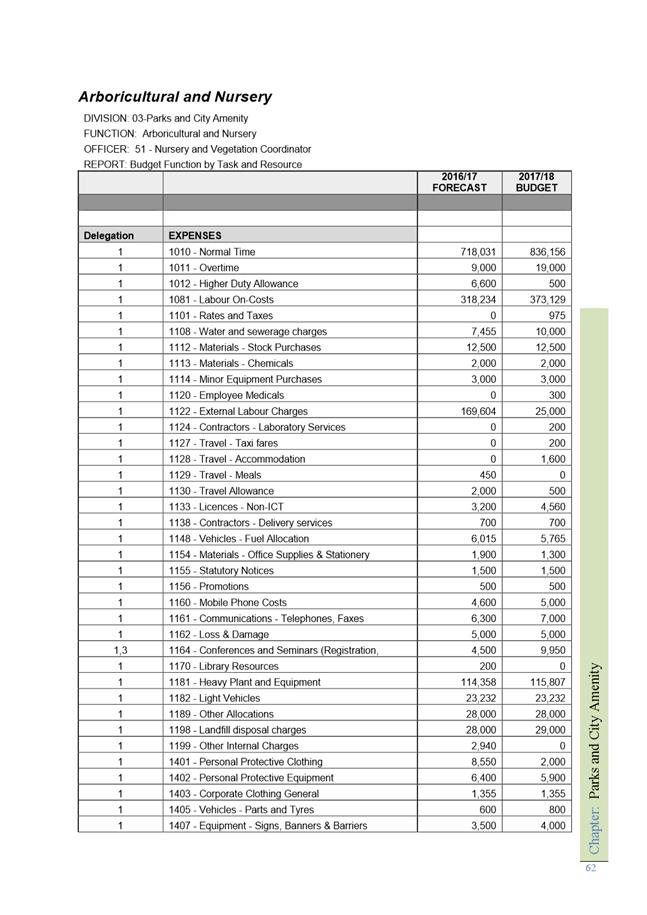

Page 62 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

Page 63 ATTACHMENT b |

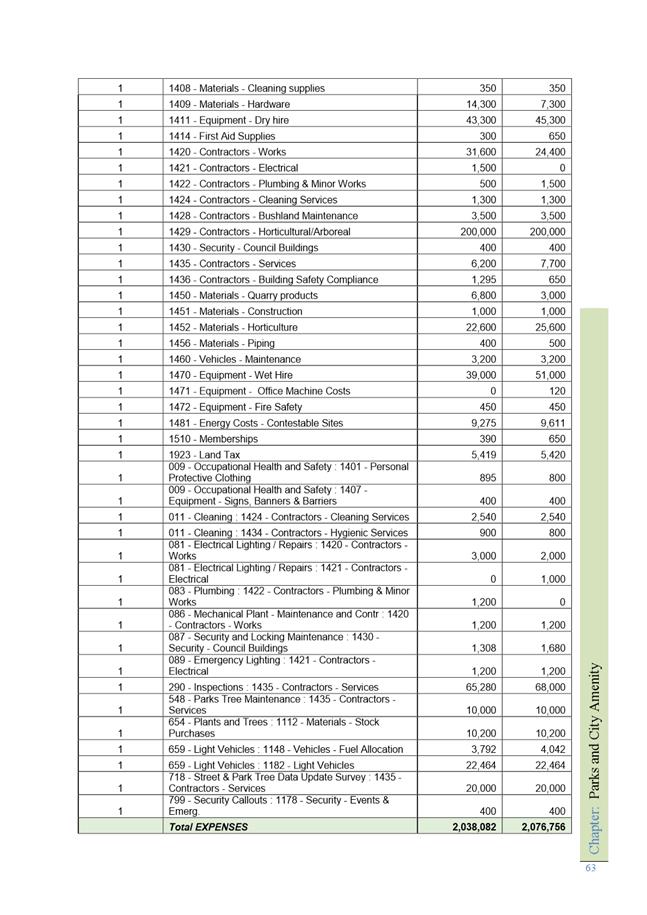

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

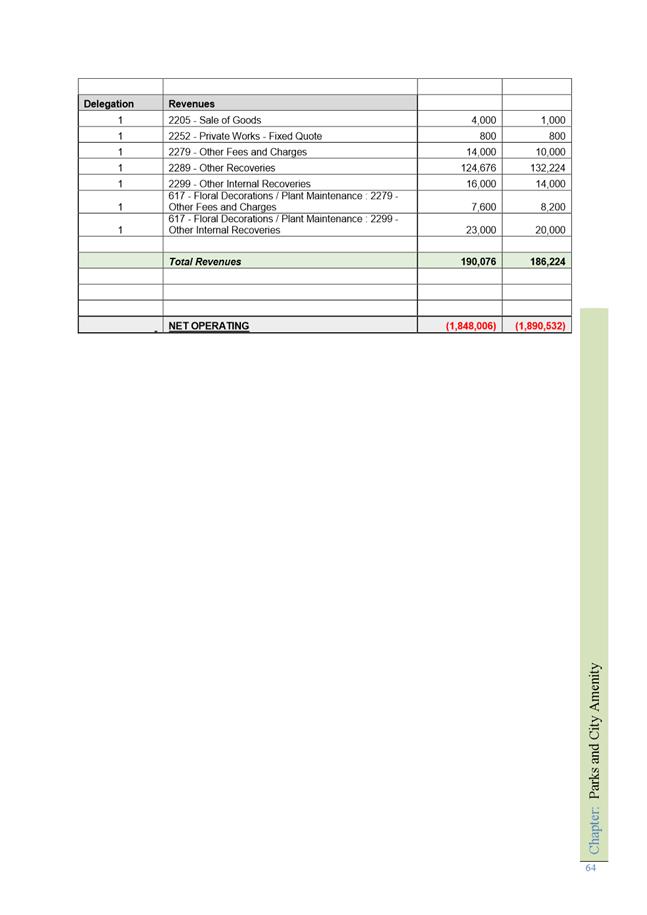

Page 64 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

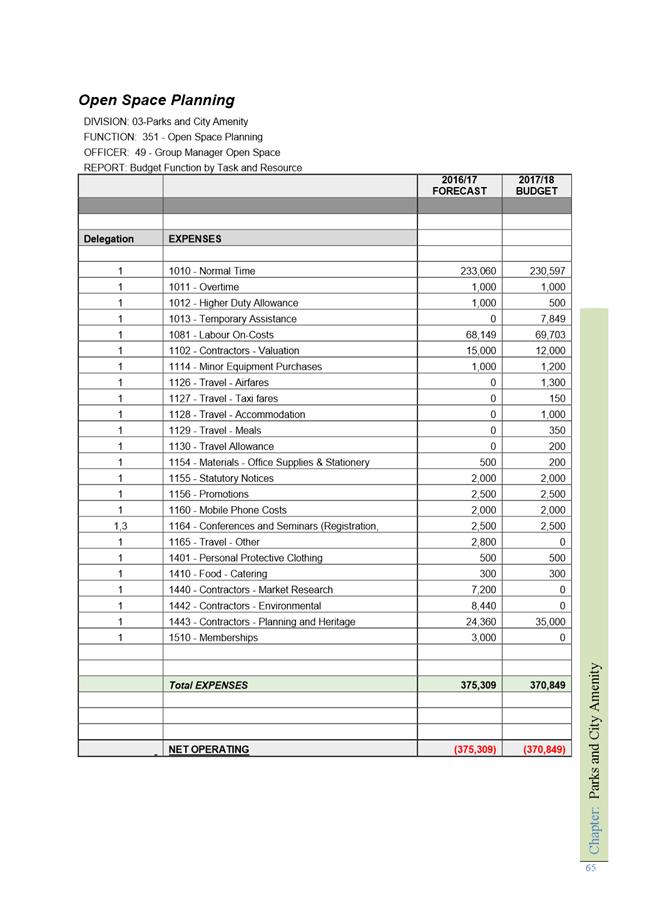

Page 65 ATTACHMENT b |

|

Item No. 4.1 |

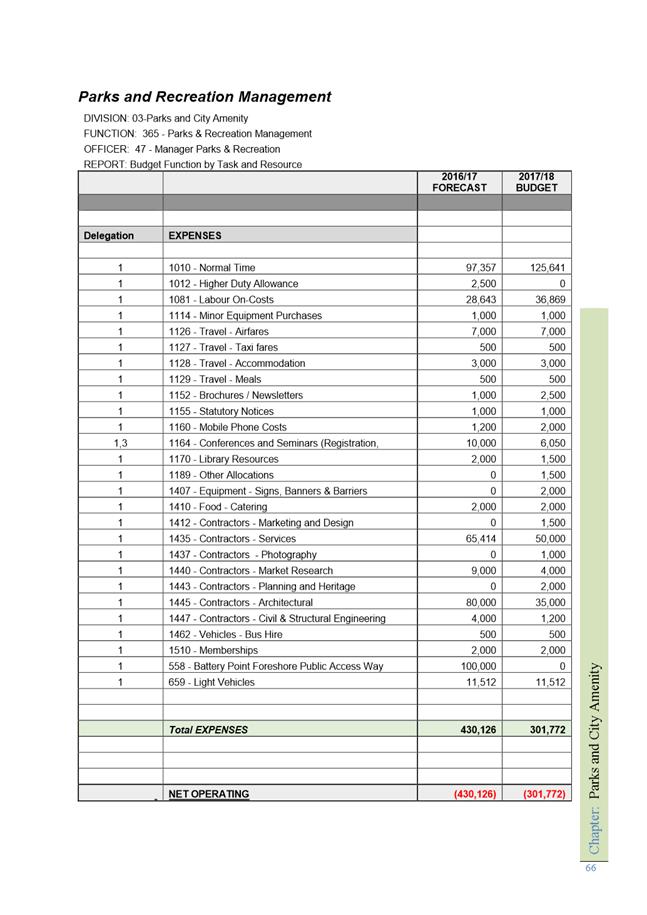

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

Page 66 ATTACHMENT b |

|

Item No. 4.1 |

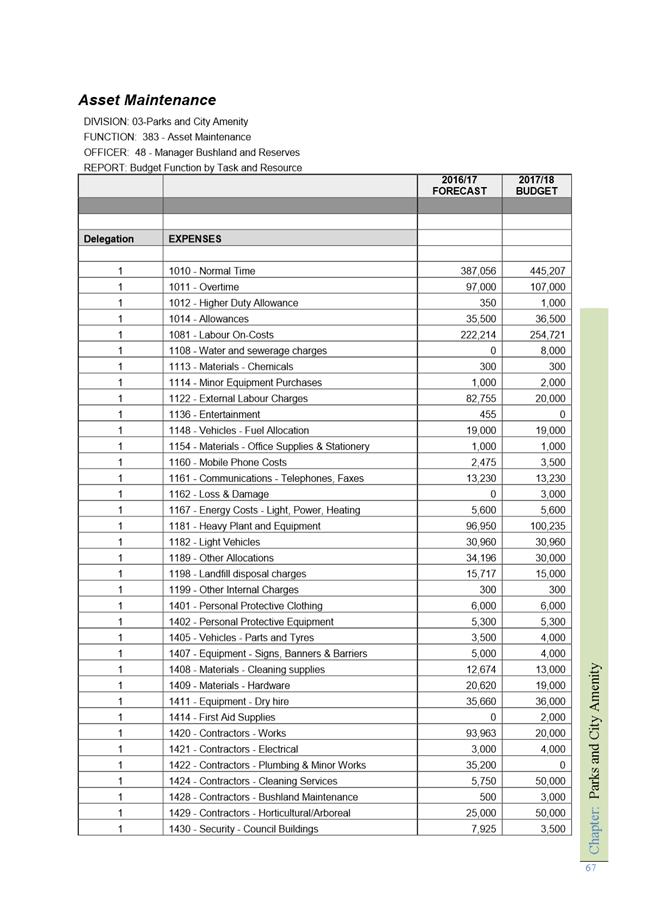

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

Page 67 ATTACHMENT b |

|

Item No. 4.1 |

