City

of hobart

AGENDA

Economic Development & Communications Committee Meeting

Open Portion

Thursday, 24 January 2019

at 5:00 pm

Lady Osborne Room, Town Hall

City

of hobart

AGENDA

Economic Development & Communications Committee Meeting

Open Portion

Thursday, 24 January 2019

at 5:00 pm

Lady Osborne Room, Town Hall

THE MISSION

Our mission is to ensure good governance of our capital City.

THE VALUES

The Council is:

|

about people |

We value people – our community, our customers and colleagues. |

|

professional |

We take pride in our work. |

|

enterprising |

We look for ways to create value. |

|

responsive |

We’re accessible and focused on service. |

|

inclusive |

We respect diversity in people and ideas. |

|

making a difference |

We recognise that everything we do shapes Hobart’s future. |

|

|

Agenda (Open Portion) Economic Development & Communications Committee Meeting |

Page 3 |

|

|

24/1/2019 |

|

Business listed on the agenda is to be conducted in the order in which it is set out, unless the committee by simple majority determines otherwise.

APOLOGIES AND LEAVE OF ABSENCE

1. Co-Option of a Committee Member in the event of a vacancy

3. Consideration of Supplementary Items

4. Indications of Pecuniary and Conflicts of Interest

6.1 kunanyi/Hobart Visitation Policy and Strategy

6.2 Summary: Friendship City Visit (Fuzhou, China)

6.3 Local Government (Meeting Procedures) Regulations 2015 - Review of Meeting Times

7. Committee Action Status Report

7.1 Committee Actions - Status Report

9. Closed Portion Of The Meeting

|

|

Agenda (Open Portion) Economic Development & Communications Committee Meeting |

Page 4 |

|

|

24/1/2019 |

|

Economic Development & Communications Committee Meeting (Open Portion) held Thursday, 24 January 2019 at 5:00 pm in the Lady Osborne Room, Town Hall.

|

COMMITTEE MEMBERS Thomas (Chairman) Zucco Sexton Dutta Ewin

NON-MEMBERS Lord Mayor Reynolds Deputy Lord Mayor Burnet Briscoe Denison Harvey Behrakis Sherlock |

Apologies:

Leave of Absence: Nil.

|

|

The minutes of the Open Portion of the Economic Development & Communications Committee meeting held on Thursday, 22 November 2018 and the Special Open Economic Development & Communications Committee meeting held on Monday, 3 December 2018 are submitted for confirming as an accurate record.

|

Ref: Part 2, Regulation 8(6) of the Local Government (Meeting Procedures) Regulations 2015.

|

That the Committee resolve to deal with any supplementary items not appearing on the agenda, as reported by the General Manager.

|

Ref: Part 2, Regulation 8(7) of the Local Government (Meeting Procedures) Regulations 2015.

Members of the committee are requested to indicate where they may have any pecuniary or conflict of interest in respect to any matter appearing on the agenda, or any supplementary item to the agenda, which the committee has resolved to deal with.

Regulation 15 of the Local Government (Meeting Procedures) Regulations 2015.

A committee may close a part of a meeting to the public where a matter to be discussed falls within 15(2) of the above regulations.

In the event that the committee transfer an item to the closed portion, the reasons for doing so should be stated.

Are there any items which should be transferred from this agenda to the closed portion of the agenda, or from the closed to the open portion of the agenda?

|

Agenda (Open Portion) Economic Development & Communications Committee Meeting |

Page 6 |

|

|

|

24/1/2019 |

|

6.1 kunanyi/Hobart Visitation Policy and Strategy

Report of the Manager Tourism of 17 January 2019.

Delegation: Council

|

Item No. 6.1 |

Agenda (Open Portion) Economic Development & Communications Committee Meeting |

Page 7 |

|

|

24/1/2019 |

|

REPORT TITLE: kunanyi/Hobart Visitation Policy and Strategy

REPORT PROVIDED BY: Manager Tourism

1. Report Purpose and Community Benefit

1.1. This report responds to a Notice of Motion for an officer report to be prepared on ‘the benefits and necessity of developing a long-term visitation policy and strategy for the City of Hobart and kunanyi/Mount Wellington to manage projected future tourist numbers.’

1.1.1. The rationale in support of the motion suggests the council consider the implications of future tourism and develop a policy and strategies to mitigate future issues.

1.2. Through the Hobart City Vision, the community has articulated a number of statements in Pillar 7 Built Environment in relation to tourism.

2. Report Summary

2.1. Based on available data it is reasonable to believe that the number of tourists visiting Hobart and kunanyi/Mt Wellington is likely to continue to grow for the foreseeable future although growth is predicted at lower rates than in recent years.

2.2. Tasmania’s visitor economy is dominated by Australian travellers mainly from the eastern states. Interstate visitors account for around four out of every five visitors to the state.

2.3. Recognising the growing popularity of kunanyi/Mount Wellington, which is managed by the City of Hobart, the City commissioned a report Visitation to the Mountain (March 2017) to inform visitor servicing of the mountain.

2.4. The City of Hobart currently has a number of projects that aim to provide a better visitor experience at kunanyi/Mount Wellington underway or in the planning phase. Completed projects include the Great Short Walk and procurement of the hop-on, hop-off all-weather mountain bus service. Projects underway include Fern Tree Park and The Springs visitor hub.

2.5. The Wellington Park Management Trust is preparing to develop a visitation and recreation strategy for Wellington Park that aims to ‘identify the tourism and recreation needs and opportunities that can be sustainably provided in the park, and provide recommendations and actions to realise these opportunities for the next 10 years.’ At the time of writing, the project scope is being finalised and a timeline for delivery of the strategy is envisaged to be two years, commencing in 2019. The City has two aldermen / councillors represented on the Trust. In addition, City officers are involved at operational level.

2.6. Through the Hobart City Vision, the community has articulated a number of statements in Pillar 7 Built Environment in relation to tourism. The Hobart City Vision, in its entirety, sets the tone to guide any future destination management of Hobart.

2.7. It is generally accepted that there can be risks associated with a growth in tourism and reporting on overtourism and overcrowding at international destinations is easily found. It is important to recognise, however, that no two destinations are the same and that many destinations are able to successfully manage risks and yield positive value from the visitor economy.

2.8. The literature on best practice destination management identifies the need for destinations to define how tourism as a whole contributes to resident wellbeing and quality of life, in addition to ascribing an economic value to tourism.

2.9. Tourism Tasmania, whose role it is to generate demand by marketing Tasmania to attract visitors, does not target ‘mass tourism’. Rather, its marketing targets a discrete sub-section of the travelling leisure market of travellers who are likely to ‘love or desire’ the Tasmanian product, spend more and who are more inclined to explore regional areas. This is consistent with the State Government key growth measures of regional dispersal and visitor spending.

