City

of hobart

AGENDA

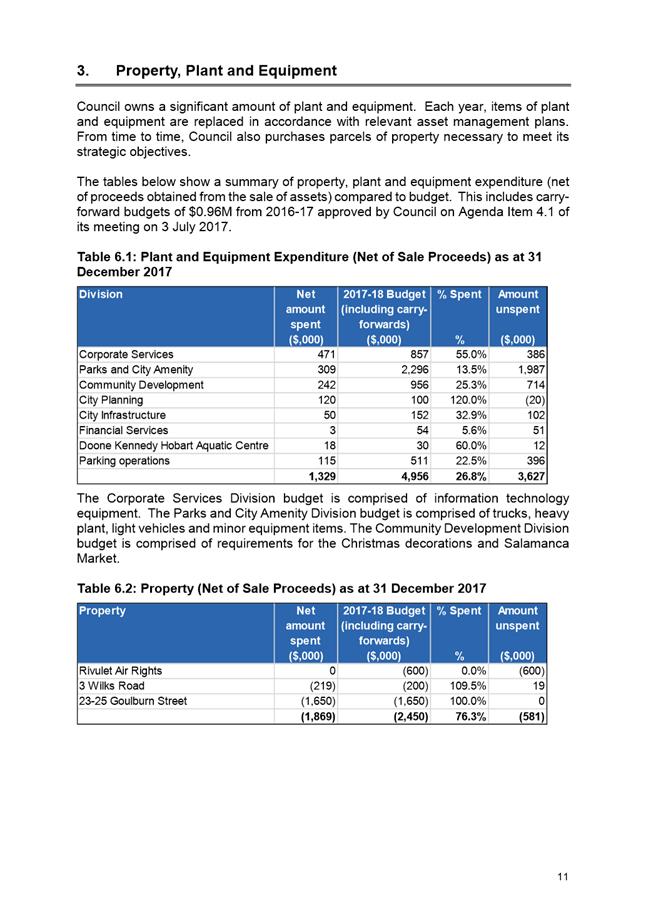

Finance and Governance Committee Meeting

Open Portion

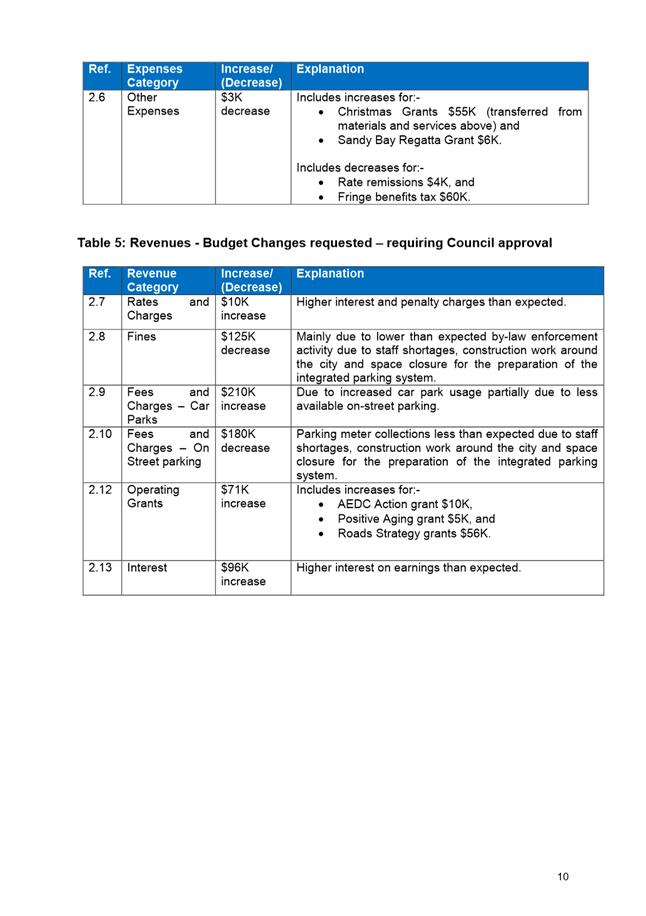

Wednesday, 14 February 2018

at 5:00 pm

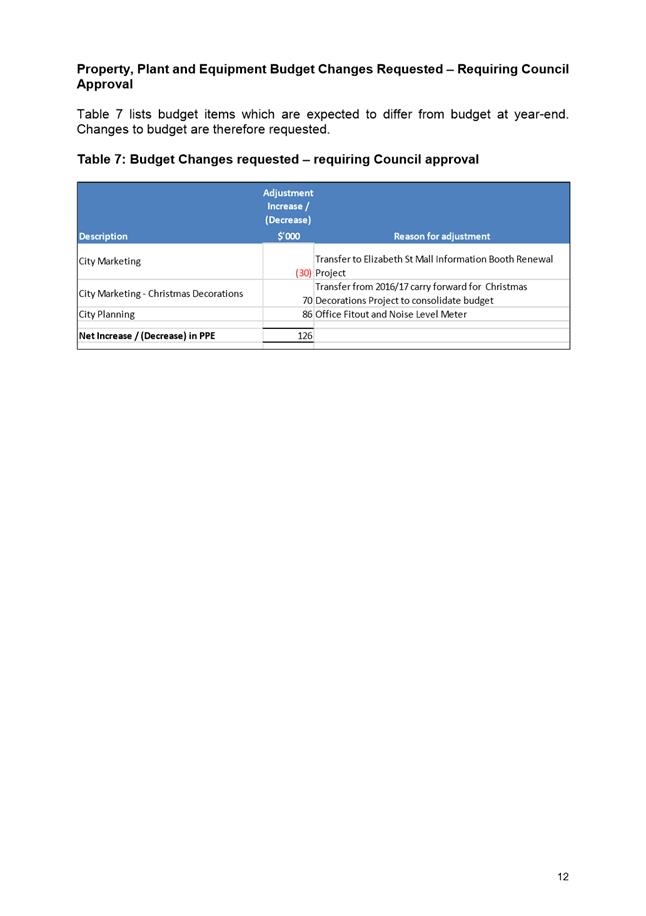

Lady Osborne Room, Town Hall

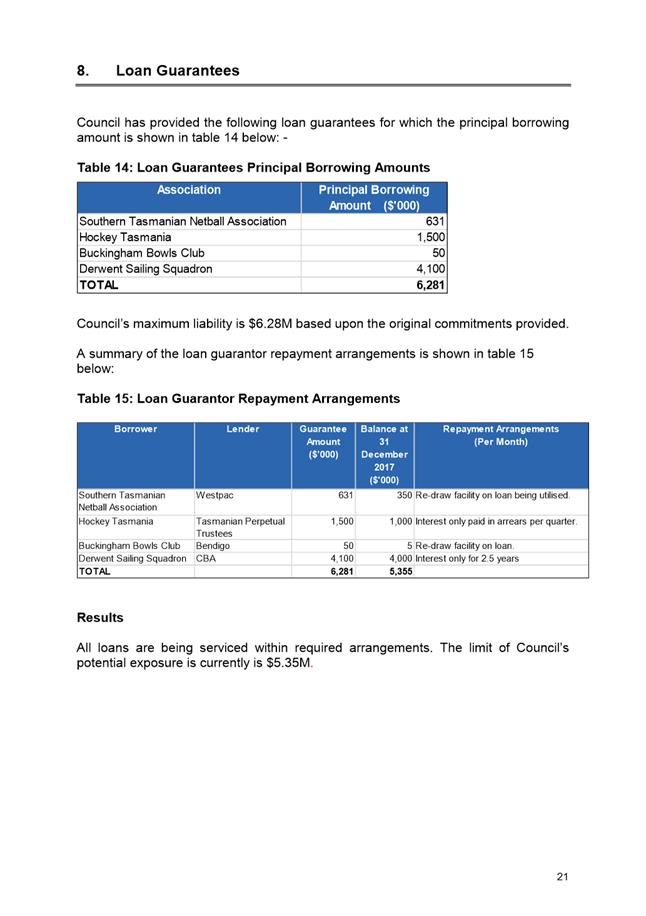

City

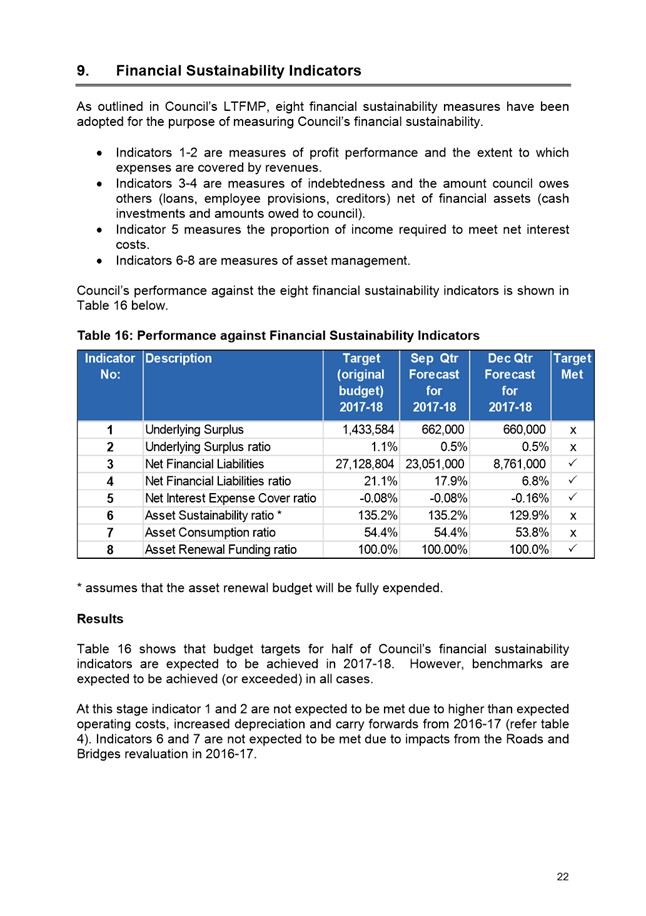

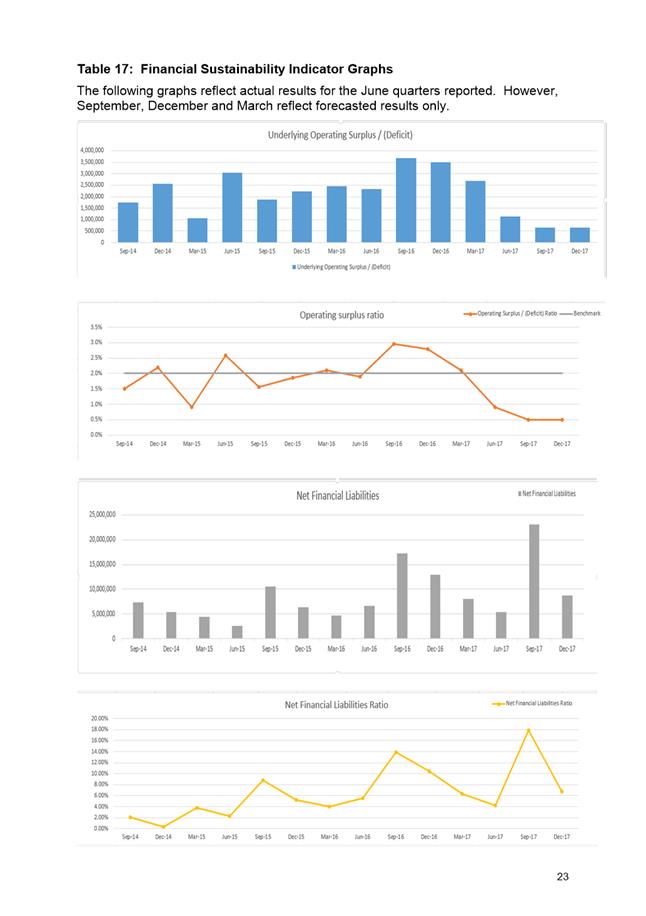

of hobart

AGENDA

Finance and Governance Committee Meeting

Open Portion

Wednesday, 14 February 2018

at 5:00 pm

Lady Osborne Room, Town Hall

THE MISSION

Our mission is to ensure good governance of our capital City.

THE VALUES

The Council is:

|

about people |

We value people – our community, our customers and colleagues. |

|

professional |

We take pride in our work. |

|

enterprising |

We look for ways to create value. |

|

responsive |

We’re accessible and focused on service. |

|

inclusive |

We respect diversity in people and ideas. |

|

making a difference |

We recognise that everything we do shapes Hobart’s future. |

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 3 |

|

|

14/2/2018 |

|

Business listed on the agenda is to be conducted in the order in which it is set out, unless the committee by simple majority determines otherwise.

