|

AGENDA Monday, 19 February 2024 AT 5:00 pm

|

|

AGENDA Monday, 19 February 2024 AT 5:00 pm

|

|

|

Agenda (Open Portion) Council Meeting |

Page 4 |

|

|

19/2/2024 |

|

APOLOGIES AND LEAVE OF ABSENCE

4. Communication from the Chairman

5. Notification of Council WorKshops

8. Consideration of Supplementary Items

9. Indications of Pecuniary and Conflicts Of Interest

10. Response to Petition - Rwandan Tutsi Memorial

11. Procurement - Quotation Exemption Report

12. South Hobart Oval Master Plan

13. New Town Sporting Precinct Master Plan – Design Concepts and Plans

14. Quarterly Financial Report - 31 December 2023

15. City of Hobart Rating and Valuation Strategy Review - Review of Rates Policies

Report of the Chief Executive Officer

17. Acting Lord Mayor Higher Duties Allowance

18. RESPONSES TO QUESTIONS WITHOUT NOTICE

20. Closed Portion Of The Meeting

|

|

Agenda (Open Portion) Council Meeting |

Page 6 |

|

|

19/2/2024 |

|

A meeting of the Open Portion of the Council will be held in the Council Chamber, Town Hall on Monday, 19 February 2024 at 5:00 pm.

Michael Stretton

Chief Executive Officer

The title Chief Executive Officer is a term of reference for the General Manager as appointed by Council pursuant s.61 of the Local Government Act 1993 (Tas).

|

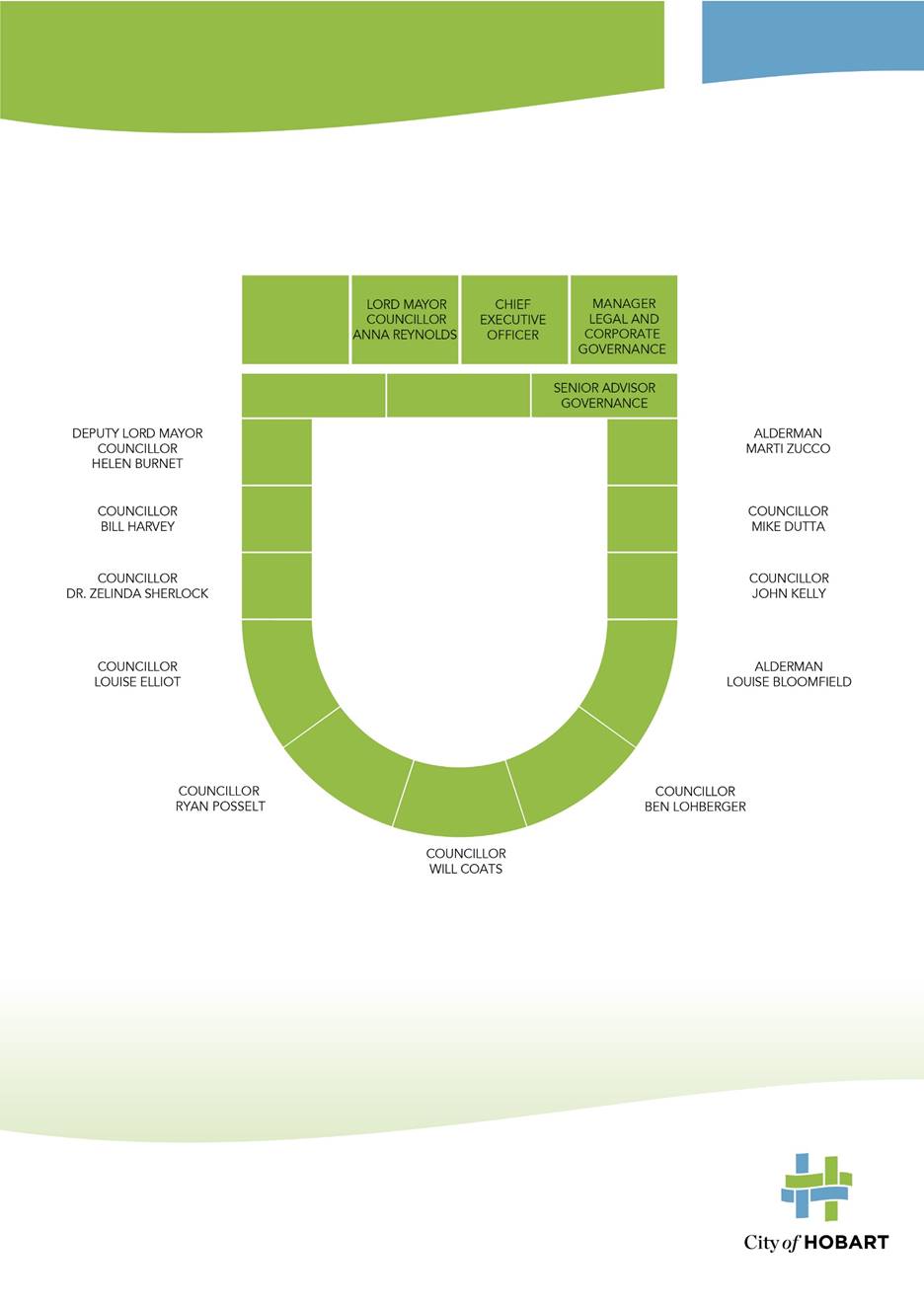

ELECTED MEMBERS: Lord Mayor A M Reynolds Deputy Lord Mayor H Burnet Alderman M Zucco Councillor W F Harvey Councillor M S C Dutta Councillor Dr Z E Sherlock Councillor J L Kelly Councillor L M Elliot Alderman L A Bloomfield Councillor R J Posselt Councillor B Lohberger Councillor W N S Coats |

APOLOGIES:

LEAVE OF ABSENCE: Alderman L A Bloomfield

|

|

The Chairperson reports that she has perused the minutes of the meeting of the Open Portion of the Council meeting held on Monday, 29 January 2024, finds them to be a true record and recommends that they be taken as read and signed as a correct record.

|

Are there any items, which the meeting believes, should be transferred from this agenda to the closed agenda or from the closed agenda to the open agenda, in accordance with the procedures allowed under Section 15 of the Local Government (Meeting Procedures) Regulations 2015?

In accordance with the requirements of the Local Government (Meeting Procedures) Regulations 2015, the General Manager reports that the following workshops have been conducted since the last ordinary meeting of the Council.

Date: Tuesday, 13 February 2024

Purpose: 2024-25 Budget Development | 23-24 Capital Projects Mid-Year Program Update

Attendance:

The Lord Mayor Councillor A Reynolds, Deputy Lord Mayor Councillor H Burnet, Alderman M Zucco, Councillors B Harvey, M Dutta, Z Sherlock, J Kelly, L Elliot, Alderman L Bloomfield, Councillors R Posselt, and B Lohberger.

Regulation 31 Local Government (Meeting

Procedures) Regulations 2015.

File Ref: 16/119-001

6.1 Public Questions

Ref: Part 2, Regulation 8(6) of the Local Government (Meeting Procedures) Regulations 2015.

|

That the Council resolve to deal with any supplementary items not appearing on the agenda, as reported by the Chief Executive Officer in accordance with the provisions of the Local Government (Meeting Procedures) Regulations 2015.

|

Ref: Part 2, Regulation 8(7) of the Local Government (Meeting Procedures) Regulations 2015.

Elected Members are requested to indicate where they may have any pecuniary or conflict of interest in respect to any matter appearing on the agenda, or any supplementary item to the agenda.

|

Agenda (Open Portion) Council Meeting |

Page 8 |

|

|

|

19/2/2024 |

|

10. Response to Petition - Rwandan Tutsi Memorial

File Ref: F24/4911

Report of the Program Lead Creative City - Arts and Culture Program, the Acting Manager Creative City and the Director Connected City of 14 February 2024 and attachments.

Delegation: Council

|

Item No. 10 |

Agenda (Open Portion) Council Meeting |

Page 10 |

|

|

19/2/2024 |

|

REPORT TITLE: Response to Petition - Rwandan Tutsi Memorial

REPORT PROVIDED BY: Program Lead Creative City - Arts and Culture Program

Acting Manager Creative City

Director Connected City

1. Report Summary

1.1. A petition to establish a Rwandan Tutsi Genocide Memorial acknowledging the tragic events in Africa in 1994 was presented to Council in August 2022 (Attachment C). Council resolved unanimously that the petition be noted and referred to the appropriate committee.

1.2. Given the committee structure was abolished in November 2022, this matter is provided directly to Council for consideration.

1.3. The purpose of this report is for Council to formally consider a response to the petition, noting information previously provided directly to representatives of the Rwandan Australian Friendship Association Inc (RAFA).

Key Issues

1.4. The RAFA first approached the City in March 2021 to discuss the potential for a large scale memorial funded by others, to be constructed on suitable council land to be given in-kind. RAFA provided the sketch of the memorial (as provided at Attachment A).

