City

of hobart

AGENDA

Finance Committee Meeting

Open Portion

Tuesday, 18 October 2016

at 5:00 pm

Lady Osborne Room, Town Hall

City

of hobart

AGENDA

Finance Committee Meeting

Open Portion

Tuesday, 18 October 2016

at 5:00 pm

Lady Osborne Room, Town Hall

THE MISSION

Our mission is to ensure good governance of our capital City.

THE VALUES

The Council is:

|

about people |

We value people – our community, our customers and colleagues. |

|

professional |

We take pride in our work. |

|

enterprising |

We look for ways to create value. |

|

responsive |

We’re accessible and focused on service. |

|

inclusive |

We respect diversity in people and ideas. |

|

making a difference |

We recognise that everything we do shapes Hobart’s future. |

|

|

Agenda (Open Portion) Finance Committee Meeting |

Page 3 |

|

|

18/10/2016 |

|

Business listed on the agenda is to be conducted in the order in which it is set out, unless the committee by simple majority determines otherwise.

APOLOGIES AND LEAVE OF ABSENCE

1. Co-Option of a Committee Member in the event of a vacancy

3. Consideration of Supplementary Items

4. Indications of Pecuniary and Conflicts of Interest.

6.1 Financial Statements for 30 June 2016

6.2 City of Hobart Rates and Charges Policy Amendment - Penalty and Interest Remissions

7 Committee Action Status Report

7.1 Committee Actions - Status Report

8. Responses to Questions Without Notice

10. Closed Portion Of The Meeting

|

|

Agenda (Open Portion) Finance Committee Meeting |

Page 5 |

|

|

18/10/2016 |

|

Finance Committee Meeting (Open Portion) held Tuesday, 18 October 2016 at 5:00 pm in the Lady Osborne Room, Town Hall.

|

COMMITTEE MEMBERS Thomas (Chairman) Deputy Lord Mayor Christie Zucco Ruzicka Sexton

ALDERMEN Lord Mayor Hickey Briscoe Burnet Cocker Reynolds Denison Harvey |

Apologies: Nil.

Leave of Absence: Nil.

|

|

The minutes of the Open Portion of the Finance Committee meeting held on Tuesday, 13 September 2016, are submitted for confirming as an accurate record.

|

Ref: Part 2, Regulation 8(6) of the Local Government (Meeting Procedures) Regulations 2015.

|

That the Committee resolve to deal with any supplementary items not appearing on the agenda, as reported by the General Manager.

|

Ref: Part 2, Regulation 8(7) of the Local Government (Meeting Procedures) Regulations 2015.

Aldermen are requested to indicate where they may have any pecuniary or conflict of interest in respect to any matter appearing on the agenda, or any supplementary item to the agenda, which the committee has resolved to deal with.

Regulation 15 of the Local Government (Meeting Procedures) Regulations 2015.

A committee may close a part of a meeting to the public where a matter to be discussed falls within 15(2) of the above regulations.

In the event that the committee transfer an item to the closed portion, the reasons for doing so should be stated.

Are there any items which should be transferred from this agenda to the closed portion of the agenda, or from the closed to the open portion of the agenda?

|

Agenda (Open Portion) Finance Committee Meeting |

Page 6 |

|

|

|

18/10/2016 |

|

6.1 Financial Statements for 30 June 2016

File Ref: F16/115715

Report of the Manager Finance and the Director Financial Services of 13 October 2016 and attachments.

Delegation: Council

|

Item No. 6.1 |

Agenda (Open Portion) Finance Committee Meeting |

Page 8 |

|

|

18/10/2016 |

|

REPORT TITLE: Financial Statements for 30 June 2016

REPORT PROVIDED BY: Manager Finance

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to present the financial statements for the year ended 30 June 2016 for adoption by the Council.

2. Report Summary

2.1. The Council’s financial statements for the year ended 30 June 2016 have been prepared and independently audited.

2.2. The financial statements were presented to the Risk and Audit Panel on 9 August 2016 and received endorsement of that Panel, subject to two changes. Firstly, update for the revised TasWater investment value as advised by TasWater, and secondly, recognition of the land under roads acquired prior to 1 July 2008.