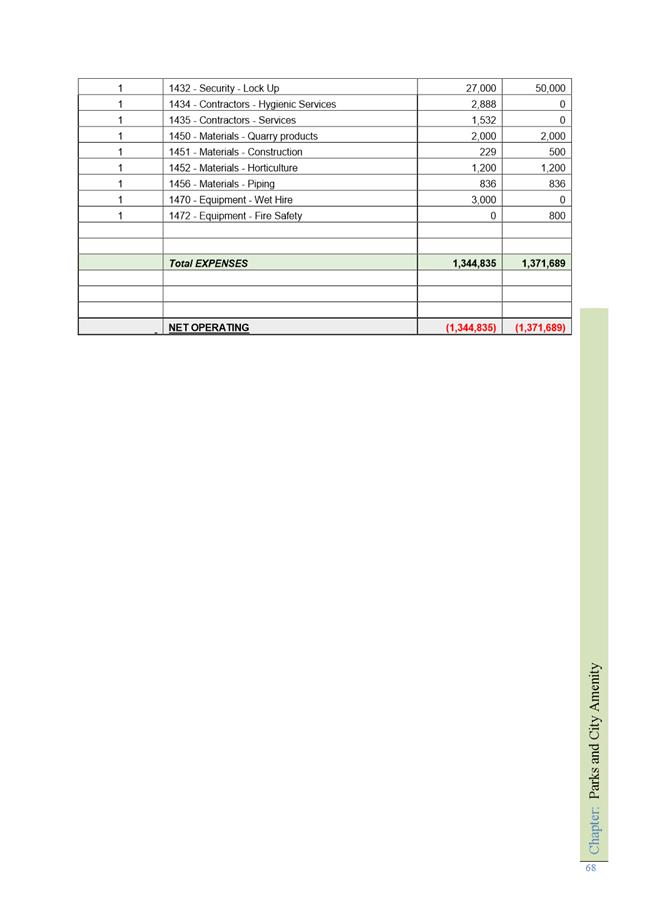

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

Page 68 ATTACHMENT b |

|

Item No. 4.1 |

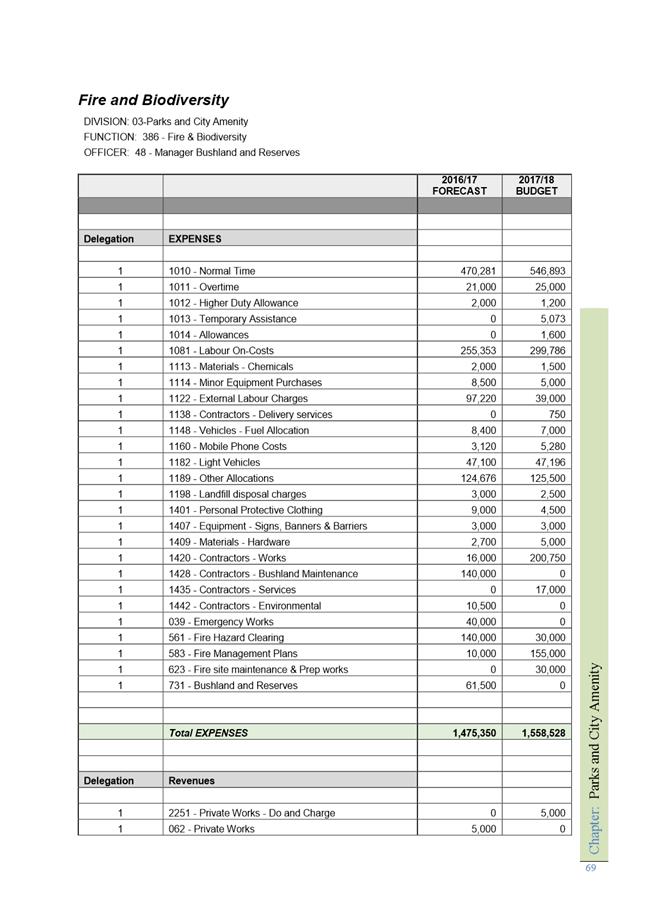

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

Page 69 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

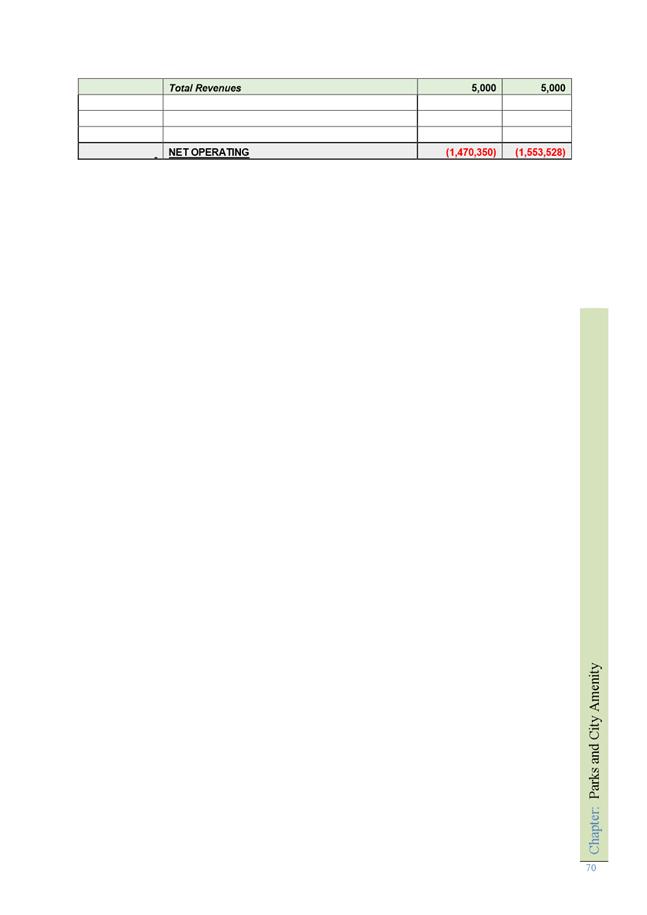

Page 70 ATTACHMENT b |

|

Item No. 4.1 |

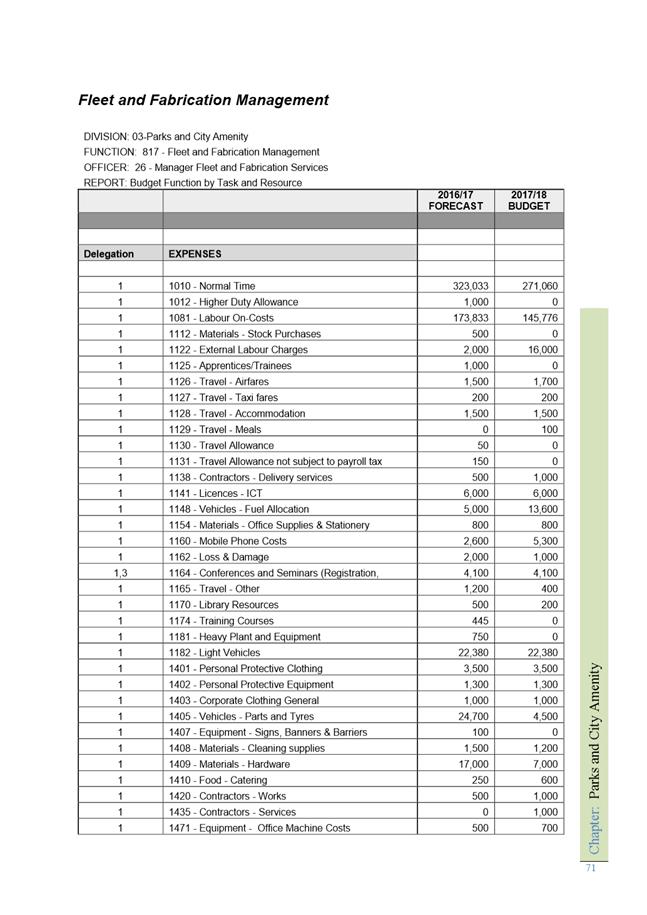

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

Page 71 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

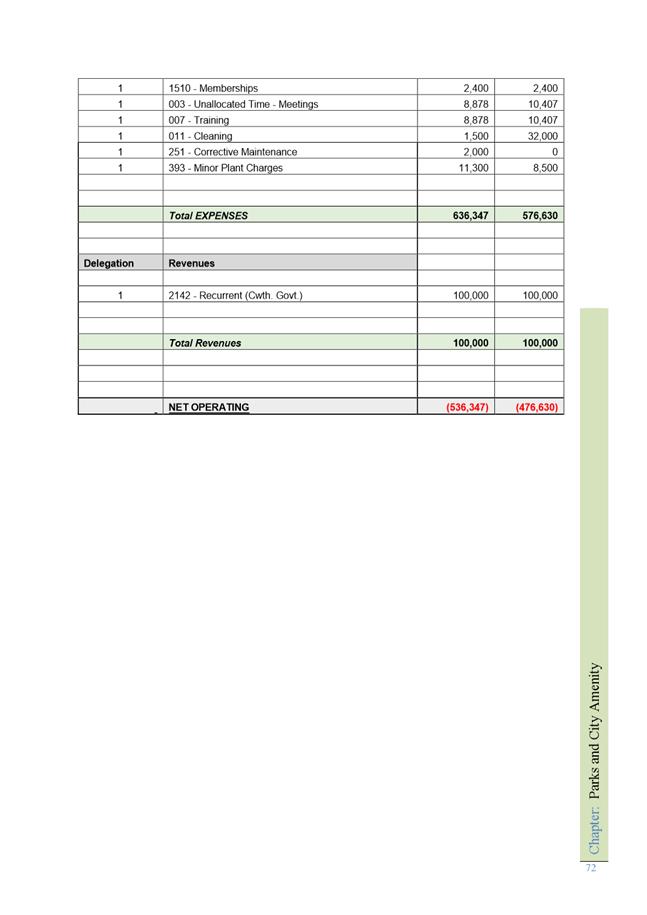

Page 72 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

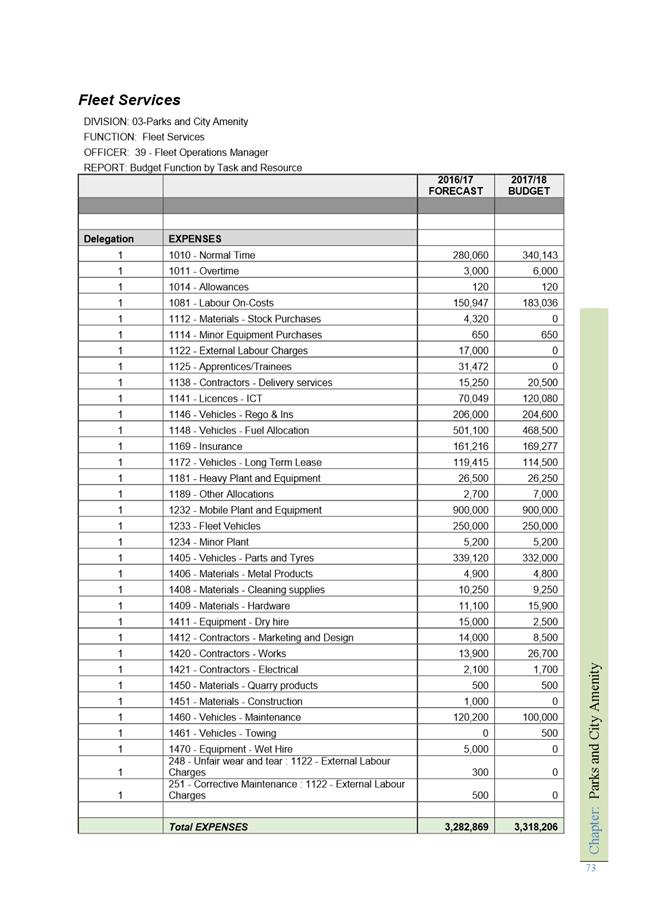