2.10. Already there are many tourism strategies in place including at state government and regional level, as well as proposed strategies that will be forthcoming. These all have something to say about how tourism is being managed and how it could benefit the City of Hobart.

2.11. In addition to these, there are developments in the pipeline, such as Macquarie Point for example, that would influence visitation numbers and patterns in the City of Hobart.

2.12. There are limits to the degree to which the City can control how many people visit. The City is, however, an essential stakeholder in the visitor economy.

2.13. Given this, it is proposed that there is a need for a strategy for the City of Hobart. Such a strategy would inform the Council to externalities and the work that is occurring within the council organisation, as well as to opportunities for the City to define its role, manage perceived risks and fulfil a positive vision for the visitor economy.

2.14. A tourism strategy is included in the Tourism Unit annual plan 2017-18 and it is proposed that this strategy would address the Council’s motion.

|

That: 1. It is necessary and would be beneficial to develop a tourism strategy for the City of Hobart to define its role, manage perceived risks and fulfil a positive vision for the visitor economy. 2. A tourism strategy be prepared, with work commencing in 2019.

|

4. Background

Tasmania’s visitor profile

4.1. At the time of its release in 2015, T21, the Tasmanian Visitor Economy Strategy 2015-2020, placed visitation at the core of Tasmania’s economic agenda with a target to achieve 1.5 million annual visitors by 2020.

4.1.1. The Tasmanian Visitor Economy Strategy 2015-2020, or T21, is the partnership agreement between the Tasmanian Government and the Tasmanian tourism industry represented by the Tourism Industry Council Tasmania.

4.1.2. In addition to T21, the state government also has an Access 2020 Air and Seat Access Strategy 2015-2020, Asia Engagement Marketing Strategy 2016-2020, and a marketing strategy that is currently under review, among other strategies.

4.2. In 2014-15, Tasmania attracted 1.15 million visitors. This was an 8% increase on the previous year and set a new record for visitor numbers to the state. For the year ending June 2018, there were 1.30 million visitors, up 2% from 1.27 million for the previous year.

4.3. In southern Tasmania, for the year ending June 2018 the figure is 1,042,700, up 2%.

4.4. Tasmania’s visitor economy is dominated by Australian travellers, mainly from the eastern states with interstate visitors accounting for around four out of every five visitors to the state. Victoria, New South Wales and Queensland accounted for 86% of interstate visitation in the year ending June 2018.

4.5. Tasmania received 307,000 international visitors during the year ending June 2018, up 21% from 253,200 the previous year. China has now grown to become Tasmania’s largest international source market. When combined with Hong Kong, it is almost double the size of our next largest market. While future market growth is likely to be dominated by Asia, Tasmania’s western markets have recovered strongly following a decline after the Global Financial Crisis.

4.6. Despite Tasmania’s average annual holiday visitor growth of 16% since 2012, this travel segment accounts for just under a half of all interstate visitors and around three quarters of all international visitors to Tasmania.

4.7. The balance of Tasmania’s visitors mainly consists of people travelling to Tasmania to visit friends and relatives living here (VFR) and those travelling to the state for business or employment purposes.

4.8. A further important visitor segment, therefore, is the business event sector. ‘Business events’ is a collective term that refers to association conferences, corporate incentive travel and government meetings and exhibitions. The business event delegate is highly desirable. They are at the high-yield end of the market, producing a daily spend well above that of the average leisure tourist.

4.9. Business Events Tasmania (BET) is the peak sales and marketing body for the business events sector in Tasmania. The City of Hobart has a Memorandum of Understanding with Business Events Tasmania and provides BET with funding in order to support the development of business events in the Hobart municipal area.

4.9.1. In the 2017-18 year, business events brought over 14,700 delegates (excluding partners) to Hobart with an estimated future economic worth around $30.1 million.

4.9.2. Over 80% of conferences and business event activity occur in the traditional shoulder and off-peak tourist periods.

Tourism industry priorities

4.10. In July 2017 the T21 strategy was reviewed.

4.11. Amongst the key themes to emerge from this review is the importance of looking to increase yield from visitors to Tasmania and improving the dispersal of visitors to regional communities.

4.12. This has resulted in a stronger emphasis on regional dispersal and visitor spending, either through longer visits or higher daily spending, as key growth measures for the future.

4.12.1. ‘Yield’ is increasingly considered a more useful measure over ‘volume’. It is suggested that visitor numbers have little meaning unless the expenditure injected into a destination is taken into account. High yielding tourists are recognised by Tourism Australia / Tasmania as likely to stay longer, spend more and visit regional areas.

4.13. In addition, Tourism Tasmania undertook a target market segment review during 2018, defining two new key target markets that would best fit the description of ‘high yield’ in the context of Tasmania’s competitive strengths. This work will underpin future creative development for marketing campaigns.

4.14. According to Tourism Tasmania, tourism in Tasmania directly and indirectly contributes about $2.3 billion or 9.1% to Gross State Product (GSP). Tourism directly and indirectly supports around 37,500 jobs in Tasmania or about 16.2% of total Tasmanian employment and directly supports around 15,000 jobs or about 6.5% of total Tasmanian employment. This is higher than the national average – the highest in the country.

Visitor engagement

4.15. The Tasmanian Visitor Engagement Strategy (2016) was prepared through the Department of State Growth and aims to support the state’s marketing efforts through a statewide approach to enhancing the visitor experience.

4.15.1. The Department of State Growth, through the Tourism and Hospitality Supply Unit (THSU), encourages investment in visitor infrastructure and works with industry to align workforce training with the emerging workforce demands of the visitor economy.

4.15.2. In addition to the Tasmanian Visitor Engagement Strategy, the THSU is responsible for the Tasmanian Cycle Tourism Strategy (2017) and the Servicing Our Growth Report – Tourism and Hospitality Workforce Taskforce (2017).

4.16. At the heart of the Tasmanian visitor engagement strategy is the desire by government to create the conditions in which visitors are able to ‘engage in meaningful experiences rather than skimming the surface of the destination’, a value that aligns with the state’s marketing strategy.

4.17. The strategy includes recommendations for visitor information centres of which the City of Hobart owns and operates Tasmania’s largest – the Tasmanian Travel and Information Centre (TTIC).

4.18. Through the TTIC, the City of Hobart makes a significant contribution to the Tasmanian visitor economy.

4.19. As the gateway visitor information centre for Tasmania, the TTIC assisted just over 280,000 customers with information and statewide bookings in the year ending June 2018. TTIC contributed $2,879,000 to the Tasmanian tourism economy through tours, experiences and hotel booking revenue and booked 398 different tourism products (accommodation and ticketed experiences) during 2017-18.