APOLOGIES AND LEAVE OF ABSENCE

1. Co-Option of a Committee Member in the event of a vacancy

3. Consideration of Supplementary Items

4. Indications of Pecuniary and Conflicts of Interest

FINANCE

6.2 Annual Review of Loan and Investment Portfolios - 31 December 2017

6.3 Financial Report as at 31 December 2017

6.4 Review of Parking - North Hobart (Update on actions)

6.5 23-25 Goulburn Street - Lease of Car Park

6.6 Grants and Benefits Listing as at 31 December 2017

GOVERNANCE

6.8 Climate Leadership Conference - 15-16 March 2018

7 Committee Action Status Report

7.1 Committee Actions - Status Report

8. Responses to Questions Without Notice

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 4 |

|

|

14/2/2018 |

|

Finance and Governance Committee Meeting (Open Portion) held Wednesday, 14 February 2018 at 5:00 pm in the Lady Osborne Room, Town Hall.

|

COMMITTEE MEMBERS Ruzicka (Chairman) Thomas (Chairman) Deputy Lord Mayor Christie Zucco Sexton Cocker Reynolds

ALDERMEN Lord Mayor Hickey Briscoe Burnet Denison Harvey

|

APOLOGIES: Nil

LEAVE OF ABSENCE: Nil

|

|

The minutes of the Open Portion of the Finance Committee meeting held on Tuesday, 16 January 2018 and the Open Portion of the Governance Committee meeting held on Tuesday, 30 January 2018 are submitted for confirming as an accurate record. |

Ref: Part 2, Regulation 8(6) of the Local Government (Meeting Procedures) Regulations 2015.

|

That the Committee resolve to deal with any supplementary items not appearing on the agenda, as reported by the General Manager.

|

Ref: Part 2, Regulation 8(7) of the Local Government (Meeting Procedures) Regulations 2015.

Aldermen are requested to indicate where they may have any pecuniary or conflict of interest in respect to any matter appearing on the agenda, or any supplementary item to the agenda, which the committee has resolved to deal with.

Regulation 15 of the Local Government (Meeting Procedures) Regulations 2015.

A committee may close a part of a meeting to the public where a matter to be discussed falls within 15(2) of the above regulations.

In the event that the committee transfer an item to the closed portion, the reasons for doing so should be stated.

Are there any items which should be transferred from this agenda to the closed portion of the agenda, or from the closed to the open portion of the agenda?

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 6 |

|

|

|

14/2/2018 |

|

Report of the Group Manager Rates and Procurement and the Director Financial Services of 9 February 2018 and attachments.

Delegation: Council

|

Item No. 6.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 7 |

|

|

14/2/2018 |

|

REPORT TITLE: Purchasing Card Policy

REPORT PROVIDED BY: Group Manager Rates and Procurement

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to present a revised City of Hobart Purchasing Card Policy for the consideration of Council.

1.2. This report will be accompanied by a brief presentation on the proposed new Purchasing Card Policy and framework.

1.3. The benefits of the new Purchasing Card Policy approach will benefit the community and business, particularly local business, as outlined in section 5.2 below.

2. Report Summary

2.1. A revised City of Hobart credit card policy (to be known as Purchasing Card Policy) is presented for consideration. If approved a final version of the revised policy would replace the City’s existing Credit Card Policy.

2.2. The revised policy has been prepared following 2016 approval by the Risk and Audit Panel to prepare a new credit card policy.

2.3. The revised Purchasing Card Policy was approved by the Risk and Audit Panel at its 5 December 2017 meeting and has been reviewed by Council’s internal auditors and the Tasmanian Audit Office. Comments received from both have been incorporated into the Purchasing Card Policy attached to this report.

2.4. The new policy has been created noting the findings from the recent report of the Auditor-General, Use of Credit Cards by Councils’ General Managers and Elected Members, and the specific recommendations for the City.

2.5. While this is a new approach for the City, using a purchasing card to pay for high volume low value transactions will realise a number of benefits for the City, including cost savings, and is an approach used in many local government, other government and non-government entities.

2.6. The Purchasing Card Policy will be part of a control framework for the City that includes procedures, practices to support the approval, timely acquittal, and review of credit card expenditure.

2.7. If the revised policy is approved, an accompanying framework including documentation to support the policy, processes and procedures will be created.

2.8. A comprehensive education and training program will be developed for all users and stakeholders.

2.9. An electronic expense management system has been procured to replace current manual systems.

|

That: 1. The Purchasing Card Policy be approved. 2. The General Manager be authorised to make any minor amendments and finalise. 3. A proactive communications strategy be developed around the new Purchasing Card framework proposal. 4. The revised policy be communicated widely to Council officers thereafter, and made available from the Council’s website. |

4. Background

4.1. In 2009 a corporate credit card facility was introduced at Council. Its aim was to increase the organisation’s capacity and convenience to procure certain goods that could not be paid for otherwise e.g. online. Credit cards were only to be used where alternative payment arrangements were not available to Council.

4.2. Council’s existing credit card policy allows limited categories of expenditure to be paid for by credit card and the issue of credit cards is limited. To run the facility a variety of manual systems, paper based approvals and reconciliations are in place together with a robust control framework.

4.3. Council’s current credit card policy and operating guidelines are dated – refer Attachments A and B.

4.4. An analysis of the City’s expenditure finds that 61% of all invoices paid have a value under $500, and 74% of all invoices paid have a value under $1000. Benchmarking studies suggest it costs between $60 and $80 to process a tax invoice via traditional means via purchase order. It is costly and time consuming to pay via traditional methods, particularly where the value of the tax invoice is low.

4.5. At its meeting of 8 March 2016, the Risk and Audit Panel considered a ‘Corporate Credit Card Use’ report and resolved that:

4.5.1. A Corporate Credit Card and/or Purchase Card policy be created for the Panel’s consideration.

4.5.2. The General Manager to provide a report analysing the expediency and the cost benefits of the use of a corporate credit card and / or purchasing card.

4.6. A new purchasing card policy has been drafted following extensive research, consultation and development.

4.7. At its meeting of 5 December 2017 the Risk and Audit Panel considered a report presenting the revised City of Hobart Purchasing Card Policy for consideration and resolved that:

4.7.1. The Risk and Audit Panel approve the draft Purchasing Card Policy.

4.7.2. The draft Policy be forwarded to Council’s internal auditors and the Tasmanian Audit Office for review and comment.

4.7.3. A proactive communications strategy be developed around the new purchasing card framework proposal.

4.8. In December 2017 officers wrote to WLF Accounting & Advisory (Council’s internal auditors) and the Tasmanian Audit Office seeking feedback on the draft Purchasing Card Policy.

4.9. Responses have been received, and circulated to the Risk and Audit Panel, and have been incorporated into the final draft Purchasing Card Policy – refer Attachments C and D.

4.10. A revised Purchasing Card Policy for the City of Hobart is provided at Attachment E.

4.11. On a separate but related matter, it is also noted that the November 2017 Report of the Auditor-General: Use of Credit Cards by councils’ general managers and elected members recommended that a model credit card policy be created and adopted by all councils.

4.12. The Local Government Association of Tasmania has commenced work on a draft model Policy for broad council and relevant stakeholder consultation.

5. Proposal and Implementation

5.1. It is proposed that Council approve the revised Purchasing Card Policy, noting that comments have been incorporated from Council’s internal auditors and the Tasmanian Audit Office.

5.2. The benefits of adopting the new Purchasing Card Policy are many, and include:

5.2.1. Less paperwork, faster receipting, increased flexibility.

5.2.2. Reduced purchase processing costs due to the reduction in requisitions, orders, payment vouchers, invoices, cheques and petty cash – estimates suggest that a single processing cost can be reduced from $60-80 to $20.

5.2.3. Less reliance on petty cash, which is less secure and has a low limit.

5.2.4. More transparency of and capacity to manage expenditure data.

5.2.5. Prompt payments for suppliers, improved cash flow particularly for small local businesses, and reduced invoicing and collection costs for suppliers.

5.3. Many organisations both local, other government and non-government have put in place similar card programs as proposed for the City. An example of the benefits Bendigo City Council have achieved are outlined in an article that appeared in the National Australia Bank publication Business Weekly – refer Attachment F.

5.4. If the new policy is approved, an accompanying framework including documentation to support the policy, processes and procedures will be created.

5.5. The revised policy will be made available from the Council Policy section of the City’s website.

5.6. A comprehensive education and training program will be developed for all users and stakeholders.

5.7. An electronic expense management system has been procured to replace current manual systems.

5.8. A communications strategy will also be implemented in relation to the new purchasing card framework. The communications strategy will promote the benefits of expanding the use of purchasing cards including the benefits for local suppliers, including small business.

Card Holders, Card Limits and Credit Risk Exposure

5.9. It is expected that the number of card holders at Council will increase.

5.10. Analysis has been undertaken of the City’s reimbursement activity, petty cash usage, high volume low value expenditure, current credit card usage and financial delegations. This analysis has identified areas of Council and individuals where current purchasing activity would support the issue of a purchasing Card.

5.11. It is proposed that for many card holders individual transaction spend limits would be set at $1000, although the card limit may or may not be higher depending upon usage requirements.

5.12. Given this, although more cards are proposed for the City, it is not expected that Council’s current overall purchasing card facility limit with the Commonwealth Bank of Australia would change. Hence, the City’s credit risk exposure will remain the same.

6. Strategic Planning and Policy Considerations

6.1. The new policy will replace the existing Credit Card Policy.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. There is no material impact on the current year operating result from this report, as benefits are likely to be realised following the adoption of the new expense management system when the new Phoenix business systems go live.

7.2. Impact on Future Years’ Financial Result

7.2.1. Cost savings are expected to be realised in the future as a result of reduced purchasing costs.

7.3. Asset Related Implications

7.3.1. Not applicable.

8. Legal, Risk and Legislative Considerations

8.1. The Purchasing Card Policy will be part of a control framework that includes procedures, practices to support the approval, timely acquittal and review of credit card expenditure.

8.2. The policy has been reviewed by WLF Accounting & Advisory (Council’s internal auditors) and the Tasmanian Audit Office. Comments received have been incorporated into the Purchasing Card policy at Attachment E. It has also been drafted to include the recommendations from the recent Tasmanian Audit Office audit on credit card usage and recommendations for the City.

8.3. As outlined in the Purchasing Card Policy, the main requirements of a Card Holder, are:

8.3.1. To use the purchasing card only for legitimate Council purchases.

8.3.2. To comply with the City’s Purchasing Card Policy, guidelines and procedures.

8.3.3. Only the person issued with a purchasing card may use it.

8.3.4. To obtain supporting documentation for all card purchases.

8.3.5. To obtain maximum value for money when purchasing on behalf of Council.

8.3.6. Not to split the cost of a single transaction into multiple payments to circumvent the card transaction limit.

8.3.7. To keep the card secure at all times.

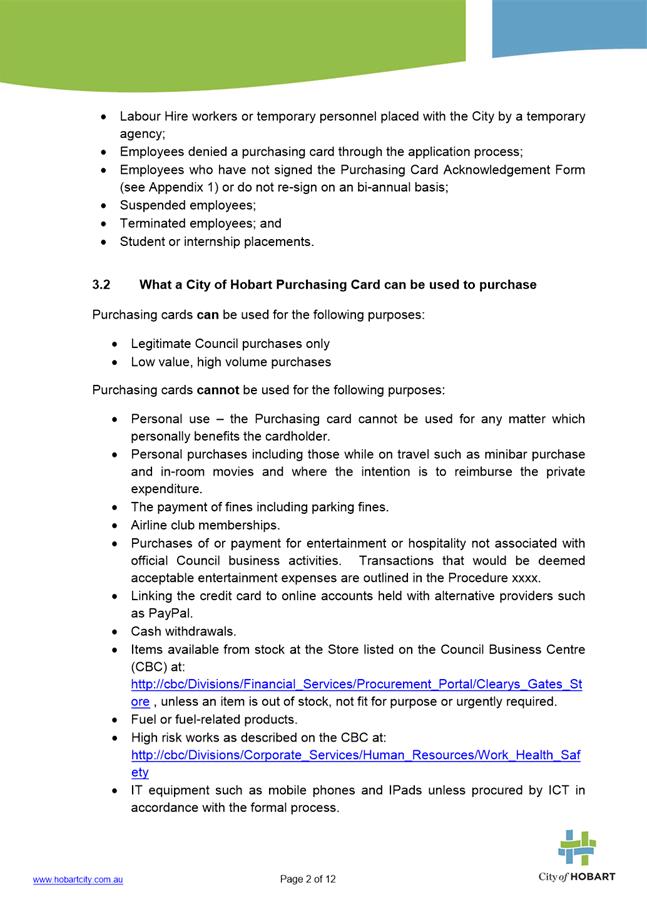

8.4. Cards will not be issued to contractors, temporary labour hire workers, students/interns or suspended/terminated employees.