1.4.1. The community was advised at that time that the proposal did not meet the criteria in relation to memorials available at the time under the Donation of Park Furniture and Equipment, Memorial Plaques and Tree Plantings in Parks, Bushland and Reserves Policy (Attachment B)

1.5. The petition (Attachment C) was presented to Council on 15 August 2022. Following this, City officers met with the proponents on two further occasions.

1.5.1. The community was advised that the proposal in the petition did not meet the criteria in the current relevant Council policy.

1.5.2. The community was also advised that a review of the policy was planned.

1.5.3. Discussion between City officers and the proponents included alternative options to a large-scale memorial.

1.6. Work on the new Memorials Policy has progressed and is scheduled to be presented to an Elected Member workshop and council meeting in June 2024.

1.7. The proposed Memorials Policy is intended to replace the existing Donation of Park Furniture and Equipment, Memorial Plaques and Tree Plantings in Parks, Bushland and Reserves Policy, (Attachment B).

1.7.1. Once the new Memorials Policy is finalised and endorsed, replacing the existing Council policy, Donation of Park Furniture and Equipment, Memorial Plaques and Tree Plantings in Parks, Bushland and Reserves Policy, RAFA may wish to review and resubmit their proposal once the proposed Memorials Policy has been endorsed by Council.

|

That: 1. The Council refuse the request for in-kind contribution in the form of land as the memorial does not align with the City’s existing policy titled ‘Donation of Park Furniture and Equipment, Memorial Plaques and Tree Plantings in Parks, Bushland and Reserves Policy’. 2. The Council request officers to contact representatives of RAFA to meet and discuss potential alternative ways to commemorate the Rwandan Tutsi Genocide. 3. The petitioners be formally advised of the outcome of the Council decision.

|

3. Background

3.1. A petition to establish a Rwandan Tutsi Genocide Memorial was presented to Council on Monday 15 August 2022 with 50 signatories.

3.2. The action sought by the petitioners was that the Council;

‘…supports the establishment of a Memorial to the Rwandan Tutsi Genocide. The memorial would be an Australian first and also be a place to educate the community on themes of peace and anti-racism.

The proposed memorial design is a modest size, encompasses accessible public seating and will make a meaningful contribution to a Hobart public space.

The project would seek external funding and so the request to the Council is an in-kind contribution in the form of a small parcel of suitable land’.

3.3. The Rwandan community requests a site to build the memorial, in order to help their community (and other communities with similar past experience) in their journey of healing. The original sketch of the proposal is attached (refer Attachment A), as is the petition (Attachment C).

3.4. City officers met with representatives of the RAFA in April 2021, May 2022 and March 2023 to discuss the proposal and provide advice in relation to the requirements of the existing Council policy, Donation of Park Furniture and Equipment, Memorial Plaques and Tree Plantings in Parks, Bushland and Reserves Policy (Attachment B).

3.5. Community members were advised in March 2023 that a new Memorials Policy was in development and that it would consider contemporary approaches to memorialising both events and individuals with due consideration to relevance to Hobart and the desired use of its Parks and the public domain.

3.6. The new Memorials Policy is intended to be a single reference point establishing a clear framework for all requests relating to physical and permanent objects described as memorials, both prospective and existing situated on land owned or managed by the City of Hobart.

3.6.1. RAFA may wish to review and resubmit their proposal once the proposed Memorials Policy has been endorsed by Council.

4. Discussion

4.1. The City’s existing policy, Donation of Park Furniture and Equipment, Memorial Plaques and Tree Plantings in Parks, Bushland and Reserves Policy, enables the community to commemorate “historically important national or state events, or people who have made a significant contribution to the social, political and cultural life of Hobart subject to the approval of the Parks and Recreation Committee.”

4.2. As the petition does not align to the existing policy, this report recommends that Council does not support the provision of land to establish the memorial. The relevant policy clauses are summarised below.

4.2.1. The form of the memorial, which is for either a tree or piece of furniture, with a plaque.

4.2.2. The commemoration of historically important national or state events, or people who have made a significant contribution to the social, political and cultural life of Hobart.

4.3. The petition proposes for land to be given in-kind to support the memorial. The City has given general guidance to the petitioners previously noting that their proposal did not align with Council’s policy. When any proposals are made requiring the use of Council-owned land, the process includes the following land-use planning approvals:

4.3.1. A formal submission seeking “general manager consent”, which the City of Hobart CEO would consider and respond to.

4.3.2. If consent was to be granted, the proponents would then be required to lodge a planning application to further progress the proposal.

4.3.3. Depending upon the proposed location, the application would be publicly advertised allowing the public to provide comment on the proposal.

5. Hobart: A Community Vision For Our Island Capital

5.1. The assessment of the proposal, and recommendations of this report, relate to the Hobart: A Community Vision For Our Island Capital as per the below outcomes

3.3.1 We create opportunities to explore diversity: ways for people to bring and share their own identities and receive the same in return.

3.3.2 We use arts and events to explore our histories and identities and tell our stories

6. Capital City Strategic Plan

6.1. The assessment of the proposal, and recommendations of this report, relate to the Capital City Strategic Plan as per the below:

1.2.1 Celebrate and highlight the distinctiveness of Hobart’s character, and historical and cultural heritage.

1.2.2 Ensure City place-making planning and initiatives embody civic pride by reflecting community values and character of local neighbourhoods.

3.2.4 Support arts and events as a means of story sharing and sparking conversations about ideas, histories and diverse cultures.

3.1.1 Support Hobart’s continued evolution as a creative and culturally engaging capital city, with a focus on community, accessibility and creative potential.

7. Regional, State and National Plans and Policies

7.1. The assessment of the proposal has been undertaken with regard to the City’s current policy, Donation of Park Furniture and Equipment, Memorial Plaques and Tree Plantings in Parks, Bushland and Reserves Policy. However, it is noted that Council seeks to develop a simple and clear policy similar to other Capital Cities in Australia which clarifies the process and criteria for assessing the important and often personal requests from the community to recognise or commemorate significant people, groups, places and events that are of local importance.

8. Financial Viability

8.1. Funding Source and Impact on Current Year Operating Result

8.1.1. There are no financial implications in considering the petition other than City officer time already spent on the matter.

8.1.2. The petition sought that land be provided in-kind for the memorial with external funding for the memorial itself. At a minimum there would be ongoing asset management associated with the maintenance of any such memorial, which the City does not presently have funding for.

9. Collaboration

9.1. Following receipt of the petition, City officers met twice with the proponents to discuss the proposal. This report recommends that the Program Leader Creative City engage with RAFA to continue the conversation around alternate ways the Rwandan Tutsi Genocide could be commemorated.

9.2. This report has been prepared in collaboration with the Acting Director City Life.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Jane Castle Program Lead Creative City - Arts and Culture Program |

Felicity Edwards Acting Manager Creative City |

|

Jacqui Allen Director Connected City |

|

Date: 14 February 2024

File Reference: F24/4911

Attachment a: Rwandan

Memorial Schematic Plans (Supporting information) ![]()

Attachment

b: Donation

of Park Furniture and Equipment, Memorial Plaques and Tree Plantings in Parks,

Bushland and Reserves (Supporting information) ![]()

Attachment

c: Petition

- Rwandan Tutsi Genocide - The Rwandan Australian Friendship Association

(Supporting information) ![]()

|

Item No. 11 |

Agenda (Open Portion) Council Meeting |

Page 1 |

|

|

19/2/2024 |

|

11. Procurement - Quotation Exemption Report

File Ref: F24/9895

Report of the Manager Rates, Procurement and Risk and the Director City Enablers of 13 February 2024 and attachment.

Delegation: Council

|

Item No. 11 |

Agenda (Open Portion) Council Meeting |

Page 15 |

|

|

19/2/2024 |

|

REPORT TITLE: Procurement - Quotation Exemption Report

REPORT PROVIDED BY: Manager Rates, Procurement and Risk

Director City Enablers

1. Report Summary

1.1. The purpose of this report is to provide a listing of exemptions from the requirement to seek three written quotations granted for the period 1 October to 31 December 2023 for the information of Elected Members.

1.2. The community benefit is providing transparency and delivering best value for money through strategic procurement decision-making.

2. Key Issues

2.1. It is a legislative requirement that Council establishes and maintains procedures for reporting by the Chief Executive Officer to Council in relation to the purchase of goods, services or works where a public tender or quotation process is not used.

2.2. At its meeting on 19 March 2018, the Council resolved that a report of exemptions granted from the requirement to seek three written quotes be presented quarterly as at 31 March, 30 June, 30 September and 31 December each year.

2.3. A report is attached for the period 1 October to 31 December 2023.

2.4. It is proposed that the Committee note the exemption from the requirement to seek three written quotes granted for the period 1 October to 31 December 2023.

|

That the Council note the exemption granted from the requirement to seek three written quotations for the period 1 October to 31 December 2023, marked as Attachment A to this report.

|

4. Background

4.1. At its meeting on 19 March 2018, the Council resolved inter alia that:

4.1.1. A report of exemptions granted from the requirement to seek 3 written quotes be presented to the Finance and Governance Committee as at 31 March, 30 June, 30 September and 31 December each year.