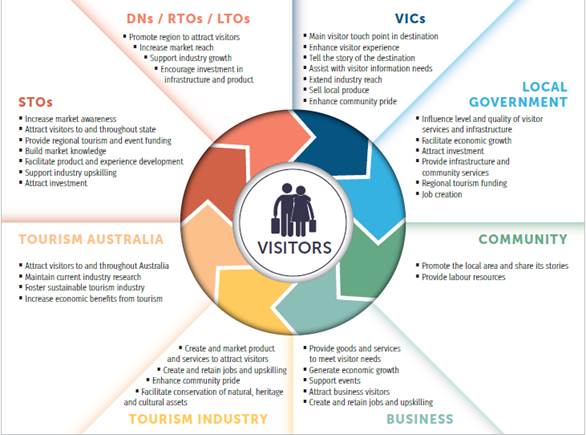

Tourism industry / visitor economy – diagram of industry stakeholders

4.20. Acronyms:

(i) STO – State tourism organisation

(ii) RTO / LTO – Regional or local tourism organisation

(iii) VIC – Visitor information centre

Hobart snapshot

4.21. It is reasonable to believe that the number of tourists visiting Hobart and kunanyi/Mt Wellington is likely to continue to grow for the foreseeable future.

4.22. Tourism Research Australia has published a 5 year average annual visitation growth rate for 2016-17 to 2021-22 forecasting 6.7% visitation growth for Hobart, with the average growth reducing to 5.6% from 2021-22 to 2026-27.

4.23. In terms of visitor numbers, Hobart and Launceston are expected to grow significantly in relative terms through greater accommodation capacity and more business travel and events.

4.24. Research undertaken by SGS Economics on behalf of the City of Hobart (2015) found that once operational, new hotel developments around the city centre would represent an increase of approximately 230,000 visitor nights in the city centre per annum. Key markets for these new hotel developments are identified as South-East Asia and China.

4.24.1. The SGS Economics research played a key role in establishing a business case for an upgraded information booth in Elizabeth Mall, staffed by travel advisors through the TTIC.

4.25. In addition, Tourism Tasmania, in partnership with Tourism Australia, participates in international sales missions. An Asian Tourism Mission in September this year involved China, Hong Kong, Malaysia and Singapore.

4.26. The Tasmanian Cruise Ship Passenger Survey, December 2016 to April 2017 found that around half of cruise ship passengers (104,000) expect to return to Tasmania for a holiday. This percentage was higher for Australian passengers (76%). Of those passengers who expect to return to Tasmania, 53% indicated they expect to do so within the next two years.

4.27. Growing access and making it easier to get to Tasmania is a key pillar of T21.

4.27.1. Tasmania’s Access 2020 Strategy shows that around 700,000 additional aircraft seats will be required to carry 1.5 million visitors per year by 2020.

4.27.2. Last year, Virgin Australia commenced offering direct flights from Perth to Hobart and Tourism Tasmania has been actively marketing in Perth.

4.27.3. From April 2019, Qantas will add 34,000 seats per annum with three additional Sydney-Hobart flights per week.

Cruise shipping

4.28. The Tasmanian Cruise Market and Regional Ports Review recently released by the Tasmanian Government has found the main ports of Hobart, Burnie and the anchorage of Port Arthur can continue to efficiently manage growth of large cruise ships and mega ships however, expedition vessels and small cruise ships are the ideal fit for Tasmania’s shore products, destination capability and brand.

4.29. While growth in cruise shipping to Tasmania is expected to continue, it is not anticipated to be at levels of 30 to 45% per annum that the sector has experienced over the past three years. The 2018-19 season features 64 ships and 180,880 passengers and crew. This represents less than 1% passenger growth, despite ship numbers increasing.

4.29.1. There are 53 port call bookings confirmed for 2019-20 as at September 2018. (Bookings for the next two years are still being taken with numbers likely to change.)

4.30. The Tasmanian Cruise Ship Passenger Survey 2016-17 found the average number of passengers per ship was 1751, down from 1975 the previous year. This was influenced by an increase in visits of the sub-1000 passenger luxury class ships.

4.31. Yield and shore tour dispersal strategies are priorities for each of the state’s main ports. TasPorts is working with Tourism Tasmania to align its focus to luxury high yield ships with passengers more aligned to the target market.

4.32. Future opportunities include developing partial turn arounds of cruise ships in Hobart enabling cruise visitors to spend time in Tasmania before or after their cruise, and developing provedore supply solutions by increasing the amount of speciality Tasmanian product on board through partnerships with local suppliers.

kunanyi/Mount Wellington

4.33. The City of Hobart manages the highest visitation area of Wellington Park, the eastern face of kunanyi/Mount Wellington.

4.34. The Tasmanian Visitor Survey (TVS) rates kunanyi/Mount Wellington as the third most visited attraction in Tasmania after (i) Salamanca Market and (ii) MONA.

4.35. Visitation to the Mountain (March 2017) was commissioned to enable the City to better understand visitation to kunanyi/Mount Wellington in order to plan for visitor servicing.

4.35.1. A Memorandum of Understanding between the City of Hobart and the Wellington Park Management Trust (WPMT) was signed in April 2016. At the time it was developed, a visitation and recreation strategy for Wellington Park was viewed as a high priority and was included in the MOU.

4.35.2. Responsibility for strategic planning rests with the WPMT and given the Trust has yet to develop its visitation and recreation strategy, as the operational land managers, the City has continued to feel the pressures of increased visitation and has sought to respond.

4.36. The Visitation to the Mountain report estimates that 445,220 people visited the mountain one or more times during 2015-16.

4.36.1. The TVS recorded over 330,000 interstate and overseas visitors visiting kunanyi/Mount Wellington between July 2017 and June 2018, up 1.3% from the previous financial year and a slight increase on the 16.6% recorded from 2015-16 to 2016-17.

4.37. The same report, whilst acknowledging ‘uncertainty from known and unknown factors’, projects future visitation (all visitor types) to be between 500,000 and 680,000 over five years. The highest estimate for 2023-24 is 686,000 and the lowest is 558,000. A single figure is difficult to determine due to the porous nature of the mountain’s borders and the complexity of use and varied access points.

4.38. The report identifies some key data on interstate and international visitors, drawing from the TVS that shows that four out of five (79%) non-Tasmanians who visit Mount Wellington are from interstate with the remainder coming from overseas.