Page 73 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

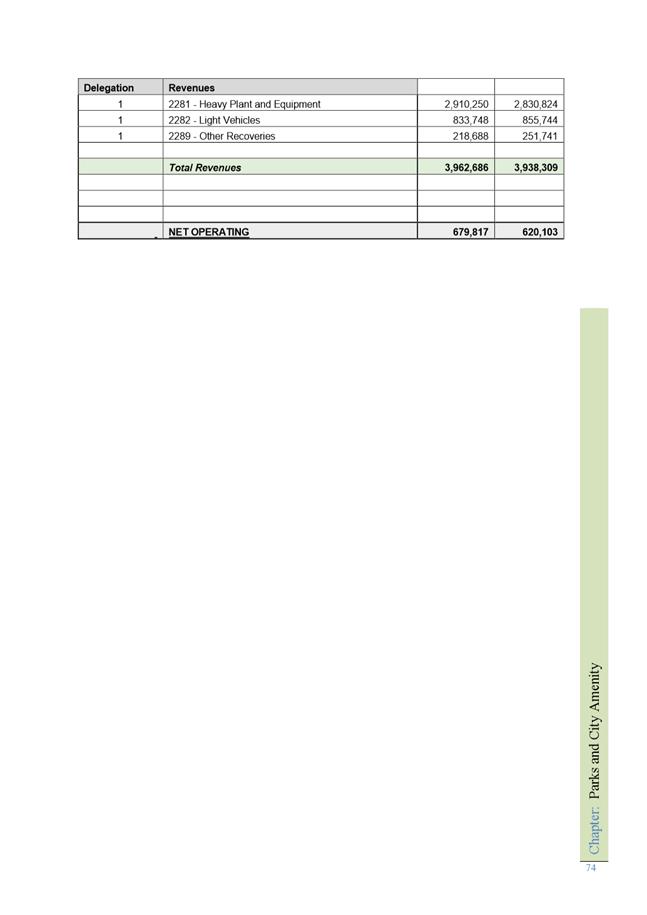

Page 74 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

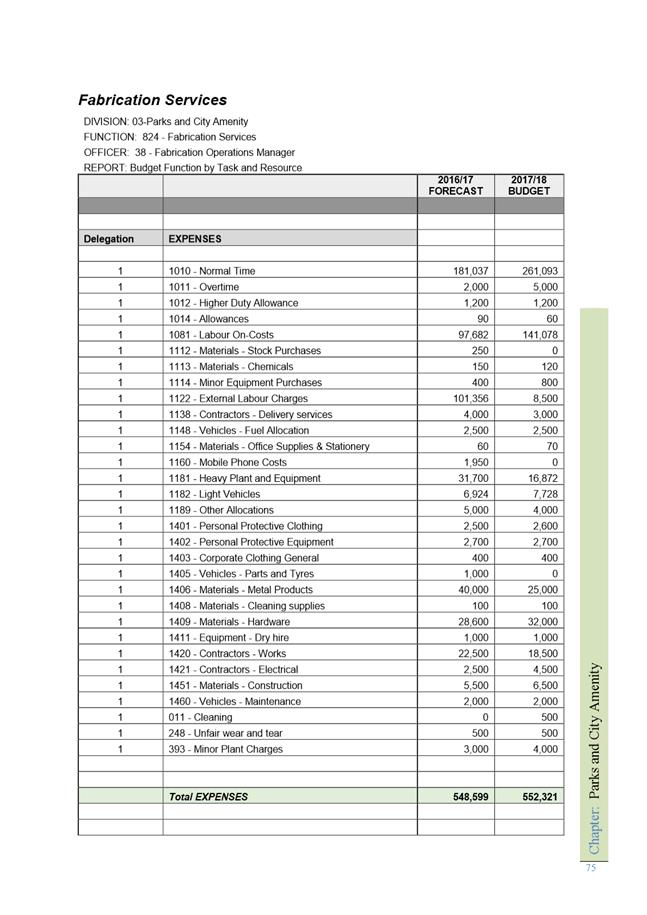

Page 75 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

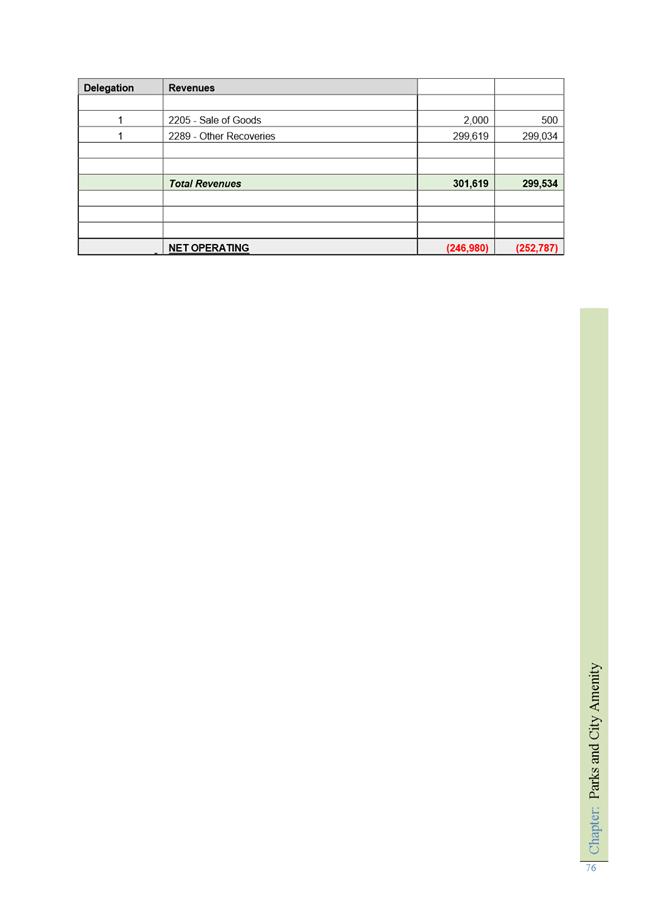

Page 76 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

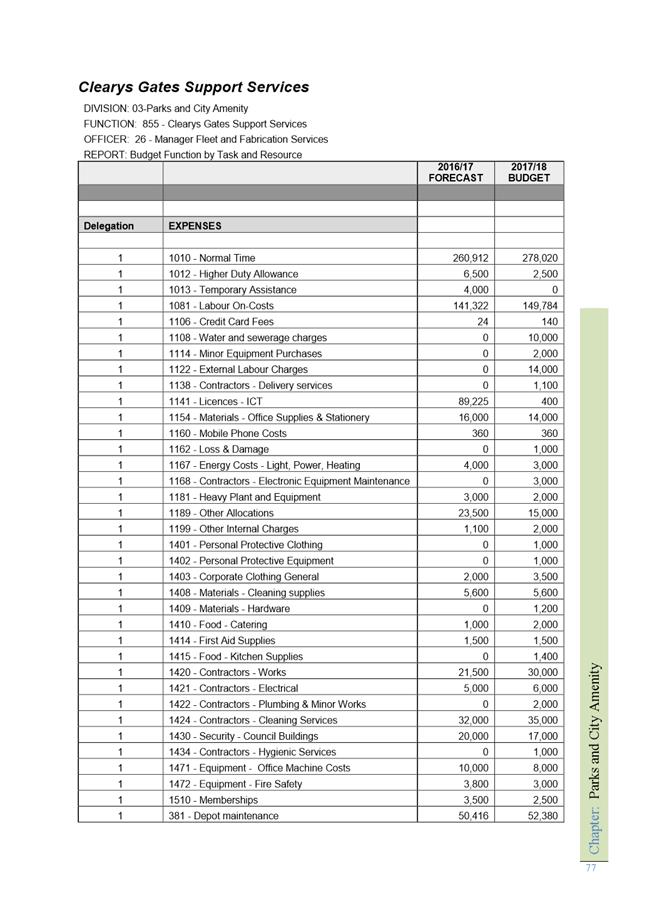

Page 77 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

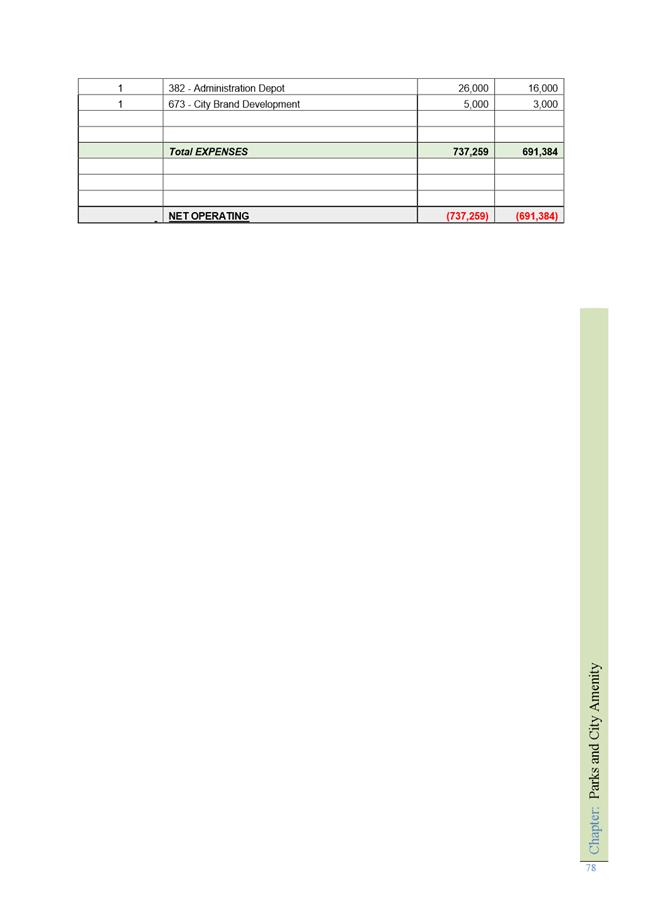

Page 78 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

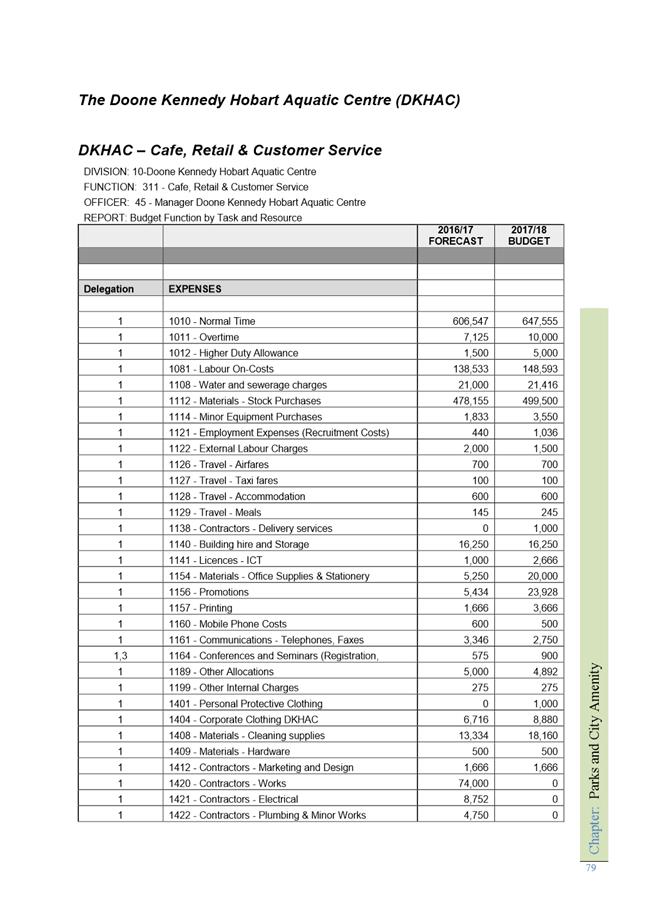

Page 79 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