8.5. While generally cards can be used for high volume low value transactions card will not be able to be used for personal purchases, personal entertainment/hospitality, cash withdrawals, fuel, IT consumables, fines incurred by the cardholder and fixed assets.

8.6. Widespread education, awareness and training will be undertaken to ensure card holders and those approving expenditure understand their role, responsibilities and the City’s expectations around appropriate card use.

8.7. The City’s new expense management system will have inbuilt approval workflow, reporting and data analytic functionality creating a transparent environment for the City’s purchasing framework to operate.

8.8. To ensure the timely acquittal of purchasing card expenditure, the following internal controls will be introduced and will apply to both staff and Aldermanic purchasing cards:

8.8.1. After 30 days reminder will be issued.

8.8.2. After 45 days referral to Manager.

8.8.3. After 60 days the credit limit on the purchasing card will be reduced to $0.

9. Delegation

9.1. Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lara MacDonell Group Manager Rates and Procurement |

David Spinks Director Financial Services |

Date: 9 February 2018

File Reference: F18/2511

Attachment a: Credit

Card Policy and Operating Guidelines ⇩

![]()

Attachment b: Credit

Card Policy and Operating Guidelines and Procedures ⇩

![]()

Attachment c: Feedback

on draft Purchasing Card Policy from TAO ⇩

![]()

Attachment d: Feedback

on draft Purchasing Card Policy from WLF ⇩

![]()

Attachment e: Article

- NAB Business Weekly - Ballarat City Council ⇩

![]()

Attachment f: Draft

Purchasing Card Policy ⇩

![]()

|

Item No. 6.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 13 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 14 ATTACHMENT b |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 20 ATTACHMENT c |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 22 ATTACHMENT d |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 25 ATTACHMENT e |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 28 ATTACHMENT f |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 40 |

|

|

|

14/2/2018 |

|

6.2 Annual Review of Loan and Investment Portfolios - 31 December 2017

Report of the Manager Finance and the Director Financial Services of 9 February 2018.

Delegation: Council

|

Item No. 6.2 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 41 |

|

|

14/2/2018 |

|

REPORT TITLE: Annual Review of Loan and Investment Portfolios - 31 December 2017

REPORT PROVIDED BY: Manager Finance

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to provide details of the Council’s current loan and investment portfolios, and to consider the feasibility of refinancing Council’s loan with the Commonwealth Bank.

2. Report Summary

2.1. The Council’s loan portfolio as at 31 December 2017 comprises six loans with a total balance of $10.96 million and a weighted average interest rate of 5.6% per annum.

2.2. The loan portfolio includes a loan from the Commonwealth Bank with a balance of $3.893 million and an interest rate of 6.41% per annum.

2.3. The Council’s investment portfolio as at 31 December 2017 comprises fourteen term deposits with a total balance of $26.8 million and a weighted average interest rate of 2.5% per annum.

2.4. The Council is able to refinance loans which are attracting higher than the current market rate of interest, but only after incurring significant up - front penalties. Furthermore, future cost savings would not be sufficient to recover the penalties in full.

2.5. Repaying loans using the Council’s owns funds is not an option due to restrictions, or funds being earmarked for future spending, in particular the 10 year capital works program.

|

That the Council not pursue refinancing of its Commonwealth Bank loan.

|

4. Background

4.1. At its meeting held on 21 September 2013, the Finance and Corporate Services Committee requested a report be provided reviewing the Council’s current loan and investment portfolios, noting the interest rate differential between the two portfolios, with such a review to occur annually.

4.2. At its meeting held on 20 November 2017, Council resolved as follows:

4.2.1. Investigate the possibility of paying out the Commonwealth bank loan, and replacing it with a lower interest rate, fixed-term loan.

4.3. Loan Portfolio

4.3.1. As at 31 December 2017, the balance of the loan portfolio was $10.96 million. The details are as follows:

|

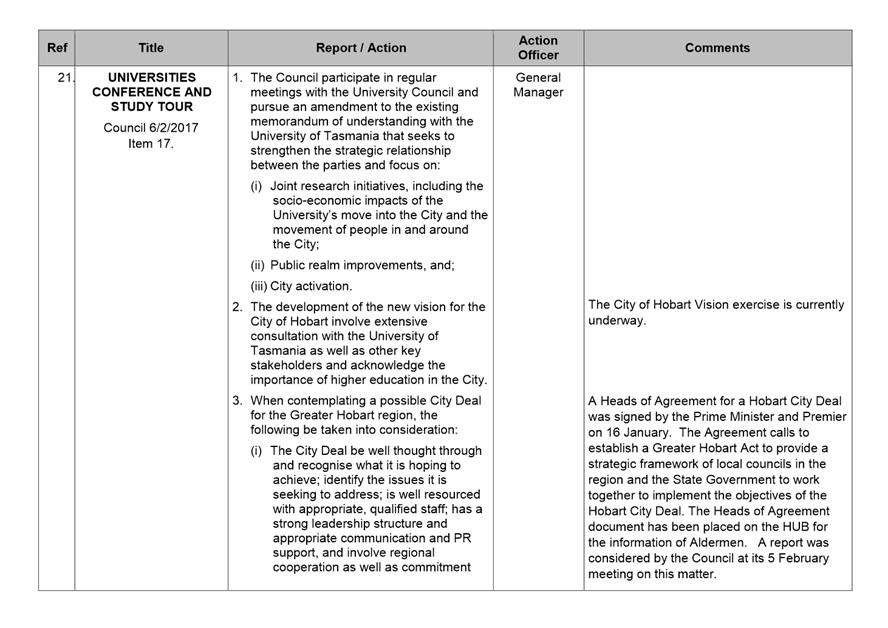

Lender |

Original Amount ($,000) |

Drawdown Date |

Term (years) |

Maturity Date |

Interest Rate (fixed) |

Balance ($,000) |

Early repayment cost ($,000) |

|

Cwth Bank |

4,800 |

30/06/2006 |

30 |

30/06/2036 |

6.41% |

3,893 |

1,217 |

|

Tascorp |

1,750 |

30/06/2010 |

10 |

30/06/2020 |

6.48% |

547 |

27 |

|

Tascorp |

1,850 |

30/06/2011 |

10 |

30/06/2021 |

6.24% |

780 |

50 |

|

Tascorp |

5,000 |

29/06/2012 |

10 |

29/06/2022 |

4.89% |

2,550 |

96 |

|

Tascorp |

2,500 |

28/06/2013 |

10 |

30/06/2023 |

5.13% |

1,529 |

78 |

|

Tascorp |

2,375 |

30/06/2014 |

10 |

30/06/2024 |

4.56% |

1,662 |

64 |

|

|

|

|

|

|

|

10,961 |

1,532 |

4.3.2. As at 31 December 2017, the weighted average interest rate of the loan portfolio was 5.6% per annum. This average rate is a low rate, but nonetheless is higher than the rate being earned on investments (see 4.4 below).

4.3.3. The loan portfolio currently includes loans taken out between 2006 and 2014, during which time interest rates have reduced. As a result, these loans are costing more than the current market rate of interest.

4.3.4. Each loan is subject to an early repayment cost (penalty) which would be payable in addition to the outstanding principal and any accrued interest.

4.3.5. Payout details for the Commonwealth bank loan as at 31 December 2017 are as follows: -

|

Principal outstanding |

$3,892,818 |

|

Early repayment penalty |

$1,216,997 |

|

Administration fee (0.08%) |

$3,114 |

|

Total |

$5,112,929 |

4.3.6. Repayments for the Commonwealth bank loan are $181,212 each half-year.

4.3.7. The Commonwealth bank loan could be refinanced with a new loan of $5,112,929 with an indicative interest rate of 3.95% per annum. This would require half-yearly repayments of $196,074.

4.3.8. The early repayment cost (penalty) therefore makes it unattractive to refinance the Commonwealth bank loan at a lower interest rate. This is the same conclusion as in previous reviews. As part of the 2015 review, Wise Lord & Ferguson reviewed the Commonwealth bank loan and also concluded that it would not be cost effective to refinance the loan.

4.4. Investment Portfolio

4.4.1. As at 31 December 2017, the Council’s investment portfolio was comprised of fourteen term deposits totalling $26.8M. The weighted average interest rate of the term deposits was 2.5% per annum.

5. Proposal and Implementation

5.1. It is proposed that the Council does not refinance its Commonwealth Bank loan due to the punitive early repayment cost (penalty) which would need to be incurred.

6. Strategic Planning and Policy Considerations

Goal 5 – Governance is relevant in considering this report, particularly;

Strategic 5.1 objective:

“The organisation is relevant to the community and provides good governance and transparent decision-making”.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. The Council is able to refinance loans which are attracting higher than the current market rate of interest, but only after incurring significant early repayment costs (penalties). Furthermore, future cost savings would not be sufficient to fully recover these costs.

7.1.2. Early loan repayment costs (penalties) have not been budgeted and are not included in current year forecast results.

7.2. Impact on Future Years’ Financial Result

7.2.1. Future cost savings would not be sufficient to recover early repayment costs (penalties) in full.

7.2.2. The Council’s Long-Term Financial Management Plan is premised on requiring further debt to fund the 10 year capital works program. Debt levels will need to increase as the capital works program progresses.

8. Delegation

8.1. This matter is delegated to the Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Peter Jenkins Manager Finance |

David Spinks Director Financial Services |

Date: 9 February 2018

File Reference: F18/3832

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 45 |

|

|

14/2/2018 |

|

6.3 Financial Report as at 31 December 2017

Report of the Budget and Reporting Manager, the Manager Finance and the Director Financial Services of 7 February 2018 and attachment.

Delegation: Council

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 46 |

|

|

14/2/2018 |

|

REPORT TITLE: Financial Report as at 31 December 2017

REPORT PROVIDED BY: Budget and Reporting Manager

Manager Finance

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to present Council’s Financial Report for the period ending 31 December 2017, and to seek approval for changes to the 2017/2018 Estimates (budget).