2.3. The financial statements were delivered to the Auditor-General on 15 August 2016.

2.4. The Auditor-General requested a number of disclosure and presentation changes including accrual of additional expenses identified following the close of the financial year.

2.5. The Auditor-General has completed his audit and has issued an unqualified audit opinion on the financial statements (see Attachments B and C).

|

That the Council formally adopt the financial statements for the year ended 30 June 2016 marked as Attachment A to this report.

|

4. Background

4.1. The financial statements for the year ended 30 June 2016 have been prepared on a consistent basis with prior years.

4.2. As was the case in 2014/2015, land under roads acquired after 30 June 2008 has been recognised as an asset. In 2015/2016 land under roads acquired prior to 1 July 2008 has also been recognised. Accounting Standards require recognition of all land under roads acquired post 30 June 2008, however do not mandate the recognition of land acquired under roads prior to that date. The Auditor–General recommends recognition of all land under roads on the basis of consistency. The Risk and Audit Panel concurred with this view.

4.3. Recognition of the pre 1 July 2008 land under roads has resulted in an increase in the value of the land class of assets by $685M with a corresponding increase in capital revenue.

4.4. This and other highlights of the financial statements are detailed in Section 7 below (see Attachment A).

5. Proposal and Implementation

5.1. It is proposed that Council formally adopt the financial statements.

6. Strategic Planning and Policy Considerations

6.1. There are no direct strategic planning and policy implications.

7. Financial Implications

7.1. Financial Sustainability Outcomes

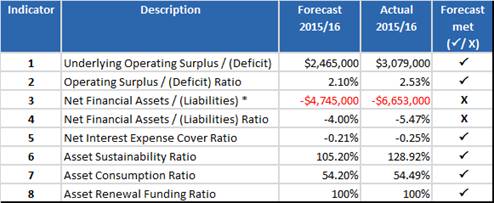

7.1.1. As outlined in Council’s Long-term Financial Management Plan (LTFMP), eight financial sustainability measures have been adopted for the purpose of measuring the Council’s financial sustainability

7.1.1.1. Indicators 1-2 are measures of profit and performance and the extent to which expenses are covered by revenues.

7.1.1.2. Indicators 3-4 are measures of indebtedness and the amount the Council owes others (loans, employee provisions, creditors) net of financial assets (cash and amounts owed to the Council).

7.1.1.3. Indicator 5 measures the proportion of income required to meet net interest costs.

7.1.1.4. Indicators 6-8 are measures of asset management.

7.1.2. Council’s performance against the eight financial sustainability indicators is shown in Table 1 below: -

Table 1: Performance against Financial Sustainability Indicators

* Note – Net Financial Assets/(Liabilities) includes all liabilities, and therefore differs from the value shown in note 18 of the financial statements (which only requires financial liabilities)

Table 1 shows that all forecast results for the year have been achieved except for the Net Financial Assets/(Liabilities) which is due to the increase in the defined benefits superannuation plan following the 2015/2016 actuarial assessment (see Section 7.9).

7.2. Operating Result

7.2.1. The Operating Result for 2015/2016 is a surplus of $691.97M (2014/2015 $15.228M). This result is impacted by a number of ‘abnormal’ items that are listed at note 9 to the financial statements. Primarily this is the land under roads brought to account ($685M) but also includes capital grants, contributed infrastructure assets, employee separation payments, and adjustments for the advance receipt of both Financial Assistance Grants and rates.

7.2.2. Excluding these ‘abnormal’ items produces an underlying operating surplus of $3.079M (2014/2015 $3.048M), or 2.56% of underlying revenue. This result represents a slight increase of $0.31M from 2014/2015, and is $0.67M favourable against the original budget position and $0.61M favourable against the March revised forecast. This result demonstrates that the Council is continuing its strategy to record modest surpluses.

7.2.3. The favourable variance from original budget is mainly due to lower employee costs ($252K), lower materials and services ($1.065M) due to the reduction in the landfill rehabilitation provision as a result of its extended closure date, increased fines revenue ($412K) due to a full complement of parking officers during the year, and higher car park income ($636K) as a result of increased use of the Council’s car parks.

7.2.4. Unfavourable variances were recorded mainly in respect of other expenses predominantly due to the second payment under the Myer deed and the payment of the South Hobart Community Hub grant funds. These were partially offset by the extinguishment of the asphalt plant rehabilitation provision that has been deemed to no longer be required.