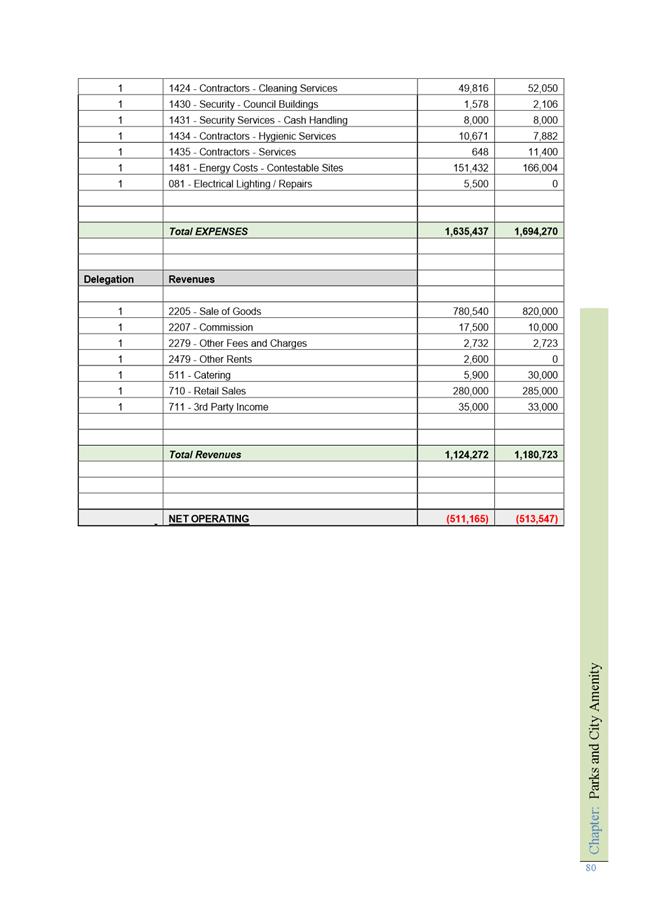

Page 80 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

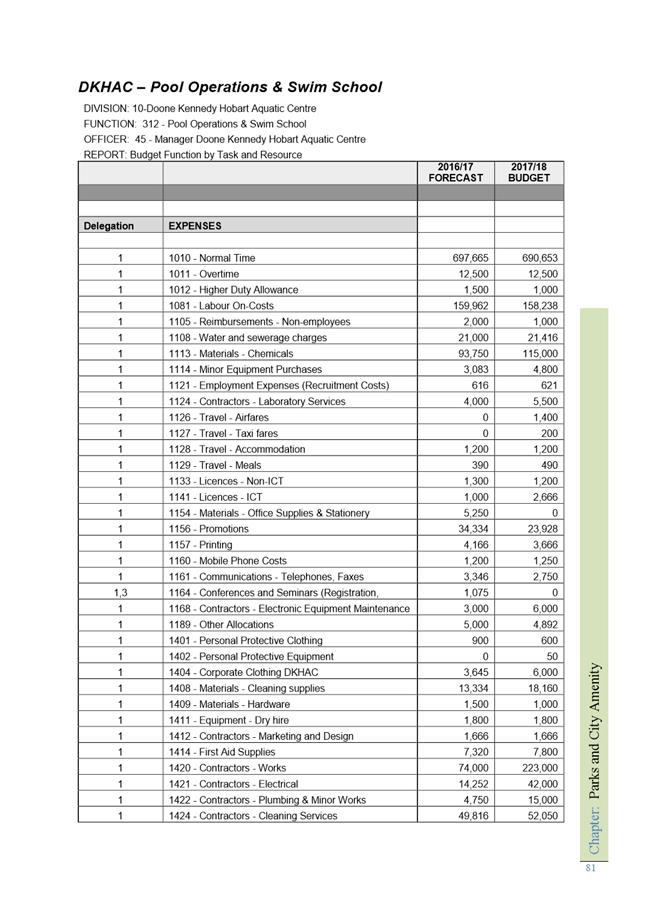

Page 81 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

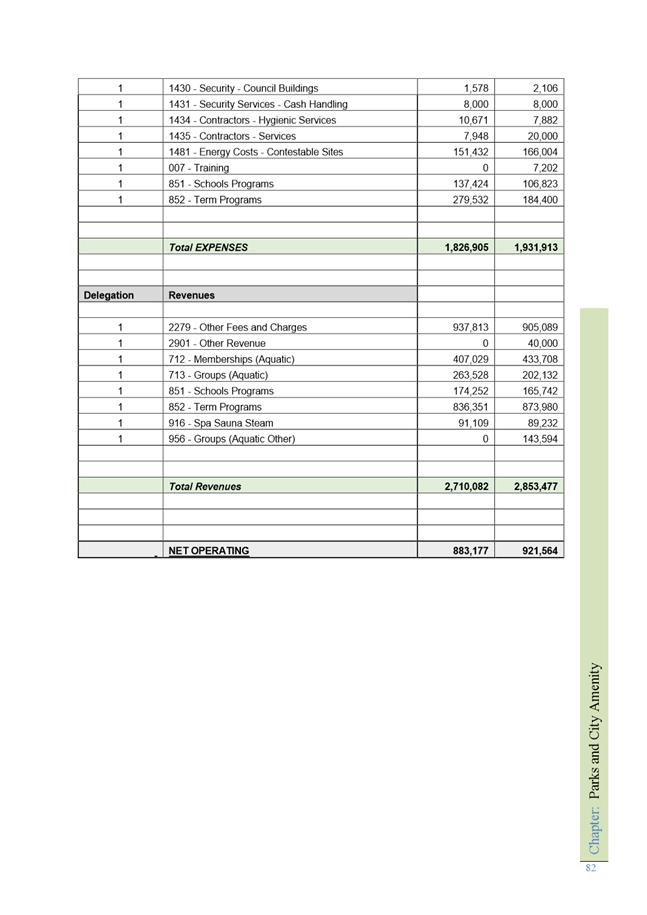

Page 82 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

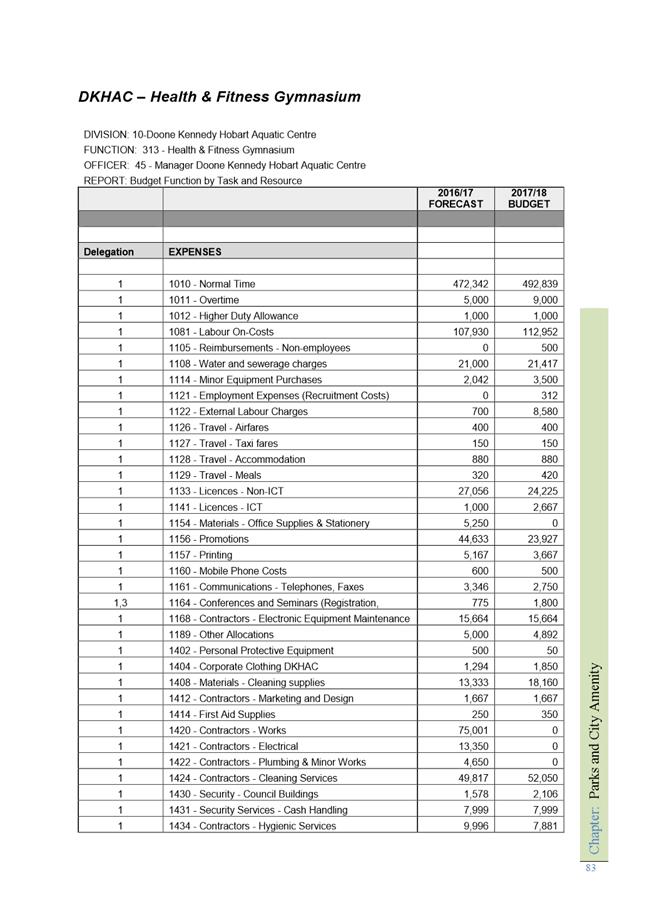

Page 83 ATTACHMENT b |

|

Item No. 4.1 |

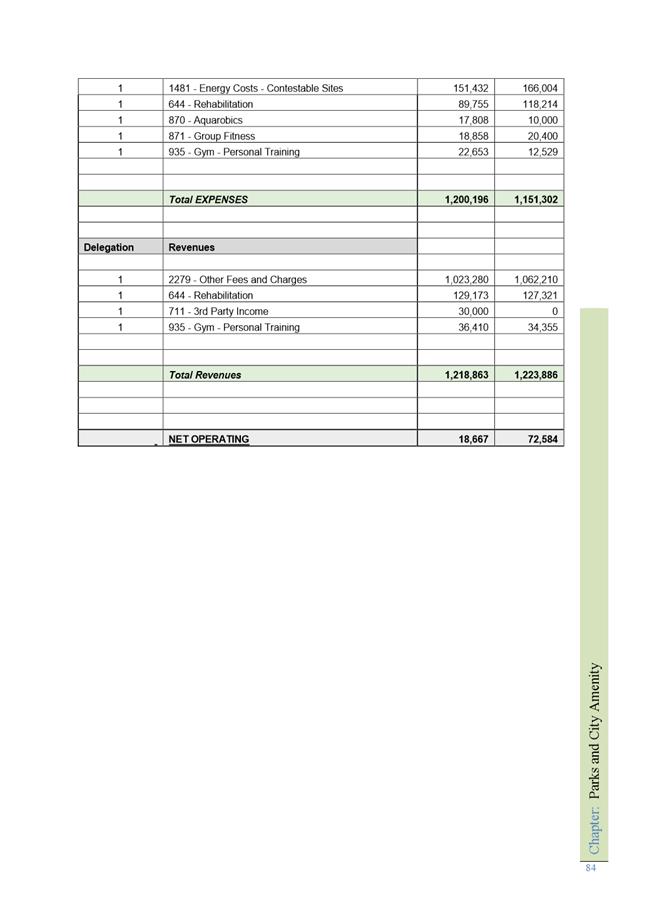

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

Page 84 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

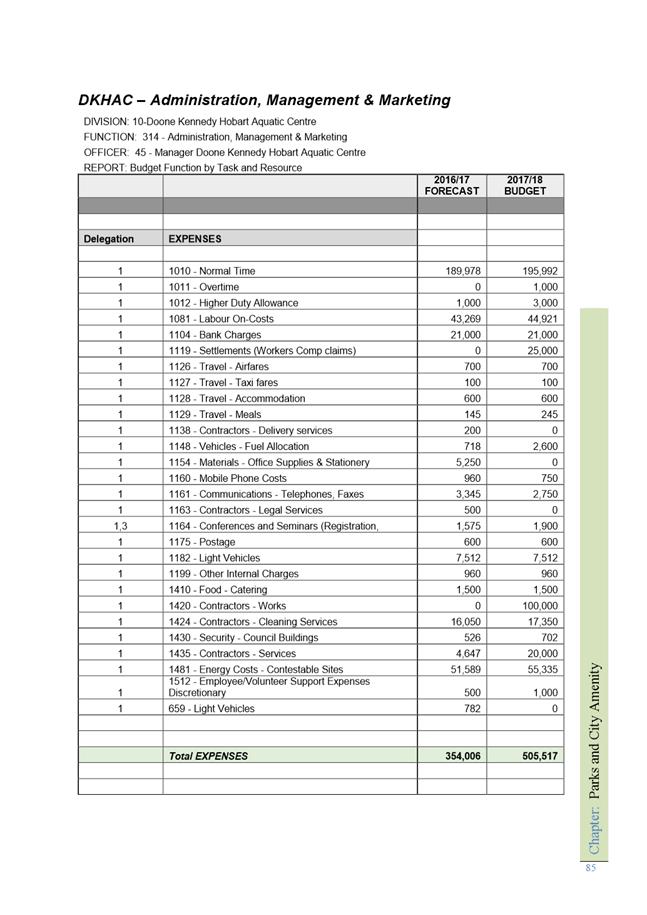

Page 85 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

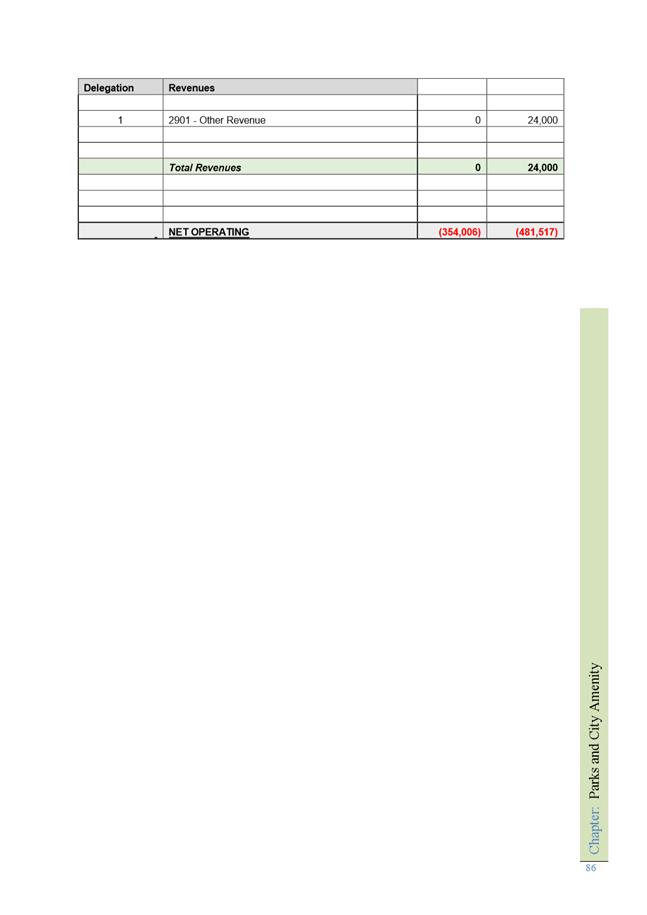