4.2. A report outlining the quotation exemption from the requirement to seek three written quotes granted during the period 1 October to 31 December 2023 is attached – refer Attachment A.

4.3. As outlined in the City’s Code for Tenders and Contracts (the Code) where a Council Contract does not exist the City will seek a minimum of three written quotes for procurements between $50,000 and $249,999.

4.4. There may be occasions where, for a number of reasons, quotation(s) cannot be obtained / sought from the market or where doing so would have no additional benefit to the City or the market.

4.5. Therefore, exemptions from the requirement to seek written quotes can be sought from the Divisional Director but only if an acceptable reason exists as outlined in the Code, as follows:

(a) where, in response to a prior notice, invitation to participate or invitation to quote:

- no quotations were submitted; or

- no quotations were submitted that conform to the essential requirements in the documentation;

(b) where the goods, services or works can be supplied only by a particular supplier and no reasonable alternative or substitute goods, services or works exist e.g. a sole supplier situation exists;

(c) for additional deliveries of goods, services or works by the original supplier that are intended either as replacement parts, extensions or continuing services;

(d) where there is an emergency and insufficient time to seek quotes for goods, services or works required in that emergency;

(e) for purchases made under exceptional circumstances, deemed reasonable by the responsible Director;

(f) where a quotation was received within the last 3 months for the same goods, services or works (e.g. a recent value for money comparison was made);

(g) for purchases made under exceptionally advantageous conditions that only arise in the very short term, such as from unusual disposals, liquidation, bankruptcy or receivership and not for routine purchases from regular suppliers; or

(h) for a joint purchase of goods or services purchased with funds contributed by multiple entities, where Council is one of those entities and does not have express control of the purchasing decision.

4.6. For the period 1 October to 31 December 2023 there was one exemption granted, where expenditure was between $50,000 and $249,999 and therefore three written quotations were required to be sought in line with the Code.

4.7. The exemption was granted on the grounds that the services were additional services by the original supplier intended as extensions or continuing services.

5. Legal, Risk and Legislative Considerations

5.1. Regulation 28 of the Local Government (General) Regulations 2015 states that the Council’s Code for Tenders and Contracts must (j) establish and maintain procedures for reporting by the general manager to the council in relation to the purchase of goods or services in circumstances where a public tender or quotation process is not used.

6. Discussion

6.1. It is proposed that the Committee note the exemption granted from the requirement to seek three written quotes for the period 1 October to 31 December 2023.

6.2. As outlined in the Code, quotation exemptions for a value under $50,000, that is where 1 or 2 written quotations are required to be sought but an exemption from that requirement has been granted by the relevant Divisional Director, have been reported to the Chief Executive Officer.

6.3. All approvals for the exemptions from the requirement to Tender are sought and reported through the formal Council approval processes.

7. Capital City Strategic Plan

7.1. The City’s Code for Tenders and Contracts is referenced in this report as it provides a framework for best practice procurement and sets out how the City will meet its legislative obligations in respect to procurement, tendering and contracting.

7.2. This report is consistent with strategy 8.2.6 in the City of Hobart Capital City Strategic Plan 2023, being:

7.2.1. Delivery high quality and timely procurement to support the delivery of programs, projects and services while achieving value for money.

8. Financial Viability

8.1. Funding Source and Impact on Current Year Operating Result

8.1.1. All expenditure noted in the attached listing of quotation exemptions granted was funded from the 2023-24 budget estimates.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lara MacDonell Manager Rates, Procurement and Risk |

Michael Reynolds Director City Enablers |

Date: 13 February 2024

File Reference: F24/9895

Attachment a: Report

- Quotation Exemption Granted (3 Quote) 1 October to 31 December 2023

(Supporting information) ![]()

|

Item No. 12 |

Agenda (Open Portion) Council Meeting |

Page 1 |

|

|

19/2/2024 |

|

12. South Hobart Oval Master Plan

File Ref: F24/10307

Report of the Acting Manager Sport and Recreation and the Dirtector City Futures of 13 February 2024 and attachment.

Delegation: Council

|

Item No. 12 |

Agenda (Open Portion) Council Meeting |

Page 1 |

|

|

19/2/2024 |

|

REPORT TITLE: South Hobart Oval Master Plan

REPORT PROVIDED BY: Acting Manager Sport and Recreation

Director City Futures

1. Report Summary

1.1. This report presents community engagement feedback on the recently completed draft South Hobart Oval Master Plan, and further seeks Council endorsement of the revised Plan to inform future planning for the site.

1.2. The Council previously considered the masterplan at its meeting of 17 July 2023 where the initial report was considered, with the Council resolving that:

1. The draft South Hobart Oval and Park Master Plan, marked as Attachment A to item 10 of the Open Planning Agenda of 17 July 2023, be endorsed for public exhibition for a period of four weeks.

2. A further report be provided to the Council following community engagement.

1.3. More than 700 submissions were received during the initial consultation and 132 surveys completed during the second stage. The feedback confirmed the views captured during stage one engagement, with this largely focussing on the community tensions associated with the use and management of the South Hobart Oval.

2. Key Issues

2.1. Key issues identified during the initial consultation stage include:

2.1.1. Managing the mixed use of the facility, with a focus on the already understood tensions between off-lead dog exercise and high-level sport.

2.1.1.1. These include opposing views from those that support the South Hobart Football Club use and proposals to upgrade the oval for topflight state-wide football competition, and similarly from those within the local community who use the oval for off-leash dog exercise.

2.1.1.2. It is proposed that the City’s Dog Management Policy 2019-2023 which is due for review, is the best framework though which to consider this issue.

2.1.2. Ageing infrastructure at the sportsground including poor quality lighting, toilets and changerooms, with this restricting participation.

2.1.3. Connectivity within the facility and between the venues on the site is poor, with suggestions to improve pathways, gates and entrances for better connectivity.

2.1.4. The playground was viewed as dated and not catering for older children, with a strong desire being expressed for nature play including water play.

2.1.5. An opportunity to improve the courts was also noted with the desire for more flexibility with markings to allow for emerging sports such as pickleball, as well as improvements for users such as provision of water bubblers and seating.

2.2. A number of comments were received in regard to adding new facilities (e.g. play, barbeques, fitness equipment, additional courts, pump tracks etc) into the existing facility.

2.2.1. However, the venue has limited capacity to provide for these kinds of facilities, without compromising current open space or leading to a loss of existing vegetation.

2.3. There were also comments about the need for improvements to traffic, parking, retaining walls and intersections in proximity to the South Hobart Oval and park.

2.3.1. These matters are outside the scope of the Master Plan but are under officer investigation and/or could be addressed through future local area traffic management planning.

2.3.2. As context, officers are currently seeking to undertake exploratory/propositional design work in FY24/25 with a view to uplift the retail activity hub in upper Macquarie Street. Subject to funding, it is hoped that this work will include consideration of the intersection of Darcey/Washington and Macquarie streets.

2.3.3. This work could draw on the successes achieved around 358 Macquarie Street and the foundational work prepared for the South Hobart Retail Precinct.

2.4. Following community feedback, a revised Master Plan has been developed (refer Attachment A) that seeks to maximise usage and access of the precinct, and includes further initiatives and actions that response to specific community feedback, including:

2.4.1. The document now notes that Wide Angle Tasmania is no longer occupying the building at the oval, and that this building has the capacity to provide a venue for training, workshops, mentoring, the arts and creativity.

2.4.2. There is a need to improve the security of fencing on the southwestern corner of the oval where children and dogs can enter and leave (safety risk with traffic).

2.4.3. There is an expressed need for night lighting to support training and night games for football.

2.4.4. Conversely, there are community concerns around the possible impacts of night lighting on residential amenity.

2.4.5. The enclosed map showing existing dog exercise areas has been extended to include all of Wellesley Park.

2.4.6. Map 3.3 has been revised to indicate shade shelter over seating, upgrading basketball and netball poles and hoops.

2.5. Should the draft Master Plan be endorsed by the Council, a delivery plan will be developed, detailing the staging for delivery and to ensure any budget bids for operational expenditure (for design and planning) and capital expenditure (for delivery) are submitted in the appropriate financial years.

2.6. Assessment and ongoing monitoring of potential grant funding opportunities to support implementation will also be progressed.

|

That that the draft South Hobart Oval Master Plan, marked as Attachment A to this report, be approved as a tool for guiding the future planning and development of the site.

|

4. Background

4.1. South Hobart Oval and Park is a recreational facility on City of Hobart land known as 42 Wentworth Street, South Hobart.

4.2. The property has three different functional areas, which include:

· South Hobart Oval – the Oval has been used for football (soccer) since the early 1900’s and is home to the South Hobart Football Club. The Oval is also used for a variety of recreational pursuits including dog exercise.