2. Report Summary

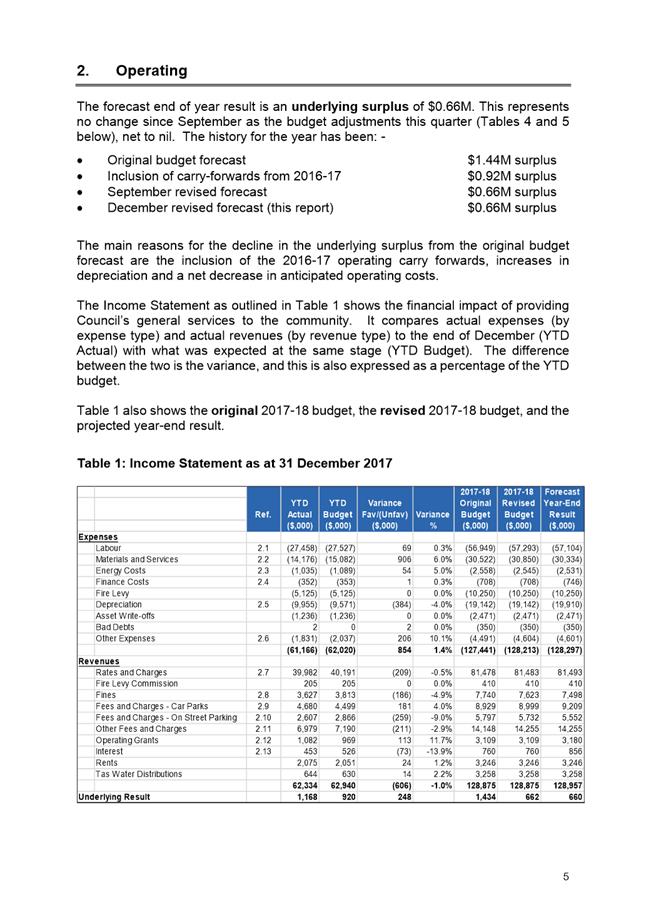

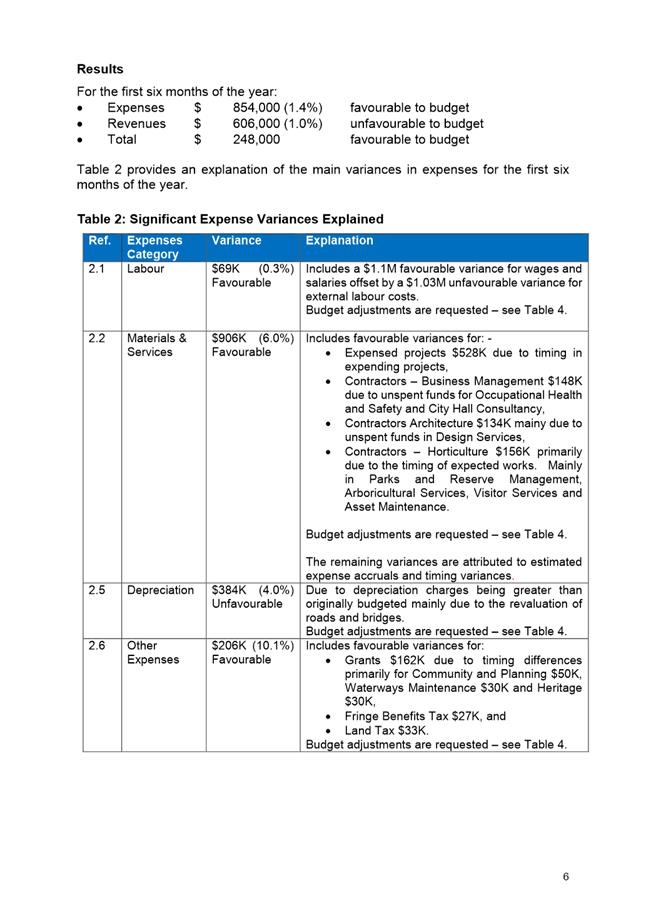

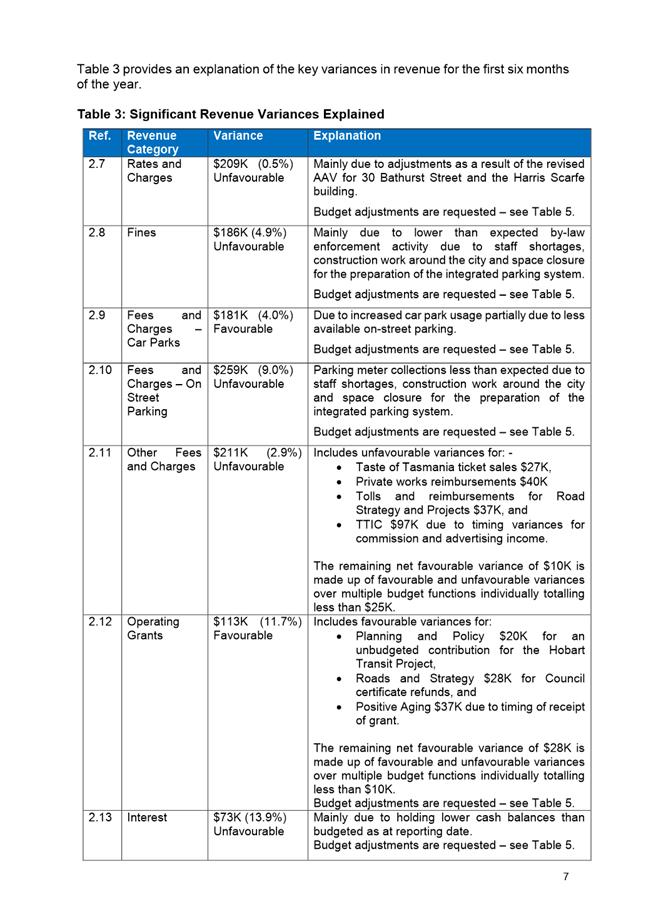

2.1. The Financial Report for the period ending 31 December 2017 is presented for consideration. It shows that expenses are currently favourable when compared to budget and revenues which are currently unfavourable, and forecasts the following financial outcomes for 2017/2018:

2.1.1. An underlying surplus of $0.66M;

2.1.2. A closing cash balance of around $38M; and

2.1.3. The achievement of targets set for half of the Council’s eight financial sustainability indicators.

2.2. The Council remains in a strong, sustainable financial position.

|

That the Council approve the changes to the 2017/2018 Estimates listed in tables 4, 5, 7 and 9 of Attachment A, the financial impacts of which are no net change to the underlying surplus, and to increase the cash balance by $0.78M. |

4. Background

4.1. The Financial Report as at 31 December 2017 is provided at Attachment A. The Financial Report provides details of:

4.1.1. The Council’s financial position as at 31 December 2017;

4.1.2. The result of operations for the first six months of the 2017/2018 financial year;

4.1.3. Forecasts for 30 June 2018; and

4.1.4. Progress towards the achievement of the Council’s financial sustainability outcomes.

4.2. In accordance with Council’s decision of 3 July 2017, unspent 2016/2017 capital funding has been carried forward to the 2017/2018 year.

4.3. Council approved operating carry forwards from 2016/2017 as part of the financial report for the period 30 September 2017, which resulted in the forecast underlying surplus decreasing by $0.52M, from $1.44M to $0.92M.

4.4. Council approved further changes to the Estimates as part of the financial report for the period 30 September 2017 which resulted in the forecast underlying surplus decreasing by $0.26M, from $0.92M to $0.66M.

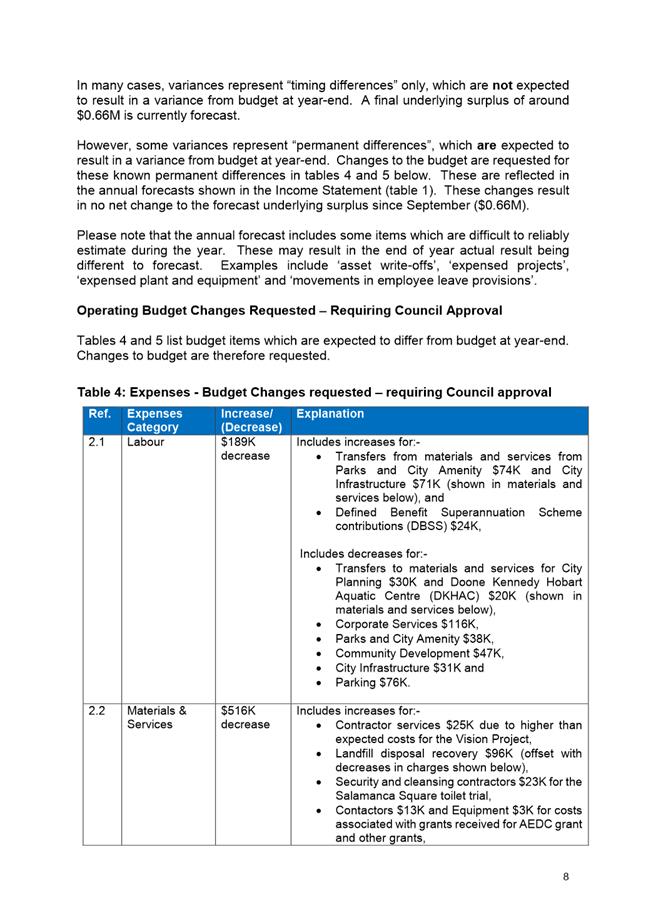

5. Proposal and Implementation

5.1. The Financial Report seeks to have the 2017/2018 Estimates (budget) amended to take account of expected differences from budget at 30 June 2018 (permanent variances).

5.2. It is proposed that the Council approve changes to the 2017/2018 Estimates as set out in tables 4, 5, 7 and 9 of Attachment A.

6. Strategic Planning and Policy Considerations

6.1. Goal 5 – Governance is applicable in considering this report, particularly Strategic 5.1 objective:

“The organisation is relevant to the community and provides good governance and transparent decision-making”.

7. Financial Implications

7.1. Funding Source

7.1.1. The proposed changes to the Estimates will result in the forecast cash balance increasing by $0.78M.

7.1.2. The increase in the forecast cash balance results from a number of factors, but is primarily due to reduced operating costs and reductions in tip rehabilitation expenditure.

7.1.3. The final cash balance may differ from the current forecast for the following reasons:

7.1.3.1. Current budget variances which are assumed to be timing variances (and therefore forecasts have not been amended) may prove to be permanent variances,

7.1.3.2. Further variances could arise during the remainder of the year, and

7.1.3.3. Capital expenditure could be higher or lower than forecast.

7.2. Impact on Current Year Operating Result

7.2.1. The proposed changes to the Estimates result in no net change to the forecast underlying surplus ($0.66M).

7.2.2. Whilst an underlying surplus of $0.66M is currently forecast for 2017/2018, expenses are currently favourable when compared to budget, and revenues are currently unfavourable. If this position continues, the final result may vary from the current forecast.

7.2.3. The final operating result may differ from the current forecast for the following reasons:

7.2.3.1. Current budget variances which are assumed to be timing variances (and therefore forecasts have not been amended) may prove to be permanent variances; and

7.2.3.2. Further variances could arise during the remainder of the year.

7.3. Impact on Future Years’ Financial Result

7.3.1. The impact on future years’ underlying surpluses is difficult to estimate reliably because some changes may be ongoing, whilst others may not.

7.4. Asset Related Implications

7.4.1. No significant asset related implications are anticipated.

7.5. Financial Sustainability Indicators

7.5.1. Budget targets for half of Council’s eight financial sustainability indicators are expected to be achieved in 2017/2018.

7.5.1.1. Budget targets for both the ‘underlying surplus’ and ‘underlying surplus ratio’ are not expected to be achieved, mainly due to higher than expected operating costs, increased depreciation, and operating carry forwards from 2016/2017.

7.5.1.2. Budget targets for both the asset sustainability ratio and asset consumption ratio are not expected to be met due to impacts from the Roads and Bridges revaluation in 2016-17.

7.5.2. Benchmarks are expected to be achieved for all financial sustainability indicators.

8. Legal, Risk and Legislative Considerations

8.1. Not Applicable.

9. Delegation

9.1. This matter is delegated to the Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Karelyn Stephens Budget and Reporting Manager |

Peter Jenkins Manager Finance |

|

David Spinks Director Financial Services |

|

Date: 7 February 2018

File Reference: F18/8875; 21-1-1

Attachment a: Financial

Report ending December 2017 ⇩ ![]()

|

Item No. 6.3 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 50 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 75 |

|

|

|

14/2/2018 |

|

6.4 Review of Parking - North Hobart (Update on actions)

Report of the Group Manager Parking Operations and the Director Financial Services of 9 February 2018 and attachment.

Delegation: Council

|

Item No. 6.4 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 76 |

|

|

14/2/2018 |

|

REPORT TITLE: Review of Parking - North Hobart (Update on actions)

REPORT PROVIDED BY: Group Manager Parking Operations

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to seek approval for an initial list of actions to be implemented in North Hobart as a result of review of the current parking situation.

2. Report Summary

2.1. At its meeting of 19 of June 2017 the Council resolved that “An internal working group be established to review the parking needs and availability in North Hobart in the context of the Transport Strategy”, and that “Within 6 months, and following consultation with the wider community and the North Hobart Traders Group, the Internal working group report back to the Council with the findings of the review, including a list of suggested actions to improve the parking availability”.

2.2. Actions from the working group meetings included the commissioning of a North Hobart parking survey, consultation with the North Hobart Traders Association, and discussions on the possible development of the Condell Place Car Park

2.3. A meeting with the Traders Association was conducted on the 18 July 2017, where the matter of parking was discussed.

2.4. A number of interested parties have approached Council regarding potential development of the Condell Place Car Park.