Page 86 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

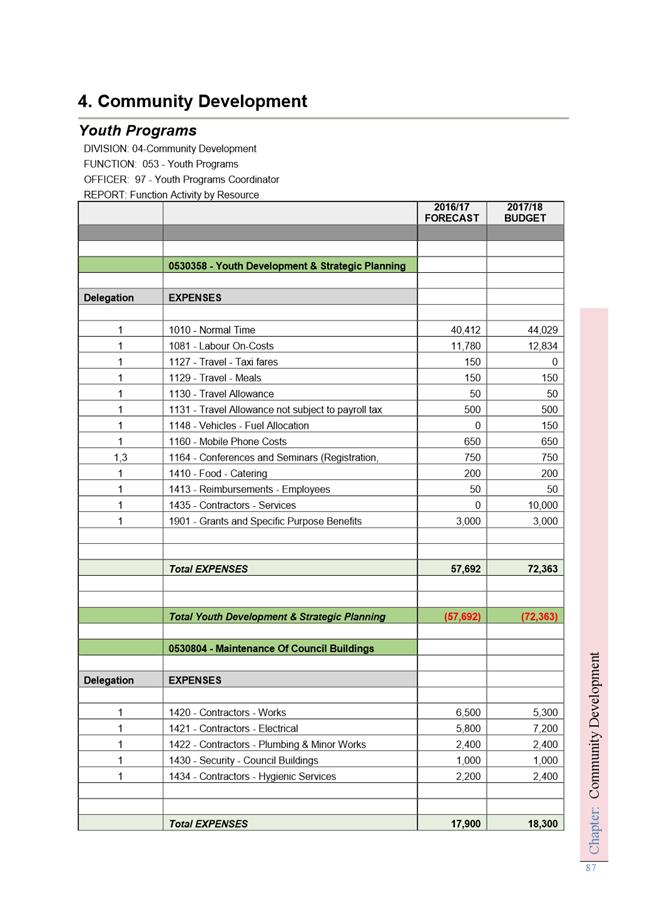

Page 87 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

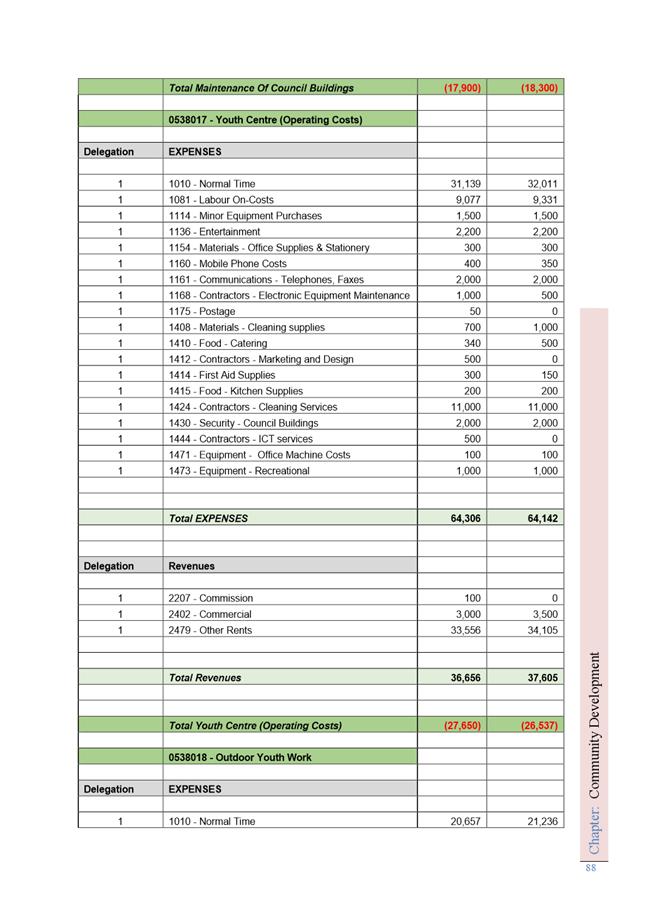

Page 88 ATTACHMENT b |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

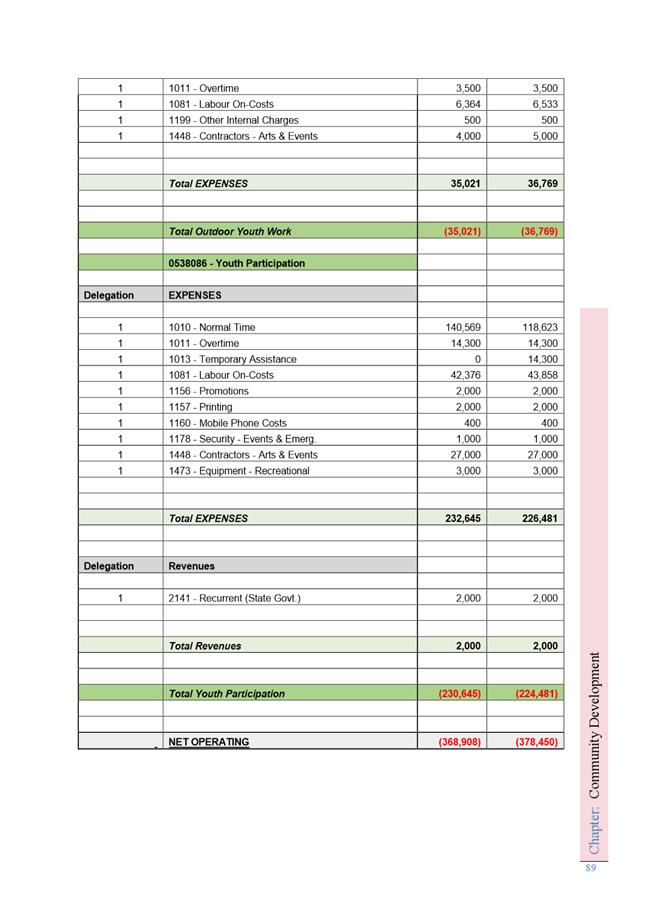

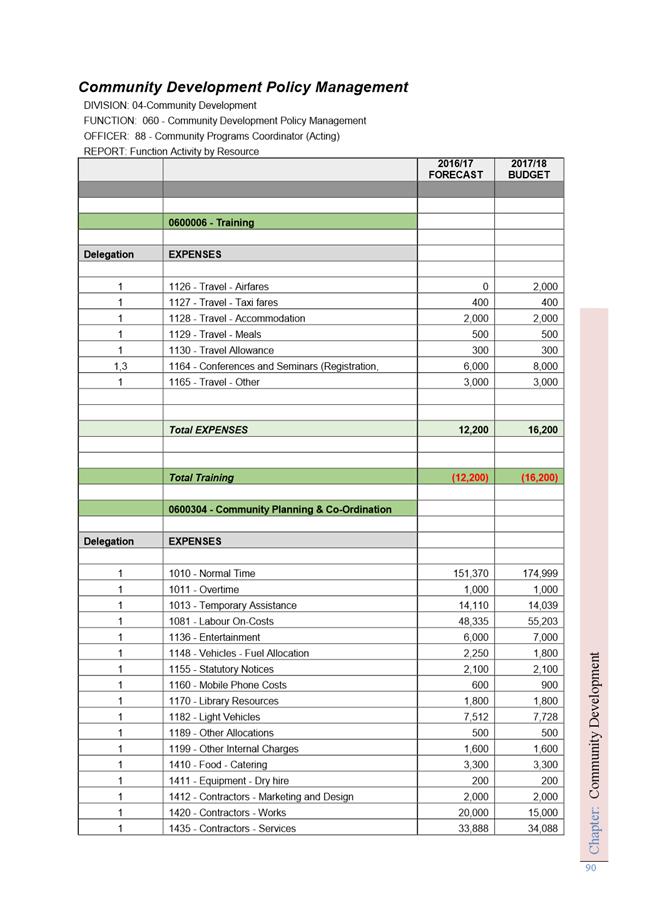

Page 89 ATTACHMENT b |

|

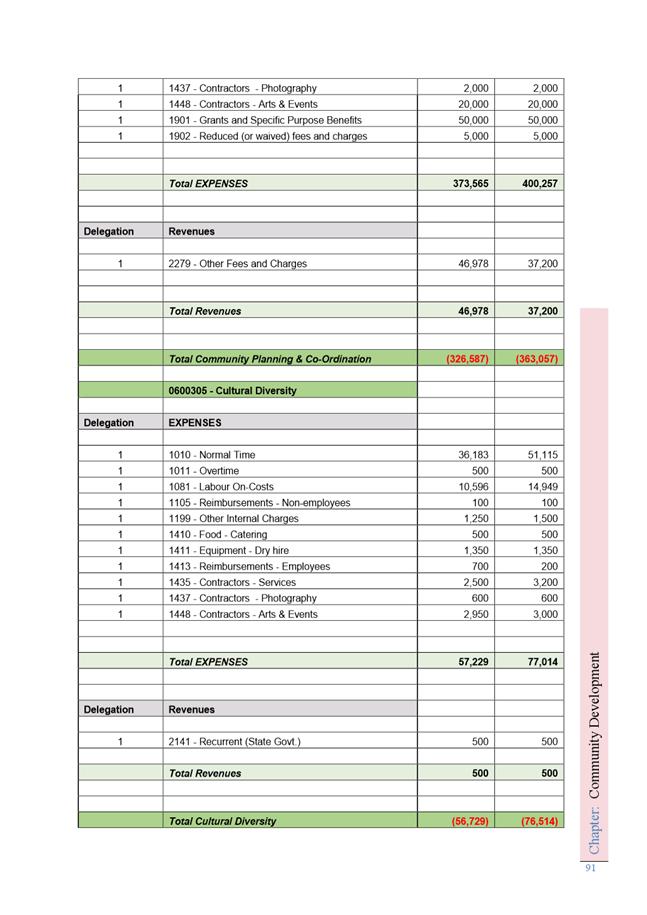

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

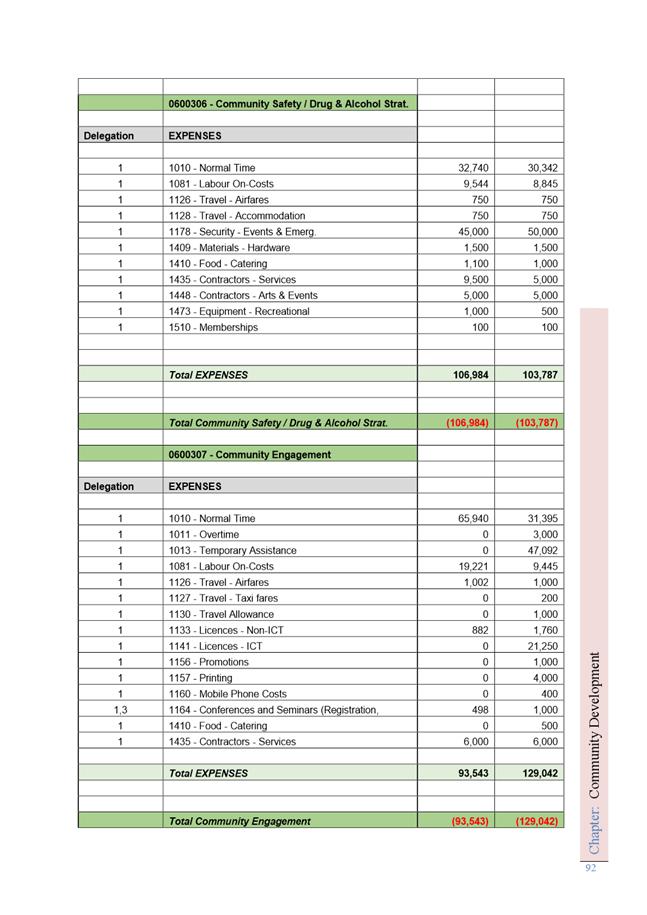

Page 91 ATTACHMENT c |

|

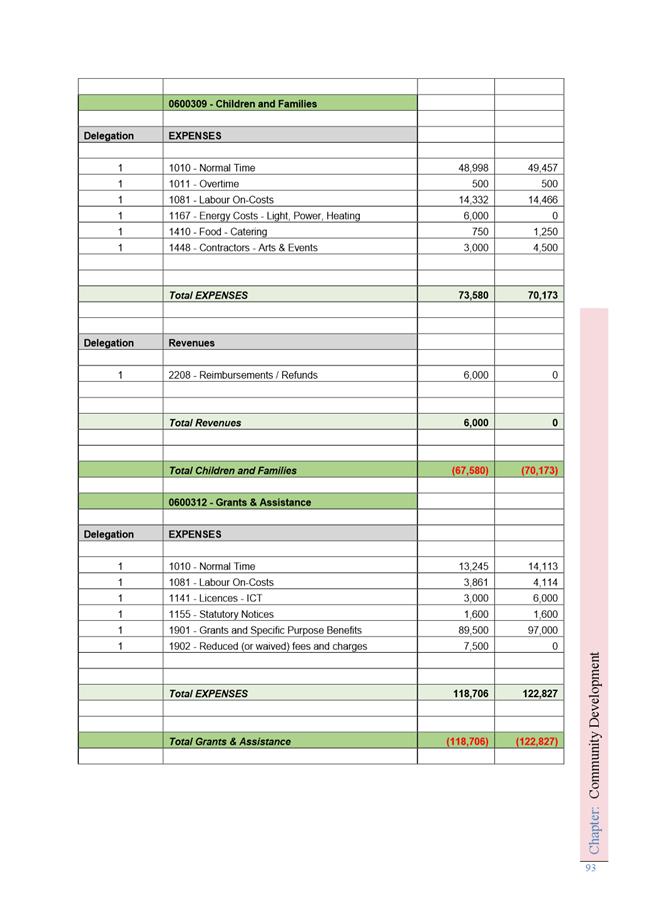

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

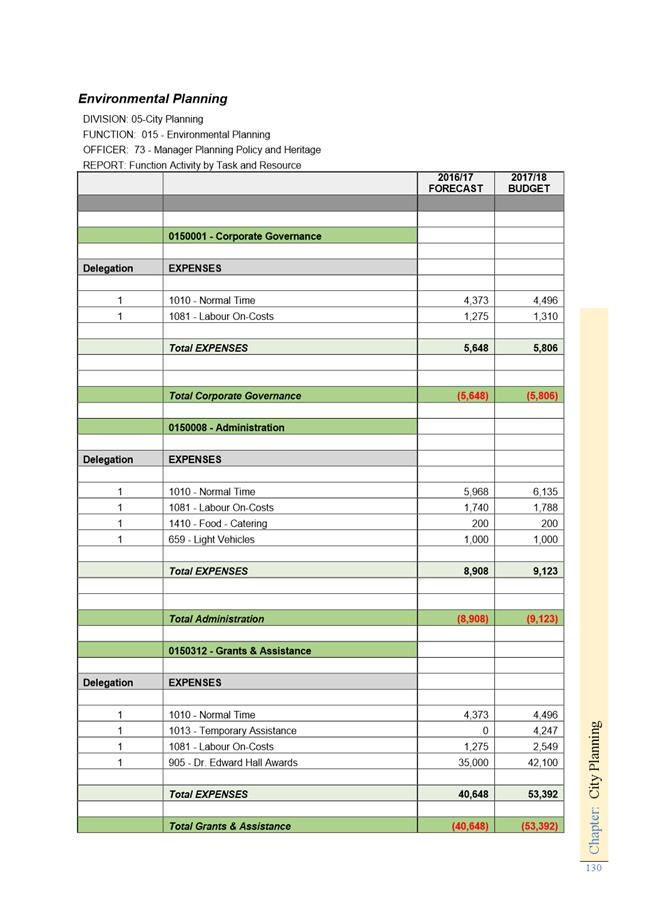