· South Hobart Playground – includes playground equipment, a small children’s cycle track, barbecue facilities as well as access to the South Hobart Community Hall.

· Multi-use Courts – located behind the Community Hall currently provides a tennis court and a basketball court as well as a cricket practice net.

4.3. The property also provides public toilets facing Washington Street, and a building formally leased to Wide Angle Tasmania which has meeting and studio spaces. These facilities along with the Community Hall and sporting areas serve as a central gathering point to meet the diverse needs of the community.

4.4. Overall, the property is highly utilised for a wide range of different activities in a relatively confined space.

4.5. The City is currently completing master or management plans for each of its sporting facilities with plans already completed for Queenborough Oval, TCA Ground, New Town Sporting Precinct and the West Hobart Recreation Ground.

4.6. It was determined the South Hobart Oval was the next logical location requiring a masterplan due to several factors including:

· Ageing infrastructure.

· Small scale footprint.

· Competing demands for use of the space.

· Limited usable green space in the area.

4.7. The City engaged Inspiring Place to develop the Master Plan for the site which involved extensive engagement with targeted stakeholders, informal site observations, formal consultation sessions as well as inviting feedback on ‘Your Say’.

4.8. Overall, the Plan received significant interest with nearly 700 submissions received.

4.9. The Plan was released for a four-week public exhibition period, including via the City’s Your Say page. Feedback received has re-confirmed the proposals and community sentiments captured in the initial draft Master Plan.

4.10. Amendments have now been included in a revised Master Plan capturing the feedback received around oval lighting, additional disability access, fencing security, shade shelter and alternative dog walking provision/sites within the area.

5. Legal, Risk and Legislative Considerations

5.1. The site is zoned Recreation (Section 18.0) under the Hobart Interim Planning Scheme 2015 and the upcoming Tasmanian Planning Scheme. The area is surrounded on three sides by Inner Residential land (Section 11.0), except for the area to the west of Washington Street that is General Residential (Section 10.0).

5.2. Access for dog exercise on the oval was introduced in 2003. The access permissions / restrictions for the site are directed by the City of Hobart Dog Management Policy 2019-2023 which is due for revision in 2023-24. The legislative basis for this municipal-wide policy arises from the Dog Control Act 2000.

6. Discussion

6.1. The revised draft Master Plan was presented to an Elected Member Workshop on Monday 22 January 2024 by lead consultant, John Hepper of Inspiring Place.

6.2. The key issues noted at this Workshop included balancing user needs, replacing ageing and dated facilities, siting new buildings / facilities and connectivity. These issues are further explored below.

Managing mixed use – high level soccer and dog exercise

6.3. Key stakeholder and “Your Say” feedback were dominated by the well-known tensions that exist between off-lead dog exercise and high-level soccer use of the South Hobart Oval.

6.4. The majority of people with an interest in soccer want dogs banned from the oval. People exercising dogs want to retain the current arrangement for off-lead access to the oval.

6.5. Given the need to progress the Master Plan, and the strength of feeling in both sides in this debate, the matter of dog access to the South Hobart Oval will be reviewed in the context of the pending statutory review of the City of Hobart Dog Management Policy 2019-2023, which will include consideration of the municipal-wide approach to off-lead dog exercise. The Dog Management policy review is not expected to identify any palatable solution that universally meet the needs of both groups of stakeholders on this issue.

South Hobart Football Club

6.6. The oval is intensively used by the South Hobart Football Club. The Club competes in the National Premier League Tasmania and the Women’s Super League Competition. The Club is currently shortlisted for selection in the national second tier competition.

6.7. It is important to note that Master Plan does not seek to address the needs of a premier league venue, and it is understood that this need may be considered at a regional level.

6.8. As detailed in the Master Plan, whatever standard of play may occur at the venue, the facility needs to be uplifted to maximise multipurpose community use, to meet contemporary community and user expectations and safety and amenity.

6.8.1. Dog faeces not being picked up, dog urine killing playing turf, and the associated churn of the playing surface is constantly reported by the South Hobart Football Club and the City of Hobart oval maintenance crew.

6.8.2. The Club is also concerned about potential health risk to players, that the current level of dog access constrains the cub’s ability to host high level games and is incompatible with plans for improving the facilities.

6.9. Darcy Street is the only sporting oval hosting high level matches where any dog access is allowed in the Hobart municipality (and indeed Kingborough, Clarence or Glenorchy municipalities).

Dog exercise (off-lead)

6.10. Dogs have been permitted to use the South Hobart Oval since 2003 when the Council permitted dog exercise on the oval at times when sport is not being played.

6.11. The ground is one of the most popular off-lead exercise areas in Hobart, and dog owners want to maintain their current access.

Sports ground facilities

6.12. There is a strong desire for upgrade the sports ground facilities. This included better change rooms, referee rooms and toilets at the oval, particularly in the context of increasing female participation in soccer. The draft Plan also includes fixing drainage problems, improving lighting and storage, and lifting the standard of playing surface for state level competition.

6.13. The South Hobart Football Club received an Australian Government grant for $1,000,000 in 2019 and $500,000 from the Tasmanian Government in 2021 to develop facilities at South Hobart Oval.

6.14. The Club has also recently undertaken consultation with the community for a proposed building and they are now seeking landlord approval to submit a development application.

6.15. The Master Plan shows the location for a potential site for this new facility but does not prescribe any specific functionality for the building.

Connectivity and access

6.16. The difficulty in moving between the different parts of the site was highlighted as part of the engagement process. There were many comments about improvements to gates and entrances, improving pedestrian paths, all abilities access, and providing a better connection between the oval and the playground which have been incorporated into the Plan.

Playground

6.17. The playground was viewed as dated and not catering to older children. There was a strong desire for nature play including water play. Despite a desire for more modern play equipment, the park and the Community Hall were seen as working well.

The Park

6.18. There were some requests for improving the basketball court, including remarking the lines, installing a bin, water fountain and seating.

6.19. The cricket net is also seen to have limited use and there were suggestions about repurposing this space to facilitate basketball use.

7. Hobart: A Community Vision For Our Island Capital

7.1. Strategic alignment with the Community Vision is outlined in the draft Master Plan. The Master Plan aligns with Pillars 1, 2 and 6.

8. Capital City Strategic Plan

6.1.1 Strengthen open space connectivity, prioritising links between the river, bushland and the mountain, through acquisitions and other opportunities.

6.1.2 Ensure the open space network across the City is planned for and managed to meet current and future population needs.

6.5.1 Manage outdoor spaces to accommodate the diverse outdoor recreational needs of the community.

6.5.3 Encourage opportunities to activate the City’s open space network for events and activities.

7.3.3 Ensure City-owned assets and public spaces are accessible, of high quality and provide a high level of amenity to meet community and visitor requirements.

7.3.5 Measure, manage and support the effective use of city facilities, infrastructure and public spaces.

7.3.6 Consider the needs of children and families in all infrastructure design.

8.2. The Council should be assured that where information is available, regional planning and considered in the plans. This has included the growth pattern for sport, with this informing the Master Plan.

8.3. All sporting facility developments need to consider the facility standards for the level of sport being played.

8.4. South Hobart Oval caters for competition up to a State level and facilities must reflect the specifications required by the State Sporting Associations to enable that level of sport to be played at the oval.

8.5. Universal design principles will be applied to cater to all users including the provision of unisex and accessible amenities, fit for purpose, multi and shared use, compatibility, public safety, health and safety and functionality are also considered alongside sporting code and guidelines.

8.6. As further context, the City of Hobart’s Open Space Unit is undertaking the development of an Open Space Strategy. The Open Space Strategy will consider land owned or managed by the City of Hobart that is set aside primarily for leisure, active or passive recreation, nature conservation, other public enjoyment or gathering. This land includes beaches, bushland, public parks, and sportsgrounds. It is anticipated that background work to inform the Open Space Strategy will continue throughout the first half of 2024.

9. Financial Viability

9.1. Funding Source and Impact on Current Year Operating Result

9.1.1. While the draft Master Plan has not been subject to a detailed design stage, officers anticipate that the cost to implement the full plan will be in the order of $6.2 million, broken down as follows:

· Oval upgrade including lighting - $2,000,000.

· Sporting pavilion/community facility -$2,000,000.

· Connectivity and safety - $500,000.

· Playground equipment - $200,000.

· Playscape and shelters - $200,000.

· Court and multisport area - $120,000.

9.1.2. It is understood that $1.5 million in external grants have been secured by the South Hobart Football Club.

9.1.3. The remaining items (both asset renewal and new capital works) are not budgeted for at this stage.

9.2. Impact on Future Years’ Financial Result

9.2.1. The comments above in point 10.1 also pertain to future financial years.

9.3. Asset Related Implications

9.3.1. The draft Master Plan provides a planning framework to prioritise and stage future works.

10. Sustainability Considerations

10.2. Plantings and other treatments will also take account of sustainability imperatives.

11. Community Engagement

11.1. The draft Master Plan has undergone an extensive community engagement process, with 132 surveys completed during the second stage following a four-week public exhibition period.