4.39. The Visitation to the Mountain report has enabled the City of Hobart to progress a range of initiatives to enhance the visitor experience and manage impacts.

Wellington Park

4.40. Wellington Park, which includes kunanyi/Mount Wellington, is managed by the Wellington Park Management Trust in partnership with the representative land management agencies. The City of Hobart is represented on the Trust by two elected members.

4.41. Within the WPMT strategic plan, the highest priority initiative is the development of a visitation and recreation strategy for Wellington Park.

4.42. At the time of writing, the project scope for the Wellington Park visitation and recreation strategy is being finalised. A timeline for delivery of the strategy is envisaged to be two years and it is understood that this project will examine visitation to the entirety of Wellington Park in more detail. The Trust will be seeking a financial contribution for the City for the development of the strategy. This request will be the subject of a separate report.

4.43. The intent of the Wellington Park visitation and recreation strategy is to ‘set out a management approach to providing a high quality and satisfying visitor experience that is environmentally and socially sustainable and ensures the protection of park values into the future’ and ‘establish a clear understanding of how to manage growth in visitor numbers’. In this context, the ‘visitor’ is not necessarily a tourist, but any user of Wellington Park and the range of activities aligned with either the tourist or recreational user can overlap.

4.44. The draft project scope states that the strategy ‘will identify the tourism and recreation needs and opportunities that can be sustainably provided in the park, and provide recommendations and actions to realise these opportunities for the next 10 years’.

4.45. City of Hobart officers would be involved with the development of this strategy.

kunanyi/Mount Wellington – visitor servicing

4.46. The City of Hobart One Mountain prospectus (2015) reviewed all strategies and plans at the time and highlighted three major projects for the City of Hobart as the basis of forward capital works planning. The Great Short Walk rejuvenation is almost complete and work is due to commence soon on Fern Tree Park.

4.47. Under the Fern Tree Park Visitor Node Master Plan, new park facilities are proposed including a nature-based playground, toilets, picnic and bus shelters, an upgraded car park, better wayfinding and safer access. Works are scheduled to begin in early 2019.

4.48. A consultant team lead by Hirst Projects was engaged to undertake a feasibility study of a visitor hub concept for The Springs and was approved by Council earlier in 2018. The visitor hub proposal is now the subject of additional investigation regarding supporting infrastructure, transport / parking, Aboriginal engagement, fire risk and to ensure it aligns with the revision of the Springs Master Plan. The Visitation to the Mountain report was used as the basis of business modelling being used for the feasibility study.

4.49. A new hop-on, hop-off all-weather mountain bus service was launched in October 2018. Called the kunanyi/Mt Wellington Explorer Bus, it can carry bikes, will run GPS-located audio commentary in eight languages and is wheelchair accessible. Another purpose built bus that will be able to take passengers to the top of the mountain in winter snow / ice conditions has also been ordered and is expected to be operational by May 2019. The summer timetable with 6 daily departures is currently operating.

Mass tourism

4.50. The term ‘mass tourism’ relates to the ability of companies to move people en masse, a trend that started at the turn of last century and that was popularised after the Second World War, especially in the period between 1960 to 1980.

4.51. Mass tourism has created problems where exponential growth in visitation has been faster than the destination’s ability to manage the impacts or define for itself a long-term vision.

4.52. ‘Mass tourism’ also describes the means by which major multinational companies are contributing to changes in cities and countries across the globe through their economic influence.

4.53. Tourism Tasmania advises ‘Tourism Tasmania’s destination marketing strategy is not, and never has been, targeted at mass tourism. Our main focus continues to be on the value of the visitor to Tasmania. Our marketing targets a discrete sub-section of the travelling leisure market, i.e. travellers who “treasure” or value what Tasmania has to offer. These visitors are likely to love or desire the Tasmanian product and spend more in our communities, and are more inclined to explore regional areas. This aligns with the renewed focus on yield and dispersal.’

4.54. Whilst it is acknowledged that tourism is in a growth phase, it is arguable that mass tourism is not evident in Tasmania.

Overtourism

4.55. While many tourists want to ‘live like a local’ and have an authentic and immersive experience during their visit, ‘overtourism’ happens when the residents of tourism-dependent destinations see the unique sense of place that characterised their home towns vanish.

4.56. The excessive growth of a destination’s popularity can lead to overcrowding in areas where residents suffer the consequences of temporary and seasonal tourism peaks and these enforce permanent changes to their lifestyles and access to amenities.

4.57. It is generally understood that the tourism industry is labour heavy, creates jobs and there is multiplier effect through which the wider economy benefits, however, sometimes sections of local communities miss the perceived benefits of tourism yet experience the inconveniences associated with tourism, leading to dissatisfaction with the tourism sector.

4.58. The following examples illustrate some of the negative and well known characteristics of overtourism:

(iv) Overcrowding in residential neighbourhoods. E.g. residents living within two blocks of Barcelona’s Sagrada Familia which receives over 3 million visitors a year.

(v) Dislocation of residents. E.g. Venetian’s who are moving to the mainland as they can no longer afford apartments in Venice. Retail outlets servicing the visitor rather than the local. Twenty million tourists visit Venice, an average of 60,000 a day.

(vi) Wear and tear. Roads, bridges, heritage and natural sites. Pollution. E.g. Thailand’s Maya Bay, made famous by the Leonardo DiCaprio movie The Beach, indefinitely closed to enable environmental recovery. The beach was attracting up to 5000 visitors a day.

(vii) Cultural tensions between residents and visitors such as showing too much bare skin or the excessive consumption of alcohol.

4.59. Overtourism is sometimes interchangeable with ‘overcrowding’.

4.60. Overcrowding is not exactly alike in any two destinations and not everyone will agree at which point popularity tips into overcrowding. The influence of politics, media and other stakeholders means that perceptions are often subjective. Popularity of a site does not necessarily mean it is under threat, but may point to a degree of risk.

4.61. Destinations may move through a tourism lifecycle that starts with discovery and trend to popularity. They move through the phases of development and consolidation, and then to stagnation and decline if not managed well. Some locals will be alienated at early stages and by the time a destination’s popularity starts to decline, these locals are already resentful and are also left with the job of repairing the local economy.

Sustainable tourism

4.62. The United Nations World Tourism Organisation, whose charter is to promote tourism as a driver of economic growth, inclusive development and environmental sustainability, defines sustainable tourism as:

(i) ‘tourism that takes full account of its current and future economic, social and environmental impacts, addressing the needs of visitors, the industry, the environment and host communities’ and

(ii) ‘sustainable tourism should also maintain a high level of tourist satisfaction and ensure a meaningful experience to the tourists, raising their awareness about sustainability issues and promoting sustainable tourism practices amongst them.’