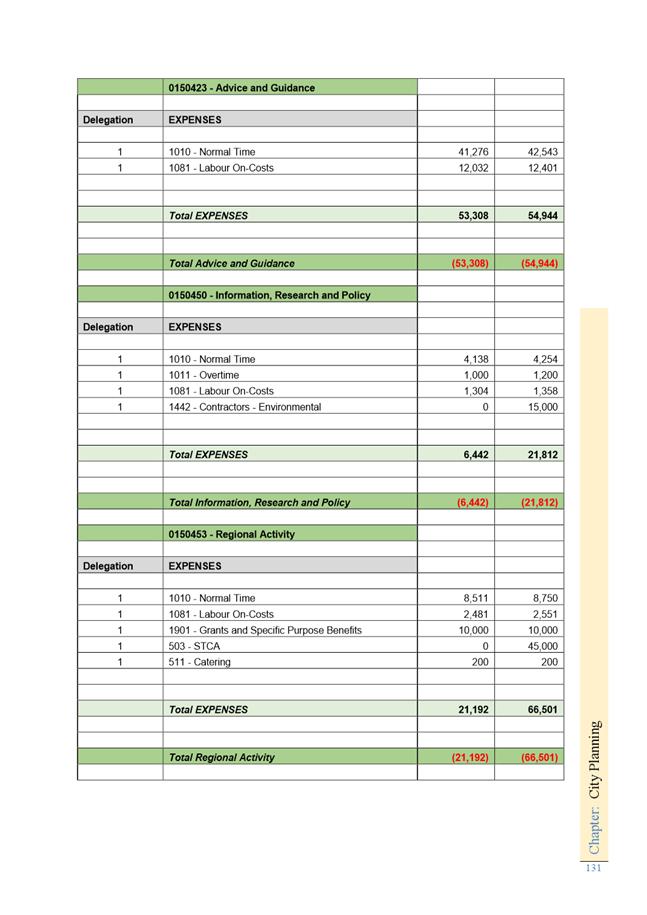

Page 129 ATTACHMENT c |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

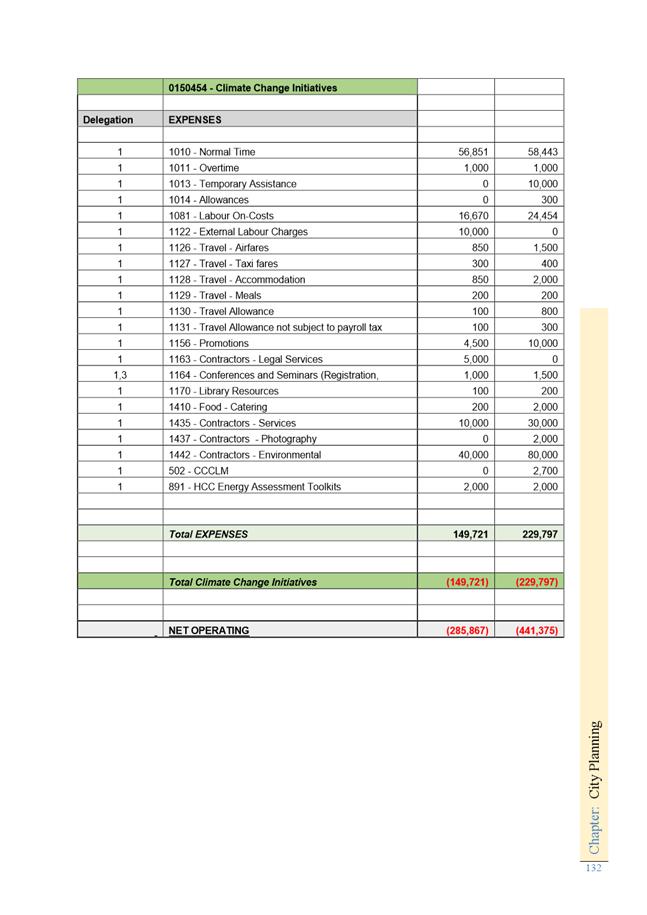

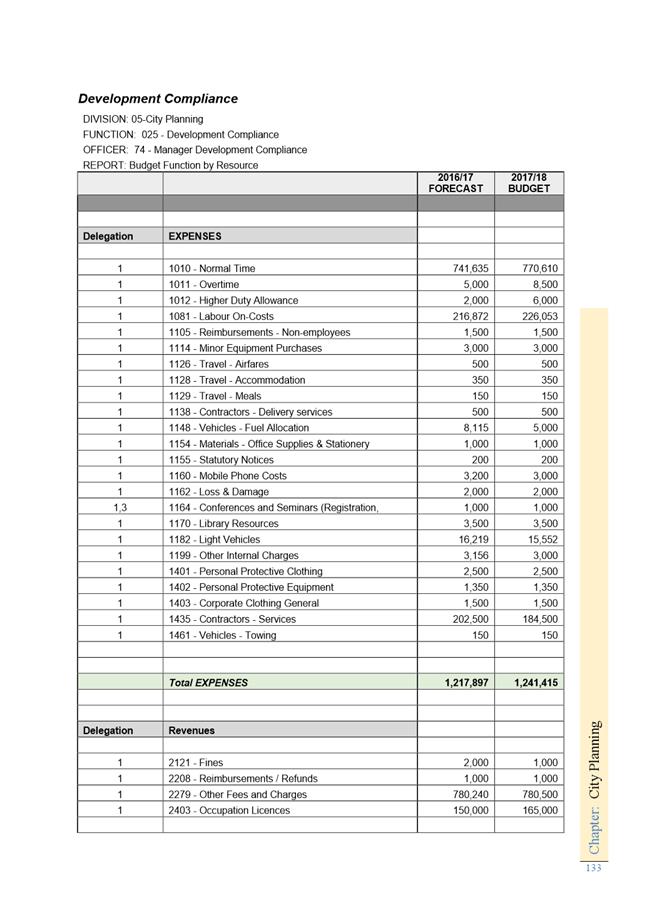

Page 132 ATTACHMENT c |

|

Item No. 4.1 |

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

Page 134 ATTACHMENT d |

|

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

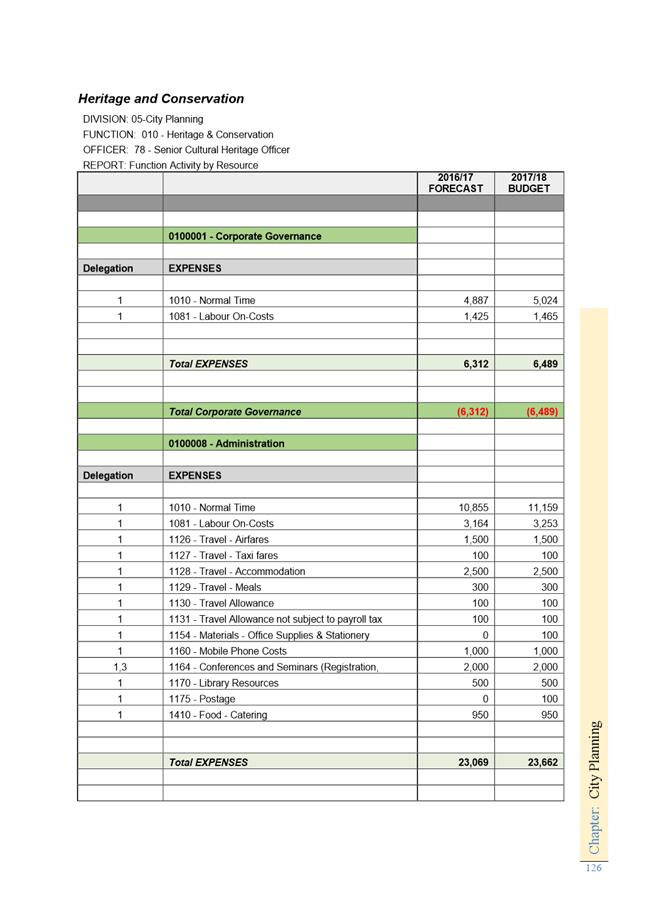

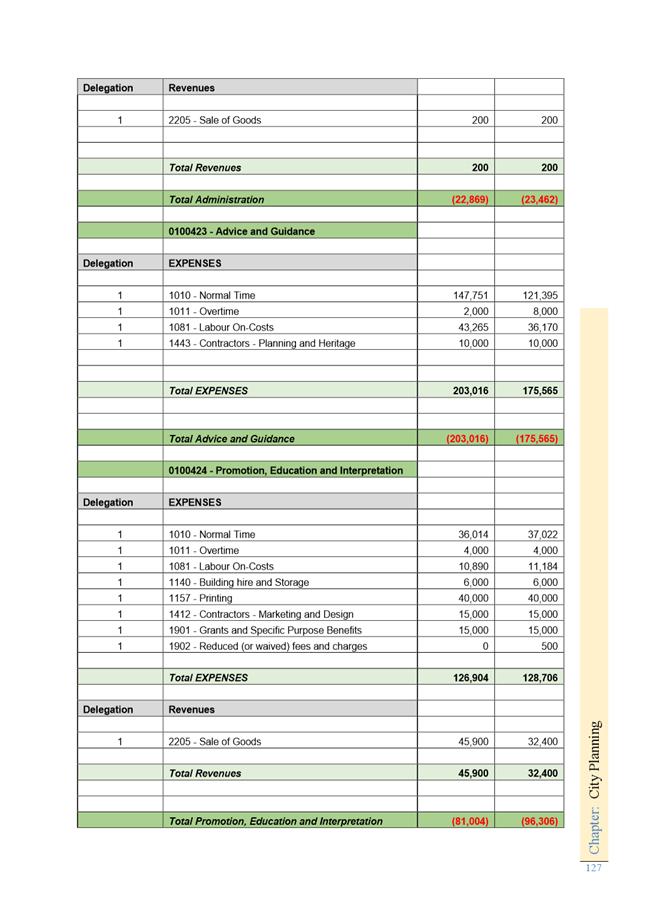

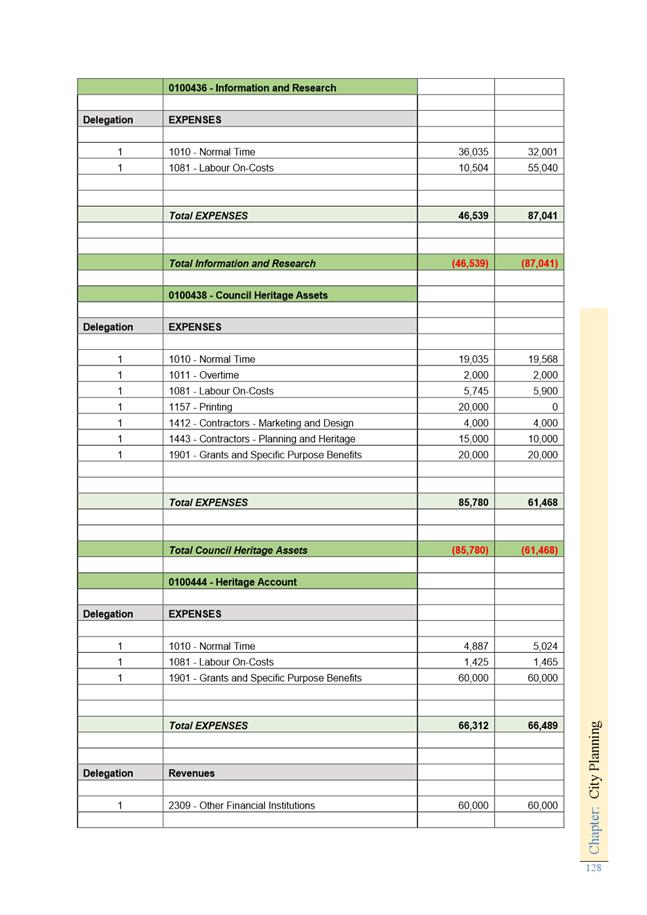

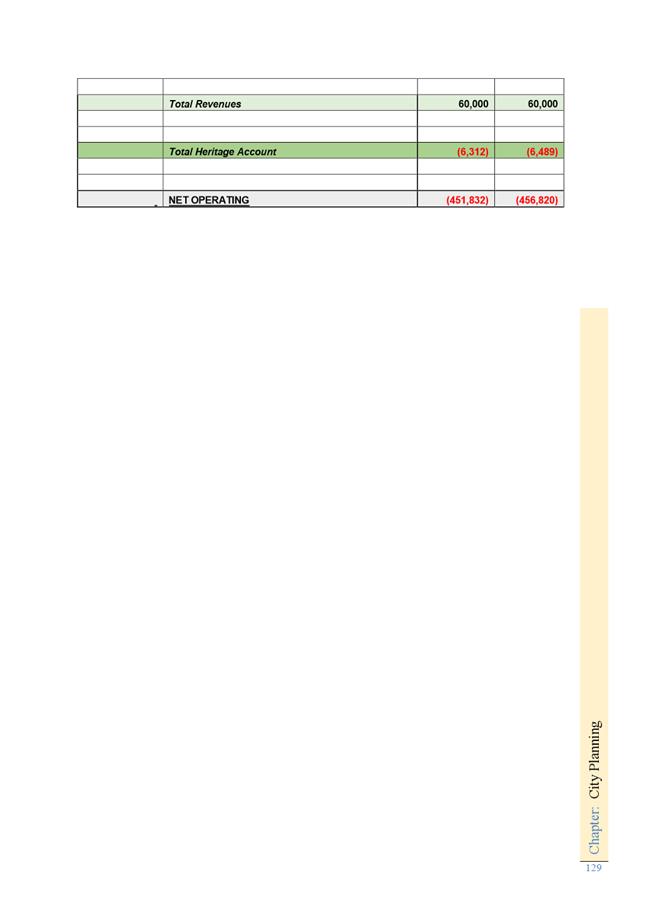

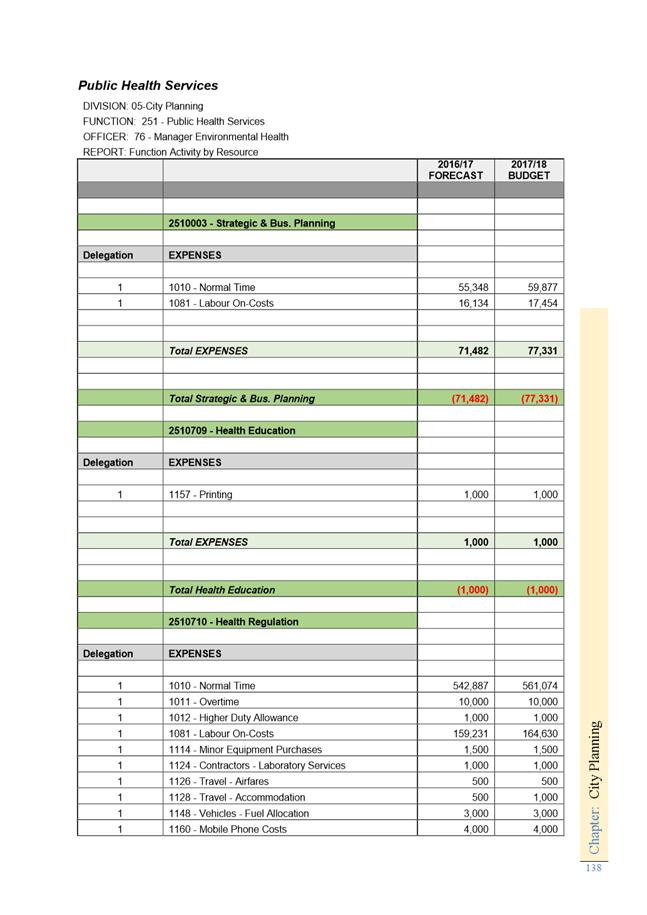

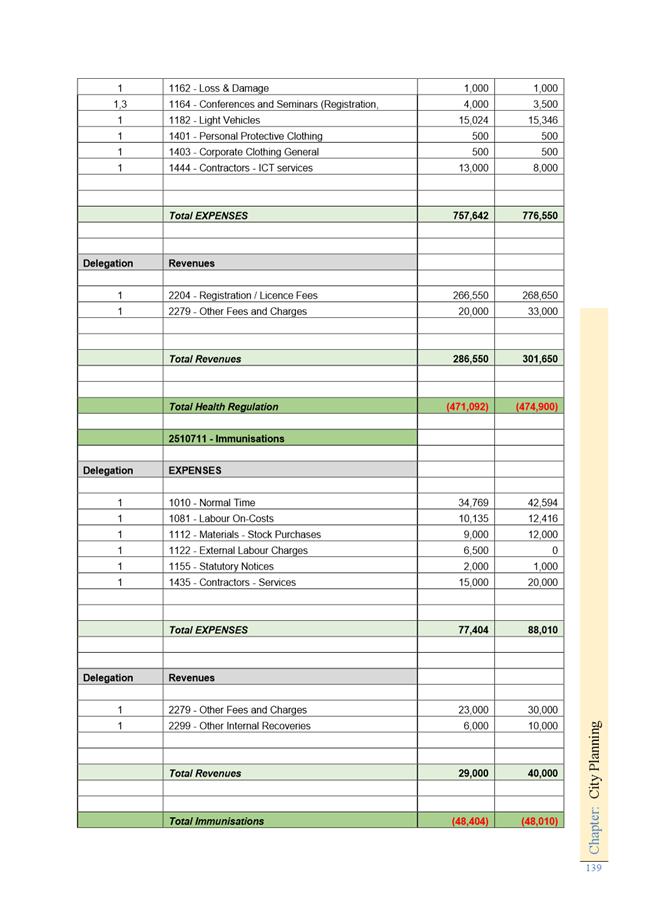

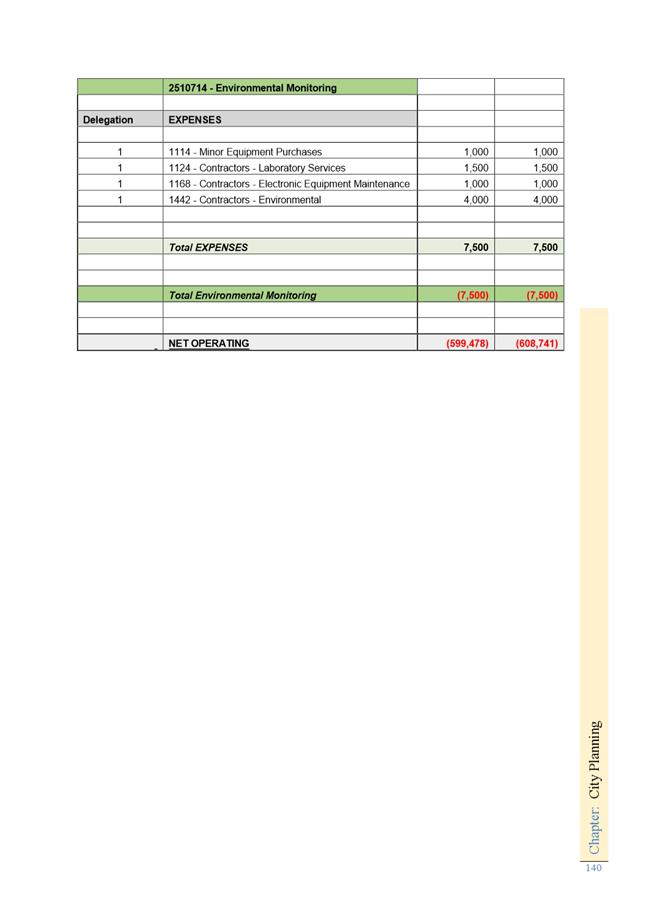