11.2. The community was also invited to participate in a survey using the City of Hobart Your Say Hobart community engagement portal to inform the preparation of a draft South Hobart Oval and Park Master Plan and received almost 700 submissions.

11.3. Key stakeholders were formally consulted, including informal site observations and discussions with users of the basketball court, tennis court, community hall, playground and oval.

11.4. The draft Master Plan was presented to the City’s Healthy Hobart Portfolio Committee on 23 May 2023, and has been largely well received by the community and ground users.

11.5. Future and more targeted consultation may be required on specific masterplan projects during the detailed design stage.

12. Collaboration

12.1. The South Hobart Oval Master Plan has been developed in very close collaboration with all key stakeholders including relevant clubs and associations.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Kellie Williams Acting Manager Sport and Recreation |

Neil Noye Director City Futures |

Date: 13 February 2024

File Reference: F24/10307

Attachment a: Draft

South Hobart Oval and Park Master Plan (Supporting information) ![]()

|

Item No. 13 |

Agenda (Open Portion) Council Meeting |

Page 1 |

|

|

19/2/2024 |

|

13. New Town Sporting Precinct Master Plan – Design Concepts and Plans

File Ref: F24/10320

Report of the Acting Manager Sport and Recreation and the Director City Futures of 13 February 2024 and attachments.

Delegation: Council

|

Item No. 13 |

Agenda (Open Portion) Council Meeting |

Page 1 |

|

|

19/2/2024 |

|

REPORT TITLE: New Town Sporting Precinct Master Plan – Design Concepts and Plans

REPORT PROVIDED BY: Acting Manager Sport and Recreation

Director City Futures

1. Report Summary

1.1. This report seeks Council endorsement of design concepts and associated plans to support the delivery of the New Town Sport Precinct Master Plan (the Master Plan).

1.2. The Council previously endorsed the Master Plan at its meeting held on 17 June 2019 where the initial report was considered, and where the Council resolved:

1. The New Town Sporting Precinct Master Plan, dated 29 May 2019 and marked at Attachment A to item 6.7 of the Open Parks and Recreation Committee agenda of 6 June 2019, be approved as a tool for guiding the future planning and development of the precinct.

2. The following actions in the Implementation Plan be progressed:

(i) The City continue to monitor the potential for any future site options and the feasibility for relocating the New Town Croquet Club;

(ii) The City undertake a local area traffic management plan, including an initial assessment of the potential benefits or implications arising from implementation of the Master Plan;

(iii) Sporting clubs initiate feasibility assessments for the proposed new sports facilities within the precinct;

(iv) The City and the clubs seek funding support and grants to support implementation of the Master Plan on a staged basis; and

(v) Should funding become available for the project, the City take a lead role in facilitating the staged implementation of the Master Plan. Minutes (Open Portion) Council Meeting Page 99 17/06/2019.

3. The City undertake development of a local area traffic management plan and progress additional planning for the site, at an estimated cost of $50,000 to be funded within Parks and Recreation Management Function within the 2019-20 Annual Plan.

4. The City continue to work with stakeholders in the management of the site.

2. Key Issues

2.1. The Master Plan contains a significant number of improvements to the site that will assist in ensuring the current and future demands for the clubs and associations are met.

2.2. Some of the key improvements to the Plan include:

· An overall increase in the number of the netball courts by two.

· An indoor show court which could potentially host Australian Netball League (ANL) matches.

· Improved parking which will see an increase in parking spaces, and improved traffic management and safety for pedestrians to the area by increasing drop off/pick up spaces and dedicated pedestrian access.

· Improved function facilities at New Town Oval and Hobart Netball and Sports Centre.

· Four new modern change rooms for New Town Oval.

· New change rooms for Hobart Netball and Sports Centre.

· New public toilet facilities.

· Improved storage.

· Relocation and construction of new clubroom facility for the New Town Croquet Club.

1.2. These improvements have been captured in the concept design and plans prepared by Gaetano Palmese Architects, as shown at Attachments A and B to this report.

1.3. Following the Council’s endorsement of the design concepts and plans, further refinement of the design will be required to enable the implementation of the plan to be staged when practical, so it is not reliant on the full funding being obtained.

1.4. Further engagement will also need to be undertaken on an as needs basis.

1.5. Should the design concepts and plans be endorsed by Council, this will allow Clubs to begin to seek funding.

|

That the Council endorse the design concepts and associated plans for the New Town Sports Precinct, as shown in Attachments A and B to this report, to support the delivery of the New Town Sport Precinct Master Plan through further refinement and subsequent funding submissions by Council and or sporting clubs.

|

4. Background

4.1. New Town Oval Sporting Precinct is located between Main Road, Creek Road and St Johns Avenue, New Town and contains several recreational facilities including:

· New Town Oval.

· Hobart Netball and Sports Centre.

· Buckingham Bowls Club.

· New Town Croquet Club.

4.2. The property is owned by the City of Hobart, however most of the site, excluding New Town Oval is under lease to the resident sporting entities.

4.3. The site is particularly challenging given it includes several highly active facilities used by wide variety of clubs, associations and other stakeholders (ten in total) with many of them experiencing membership and participation growth.

4.4. Many of the facilities on the site are also dated and in need of infrastructure improvements.

4.5. Following the Council’s endorsement of the Master Plan, a Local Area Traffic assessment was completed.

4.6. The clubs were also successful in obtaining $1 million in funding from the State Government (which was granted to the City) to complete the following actions:

1. Commence the implementation of the masterplan by converting a disused bowling green to netball courts.

2. Development of the masterplan to provide more detailed designs to enable clubs and associations to seek funding for further implementation stages.

4.7. Following receipt of this funding, Gaetano Palmese Architects were engaged to develop the masterplan to a detailed design level.

5. Legal, Risk and Legislative Considerations

5.1. The site is zoned Recreation under the Hobart Interim Planning Scheme 2015 and the upcoming Tasmanian Planning Scheme. The Heritage Consultant has confirmed that the Master Plan and associated design concepts and plans do not impact the heritage elements of the site specifically the trees along St Johns Road and Gate House buildings on the corner of St John Road and New Town Road.

6. Discussion

6.2. Further to discussion and Elected Member questions provided at this workshop, the following additional commentary is provided.

6.3. Seating capacity for the Hobart Netball and Sports Centre will be increased to meet the needs of signature sporting events. The current facility does not meet existing and projected needs.

6.4. The proposed design for this facility also includes the opportunity for a partnership with Hobart High for whole of school meeting venue.

6.5. The overall design enhances access for various codes/sports and increase multipurpose use.

6.6. The project will importantly deliver an upgraded cycling track for the only cycling facility of its type in the south.

6.7. While the current facility is regional and attracts 400,000 attendances annually, it is one of the City’s most constrained sport and recreation sites. The new design seeks to maximise the use of the site in the most flexible way.

6.8. The opportunity to relocate some current site uses/activities was investigated, but none have been identified at this time.

6.9. In terms of vehicle and pedestrian access:

· A dedicated pick-up drop-off zone and re-configured parking areas will alleviate congestion and improve safety.

· Parking provision will increase to 120 spaces, including six equal access parking spaces.

· In addition, active travel and end of trip facilities will be supported with bicycle and scooter parking.

· Bus stops on New Town Road and Creek Road in both directions are also nearby.

7. Hobart: A Community Vision For Our Island Capital

7.1. Strategic alignment with the Community Vision is supported in the development of the Master Plan. The Master Plan aligns with Pillars 1, 2 and 6.

8. Capital City Strategic Plan

8.1. The Master Plan and concept designs strongly align with the following elements of the City of Hobart Strategic Plan 2023:

6.1.1 Strengthen open space connectivity, prioritising links between the river, bushland and the mountain, through acquisitions and other opportunities.

6.1.2 Ensure the open space network across the City is planned for and managed to meet current and future population needs.

6.5.1 Manage outdoor spaces to accommodate the diverse outdoor recreational needs of the community.

6.5.3 Encourage opportunities to activate the City’s open space network for events and activities.

7.3.3 Ensure City-owned assets and public spaces are accessible, of high quality and provide a high level of amenity to meet community and visitor requirements.

7.3.5 Measure, manage and support the effective use of city facilities, infrastructure and public spaces.

7.3.6 Consider the needs of children and families in all infrastructure design.

9. Regional, State and National Plans and Policies

9.2. All sporting facility developments need to consider the facility standards for the level of sport being played.

9.3. The facility caters for competition up to a State Level and facilities must reflect the specifications required by the State Sporting Associations to enable that level of sport to be played at the oval.

9.4. Universal design principles will be applied to cater to all users including the provision of unisex and accessible amenities, fit for purpose, multi and shared use, compatibility, public safety, health and safety and functionality are also considered alongside sporting code and guidelines.