Destination management

4.63. Destination management is generally regarded as an ongoing process in which tourism, industry, government and community leaders plan for the future and manage a destination. This seeks to ensure the needs and aspirations of communities of interest are addressed.

4.63.1. A feature of destination management is often marketing a destination to grow visitation. In the case of Hobart, the City is a financial member of Destination Southern Tasmania, the regional tourism association for southern Tasmania responsible for marketing, advocacy and industry development.

4.63.2. Tourism Tasmania is responsible for driving demand for the state.

4.64. Destination action plans are an implementation initiative of T21 and the City of Hobart participated in the development of the Destination Action Plan for Greater Hobart (2016) (DAP).

4.65. This DAP, which takes a greater Hobart approach including Clarence and Glenorchy councils, is coordinated through Destination Southern Tasmania (DST).

4.66. The DAP is currently being reviewed by DST and the Department of State Growth.

4.67. Through the Hobart City Vision, the community has articulated a number of statements in Pillar 7 Built Environment in relation to tourism, including:

7.4.1 We invite visitors and tourists to enjoy our city and recognise their important contributions to city life.

7.4.2 We manage visitor accommodation so that it does not negatively affect or infringe on the availability of longer-term housing or reduce neighbourhood safety or cohesion.

7.4.3 We support investors to understand the communities they are buying into. The value of housing as investment does not override the value of housing as a place to live.

4.68. Whilst it is arguable that mass tourism is not evident in Tasmania, it is acknowledged that tourism is in a growth phase and that it would be beneficial for the Council to more closely examine any perceived risks as well as the opportunities for Hobart to realise the benefits of the visitor economy.

4.69. Already there are many strategies in place including at state government and regional level, a number of which have been outlined in this report, as well as proposed strategies that will be forthcoming. These all have something to say about how tourism is being managed and how it could benefit the City of Hobart.

4.70. In addition, there are developments in the pipeline, such as Macquarie Point for example, that will influence visitation.

4.71. Given everything that this report has discussed, it is proposed that there would be benefit in a strategy for the City of Hobart. Such a strategy would inform the Council to externalities and the work that is occurring within the council organisation, as well as to opportunities for the City to define its role, manage perceived risks and fulfil a positive vision for the visitor economy.

4.72. A tourism strategy is included in the Tourism Unit annual plan 2017-18 and it is proposed that this strategy would address the Council’s motion.

5. Proposal and Implementation

5.1. There are limits to the degree to which the City can control how many people visit. The City is, however, already an essential stakeholder in the visitor economy.

5.2. A tourism strategy is included in the Tourism Unit annual plan 2017-18 and it is proposed that this strategy would directly address the Council’s motion.

6. Strategic Planning and Policy Considerations

6.1. Through the Hobart City Vision, the community has articulated a number of statements in Pillar 7 Built Environment in relation to tourism.

6.2. In light of the Hobart City Vision, the City will be reviewing the Capital City Strategic Plan 2015-2025 and the proposed tourism strategy, through a symbiotic relationship, would be aligned to the corporate strategic plan.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. It is proposed that the tourism strategy would largely be developed in-house, however, there may be a need for some external specialist support in regards to data or analysis and an allowance of up to $30,000 should be considered to enable this.

7.2. Impact on Future Years’ Financial Result

7.2.1. As above.

7.3. Asset Related Implications

7.3.1. Nil.

8. Legal, Risk and Legislative Considerations

8.1. There are no direct legal, risk or legislative considerations arising from this report.

9. Community and Stakeholder Engagement

9.1. A stakeholder engagement plan would be prepared for the development of the tourism strategy. Key industry stakeholders include Tourism Tasmania, the Tourism Industry Council of Tasmania, Destination Southern Tasmania, the Department of State Growth and Business Events Tasmania.

10. Delegation

10.1. This matter is delegated to the Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Iris Goetzki Manager Tourism |

|

Date: 17 January 2019

File Reference: F18/137624

|

Item No. 6.2 |

Agenda (Open Portion) Economic Development & Communications Committee Meeting |

Page 23 |

|

|

24/1/2019 |

|

6.2 Summary: Friendship City Visit (Fuzhou, China)

Report of the Economic Development Project Officer of 16 January 2019.

Delegation: Committee

|

Item No. 6.2 |

Agenda (Open Portion) Economic Development & Communications Committee Meeting |

Page 24 |

|

|

24/1/2019 |

|

REPORT TITLE: Summary: Friendship City Visit (Fuzhou, China)

REPORT PROVIDED BY: Economic Development Project Officer

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to provide a summary of a recent officer trip to Fuzhou (one of Hobart’s two friendship cities in China).

1.1.1. The benefit of this report is that the community are kept informed of the most recent developments with regard to the relationship between Hobart and Fuzhou.

1.1.2. The more informed the community is about their city’s international relationships, the more opportunity there is for the community to become involved. Some of the most innovative ideas for collaboration have come from the local community.

2. Report Summary

2.1. The City of Hobart’s Economic Development Project Officer on invitation from the Fuzhou Foreign and Overseas Chinese Affairs Office visited Fuzhou - China between 30 November and 5 December 2018. All of Fuzhou’s international relationships are managed through this office.

2.2. The purpose of this visit was to attend the 4th Maritime Silk Road International Tourism Festival and the ‘Glimpse of Fuzhou’ seminars and site visits. These were arranged as a means of sharing information about Fuzhou with its sister / friendship cities and strengthening people to people and city to city relationships.

2.3. Whilst in Fuzhou, the officer separately visited the Fujian Australian Business Centre, the Fuzhou Polytechnic College and the Fuzhou No. 18 Middle School.

2.4. The Tourism Festival and seminars were attended by 11 of Fuzhou’s other friendship / sister cities. This provided a valuable opportunity for the Hobart officer to learn more about some of Fuzhou’s other relationships and how local governments work in other cities around the world.

2.5. The City of Hobart officer took the opportunity to have a number of discussions with her counterpart and Director of the Fuzhou Foreign and Overseas Chinese Affairs Office about the Hobart – Fuzhou relationship and potential future projects which include:

· Dragon boaters from Greater Hobart competing in a Fuzhou dragon boat festival in 2019.

· Dragon boaters from Fuzhou returning to Hobart at the end of 2019 / start of 2020.

· Fuzhou’s attendance of the Australian Wooden Boat Festival 2019 with potential involvement in 2021.

· A Hobart soccer club sending a team to compete in a ‘sister city soccer tournament’ at the end of 2019.

|

That the summary report and presentation of the Economic Development Project Officer’s recent visit to Fuzhou be received.

|

4. Background

4.1. On invitation by the Fuzhou Foreign and Overseas Chinese Affairs Office of the Municipal Government of Fuzhou, the Economic Development Project Officer visited Fuzhou from 30 November and 5 December 2018.