7.2.5. The Auditor-General has indicated his in-principle agreement to our method of calculating the underlying result, and has agreed to reflect this calculation in his report to Parliament.

7.3. Cash Position

7.3.1. Cash balances have decreased by $4.4M, from $40.7M to $36.3M. This amount is allocated to the various purposes listed in note 16 to the financial statements. Note 16 demonstrates that the cash on hand is not “unutilised funds”. Rather, the vast majority of these funds are accounted for in some way. Some funds are restricted (the Heritage Account and unspent grants) and remaining funds are earmarked for various purposes (e.g. Public Infrastructure Fund, McRobies Gully Landfill Rehabilitation, and carry forward capital works).

7.3.2. The decrease in cash is predominantly due to higher than expected operating payments to suppliers and for other payments, financial assistance grants received in advance in the prior year, higher than expected capital expenditure on plant and equipment, together with various timing issues that contribute to the cash balance at any given point in time.

7.4. Rate Revenue

7.4.1. Rate revenue for 2015/2016 totalled just over $75M, and represents approximately 62% of underlying revenue.

7.4.2. The increase from the previous year of $1.26M is the result of:

7.4.2.1. A 2.6% rate increase to fund the increased cost of providing services (including 0.7% to fund the increase in the State fire levy);

7.4.2.2. A 0.07% increase in Council’s rate base (total AAV) during 2015/2016.

7.5. Asset Revaluations

7.5.1. In accordance with the requirement to ensure that reported asset values do not differ materially from their fair value, some asset classes were revalued during 2015/2016, with indexation being applied to the remainder.

7.5.2. The results of the revaluation exercise were:-

|

Other Structures |

$2.509M |

Increment |

|

Infrastructure Plant |

$0.402M |

Decrement |

|

$2.107M |

Increment |

7.5.3. The results of the indexation exercise were:-

|

Buildings |

$2.513M |

Increment |

|

Land Improvements |

$0.323M |

Increment |

|

Roads and Bridges |

$3.141M |

Increment |

|

Storm Water |

$1.828M |

Increment |

|

Other |

$0.059M |

Increment |

|

$7.864M |

Increment |

7.6. Contributed Property, Plant and Equipment

7.6.1. Contributed property, plant and equipment essentially comprises assets required to be constructed for the Council by developers.

7.6.2. During 2015/2016, these amounted to $686.166M (2014/2015 $4.477M) and were mainly derived from recognition of land under roads contributed prior to July 2008 plus storm water and road related assets.

7.7. Asset Write-offs

7.7.1. Asset write-offs are mainly comprised of infrastructure assets replaced as part of the Council’s on-going asset renewal program.

7.7.2. Asset write-offs totalled $2.220M (2014/2015 $2.656M) and were in respect of the following asset classes: -

|

Footpaths, Kerb & Gutter |

$0.728M |

|

Land Improvements |

$0.281M |

|

Storm Water Mains |

$0.119M |

|

Other Structures |

$0.180M |

|

Roads |

$0.492M |

|

Plant & Equipment |

$0.140M |

|

Other |

$0.280M |

|

|

$2.220M |

7.7.3. Asset write-offs were originally budgeted to be $2.012M for 2015/2016, and are therefore $0.21M unfavourable against the original budget.

7.8. Investment in TasWater

7.8.1. Council has an ownership interest in TasWater which is accounted for as an ‘available-for-sale financial asset’. This investment replaces the Council’s ownership interest in Southern Water with effect from 1 July 2013.

7.8.2. Distributions received from TasWater (including dividends) are recognised as revenue, and included in the Council’s surplus/(deficit).

7.8.3. The value of the Council’s ownership interest at any point in time is calculated by applying the Council’s voting interest percentage (10.39%) to TasWater’s net asset value. Applying this methodology at 30 June 2016 produces a value for Council’s ownership interest of around $163.6M, which represents a $2.7M increase from 30 June 2015. The $2.7M increase from the previous year has been recognised in ‘other comprehensive income’ rather than in the surplus/(deficit).