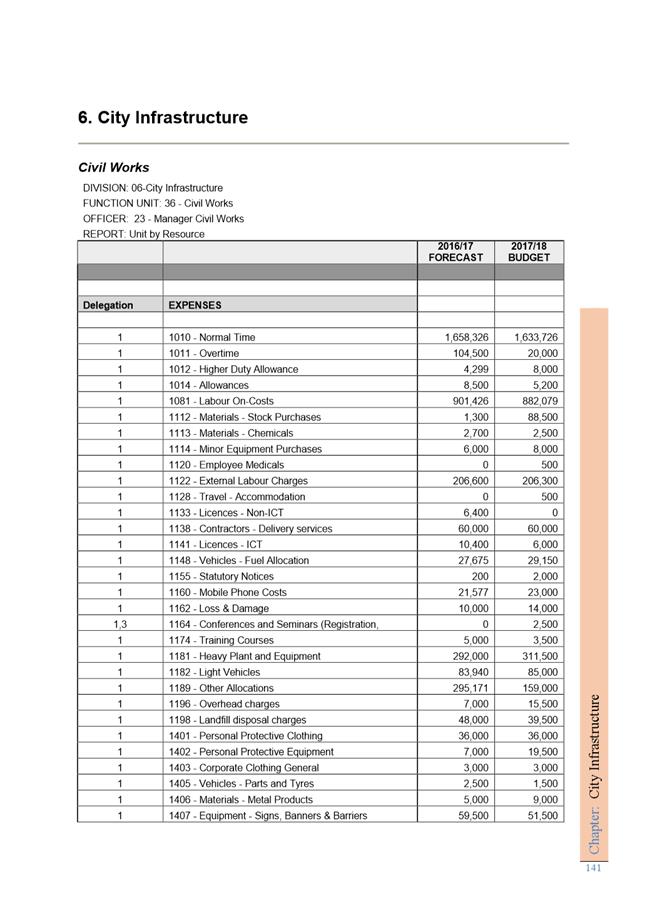

Page 136 ATTACHMENT e |

|

Agenda (Open Portion) Special Finance Committee Meeting - 27/6/2017 |

Page 324 ATTACHMENT f |

|

|

Agenda (Open Portion) Special Finance Committee Meeting |

Page 328 |

|

|

27/6/2017 |

|

Draft resolution – item 6.1.

The Panel resolved the following recommendation, as detailed below, be received and noted:

1. In accordance with Section 4.6.1 Long Term Sustainability of the Risk and Audit Panel Terms of Reference the Panel:

(i) Notes the Long Term Financial Management Plan appears to be in alignment with the City of Hobart Capital City Strategic Plan 2015-2025.

(ii) Notes the proposed 2017-18 Budget Estimates appear to be consistent with achieving the objectives of the City’s Long Term Financial Management Plan 2018-2038.

2. The Panel notes that the modelling of the various financial scenarios and LTFMP indicate reduced flexibility in future decision making (mainly due to increased debt levels as a result of the increased capital works program) and encourages Council to use the Plan not only for forecasting, but as a planning tool.

(i) The Panel notes that the LTFMP and the Capital Works Program are reviewed annually by the Council and that scenario analyses will be included as part of this annual review.

3. Notes the thorough process undertaken in the preparation and development of the budget.