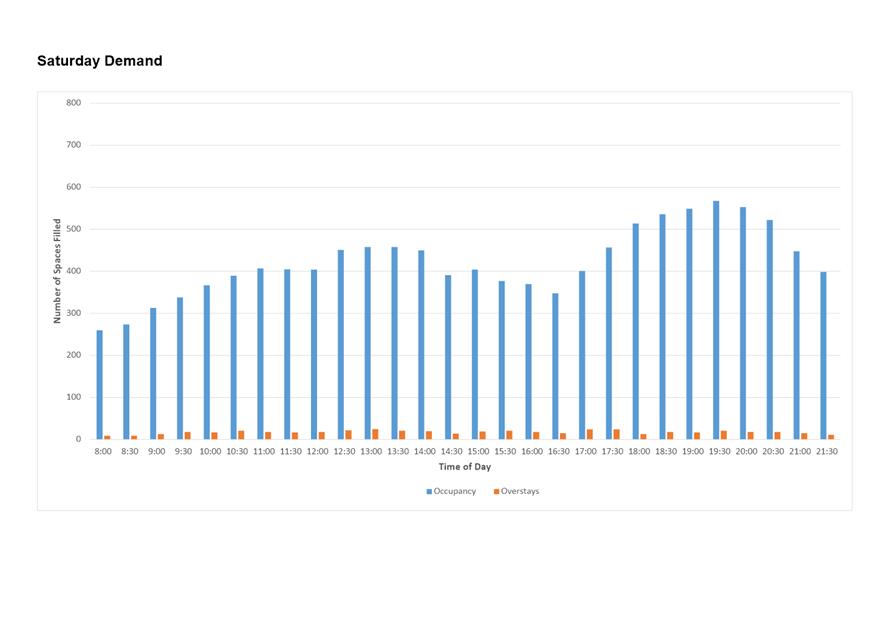

2.5. A survey of the use of parking spaces in the North Hobart restaurant area was conducted in August 2017 by a local research and survey company specialising in traffic data, and a summary of the survey’s findings is provided at Attachment A.

2.5.1. The survey confirmed that on street parking in and around the restaurant area is at a premium, with a large number of overstays occurring, particularly outside of the hours that enforcement officers are normally present in the area.

2.5.2. The survey also revealed that the Condell Place and Lefroy Street Car Parks are heavily used, with occupation rates at 100 per cent from 5.00pm onwards, with the current operating time being 8.30am – 6.00pm daily.

|

That: 1. Approval be granted to extend the operating hours of the Condell Place and Lefroy Street Car Parks to 7.00pm daily. 2. The results of the recent North Hobart parking survey be released to the North Hobart Traders Association and other interested parties for their review. 3. Council consider undertaking a public expression of interest process for the development of the Condell Place Car Park. 4. A draft expression of interest document be submitted to Council for approval.

|

4. Background

4.1. The North Hobart Parking Working Group comprises three staff members from the Parking and Traffic sections of Council, the General Manager, and four Aldermanic representatives.

4.2. At the initial meeting of the group in July 2017, it was decided that as a starting point a survey of parking space usage should be conducted, and a representative of the group should meet with the Traders Association to inform them of the parking review and possible outcomes.

4.3. A meeting with The Traders Association was conducted on 18 July 2017, where the matter of parking and the survey was discussed. The association was also advised that they would be provided a copy of the survey results.

4.4. The survey of the use of parking spaces in the North Hobart Restaurant area was conducted by “Matrix Traffic and Transport Data”, who are a local research and survey company specialising in traffic data.

4.4.1. The survey was conducted on 715 parking spaces that are in the Elizabeth Street restaurant strip from Warwick Street to Federal Street, as well as all side streets that branch one street back from Elizabeth Street.

4.4.2. It was conducted using week day and weekend parking occupation rates, and also includes details of overstays in time regulated zones.

4.4.3. The survey confirmed the fact that on street parking in and around the restaurant area is at a premium, with a large number of overstays occurring, particularly outside of the hours that enforcement officers are normally present in the area.

4.4.4. The survey also revealed that the Condell Place and Lefroy Street Car Parks are heavily used, with occupation rates at 100 per cent from 5.00pm onwards.

4.4.5. In order to regulate behaviour and encourage turnover, the working group is recommending an extension of the operating hours of Condell Place and Lefroy St car parks to 7.00pm, and to have parking officer patrols be extended to incorporate the new operating hours.

4.4.6. The majority of parking spaces in Elizabeth Street, North Hobart currently operate into the evening, therefore parking officers will also patrol the main restaurant strip as well as the car parks of an evening.

4.4.7. In addition, several interested parties have also approached Council regarding potential development of the Condell Place Car Park, and therefore the working group is recommending that a public expression of interest process be undertaken for possible development of the car park.

4.4.8. If approved the draft expression of interest document would be submitted to Council for approval.

5. Proposal and Implementation

5.1. The parking survey results be supplied to the North Hobart Traders Association immediately.

5.2. A draft expression of interest document for the potential development of the Condell Place Car Park be drawn up and submitted to Council for approval within the next few months.

5.3. The extension of the operating hours of the Condell Place and Lefroy Street Car Parks can be implemented within two months. The requirements will be new signage, advertising and reprogramming of the meters.

5.4. The Local Government Highways Act 1982 requires the advertising of changes to parking meter operating times by public Notice - Section 96 (1). Accordingly, the appropriate notice will be placed in the local newspaper, along with advertising on Council’s website and social media, plus the installation of a variable message sign in each of the car parks for the first week of operation.

5.5. Parking officer patrols will commence once the changes to the signage and equipment have been implemented.

6. Financial Implications

6.1. Funding Source and Impact on Current Year Operating Result

6.1.1. Parking officers currently conclude patrols at 5.00pm daily, or 6.00pm with overtime. This proposal will require two officers to work from 5.00pm to 7.00pm daily at an annual cost of $45,000.

6.1.2. Income from infringements is expected to cover the cost of the enforcement, and it is calculated that five infringement notices per evening will cover the cost.

6.1.3. Both income and expenditure will be funded from the Parking Enforcement budget function.

6.2. Impact on Future Years’ Financial Result

6.2.1. Estimates are that the budget results for future years will be in line with the year one results.

6.3. Asset Related Implications

6.3.1. Nil.

7. Legal, Risk and Legislative Considerations

7.1. The Local Government Highways Act 1982 requires the advertising of changes to parking meter operating times to be advertised by public Notice - Section 96 (1). Accordingly, the appropriate notice will be placed in the local newspaper.

8. Social and Customer Considerations

8.1. Advertising of the extended hours of operation of the car parks will be placed on Council’s website and in social media, along with the installation of a variable message sign in each of the car parks for the first week of operation.

9. Delegation

9.1. The approval of the initial list of actions to be implemented in North Hobart as a result of review of the current parking situation is delegated to Council.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Matthew Tyrrell Group Manager Parking Operations |

David Spinks Director Financial Services |

Date: 9 February 2018

File Reference: F18/10600

Attachment a: Summary

of North Hobart Parking Spaces Survey - August 2017 ⇩ ![]()

|

Item No. 6.4 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 81 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 83 |

|

|

|

14/2/2018 |

|

6.5 23-25 Goulburn Street - Lease of Car Park

Memorandum of the Manager Legal and Governance of 7 February 2018.

Delegation: Committee

|

Item No. 6.5 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 84 |

|

|

14/2/2018 |

|

Memorandum: Finance and Governance Committee

23-25 Goulburn Street - Lease of Car Park

The Council sold the property at 23-25 Goulburn Street, Hobart to the Director of Housing in 2017 for redevelopment for the purpose of affordable housing catering primarily to older people and people with disabilities.

Since the property was sold, the Council has leased the property back for a period of 6 months at a rental of $1 per annum. The Council has continued to operate it as a car park – in the same manner as before it was sold.

The 6 month term of the lease is due to expire on 22 February 2018. The Director of Housing has suggested that a new lease be granted to the Council for a period of three months with the ability to extend it on a monthly basis.

It is expected that development will commence this financial year but the exact timing is not yet known. The proposed lease extension therefore provides flexibility and allows the Council to continue generating income from the site until such time as the Director is in a position to commence construction.

|

That: 1. The Council extend its lease of the property at 23-25 Goulburn Street, Hobart for a period of 3 months with the ability to extend it on a monthly basis. 2. The General Manager be delegated the authority to negotiate and agree to the terms of the extension.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Paul Jackson Manager Legal and Governance |

|

Date: 7 February 2018

File Reference: F18/11735; 5664666R

|

Item No. 6.6 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 86 |

|

|

14/2/2018 |

|

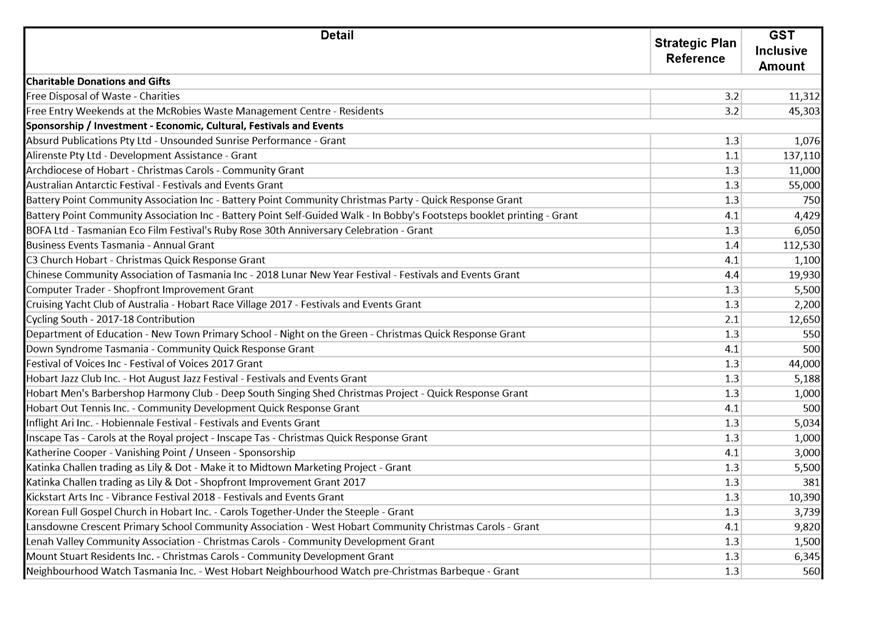

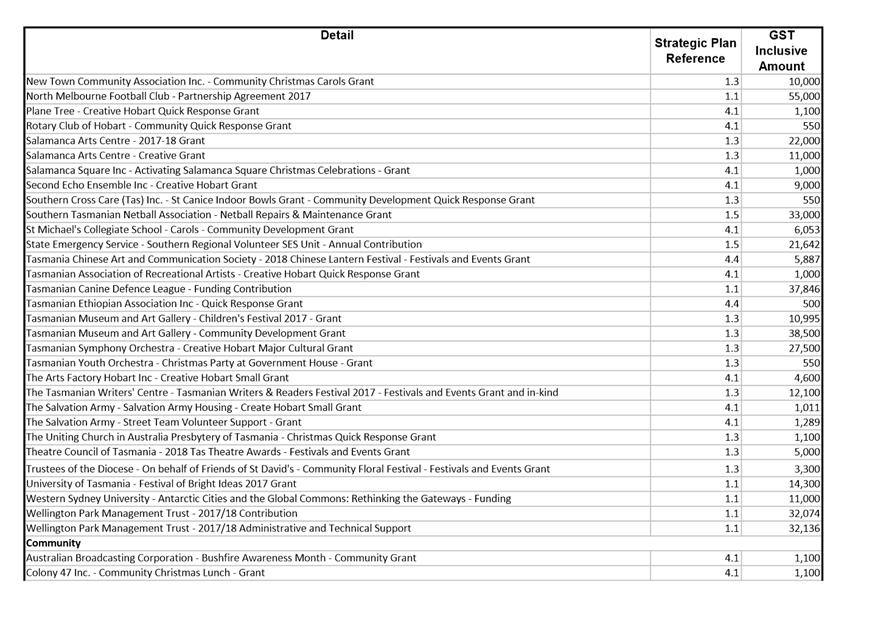

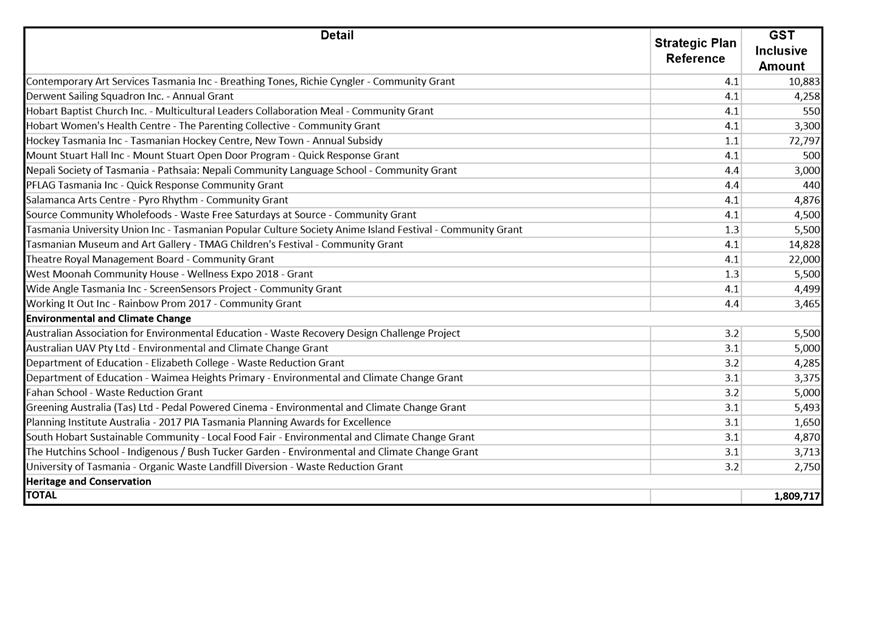

6.6 Grants and Benefits Listing as at 31 December 2017

Report of the Group Manager Rates and Procurement and the Director Financial Services of 9 February 2018 and attachments.