7.9. Defined-Benefit Superannuation Plan

7.9.1. Council’s defined-benefit superannuation liability has increased by $2.143M to $3.54M at 30 June 2016. This increase has arisen for the following reasons: -

7.9.1.1. The return on the assets for 2015/2016 was lower than expected, and

7.9.1.2. Lower discount rate at 30 June 2016 of 1.78% pa (2015: 2.2% pa).

7.9.2. The triennial actuarial review of the fund is due next year ie: as at 30 June 2017.

8. Legal, Risk and Legislative Considerations

8.1. Section 84(1) of the Local Government Act 1993 requires the General Manager to prepare and forward to the Auditor-General a copy of Council’s financial statements in accordance with the Audit Act 2008.

8.2. Section 17(1) of the Audit Act 2008 requires the General Manager to prepare and forward a copy of the Council’s financial statements to the Auditor-General within 45 days after the end of each financial year.

8.3. Section 17(4) of the Audit Act 2008 requires the Council’s financial statements to be prepared in accordance with the accounting standards and other requirements issued by the Australian Accounting Standards Board.

8.4. Section 84(3) of the Local Government Act 1993 requires the General Manager to certify that the financial statements fairly represent Council’s financial position, the results of the Council’s operations, and the cash flow of the Council. This certification is attached (refer attachment D).

8.5. Section 84(4) of the Local Government Act 1993 requires the General Manager to table the certified financial statements at a meeting of the Council as soon as practicable.

8.6. All of the above legal requirements have been complied with.

9. Delegation

9.1. This matter is delegated to the Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Fiona Dixon Manager Finance |

David Spinks Director Financial Services |

Date: 13 October 2016

File Reference: F16/115715

Attachment a: Financial

Statements for Year Ended 30 June 2016 ⇩ ![]()

Attachment

b: Final

Management Letter dated 29 September 2016 ⇩ ![]()

Attachment

c: Independent

Audit Report dated 29 September 2016 ⇩ ![]()

Attachment

d: Certification

by General Manager dated 9 August 2016 ⇩ ![]()

|

Agenda (Open Portion) Finance Committee Meeting |

Page 86 |

|

|

|

18/10/2016 |

|

6.2 City of Hobart Rates and Charges Policy Amendment - Penalty and Interest Remissions

File Ref: F16/113755; 22-2-2

Report of the Group Manager Rates and Procurement and the Director Financial Services of 13 October 2016 and attachment.

Delegation: Council

|

Item No. 6.2 |

Agenda (Open Portion) Finance Committee Meeting |

Page 88 |

|

|

18/10/2016 |

|

REPORT TITLE: City of Hobart Rates and Charges Policy Amendment - Penalty and Interest Remissions

REPORT PROVIDED BY: Group Manager Rates and Procurement

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to seek Council’s approval of an amendment to the City of Hobart Rates and Charges policy to reflect criteria and conditions for penalty and interest remission requests.

1.2. The criteria and conditions make it easier for applications for penalty and interest remissions to be made by ratepayers and for the General Manager to assess the eligibility of such requests.

1.3. The amendment to the Rates and Charges policy will increase transparency and community awareness of decision making in relation to penalty and interest remission requests.

2. Report Summary

2.1. Under Section 129 of the Local Government Act 1993 (LG Act), a ratepayer can apply for a remission of penalty and / or interest pertaining to Council rates. At its meeting on 15 December 2014, the Council delegated the responsibility to determine the outcome of these types of requests to the General Manager in the interests of administrative efficiency given the low monetary value of these requests.

2.2. Applications for penalty and interest charges pertaining to Council rates are currently considered by the General Manager pursuant to the City of Hobart Rates and Charges policy.

2.3. In the interests of transparency and increased community awareness, it is proposed that the criteria for granting a remission of penalty and / or interest charges, which is based on extenuating circumstances, and the conditions required for requests, be included in the City of Hobart Rates and Charges policy, which is made available to the community in print and online.

|

That: 1. The Council adopt the amended City of Hobart Rates and Charges policy marked as Attachment A to this report. 2. The General Manager be authorised to finalise the City of Hobart Rates and Charges policy and arrange for it to be made available to the public in a paper format from the Council’s Customer Service Centre and in an electronic format from Council’s website. |

4. Background

4.1. At its meeting on 15 December 2014, the Council resolved that:

“Pursuant to section 22 of the Local Government Act 1993, the Council delegate to the General Manager the authority to determine future applications for the remission of penalty and interest charges pertaining to Council rates, in the interests of administrative efficiency given the monetary value of these charges. “

4.2. Applications for penalty and interest charges pertaining to Council rates are currently considered by the General Manager pursuant to the City of Hobart Rates and Charges policy.