9.5. As further context, the City of Hobart’s Open Space Unit is undertaking the development of an Open Space Strategy. The Open Space Strategy will consider land owned or managed by the City of Hobart that is set aside primarily for leisure, active or passive recreation, nature conservation, other public enjoyment or gathering. This land includes beaches, bushland, public parks, and sportsgrounds. It is anticipated that background work to inform the Open Space Strategy will continue throughout the first half of 2024.

10. Financial Viability

10.1. Funding Source and Impact on Current Year Operating Result

A high-level quantity surveyor report has determined the full cost for implementation of the improvements as significant, at approximately $55 million.

10.1.1. It is noted that the cost of implementation of the plan is well beyond the capacity of the Council and sporting clubs and associations to fund, and as such will be reliant on significant grant funding.

10.1.2. As the site hosts over 400,000 visitors per year and given there are ten clubs and associations based at the site, it is understood that the funding administrators view the project favourably, given the number of participants that will benefit.

10.1.3. It is ‘however’ very likely the project will need to be staged to match potential funding availability.

10.1.4. The contracted architect is currently developing an implementation plan to demonstrate to the potential funders how the masterplan can be achieved over time.

10.2. Impact on Future Years’ Financial Result

10.2.1. The comments above in point 10.1 also pertain to future financial years.

10.3. Asset Related Implications

10.3.1. Allocations to replace or upgrade key assets will be subject to a competitive process as part of the City’s Capital Works and Asset Renewal Program’s.

11. Sustainability Considerations

11.1. This project will provide the opportunity to improve sustainability outcomes in terms of improved water and power use.

11.2. Plantings and other treatments will also take account of sustainability imperatives.

12. Community Engagement

12.1. The City initiated a working group of all stakeholders on the site in 2019 and have met on a regular basis during the development of these plans.

12.2. Each of the clubs and associations appear to be satisfied with the plans.

12.3. Given site constraints, the masterplan does not include provision for an indoor training venue predominately for cricket (although will also potentially cater for other sports). The New Town Cricket Club is seeking potentially partnerships with the State Government for provision of additional land nearby to accommodate this need.

12.4. There is a level of community expectation in delivering this plan due the current capacity of the site which restricts clubs and associations from growing, as well as the age of the infrastructure (particularly at New Town Oval and the New Town Croquet Club).

12.5. Given the anticipated scale and cost, there is a risk that the project may not proceed for some time. While there are some minor internal upgrades planned for the site such as improvements to toilets and replacement of some infrastructure, which will improve the experience for visitor, these will not address the fundamental site capacity issues.

12.6. The Master Plan was subject to stakeholder engagement during development as well as following initial Council endorsement.

12.7. The Master Plan was presented to the Access Advisory Committee on 5 September 2023 and received favourably.

13. Communications Strategy

13.1. Officers will continue to work with key stakeholders as the projects detailed in this report progress.

14. Collaboration

14.1. The New Town Sport Precinct Master Plan and associated designs has been developed in close collaboration with all key stakeholders including relevant clubs and associations.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Kellie Williams Acting Manager Sport and Recreation |

Neil Noye Director City Futures |

Date: 13 February 2024

File Reference: F24/10320

Attachment a: New

Town Sporting Precinct Master Plan - Detailed Designs (Supporting information) ![]()

Attachment b: New

Town Sporting Precinct Reduced (Supporting information)

![]()

|

Item No. 14 |

Agenda (Open Portion) Council Meeting |

Page 1 |

|

|

19/2/2024 |

|

14. Quarterly Financial Report - 31 December 2023

File Ref: F24/11375

Report of the Chief Financial Officer of 13 February 2024.

Delegation: Council

|

Item No. 14 |

Agenda (Open Portion) Council Meeting |

Page 1 |

|

|

19/2/2024 |

|

REPORT TITLE: Quarterly Financial Report - 31 December 2023

REPORT PROVIDED BY: Chief Financial Officer

1. Report Summary

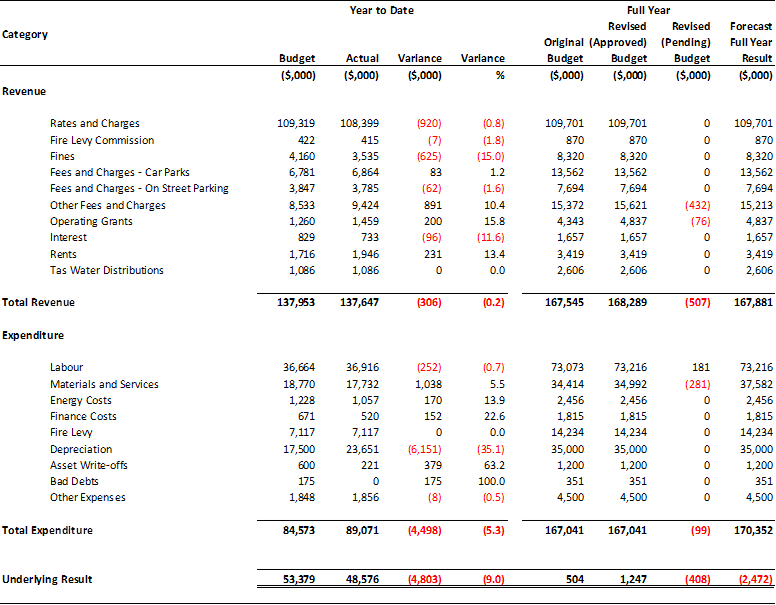

1.1. As at 31 December 2023, the City was reporting an operating deficit of $4.8 million.

1.2. The full year 2023-24 Budget forecast is a deficit of $2.5 million.

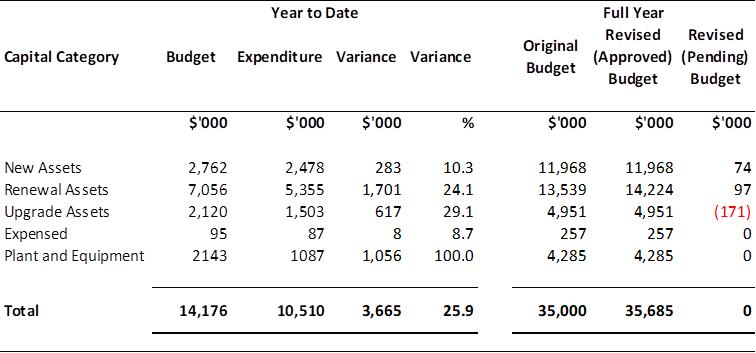

1.3. As at 31 December 2023, the City had spent $10.5 million, or 29.5 per cent of the full year Budget of $35 million for capital activities, including plant and equipment.

2. Operating Activities

3. Year-to Date Variations

3.1. As at 31 December 2023, revenue is below budget by $306 000. This is primarily due to:

3.1.2. Offset by an improved actual position compared to budget of $891 000 in Other Fees and Charges. Included in this amount were timing issues relating to animal registration fees and the Tasmanian Travel and Information Centre advertising fees. Developmental planning fees were also tracking above budget for the first half of the year.

3.2. As at 31 December 2023, expenditure is $4.5 million greater than the against the budget. This is primarily due to:

3.2.1. The Depreciation expense being $6.2 million greater than the initial estimate.

3.2.2. The City has commenced a review of depreciation expenses. Any forecast update from this review will be reflected in the March 2024 quarter report.

3.2.3. The additional Depreciation expenditure is offset by under expenditure of $595 000 in Materials and Services, which reflects timing issues predominately in contractor accounts.

4. Forecast Full Year Result

4.1. The full year forecast has deteriorated from a $504 000 surplus reported at 30 September 2023, to a $2.2 million deficit at 31 December 2023. This forecast is being driven by the following factors:

4.1.1. $408 000 reduction in Fees and Charges at Doone Kennedy Hobart Aquatic Centre due to less revenue being collected compared to the initial budget estimates. This has been included as an operational adjustment in this report;

4.1.2. $590 000 increase is waste contractor charges compared to the original budget. The original budget was based on a lower price and tonnage for refuse going to Southern Waste, and underestimated charges for green waste collection and processing; and

4.1.3. $2 million increase in Materials and Services as a result of not achieving internal efficiencies that were targeted during the preparation of the 2023-24 Budget.

4.2. The forecast outcome will not reflect the depreciation review until this work has been completed.

5. Land Under Road Valuation

5.1. Whilst not impacting on the operation activities, there is a potential valuation issue relating to Land Under Roads.

5.2. The value of Land Under Roads in Hobart is significantly higher than any other Council in Tasmania.

5.3. This issue will be discussed with the Tasmanian Audit Office and if an adjustment is required, this will impact the Statement of Financial Position in the 2023-24 Financial Report.