4.2. The officer was invited in order to attend the 4th Maritime Silk Road International Tourism Festival and ‘Glimpse of Fuzhou’ seminars and site visits. Whilst in Fuzhou, the officer conducted other visits and was able to have a number of conversations in relation to Fuzhou’s international relationships with other cities, her counterpart in Fuzhou and Director of the Fuzhou Foreign and Overseas Chinese Affairs Office about the Fuzhou – Hobart relationship.

4th Maritime Silk Road International Tourism Festival

4.3. The 4th Maritime Silk Road International Tourism Festival was organised by the Fuzhou Municipal Government and the Fujian Provincial Administration of Tourism.

4.4. The launch of the festival took place on 30 November and was attended by between 800-900 domestic tourism officials, domestic and foreign travel agencies, investors and media. Representatives of Tasmanian tourism businesses such as the Federal Group were also in attendance.

4.5. The festival showcased a number of attractions in and around Fuzhou such as the Minjiang River and the ‘three lanes and seven alleys’. The festival also offered an opportunity for media exposure for visiting sister / friendship cities.

As part of the tourism festival, the Economic Development Project Officer gave a 10 minute interview and shared a City of Hobart promotional video. This interview and video was aired on the Fuzhou TV station and also on the internet via apps such as Fuzhou New, Tecent, Sina and Weibo.

A Glimpse of Fuzhou Seminars and Site Visits

4.6. A number of seminars were attended. The content of the seminars were very informative and in-depth and the opportunity was given to ask the presenters questions which was very useful. The seminars were on the following topics:

· China’s Foreign Policy and Foreign Relations.

· Culture of Fuzhou.

· Conditions and Investment Environment of Fuzhou.

· Inheritance of Chinese Traditional Culture and Arts.

· Fuzhou and its Sister Cities and 21st Maritime Cooperation Committee.

4.7. Site visits were to:

· The Chunlun Jasmine Tea and Culture Park.

· Yongtai County Hot Springs.

· Minjiang University.

· Fuzhou Public Service Centre.

· Three Lanes and Seven Alleys.

· Minjiang River.

· Binhai New City.

Fuzhou Public Service Centre

4.8. The public service centre was created with the Fuzhou community in mind. Its essence is that it is a ‘one stop shop’ for residents, providing them access to government services.

4.9. The centre was opened in 2015 and serves 10,000 people per day.

4.10. It covers an area of 40,000 sq metres and provides 426 services.

4.11. Over 400 people work there and it is open at the weekend to provide the community with convenient access. There is an on-site crèche and some of the self-serve functions of the centre can be accessed by residents 24 hours per day.

4.12. The service centre prompted much discussion amongst the international group about this kind of facility in other countries.

Three Lanes and Seven Alleys

4.13. This is Fuzhou’s most famous tourist attraction covering around 38 hectares and providing access to architecture and history of the Ming (1368 -1644) and Qing (1644 - 1912) dynasties.

4.14. The area is an example of the successful blend of history, culture and commercialisation, having received an honourable mention in the 2015 UNESCO Asia Pacific Heritage Awards. It has also been named as one of the top ten famous historical and cultural streets in China.

Binhai New City

4.15. This new city is in the Changle District of Fuzhou on the coast of the East China Sea and strategically positioned between the Changle International Airport and the Songxia Port.

4.16. Binhai New City has a planning area of 188 km2 and a core area of 86 km2. The planned population for the city when complete is 1.3M.

4.17. The construction started in 2017 and will be completed in 3 phases which will include the realisation of 136 key projects at an investment value of $34.3 billion RMB.

4.18. Projects include 122,000 m2 for housing, rail links, cloud computing centre, schools, hospitals, hotels and enterprise zones with associated housing for new talent.

Other Visits

4.19. The City of Hobart officer along with Tasmanian Tourism businesses and Mr Jason Xu (Executive Chairman of the Fujian Association Tasmania) independently visited the Fujian Australian Business Centre.

The Fujian Australian Business Centre is used by the owner of the facility as a location from which to promote Australian products including Tasmanian leatherwood honey and a variety of wines and is an interesting space with a number of offices themed on the capital cities of Australia’s states and territories including Hobart. It is also used by organisations such as Austrade as a base for meetings.

4.20. The City of Hobart through its friendship city relationship with Fuzhou helped to facilitate the development of a sister school relationship between St Mary’s College and Fuzhou No. 18 Middle School. The City officer visited No 18. Middle School to demonstrate the City’s on-going support for the school to school relationship.

4.21. Discussions have been held recently with TasTAFE about whether there may be any opportunities for them arising from Hobart’s friendship / sister cities. TasTAFE has established relationships in Xi’an and Shanghai but was interested to investigate opportunities in Fuzhou. The Economic Development Officer met with the Fuzhou Polytechnic to make initial enquiries and introductions. TasTAFE and Fuzhou Polytechnic have since exchanged emails and are discussing potential collaborations.

4.22. Fuzhou Polytechnic ranks very highly in the Fujian Province (population approximately 37 M). It was the first Chinese college to found an ‘Alibaba Big Data School’ and the first to found a Microsoft Innovation College. It was ranked number 1 among 88 Fujian institutions of higher learning in terms of employability of its graduates.

Valuable Discussions

4.23. The City officer took the opportunity to speak in depth with all of the 11 cities and has become an informal coordinator of a network of these cities, having already shared notes and the City of Hobart Waste Strategy.

4.24. This group provided many opportunities for the Hobart officer to learn of the nature of the relationships between Fuzhou and other cities around the world, noting projects that might be replicable in the Hobart Fuzhou relationship.

4.25. The Hobart officer, her counterpart in Fuzhou and the Director of the Fuzhou Foreign and Overseas Chinese Affairs Office were able on a number of occasions to discuss the relationship between the two cities. Topics included:

· Invitation to Fuzhou to attend the Australian Wooden Boat Festival to discuss whether China might be the feature country for 2021 (Fuzhou has a long and rich maritime history).

· An invitation to Greater Hobart Dragon Boaters to take part in a dragon boat festival in June (collaboration with Fuzhou dragon boaters).

· A return trip of dragon boaters to Hobart in late 2019 or early 2020.

· Soccer tournament at the end of 2019 in Fuzhou for young people from Fuzhou sister / friendship cities.

5. Proposal and Implementation

5.1. It is proposed that committee receive the Economic Development Project Officer’s summary report and presentation of her recent visit to Fuzhou.