4.3. Under Section 129 of the LG Act, a ratepayer can apply for a remission of penalty and / or interest. The criteria for granting a remission is based on extenuating circumstances, as follows:

4.3.1. Penalty was incurred as a result of an error on the part of Council staff such as a receipting error;

4.3.2. The amount was paid to a past property or using an incorrect property number;

4.3.3. The ratepayer is able to provide evidence that their payment has gone astray in the post or late payment has otherwise resulted from matters outside their control e.g. a disruption to normal banking service;

4.3.4. If a new owner receives penalty and / or interest resulting from the Notice of Sale procedure i.e. lateness of issue of sale notice, incorrect postal address or late payment of rates on property settlement.

4.3.5. Council accepts that there are extraordinary or compassionate grounds for the remission. Examples are:

4.3.5.1. Serious illness or accident of ratepayer or family member at the due date;

4.3.5.2. Death of immediate family member at the due date; and

4.3.5.3. Birth.

4.3.6. Other extenuating circumstances deemed reasonable by the General Manager.

4.4. Requests for penalty and / or remissions should meet the following conditions:

4.4.1. Requests must be made in writing to the General Manager.

4.4.2. A good payment history which means that over the past 2 years all instalments of rates have been paid on time and payment is made within a short time following the ratepayer becoming aware of any non-payment.

4.4.3. No previous penalties or interest amounts have been remitted for the two years immediately prior to the application for penalty and / or interest remission.

4.4.4. The ratepayer attempted to have the amount paid on time and / or extenuating circumstances exist for its non-payment on time.

4.5. Each application is considered on its merits and remissions are granted where it is considered just and equitable to do so.

4.6. The detail outlined in sections 4.3 to 4.5 above is not currently included in the City of Hobart Rates and Charges policy.

4.7. Pursuant to Section 86B of the LG Act, the Council is required to adopt a Rates and Charges policy by 31 August 2012, update it at least every four years and make it available to the public in print and online.

4.8. The purpose of Section 86B of the LG Act is to increase transparency and community awareness of council decision making in relation to Council rates by adopting publically available rating policies.

4.9. At its meeting on 27 August 2012, the Council adopted its Rates and Charges policy. Since then the Council has resolved to amend the policy on three occasions to reflect the limited rates remission delegation to the General Manager, the introduction of the Green Waste Management Service Charge and most recently as a result of the legislatively required 4-year review.

4.10. An amended version of the City of Hobart Rates and Charges policy is attached – refer Attachment A.

5. Proposal and Implementation

5.1. It is proposed that the City of Hobart Rates and Charges policy be amended to include the criteria for granting a remission of penalty and / or interest charges outlined in section 4.3 above, the conditions for remission requests outlined in section 4.4 above and the statement outlined in section 4.5 above.

5.2. This will ensure that the conditions and criteria are transparent and publically available to the community.

5.3. It is proposed that the Council adopt the attached City of Hobart Rates and Charges policy, as amended, and make copies available to the public in a paper format from the Customer Service Centre and in an electronic format prominently from the Council’s website.

6. Strategic Planning and Policy Considerations

6.1. Section 11 of The City of Hobart Rates and Charges policy states that:

6.1.1. Council will exercise its rate recovery powers under the Act in order to reduce the overall rate burden on ratepayers and to better manage the scarce financial resources of the Council. It will be guided by the principles of:

6.1.1.1. Responsibility – making clear the obligation of ratepayers to pay rates.

6.1.1.2. Transparency – making clear the consequences of failing to pay rates.

6.1.1.3. Accountability – ensuring due legal processes are applied to all ratepayers in the recovery process.

6.1.1.4. Capacity to pay – negotiating payment where appropriate.

6.1.1.5. Equity – applying the same treatment for ratepayers with the same circumstances.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. Not applicable.