6. Operating Variation Requests

6.1. The following amendments to the existing Operational Budget are proposed:

|

Amount ($’000) |

Reason |

|

|

Revenue (decreases) |

408 |

Reduction in the Doone Kennedy Hobart Aquatic Centre Fees and Charges income to more accurately reflect anticipated revenue. |

7. Capital Works Activities

7.1. As at 31 December 2023, $10.5 million or 29.5 per cent of the revised full year budget has been spent.

7.2. Capital Works expenditure is $3.7 million less than the year-to-date budget allocation.

7.3. A mid-year review of all projects is being conducted by the City Projects Office to evaluate the current project performance against budget.

8. Capital Works Variation Requests

8.1. The following transfer amendments to the existing Capital Works Budget are proposed:

|

Category |

Net Amount ($’000) |

Transfer From |

Transfer To |

|

Capital Transfer |

0 |

J002262-Parks Annual Allocation FY23/24 – $95,000 |

Parks Asset Categories – Fences, Walls and Edges $20,000 Bins $10,000 Signage $10,000 Benches $10,000 Playgrounds $10,000 Pavements $10,000 Other Assets $25,000 |

|

Capital Transfer |

0 |

J002110-Buildings Partial Renewal Works - $104,146 |

J002113-Buildings Compliance Work - $104,146 |

|

Capital Transfer |

0 |

J001595-Litter bins & public waste infrastructure renewal - $40,000 |

J002367-The Good Water project - $40,000 |

|

Capital Transfer |

0 |

J001717-Middle Island and Inglewood Fire Trail - $34,000 |

J002369-Middle Island Creek Crossings - $34,000 |

|

Capital Transfer |

0 |

J002053-Mt Wellington Pinnacle Toilet Upgrade - $70,000 |

J002363-Pinnacle Toilets Septic Tank Repair - $70,000 |

|

Capital Transfer |

0 |

J001892-Local Area Traffic Management Works Annual Alloc. - $16,667 |

J002229-New Town Retail Precinct 40kmh VMS - $16,667 |

|

Capital Transfer |

0 |

J002292-Bus Stop DDA Upgrade - $50,000 |

J002287-Program Contingency FY23/24 - $50,000 |

|

Category |

Net Amount ($’000) |

Transfer From |

Transfer To |

|

Capital Transfer |

0 |

J002287-Program Contingency FY23/24 - $37,068 |

J002032-Sandown Oval (No 2) lighting - $37,068 |

|

Capital Transfer |

0 |

J002287-Program Contingency FY23/24 - $55,000 |

J001925-New Town Rd Bridge – $55,000 |

|

Capital Transfer |

0 |

J002287-Program Contingency FY23/24 - $17,135 |

J002032-Sandown Oval (No 2) lighting - $17,135 |

|

Capital Transfer |

0 |

J002287-Program Contingency FY23/24 - $320,000 |

J002366-Castray Esplanade Light Pole Replacement - $320,000 |

|

Capital Transfer |

0 |

J002283-Access & Identity Control Upgrade for Buildings - $150,000 |

J002287-Program Contingency FY23/24 - $320,000 |

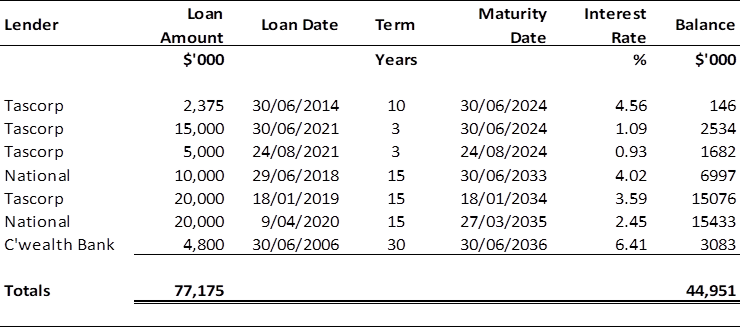

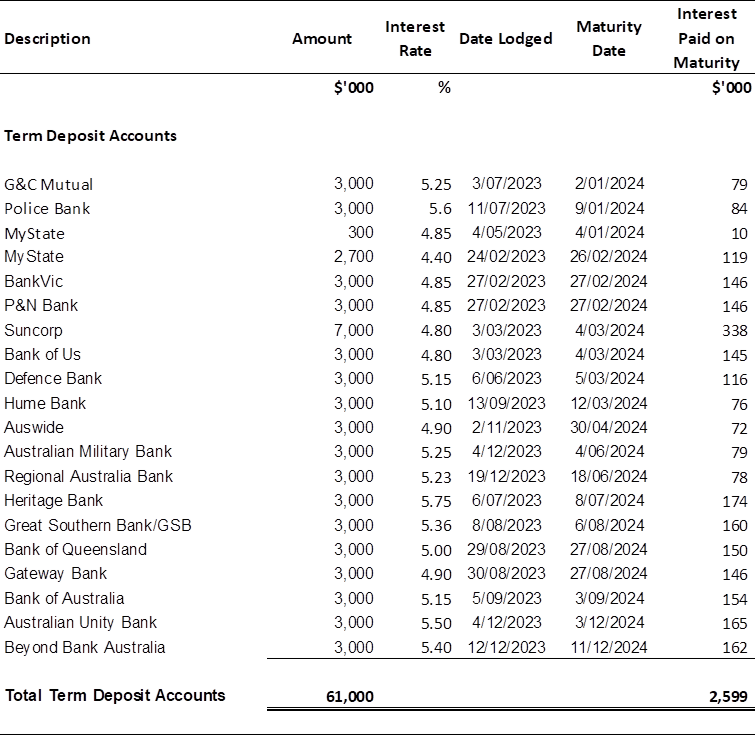

9. Loans and Investments

9.1. As at 31 December 2023, the City had:

9.1.1. Seven loans with an outstanding balance of $45 million:

9.1.2. 20 current term deposit investments, with the total invested being $61 million:

9.1.3. $11.4 million in cash, in addition to the investments. The total included $1.7 million in the Heritage Account.

|

That: 1. The Council note the Quarterly Financial Report – 31 December 2023; and 2. The Council approve the following proposed Operational and Capital Works variation requests to update the City’s 2023-24 Budget Estimates: Operational Variations:

Capital Works Transfers:

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Michelle Wickham Chief Financial Officer |

|

Date: 13 February 2024

File Reference: F24/11375

|

Item No. 15 |

Agenda (Open Portion) Council Meeting |

Page 1 |

|

|

19/2/2024 |

|

15. City of Hobart Rating and Valuation Strategy Review - Review of Rates Policies

File Ref: F24/11504

Report of the Manager Rates, Procurement and Risk and the Director City Enablers of 14 February 2024 and attachments.

Delegation: Council

|

Item No. 15 |

Agenda (Open Portion) Council Meeting |

Page 1 |

|

|

19/2/2024 |

|

REPORT TITLE: City of Hobart Rating and Valuation Strategy Review - Review of Rates Policies

REPORT PROVIDED BY: Manager Rates, Procurement and Risk

Director City Enablers

1. Report Summary

1.1. The purpose of this report is to present the outcomes of a review of a number of rates policy positions for the approval of Council, which is part of the City’s review of its rating and valuation strategy.

1.2. The community benefit is consistent with the Capital City Strategic Plan 2023, strategy 8.2.5 – maintain a rating system that supports fairness, capacity to pay and effectiveness.

2. Key Issues

2.1. As approved by Council at its meeting on 23 January 2023, the City is undertaking a strategic review of its rating and valuation strategy (the Review).

2.2. Council resolved that part of the Review will consider and include the following, which are integral to the City’s rates and charges policy:

2.2.1. Service rates and charges including funding models for waste management services.

2.2.2. Payment due dates and payment options, including discounts for early payment of rates.

2.2.3. Debt management and late payment fees.

2.2.4. Rebates, remissions and discounts including Council’s contribution to the State Government pensioner remission scheme.

2.2.5. Whether support measures for those with least capacity to pay are sufficient.

2.3. This report will consider items 2.2.1 to 2.2.4, s2.2.5 above will be considered at the Council’s March 2024 meeting, together with consideration of offering a SMS notification service for notification of unpaid rates.

2.4. Decisions on this part of the Review will inform the development of the Rating and Valuation Strategy for the City, which is intended to be presented to Council at its April 2024 meeting following the outcomes of community consultation on the City’s Rating Review Options Paper.

2.5. It is proposed that Council reconfirm its policy positions on service rates and charges, including funding models, with minor amendment, payment due dates and late payment fees, endorse amendments to debt management, Council’s $10 contribution to the pensioner discount with funding being redirected to other support initiatives and minor amendments to charitable rates exemptions.