6. Strategic Planning and Policy Considerations

6.1. Taking part in the 4th Maritime Silk Road International Tourism Festival and the ‘Glimpse of Fuzhou’ seminars and site visits is in line with the following Council strategy:

Capital City Strategic Plan (2015 - 2025) Goal 1 - Economic Development, Vibrancy and Culture “City growth vibrancy and culture comes when everyone participates in city life”:

“1.1.5 Implement the City of Hobart’s Economic Development Strategy.

1.2.4 Support the Council’s existing sister city relationships with Yaizu, L’Aquila and Xi’an and respond to new opportunities.”

6.2. This is also in line with the recently endorsed community vision pillar 4 – City Economies:

4.3.6 We value pilgrimage – the choice to explore places beyond our island. Those who stay elsewhere take our culture to the world. Those who return bring new experiences with them, which we can use to enrich and evolve our own.

4.3.7 We embrace those who have moved to Tasmania from elsewhere and work together for better economic outcomes. We welcome new people into our culture, quality of life and opportunities for meaningful employment.

4.3.8 We promote Hobart as a perfect environment for remote workers, sole traders, and niche small businesses.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. Transfers, hotel and meals were funded by the Fuzhou Foreign and Overseas Affairs Office (Fuzhou Municipal Government).

7.1.2. The total cost of the visit to the City of Hobart was $2010.19. This was met by the Economic Development budget function.

7.2. Impact on Future Years’ Financial Result

7.2.1. Projects may arise from discussions had during the visit. These will be incorporated into the budgetary planning of the Economic Development Unit for future financial years.

7.3. Asset Related Implications

7.3.1. None

8. Legal, Risk and Legislative Considerations

8.1. The nature of friendship / sister city relationships are non-binding.

9. Environmental Considerations

9.1. Fuzhou and the Fujian Province pride themselves for their quality of air and environment. They have worked with their sister city of Nagasaki in Japan to develop water improvement facilities and have expressed the desire to examine ways in which they can learn from some of the exemplar environmental practices in Tasmania around generation of energy and the protection of the environment.

10. Social and Customer Considerations

10.1. In line with community vision pillar 4, it is of social importance that the City of Hobart fosters a diverse selection of international relationships based on geography, industry and nature of outcomes (community, culture, economic).

10.2. The City establishing sister or friendship city agreements facilitates a broader local understanding and appreciation for different cultures and communities.

10.3. Fostering these relationships is also a powerful and respectful message to people within the community who have close cultural ties with the cities in question.

The fastest growing population in Hobart are those born in China which was 1,030 in 2011 and 1,747 in 2016. The Chinese population is second only to those born in England (2,175 in 2016). The total population of the Hobart LGA (local government area) is 50,439.

10.4. The community may question the value of international relations if the City of Hobart does not continue to continuously consider the way in which it measures and reports this information and involves the community in maximising opportunities arising.

11. Marketing and Media

11.1. The officer who travelled to Fuzhou took a number of opportunities to promote the City of Hobart through information sharing, media interview and through the distribution of marketing collateral such as the investor prospectus and City of Hobart keep cups. Marketing materials for TasTAFE were also shared.

12. Community and Stakeholder Engagement

12.1. Key activities with sister / friendship cities are promoted in City News and on the City of Hobart website with the assistance of the Marketing and Communications Unit.

12.2. A number of innovative and interesting ideas in relation to Hobart’s four sister / friendship cities have come from the community to date. It is therefore paramount that community awareness of these relationships continues to be increased.

13. Delegation

13.1. This matter is one for Committee.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lucy Knott Economic Development Project Officer |

|

Date: 16 January 2019

File Reference: F18/153142

|

Item No. 6.3 |

Agenda (Open Portion) Economic Development & Communications Committee Meeting |

Page 33 |

|

|

24/1/2019 |

|

6.3 Local Government (Meeting Procedures) Regulations 2015 - Review of Meeting Times

Memorandum of the General Manager of 5 December 2018.

Delegation: Committee

|

Item No. 6.3 |

Agenda (Open Portion) Economic Development & Communications Committee Meeting |

Page 34 |

|

|

24/1/2019 |

|

Memorandum: Economic Development & Communications Committee

Local Government (Meeting Procedures) Regulations 2015 - Review of Meeting Times

Regulation 6(2) of the Local Government (Meeting Procedures) Regulations 2015 require that after each ordinary election, a council and council committee are to review the times of commencement of their meetings.

Regulation 6(1) states that a meeting is not to start before 5:00 pm unless otherwise determined by the council committee by simple majority.

Accordingly, the commencement time for ordinary meetings of the Economic Development and Communications Committee is submitted for consideration.

|

That in accordance with Regulation 6(2) of the Local Government (Meeting Procedures) Regulations 2015, the Committee determine the commencement time for ordinary meetings of the Economic Development and Communications Committee.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N.D Heath General Manager |