Delegation: Committee

|

Item No. 6.6 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 87 |

|

|

14/2/2018 |

|

REPORT TITLE: Grants and Benefits Listing as at 31 December 2017

REPORT PROVIDED BY: Group Manager Rates and Procurement

Director Financial Services

1. Report Purpose and Community Benefit

1.1. The purpose of this report is to provide a listing of the grants and benefits provided by the Council for the period 1 July 2017 to 31 December 2017.

2. Report Summary

2.1. At its meeting on 12 February 2015, the previous Parks and Customer Services Committee requested that a quarterly report be provided for the information of the then Finance and Corporate Services Committee outlining all grants and benefits provided by Council Committees and Council.

2.2. A report is attached for the period 1 July 2017 to 31 December 2017 (Attachment A).

2.3. It is proposed that the Committee note the listing of grants and benefits provided for the period 1 July 2017 to 31 December 2017, and that these are required, pursuant to Section 77 of the Local Government Act 1993 (“LG Act”), to be included in the annual report of Council.

|

That the Finance Committee receive and note the information contained in the report titled “Grants and Benefits Listing as at 31 December 2017”.

|

4. Background

4.1. At its meeting on 12 February 2015, the then Parks and Customer Services Committee resolved that:

4.1.1. A quarterly report be provided for the information of the [then] Finance and Corporate Services Committee outlining all grants and benefits approved by Council Committees and Council.

4.2. At its meeting on 19 May 2015, the Finance Committee resolved that:

4.2.1. Details of all grants and benefits provided under Section 77 of the Local Government Act 1993 be listed on the City of Hobart’s website.

4.3. A report outlining the grants and benefits provided for the period 1 July 2017 to 31 December 2017 is provided at Attachment A.

4.4. Pursuant to Section 77 of the LG Act, the details of any grant made or benefit provided will be included in the annual report of the Council.

4.5. The listing of grants and benefits marked as Attachment A, has been prepared in accordance with the Council policy titled Grants and Benefits Disclosure – refer Attachment B.

5. Proposal and Implementation

5.1. It is proposed that the Committee note the grants and benefits listing as at 31 December 2017.

5.2. It is also proposed that the Committee note that the grants and benefits listed are required to be included in the Annual Report of the Council and will be listed on the City of Hobart’s website.

6. Strategic Planning and Policy Considerations

6.1. Grants and benefits are provided to organisations which undertake activities and programs that strongly align with the Council’s Strategic Framework – Hobart 2025, the City of Hobart Capital City Strategic Plan 2015-2025 as well as other relevant City of Hobart strategies.

6.2. The linkage between the City’s grants and benefits provided and the City of Hobart Capital City Strategic Plan 2015-2025 is referenced in Attachment A.

7. Financial Implications

7.1. Funding Source and Impact on Current Year Operating Result

7.1.1. All grants and benefits provided as at 31 December 2017 were funded from the 2017-18 budget estimates.

8. Legal, Risk and Legislative Considerations

8.1. The Council provides grants and benefits within the requirements of Section 77 of the LG Act as follows:

8.1.1. Grants and benefits

(1) A council may make a grant or provide a pecuniary benefit or a non-pecuniary benefit that is not a legal entitlement to any person, other than a councillor, for any purpose it considers appropriate.

(1A) A benefit provided under subsection (1) may include:

(a) in-kind assistance; and

(b) fully or partially reduced fees, rates or charges; and

(c) remission of rates or charges under Part 9 (rates and charges)

(2) The details of any grant made or benefit provided are to be included in the annual report of the council.

8.2. Section 72 of the LG Act requires Council to produce an Annual Report with Section 77 of the LG Act providing an additional requirement where individual particulars of each grant or benefit given by the Council must be recorded in the Annual Report.

8.3. Section 207 of the LG Act provides for the remitting of all or part of any fee or charge paid or payable.

8.4. Section 129 of the LG Act provides for the remitting of rates.

9. Delegation

9.1. This report is provided to the Finance Committee for information.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Lara MacDonell Group Manager Rates and Procurement |

David Spinks Director Financial Services |

Date: 9 February 2018

File Reference: F18/2501; 25-2-1

Attachment a: Grants

and Benefits Listing as at 31 December 2017 ⇩ ![]()

Attachment

b: Council

Policy - Grants and Benefits Disclosure ⇩ ![]()

|

Item No. 6.6 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 90 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 95 ATTACHMENT b |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 101 |

|

|

|

14/2/2018 |

|

6.7 Property Insurance

Memorandum of the Deputy General Manager of 9 February 2018.

Delegation: Council

|

Item No. 6.7 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 102 |

|

|

14/2/2018 |

|

Memorandum: Finance and Governance Committee

Property Insurance

The purpose of this memorandum is to seek Council approval to include public toilets as insured assets for the upcoming insurance year.

A Council decision was made in June 1999 to exclude all public conveniences from being insured. Considering the capital investment continuing to be made in public toilets it is recommended that this decision be reviewed and these structures included in the insured asset portfolio.

In 2017 the City of Hobart engaged the services of a valuer to re-value for insurance purposes each of the buildings within the City’s asset register, including public toilets.

Discussions have been undertaken with the City’s mutual property insurer, JMAPP, to seek a preliminary estimate of the premium increase should the declared insured asset portfolio be updated to reflect contemporary values and public toilets included as insured assets. This will result in an approximate $20m increase to the insured asset portfolio for buildings.

The preliminary estimate to apply this increase to the asset portfolio will result in an approximate premium increase of $15,000 on the current premium of $277,185.28. This preliminary estimate is based on the current year’s premium calculations. An increase to the property insurance premium is predicted for the 2018/2019 insurance year due to hardening of the property market resulting from a number of global disasters.

|

That: 1. The Council Decision to exclude all public conveniences from the insurable asset listing be revoked. 2. Public toilets be included on future insured asset declarations, commencing in the 2018/2019 insurance year.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Heather Salisbury Deputy General Manager |

|

Date: 9 February 2018

File Reference: F18/10297; 16/182

|

Item No. 6.8 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 104 |

|

|

14/2/2018 |

|

6.8 Climate Leadership Conference - 15-16 March 2018

Memorandum of the General Manager of 9 February 2018 and attachment.

Delegation: Council

|

Item No. 6.8 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 105 |

|

|

14/2/2018 |

|

Memorandum: Finance and Governance Committee

Climate Leadership Conference - 15-16 March 2018

“The attached program is provided to enable Aldermanic nominations to be sought for attendance at the Climate Leadership Conference to be held in Sydney from the 15 March 2018 to 16 March 2018.

Clause 3 of the Council’s policy titled Aldermanic Development and Support provides that:

The Council may approve the attendance of Aldermen at relevant conferences as representatives of the City, in the capacity as a delegate or conference presenter, subject to budget availability.

Particular conferences where Council representation may be considered appropriate may be brought to the notice of the Council by the General Manager or an individual Alderman.

When such conferences are listed on the relevant committee agenda for consideration of representation, the relevance of the conference to the city’s strategic objectives is to be addressed as part of the process.

The content of the conference is relevant to local government and the Capital City Strategic Plan 2015-2025, in particular Goal 3 – Environment and Natural Resources Objective 3.1 – Increased resilience to climate change.

The estimated cost of full attendance is approximately $4,035 per person, which is inclusive of registration fees, three night’s accommodation, travel expenses and other incidental expenditure.

As at 31 January 2018, the allocation for aldermanic conferences and training and development activities within the Aldermanic Allowances and Expenses function of the 2017-18 Annual Plan had $6,848 remaining. From this, an estimated $2,985 is committed with respect to Aldermanic attendance at the Coast to Coast Hobart conference as resolve by the Council at its meeting of 22 January. This leaves a balance remaining of $3,865.

In the event that the Council approves attendance, the estimated cost is likely to exceed the approved budget in the 2017-18 Annual Plan. As such, an appropriate off-set has been identified from the Study Assistance line item within the People and Capability function which is unlikely to be fully expended. The costs of attendance will be attributed to the Conference Attendance allocation within the Aldermanic Allowances and Expenses function of the 2017-18 Annual Plan and a corresponding reduction to the Study Assistance line item in the People and Capability function budget will occur.

The information is submitted for consideration.”

|

That: 1. The Council consider Aldermanic representation at the Climate Leadership Conference 2018 to be held in Sydney from 15 to 16 March 2018. 2. The estimated cost of $4,035 per person be attributed to the Conference Attendance allocation within the Aldermanic Allowances and Expenses function of the 2017-18 Annual Plan with a corresponding off-set from the Study Assistance line item in the People and Capability function for any expenditure in excess of the existing budget in accordance with s82 of the Local Government Act 1993.

|

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N.D Heath General Manager |

|

Date: 9 February 2018

File Reference: F18/11733

Attachment a: Climate

Leadership Conference 15-16 March 2018 - Information ⇩ ![]()

|

Item No. 6.8 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 107 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 122 |