2.6. The City’s Rates and Charges Policy will be updated to reflect the City’s Rating and Valuation Strategy, once approved by Council.

|

That the Council: 1. Continues to fund stormwater removal services by way of a service rate pursuant to s93 of the Local Government Act 1993 (Tas). 2. Continues to fund waste management services, including general waste, recycling and food organics garden organics collection, by way of a service charge pursuant to s94 of the Local Government Act 1993 (Tas). 3. Endorse the amended Council Policy – Rate Remissions Service Rates and Charges, marked as Attachment A to this report. 4. Continues to offer payment of rates by instalment and makes no change to its payment due dates, being: (i) 15 August (ii) 15 November (iii) 15 February (iv) 15 April 5. Resolves to continue to not offer ratepayers a discount on rates paid early or in full by the first instalment. 6. Continues to charge 3 per cent penalty and the prescribed interest rate on unpaid rates. 7. Endorse the amended Council Policy – Collection of Rates Arrears, marked as Attachment B to this report. 8. Endorse minor amendments to the Council Policy – Rates Exemption Charitable Purposes, marked as Attachment C to this report. 9. Ceases the $10 contribution to the pensioner rates discount with the $30,000 budgeted each year to be redirected to other pensioner support initiatives in the 2024-25 budget. 10. Endorse the amended Council Policy – Pensioner Rates Remissions, marked as Attachment D to this report. 11. Notes that all changes to Council’s rates policy positions will take effect from 1 July 2024 for the 2024-25 rating year and onwards. |

4. Background

4.1. The City of Hobart is undertaking a review of its Rating and Valuation Strategy (the Review). The City requires a sustainable Rating and Valuation Strategy (Strategy) to ensure that programs, services and infrastructure needs of the community are met now but also into the future to avoid burdening future generations of ratepayers with large rate increases. It’s also important that the City has sufficient revenue to ensure it can meet the Community Vision and the strategic objectives outlined in the Capital City Strategic Plan 2023. Rates comprise 65% of the City’s total revenue.

4.2. The Review is being conducted through a series of Elected Member workshops and community consultation.

4.3. At its meeting on 23 January 2023, Council considered a proposal for the review of the City’s rating and valuation strategy (the Review) and develop a new strategy for the City for the 2024-25 rating year and beyond. Council resolved that:

4.3.1. The proposed approach and methodology for the City of Hobart Rating and Valuation Strategy Review be endorsed.

4.3.2. The timeline for the review process marked as Attachment A to the report be endorsed.

4.3.3. The Rating and Valuation Strategy Discussion paper prepared to support the review process marked as Attachment B to the report be endorsed.

4.3.4. The proposed Community Engagement Plan to support the review marked as Attachment C to the report be endorsed.

4.3.5. An appropriate communications and media strategy be developed to support the Rating and Valuation Strategy review.

4.3.6. It be noted that a review of Council’s other revenue sources, including fees and charges, will be considered separately.

4.4. Council noted that as part of the review, an interim strategy would be prepared for the 2023-24 rating year that would address Council’s decisions at its meeting on 1 August 2022 in relation to short stay visitor accommodation and vacant residential land. That interim rating strategy for 2023-24, which included a differential rating model and included a higher differential for short stay visitor accommodation and vacant residential land, was approved by Council at its 19 June 2023 meeting.

4.5. As part of the Review, at its meeting on 30 October 2023, Council approved a change to the City’s property valuation base for the purpose of rating from Assessed Annual Value to Capital Value to take effect from 1 July 2024 for the 2024-25 rating year.

4.6. As part of the Review, at its meeting on 27 November 2023, Council approved a draft Rating System Options Paper for community consultation and the commencement of community consultation on the Review until 2 February 2024.

4.7. Council has resolved that part of the Review will consider and include the following:

4.7.1. Service rates and charges including funding models for waste management services.

4.7.2. Payment due dates and payment options, including discounts for early payment of rates.

4.7.3. Debt management and late payment fees.

4.7.4. Rebates, remissions and discounts including Council’s contribution to the State Government pensioner remission scheme.

4.7.5. Whether support measures for those with least capacity to pay are sufficient.

4.8. Council has a suite of existing rates policies that cover the topics in s4.7 of this report, above. These topics are also included in the City’s Rates and Charges Policy.

4.9. This report will consider items 4.7.1 to 4.7.4, s4.7.5 above will be considered at the Council’s March 2024 meeting together with consideration of offering a SMS notification service for overdue rates.

4.10. Decisions on this part of the Review will inform the development of the Rating and Valuation Strategy for the City, which is intended to be presented to Council at its April 2024 meeting following the outcomes of community consultation on the City’s Rating Review Options Paper.

4.11. It is proposed that Council reconfirm its policy positions on service rates and charges, including funding models, with minor amendment, payment due dates and late payment fees, endorse amendments to debt management, Council’s $10 contribution to the pensioner discount with funding being redirected to other support initiatives and charitable rates exemptions.

4.12. The City’s Rates and Charges Policy will be updated to reflect the City’s Rating and Valuation Strategy, once approved by Council.

5. Legal, Risk and Legislative Considerations

5.1. Part 9 of the Local Government Act 1993 (Tas) (LG Act) sets out the provisions for rates and charges. It is noted that pursuant to Section 86A of the LG Act, rates constitute taxation for the purposes of local government, rather than a fee for a service and…. the value of rateable land is an indicator of the capacity of the ratepayer… to pay rates.

5.2. Part 9 of the LG Act provides councils with the framework for making their rates and charges resolutions. This framework provides a range of rating tools and approaches that provide councils with the flexibility to develop a rating strategy that is tailored to the needs of their municipal area.

5.3. Council’s Rates and Charges Policy is required to be updated to reflect the change to Council’s current rating strategy. This is a requirement pursuant to section 86B(4)(c) of the LGA, which states that:

A council must review its rates and charges policy at the same time, or before, making under section 107 a variation of a rate or charge in respect of a financial year, if such a variation of that rate or charge was not made in respect of the previous financial year.

5.4. References to specific legislation relating to Council’s rating policies are included elsewhere in this report.

6. Discussion - Service Rates and Charges including Funding Models for Waste Management Services.

6.1. The purpose of considering Council’s service rates and charges is to consider whether Council should continue to have these service rates and charges, whether a service rate or a service charge is appropriate and / or whether the revenue required for these services is included in General Rates.

6.2. Under the LG Act, a council can have a service rate or charge for any, all or a combination of the following services:

6.2.1. Nightsoil removal;

6.2.2. Waste management;

6.2.3. Stormwater removal;

6.2.4. Fire protection – fire service contributions councils collect under the Fire Service Act 1979;

6.2.5. Any other prescribed service.

6.3. A service rate is valuation based. The Council calculates a rate in the dollar and the amount of rates paid by a property is calculated by multiplying the rate in the dollar by a properties property value (currently AAV). A service charge is a fixed $amount charge that all properties pay, which can be varied e.g. residential properties pay X and non-residential properties pay Y.

6.4. Council currently raises its rate revenue through the following rates and charges:

6.4.1. General Rate;

6.4.2. Stormwater Removal Service Rate (all properties pay the same rate in the dollar);

6.4.3. Waste Management Service Charge (which includes amounts for the Landfill Rehabilitation Levy. Non-residential properties pay double the charge for residential properties to reflect the difference in bin sizes e.g. 240Ltr vs 120 Ltr);

6.4.4. Food Organics Garden Organics (FOGO) Collection Service Charge (all properties pay the same that receive a FOGO collection service); and

6.4.5. Council also collects the Fire Service Levy pursuant to the Fire Services Act 1979 and the state-wide landfill levy pursuant to the Waste and Resource Recovery Act 2022 through Council rates. The Fire Service Levy is a service rate and the State Government landfill levy is a service charge. These are not Council charges and the monies raised are passed onto the State Government.

6.5. It is proposed that Council continues to apply a Waste Management Service Charge, FOGO Collection Service Charge and Stormwater Removal Service Rate as part of its Rating strategy based on full cost recovery of the waste collection and disposal, FOGO collection and stormwater removal functions rather than combining the revenue required for these services into the General Rate.

6.6. As outlined in the LG Act, waste management and stormwater removal are considered discreet services that can be funded using a service charge or a service rate as part of a councils rating strategy. It is considered to be more transparent to have a service charge / rate for these services rather than fund these services from the General Rate. It also allows Council to implement its rates remissions policy for service rates / charges to ensure that only those properties which receive the service from Council pays for it. The Council’s policy states that:

6.6.1. Generally, a property will only receive a remission of the stormwater removal service rate and / or the waste management service charge in the event that:

6.6.2. The property does not receive and is not capable of receiving a standard garbage collection service or stormwater removal service from the Council whatsoever; and

6.6.3. Even if the property were capable of receiving such a service, a request to Council for such a service would be denied.

6.7. The term ‘standard garbage collection service’ means:

6.7.1. In the case of a residential property, 120 litres of solid waste per week; or

6.7.2. In the case of a non-residential property, 240 litres of solid waste per week.

6.8. The advantage of the service charge for waste and FOGO is that it is simple, easy to understand and accepted by ratepayers as a fee for a direct service that they receive. It provides equity in the rating system in that all ratepayers who receive exactly the same service level pay an equivalent amount. The Waste Management Service Charges is varied by land use to reflect that residential properties have a 120ltr bin and non-residential properties have a 240ltr bin. Non-residential properties pay double the service charge as residential properties reflecting that Council removes double the waste from non-residential properties.