|

Item No. 10

|

Supplementary Agenda (Open Portion)

Finance Committee Meeting

|

Page 2

|

|

|

16/5/2017

|

|

10 Corporate Services Division - Proposed Fees and

Charges for the 2017/2018 Financial Year

Report of the

Group Manager City Government and Customer Relations of 12 May 2017 and

attachments.

Delegation: Council

The General

Manager reports:

“That in

accordance with the provisions of Part 2 Regulation 8(6) of the Local Government

(Meeting Procedures) Regulations 2015, this supplementary matter is

submitted for the consideration of the Committee.

Pursuant to

Regulation 8(6), I report that:

(a) information in relation to the matter was provided subsequent to the

distribution of the agenda;

(b) the matter is regarded as urgent; and

(c) advice is

provided pursuant to Section 65 of the Act.”

|

Item No. 10

|

Supplementary Agenda (Open Portion)

Finance Committee Meeting

|

Page 3

|

|

|

16/5/2017

|

|

REPORT TITLE: Corporate Services Division - Proposed

Fees and Charges for the 2017/2018 Financial Year

REPORT PROVIDED BY: Group Manager

City Government and Customer Relations

1. Report

Purpose and Community Benefit

1.1. The purpose of

this report is to submit the proposed fees and charges for 2017/2018, relating

to the following activities of the Corporate Services Division:

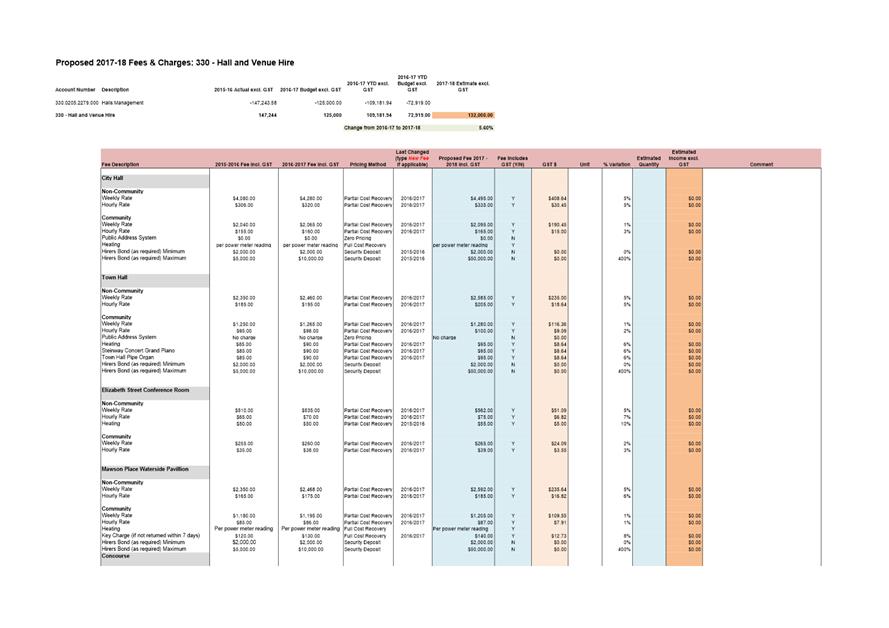

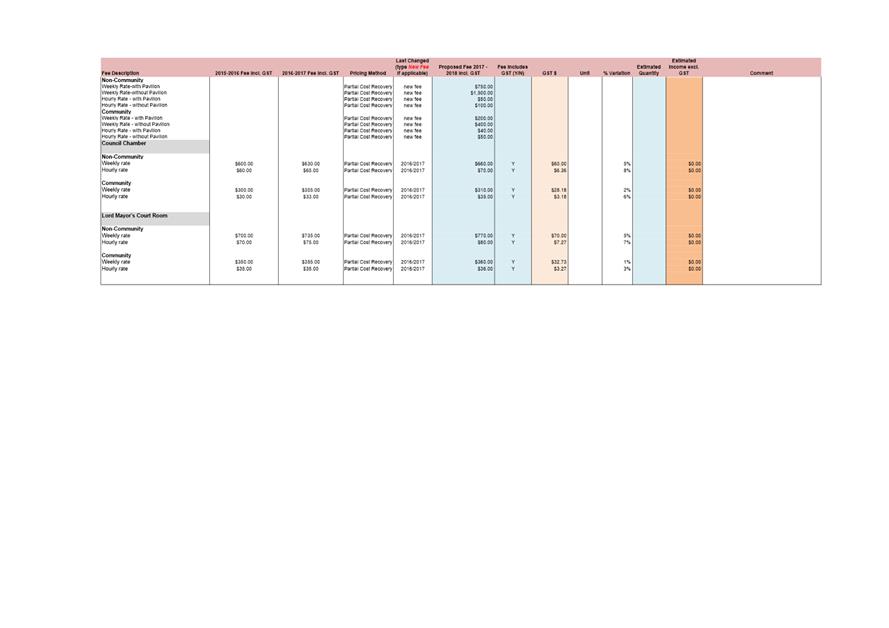

· Hire of halls and spaces, including the City Hall, Town Hall,

Elizabeth Street Conference Room, Waterside Pavilion and adjacent concourse,

Town Hall Council Chamber and Lord Mayor’s Courtroom; and

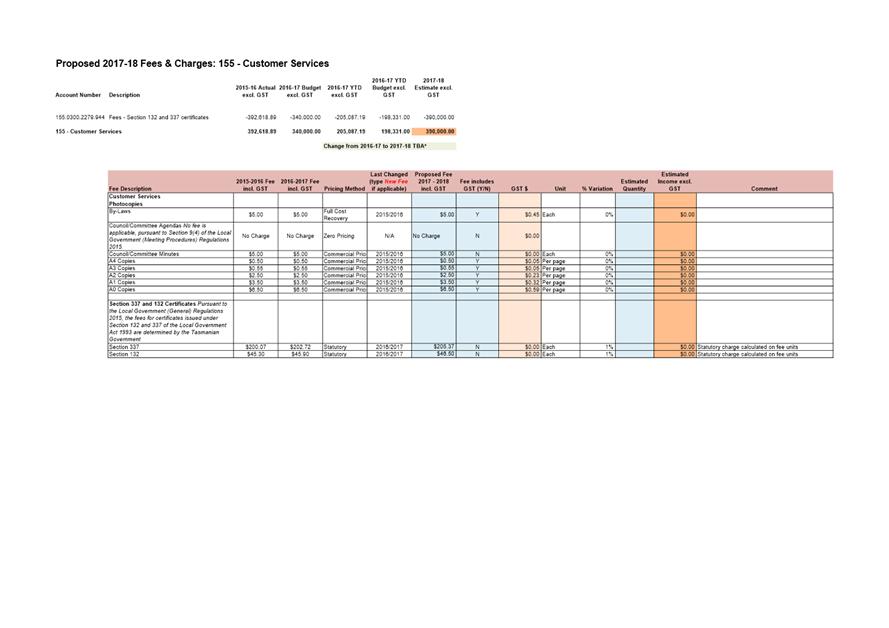

· Customer Services activities.

2. Report

Summary/Background

2.1. The

Council is required to set its fees and charges for the ensuing financial year

as part of its annual budget preparation process.

2.2. Subsequent

to a comprehensive independent review of pricing structure for Council venues

in 2014/2015, annual increases have been applied with consistency to retain

relevance and avoid the need for major or catch-up adjustments.

2.2.1. Annual

increases for community use are in the order of CPI movements, with

non-community use attracting increases averaging 6%.

2.2.2. CPI

for the March quarter is 2.35%.

2.3. The

fees and charges include the hard-standing area adjacent to the Waterside

Pavilion, which was previously managed by the Parks and City Amenity

Division.

|

3. Recommendation

That

the proposed schedule of fees and charges for 2017/2018, as outlined in

attachments A and B, be adopted.

|

4. Proposal

and Implementation

4.1. In

addition to the recommended fee structure for the next financial year, it is

proposed to increase the upper limit which may be required as a bond for the

use of Council spaces.

4.2. The

maximum bond provided under the fees and charges is currently $10,000.

4.3. It

is recommended that this be increased to $50,000 which will enable the Council

to retain a realistic bond in circumstances where the use or configuration of a

space may be unusual and/or the risk of damage to infrastructure may be

considered as high.

4.4. It

is also proposed to vary the descriptors currently applied to the two-tiered

fee structure, from the existing nomenclature of community/commercial, to

community/non-community.

4.5. This

recognises the Council’s longstanding commitment to maximise access to its

spaces for community use through the application of a lower fee structure.

4.6. The

fees attaching to the customer services activity relate substantially to income

collected for the preparation of Section 132 and 337 certificates which

predominately apply upon the sale and purchase of property.

4.6.1. These

fees are set by the Government under schedule 3 of the Local Government

(General) Regulations, and are to be ratified by the Council.

5. Financial

Implications

5.1. Funding

Source and Impact on Current Year Operating Result

5.1.1. There

is no impact on the current financial year result.

5.2. Impact

on Future Years’ Financial Result

5.2.1. Forecast

income from the fees and charges has been factored into the Council’

annual budget preparation.

5.3. Asset

Related Implications

5.3.1. There

are no asset related impacts.

6. Legal,

Risk and Legislative Considerations

6.1. There

are no legal or risk considerations.

7. Delegation

7.1. Setting

of fees and charges is reserved to the Council under s 205 of the Local

Government Act 1993.

As signatory to this report, I certify

that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no

interest, as referred to in Section 49 of the Local Government Act 1993, in

matters contained in this report.

|

Margaret Johns

Group

Manager City Government and Customer Relations

|

|

Date: 12

May 2017

File Reference: F17/47739

Attachment a: Halls

Fees and Charges 2017/2018 ⇩

Attachment

b: Customer

Services Fees and Charges 2017/2018 ⇩