|

|

|

14/2/2018 |

|

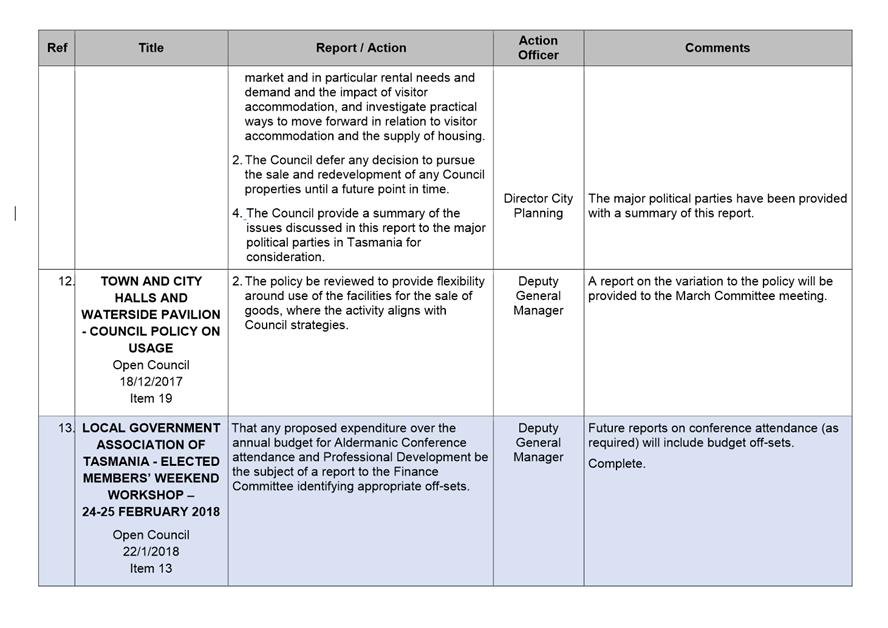

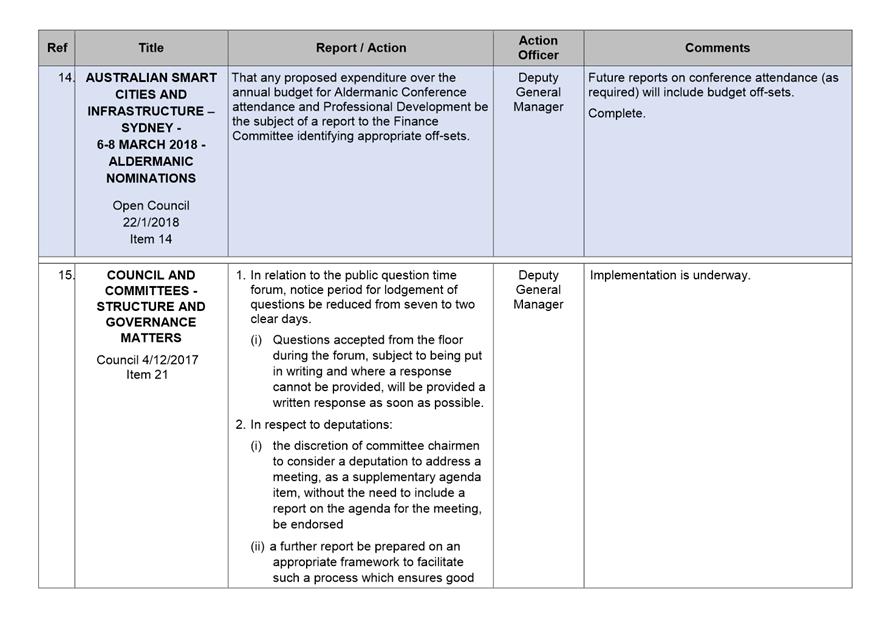

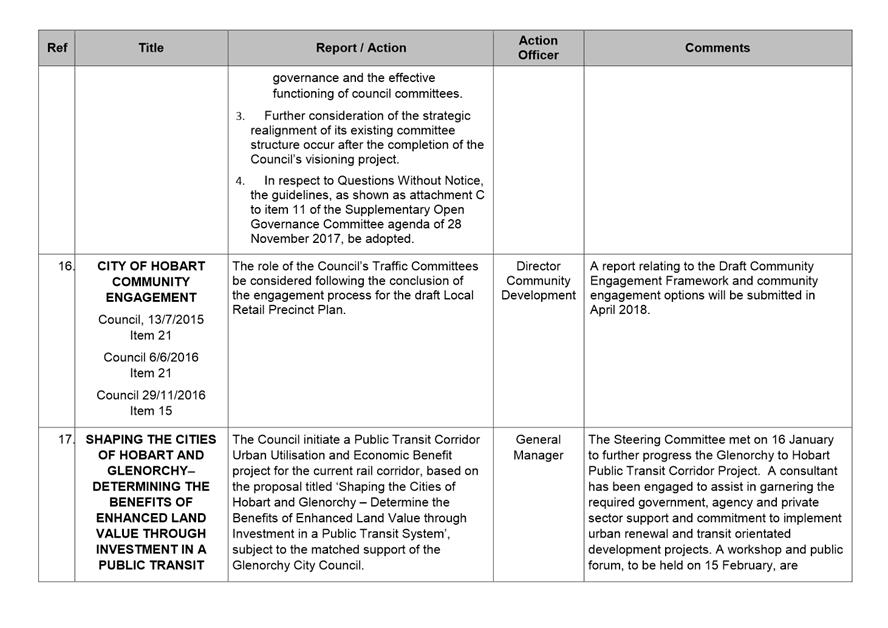

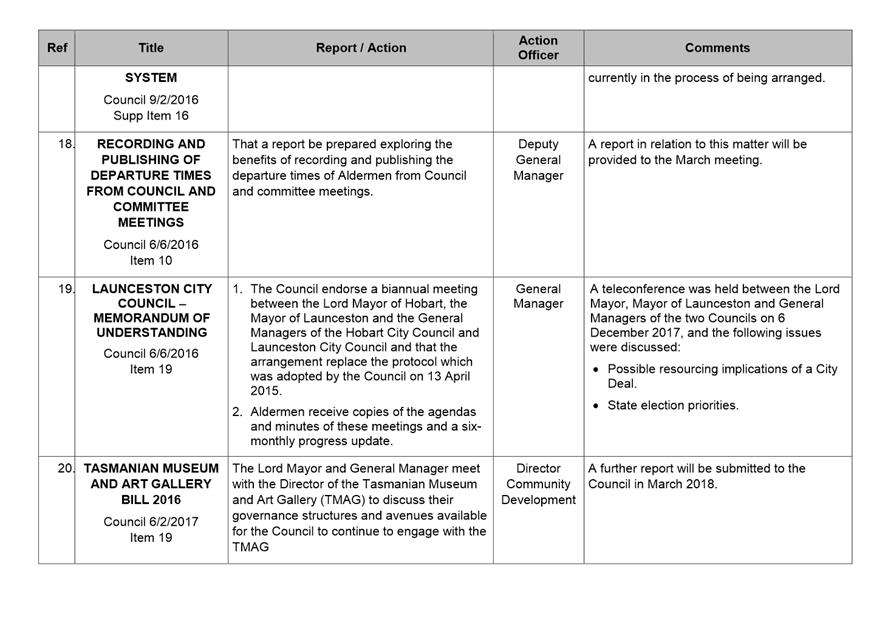

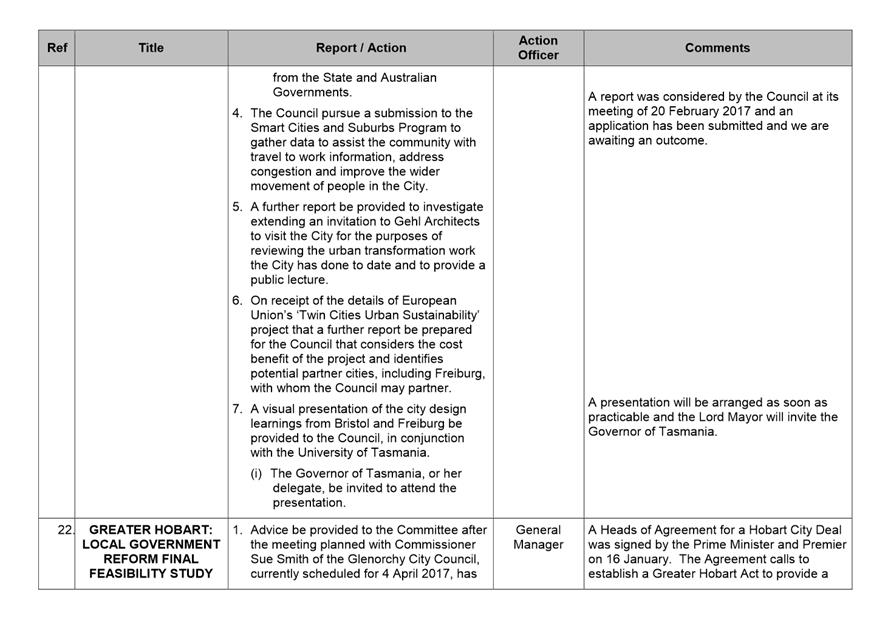

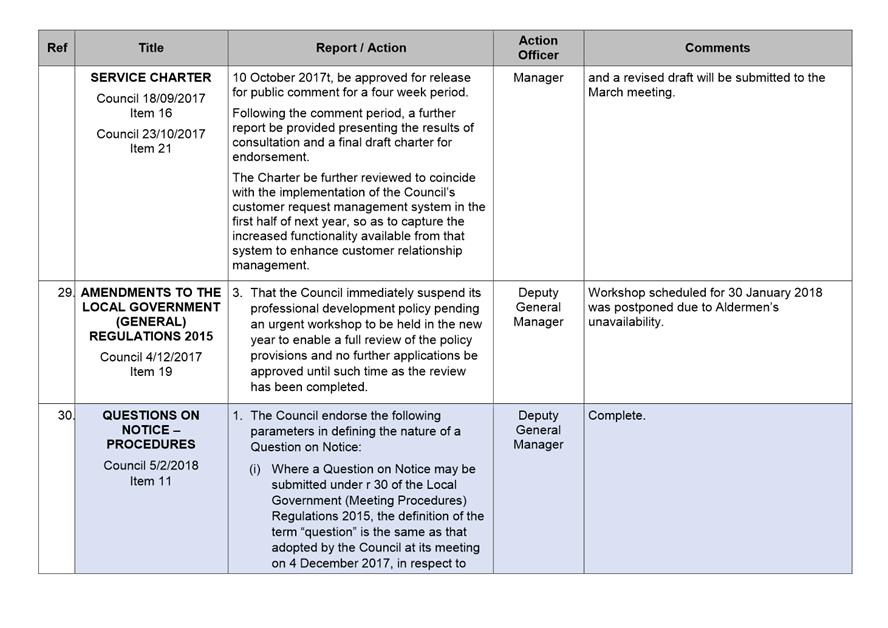

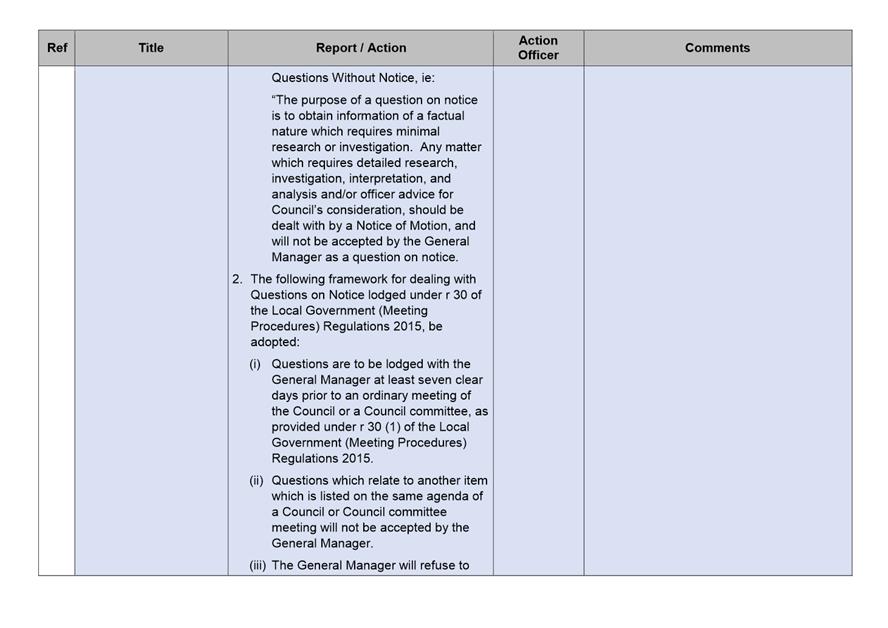

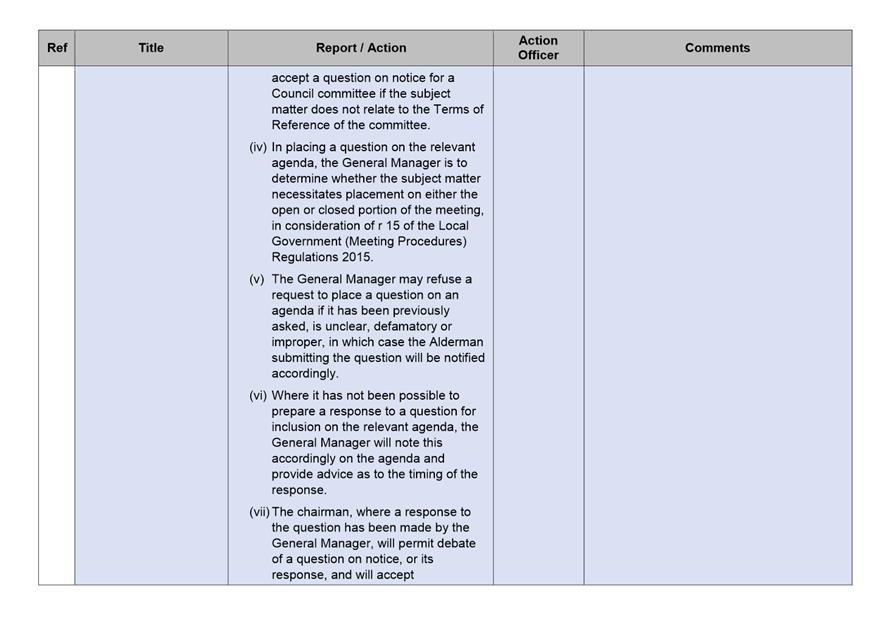

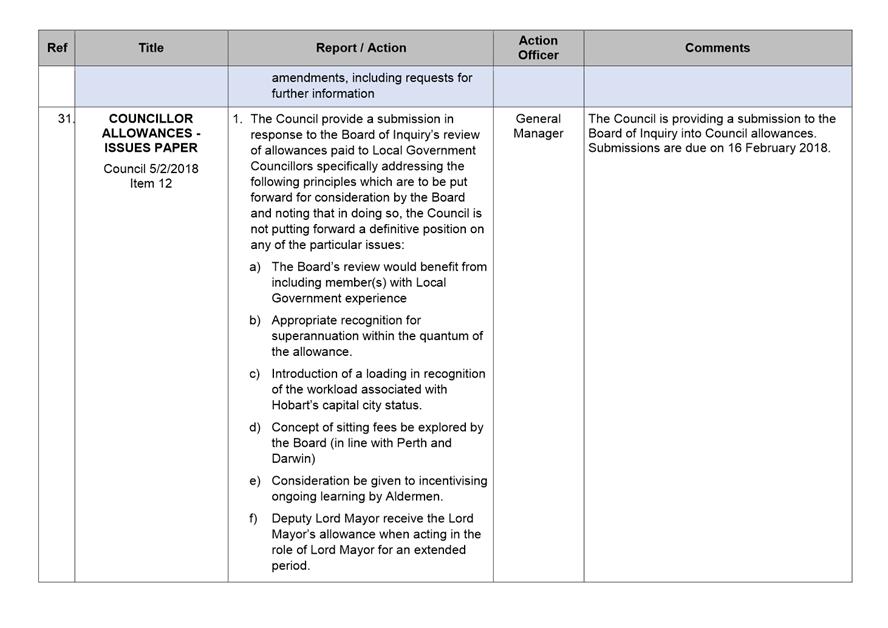

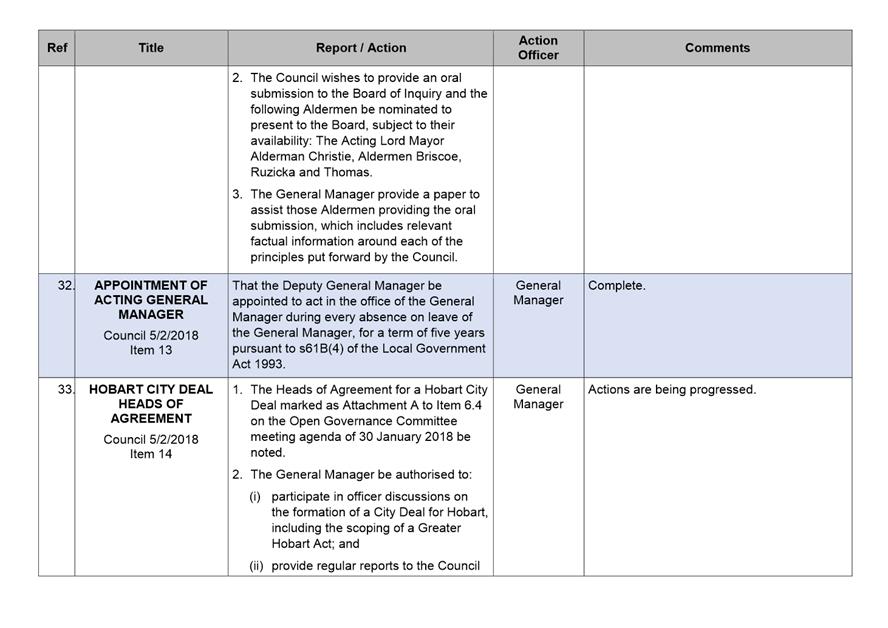

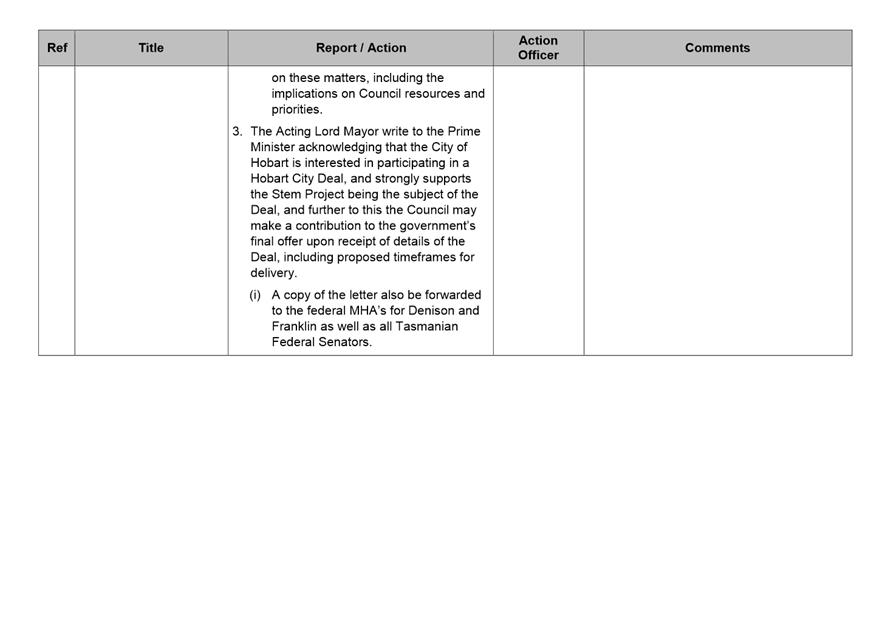

A report indicating the status of current decisions is attached for the information of Aldermen.

REcommendation

That the information be received and noted.

Delegation: Committee

|

Item No. 7.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting - 14/2/2018 |

Page 123 ATTACHMENT a |

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 143 |

|

|

|

27/2/2018 |

|

Regulation 29(3) Local Government

(Meeting Procedures) Regulations 2015.

File Ref: 13-1-10

The General Manager reports:-

“In accordance with the procedures approved in respect to Questions Without Notice, the following responses to questions taken on notice are provided to the Committee for information.

The Committee is reminded that in accordance with Regulation 29(3) of the Local Government (Meeting Procedures) Regulations 2015, the Chairman is not to allow discussion or debate on either the question or the response.”

8.1 Questions on Notice

File Ref: F18/6631

Report of the Deputy General Manager of 14 February 2018.

8.2 Corporate Purchasing Cards

File Ref: F18/5286; 13-1-10

Report of the General Manager of 14 February 2018.

Delegation: Committee

|

That the information be received and noted.

|

|

Item No. 8.1 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 144 |

|

|

27/2/2018 |

|

Memorandum: Lord Mayor

Deputy Lord Mayor

Aldermen

Response to Question Without Notice

Questions on Notice

|

Meeting: Governance Committee

|

Meeting date: 28 November 2017

|

|

Raised by: Alderman Reynolds |

|

Question:

Can the Deputy General Manager provide advice on why the Council does not have Questions on Notice?

Response:

Questions on notice are provided for under Regulation 30 of the Local Government (Meetings and Procedures) Regulations 2015 and if questions are received they would be included on a relevant agenda.

A report on this matter was provided on the Governance Committee meeting of 30 January 2018 and considered by Council on 5 February 2018.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

Heather Salisbury Deputy General Manager |

|

Date: 8 February 2018

File Reference: F18/6631

|

Item No. 8.2 |

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 145 |

|

|

14/2/2018 |

|

Memorandum: Lord Mayor

Deputy Lord Mayor

Aldermen

Response to Question Without Notice

Corporate Purchasing Cards

|

Meeting: Finance Committee

|

Meeting date: 16 January 2018

|

|

Raised by: Alderman Sexton |

|

Question:

Could the General Manager please provide information on the following questions relating to corporate credit cards?

1. How are expenses incurred by the General Manager paid, including costs associated with travel, meals and transport?

2. Are corporate credit cards issued in the name of the City of Hobart and the individual?

3. Who is authorised to make transactions using corporate credit cards and how are these transactions approved? and

4. Are transactions using corporate credit cards allocated to the individuals who have incurred the expense/s and to whom are these transactions reported?

Response:

How are expenses incurred by

the General Manager paid, including costs associated with travel, meals and

transport?

As Aldermen are aware, the General Manager does not have a corporate purchasing card. Any work related expenses incurred by the General Manager, including travel, meals and transport are paid for on his personal credit card and reimbursement is sought pursuant to the City’s travel expenses policies and procedures through appropriate invoices and receipts being produced to support such reimbursement. In such instances, a payment voucher is prepared by the appropriate Officer and approved by an authorised financial delegate (neither of which are the General Manager).

In some instances, payments are made through the use of the purchasing card allocated to the Project and Executive Officer in the Office of the General Manager, in accordance with the City’s purchasing card policy and procedures.

Are corporate credit cards issued in the name of the City of Hobart and the individual?

Yes, the Hobart City Council holds a number of purchasing cards used to transact the business of Council and these are issued in the name of Hobart City Council and the specific staff member.

Who is authorised to make transactions using corporate credit cards and how are these transactions approved?