|

Date: 5 December 2018

File Reference: F18/140999; 13-1-2

|

Agenda (Open Portion) Economic Development & Communications Committee Meeting |

Page 35 |

|

|

|

24/1/2019 |

|

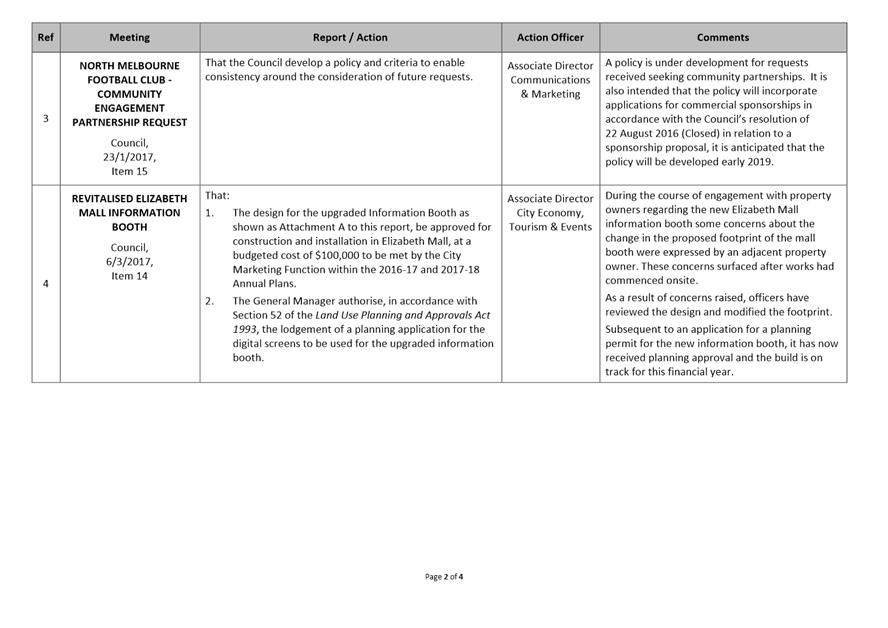

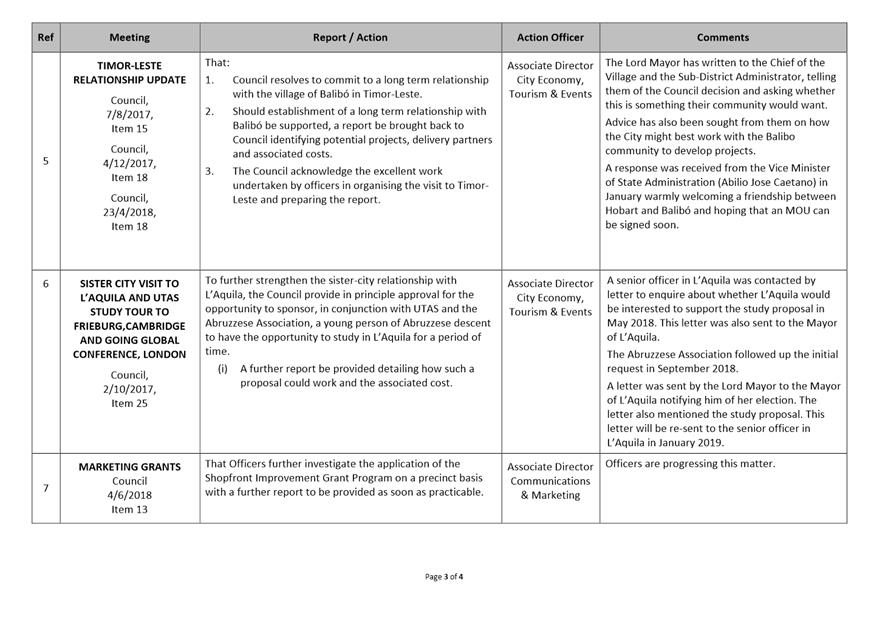

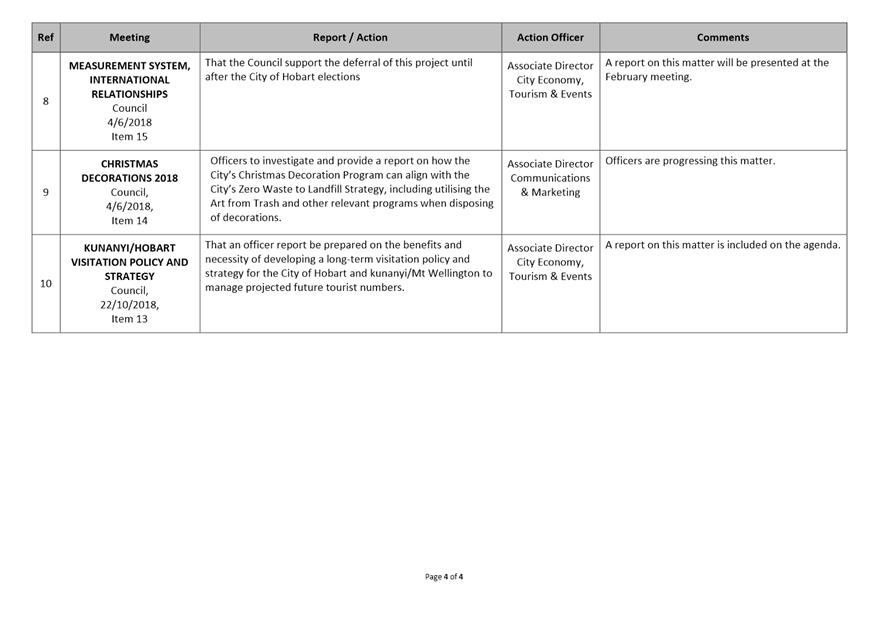

A report indicating the status of current decisions is attached for the information of Elected Members.

REcommendation

That the information be received and noted.

Delegation: Committee

|

Item No. 7.1 |

Agenda (Open Portion) Economic Development & Communications Committee Meeting - 24/1/2019 |

Page 36 ATTACHMENT a |

|

|

Agenda (Open Portion) Economic Development & Communications Committee Meeting |

Page 41 |

|

|

24/1/2019 |

|

Section 29 of the Local Government (Meeting Procedures) Regulations 2015.

File Ref: 13-1-10

An Elected Member may ask a question without notice of the Chairman, another Elected Member, the General Manager or the General Manager’s representative, in line with the following procedures:

1. The Chairman will refuse to accept a question without notice if it does not relate to the Terms of Reference of the Council committee at which it is asked.

2. In putting a question without notice, an Elected Member must not:

(i) offer an argument or opinion; or

(ii) draw any inferences or make any imputations – except so far as may be necessary to explain the question.

3. The Chairman must not permit any debate of a question without notice or its answer.

4. The Chairman, Elected Member, General Manager or General Manager’s representative who is asked a question may decline to answer the question, if in the opinion of the respondent it is considered inappropriate due to its being unclear, insulting or improper.

5. The Chairman may require a question to be put in writing.

6. Where a question without notice is asked and answered at a meeting, both the question and the response will be recorded in the minutes of that meeting.

7. Where a response is not able to be provided at the meeting, the question will be taken on notice and

(i) the minutes of the meeting at which the question is asked will record the question and the fact that it has been taken on notice.

(ii) a written response will be provided to all Elected Members, at the appropriate time.

(iii) upon the answer to the question being circulated to Elected Members, both the question and the answer will be listed on the agenda for the next available ordinary meeting of the committee at which it was asked, where it will be listed for noting purposes only.

|

|

Agenda (Open Portion) Economic Development & Communications Committee Meeting |

Page 42 |

|

|

24/1/2019 |

|

|

That the Committee resolve by majority that the meeting be closed to the public pursuant to regulation 15(1) of the Local Government (Meeting Procedures) Regulations 2015 because the items included on the closed agenda contain the following matters:

· commercial information of a confidential nature that if disclosed is likely to prejudice the commercial position of the person who supplied it. · information provided to the Council on the basis that it be kept confidential.

The following items are listed for discussion:-

Item No. 1 Minutes of the last meeting of the Closed Portion of the Council Meeting Item No. 2 Consideration of supplementary items to the agenda Item No. 3 Indications of pecuniary and conflicts of interest Item No. 4 Committee Action Status Report Item No. 4.1 Committee Actions - Status Report Item No. 5 Questions Without Notice

|