7.2. Impact on Future Years’ Financial Result

7.2.1. Not applicable.

7.3. Asset Related Implications

7.3.1. Not applicable.

8. Legal, Risk and Legislative Considerations

8.1. These have been highlighted elsewhere in the report.

9. Delegation

9.1. This matter is delegated to the Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lara MacDonell Group Manager Rates and Procurement |

David Spinks Director Financial Services |

Date: 13 October 2016

File Reference: F16/113755; 22-2-2

Attachment a: Amended

City of Hobart Rates and Charges Policy ⇩ ![]()

|

Agenda (Open Portion) Finance Committee Meeting |

Page 111 |

|

|

|

18/10/2016 |

|

A report indicating the status of current decisions is attached for the information of Aldermen.

REcommendation

That the information be received and noted.

Delegation: Committee

|

Agenda (Open Portion) Finance Committee Meeting |

Page 123 |

|

|

|

18/10/2016 |

|

Regulation 29(3) Local Government

(Meeting Procedures) Regulations 2015.

File Ref: 13-1-10

The General Manager reports:-

“In accordance with the procedures approved in respect to Questions Without Notice, the following responses to questions taken on notice are provided to the Committee for information.

The Committee is reminded that in accordance with Regulation 29(3) of the Local Government (Meeting Procedures) Regulations 2015, the Chairman is not to allow discussion or debate on either the question or the response.”

8.1 Council Residence

File Ref: F16/110798

Memorandum of the Manager Legal & Governance of 18 October 2016.

Delegation: Committee

|

That the information be received and noted.

|

|

Item No. 8.1 |

Agenda (Open Portion) Finance Committee Meeting |

Page 125 |

|

|

18/10/2016 |

|

Memorandum: Lord Mayor

Deputy Lord Mayor

Aldermen

Response to Question Without Notice

Council Residence

|

Meeting: Finance Committee

|

Meeting date: 13 September 2016

|

|

Raised by: Alderman Cocker |

|

Question:

Could the General Manager please advise of the long term plan for the Council’s house located on the Parking Deck?

Response:

The Town Hall Caretaker’s flat was previously used for residential purposes but has been vacant for a number of years. It is currently used for limited storage.

Options for non-residential use / office space were explored previously as part of the consideration of the future use of the Council Centre but required building compliance works were deemed cost prohibitive at that time.

The most likely use for the Town Hall Caretaker’s flat would appear to be a use associated with the City’s Creative Hobart Strategy. The Council is currently undertaking a review of its cultural programs, including the City of Hobart Art Prize and the future of the flat will be considered as part of that review. The outcomes of this review will be reported to the Council before the end of 2016.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Paul Jackson Manager Legal & Governance |

|

Date: 13 October 2016

File Reference: F16/110798

|

|

Agenda (Open Portion) Finance Committee Meeting |

Page 126 |

|

|

18/10/2016 |

|

Section 29 of the Local Government (Meeting Procedures) Regulations 2015.

File Ref: 13-1-10

An Alderman may ask a question without notice of the Chairman, another Alderman, the General Manager or the General Manager’s representative, in line with the following procedures:

1. The Chairman will refuse to accept a question without notice if it does not relate to the Terms of Reference of the Council committee at which it is asked.

2. In putting a question without notice, an Alderman must not:

(i) offer an argument or opinion; or

(ii) draw any inferences or make any imputations – except so far as may be necessary to explain the question.

3. The Chairman must not permit any debate of a question without notice or its answer.

4. The Chairman, Aldermen, General Manager or General Manager’s representative who is asked a question may decline to answer the question, if in the opinion of the respondent it is considered inappropriate due to its being unclear, insulting or improper.

5. The Chairman may require a question to be put in writing.

6. Where a question without notice is asked and answered at a meeting, both the question and the response will be recorded in the minutes of that meeting.

7. Where a response is not able to be provided at the meeting, the question will be taken on notice and

(i) the minutes of the meeting at which the question is asked will record the question and the fact that it has been taken on notice.

(ii) a written response will be provided to all Aldermen, at the appropriate time.

(iii) upon the answer to the question being circulated to Aldermen, both the question and the answer will be listed on the agenda for the next available ordinary meeting of the committee at which it was asked, where it will be listed for noting purposes only.

|

|

Agenda (Open Portion) Finance Committee Meeting |

Page 127 |

|

|

18/10/2016 |

|