Current policy provides that only the cardholder may purchase using their particular card.

The full list of approved officers has been distributed to the Aldermen via the HUB.

An appropriate financial delegate authorises the purchase and purchasing card statements are reconciled monthly with all reconciliations approved by the relevant Director (see below).

Are transactions allocated to the individuals who have incurred the expense/s and to whom are these transactions reported?

In the case of officers, the purchasing card statement received from the bank is reconciled by the card holder and the statement together with all supporting invoices and receipts are forwarded to the Divisional Director for approval. Expenses are reconciled within one month of receiving the purchasing card statement from the bank and are assigned to the appropriate budget item with amounts reported in the monthly budget reports.

For Aldermen, a similar process applies with Aldermen reconciling the purchasing card statement and providing receipts and other documentation. In the case of Aldermen, the transactions are reported on the Council’s website against individual Aldermen.

The Financial Services Division monitors the monthly reconciliation process of all cards, as well as monitoring expenditure against budget more generally. Any variances in excess of 10% or $50,000 are reported to the Aldermen on a six monthly basis and the budgetary performance is reported to the Council via the Finance Committee quarterly.

A review of the Council’s purchasing card policy and framework commenced in 2017 and a presentation and report was delivered to the Risk and Audit Panel at its December 2017 meeting.

The Risk and Audit Panel resolved to approve the draft Purchasing Card Policy and forward it to Council’s internal auditors and the Tasmanian Audit Office for review and comment.

The City has now received the said comments and a full and comprehensive report on the Council’s purchasing card policy will be submitted to the February Finance Committee.

It is also noted that the November 2017 Report of the Auditor-General: Use of Credit Cards by councils’ general managers and elected members recommended that a model purchasing card policy be created and be adopted by all councils.

The Local Government Association of Tasmania (LGAT) has commenced work on a draft Model Policy which will be presented to its General Management Committee on 7 March 2018. The draft Policy will also be discussed at the LGAT General Manager’s workshop being held on 21 and 22 March 2018.

As signatory to this report, I certify that, pursuant to Section 55(1) of the Local Government Act 1993, I hold no interest, as referred to in Section 49 of the Local Government Act 1993, in matters contained in this report.

|

N.D Heath General Manager |

|

Date: 8 February 2018

File Reference: F18/5286; 13-1-10

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 148 |

|

|

14/2/2018 |

|

Section 29 of the Local Government (Meeting Procedures) Regulations 2015.

File Ref: 13-1-10

An Alderman may ask a question without notice of the Chairman, another Alderman, the General Manager or the General Manager’s representative, in line with the following procedures:

1. The Chairman will refuse to accept a question without notice if it does not relate to the Terms of Reference of the Council committee at which it is asked.

2. In putting a question without notice, an Alderman must not:

(i) offer an argument or opinion; or

(ii) draw any inferences or make any imputations – except so far as may be necessary to explain the question.

3. The Chairman must not permit any debate of a question without notice or its answer.

4. The Chairman, Aldermen, General Manager or General Manager’s representative who is asked a question may decline to answer the question, if in the opinion of the respondent it is considered inappropriate due to its being unclear, insulting or improper.

5. The Chairman may require a question to be put in writing.

6. Where a question without notice is asked and answered at a meeting, both the question and the response will be recorded in the minutes of that meeting.

7. Where a response is not able to be provided at the meeting, the question will be taken on notice and

(i) the minutes of the meeting at which the question is asked will record the question and the fact that it has been taken on notice.

(ii) a written response will be provided to all Aldermen, at the appropriate time.

(iii) upon the answer to the question being circulated to Aldermen, both the question and the answer will be listed on the agenda for the next available ordinary meeting of the committee at which it was asked, where it will be listed for noting purposes only.

|

|

Agenda (Open Portion) Finance and Governance Committee Meeting |

Page 149 |

|

|

14/2/2018 |

|